A payment gateway is a customer-facing platform that collects payment information during checkout. The gateway then encrypts the customer’s data and sends it to the payment processor to initiate the transfer of funds.

Payment gateways are used by:

- Businesses selling remotely, on a website, on social media, or on mobile.

- Checkout counters in brick-and-mortar stores to enter customer’s payment information in the system.

- Sellers accepting both card and non-card payments such as ACH, echecks, and bank transfers.

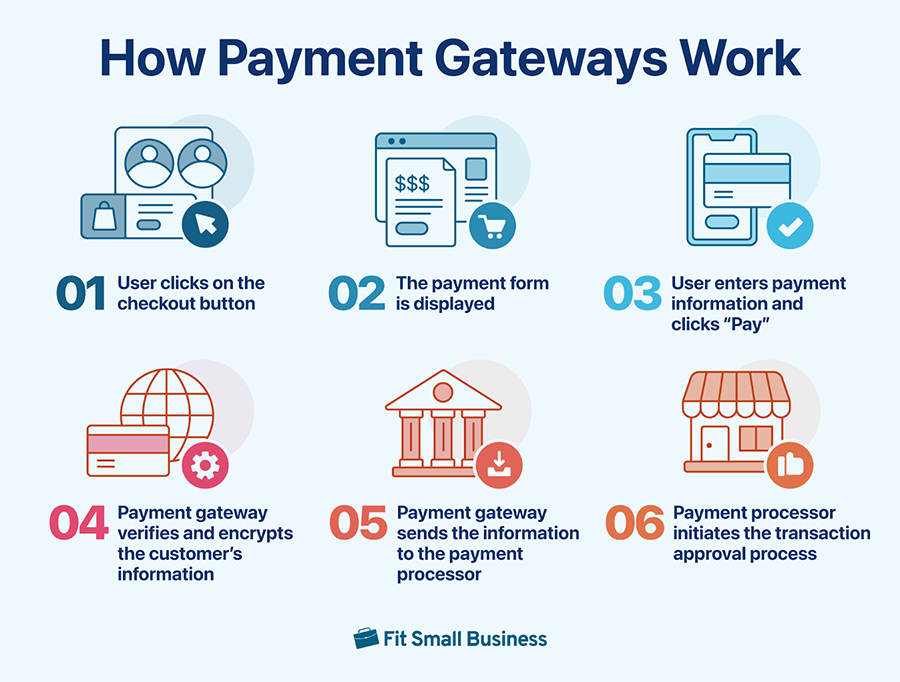

How Does A Payment Gateway Work?

Upon checkout, customers’ payment details are entered into the payment form. For card payments, the payment information is then encrypted and passed on to the card networks, while payment data for non-card transactions are sent to the relevant networks (e.g., the ACH network for ACH payments) for additional verification.

The customer’s payment request is then sent to the customer’s card issuing bank for approval (for credit card transactions) or the customer’s bank to confirm the validity of funds (for non-card transactions).

Related reading:

Payment Gateway Features

The role of a payment gateway in payment processing is simple—to capture and encrypt customer payments. However, many providers include a variety of features such as data verification to help improve customer checkout experience.

Address & Card Brand Identification

Payment gateways can be customized to identify card brands the moment a customer enters their credit card number. Some payment gateways can autocomplete addresses for repeat customers. This not only makes it easier for customers to go through the payment process, but also initiates real-time card validation.

Stripe’s checkout feature comes with an address and card brand recognition tool. (Source: Stripe)

Fraud Monitoring and Prevention (AVS, CVV, IP Verification)

Part of a payment gateway’s main function is to monitor and protect your business from fraudulent transactions. Depending on your payment gateway provider, the checkout form can be equipped with a number of fraud detection tools such as CVV, address, and IP verification functionalities. Most payment processors have this, but some offer the ability to customize these tools based on the merchant’s risk tolerance.

These features are a merchant’s first line of defense from costly chargeback claims. Learn more about preventing chargebacks.

Multi-language & Multi-currency

If your payment gateway supports cross-border transactions, this feature is something you should expect. For businesses that sell online to customers around the world, a multi-language and multi-currency checkout can make customers choose to bring their business to you over competitors.

Stripe is a leader in offering multi-language and multi-currency checkout services. (Source: Stripe)

One-click Checkout

By saving customer information, the one-click checkout enables customers to complete their purchase in a single step instead of going through the multi-step checkout process. This convenience is an excellent way to keep existing customers loyal to your business. More and more payment gateway providers such as Stripe, PayPal, and Shopify come with a built-in one-click checkout functionality.

Shop Pay by Shopify accelerates the checkout process for merchants using Shopify platform. (Source: Shopify)

Shipping Management Integration

Shipping is an integral part of the checkout process. Customers would be more confident completing a payment transaction if a merchant’s checkout process also includes adding, updating, and confirming shipping details and policies. Most payment gateways have this feature but the customization tools will vary depending on the provider.

Cryptocurrency Support

If you accept cryptocurrency as a payment method, you will need a payment gateway that can process cryptocurrency features. And because it’s less regulated, merchants should look for certain features such as legality and security features before adopting a crypto payment gateway. Merchants should also make sure that the platform comes with the proper integrations and easy payout process.

PayPal offers its own cryptocurrency wallet and allows merchants to accept supported cryptocurrency as a payment method. (Source: PayPal)

Check out our list of recommended cryptocurrency payment gateways.

How to Choose a Payment Gateway

Payment gateways should match your business requirements in order to maximize the cost of accepting payments. Consider the following:

- Your preferred payment method: If you accept payment methods other than cards, such as ACH, echeck, or even cryptocurrencies, it’s important to make sure that your payment gateway supports these payment types.

- Your customer profile: Merchants with international customers should choose a payment gateway that accepts cross-border payments. Similarly, B2B merchants require additional information in order to process payments if they want to save on transaction fees.

- Your business model: If you run a subscription-based business, it’s important to have a payment gateway with an integrated CRM feature and the ability to securely save customer information. The payment gateway should also have a guest-checkout option to acquire new customers. Meanwhile, make sure that your payment gateway supports invoicing if your business collects payments via invoice.

Recommended Payment Gateways

As mentioned earlier, most payment processors now have their own payment gateway platform along with providing merchants with a merchant account.

The following are some of our recommended payment gateways evaluated based on a 22-point criteria that includes the above considerations:

Best For | Monthly Account Fee | Online Transaction Fee | |

|---|---|---|---|

| Versatility | $25 | 2.9% + 30 cents or 10 cents per transaction and 10 cents batch fee |

Startups | $0–$60 | 2.9% + 30 cents | |

| Customizations | $0 | 2.9% + 30 cents–3.4% + 30 cents |

Read our complete list of the best payment gateways.

Frequently Asked Questions (FAQs)

Click through the sections below for some of the questions we encounter most often about payment gateways.

Payment gateways can cost anywhere from $0–$30 per month depending on the solution you choose. If you work with a payment processor that offers its own payment gateway, it will most likely not cost you extra unless there is an option for added customizations such as interface design and fraud monitoring tools.

Meanwhile, standalone payment gateway providers like Authorize.net that can integrate with most payment processors do charge a monthly fee that averages around $25.

New businesses should work with a payment processor that comes with its own payment gateway and free merchant account like Square.

Meanwhile, growing businesses should consider payment gateways such as Authorize.net, Helcim, and Stripe that can offer added security, customization, and discounted rates to make the most out of the cost of accepting payments.

If you plan on accepting credit and debit card payments, yes, you will need a merchant account.

Bottom Line

Payment gateways are an integral part of payment processing. Merchants should choose a platform that securely captures and transmits customer transaction information with proper encryption. At the same time, it initiates the validation process to protect small businesses from fraud. Knowing what a payment gateway is and understanding how it works will allow merchants to choose the best payment gateway for their business.