Ecommerce sales tax (also called online sales tax) is a type of consumption tax that online merchants collect from customers and then pass on to the government. It’s calculated as a percentage of each item’s selling price, and it works much like the tax you’d collect from a customer in a traditional retail setting.

In the US, ecommerce tax rates change by state, which makes selling across state lines somewhat complicated. However, ecommerce platforms like Shopify and BigCommerce can automate sales tax collection at checkout, making it simpler for online sellers.

What Is Ecommerce Sales Tax?

Ecommerce sales tax is a tax applied to sales made through online stores or digital marketplaces. It’s a percentage of the sales price of the goods or services sold, which online merchants are required to collect from their customers during the purchase.

Like sales tax in physical stores, this tax is then remitted to local or state tax authorities.

The main aim of sales tax for ecommerce is to ensure that online retail also contributes to public revenue, just like brick-and-mortar stores do. The rules for calculating and paying this tax can change from state to state, making it important for online business owners to understand and manage ecommerce sales tax effectively.

How Ecommerce Sales Tax Works

Sales tax is charged as a percentage of each item. Each state sets its own percentage, as well as parameters around which goods are eligible for sales tax. Some states add sales tax to everything, while others add it to nothing. And others still apply sales tax to some items and not to others. The rules change depending on the state and sometimes local jurisdictions override state rules with their own.

Selling online makes sales tax a bit tricker because your location is less straightforward. Your business’s headquarters might be in one state, with warehouses in another. And your customer base could be all over the country—or the world.

The government assesses an online merchant’s sales tax responsibilities by looking at the business’s connection to each state, or “sales tax nexus.” We’ll cover this nexus in detail below, but it isn’t just about where you’re physically located—it may also consider where your customers are and other business activities that link you to a state.

This wasn’t always the case. Until a few years ago, online merchants were only required to pay sales tax for ecommerce to states where they have a physical presence. But the 2018 South Dakota vs Wayfair Supreme Court ruling changed that.

Physical presence: A store, office, warehouse, or other business facility as defined by the state

Now, most businesses need to collect state sales taxes if they surpass 200 transactions or $100,000 in in-state sales—even without a physical presence there. However, some states like California, Massachusetts, and New York have a higher $500,000 threshold. Since 2018, 45 states and Washington D.C. have implemented their own ecommerce tax rules.

States also get to choose the following sales tax factors:

- Physical presence: States can decide which business activities qualify as a “physical presence.”

- Economic threshold: States can impose higher transaction rates or gross sales amounts. Some states use only the in-state revenue and don’t count transaction rates.

- Additional taxes: Several states have local sales taxes, which are added on top of the state sales tax.

- Tax categories: Some states impose higher tax rates on goods like luxury items, tobacco, alcohol, and gasoline, while lower taxes might be applied to essentials like food or medical supplies.

- Marketplace facilitator: Several states have passed marketplace facilitator laws requiring third-party marketplace sites like Etsy or Amazon to collect and remit sales tax with each sale.

States can also choose whether they’re an “origin-based” or “destination-based” sales taxing source:

- Origin-based states impose ecommerce sales tax based on the location of the seller’s business.

- Destination-based states use sales tax based on the customer’s state and local tax rates. Most states are destination-based.

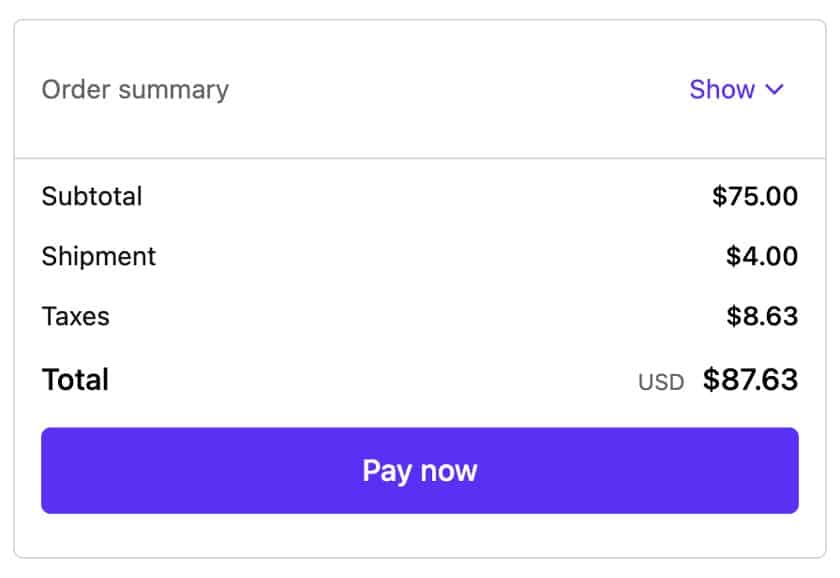

When a customer comes to your online store and makes a purchase, your checkout will automatically calculate the necessary sales tax based on the customer’s shipping and billing information. This tax is an additional line item and added to the total cost of the transaction.

In this Shop Pay example, the total cost for the products is $75 while the taxes are calculated at $8.63. Shopify doesn’t remit these taxes for you, but its precise calculations make it simpler when it comes time to file.

Why Ecommerce Sales Tax Is Important

Ecommerce sales tax is important for several key reasons. Firstly, it creates a fair marketplace by taxing online sales in the same way as in-person sales, contributing to a balanced business environment.

Online sales tax also generates significant revenue for states and local governments, helping to fund essential public services like education, infrastructure, and healthcare.

Lastly, understanding and adhering to ecommerce sales tax laws is important for online businesses to remain compliant and avoid legal issues. This tax structure also encourages online businesses to be transparent about their sales activities, promoting a culture of accountability within the ecommerce market.

When to Charge Ecommerce Sales Tax

You’re responsible for sales tax if you sell a taxable product or service in a state where you have a sales tax nexus. If you qualify, you’ll need to collect and remit the taxes back to the appropriate state.

What Is a Sales Tax Nexus?

If your online store conducts a certain amount of business in a particular state, it will trigger tax obligations, creating a sales tax nexus. You’ll always qualify for a sales tax nexus in your business’s home state—but you might also qualify in other states as well.

The following business activities may create a nexus:

- Owning or renting a physical space: An office, warehouse, storage facility, store, or home office creates a presence in the state.

- Staff: Having an employee, contractor, salesperson, or other personnel in a state may create a nexus.

- Inventory: Storing inventory in a warehouse or through other third-party fulfillment centers like Fulfillment by Amazon could prompt tax responsibilities.

- Click-through nexus: Some states have laws regarding third-party affiliates and sales tax obligations.

- Temporary locations: Retail businesses that have a short-term physical business in a state, such as pop-up shops, trade shows, or craft fairs, can be required to collect sales tax.

- Economic threshold: If your business exceeds a specific dollar amount in sales or a certain number of transactions to customers located within a state, you might need to collect and remit taxes to the state.

Ecommerce Sales Tax Requirements by State

Expand the sections below for a list of the states that currently impose ecommerce sales tax. It’s always best to consult your local jurisdiction directly for the latest information and to confirm additional details.

Alabama: 4%

Alabama’s Department of Revenue states that online retailers have a nexus if they have a physical presence, such as a retail store, warehouse, inventory, or regular visits of traveling salespeople, or has a remote entity nexus. Alabama is a destination-based state.

Alaska: 0%

Alaska doesn’t have a state sales tax, but it does allow local municipal governments to implement a sales tax. The charges are destination-based if the retailer qualifies for a nexus.

Arizona: 5.6%

Arizona’s Transaction Privilege Tax (TPT) is a tax on the vendor for the privilege of doing business in the state. Vendors must collect and remit payment back to the state. Arizona is an origin-based state for sellers with a nexus. Arizona also allows local municipalities to set their own ecommerce sales tax rates.

Arkansas: 6.5%

All remote sellers and marketplace facilitators must collect and remit sales tax to the State of Arkansas when selling tangible personal property, taxable services, a digital code, or specified digital products for delivery exceeding $100,000 or 200 transactions within the current or previous year. The food sales tax rate is 0.125%. Arkansas is a destination-based state.

California: 7.25%

California requires all remote sellers to collect tax if the total combined sales of tangible personal property for delivery in California exceeds $500,000 during the previous or current year. Districts can also add a tax if they want. California’s sourcing is mixed, which means that city, county, or state taxes are based on the seller’s location, while district taxes are destination-based.

Colorado: 2.9%

Colorado mandates retailers to obtain a sales tax license if sales exceed $100,000 in a year. Colorado is a destination-based state. Colorado also allows local municipalities to add an ecommerce sales tax.

Connecticut: 6.35%

In Connecticut, if you make at least 200 retail sales into the state and at least $100,000 in gross receipts from sales, you’ll need to pay ecommerce sales tax. Marketplace facilitators also need a permit if they had more than $250,000 in sales the previous year. Connecticut is a destination-based state.

Delaware: 0%

Delaware is one of five states without a sales tax. However, some online merchants may have to pay a Gross Receipts Tax. In Delaware, wholesale transactions are destination-based while retail sales are “based on the passage of the title within Delaware.”

Florida: 6% + 0.5%–1.5% Discretionary Tax

If you’re out of state but make more than $100,000 in total sales from Florida customers, you’ll need to register and collect, report, and remit Florida sales tax and discretionary sales surtax, which varies by county. Some counties do not impose a surtax. Florida is a destination-based state.

Georgia: 4%

Out-of-state merchants and marketplace facilitators in Georgia need to collect ecommerce sales tax if they gross more than $250,000 per year or process more than 200 transactions in the previous or current calendar year. Georgia is a destination-based state.

Hawaii: 0.5%, 4%, or 4.5%

Hawaii has a General Excise Tax (GET) instead of a sales tax. GET is a tax on businesses rather than the customers, but merchants have the right to pass it on to shoppers. The type of business activity determines rates. The general GET rate in Hawaii is 4% (4.5% in some counties) but it’s 0.5% for wholesaling goods, manufacturing, and some other business activities. Merchants need to pay a one-time $20 fee to register for GET.

Idaho: 6%

Idaho requires you to register for a state seller’s permit and pay ecommerce sales tax, or use tax, if your Idaho sales or Idaho third-party sales exceed $100,000 in a year. If you use a marketplace facilitator, then you’ll also have to pay ecommerce sales tax should your annual sales exceed $100,000. Note that you’ll need a separate permit for your direct sales and marketplace facilitator sales. Idaho is a destination-based state.

Illinois: 6.25%

Illinois requires remote retailers or marketplace facilitators making at least $100,000 in sales or processing at least 200 transactions in the state to pay ecommerce sales tax. Illinois is an origin state if your business is located within it. If you’re not an in-state seller, then you’re considered destination-based.

Indiana: 7%

Any remote retailer that processes 200 or more separate transactions or grosses more than $100,000 in a year in Indiana will have to pay sales tax to the state. You can register via the Streamlined Sales Tax Registration System or with INBiz. Indiana is a destination-based state.

Iowa: 6% + 1% Local Option Sales Tax (LOST)

Iowa requires any remote seller that earns $100,000 per year in gross revenue or processes more than 200 transactions for sales into Iowa in a single year must collect and remit sales tax. The Iowa sales tax rate is 6%, and most cities and unincorporated areas have adopted an additional 1% tax that must be applied if delivery of the item occurs within the LOST jurisdiction. You’ll need to register for a sales tax permit with the state, either through the Streamlined Sales Tax Registration System or the Iowa Department of Revenue’s Business Tax Registration System. Iowa is a destination-based state.

Kansas: 6.5%

Kansas requires any retailer that makes more than $100,000 from sales to customers in the state to pay ecommerce sales tax. Kansas is a destination-based state.

Kentucky: 6%

Out-of-state remote sellers who make more than 200 sales into Kentucky or $100,000 in gross receipts from sales must register and collect sales and use tax. Kentucky is a destination-based state.

Louisiana: 8.45%

Louisiana requires ecommerce businesses to charge a Consumer Use Tax for all customers located in the state. Merchants can either pay annually or report and pay via Consumer Use Tax Return, Form R-1035. Louisiana is a destination-based state.

Maine: 5.5%

Maine requires sales tax from any business that sells tangible personal property, products transferred electronically, or taxable services to customers in the state. Businesses that make 200 or more sales or earn more than $100,000 from sales in a year are also required to register and collect sales tax. Maine is a destination-based state.

Maryland: 6%

Maryland charges a flat statewide use tax rate of 6% on most goods. The items must be used or intended for use within the state. Maryland also has two, week-long shopping events during each year (in February and August) when the state sales tax on certain purchases is waived. Maryland is a destination-based state.

Massachusetts: 6.25%

Online merchants will owe ecommerce sales tax to Massachusetts if they make at least $100,000 in sales to customers in the state in a single year. If eligible, you’ll need to register with the Department of Revenue (DOR). Massachusetts is a destination-based state.

Michigan: 6% Sales Tax + 6% Use Tax

Michigan requires any business that exceeds $100,000 per year in gross revenue or makes more than 200 transactions in the previous or current year to collect and pay a sales tax of 6% as well as a 6% use tax. Michigan is a destination-based state.

Minnesota: 6.875%

Minnesota requires qualifying ecommerce merchants to collect and remit sales tax. Marketplace sellers don’t need to remit sales tax to the state of Minnesota because the respective marketplace does so. Minnesota has what it calls the Small Seller Exception. The Small Seller Exception means sellers who make less than $100,000 or process fewer than 200 transactions for purchases made by Minnesota customers do not have to pay sales tax. If you exceed this threshold, you’ll need to notify Minnesota within 60 days. Minnesota is a destination-based state.

Mississippi: 7%

Mississippi charges a sales tax based on gross proceeds of sales or gross income. Merchants need a permit or registration license from the Department of Revenue before they collect sales tax. Mississippi is an origin-based state.

Missouri: 4.225%

Missouri’s Department of Revenue states that any sales to customers in the state should collect and pay sales and use tax. Cities and counties may also add their own additional taxes. Missouri is an origin-based state.

Montana: 0%

Montana is one of the few states that doesn’t charge a sales tax or an ecommerce-specific sales tax.

Nebraska: 5.5%

Nebraska requires sales and use tax from online merchants earning $100,000 per year in gross revenue or making more than 200 transactions in the previous or current calendar year. City and county governments can also choose to tack on an additional sales and use tax at 0.5%, 1%, 1.5%, 1.75%, or 2%. Nebraska is a destination-based state.

Nevada: 4.6%

Remote sellers in Nevada are also subject to the $100,000 and 200 transactions threshold. The state offers the option to volunteer to register and collect the tax as a “benefit to their Nevada customers.” Local jurisdictions can add their own sales and use tax. Delivery charges are not taxable. Nevada is a destination state.

New Hampshire: 0%

New Hampshire doesn’t charge a sales tax or an ecommerce-specific sales tax.

New Jersey: 6.625%

Similar to other states, New Jersey follows the $100,000 sales and 200 transactions per year limit. New Jersey gives merchants a 30-day grace period after they’ve met the threshold. New Jersey is a destination-based state.

New Mexico: 5.125%

New Mexico has a Gross Receipts Tax (GRT) rather than a sales tax, and businesses will have to pay rates based on where the products or services are delivered. New Mexico is an origin-based state.

New York: 4%

New York requires all vendors that meet either their physical presence or economic threshold to pay sales tax. However, their economic threshold is different from other states. They require vendors and marketplace facilitators that exceeded $500,000 and made more than 100 sales of tangible personal property delivered in the state during the “previous four tax quarters” to register as a sales tax vendor. New York City boroughs charge an additional 4.875% sales tax, which is the highest for the state. However, many other counties, such as Westchester, also charge additional sales tax. New York is a destination-based sales tax state.

North Carolina: 4.75%

Any remote retailer who meets North Carolina’s threshold of 200 or more separate transactions or earns gross revenue of more than $100,000 in North Carolina in the current or preceding calendar year will be required to collect and remit sales tax. Local municipalities also add a sales tax. North Carolina is a destination-based state.

North Dakota: 5%

In North Dakota, ecommerce retailers have to pay state sales tax as well as city and county taxes. The economic threshold is the standard $100,000 in retail sales into the state or 200 or more transactions in a year. North Dakota is a destination-based state.

Ohio: 5.75%

Ohio has a standard sales and use tax, plus additional taxes that vary by county. All out-of-state sellers with at least $100,000 of retail sales into the state or more than 200 transactions in the current or previous calendar year need to pay the tax. New online business owners should apply for tax payments 30 days prior to launching their website. Ohio is an origin-based state.

Oklahoma: 4.5%

Oklahoma requires any remote seller that sells at least $100,000 worth of taxable items in the state during the current or previous year to collect sales tax from the customer. If remote sellers don’t meet the threshold, they must notify customers that a use tax must be paid by the customer unless the product is exempt. Local jurisdictions can also add a sales tax; in some places, the total sales tax reaches 11.5%. Oklahoma is a destination-based state.

Oregon: 0%

Oregon doesn’t charge a sales tax or an ecommerce-specific sales tax.

Pennsylvania: 6%

Pennsylvania mandates online retailers and marketplace facilitators with annual gross sales greater than $100,000 to register, collect, and remit sales tax payments to the state. Local municipalities may also add a sales tax. Pennsylvania is an origin-based state.

Rhode Island: 7%

Any online retailer or marketplace facilitator with a sales nexus in Rhode Island must pay sales and use tax. Like other states, the economic threshold is $100,000 in sales or 200 transactions in a year. Rhode Island is a destination-based state.

South Carolina: 6%

South Carolina requires sales tax from ecommerce sellers with gross sales revenue exceeding $100,000 into the state in the previous or current calendar year. You’ll need a retail license to remit sales tax. Municipalities can also add on their own sales tax of up to 1%. South Carolina is a destination-based state.

South Dakota: 4.5%

Ecommerce businesses that exceed $100,000 in sales into the state or 200 transactions in the current or previous calendar year must pay sales tax in South Dakota. South Dakota is a destination-based state.

Tennessee: 7%

Tennessee requires sales tax payments from any ecommerce business with at least $100,000 in sales to customers in the state in the previous 12-month period. Additional local tax rates vary by county or city. Tennessee is an origin-based state.

Texas: 6.25%

Texas allows remote sellers with less than $500,000 in sales for the prior year and without a physical presence in the state to choose to collect the alternate single local use tax rate instead of the total local tax rate. Local jurisdictions can also tack on additional sales taxes, but they can’t exceed 2%. Texas is an origin-based state.

Utah: 4.85% + 1% Use Tax + Variable Local Taxes

Utah charges a state sales tax rate of 4.85%, a 1% use tax, and additional taxes that vary by local jurisdiction. Throughout the state, total ecommerce sales taxes range from 6.35% to 9.05%. Like other states, online sellers with over 200 transactions or $100,000 in sales in the current or previous year must pay taxes to the state. You’ll need to register for a sales tax license through the Taxpayer Access Point, mailing or faxing form TC-69, Utah State Business and Tax Registration, or registering with the Streamlined Sales Tax member states. Utah is an origin-based state.

Vermont: 6%

Vermont requires ecommerce businesses to pay sales tax if they generate over $100,000 of retail sales into the state or have at least 200 transactions in the current or previous calendar year. Vermont is a destination-based state.

Virginia: 5.3%

Ecommerce businesses must collect and remit sales tax to the state of Virginia if they sell more than $100,000 or process more than 200 transactions in the current or previous calendar year. Additional local sales taxes may also apply. Virginia is an origin-based state.

Washington: 6.5%

Washington State requires remote sellers and marketplace facilitators with more than $100,000 in sales to in-state customers in a year. You’ll need to file a Business License Application to collect and remit sales tax. Resellers will also need a specific Reseller permit. Washington is a destination-based state.

Washington D.C.: 6%

The District of Columbia also requires ecommerce sales tax from sellers with more than $100,000 in sales or more than 200 transactions in a year. Washington D.C. is a destination-based state.

West Virginia: 6% + 0.5% or 1% Municipal Tax

In West Virginia, local municipalities often set additional ecommerce sales tax rates on top of the 6% state sales tax. Most charge an extra 1%, though some have a rate of 0.5%. The state mandates sales and use tax from online retailers and marketplace facilitators with more than $100,000 in sales or 200 transactions in a year. West Virginia is a destination-based state.

Wisconsin: 5%

Wisconsin requires remote sellers and marketplace facilitators to pay sales tax if they have annual gross sales of more than $100,000 or if they have 200 or more retail transactions in the current or previous calendar year. Local jurisdictions also have the option to charge an additional tax; in most cases, this is 0.5%. Wisconsin is a destination-based state.

Wyoming: 4%

Like many other states, Wyoming requires a state use tax from online sellers who process either at least 200 transactions or $100,000 in sales in a year. Wyoming is a destination state.

Ecommerce Sales Tax Requirements by Product

Ecommerce sales tax requirements for products vary by state. Most tangible personal property items and a variety of services are taxable; however, some states exempt certain products.

Exemptions include:

- Clothing: Most states tax clothing; however, several states have exceptions based on certain thresholds. Some states, like Connecticut, have a luxury tax on clothing and footwear priced over $1,000.

- Food and groceries: 13 of the 45 states with a sales tax still tax groceries at a reduced or full rate.

- Medications: Prescription drugs are almost always tax-exempt, but non-prescription and supplements are usually taxable items.

It’s also wise to periodically check with your state to ensure you tax your customers correctly.

How to Stay Compliant With Ecommerce Sales Tax

Ecommerce sales tax compliance is crucial for online sellers, and requires taking a few steps to ensure adherence. Here are the essential actions to avoid compliance issues and simplify the process:

Register for Your Sales Tax Permit

Once you’ve determined that you have nexus with a particular state, you might need a sales tax permit for that state. Registering your business with the state’s taxing authority ensures compliance and will alleviate potential issues.

The specific steps to register for a permit vary by state, but generally, the process is as follows:

- Gather essential business documentation, like your employer identification number (EIN).

- Go to the state’s tax agency website.

- Locate the “Sales and Use Tax” section—use “ecommerce” or “remote seller” as keywords for your search.

- Follow the steps to register your business.

Set Up Your Business’s Tech Platforms

Keeping up with the laws and ecommerce sales tax rules of each state can be difficult. Choosing the right ecommerce platform and accounting software is important because many options automatically calculate ecommerce sales tax for you.

Prioritize platforms with settings to accurately and automatically calculate sales tax rates for each state where you have a nexus. Some programs, like TaxJar, integrate with many popular ecommerce platforms and can calculate the sales tax, track your economic nexus threshold in each state, and automatically submit returns for multi-state filings.

Consider Wholesale & B2B Sales Tax Exemptions

If you plan on selling products wholesale to other businesses, different sales tax rules may apply. Some states don’t require sales tax to be collected when you sell products to a business that will turn around and sell the product again. This is because, in the US, sales tax is only charged at the point of sale to the end customer.

Make sure any B2B customers you have that claim to be exempt from sales tax withholding have the proper exemption form from the state. You might consider not accepting exemption certificates just to play it safe; resellers that do unnecessarily pay sales tax can usually apply for a refund from the state.

Learn more about wholesale sales tax.

Frequently Asked Questions (FAQ)

Ecommerce sales tax works like sales tax in traditional retail, where a percentage of the sale is collected by the retailer and sent to tax authorities. However, ecommerce can be more complex due to sales across region, state, or country lines. Tax rates, taxable items, and tax collection duties can change based on location.

Yes, if you plan to operate an ecommerce business, you’ll need a Tax Identification Number (TIN) or Employer Identification Number (EIN). This ID is essential for tax purposes and is used by tax authorities to track your business transactions. It’s required for various business activities such as opening a bank account under your business name, applying for business licenses, and, most importantly, filing your tax returns.

Yes, if you sell on Shopify, you need to collect ecommerce sales tax where it’s required. Shopify offers tools to automatically calculate sales tax based on your business details and selling regions. It’s important to correctly set up your tax settings in Shopify and keep them updated to comply with tax laws and regulations.

Yes, you pay sales tax on Amazon purchases. The tax amount can change based on where the buyer and seller are and what is sold. Amazon collects and sends the sales tax to the government for sellers in some states, but in others, the sellers must do it themselves. It’s important for sellers to know the sales tax laws to stay compliant and avoid legal issues.

Bottom Line

When you sell online, it’s important to keep up with current ecommerce tax rates and regulations in the states where your business, products, staff, and customers are located. Remote seller and marketplace facilitator laws will continue to evolve, so it’s important to integrate software and conduct occasional audits to ensure compliance.