QuickBooks Online and time tracking system integrations make it easy for you to get employee time data to manage client invoicing, labor costs, business expenses, and accounting ledgers. The best time tracker integrations for QuickBooks Online not only allow seamless data syncs between software but also provide access to solid solutions for capturing and monitoring the actual hours that employees spend working on tasks and projects.

There are dozens of time tracking software that integrate with QuickBooks Online. We evaluated 16 popular options and narrowed them down to our top five picks:

- ClockShark: Best for construction businesses

- QuickBooks Time: Best for QuickBooks users who want seamless client billing

- Homebase: Best for multilocation companies with hourly employees

- Timesheets.com: Best for employers needing an affordable time tracker

- Time Tracker by eBillity: Best for professional service companies

Top Time Tracking Integrations for QuickBooks Online

Aside from capturing and monitoring employee work hours, all of the software we reviewed come with staff scheduling, alerts and reminders, basic reporting, paid time off (PTO) tracking, and user permission settings. Here are some of the key features and pricing details.

Our Score (out of 5) | Free Plan | Starter Monthly Pricing | Key Features | |

|---|---|---|---|---|

| 4.34 | ✕ | $8 per user + $40 base fee |

|

4.27 | ✕ | $8 per user + $20 base fee |

| |

4.24 | For one-location businesses with up to 20 employees | $24.95 per location |

| |

4.18 | For one freelancer | $5.50 per user |

| |

4.11 | ✕ | $12 per user + $20 base fee |

| |

If you want to know more about QuickBooks Online and its plans, check out our QuickBooks Online plan comparison to help you gauge which one is best for you. You can also read our What Is QuickBooks guide to learn about the different accounting features that it offers.

ClockShark: Best for Construction Businesses

Pros

- Has a 14-day free trial

- Is generally easy to learn and use

- Supports multiple client payment options (such as cash and card)

- Has offline time tracking

Cons

- Can get pricey, if you have 20 or more employees

- Onlys offers PTO tracking and advanced job costing controls in premium tier

- Requires a dedicated time tracking device for clock-ins with facial recognition scans

Overview

Who should use it:

ClockShark is one of our top time tracking solutions, especially for those in the construction industry, as it helps business owners track their field employees’ work hours, locations, client jobs, and schedules. It can capture worker clock ins/outs via its iOS and Android apps, but its time clock kiosk feature lets you designate a mobile device as your team’s centralized time tracker.

Why I like it:

Like most of the providers on our list, ClockShark supports multiple clock-ins, including a facial recognition option, which can help eliminate time theft and prevent buddy punching. You can use ClockShark’s client invoicing and payments features, but integrating the software with QuickBooks Online allows you to use Intuit’s accounting solution to do the same and more, such as track your business’ cash flow and monitor expenses. And, if you get QuickBooks Payroll, you can use it and ClockShark’s time data to pay employees.

- Free trial: 14 days

- Free plan: None

- Paid plans:

- Standard: $40 base fee + $8 per user monthly

- Pro: $60 base fee + $10 per user monthly

- Annual subscription option: None

- Customer job quotes, invoices, and payments: What sets ClockShark apart from the other providers on our list is its capability to create and send customer job quotes directly from its platform. You can also bill customers based on the actual hours that your staff worked on the job, as well as accept online payments.

- Offline time tracking: Your field staff may be assigned to areas where the internet connection is unstable or unavailable. In such cases, they can still use ClockShark’s mobile apps to clock in or out and add job notes. The system will sync the data with your dashboard once the internet connection has been restored.

- GPS tracking with breadcrumb trail: Similar to QuickBooks Time, ClockShark’s GPS functionality not only tracks your employees’ location while doing fieldwork, but it also provides a bird’s eye view of their job locations throughout the day.

- Easy integration: Connecting the two software only takes a few minutes. Once the integration is complete, you can export employee timesheets to QuickBooks for job costing, invoicing, and even payroll (if you have QuickBooks Payroll). ClockShark also imports your customer, employee, and service data (if available) from QuickBooks Online to its platform. This prevents potential errors from manual inputs and data reentries.

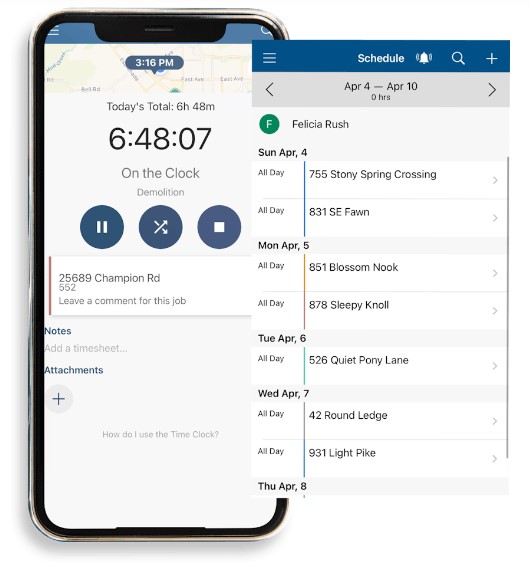

ClockShark lets your workers clock in or out, check schedules, add notes about client jobs, upload attachments, and more. (Source: ClockShark)

ClockShark topped our list of best time tracker integrations for QuickBooks because of its solid time tracking features, stellar ease of use, and excellent customer service. It has a support team that you can contact any day of the week (QuickBooks only offers weekday support). Those who left feedback on review sites, such as G2 and Capterra, even said that its support reps are very responsive (the quality of QuickBooks customer service is inconsistent). The software is also one of the highly-rated time tracking apps on QuickBooks’ marketplace (4.5 vs QuickBooks Time’s 4 out of 5 score as of this writing), with very few user complaints about data sync issues and integration errors.

QuickBooks Time: Best for QuickBooks Users Who Want Seamless Client Billing

Pros

- Offers seamless integration with QuickBooks Online and other Intuit products

- Has multiple time tracking options (via web browsers, mobile apps, and a time kiosk)

- Has client invoicing and mileage tracking tools

- Has unlimited live phone and chat support

Cons

- Can get expensive because you have to pay for several QuickBooks products (accounting, time tracking, and/or payroll if you need it)

- Includes geofencing, project monitoring, timesheet signatures, and mileage tracking in highest plan

- Has facial recognition clock-ins that only work on the time kiosk

- Has inconsistent customer support quality

Overview

Who should use it:

If you want seamless data transfers between time tracking and accounting software, then QuickBooks Time may be right for you. Data imports between Intuit solutions are easier, with automatic time data transfers for client billing and even pay processing (if you have QuickBooks Payroll).

Why I like it:

The easy connection between Intuit products is one of the reasons why I like the QuickBooks Time integration. Plus, upgrading to its Elite plan unlocks mileage tracking and project monitoring features, including an electronic signature tool for digitally signing timesheets.

However, QuickBooks Time didn’t get the top spot on our list because of the inconsistent quality of service that its support team provides and the occasional software glitches reported by actual users on review sites (such as G2 and Capterra). Support hours are also limited to weekdays, whereas ClockShark offers phone and chat support the whole week through.

In addition, it isn’t as affordable as some of the providers on our list. You have to shell out at least $20 plus $8 per employee monthly for QuickBooks Time, whereas Timesheets.com only costs $5.50 per employee monthly.

- Free trial: 30 days (new clients can choose a free trial or get 50% off base fees for the first three months)

- Free plan: None

- Paid plans*:

- Premium: $20 base fee + $8 per employee monthly

- Elite: $40 base fee + $10 per employee monthly

- Annual subscription option: None

*Requires QuickBooks Online

- Flexible time tracking: Similar to Timesheets.com, QuickBooks Time offers versatile time tracking options that not only count down the number of hours employees spent on a client project but also record your workers’ actual clock-in and -out transactions. This is great if you want to track billable hours to charge customers or monitor staff attendance for pay processing.

- Geolocation tracking with breadcrumbs trail: Similar to ClockShark, its mobile GPS tracking feature logs the locations where your employees clock in or out for work and also offers a breadcrumb trail of where they went during a work day. This makes it easy for you to see who is working and where your field staff are at any time during their shift (except break times).

- Project time tracking: With QuickBooks Time, you can track hours worked on projects and the different tasks linked to specific projects. Comparing budgeted work hours with actual attendance data is also easy with its reporting tools that let you drill down data to jobs, tasks, and employees. It even has an in-app project activity feed that you and your team can use to share task updates and upload photos as proof of the completed job (if needed).

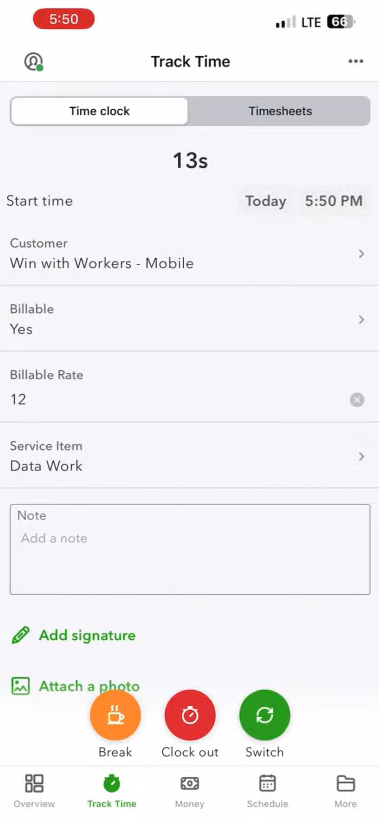

With QuickBooks Time, your employees can clock in and switch between work projects. (Source: QuickBooks Time)

Homebase: Best for Multilocation Businesses With Hourly Employees

Pros

- Offers a 14-day free trial and a free plan for one-location businesses with up to 20 employees

- Has paid time tracking plans with unlimited employee seats

- Has scheduling, time tracking, hiring, communication, onboarding, and payroll tools

- Has multiple time tracking options; via web browsers, mobile apps, and point of sale (POS) systems

Cons

- Only offers team communication, PTO tracking, hiring, onboarding, labor cost controls, and compliance solutions in paid plans

- Lacks client invoicing tools; you need to upgrade to at least QuickBooks Online’s Essentials tier if you want invoicing features

- Has occasional overtime data sync issues reported by user

Overview

Who should use it:

Unlike the other time tracker integrations for QuickBooks we reviewed, Homebase doesn’t charge on a per-employee basis—instead, monthly fees are based on the number of work locations you have. Plus, it logs the actual time when workers clock in and out for work and computes the total hours minus break times. This makes Homebase a perfect fit for multilocation businesses that employ mostly hourly workers.

Why I like it:

If you connect Homebase with QuickBooks Online, you can easily export employee work hours for client invoicing while avoiding data entry errors. Even if you decide to use Homebase’s payroll add-on to pay employees, its integration with QuickBooks allows you to efficiently update your labor costs and general ledgers. If you prefer to use QuickBooks Payroll to process employee payments, Homebase lets you get information about its employee time cards (with break, overtime, and PTO details) for payroll.

Users who left Homebase reviews on G2 and Capterra also appreciate its ease of use and depth of features that extend to more than time tracking and staff scheduling (it even has hiring tools). However, some users reported overtime data sync issues between Homebase and QuickBooks. And if you need live phone support, you have to upgrade to its paid tiers (email-only support available for all plans).

- Free trial: 14 days for its All-in-One plan

- Free plan: Basic package ($0) for one-location businesses with up to 20 employees

- Paid plans:

- Essentials: $24.95 per location monthly

- Plus: $59.95 per location monthly

- All-in-One: $99.95 per location monthly

- Add-on solutions:

- Payroll: $39 + $6 per employee monthly

- Job post boosts: Starts at $79 per job post

- Annual subscription option: Save 20% if you commit to an annual plan (note that yearly fees are paid in a lump sum and upfront)

- Free plan: For one-location businesses without any immediate plans to grow their workforce to more than 20, Homebase’s free plan is a good option. It comes with the basic time tracking tools you need to capture and monitor attendance and also integrates easily with QuickBooks Online to help you bill clients and track payments.

- Feature-rich HR platform: In terms of HR functionality, Homebase’s platform is more feature-rich than the others on our list. The other software we reviewed mostly offer employee attendance and scheduling tools. It lacks the job posting, applicant tracking, and new hire onboarding solutions that Homebase offers.

- Robust compliance and time controls: Homebase, which is one of our top time and attendance software, is the only provider in this guide that comes with robust controls for preventing early clock-ins and overtime. It even lets you limit the number of employees who can file PTO for specific dates and identify blackout dates for days when PTO isn’t allowed. It can also track employee certifications, timesheet edits, and federal and local breaks or overtime rules to help you stay compliant.

- Integrated payroll tool: While payroll is a paid add-on to Homebase’s main time tracking and scheduling platform, this solution is slightly cheaper than QuickBooks Payroll ($39 + 6 per employee monthly vs $50 + $6 per employee monthly). Plus, the transfer of employee time data is more seamless between Homebase products.

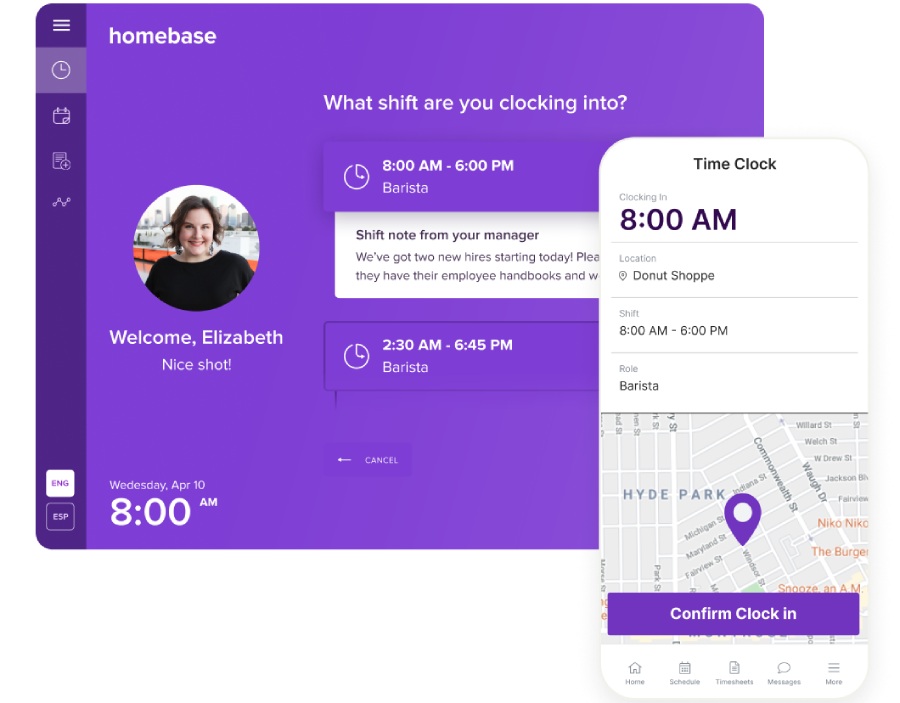

Homebase lets you track employee attendance from any web browser and mobile device. (Source: Homebase)

Timesheets.com: Best for Employers Looking for an Affordable Time Tracker

Pros

- Has a 30-day free trial and a free plan for one freelancer

- Has project timesheets that can track job costs, client bill rates, and grant allocations

- Has live phone, chat, and email support

- Offers document management tools that help store your HR files, annual performance reviews, and other employee-related forms

Cons

- Has an interface that looks a bit dated

- Has some features that aren’t intuitive (requires several clicks)

- Lacks geofencing capabilities (only limits clock ins/outs based on IP addresses and not by location)

Overview

Who should use it:

While there are different ways that you can track employee hours, Timesheets.com offers the basics for capturing time data—via employee clock ins/outs or an online timer for tracking the number of hours worked. Aside from tracking time, it has staff scheduling, PTO monitoring, and even mileage and expense monitoring tools. Its monthly rate is also less expensive than the other time tracking QuickBooks integration options in this guide, with its basic plan costing only $5.50 per user ($4.40 per user for nonprofit organizations).

Why I like it:

Online timesheets are available to help you keep track of staff attendance, job costs, bill rates, and even grant allocations (none of the software we reviewed can monitor grants for nonprofits). Integrating it with QuickBooks Online helps you send client invoices, monitor customer payments, and update your accounting ledgers. If you have QuickBooks Payroll, you can use its employee attendance data to process salary payments and mileage and expense reimbursements.

However, its mobile apps only have geolocation tracking features. Unlike the other providers in this guide, it doesn’t prevent clock ins/outs from unauthorized locations—you can only limit the transactions based on IP addresses. You may also have to deal with occasional software issues. Users who left Timesheet.com reviews on G2 and Capterra reported having experienced system glitches and errors when downloading reports.

- Free trial: 30 days

- Free plan: Freelancer plan ($0) for one user

- Paid plans:

- Standard: $5.50 per user monthly

- Nonprofit: $4.40 per user monthly (for nonprofit organizations)

- Add-on solutions: Photo timestamps for $1 per user monthly

- Annual subscription option: Yes, with slightly lower rates (note that yearly fees are paid in a lump sum and upfront)

- Solid time tracking: While its interface may not be as intuitive or look as modern as the others on our list, it has solid solutions for tracking employee attendance, billable hours, and worker location. GPS punches are enabled for its mobile apps, and if you purchase its photo timestamp add-on, you can use facial recognition scans to verify employee clock ins/outs. It also keeps track of timesheet edits and any state-mandated PTO rules to keep you compliant.

- Easy integration setup: Connecting Timesheets.com with QuickBooks Online is generally simple to do. Plus, as of this writing, there are no user-reported data sync and integration errors posted on the QuickBooks app marketplace.

- Good customer support: Most of the reviewers who left feedback on G2 and Capterra said that the provider offers excellent customer service. Even those who shared reviews on the QuickBooks app marketplace said that its support team is helpful and responsive.

- Document storage: What makes Timesheets.com unique from the other time tracking solutions we reviewed is the additional employee management feature included in its document management tools. Aside from securely storing annual performance reviews, incident reports, employee application forms, and other HR- and worker-related documents, it allows you to create staff termination notices and save your notes in its online employee profiles.

Timesheets.com lets your workers clock in/out via computers, tablets, and smartphones. (Source: Timesheets.com)

Time Tracker by eBillity: Best for Professional Service Businesses

Pros

- Has a 14-day free trial

- Has staff scheduling, time tracking with automatic reports, and project monitoring tools

- Has offline time tracking

- Includes legal features in its LawBillity plan

Cons

- Can get pricey if you have 15 or more employees

- Only offers project and expense tracking, job costing, invoicing, legal features, and the client portal in higher tiers

- Has occasional software glitches reported by users

Overview

Who should use it:

Time Tracker by eBillity is designed for professional service businesses, such as those providing legal, accounting, and marketing services. Aside from tracking your workers’ billable hours, it can handle staff scheduling and project monitoring, as well as GPS tracking via its mobile apps. It even offers a client portal, which your customers can use to monitor project progress, view invoices, and process payments online.

Why I like it:

While Time Tracker by eBillity may have invoicing and payment features, integrating it with QuickBooks Online makes updating your general ledgers easy for accountants. You can also opt to use QuickBooks’ client invoices and payments tools for seamless bookkeeping since QuickBooks will only need to get your actual hours worked from Time Tracker by eBillity to handle invoicing and accounting processes.

However, you have to upgrade to its higher tiers to get additional features, such as project tracking, job costing, and client billing. Like most of the software on our list, users who left feedback on G2 and Capterra said that its platform glitches from time to time. A few users on QuickBooks’ app marketplace also reported having experienced integration issues between Time Tracker by eBillity and QuickBooks Online.

- Free trial: 14 days

- Free plan: None

- Paid plans:

- Time Tracker: $20 base fee + $12 per user monthly

- Time Tracker Premium: $27.50 base fee + $18.75 per user monthly; comes with additional project, expenses, and billing tracking features

- LawBillity: $37.50 per user monthly; includes additional legal features, such as trust account payments, invoices in legal format, and a conflict checker

- Annual subscription option: Save 20% if you commit to an annual plan (note that yearly fees are paid in a lump sum and upfront)

- Client portal: Aside from the legal features, the branded client portal that it offers makes it easy for customers to see project task updates online. Invoices can be sent directly through the portal, and your customers can use it to send payments online. However, the client portal and legal features are only available in its higher tiers.

- Global payments: Time Tracker by eBillity’s integration with Stripe lets it accept client payments from major debit and credit cards. It can even handle global payments through WeChat Pay and Alipay. None of the providers we reviewed offer international payments.

- Automatic reporting: You get standard and detailed reports to help you view and track employee attendance, job costs, and labor forecasts. With its autoreporting feature, you can set it to generate and email reports based on specific rules, such as sending the system administrator a user time entry report every first of the month.

- Offline time tracking: Similar to ClockShark, if your workers are in an area where the internet connection is unstable, Time Tracker by eBillity will still record their clock ins/outs and then update its main system once the internet connection has been restored.

Time Tracker by eBillity’s time kiosk solution supports facial recognition clock-ins. (Source: Time Tracker by eBillity)

What to Consider When Selecting a Time Tracking QuickBooks Online Integration

In selecting the time tracking software that integrates with QuickBooks Online, consider the following factors:

- Ease of setup and use: In addition to checking if the time tracking software has a user-friendly platform, you should look for solutions that easily integrate with QuickBooks Online so you can start using its features right away. Unless you have an in-house IT team, avoid those that require technical expertise or customizations to make the basic integration work.

- Your business needs: Take stock of the time tracking features your business needs, including the time data that you want to incorporate into QuickBooks Online. Let’s say your firm offers professional services, it’s best to get a time tracking system with an online timer for monitoring billable hours instead of one that only logs the time when your workers clock in or out.

- Pricing: Look for providers that offer transparent pricing so you don’t get billing surprises for additional fees that aren’t included in the original quote. Bear in mind that you may need to pay for two separate providers—the time tracking software and QuickBooks Online—so be sure to check your budget.

- Integration capabilities: Evaluate the extent of integration the solution offers. Also, check if it correctly syncs timekeeping data with QuickBooks Online. You can do this by looking at user reviews posted on review sites (like G2 and Capterra) or on the QuickBooks Online app marketplace.

- Customer support: In case you have questions about its features or encounter software issues, having access to phone support will make contacting the provider’s support team easier for you. Be sure to check the support team’s availability and the customer service quality offered by the provider.

How We Chose the Best Time Tracking Integration With QuickBooks Online

To find the best time tracker integrations for QuickBooks, I checked the QuickBooks Online app marketplace to view the list of time tracking software providers that connect with its platform. I considered the ease of integration and looked at user reviews that mention data sync errors and other integration errors.

In addition, I looked for attendance monitoring and scheduling features, including client invoicing, geolocation and geofencing tools via mobile apps, and customer support options. I also compared each software’s ease of use and pricing information.

Click through the tabs below for a more detailed breakdown of the evaluation criteria.

20% of Overall Score

I looked for providers with a free plan and transparent pricing for its paid tiers. Extra points were given to those with paid subscriptions that are priced at $10 or less per employee monthly.

25% of Overall Score

I evaluated each time tracking software based on its ability to track time for specific clients or projects. Plus points were given to those with break options and PTO tracking, staff scheduling and client invoicing, time controls to limit early clock-ins and overtime, and a self-service portal to view attendance data.

20% of Overall Score

I checked if the time tracking software is one of QuickBooks Online’s partner systems (as of this writing). I gave additional points to those that easily integrate with QuickBooks and have very few user-reported data sync errors.

15% of Overall Score

I looked for providers with live phone support and a customer service team that’s available 24/7. Additional scores were given to those whose support teams are easy to contact.

20% of Overall Score

I choose tools that are intuitive and easy to learn, with very few to zero user-reported software glitches. I even considered online user reviews from popular review sites like G2 and Capterra; any option with an average of 4-plus stars is ideal. Also, any software with 1,000-plus reviews on any third-party site is preferred.