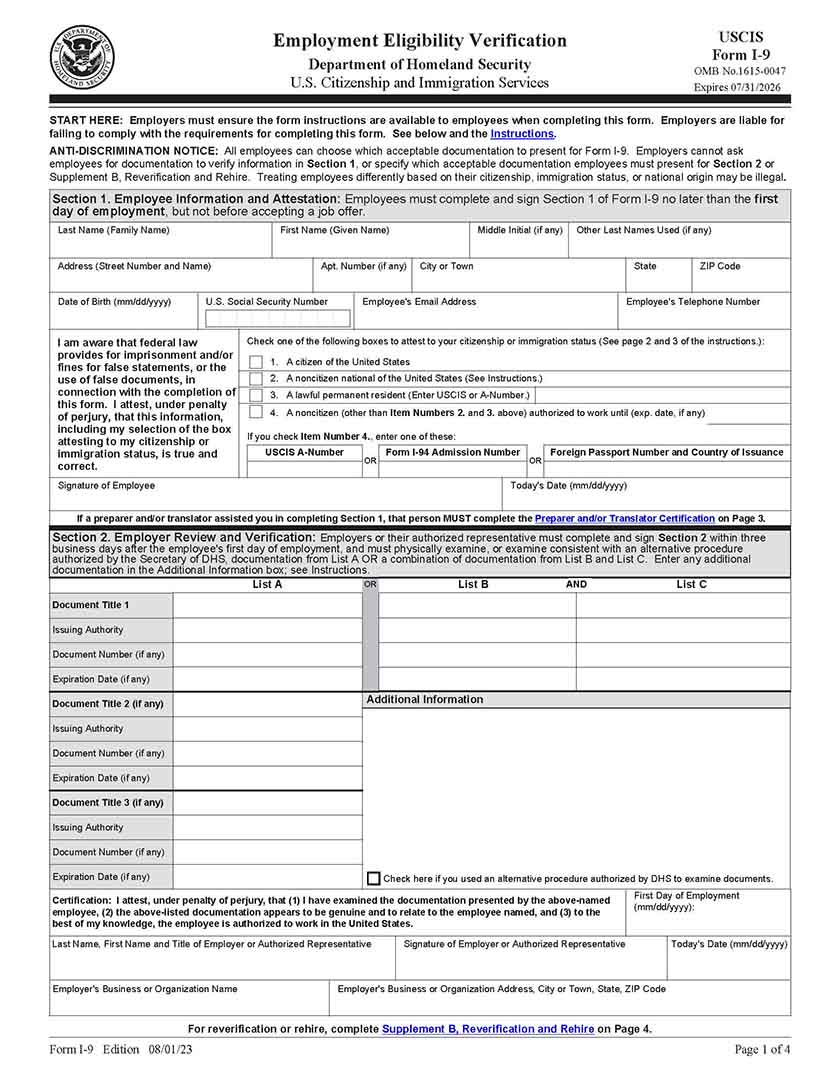

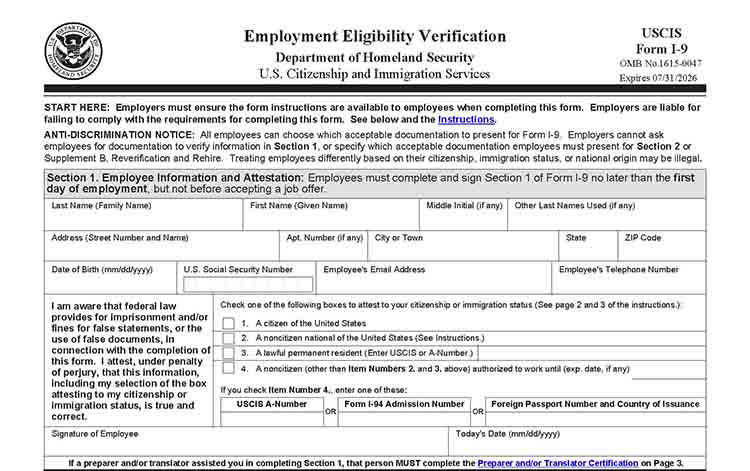

The I-9 form is a Department of Homeland Security (DHS) document used to verify a person’s eligibility to work in the US. Workers provide identification such as a Social Security card and driver’s license or passport. The employer then physically verifies these documents to confirm the employee’s work eligibility. Both employer and employee complete and sign the form.

What’s New on the I-9 Form?

On Aug. 1, 2023, a new I-9 form was introduced. The new form includes all required information on one page, making it easier for employers and employees to complete. Additionally, the form provides clearer instructions and additional guidance.

Thank you for downloading!

From I-9’s to W-2’s, Rippling automatically handles your compliance work and ensures your company is always in compliance with all relevant forms, laws, and regulations so you never have to worry about it.

How the I-9 Form Works

The I-9 form supports a Homeland Security procedure that ensures US employers hire only those who have the proper work eligibility and identification documents. This is different from a W-4 form, which provides similar information for tax purposes.

When employers are learning what an I-9 form is and how it works, it’s important to point out that they are responsible for getting it completed within three days of a new hire’s start date. Therefore, this should be part of your new hire onboarding process.

Here are the basic I-9 form requirements:

- Request ID: New employees must provide ID to complete the I-9 form within three days of hire.

- Verify ID: You physically confirm the employee’s ID as proof of eligibility and document it on the form.

- File the I-9: You keep a copy of the completed and signed I-9 form in a secure folder.

For more information on correctly completing the I-9 form, visit our full article: How to Fill Out an I-9 Form by Section.

Storage & Retention for I-9 Forms

The signed I-9 form should be stored in the company’s business office in case your business is audited or a government agent from the Department of Labor (DOL), DHS, or immigration services requests to see a copy. It should not be kept in an employee’s personnel file due to the confidential information that’s on it. You do not need to send or mail it to any government agency.

The US Citizenship and Immigration Services (USCIS) requires you to retain I-9 documents for one year. Some states may have more extended payroll document retention requirements. It’s risky to keep the documents longer than they’re needed since I-9 forms contain confidential employee information. If that information is used inappropriately, your business may be held liable.

The complete handbook for the I-9 form, called I-9 Handbook for Employers M-274, is available from the USCIS website.

Where to Find Downloadable & Printable I-9 Forms

The most updated I-9 form can be found on the DHS USCIS website. The I-9 form itself is four pages, and the instructions are an additional 8 pages (shortened from the original 14 pages). Both the form and the instructions are available in English and Spanish (however, only employees in Puerto Rico may complete the Spanish version of the form).

Many payroll providers, like Rippling, provide the I-9 form in an electronic new hire packet that is emailed to the employee. Sign up for a Rippling plan and you get the first month FREE!

Paper I-9 forms are another option and can be downloaded from USCIS and handed or mailed to the employee for completion.

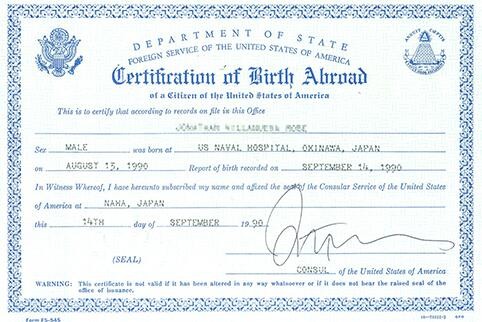

What an I-9 Form Verification Document Is

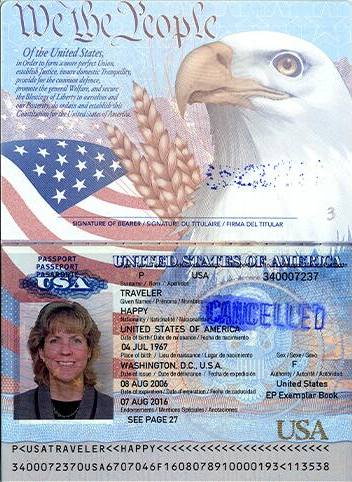

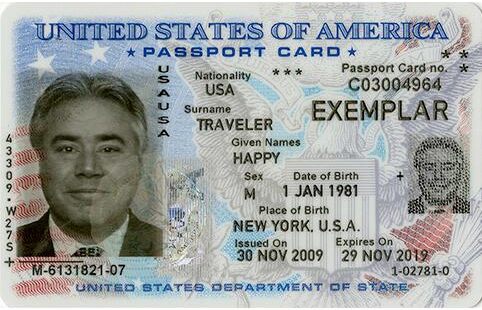

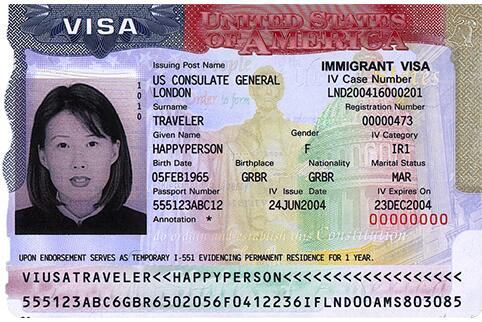

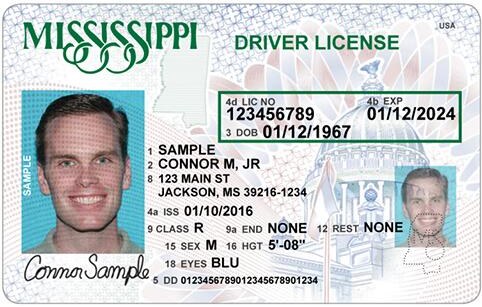

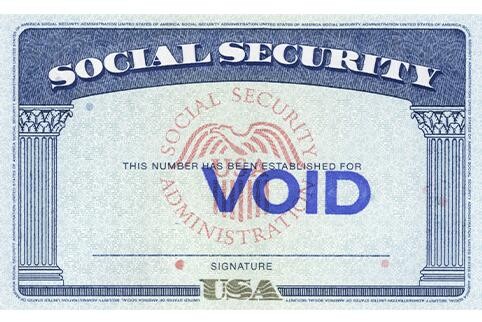

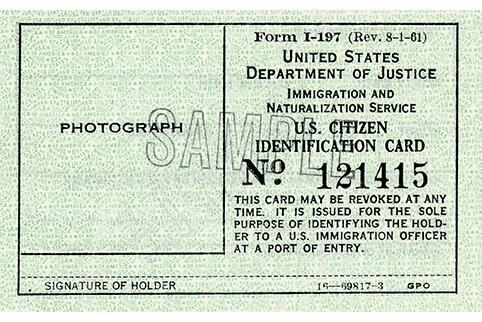

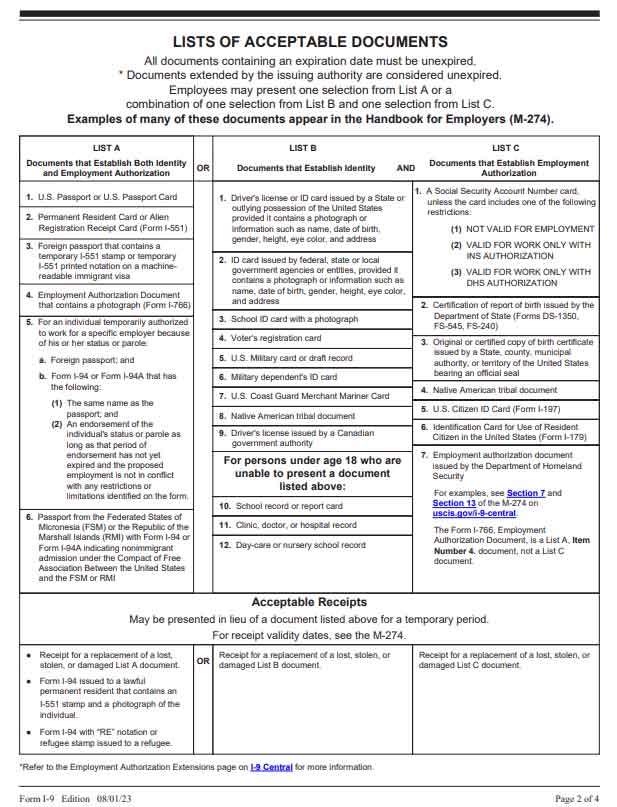

To simplify I-9 verification, USCIS provides a list of acceptable verification documents directly on Page 2 of the I-9 form. Most new hires who are US citizens provide either a driver’s license and Social Security card or a US passport as their I-9 form verification document.

A list of acceptable documents is found on Page 2 of the I-9 form.

A US passport acts as both identity verification and US workforce eligibility, so it serves both purposes in one document. When a new hire presents a valid (not expired) US passport as their I-9 documentation, that’s all you need. No other documentation is required.

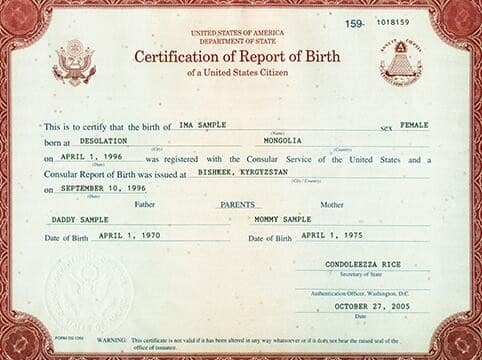

Employees who do not have a valid US passport must provide two forms of work authorization: one from the column on the left and one from the column on the right. A driver’s license and Social Security card are the most common. Additionally, a government-issued document or school, military, or tribal ID will often suffice along with a birth certificate or Social Security card.

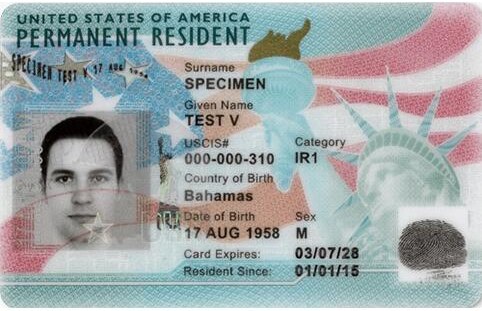

Non-US citizens may need to provide an employment authorization or resident ID card as they are not likely to have a valid Social Security card or a US birth certificate.

I-9 Form Legal Requirements

US employers are required to have each new hire complete an I-9 form. The completed form, verified and signed, should be kept on file for up to three years for any employee currently employed and up to one year for terminated employees. You may need to show these documents to immigration officials or other government employees who may check to make sure your business is only hiring documented workers eligible to work in the US.

There are four kinds of workers who may legally work in the US with proper I-9 documentation:

- US citizens: Including both native-born and naturalized citizens

- Lawful permanent residents: Immigrants who live in the US full time

- Individuals with work authorization: Foreign workers with work permits

- Non-citizen nationals: Individuals working in the US while remaining a citizen of another country

Taking the time to learn what an I-9 form is and how to complete it correctly benefits your business in several ways, primarily if you’re ever audited or raided by the Immigration and Naturalization Service (INS). However, not completing it correctly can wreak havoc on your business.

Why I-9 Forms Must Be Done Correctly | Pitfalls of Not Doing I-9 Forms Correctly |

|---|---|

Labor law compliance: Collecting acceptable documentation keeps your company in legal compliance. | Employee fraud: Accepting unverified paperwork can lead to compliance issues. |

Reduced likelihood of losing workers: Undocumented workers may not show up for work if they fear they’ll be found out and deported. That affects your operations. | INS raids: A surprise visit that causes you to lose much of your workforce. |

Payroll accuracy: You’ll be sure payroll taxes are being sent to the correct IRS account. | Tax issues: Incorrect tax payments and possible tax audits. |

Lower risk of fines or penalties: You’ll have proof that you applied due diligence when hiring, reducing (or eliminating) any chances you’ll be fined. | Lower employee morale: Employees may not appreciate undocumented co-workers. |

I-9 Document Verification

The employer is responsible for physically verifying the documents provided by employees. However, the government doesn’t require you to be a forensic expert. Instead, it expects you’ll use common sense and due diligence when you review documents. For example, if a document appears to be photocopied or modified, ask to see the original document instead.

Employers can also use a government tool called E-Verify to verify work eligibility online and reduce their risk of hiring an ineligible worker. E-Verify is required in some states, as well as required for any business doing federal contract work. In some locations, the use of E-Verify may be a condition of obtaining a business license. If you want to prevent undocumented workers from applying for jobs in your business, consider using an E-Verify logo that alerts job seekers that you’re using the system.

How to Identify & Report Fraud

You may come across falsified identification. The USCIS provides complete instructions on how to examine documents. If you feel that fraud or a scam is taking place regarding immigration documentation, you can report that on the USCIS website. However, immigrants have rights, and one of those rights is not to be discriminated against. If you’re concerned about discrimination, refer to the Justice Department’s webpage on immigrant and employee rights.

Some examples of possible fraud:

- Employee presents a document that is not on the list of acceptable documents.

- Employee presents a document with a different name.

- Employee presents a document with different spelling in the name.

- Employee presents a document that appears to be tampered with.

I-9 Requirements for Remote Workers

When it comes to remote workers and completing the I-9 form, the employer or an authorized representative must physically examine, with the employee present, each document presented. This means that the employee must physically be in front of the person reviewing their documents—reviewing or examining documents via webcam is not permissible.

If someone from your company is not able to physically review a remote employee’s documentation (e.g., if they are located in another state) an authorized representative must review the documents in person.

An authorized representative can be anyone—a friend, relative, etc.—so long as they physically review the documents and sign the I-9 form. If a notary public is used, they act as the authorized representative and not a notary. Therefore, a notary seal on an I-9 will not be accepted.

I-9 Violation Penalties

I-9 violation penalties can cost nearly $5,000. This includes document mistakes, such as failing to complete an I-9 for a new hire, to willful mistakes, such as knowingly hiring illegal workers or falsifying records. Fines can be applied to each I-9 form, and they increase with each offense. For example, if the same mistake is made on 75 employee forms, the fines can add up.

Common Legal Mistakes

If you follow the USCIS instructions and complete I-9 forms for all new hires, you’re likely to be in good shape. However, there are common mistakes that anyone who processes I-9 forms should avoid:

- Allowing employees to provide you with a photocopy instead of an original document

- Not filling out the I-9 form completely—leaving blanks in required fields

- Missing the documentation deadline of filling out the I-9 form within three days of hire

- Failing to verify documentation yourself and just “taking an employee’s word for it”

- Failing to keep copies of the signed I-9 form in an on-site office location

- Failing to store the documents in a secure place to protect confidential employee data

When I-9 Forms Are Not Needed

While all statutory employees (employees whose names and information you send to the state as part of state new hire reporting) need to demonstrate workforce eligibility, you do not need to request or complete I-9 documents for contract workers, temporary staff hired through an agency, domestic workers who work intermittently, or remote employees—often outsourced through a virtual assistant company—who live and work outside the US.

Contract Workers

Freelance employees and contract workers are paid by project or assignment and don’t require that you complete an I-9 form. Instead, you gather data when they complete a W-9 tax withholding form. This option comes with big risks if you misclassify what should be considered an employee as a contract worker instead. For information, check out our piece on W2 vs 1099 workers.

Temporary Staff

Some employers build their business (at least in the beginning) with staff provided by a temp agency. Instead of paying a wage and salary, they instead lease workers from a staffing agency that hires and pays the worker. The staffing agency (not you) manages new hire paperwork and I-9 verification. You instead pay an invoice to the staffing firm—typically a markup of 25% or more.

Intermittent Domestic Workers

Domestic workers, such as house cleaners, childcare workers, or lawn maintenance workers, that work intermittently (not on a regular schedule) are not required to provide I-9 documentation. Additionally, if you employ domestic workers through an agency (i.e., a maid service company), you do not need to complete and verify I-9 documentation.

Virtual Assistant Agency Workers

Virtual assistant (VA) companies hire workers, often overseas, to provide task-based work. As the employer of record, the VA company manages all employee compliance. You simply sign up for the kind of work you need—from office administration to IT programming—and pay a fee based on hours, tasks, or a monthly package price.

I-9 Form Frequently Asked Questions (FAQs)

Who is required to fill out an I-9 form?

An I-9 form is required of all full-time and part-time employees. Any person you pay through traditional payroll methods should fill out the form, including salaried employees, hourly employees, temporary employees (except those hired through a temp agency), and seasonal employees.

Do I need to update I-9 forms when employees have information updates?

When an employee changes their address or their name, you are not required to update the I-9 form you have on file. However, the updated I-9 form does offer a place to update information. This is on Page 4 of the I-9 form, entitled Supplement B – Reverification and Rehire (formerly Section 3). You can use this form if your employee has a name change, requires reverification, or is rehired within three years of the original I-9 signature date.

Do I need a new I-9 form if I rehire a former employee?

If you rehire a former employee within three years of their original hire date, and you have retained their original I-9 form, you do not need to have them complete a new I-9 form. However, if you rehire an employee three years or more after their original hire date, then yes, you need to have them complete a new I-9 form.

Bottom Line

All businesses, small and large, are required to collect acceptable documentation and fill out I-9 paperwork. Once you learn the process, it should come as second nature to you with each new hire. The I-9 form, if completed correctly and within the required timeframe, can save you money by avoiding fines. Take the time to familiarize yourself with what the I-9 form is all about and the requirements before your next hire. Then, consider auditing your current I-9 files to ensure existing forms were done correctly.

If you are in need of a payroll provider, consider Rippling. They will collect and store I-9 forms for you. However, you will still be responsible for physically reviewing documentation. And, if you sign up now, you’ll get your first month FREE – but hurry! Offer ends Dec. 1, 2023.