A pay stub is a document that details an employee’s earnings, deductions, and net pay for a specific pay period. While it might seem like a simple document, it’s a powerful tool for record-keeping, compliance, and maintaining transparency with your employees. For an easy way to create one with all the required information, use our free pay stub generator below below.

Create free paystub

If you want flexibility and automation features, use a payroll system since its pay stubs are formatted to work with businesses in most industries. I recommend Gusto because it has a user-friendly platform designed to handle small business payroll. For other options, read our guide to the best payroll software to find one that fits your needs.

How to use the free paystub creator

Our pay stub maker is straightforward to use. It has sections that require manual data inputs and data fields that will automatically compute the applicable amounts based on the information provided.

Step 1: Start by inputting the name of your company and your business address in the Company Information section.

Step 2: The Company Information section also has data fields for the pay period. Click the calendar icon to choose the start date and payout date of your pay period. Note that the “To” data field will automatically show the applicable date based on a seven-day pay schedule. You can change this to 14 days by clicking the blue-colored text “Change 7 days period.”

Vacation Leave/PTO

Step 3: In the Employee Information section, input your worker’s name, address, employee ID, and Social Security number.

Step 4: For the Earning section, select the applicable earning type (e.g., regular, overtime, commission, bonus, and other earnings) and add the rate. You should also input the total hours worked for the current pay period, including the year-to-date data. The pay stub template will calculate the total earnings for both periods.

Click the “Add Earning Type Row” option to add other information, such as overtime and bonus payments. Note that for bonus and commission payments, add the number “1” to the total hours worked data field for the template to compute the applicable amount.

Step 5: For the Deduction section, follow the instructions in Step 4 to input applicable deductions like Social Security, Medicare, insurance, 401(k), federal tax, state tax, and local tax.

Step 6: Go to the Time-off Balances section and select the applicable balance type (e.g., vacation or PTO and sick leave). Input the accrued days and leave days taken for the current pay period. The pay stub will automatically compute the remaining leave days. Click the “Add Balance Type Row” option to input other time-off types, such as sick leave.

Note that the pay stub will automatically calculate gross pay and net pay for the current pay period, including the year-to-date amounts, in the Gross Pay and Net Pay sections.

Pay stub legal considerations

While there is no federal law regulating or requiring pay stubs, it’s a good idea to use them. They can serve as a useful record-keeping tool, helping you meet state requirements for tracking hours worked and wages paid. Most states require you to use pay stubs in some form.

State pay stub regulations

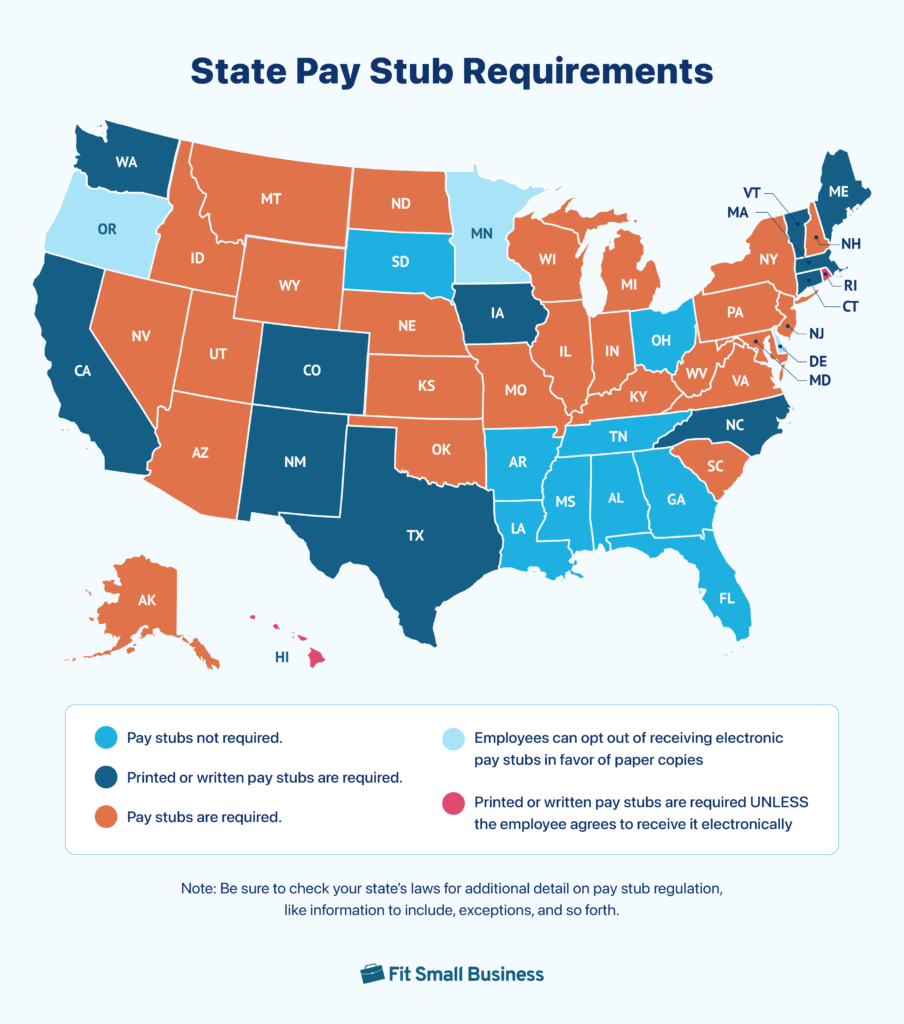

Forty-one states, plus Washington, D.C., require employers to provide pay stubs to their employees, while the remaining nine — mostly states in the southeastern US — don’t require employers to provide pay stubs to employees at all. Regardless, providing a pay stub is good practice because it ensures you have solid backup information in the event of an audit.

Some states also mandate in what form employees must receive their pay stubs. Colorado, for example, requires that all pay stubs be provided in a printed or written form, while Hawaii allows employees to opt out of written/printed pay stubs to receive pay stubs electronically instead.

Use the map below to determine if your state requires you to provide pay stubs to your employees and in what form:

State pay stub information

State law can also dictate the information you should include on a pay stub. Keep in mind that this is based on where your employee lives and works, so if you have remote workers, you’ll need to adhere to the pay stub laws of the state in which your employee resides.

Our free pay stub generator has all the needed information, but for guidance, pay stubs should generally include:

- Employee information: Name, address, and employee identification number, if you have one

- Pay period: Start and end dates or the end date only (depending on the state requirements)

- Hours worked: Not required by all states but a best practice because you have to track the information to ensure that you pay and calculate overtime correctly

- Gross earnings: Hourly earnings, commission earnings, tips, and any earnings based on piecework

- Required taxes: Federal and state taxes, unemployment taxes, and local taxes (if any), as well as Social Security taxes

- Taxable deductions: Wage garnishments, remote work stipends, etc.

- Tax-free deductions: Health insurance; FSA, HSA, or 401(k) contributions; etc.

- Net pay: Amount the employee takes home after all deductions

- Time off balances: Vacation leave/PTO, sick leave (required in states like California and New York, which have mandatory paid sick time laws)

- Year-to-date totals: How much an employee has earned, contributed, and had deducted for their pay in the current year

Pay stub retention

The United States Department of Labor (DOL) has no mandatory retention requirements for specific documents like pay stubs, but it does require that payroll information be retained for three years. Meanwhile, the Internal Revenue Service (IRS) requires that tax documentation is retained for four years. Some states, like California, require employers to retain payroll documentation for six years.

Our state payroll guides break down everything you need to know about pay stubs — from whether or not they’re required to what they need to include and how long you’re required to keep them on file. For all the details you may need, check out your state below:

State Payroll Directory

Other free payroll resources

If you find our free pay stub generator helpful, check out some of our articles with downloadable payroll templates.

Free Payroll Templates | Employee Expense Report Template | Tip Pooling Template | Time Sheet Templates | Pay Period Calendar Template | How to Do Payroll in Excel | How to Do Payroll Checklist

We also offer online payroll calculators if you need help making payroll calculations for each pay stub field.

Gross Pay Calculator | Overtime Pay Calculator | FICA Tax Calculator | FUTA Tax Calculator | Time Card Calculator | PTO Accrual Calculator | Employee Mileage Reimbursement Calculator

Pay stubs frequently asked questions (FAQs)

Yes, they are. There are no laws that prevent you from creating a pay stub generator or a pay stub template. However, if it contains falsified information in order to scam someone, then that can be considered illegal.

You can certainly create free paystub templates if you have the knowledge and resources to do so. However, using our free pay stub generator can save time and ensure you’re including all the necessary information for compliance.

The frequency of issuing pay stubs largely depends on your company’s pay schedule. This could be weekly, every two weeks, twice monthly, or monthly. Regardless of the pay schedule, employees should receive a pay stub each time they’re paid.

Yes. A pay stub is one of the common documents that your employees can use to show proof of income.

If you’re generating pay stubs digitally, make sure to use a secure platform. If you’re using paper pay stubs, store them in a secure location and dispose of them properly when no longer needed.

Not providing pay stubs to employees can lead to legal issues since many states require pay stubs in some form. Even in states where it’s not required, it’s still a good idea to provide pay stubs to maintain transparency about pay and deductions. Failure to do so can lead to misunderstandings, mistrust, and potential disputes.