AccountEdge is locally installed accounting software that lets you create and send invoices to your customers, manage purchases and expenses, and track inventory. Starting at $20 per month, it offers strong value compared with other desktop options I’ve reviewed.

I appreciate its robust banking and inventory features, but it uses a more traditional approach with its flowchart-based navigation. Features are organized within command centers, which may not be that intuitive to those used to cloud-based solutions. However, with some patience and practice, it becomes easy to use and functional. See if it’s worth considering through my detailed AccountEdge review.

Pros

- Locally installed; doesn’t require internet

- Has a hosted version for remote access

- More affordable than similar desktop software

- Manage unlimited company files

- Comprehensive inventory management features

- Department-level reporting

Cons

- Bank feeds require an additional fee

- Traditional flowchart-based interface

- No mobile app

- Additional cost for customer support

Monthly Pricing |

|

|---|---|

Annual Pricing | ✕ |

Free Trial | 30 days; no credit card required |

Standout Features |

|

Ease of Use | Moderate—due to outdated user interface |

Customer Support | Self-help guides, free email support, and live chat (additional $10 per month for phone support) |

Average User Review Ratings |

- Businesses operating in areas with unreliable internet: As locally installed software, AccountEdge doesn’t require the internet to run. This allows you to work and continue on your accounting tasks uninterrupted, regardless of connectivity in your area.

- Companies working with experienced bookkeepers: Given its outdated interface and flowchart-based navigation, the platform can be advantageous for businesses with experienced in-house bookkeepers. They are likely familiar with desktop accounting processes and can effectively navigate and use the platform without needing extensive external support.

- Businesses managing multiple entities: You can add and manage as many company files as needed without any additional fees.

- Companies needing robust inventory management features: AccountEdge provides advanced inventory tracking features, such as the ability to manage inventory across multiple locations and build items and kits.

AccountEdge Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Great when you have accounting experience | Plenty of bugs |

| Customizable reports | Unresponsive customer support |

| Integrates with Shopify | |

Users haven’t left recent AccountEdge reviews as of this writing, but here’s a summary of older feedback, plus my expert insights:

- One user who left a positive AccountEdge review mentioned that it’s a good accounting platform if you have accounting experience. I couldn’t agree more, considering the solution’s complex nature. If you have basic accounting knowledge, you should be able to learn how to use it without much trouble.

- Another reviewer likes that it can generate customizable reports. I explored its reporting feature and agreed that reports can be customized by choosing what data to include. However, I didn’t see any customizations in terms of the look and layout of the reports.

- Someone who left negative feedback complained that there are plenty of bugs whenever a new update is released.

- Other users pointed out that it’s difficult to contact a customer support agent. I can’t vouch for this, but I believe that the quality of support varies depending on the approach of the agent assigned to you.

- Another reviewer appreciates that AccountEdge integrates with Shopify, allowing them to better manage and update their inventory; they can keep their stock levels accurate across both platforms without manual entry.

Here are the average AccountEdge review scores I gathered from top review sites:

The Fit Small Business accounting team formulated an internal case study to see how AccountEdge stacks up against its top three competitors, QuickBooks Online, Zoho Books, and FreshBooks. Below is the result of the case study.

Touch the graph above to interact Click on the graphs above to interact

-

ACCOUNTEDGE PRO $20 PER MONTH

-

QUICKBOOKS ONLINE PLUS $99 PER MONTH

-

ZOHO BOOKS PRO $50 PER MONTH

-

FRESHBOOKS PREMIUM $60 PER MONTH

Based on the chart, AccountEdge’s biggest strengths lie in value (pricing), banking, and reporting. However, it is generally weaker than Zoho Books and FreshBooks in terms of feature set, but it beats FreshBooks in inventory management. Its main drawback is its lack of mobile accounting, which was aced by Zoho Books. Additionally, AccountEdge didn’t do well in terms of overall usability, especially when compared with QuickBooks Online.

AccountEdge is more affordable than most desktop software, making it a cost-effective solution for small and midsize businesses. However, users having to pay an additional fee to use bank feeds and access phone support cost AccountEdge points in my evaluation of the category.

The AccountEdge pricing table below sums up the available subscription options:

AccountEdge Pro | AccountEdge Network Edition | AccountEdge Hosted | |

|---|---|---|---|

Monthly Pricing | $20 | $30 | $50 |

Number of Users | 1 | 2 | 1 |

Deployment Type | Desktop | Desktop | Cloud |

Customer Support | Email | Email | Live chat |

You can also purchase add-ons, including:

- Payroll Process payroll for an unlimited number of employees : $20 per month for unlimited employees

- Telephone support: $10 per month

- Workstation licenses Allow installation on multiple computers, either for simultaneous access or for installation on additional devices : $10 per month

- Bank feeds Connect to an unlimited number of bank and credit card accounts : $5 per month

- AccountEdge Connect Enter sales, purchases, and time entries online and sync them to the desktop version : From $15 per month

- AccountEdge WebPay Send a payment link to customers where they can easily process payments : Included in AccountEdge Connect

- Credit Card Processing Accept credit card payments via the AccountEdge software, AccountEdge Connect, or WebPay : From 1.79% per transaction

- Customized business checks and forms: Custom-priced

AccountEdge falls short in some essential areas. For instance, it doesn’t allow me to import beginning balances into the system, which could be important if I transition from another accounting software. This limitation can cause additional setup time and possible inaccuracy during transition. Also, I can’t give my accountant direct access to my data unless I upgrade to the hosted version, which adds to the overall cost.

However, the program provides the necessary tools I need to set up my company files effectively. I can manually enter the initial balances of my accounts and import my chart of accounts directly into the software. During setup, I could customize various aspects of my company file, including setting up my business details—like company name, address, and contact information.

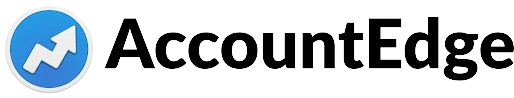

I would have awarded AccountEdge a perfect mark if bank feeds had been free and the bank reconciliation process had been more streamlined. When reconciling transactions, I can’t pause and resume my work without losing progress—something I can do with most modern cloud software like QuickBooks Online.

Additionally, the bank statement details are not shown alongside my accounting records and are instead accessed by clicking the Bank Statement button. This requires more manual toggling, as compared with other software like Xero, which displays a side-by-side view of your bank statement and accounting records for easier matching.

Bank reconciliation in AccountEdge

Despite AccountEdge’s weaknesses, the platform provides many useful tools to help manage bank transactions, including receiving payments, entering deposits, tracking petty cash expenses, and transferring money between accounts. You can import your transactions manually if you don’t want to connect your bank or credit card accounts.

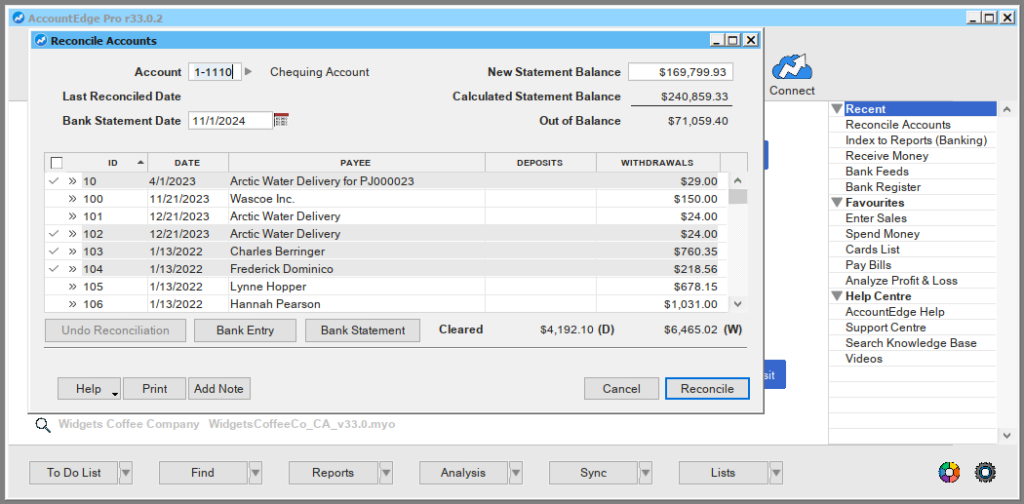

The program has good A/P management features, but I encountered some issues. For example, it doesn’t allow me to capture expense receipts, which I can do in most cloud-based software like QuickBooks Online.

And while I can pay bills directly from the software, the Pay Bills screen only allows me to pay vendors by check or electronic payments. If I need to pay a bill using a credit card, I need to enter the bill payment through the Spend Money screen in the Banking module.

Pay bills in AccountEdge

To help track outstanding bills, you can use the Purchases register, which shows a list of all A/P transactions, including quotes, orders, open bills, and closed bills. Click on the Open Bills tab to show the outstanding bills you owe to your vendor.

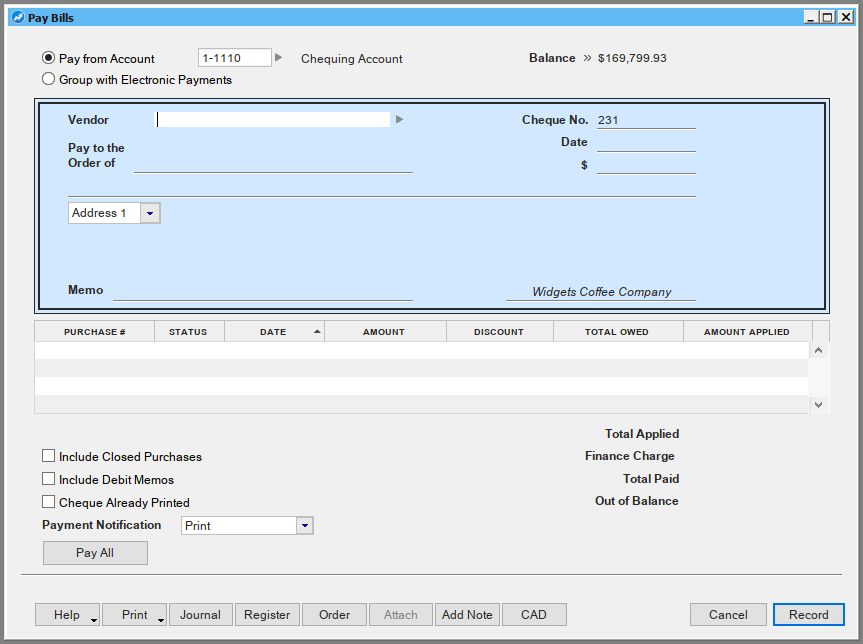

AccountEdge took a slight hit in my evaluation of A/R management because the invoicing process isn’t that streamlined and lacks some advanced A/R features, such as a vendor portal. I also don’t find the invoicing process smooth. For example, I have to use two different screens for creating and emailing or printing the invoice.

To create a new invoice, I need to use the Enter Sales window and then switch to the Print/Email invoices window to send or print the invoice. I prefer to use QuickBooks Online since the invoicing screen allows me to directly email the invoice to my customer or print it if needed. Also, I don’t see a preview button, so I don’t know how my invoices look when emailed to customers.

Emailing invoices in AccountEdge

Additionally, invoices in AccountEdge aren’t that professional-looking. I was able to upload my company logo and choose from several default forms—but I couldn’t change the invoice color and personalize the customer message.

However, I still like many things about AccountEdge’s A/R features. For example, it allows me to easily track outstanding invoices and run aging reports to identify customers behind on payments. I can also use it to bill clients for advanced payments, track retainer balances, and apply retainers to future invoices.

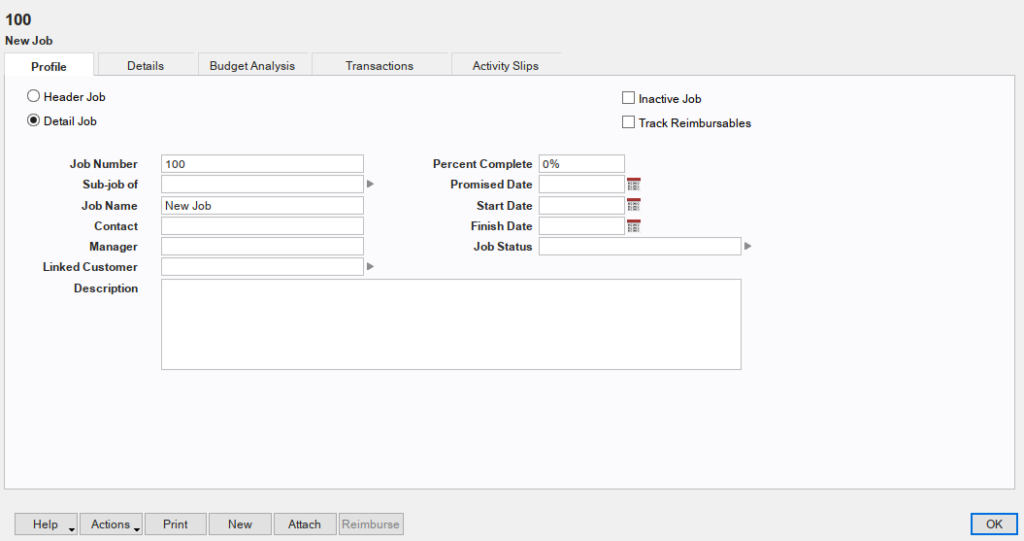

AccountEdge took a hit in my evaluation of project accounting features primarily because it doesn’t allow users to create estimates—which are an essential part of project management. Also, there’s no dedicated command center for project management. To create a job or project, you need to click on Jobs under Lists from the menu bar located at the top of the screen.

However, it offers some features that—while not part of my evaluation—are commendable and provide value to users. For instance, it allows me to set up project templates with cost and revenue budgets, log expenses and time entries against projects, generate profitability reports, and bill clients from project records.

Creating a new job in AccountEdge

You can create and manage sales taxes in AccountEdge, but you have to manually set up sales tax codes for various tax rates and jurisdictions. This is acceptable, but I would have appreciated it more if the platform could automatically calculate sales tax rates based on the customer’s location.

Additionally, you can’t pay sales tax electronically or file sales tax returns through the software. This means you must handle these tasks manually or through another platform.

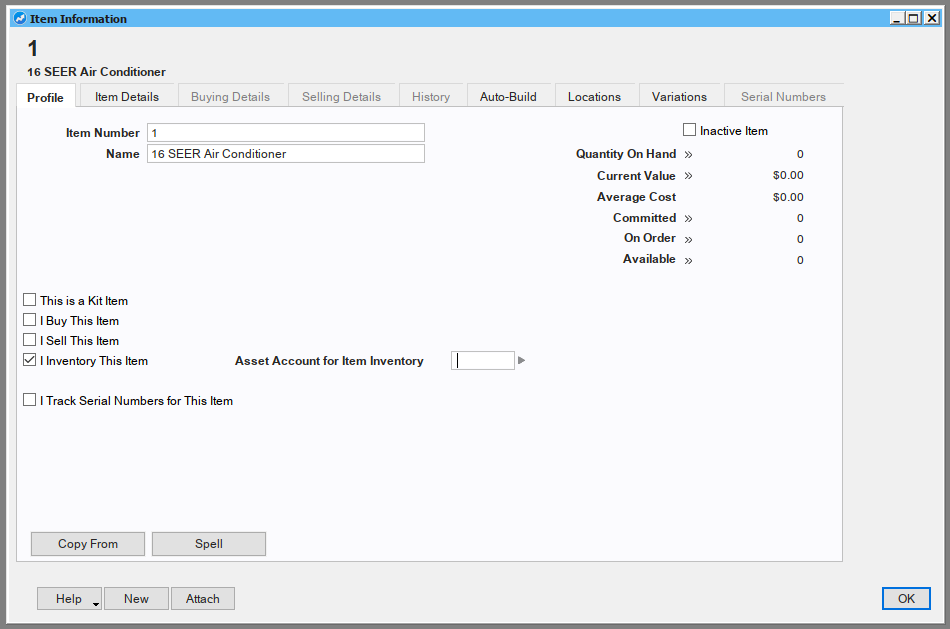

The only downside I found in AccountEdge in terms of inventory management is that I can’t view inventory levels on purchase orders. This can cause problems like overordering and stockouts. Despite this weakness, there are many inventory management features I love in AccountEdge. It allows me to track and monitor the COGS, set up pricing based on average or last cost, and make adjustments if needed.

You can create a new inventory item using the Items list window under the Inventory command center. When you create an item, you can choose to buy, sell, or inventory the item. If you have bundled products or assemblies where multiple components are sold as a package, you can also create a kit item.

Adding a new inventory item in AccountEdge

It also provides advanced tools, such as the ability to track inventory by location and build items and kits for businesses that purchase and sell bundled packages. You can also run reports on inventory status, valuation, location-specific stock levels, and pricing analysis.

AccountEdge is by far the best value I’ve found for accounting software that includes solid inventory accounting. Most value-minded software will not separate your inventory costs into COGS and cost of inventory on hand.

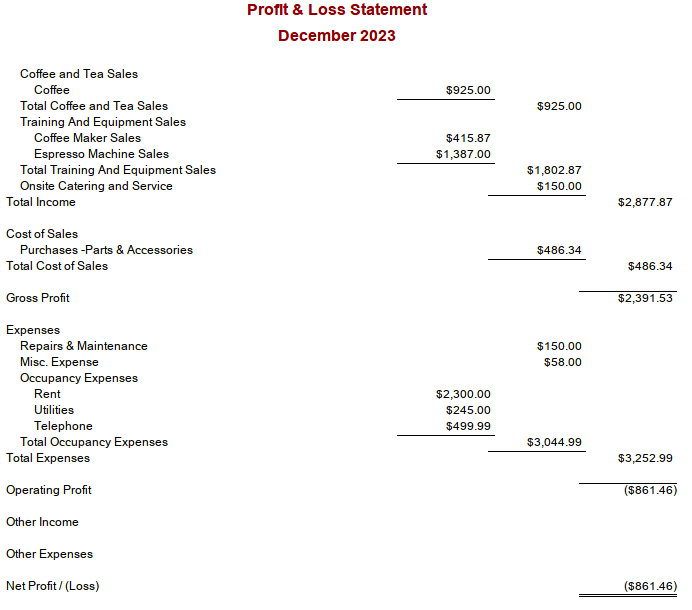

The range of available reports in AccountEdge is impressive. I can generate detailed financial statements, P&L reports, balance sheets, A/P and A/R aging reports, and more. Also, I appreciate that it offers department-level reporting, which lets users track their business by different attributes, such as product lines and locations where your business operates.

While I appreciate the overall reporting functionality, I hope the provider considers making its reports more visually appealing and professional. When I created a sample report, the output wasn’t as polished as I had hoped.

Sample Profit & Loss Report in AccountEdge

AccountEdge has no dedicated mobile app, which isn’t surprising given that it’s a locally installed software. If mobile accounting is important to you, consider Zoho Books, which leads our roundup of the best mobile accounting apps.

The only reason AccountEdge didn’t ace this criterion is that it has no sales tax integration. This would have been a huge feature for those who need automated sales tax calculations and compliance.

However, it still provides built-in and third-party integrations for many core business functions, like payroll, electronic bill pay, and time tracking. For example, it has a built-in payroll integration, which lets you manage unlimited employees. Additionally, the AccountEdge Connect integration enables your customers to pay you online.

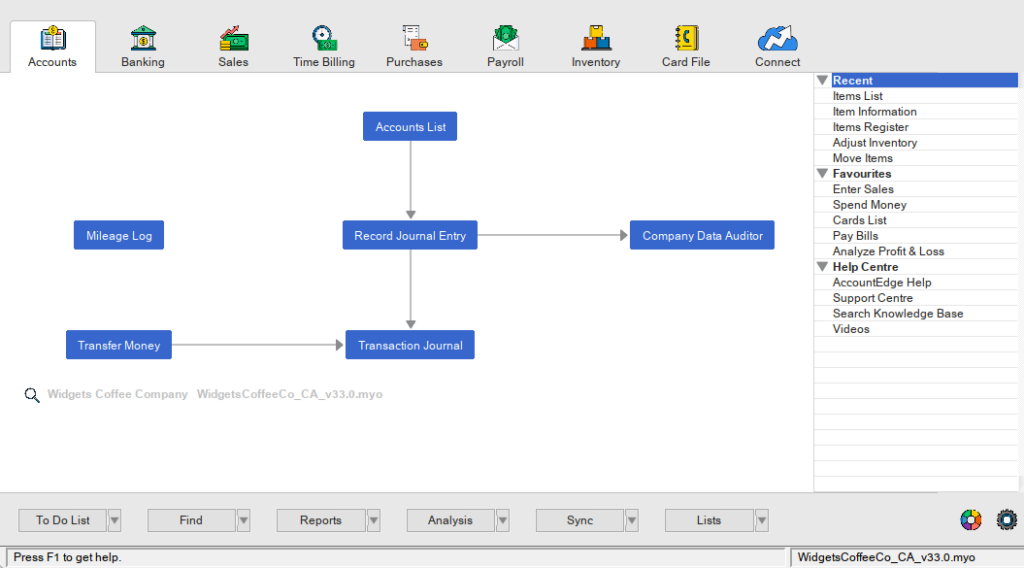

I evaluated AccountEdge’s usability based on four sub-categories: ease of setup, ease of use, customer support, and the availability of bookkeeping assistance.

AccountEdge has a New Company File Assistant wizard that helped me set up my company. I was able to quickly set up my company file, but I wish there was also an option to enter a beginning balance, which would have been helpful if I was transitioning from another accounting system. Also, I had to install the system first, making the setup process a bit time-consuming.

Many users may find AccountEdge’s UI outdated compared with modern, cloud-based accounting software. The interface relies on flowcharts and desktop-based navigation, which can feel less intuitive for new users.

Also, some of the features aren’t that intuitive. For example, when I first created an item, I didn’t figure out why the name field was locked right away. It turns out that I needed to enter the item number first and press Enter before I could add the name and other details.

Here’s what AccountEdge Pro’s dashboard looks like:

AccountEdge’s dashboard

AccountEdge scored poorly in customer support, as users only have access to email support. If you wish to talk to an agent over the phone, then you have to pay an additional fee of $10 a month. Given its complexity, it’s highly likely that new users will require phone support to navigate through the platform and troubleshoot issues.

If you aren’t willing to spend extra, you can talk to customer support via live chat or browse through AccountEdge’s online resources. For minor issues, you might appreciate the vast number of resources available online, from setup guides to troubleshooting tips and videos.

There’s an AccountEdge directory where you can find experts for bookkeeping support, but there are only around 40 of them. These options may be enough for some, but I wish it were more extensive, similar to QuickBooks Online ProAdvisors, which consists of thousands of certified experts. Additionally, it would be beneficial if the provider considered adding a built-in or integrated bookkeeping service for users.

How I Evaluated AccountEdge

The Fit Small Business accounting team developed an internal rubric to evaluate small business accounting software. I used that to assess AccountEdge’s value, features, usability, and more.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

Yes, and you can do so by purchasing the hosted version, AccountEdge Hosted, which is available for $50 monthly per user.

Yes, it allows you to manage unlimited company files.

Yes, it includes integrated payroll, which costs $20 per month for unlimited employees.

Bottom Line

If you are looking for affordable desktop accounting software with a powerful feature set, I recommend considering AccountEdge. It’s a solid choice, especially if you are working with an experienced bookkeeper who is comfortable navigating its complex user interface.

User review reference:

[1]Software Advice

[2]G2