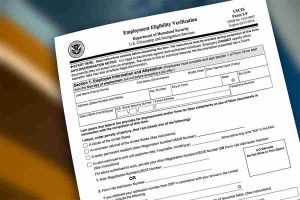

The I-9 form is used to verify a person’s eligibility to work in the US. Workers provide identification, and employers physically verify these documents to confirm the employee’s work eligibility.

I-9 Form: Definition & Legal Requirements (+ Free Download)

What Is the I-9 Used For? The I-9 form supports the Homeland Security procedure to ensure US employers hire employees who have the proper work eligibility and identification documents and should be part of your new hire onboarding process. This differs from a W-4 form, which provides similar information for tax purposes. To be in compliance, the I-9 form…