The best free invoice generator should be easy to use and provide plenty of invoice customization options, such as the ability to choose from different templates and upload your company logo. It should be able to track outstanding invoices and offer enhanced features to simplify the billing process, like the ability to create recurring invoices, add tracked expenses to invoices, and set up payment reminders.

We’ve rounded up the six best free invoicing software for small businesses:

- Zoho Invoice: Best overall free invoice generator

- Square Invoices: Best for accepting point-of-sale (POS) and online payments

- Zoho Books: Best free mobile invoicing app for businesses with $50,000 or less in annual revenue

- Wave: Best free accounting software with unlimited invoicing

- Invoice Ninja: Best free open-source invoice generator

- ZipBooks: Best for occasional invoicing

Our team of expert writers meticulously evaluated the best free invoice generators through hands-on experience. We delved deep into the features of each program and drew realistic comparisons with other software in the market. The result is a well-written and unbiased review that provides the best answers to people’s questions—aligning with our Fit Small Business Editorial Policy.

Create unlimited invoices, estimates, and bills for FREE with Wave |

|

Best Free Invoice Generators: Quick Comparison

Zoho Invoice: Best Overall Free Invoice Generator

Pros

- Is always free for all users and includes all features

- Allows you to create and send an unlimited number of invoices

- Provides fully customizable invoices

- Ability to automate workflows like calculating and adding discounts

- Integrates with other Zoho apps to manage your whole business

- Lets you add tracked expenses to invoices easily

Cons

- Doesn’t allow you to edit invoice templates on the mobile app

- Lacks approval workflows for issuing invoices

- Isn’t a complete bookkeeping system; requires integration with Zoho Books

- Doesn’t calculate sales tax rates based on customer’s location automatically

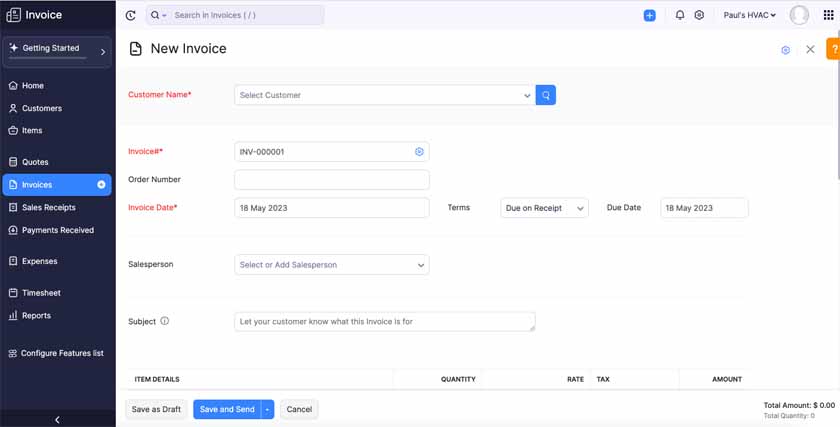

- Free for businesses of any size: Zoho Invoice is completely free and it can accommodate the needs of both small and large businesses needing simple invoicing software. You can add as many users as needed, and you can send unlimited invoices for free to clients.

- Customizable invoices: You can select the invoice template and customize it with your logo, font, and colors.

- Mobile app: Zoho Invoice has a full-featured mobile app, which is available for both Android and iOS devices. It allows you to send invoices, estimates, and account statements to customers via iMessage, and use the time tracking widget for billing.

- Self-service client portal: Your customers will log into the portal to view and pay invoices, and you will receive an alert. Users can also share project data with clients, accept or decline estimates, or provide comments and feedback.

- Multiple currencies and languages: Not only can you send your invoice in your customer’s currency, but you can also select from a variety of languages.

- Time and reimbursements: You can track time, mileage, and billable expenses, which you can add to invoices.

Zoho Invoice emerges as our best free invoice generator due to its user-friendly interface and exceptional features, most notably the ability to completely customize invoices, set up recurring invoices, and add tracked expenses directly to invoices.

Unlike other free invoicing software that often provide limited design templates to choose from, Zoho Invoice presents a wide selection of professionally designed templates as a starting point. Also, its invoices are more customizable than those in similar software. You can effortlessly personalize your invoices by customizing the design elements—such as colors, fonts, and layouts—to align with your brand aesthetics. This makes Zoho Invoice one of our best invoicing software for small businesses.

Additionally, it allows you to include your tracked expenses within your invoices, meaning that you can easily add relevant expenses, such as project-related costs or reimbursable items. You can even set up recurring invoices if you have ongoing or repetitive billing cycles, such as retainers or service contracts and subscriptions.

On the downside, Zoho Invoice doesn’t allow you to edit invoice templates on the mobile app, which can be problematic if you are frequently on the go and need to send invoices at any time. If you rely heavily on mobile invoicing, we recommend Zoho Books Free, which is our best free invoice generator for mobile devices.

Square Invoices: Best for Accepting POS & Online Payments

Pros

- Integrates seamlessly with Square for Retail for POS and ecommerce payment processing

- Has transparent, predictable payment processing fees

- Lets you send unlimited estimates and invoices for free

- Allows you to set up recurring and future-dated invoices

Cons

- Requires the paid version to customize invoices

- Is not a complete bookkeeping solution

- Doesn’t allow you to send invoices by batch in the free plan

- Lacks built-in expense tracking features

- Flexible payment options: Square Invoices’ Free and Plus plans allow you to accept payments in different ways, including in-person, via bank, and through credit and debit cards.

- Invoice customization: Free users can customize their invoices by adding their company logos and setting up personalized messages for their customers. Those who need added flexibility, such as the ability to choose from invoice templates, edit invoice fields, and change invoice colors, should upgrade to the Plus plan.

- Item library: Both the free and paid plans allow you to build an item library of your products and services in all its plans. Once an item is in your library, it can be added to any invoice.

- Invoice scheduling: For your convenience, Free and Plus allow for both recurring invoices and scheduling your invoice to be sent in the future.

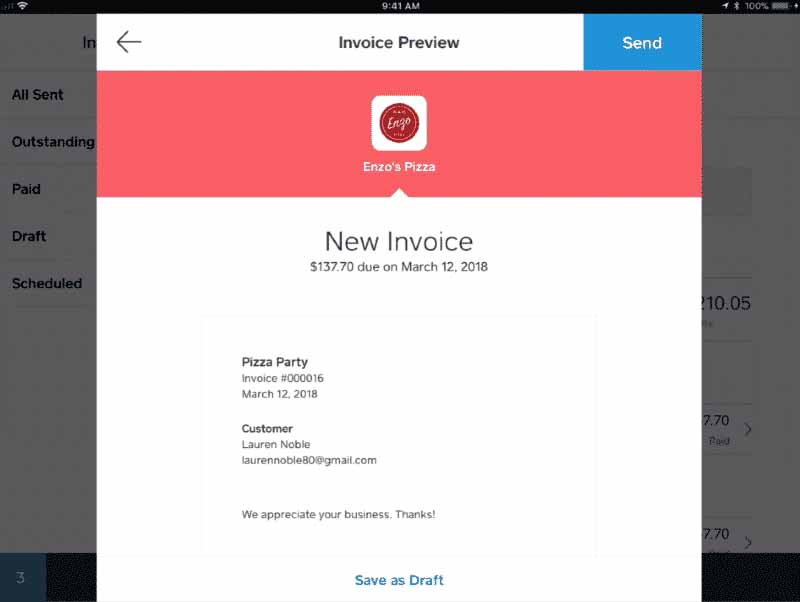

- Mobile app: No matter where you are, the Square Invoices mobile app, available in both the Fee and Plus plans, allows you to send digital estimates and invoices, track the status of payments, send payment reminders, and accept payments.

Square Invoices works with almost any ecommerce platform—such as Shopify, Magento, and WooCommerce—making it an ideal choice if you’d like to accept POS and online payments. It offers flexible payment options, including bank transfers, credit and debit cards, Square gift cards, and mobile wallets like Apple Pay and Google Pay.

Also, it has seamless integration with another Square product called Square for Retail, a comprehensive POS system designed specifically for retail stores, offering advanced inventory management, sales, and staffing tools. This integration allows you to unify your POS and online payment workflows—meaning all transactions, whether in-person or online, are seamlessly processed within the Square platform. You can read our review of Square for Retail to learn more about the solution.

While Square Invoices offers robust invoicing features, it lacks the extensive bookkeeping capabilities typically found in complete accounting software like Wave and Zoho Books.

Zoho Books Free: Best Free Mobile Invoicing App for Businesses With $50,000 or Less in Annual Revenue

Pros

- Is free for businesses with annual revenue of $50,000 or less

- Has an excellent invoicing app with added features, like expense tracking and payment recording

- Allows you to create automated payment reminders

- Has built-in accounting features

- Provides fully customizable invoices

- Integrates with other Zoho Books apps

Cons

- Allows you to send up to 1,000 invoices a year only

- Has no live customer support; email only

- Supports only a single user

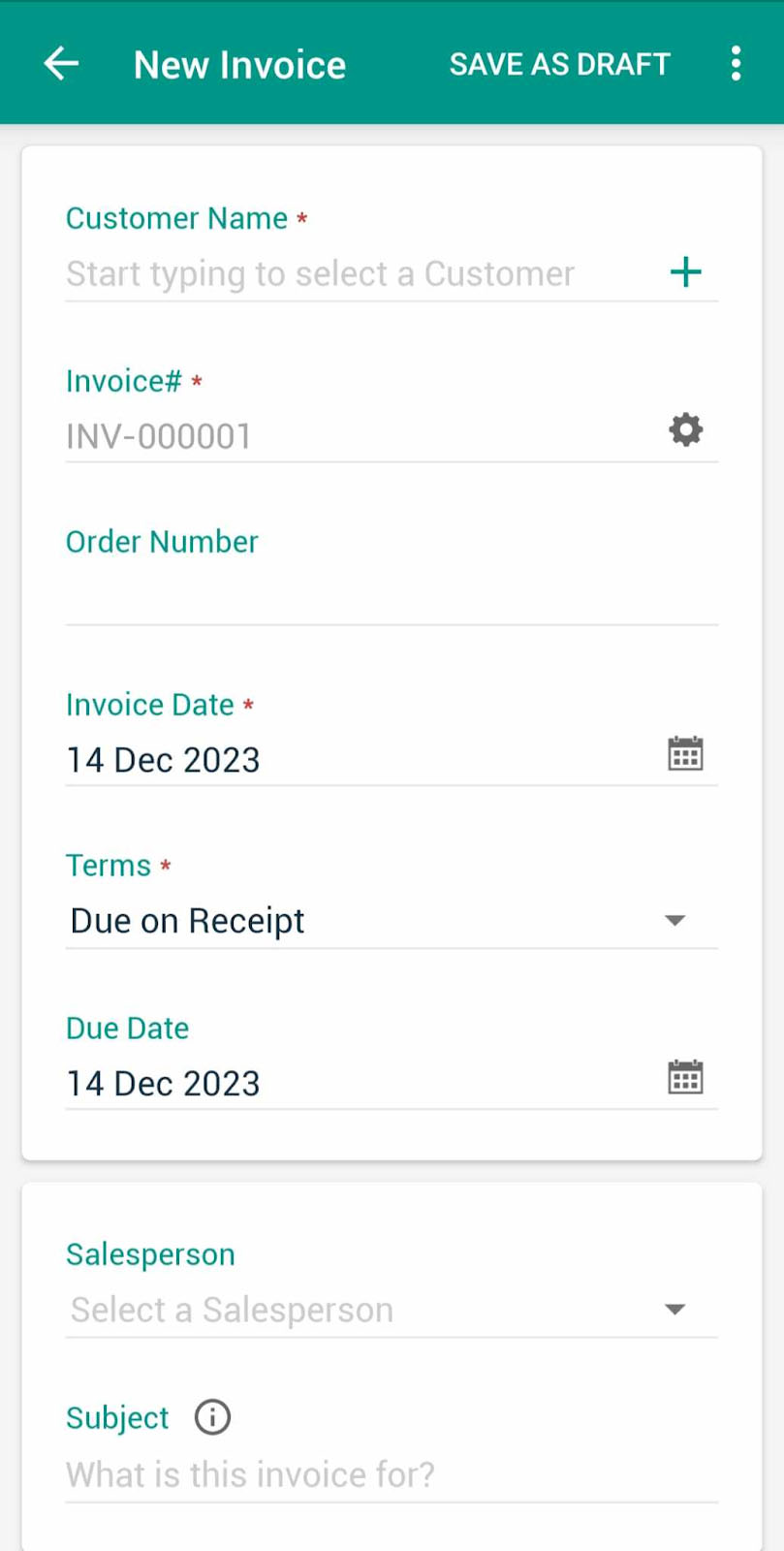

- Mobile app: The Zoho Books Free version has a powerful mobile app for Android and iOS devices that allows you to create and send invoices on the go. You can also customize invoices and set up payment reminders from your mobile devices.

- Complete bookkeeping system: The program has built-in bookkeeping features, like expense tracking, bank and cash management, and reporting.

- Client portal: Your clients can see and track their invoices and payment history directly through the client-side portal.

- Invoice customization: The free plan provides fully customizable invoices. You can upload your company logo, choose from various invoice templates, change invoice color, and add personalized messages to your customers.

- Integrated payment: Zoho Books Free integrates with Stripe and PayPal so that you can accept electronic payments from your customers.

We recommend Zoho Books Free over Zoho Invoice for part-time freelancers and businesses that make $50,000 or less in annual revenue because Zoho Books Free has similar invoicing features and comes built into a complete bookkeeping system. It includes up to 1,000 invoices a year, which is likely more than sufficient for part-timers. In addition to its invoicing features, the app has some other useful functionality, such as the ability to accept payments and view reports.

While the Free plan has most of the core invoicing features of Zoho Books, you might want to upgrade to the higher plans if you need unlimited invoicing. Also, the higher plans have enhanced mobile features, including the ability to track time worked and add tracked time to invoices. This is why Zoho Books leads our roundup of the best mobile accounting apps.

Wave: Best Free Accounting Software With Unlimited Invoicing

Pros

- Free plan includes a complete bookkeeping system

- Lets you send unlimited invoices

- Very easy to add Wave Payments

Cons

- More than one user requires a paid upgrade

- Doesn’t allow you to add tracked expenses to invoices

- Has no advanced accounting features, such as project tracking and inventory management

- Sales tax: Wave lets you add sales tax to invoices, bills, estimates, and expense and income transactions. Whenever you enter a transaction with sales tax, it records the amount automatically in the sales tax liability account.

- Reporting: Wave has a robust reporting capability as free software, with all standard reports, such as profit and loss (P&L) statements, general ledger, trial balance, accounts receivable (A/R) aging, and accounts payable (A/P) aging, included.

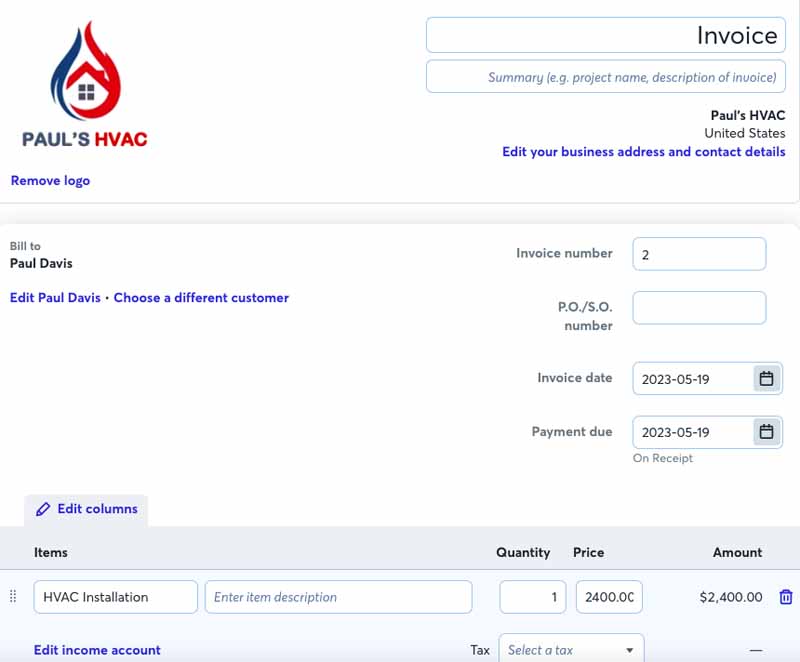

- Invoice customization: There are different ways to customize your Wave invoices, including the ability to choose from different templates, add your logo, change colors, and include a personalized message.

- Accounting software: In addition to invoicing, Wave is a complete bookkeeping software. You can track and pay your bills, add integrated payroll (for a fee), track income and expenses, and print financial statements.

Just like Zoho Books Free, Wave is a free invoicing software built into bookkeeping software. However, unlike Zoho Books, Wave can be used for free by any size company – although the free version is limited to one user. As an all-in-one accounting and invoicing solution, you can generate invoices, track payments, manage expenses, and generate financial reports for free—all in one place.

As our leading free accounting software, Wave offers free invoicing and accounting features. You can create invoices easily and customize them by adding your logo, selecting invoice colors, and choosing from prebuilt templates. You can also email and print invoices if needed. While Wave’s invoicing software is free, there are associated costs for payment processing. However, these fees are generally affordable and enable you to receive payments from your clients through your invoices conveniently.

If you only require basic bookkeeping with your invoicing software, then Wave is a good choice. However, if you anticipate needing more advanced bookkeeping features, such as inventory management and class and location tracking, you may need to upgrade to a premium accounting solution, such as QuickBooks Online, which doesn’t offer a free version.

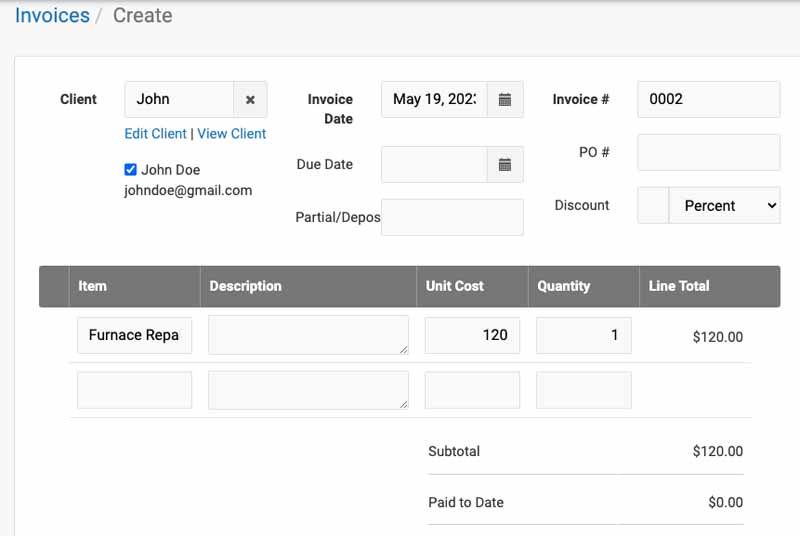

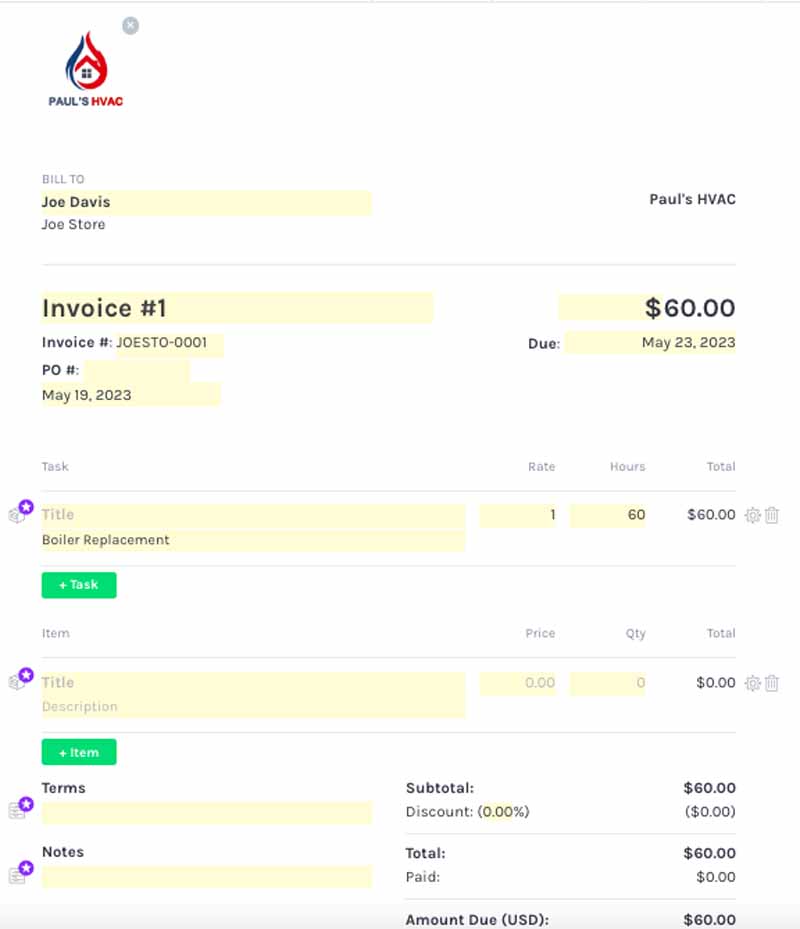

Invoice Ninja: Best Free Open-source Invoice Generator

Pros

- Has a free open-source, self-hosted version; ideal for those with coding skills

- Accepts credit cards, PayPal, automated clearing house (ACH), and Bitcoin

- Supports multiple currencies and languages

- Lets you set up automatic payments for recurring customers

- Allows you to generate one-click pay invoices to send to clients

- Has an Android and iOS mobile app for creating and sending invoices

Cons

- Includes watermarks in the invoices unless you upgrade to paid plan

- Requires coding skills to use the self-hosted version

- Doesn’t allow you to customize invoices in the free version

- Free open-source version: As an open-source program, users with coding skills can fully customize the system and their invoices based on their unique needs.

- Client portal: Invoice Ninja provides a portal for your clients that allows them to open and view your invoices and make payments. You can also view when a client has opened your invoice and track the status of payments.

- Bulk invoicing: If you need to send the same invoice to multiple customers, you can take advantage of this time-saving feature.

- Automatic payments: You can set up automatic payments for recurring customers, and also automatic reminders for late payments.

- Time tracking: Invoice Ninja comes with a free time tracker, which can be launched from within your online account or by using a downloaded desktop icon. Once you have completed the task, you can click and add your time to an invoice.

Invoice Ninja’s self-hosted version is an excellent tool for businesses seeking completely customizable invoicing software, especially those with coding skills. The version is locally installed, making it ideal for those who frequently operate in locations with limited or no internet connectivity.

If you sign up for the free plan, you can manage up to 20 clients and unlimited invoices, plus get advanced features like branded invoices, auto-billing, time tracking, and direct payment integration with over 40 gateways. However, the drawback is that each invoice has a “Created by Invoice Ninja” watermark—which can be removed when you upgrade to the paid plan for $10 per month.

Unfortunately, the presence of watermarks on invoices in Invoice Ninja’s free plan can be an issue for businesses, especially those wanting to maintain a professional impression with their clients. If you wish to create professional-looking invoices for free, you can consider Zoho Invoice, Wave, or Zoho Books Free.

ZipBooks: Best for Occasional Invoicing

Pros

- Lets you manually input invoice info, so you have precise control over the details of each invoice

- Is extremely easy to use

- Allows you to send unlimited invoices

- Lets you connect your bank account to the platform for automated bank transaction import

Cons

- Has no mobile app

- Can’t change the basic layout of the invoice

- Lacks integration for electronic bill payments to vendors

- Customizable invoices: ZipBooks offers a variety of customizable invoices that can be sent as a PDF, or it creates a link automatically for your customer to access the invoice.

- Late payment reminders: The ability to send late payment reminders to customers is a convenient feature that lets you stay on top of your A/R.

- Ease of use: ZipBooks consistently receives high praise for its ease of use and its highly intuitive and color-coded UI.

- Invoice Quality Score: ZipBooks created the Invoice Quality Score to let you know how your invoices rate on a scale of 1 to 100. The higher the score, the more likely you are to receive optimal outcomes like getting paid on time.

- Time and project tracking: You can track time by multiple activities, create projects, and assign them to customers, and then add specific tasks to those projects. These are paid features that are available with the Smarter and Sophisticated plans.

While not the most efficient, ZipBooks is extremely easy to use because it allows you to manually input whatever you want to appear on each invoice. This makes it particularly well-suited for businesses engaging in occasional invoicing rather than high-volume invoicing. For instance, if you are a project-based freelancer or a very small service provider that works less frequently, you can use ZipBooks to bill for services rendered as needed rather than on a set schedule.

One thing we like about ZipBooks is that it offers a unique feature called invoice quality score, which assigns a score to each invoice you create. This score indicates how well your invoice is structured and suggests the important details that can help you get paid faster.

Its free plan (Starter) offers a good variety of features, including the ability to connect a single bank account and track unlimited customer and vendor details. If you need to track time and send recurring invoices, you have to upgrade to a paid plan.

How We Evaluated the Best Free Invoice Generators

We evaluated and rated our top free invoicing software using the rubric below.

10% of Overall Score

The most important factor in our pricing score is the monthly cost of the program. However, we also considered any limitations on transactions, vendors, or customers. Finally, we scored programs that offer a monthly option higher.

25% of Overall Score

A fully customizable invoicing software allows you to upload your company logo, select from various invoice templates, change invoice colors, edit invoice fields, and add personalized messages to customers.

25% of Overall Score

We looked into essential invoicing features, such as the ability to create recurring invoices and set up automatic payment reminders.

10% of Overall Score

Along with subjective evaluation by our accounting expert, the ease-of-use score indicates whether the software is cloud-based. Other components include whether it requires a third-party bookkeeping software integration.

5% of Overall Score

A mobile accounting app comes in handy for businesses that need to send invoices on the go.

15% of Overall Score

A good invoicing software must also provide sufficient customer support options for users, such as phone support and live chat.

10% of Overall Score

We gathered average review ratings of all providers from leading user review sites.

When To Use Bookkeeping Software

If you’re looking for a solution that offers more than invoicing capabilities, then you might want to consider full bookkeeping software that comes with great invoicing, such as QuickBooks Online, which is our overall best invoicing software. You should consider bookkeeping software for:

- Tracking income and expense to file a tax return

- Tracking cash flow

- Managing bills from vendors

- Analyzing profit and loss from specific projects

- Printing financial statements for banks, insurance companies, or other interested parties

Frequently Asked Questions (FAQs)

An invoice generator is an online tool that allows you to create and send invoices for your business. It typically includes features like invoice templates, the ability to customize your invoices with your branding, and tools to track payments and customer information.

We selected Zoho Books Free as the best free invoice generator for mobile users because you can create and send fully customizable invoices. The app also has additional features, like income and expense tracking and payment recording.

Yes, there are many high-quality invoice apps that are absolutely free. Our recommendation for the best free invoice app is Zoho Invoice, which offers all features completely free, regardless of your company size.

Bottom Line

Invoicing customers for the products and services that you sell is a key component of your cash flow. Using an invoice generator is a great option if you are on a budget or have a new small business with very few expenses. Each of the options discussed above allows you to create professional-looking invoices and, in many cases, accept payments online. The best option for you is the one that suits the needs of your business.