The process of purchasing an existing business can be quite daunting, especially if it’s your first time. Our guide to buying a business will go over the entire process of acquiring a business—from choosing the right one and evaluating all the necessary information, to financing the purchase and closing the deal. Read on to examine the steps in detail, including:

- Choose What Kind of Business to Buy

- Create a List of Potential Businesses to Buy

- Evaluate Business Price and Other Costs

- Do Your Due Diligence

- Secure Capital

- Prepare Documents for Closing the Deal

Step 1: Choose What Kind of Business to Buy

Buying a business starts with choosing the best possible one to purchase—and that will depend on both practical factors and personal preferences. Here are some details you need to examine when choosing a business to buy.

Cash Flow and Profitability Potential

Before anything else, any business you are considering purchasing needs to have good cash flow or at least a strong potential for profitability based on hard data. You are aiming to buy a business, not start a hobby, hence profitability needs to be a top priority. Also consider the business’ long-term projections and viability; if it is doing fine at the moment but shows signs of being unsustainable, then buying it now could only result in losing investments over time.

When gauging a business’ profitability, look at its net profit margin to begin with. This is simply the total yearly revenue minus the total yearly expenses. The business’ Profit and Loss Statement should provide you a broad look at this information.

Other ways to measure profitability include:

- A pro forma income statement: Predicts future profitability based on income and expenses for an upcoming period of time. This helps you decide whether the business could be a good long-term investment.

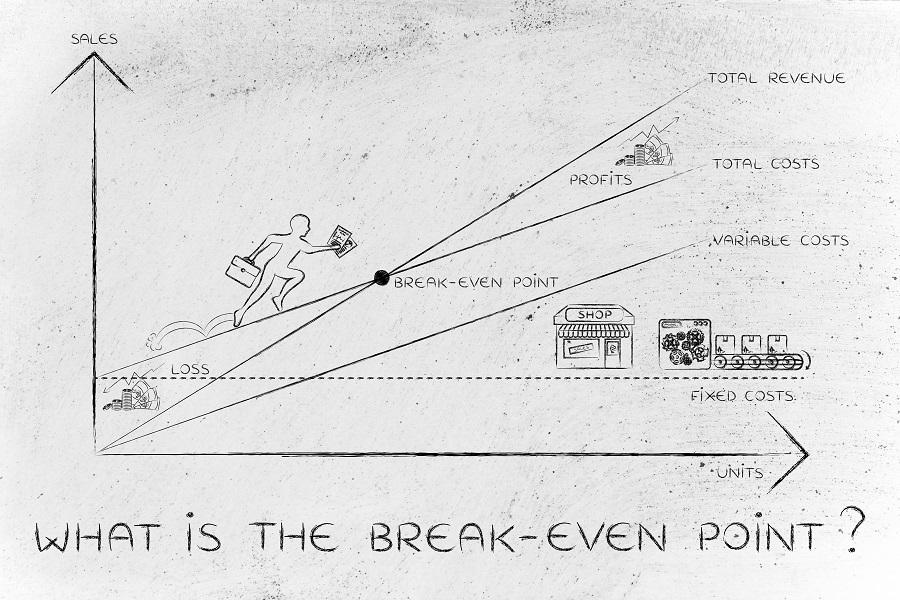

- A break-even analysis: Lets you determine the point at which the business’ revenue matches its expenses (the break-even point). This analysis is useful because it tells you how much profit the business is (or isn’t) making above its operating expenses, and also gives you an idea of how your business will respond if sales drop for some time.

- Profit-per-client reports: Tells you which customers contribute the most to the business’ profits. These reports are useful because they can help you create customer personas, which you can use to craft more effective marketing campaigns for the right type of customers—thus increasing long-term profits even more.

Understanding a business’ break-even point is essential to achieving profitability. (Source: faithie)

Learn more:

Familiarity With the Industry

When buying a business, it’s wise to choose one that operates within an industry you already know. Having prior knowledge of the industry makes it more likely that you will enjoy working on the business and be able to stick with it long-term; it’s also good for profitability. If you are familiar with (and enjoy working in) the industry, you’ll be better able to spot trends, make predictions about where the industry is going, and prepare for changes in the future.

For example, if you choose to buy a bicycle shop and are also a cycling enthusiast yourself, you’ll know what types of frame, wheels, gear sets, and materials are gaining popularity at the moment—and so you’ll know what kind of inventory to stock up on. You’ll also gain more credibility with customers if you can talk about cycling with genuine experience and passion.

So, when choosing a business to buy, don’t discount your own passions, interests, skills, enjoyment, and experience. These will have a noticeable impact on how well you run the business after you purchase it.

Step 2: Create a List of Potential Businesses to Buy

Once you are familiar with how to evaluate a business’ cash flow and profitability potential, and have a solid grasp of your own interests and experiences, it’s time to create a list of businesses that actually exist and could potentially be purchased.

There are a number of ways to find such businesses; here are a few ideas.

Work With a Business Broker

A business broker is an individual or company that assists buyers and sellers when a business is about to change ownership. Brokers can help with a wide variety of relevant tasks, such as:

- Estimating or calculating the value of the business

- Advertising businesses for sale

- Facilitate meetings and negotiations between buyers and sellers

- Assisting with paperwork, documentation, and due diligence

Besides these skills, brokers are experienced in the particular field of buying and selling business, and can provide advice about which ones seem like good investments. An experienced broker who’s been in the game for a long time will also have an extensive list of contacts including additional buyers and sellers, other brokers, and attorneys of various specialities.

Brokers are paid for their services through commissions—in this case, a percentage of the business transaction price which they helped negotiate and facilitate.

Check Online Marketplaces

If you don’t want to work with a broker—or you want to do some preparation before you contact one—you can check online marketplaces that list businesses for sale. Here are some examples:

- BizBuySell: Search for individual businesses or franchises, filtered by state and industry. The site claims more than 65,000 businesses listed each year, with over 100,000 successful sales.

- BusinessBroker.net: Find a broker in addition to buying and selling businesses. You can also set filters for upper and lower price limits.

- LoopNet: This site focuses on commercial real estate for sale and lease. It gives you information on real estate properties that are up for auction, and includes a blog on various related topics such as real estate trends and design.

- BizQuest.com: BizQuest also lists businesses and franchises for sale, and includes tools for connecting with brokers. It has business listings by state, city, and industry or business type.

- BusinessesForSale.com: Search for thousands of businesses for sale in categories such as real estate, retail, services, food, tech, and more.

Leverage Your Network

You may be able to tap into the list of contacts you’ve accumulated over the years to build a shortlist of businesses for sale.

Friends, family, current and previous co-workers and employers, business partners, and contacts you made at conferences or other events are all potential sources of information you can use to discover something that you might not have found with a method like online searching. Using your personal network this way can also open up opportunities for discounts, getting additional help with fulfilling requirements, and more.

Step 3: Evaluate Business Price and Other Costs

When you have one or more businesses on your radar as contenders, start thinking numbers—the value of each business, your own needs and available resources, and the purchase price (or price range) that would be acceptable to you.

Valuing a Business

To determine the value of a business, you’ll need to take stock of its assets, total earnings, and overall market value.

- Assets refers to all items of value that a business owns. These can range from physical goods like vehicles, machinery, computers, and office equipment; to intangible goods such as patents, trademarks, and intellectual property. Business assets should be listed on the company’s balance sheet.

- Earnings refers to the total net income of the business, after it has paid all taxes and other dues. This is essentially the pure profits that remain after all expenses have been settled. Earnings can either be reinvested into the business to improve future performance and earnings, or distributed as rewards to stockholders. Profits are recorded in a business’ financial statements.

- Market value refers to the company’s value according to the stock market. It reflects how much the business or its assets would sell for in the marketplace. You can determine total market value by multiplying the market price of a single company share with the number of outstanding shares.

Several methods are available to help you determine the overall value of a business: market capitalization (the calculation for total market value given above), revenue over time, profits over time, profit projections vs cash flow that could be invested elsewhere, shareholder equity value, and more.

Determining a business’ value can be complex, and it’s not a bad idea to hire a professional to do this if possible. They will likely be able to perform the evaluation more accurately than you can, unless you have training or experience of your own in this area. They will also decide which methods are best to determine the value of the business, so you can get the best guidance possible about whether or not you ultimately want to buy the business. When choosing a professional, look for a CPA with an Accreditation in Business Valuation; someone with this designation will have received specialized training for calculating a business’ value.

Evaluating Your Needs, Resources & Commitment

Valuing a business is a crucial step when deciding whether or not you want to buy it, but the other side of the coin is evaluating your own needs, wants, and ability to commit resources to this investment.

This evaluation goes beyond your financial ability to obtain the business. You also need to think about what you need and want. Why exactly are you thinking about buying a business? Do you want additional income? To be your own boss? An avenue to work on your hobbies and interests?

You’ll also need to give some thought to how much you can commit to this venture. Assuming you do buy the business, how much time are you willing to give it? How much money? If something goes wrong, what are you willing to sacrifice or put aside temporarily in order to address the problem? If the business does well, are you prepared to hire, train, and pay additional employees to meet the increased demand?

Decide on the answers to these questions before you make the jump and buy the business. Otherwise, though you may have the money to buy it, you may find yourself stuck and frustrated down the line.

Step 4: Do Your Due Diligence

The necessity of performing due diligence when buying an existing business cannot be understated. (Source: MailHamdi)

Performing due diligence refers to doing all the necessary research, background checking, and investigation to learn as much as possible about a business before deciding whether to buy it. This investigation includes looking into the business’ current financial state, debts, future prospects, tax and legal compliance, and the people currently involved in the business—both management and employees.

As with valuing the business, consider hiring a professional who knows how to perform due diligence as thoroughly as possible. An accountant will help you examine and understand the business’ financial statements; and a business attorney or broker can assist in negotiations and ensure that the entire sale process is followed properly.

Understand Why Each Business Is for Sale

Part of the due diligence process is understanding why the current business owner is putting the business up for sale.

While the majority of sellers will be acting in good faith and selling their businesses for legitimate reasons (like retirement, career advancement, or simple profit), others may be selling for reasons that will negatively impact you as the buyer. This often comes in the form of difficulties or problems with the business such as a poor financial position, bleak future prospects, a failing business reputation, or massive debts.

As a potential buyer, it’s your responsibility to protect yourself and find out everything there is to know before you pull the trigger on the purchase. Once again, accountants, attorneys, and brokers will be your allies here—while you’ll be paying fees for their services, you may end up paying much more down the line if you buy a business that turns out to be on a negative trajectory.

Step 5: Secure Capital

When you’re confident that you know everything there is to know about the business, and you and the seller have agreed on a purchase price, it’s time to secure the capital necessary to buy the business. The most straightforward way to buy the business would be to purchase using straight cash, allowing both the buyer and seller to walk away from the transaction after a single payment. However, few aspiring small-business entrepreneurs will have the liquid capital to buy a new business with one full payment. Here are some other options for getting the financing you need:

Borrow From a Bank or Other Lending Institution

Banks and licensed moneylenders will be able to provide you with a loan that you can use to buy the business. If you’ve done due diligence and properly valued the business (which you should have done by this point), the lending institution will want to see these documents before they approve the loan. They will likely also want to see your credit score. Be sure to fully understand the repayment terms before you commit to taking out a loan.

Borrow From the Seller Themselves

In owner financing (also known as seller financing), the person selling the business finances the person buying the business. The seller may do this by agreeing to delayed or staggered payments from the buyer, for example. This kind of financing can provide flexibility and benefits to both parties —the seller can charge interest and gain an income stream until the purchase price plus interest is fully paid, and the buyer can effectively take out a loan without needing a bank intermediary (which can come with additional fees). Negotiations and compromises may also be more straightforward with seller financing, compared to dealing with a bank.

Borrow From Friends and Family

Borrowing from personal contacts may be the simplest way to obtain financing—little or no paperwork and background checking required. However, it carries risks as well, and not just financial ones. If you are unable to repay the loan promptly and in full, personal relationships could be put in danger. Consider this risk carefully before borrowing from anyone you know personally.

Step 6: Prepare Documents for Closing the Deal

All of the valuing, negotiating, and financing that you’ll be doing in the process of buying a business will come with corresponding paperwork (likely mountains of paperwork). You will probably complete some of the necessary paperwork while doing due diligence—financial records, profit and loss statements, and the like. Additional documentation that you will need to prepare or review includes:

- Updated permits and licenses required to keep the business in operation

- Paperwork relating to zoning laws, depending on business type

- Contracts with the business’ existing customers, partners, and employees

- An existing or new business plan that ensures the business’ continued profitability

- A Letter of Intent that formally records the terms of the transaction and the commitment of both parties to go through with it

A business broker and attorney will be helpful in ensuring that all documentation is updated and ready before the sale takes place, so hiring these professionals to assist with the process will likely be money well-spent.

Pros and Cons of Buying a Business

Buying an existing business—as opposed to building one from the ground up—carries advantages and disadvantages to you as the entrepreneur making the purchase. Here are a few of the pros and cons:

| PROS | CONS |

|---|---|

| Additional income stream | Investment risk |

| Existing assets and processes | Potential integration difficulties |

| Existing customers and marketing plan | Can be expensive |

Advantages of Buying a Business

- Additional income stream: Once you’ve purchased a business, all of its profits will be yours to keep and disburse as you see fit. This not only has obvious benefits for quality of life, but can be a force multiplier for your other projects. Earnings from a business that you bought can be used to reinvest in other businesses, projects, hobbies, or passions.

- Existing assets and processes: One of the biggest advantages of purchasing an existing business is that it will already have tangible and intangible assets that you can use immediately, as well as business processes that will have been tested and refined over time. In other words, as long as the business is fairly healthy when you buy it, you can be assured that the systems already in place are effective at generating income.

- Existing customers and marketing plan: As with assets and business processes, you’ll also be buying the company’s current customers and marketing plan. Again, you will have the assurance that the customers have developed some level of loyalty towards the business, and that the marketing plan is effective in attracting at least some buyers. This existing template will give you a base to work off in the event that you decide to make changes.

Disadvantages of Buying a Business

- Investment risk: Buying a business is an investment, and any investment carries risk. Despite the previous success as well as any existing processes, customers and other assets, there is no guarantee that the business will continue to do well under your ownership. Worse still, if the business does not survive and you had taken out a loan to buy it, you will be forced to continue making repayments without the additional income of the now-failed business.

- Potential transition difficulties: The ideal situation when buying a business would be that the new entity fits quickly and neatly into all your existing operations and lifestyle. However, this isn’t always the case—incorporating the business into everything else you have going on often proves to be more difficult and time-consuming than buyers realize. You may need to spend a lot of time and effort smoothing things over, and profits may not come in as immediately as you’d like. Likewise, you’ll need to learn the culture and processes of the business you purchased.

- Expense: Even small businesses are expensive, and it’s unlikely that you’ll have the liquid capital to purchase one outright. That means borrowing money in some capacity, or making regular payments to the seller. In either case, this is an additional financial obligation that you’ll need to account for. If you fail to make payments promptly, you risk significant consequences—especially if you borrow from a large institution such as a bank.

Frequently Asked Questions (FAQs) About Buying a Business

All the steps and information in this guide may seem overwhelming, but buying a business need not feel intimidating or out of reach. Click on the questions below for a quick summary of how to buy a business plus other useful information.

Begin by thinking about what kind of business you’d like to buy, and how this fits into your wants, needs, and ability to commit time and resources to the venture. Use online marketplaces to explore different businesses for sale, and make initial contact with brokers, accountants, and attorneys who will help you through the process.

It can be a very good idea, if you are confident in the business’ profitability and future prospects, it aligns with your goals and lifestyle, and can secure the necessary financing. Of course, you need to do as much research and due diligence as possible to be sure of what you are thinking of buying.

If you don’t want to buy an existing business, you can buy into a franchise and pay ongoing royalties; or you can choose to start your own business from scratch. All of these options have corresponding pros and cons, so you’ll need to do your own research and decide what you want and what you are willing to sacrifice.

Bottom Line

Buying an existing business is often a long and complicated process, but this guide will help you start things off on the right foot. If you are starting to feel overwhelmed at the complexity, begin by thinking about your wants, needs, and what you can commit in terms of time, energy, and money. Then, start looking around for businesses for sale that align with these. And don’t forget that you can hire professionals to help you along every step of the process.