An expense report template makes it easy for your workers to record the details of reimbursable business-related expenses and for you to track those expenses and ensure accurate reimbursement. To help you monitor your employees’ work-related spending effectively, I’ve created a free employee expense report template and expense reimbursement policy you can use and customize to fit your requirements.

Tracking and controlling employee spending and expenses can be challenging and cumbersome. If you want to simplify and automate expense reimbursement processes, consider Rippling. In addition to its feature-rich HR payroll platform, it offers corporate cards with customizable spending rules and an expense management solution that integrates seamlessly with its payroll module for stress-free reimbursements.

What Is an Employee Expense Report

An employee expense report is a form employees fill out to document their work-related expenses. The report typically provides the details of each expense, the date incurred, the amount, what it was for, and any receipt or documentation verifying the purchase. Employers use this report to reimburse employees for the approved expenses tax-free.

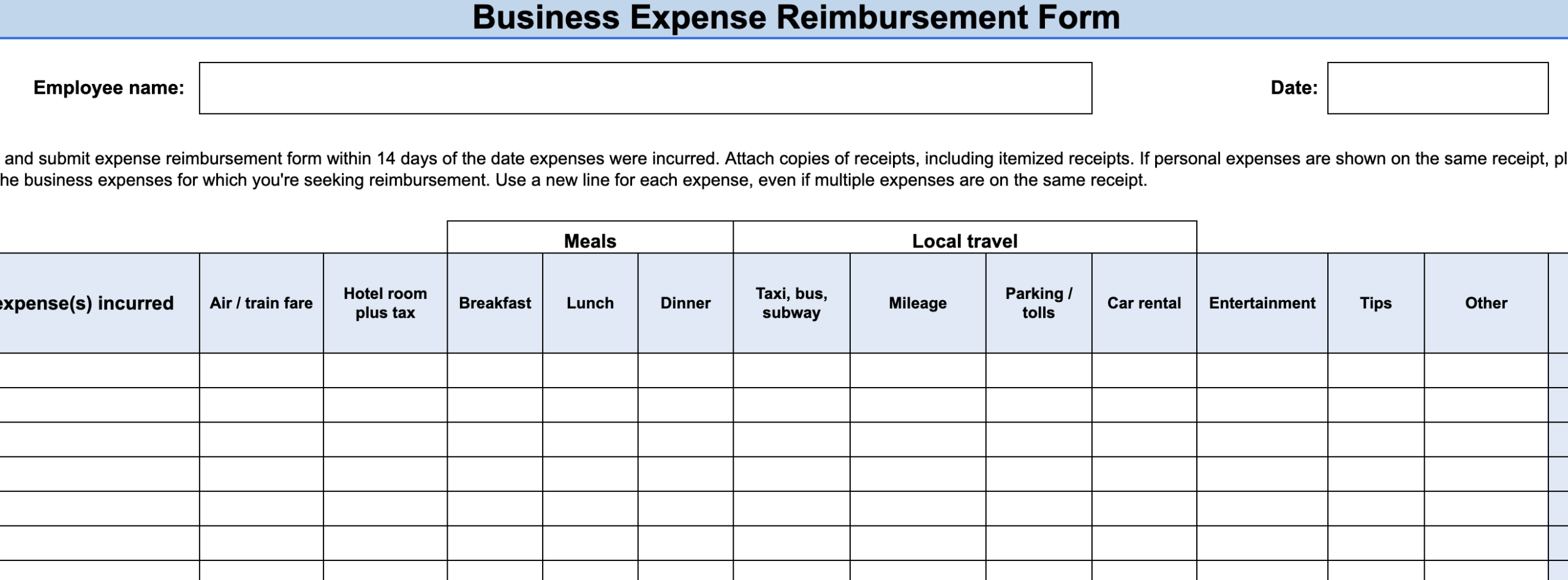

Your expense report template may include fields for travel-related expenses such as airfare and meals.

If your business anticipates employees making work-related purchases, it’s prudent to develop a policy and form for accurate tracking and recordkeeping. Expense reports provide employers with a detailed account of how company resources are being used, enabling informed financial decisions.

Why Are Expense Reports Important

Using employee expense reports is vital for running a business, even if you only have a small company. In addition to reimbursing employees for work related-expenses, these reports help with:

- Financial control: They ensure that employees spend money properly and within budget.

- Budgeting and expense tracking: You can monitor business-related employee spending for future financial planning. Plus, these reports itemize the expenses, providing you with a better understanding of how, where, and when these business costs were incurred.

- Tax compliance: Having employees submit expense reports allows you to accurately deduct eligible expenses from taxable income and have a verified record for tax reporting.

- Payroll audit and recordkeeping: Since employee expense reimbursements are processed through payroll, keeping detailed reports is necessary if you conduct payroll audits. In addition to the expense report sheet, you have to store the receipts, mileage logs, and other supporting documents.

- Fraud prevention: Expense reports allow you to detect potential misuse of company funds and prevent payroll fraud.

How to Use the Free Expense Report Template

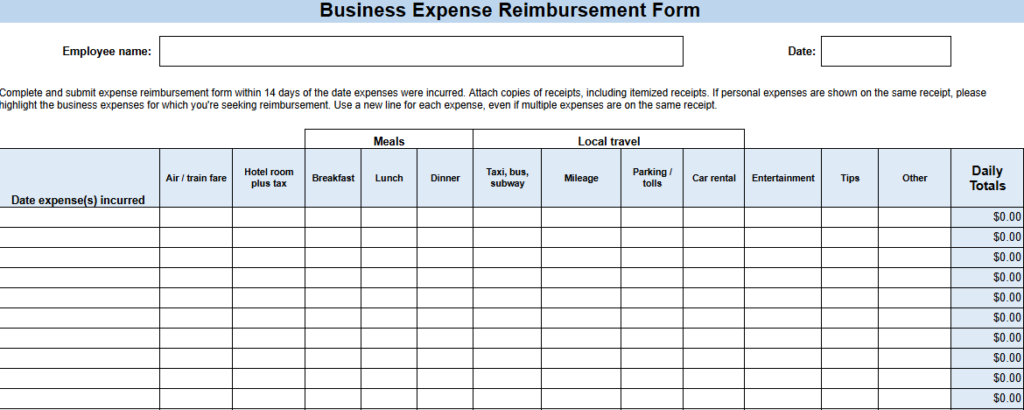

The free employee expense report template in this guide is straightforward to use. After downloading it, you can immediately utilize the form or customize it to fit your requirements. It contains cells or data fields where employees can input their name, the amounts for specific expense types (e.g., meals, parking fees, and tips), the transaction dates for each expense, and the name of the manager or supervisor who will approve the report.

In customizing the sample employee expense report, you can easily change the instructions on row 5 and rename the expense types on row 8, specifically, columns B to M. While you can add or remove columns, note that some contain Excel formulas to calculate the totals. I don’t suggest this unless you’re an Excel expert or familiar with adjusting the row or column sizes and correcting the formulas.

Apart from showing the totals per expense type, the template has data fields for acknowledging the content’s accuracy and expense claim approval.

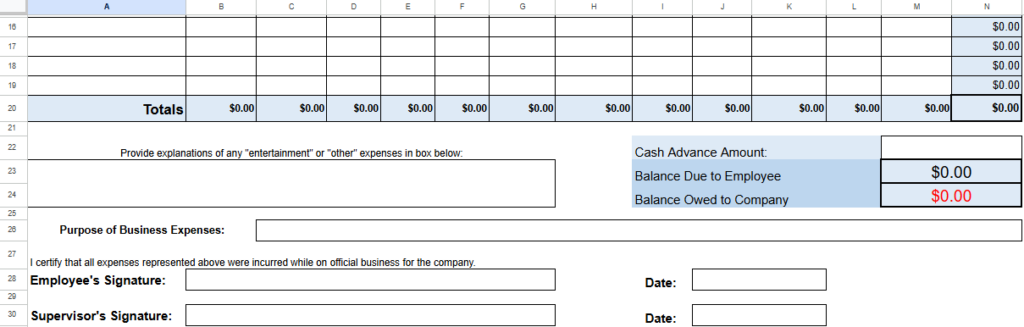

For reference, the cells with Excel formulas are:

- Row 20: Nearly the entire row, from column B to N, contains formulas that calculate the totals for each expense type, including the total sum of expenses.

- Column N: If row 20 shows the totals for each expense, this column shows the total amount claimed for each transaction date for all expenses.

- Row 22, columns M and N: These cells don’t contain a formula but it’s an important data source to determine cash advance computations, provided your employee was granted a salary advance to spend on business-related expenses and would need to liquidate it.

- Row 23, columns M and N: The Excel formula here calculates the amount that should be reimbursed. If the employee was given a cash advance and the actual expense is bigger, the form will automatically compute the applicable amount to be paid to the worker.

- Row 24, columns M and N: These cells contain the formula that computes the amount employees have to return to the company. Note that this happens if the employee’s cash advance exceeds the actual expenses claimed.

Additional Expense Report Guidelines

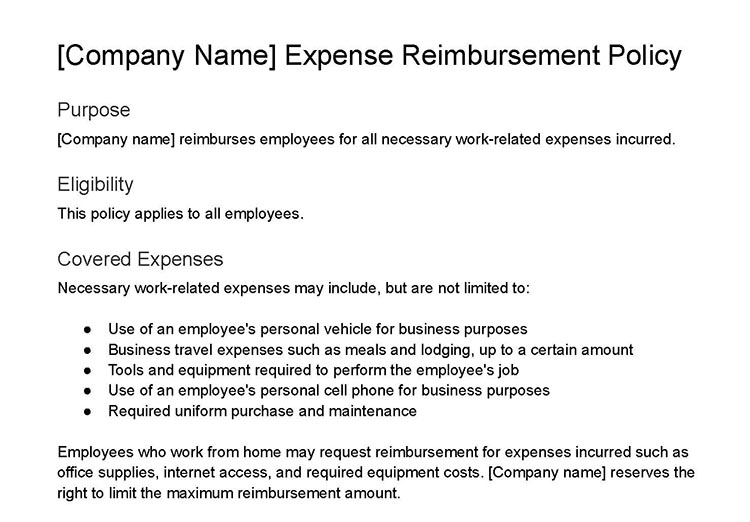

If you are creating your own expense form or employee reimbursement policy, or are customizing the templates I provided above, here are additional guidelines to consider:

Identify Types of Expenses

Reimbursable expenses listed on your report and in your policy should include those that are and are not approved, as well as those requiring pre-approval. While this guide’s sample expense policy template is fairly basic, you might want to specify which expenses are approved if your employees frequently travel or meet with clients. You could also establish a daily limit (per diem) on employee spending—usually ranging from $60 to nearly $400 per day, depending on your state and permitted expenses.

You can provide ranges of what’s acceptable for expenses, such as meals while traveling or mileage reimbursements. You can also limit the kinds of approved expenses to what the IRS will allow, which can include:

- Business-related meals (e.g., a sales lunch)

- Car rental

- Hotel expenditures

- Parking and tolls

- Standard mileage rate (70 cents per mile

This is the IRS' standard mileage rate for 2025. It can change on an annual basis, so check the IRS website for updates.

for transportation and travel expenses)

Other nontraditional approved expenses may include:

- Remote office supplies (e.g., computer and printer)

- Employee perks (e.g., T-shirts and coffee mugs)

- Food (e.g., pizza for a company event and donuts for a meeting)

- Entertainment

Don’t list every possible expense reimbursement in your policy. Provide general items that may be approved, and note that the list is not exhaustive. However, I suggest including expenses that will not be approved, including transactions that will require pre-approval. Check out the tabs below for examples.

Aside from filling out an expense report form, be sure to communicate what else your employees need to provide (such as original receipts, pictures of receipts, dates, times, client names, and reasons for expenses). This is usually the section of your expense policy that needs to be as clear as possible to prevent issues.

You may want to add columns in your expense report template to track the client name and reason for the expense. In fact, some companies go so far as to require each employee to assign each expense to a cost center to make it easier for the finance team to do payroll accounting.

Make it clear in your policy that any expense over the limit, if one is set, needs approval. This can be a good policy if team members buy equipment that can be expensive.

Notify your employees about how they report expenses to you, whether through their supervisor, HR, or your payroll provider. I recommend having one point of contact (POC) for tracking reimbursable employee expenses to avoid chaos. The POC can also ensure that expenses are properly allocated to the correct cost center in your accounting system.

You should let your workers know how often they should submit expenses (e.g., immediately or on the first of every month). Be as specific as possible by listing the day of the month or date by which they should submit expense reports and whether the expenses expire. Also, note how long it will take to process the expense report so employees have an idea of when to expect reimbursement.

The most common reimbursement periods are monthly and quarterly, with an expense submission timeline of at least five to 10 days before the next payroll cycle. If expenses are reported late, they can be reimbursed the following pay period.

The most common practice to document employee expenses is to use a form, like the free template for the expense report above. Whatever method you use, track employees’ expense amounts and make sure they are appropriate.

I recommend keeping your expense report template in your company’s shared drive or leaving copies in a designated folder everyone can access. Also, have your accountant or HR professional review your employee reimbursement policy before you distribute it to workers. Then, once you have finalized it and the accompanying form, ensure all employees get a copy of the policy and understand it (e.g., hold a companywide meeting or video call).

Tracking and recording the expense reports also gives you insight into any potential misuse or abuse of company funds. While most employees are honest, some employees might try to get reimbursed for personal purchases.

To avoid this, have each employee sign and date a copy of the expense policy and document this in their personnel files (electronic or paper is fine). The expense policy should also be added to your company’s employee handbook for full visibility.

Having employees use personal credit cards to make purchases and then request reimbursement has advantages. You can better control how business resources are used since you won’t be providing upfront funding. It also eliminates the risk of misuse of company credit cards.

However, using personal credit cards may lead to higher costs for the company because of extra administrative work. Some companies don’t want the hassle of using employee expense reports, so they provide company-issued credit cards to authorized workers or loan the sole company credit card to an authorized employee to make a specific purchase.

When deciding which option is best for your company, consider how employee credit cards work and how much control and oversight you want for employee spending. Company credit cards provide more visibility than personal cards and less administrative burden.

It also depends on the types of expenses you intend to reimburse. If the purchase transactions are for office supplies, a company card might be the best choice. However, if most expenses are related to work-from-home supplies, personal vehicle or cell phone usage, or similar items, it might be best to have employees front these costs and request reimbursement using the expense report form.

Expense Reimbursement Alternative: Work-from-home Stipend

If you have distributed team members who regularly have work-related expenses, consider offering a work-from-home stipend. This can be a static amount, say $100, for each full-time employee. Each month, they receive an additional $100 on their paycheck to help cover any work-related expenses, like improved internet service, a better desk, or a more ergonomic chair.

While these stipends reduce the administrative burden, it’s important to note they are not expense reimbursements. This means that the stipend is generally taxable income to both your company and your employees.

How Expense Reimbursements Affect Payroll

Regardless of whether you’re using payroll software or doing payroll via Excel, when an employee is reimbursed for expenses incurred on behalf of the company, it can affect payroll calculations, depending on how the reimbursement is distributed. If paid through payroll with a nonaccountable plan, it increases the employee’s gross pay because the reimbursement amount is included in the employee’s taxable income. Any associated taxes (e.g., FICA tax or Social Security and Medicare taxes) are also taken out of that amount.

When done correctly, an expense reimbursement is fully tax-free. This ensures the employee gets back the full amount and your company doesn’t incur additional and unnecessary payroll taxes.