Companies hiring independent contractors usually have short-term projects or part-time work that need to be completed in a specific time frame, or work requiring subject matter expertise. To hire independent contractors, you’ll identify the work that needs to be done and decide on the qualifications a contractor needs to perform the job successfully. Then, if you opt to post a job on a website, you should prepare a job description—make sure you note the job is for independent contractors only. Finally, compile a list of interested contractors and screen the top applicants.

Cost is also a significant factor, so determining an acceptable contractor budget at the beginning of the process will prevent you from wasting time considering those who are outside your range.

1. Plan Contractor Projects

Before you make any major decisions about hiring independent contractors, consider whether you really need them or if an employee would be a better fit. Sometimes employers are penalized for misclassifying employees as contractors.

Take time to evaluate the project you need help with. Is it long term or short term? Can one contractor handle the job, or do you need multiple? Does the project require someone with advanced education or special certifications?

Generally, the best work for contractors is temporary and doesn’t require years of company-specific experience. Contractors often operate as a business, whether a formal entity or sole proprietorship, and usually have multiple customers. So, if you have a long-term project that requires a full-time work schedule, you should consider whether an alternative option would be more feasible than using contract labor. Cost, expertise, and convenience are all important factors.

2. Determine Contractor Qualifications

After verifying your need for a contractor and identifying the work you want performed, determine the qualifications you need in a contractor. Be sure to separate preferences from deal breakers. For instance, if you’re looking for a bookkeeper to “clean up your books” because you haven’t had the time to do it, consider whether you want the person to be certified or have a degree. Typically, bookkeeping certification would be a preference, while experience would be a requirement.

3. Write a Job Description

Figuring out what you need and want in a contractor will help you create a solid job description that saves you time by primarily attracting your target candidates. It’s disappointing to sift through a list of contractors who can’t perform the work you have or just don’t meet the qualifications. This is why it’s important to be direct when writing your job description and clearly note you’re specifically looking for independent contractors.

Here are the most important items you should include in a job description:

- Job details: Provide detail on what the project entails.

- Required credentials: If you require a degree, license, or other credentials, include it so contractors who don’t qualify won’t apply. State if it’s a preference rather than a requirement, so you don’t miss out on eligible candidates.

- Length of job: Estimate the length of time you expect the project to take. If you’re looking to build a long-term relationship over a series of projects, express this in the job description.

- Ideal contractor: It’d be helpful to spell out what your ideal contractor is like. You can list traits like adaptability, charisma, and so on.

- Company profile: Include a brief description of your company with details on its industry and clients.

- Pay: Some companies list the pay amount (either by hour or project) directly on the job description. Although pricing is an important detail that governs the owner-contractor relationship, it’s not always a good idea to include it in the job description. Instead, request quotes from the contractors you’re interested in; this leaves room to negotiate.

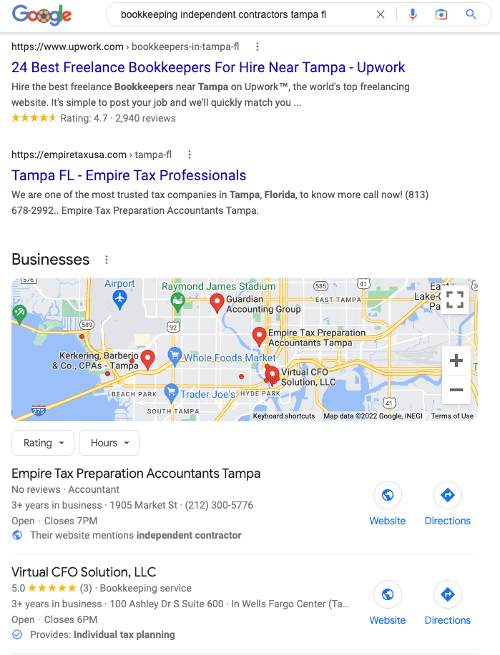

If you’re interested in posting your contract work on a job board, consider Upwork. It offers the largest network of independent contractors, and you can put parameters on your jobs so that only top qualified candidates can apply. Additionally, you can post jobs for free on the site but you are subject to a 2.75% client fee when you pay your contractor.

4. Search for Contractor Candidates

Once you know what your needs are and have your job description, you can begin searching for contractors. Deciding where to search sets the stage for this step, and it primarily depends on the type of work you have available. For instance, you’d look for bookkeepers, virtual assistants, and roofing contractors using different platforms. There are numerous avenues you can use to search, but you should take advantage of the internet as it’s convenient and offers a wide reach.

5. Compile Applicant List & Screen for Best Candidates

As you proceed through the process of hiring a contractor, start compiling a list of eligible candidates. You should be able to eliminate some contractors before doing any major evaluation. Always refer to your qualification list and job description to keep you on track because it’s easy to become sidetracked when reviewing dozens of candidates.

Be aware that some contractors will look great on paper but aren’t exactly what you need. They may have more qualifications than the job requires and hence exceed your budget. On the opposite end, you’ll find some deals that look very attractive financially, but the contractor’s experience may be questionable.

Once you compile your list, filter it for the candidates that fit your profile of an “ideal contractor” for the job. If you struggle to find ideal candidates, screen for the next best.

6. Request Quotes From Each Contractor

Once you know which contractors you’re willing to work with, you can hone in on pricing. By the time you reach this step, you’ll most likely already have insight into the amount each professional charges. It’s up to you whether you want to negotiate; you should wait until officially meeting with them before starting the process.

Be cautious of quotes that are too high or low. Any quotes significantly outside of the general range could signal a red flag. Compare all prices and consider factors such as experience and contractor business structure before drawing any conclusions. Eliminate any contractors that don’t fit.

7. Interview Top Independent Contractor Applicants

After receiving a few bids for the job, you’ll interview the best contractors and negotiate a price before making your final decision. Similar to scheduling a job interview, you should set up a meeting or call with the top independent contractor applicants. Three is a good number to consider, but add more if you want additional options. Use the meeting to ask questions and assess the contractors’ capabilities and compare your findings with the research you’ve already gathered.

Ask questions and review attributes during the interview stage so you’re ready to make a decision shortly after.

Those are great questions to ask. However, there are some questions and comments you should avoid:

- Are you able to come to our office from nine-to-five each day?

- We have a weekly staff meeting every Wednesday at 9 a.m. We’ll expect you to attend.

- You don’t need to send us an invoice; we’ll just pay you a regular salary with normal payroll runs.

- You’ll be reporting to X employee and they’ll conduct your performance reviews quarterly.

- Have you overseen employees before? This role will require you to manage two employees.

All of these questions and comments blur or outright eliminate the line between an independent contractor and an employee. You don’t want to do that as it could be costly for your company.

8. Extend Offer & Prepare Independent Contractor Agreement

You’ll need to decide which contractor you’ll hire and prepare to extend an offer. An offer to an independent contractor doesn’t come in the form of an offer letter as it would for an employee. Instead, you’ll prepare an independent contractor agreement that clearly describes the relationship between the parties, the scope of work that’s expected, the rate you’ll pay (only after receiving an invoice from the contractor), and any milestones or deliverables and their timeline.

While you should speak with the contractor first to line up all these details, putting it in writing is important to protect both you and the independent contractor. This agreement will have legal consequences if you violate the terms so make sure you’re comfortable with the final version.

For the contract to be legally binding, both you and the contractor must sign. It’s best not to begin working with any contractors until a fully executed (signed) contract is in place.

For more information on independent contractor agreements, as well as specifics on hiring international contractors, check out our guide to hiring international contractors.

Federal Laws on Hiring a Contractor

One of the best parts about hiring independent contractors is the lack of extensive regulation. Hiring employees subjects employers to numerous laws, but working with contractors is much less complex. Depending on your state, you may have to report new contractors to a state agency. Your primary concern should be ensuring that your contractor is indeed a contractor and not an employee. You shouldn’t dictate how or when the contractor works, only what the final product should be.

Potential 2023 Change

The Biden Administration released a proposed rule that could make some workers currently classified as independent contractors employees instead—if it becomes law. This would come from a change in how employers are required to classify contractors.

The biggest change focuses on workers who are economically dependent, while still weighing other factors. Generally, independent contractors have the ability to earn a living from multiple sources at once. If a contractor is economically dependent on a single company, however, they will most likely be classified as an employee.

Penalties for Misclassifying Independent Contractors

Penalties for not complying with federal laws can be costly. The IRS is very sensitive to contractor-employee misclassifications and will search for those occurrences when conducting audits. If the IRS discovers you misclassified any employees as contractors, the contractors are automatically reclassified and you may owe back payroll taxes (15.3% for Social Security and Medicare (FICA) and possibly 20% for income taxes) and penalties of $1,000 per misclassified worker; you’ll also be subject to paying the misclassified worker back overtime pay, if applicable. We should note that you could also get a year in prison.

Be sure that you’re not setting your contractors’ work hours or controlling how they perform their work; otherwise, they should probably be employees.

State Contractor Classification

It’s also a good idea to check whether your state has specific contractor classification tests that you can follow to ensure you comply. Several states use the ABC test to determine if someone is really an independent contractor. The ABC test has three phases:

- Is the contractor free from the direction and control of the hiring entity?

- Is the contractor doing work that is outside the scope of the hiring entity’s business?

- Is the contractor customarily engaged in an independently established occupation, business, or trade that is the same as the work being performed?

If you can answer “yes” to all three of these questions, you will pass the ABC test. The second one is often the most precarious for companies engaging independent contractors.

Say your business provides accounting services to clients. You have four full-time accountants who provide these services and now you want to add an independent contractor accountant to supplement additional work for clients. You can’t. That new worker would be an employee because they don’t pass the second question.

The following states use the ABC test. If your state isn’t listed, that doesn’t mean you’re free to classify however you like. Your state probably has very similar classification steps it will follow to determine whether a worker is an employee or an independent contractor. Also keep in mind that if you’re partnering with a remote independent contractor, the state laws where they live and work will apply.

- California

- Connecticut

- Delaware

- Illinois

- Indiana

- Massachusetts

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- Vermont

- Washington

- West Virginia

New Hire Reporting for Independent Contractors

Federal law doesn’t require new hire reporting for contractors, but some states do. These states match the reports against their child support records to locate parents, establish a child support order, or enforce an existing order. All laws differ, so it’s best to check your state’s website for specifics.

Here are the states that require businesses to report independent contractors with a link to the new hire reporting portal or other relevant site:

- Arizona

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Iowa

- Maine

- Massachusetts

- Michigan

- Minnesota

- Nebraska

- New Hampshire

- New Jersey

- Ohio

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

- West Virginia

Federal Laws on Paying Independent Contractors

Generally, you aren’t required to withhold taxes from an independent contractor’s pay. They are obligated to pay their own contractor taxes. However, if you’re unable to gather their Social Security Number (SSN) or Tax Identification Number (TIN), you’ll need to withhold 24% from each payment to remit for taxes.

The IRS requires you to collect your contractors’ identifying information, like name, SSN or TIN, and address (usually on Form W-9), at the time of hire so you can file the 1099 tax form at year-end with ease. 1099 reports all contractor earnings for the year. You’ll send a copy to each contractor, the IRS, and your state tax agency. This ensures the tax agencies are aware of who should be paying their own taxes.

Need help paying your independent contractor? Check out our guide on how to pay contractors. Keep in mind good payroll software will make processing payroll much easier than doing it manually.

Bottom Line

Hiring independent contractors requires analyzing the work you need to be completed so you can determine the best professional for the job. You’ll spend time researching different options and strive to choose the best one based on cost, ability, and ease of use. Understanding federal and state laws is also important so you avoid penalties and taxes.