When finding a bookkeeper for your small business, you need someone who is trustworthy and able to keep your company’s financial details confidential. A worker in this role must have extreme attention to detail; otherwise, your company’s financial picture may be skewed, leading to poor business decisions, inaccurate tax filings, and government fines. You can opt to hire a full-time bookkeeper, but many small businesses start by using a contractor until they grow into needing an employee on staff.

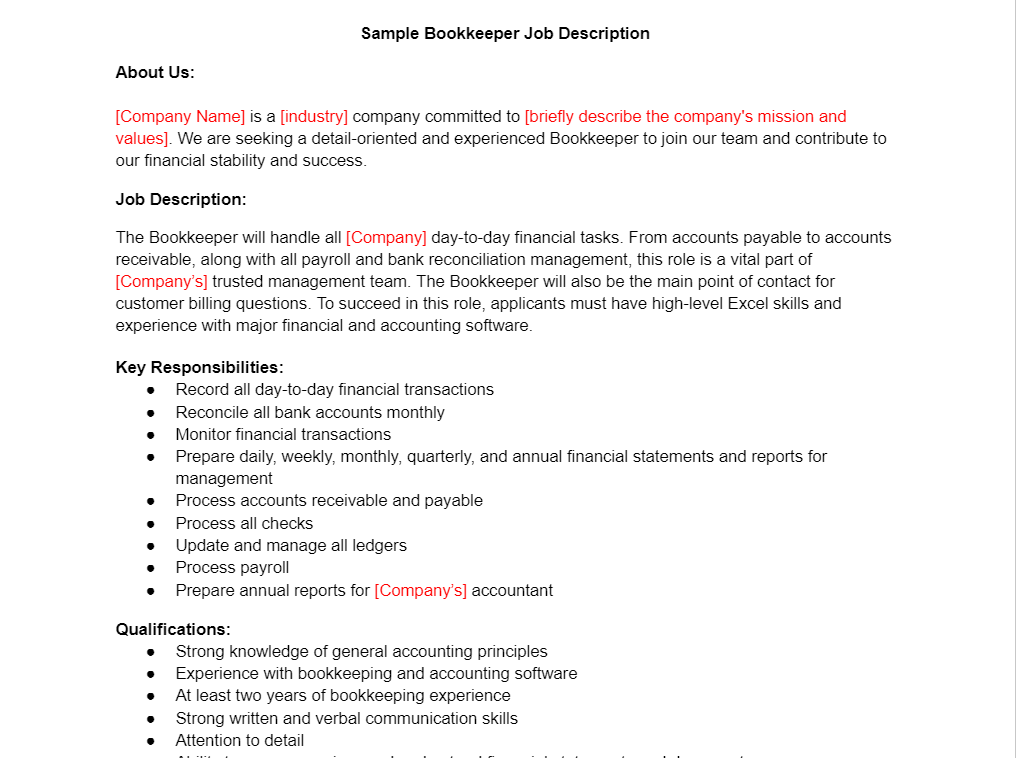

To save time, use our free bookkeeper job description template, which you can tweak according to your business needs. And, continue reading for other considerations when you are looking for a bookkeeper.

Thank you for downloading!

If you’re interested in hiring a contract bookkeeper, consider Bench, a virtual accounting service provider. When you sign up, you’ll be paired with a dedicated bookkeeper who acts as your in-house accounting team. Bench offers affordable plans for any business budget. Sign up to try it today.

If you’re interested in hiring a contract bookkeeper, consider Bench, a virtual accounting service provider. When you sign up, you’ll be paired with a dedicated bookkeeper who acts as your in-house accounting team. Bench offers affordable plans for any business budget. Sign up to try it today.

1. Consider the Necessary Qualifications

While bookkeepers have no licensing requirements like a CPA, voluntary organizations can certify applicants. You want a bookkeeper who is up-to- date on relevant laws and maintains a certain skill level. If an applicant has been certified by a bookkeeping organization like the National Association of Certified Public Bookkeepers (NACPB) or the American Institute of Professional Bookkeepers (AIPB), you should have confidence they have the skills and knowledge necessary to do the job.

Your specific job qualifications may vary, but—at a minimum—you need a bookkeeper proficient in:

- Excel or Google Sheets

- Bookkeeping software

- Debits and credits

- Invoicing

- Balance sheets

- Payroll

- Deferral transactions

- Journal entries

- Benefits calculations

- Customer relations

Most bookkeepers should have at least some experience with Microsoft Excel. Use our free Excel test to assess your candidates before hiring.

2. Choose Between Employee vs Freelance vs Remote vs Firm

The choice between a freelance bookkeeper, a bookkeeping firm, or a remote bookkeeper depends on factors like your specific business needs, budget, and your preference for communication and support. Each option offers a unique set of advantages and disadvantages:

Employed Bookkeeper

Use When: You have a consistent and substantial volume of financial transactions that require daily or ongoing attention.

Common Scenarios: Established businesses with a steady flow of financial activity, larger companies with complex financial operations, or industries with strict regulatory requirements often benefit from full-time bookkeepers.

| PROS | CONS |

|---|---|

| Dedicated availability: A full-time bookkeeper is available during regular working hours and can provide continuous support for your financial needs. | Cost: Hiring a full-time bookkeeper comes with the expense of salary, benefits, and potentially office space, which may be costly for small businesses. |

| In-house expertise: They become intimately familiar with your business's financial operations, which can lead to improved accuracy and understanding. | Limited flexibility: Full-time bookkeepers may not be available outside regular office hours or during periods of lower workload. |

| Team integration: Full-time bookkeepers can work closely with other departments or employees to address financial concerns promptly. | Recruitment and training: Finding and onboarding a full-time bookkeeper can be time-consuming, and you may need to invest in training. |

| Data security: You have more control over sensitive financial data and can implement security measures within your own environment. | |

Freelance Bookkeeper

Use When: Your business has periodic or project-based bookkeeping needs. Freelance bookkeepers are suitable when you want flexibility in engagement, cost control, and specialized expertise for specific tasks or short-term projects.

Common Scenarios: Startups, small businesses, or businesses with occasional surges in accounting work often find freelance bookkeepers cost-effective and adaptable to their changing requirements.

| PROS | CONS |

|---|---|

| Cost-effective: Freelance bookkeepers often have lower hourly rates compared to firms | Inconsistent availability: Availability may vary depending on the freelancer's schedule, which can lead to delays in service. |

| Flexibility: Freelancers can adapt to your schedule providing flexibility in how and when they deliver services. | Dependence on one person: Relying on a single freelancer for bookkeeping can pose a risk if they become unavailable or if there's a change in their circumstances. |

| Personalized service: You have direct access to the bookkeeper | Accountability: There may be fewer layers of accountability compared to firms, potentially leading to a lack of oversight and quality control. |

| Diverse client experience: Freelancers may work with a variety of clients and industries, bringing diverse experience to the table. | Limited scalability: Freelancers may not be well-suited for businesses with complex or rapidly growing financial needs. |

| Independence: Freelance bookkeepers are typically independent, making decisions without corporate constraints. | |

Bookkeeping Firm

Use When: You require comprehensive financial services, a team of professionals with diverse expertise, scalability, and a high level of reliability. Bookkeeping firms are suitable when you want a one-stop solution for your financial needs.

Common Scenarios: Medium to large enterprises, businesses with complex financial structures, and those seeking a comprehensive financial strategy often turn to bookkeeping firms for their expertise and resources.

| PROS | CONS |

|---|---|

| Team of experts: Firms typically have a team of professionals with varied expertise, providing comprehensive financial services. | Higher costs: Firms may have higher hourly rates or fees compared to freelance bookkeepers. |

| Range of services: Firms may offer a wide range of financial services, including accounting, tax planning, and audit support. | Limited direct contact: Direct communication with the assigned bookkeeper may be limited, as firms may assign a dedicated account manager or team. |

| Established processes: Firms often have established processes and quality control measures in place, ensuring consistency and accuracy. | Potential for staff changes: The firm may assign a different bookkeeper if the primary one becomes unavailable, leading to a shift in familiarity. |

| Accountability: Firms have layers of accountability, reducing the risk of errors or oversights. | Fixed hours: Firm hours may not always align with client needs, potentially causing delays in communication and response. |

| Scalability: Firms can handle large-scale projects and adapt to growing business needs. | |

Remote Bookkeeper

Use When: You need a cost-efficient solution with the flexibility to work with professionals from different geographic locations. Remote bookkeepers are suitable when physical proximity is not a necessity, and you prefer to access a broader talent pool.

Common Scenarios: Businesses of various sizes and industries can benefit from remote bookkeepers, especially if they are comfortable with digital communication tools and cloud-based accounting software.

| PROS | CONS |

|---|---|

| Flexibility: Remote bookkeepers can work from anywhere, providing flexibility for both the bookkeeper and the client. | Time zone differences: Time zone differences can impact communication and response times, especially for international remote bookkeepers. |

| Access to global talent: You can choose a bookkeeper from anywhere in the world, potentially accessing specialized expertise. | Dependence on one individual: Relying on a single remote bookkeeper can be a risk if they become unavailable. |

| Reduced overhead: Remote bookkeepers often have lower overhead costs, which can translate into cost savings for clients. | Limited on-site assistance: Remote bookkeepers may not provide on-site support or training, which can be a disadvantage for some clients. |

| Direct communication: Clients can have direct communication with their remote bookkeeper, fostering transparency and collaboration. | Resource limitations: The remote bookkeeper may have limited access to resources and support compared to those working within a firm. |

| Accountability: Accountability depends on the individual remote bookkeeper, which may vary in terms of quality and reliability. | |

3. Use Job Boards

To find a bookkeeper, you need to go where candidates are—job boards. I recommend posting to at least three different job boards so you get a good mix of applicants. To specifically seek freelance bookkeepers, check out our top picks for online bookkeeping services. You can also use a website that’s specifically for hiring freelancers. Expand your search to additional job board sites if you want to hire an employee for the role. You want to make sure you get your job posting in front of as many qualified applicants as possible.

You can also actively search for candidates. Using your job board of choice, you can scan for bookkeepers in your area with the experience you seek. Here are some tips when posting to job boards.

We offer a full guide on how to write a job description, but there are a few points we want to call out here specifically for bookkeeping. For one, make sure to indicate the type of employee you need. As stated, it’s dependent on your company’s needs and how you plan to grow your business.

Next, make sure your job ad is relevant to your business. For example, if you run a restaurant where employees routinely have tips, minimum wage is frequently an issue. You’ll likely want a bookkeeper that’s worked in the same industry. So, make sure your job description is clear about the job history and experience you need.

Make sure your job ad includes a few brief sentences about your company. Why would someone want to work for you? What makes your business unique? Why do employees stay with your company? What benefits do you offer? Answer these questions in advance to get applicants excited about joining your company.

Finally, make sure you’re following your local laws. Some cities and states have begun enacting pay transparency laws where companies must list a target salary or a salary range in the public job ad. Minimum wage laws will also be factored in here. Even if your company doesn’t have an office in one of these locations but you’re open to hiring someone remotely, you’ll need to comply with these laws. However, if you’re hiring a freelance bookkeeper, you may not have to consider such compliance laws—more often than not, these only apply when hiring an employee.

4. Decide on Bookkeeper Pay Rates

You’ll need to decide ahead of time how much you want to pay your bookkeeper; including this information in your job ad can help you attract more quality applicants—and it may be legally required. The amount you choose will vary based on your company’s location, the experience you’re requiring, whether they’re contractors or employees, and the industry in which your company operates.

The annual salary of a full-time bookkeeper, according to the Bureau of Labor Statistics (BLS), averaged about $45,000 in 2022. According to BLS data, bookkeeper salaries range from as low as about $30,000 to over $65,000. Although these are fairly wide ranges, they can be narrowed down based on your industry, the experience of the bookkeeper, the nuances of your business, and your company location.

Use a salary comparison tool to help determine your compa ratio, or how competitive your proposed salary is in the market.

5. Determine What You Need a Bookkeeper to Do

Companies often throw around titles without thinking about how the job title describes the duties for that role. A bookkeeper is different from an accountant, a comptroller, a financial analyst, and other finance-related positions. While bookkeeping is more than just copying numbers into a spreadsheet, it is a basic finance position, so you don’t need to look for someone with decades of experience.

Bookkeepers are typically involved in the following tasks:

- Accounts receivable

- Accounts payable

- Monitoring debt levels

- Making all business payments (rent, loan, vendor)

- Reconciling bank accounts monthly

- Maintaining a budget

- Recording incoming and outgoing expenses (including making physical bank deposits)

- Recording payroll and taxes

- Partnering with your CPA to provide accurate financial statements for corporate taxes

With a reliable bookkeeper, you can focus on your business instead of constantly worrying about cash flow and expenses. Ultimately, a proficient bookkeeper gives you invaluable insight into your company’s finances, allowing you to make better decisions.

Bookkeeper vs Accountant

Both bookkeepers and accountants are integral to a company’s financial management, but they have distinct roles and responsibilities.

Here’s a comparison of bookkeepers and accountants on various aspects:

Aspect | Bookkeeper | Accountant |

|---|---|---|

Primary Role | Record and maintain financial transactions, manage ledgers, and ensure accuracy in financial records. | Analyze financial data, prepare financial statements, provide strategic financial guidance, and offer tax planning services. |

Education | Typically have a certificate or associate's degree in accounting or bookkeeping. | Typically hold a bachelor's degree in accounting or a related field. Some may have advanced degrees or professional certifications (e.g., CPA). |

Scope of Work | Focus on day-to-day financial tasks, such as data entry, reconciliations, and payroll processing. | Engage in broader financial analysis, strategic planning, budgeting, auditing, and tax-related activities. |

Reporting | Generate basic financial reports (e.g., income statements, balance sheets) based on transactions recorded. | Prepare detailed financial statements, analyze financial trends, and provide comprehensive financial reports for stakeholders. |

Regulatory Compliance | Ensure compliance with accounting standards and may assist with basic regulatory filings. | Handle complex regulatory compliance, including audit preparations and adherence to various financial regulations. |

Strategic Planning | Generally not involved in long-term strategic planning. | Play a crucial role in strategic financial planning, forecasting, and providing guidance for business growth. |

Client Base | Commonly work for small to medium-sized businesses. | Serve a diverse range of clients, including large corporations, individuals, and government entities. |

Cost | Usually more cost-effective for routine bookkeeping tasks. | May command higher fees due to their specialized skills and expertise in financial strategy and analysis. |

Benefits of Hiring a Bookkeeper

Hiring a bookkeeper can provide numerous benefits for businesses of all sizes and types. Here are some of the key advantages of bringing a bookkeeper on board:

- Financial accuracy: A bookkeeper’s primary role is to maintain accurate financial records. Their attention to detail helps prevent errors in financial reporting, reducing the risk of costly mistakes.

- Time savings: Handling financial transactions and record-keeping can be time-consuming. Hiring a bookkeeper frees up your time and allows you to focus on core business activities and strategic planning.

- Compliance: Bookkeepers are knowledgeable about accounting standards, tax regulations, and financial reporting requirements. They help ensure your business remains compliant with local, state, and federal laws.

- Cost-efficiency: While hiring a bookkeeper is an expense, their expertise can actually save you money in the long run. They can identify cost-saving opportunities, prevent financial errors, and help you make informed financial decisions.

- Improved decision-making: Accurate and up-to-date financial records provide valuable insights. A bookkeeper can generate reports that help you make informed decisions about budgeting, forecasting, and investment.

- Reduced stress: Managing finances can be stressful, especially for small business owners. Hiring a bookkeeper can alleviate this stress, allowing you to focus on running your business without worrying about the books.

- Vendor and employee relations: Timely payments to vendors and employees are essential for maintaining positive relationships. A bookkeeper ensures that payments are made on time, improving your business’s reputation.

- Resource optimization: By outsourcing bookkeeping tasks to a professional, you can avoid the cost of hiring a full-time accountant or finance team, making it a cost-effective solution for small and medium-sized businesses.

How to Hire the Best Bookkeeper Candidate

Identifying the best candidate for a Bookkeeper position requires a careful evaluation of their skills, qualifications, and attributes that are essential for success in the role. Here are some key steps to help you identify the best candidate:

Look for candidates with relevant educational backgrounds, such as a degree in Accounting, Finance, or a related field. Pay attention to the candidate’s work experience, particularly if they have prior experience as a bookkeeper or in a similar financial role.

Read our comprehensive guide on resume screening.

Evaluate the candidate’s proficiency in accounting software, such as QuickBooks, Xero, or other relevant platforms. Check their knowledge of Microsoft Excel and other software tools commonly used in bookkeeping.

Check our article on the skills-based hiring process.

When interviewing applicants, you need to know that candidates have the right skills for the job. Open-ended questions and icebreakers are great ways to start a conversation with an applicant. But you have to determine the applicant’s skill level and proficiency with bookkeeping tasks.

Once you get a better sense of the applicant, move to more specific and detailed questions. Below are some questions I like to ask when interviewing for financial positions:

- What types of financial reports have you regularly created, and how was the data used?

- What’s the biggest financial blunder you’ve experienced? This might be something you discovered and had to bring to your manager’s attention.

- How do you handle customers who are angry about an invoice or bill?

- Under what circumstances would you post an adjusting entry?

- How would you know if someone posted an adjusting journal entry to accounts receivable and how would you correct it?

- What do you do if a bank reconciliation is off by a small amount?

- Colleagues may ask you questions about the company’s finances. How do you handle those discussions while keeping company information confidential?

Check out the best interview questions you can ask candidates or learn about illegal interview questions.

During the interview, you can also evaluate candidates for the following:

-

- Communication and interpersonal skills

- Attention to detail

- Organizational skills

- Analytical skills

- Ethical conduct

- Teamwork and independence

- Problem-solving skills

- Cultural fit

- Adaptability

You can find more information on our article on behavioral interview topics and questions. It also has a free template you can use.

Check if the candidate has relevant certifications, such as Certified Bookkeeper (CB) or Certified Public Accountant (CPA), and inquire about their commitment to ongoing professional development.

Consider administering a practical bookkeeping test or assessment to evaluate their technical skills and problem-solving abilities.

Explore our article on pre-employment assessment for more information.

Contact the candidate’s references to verify their work history, reliability, and professional demeanor.

If you opt to hire a bookkeeping employee and want more in-depth tips, check out our guide to hiring employees.

Background Check Process for Bookkeepers

Many companies have a background check policy to run a criminal background check on all new hires. While some states prohibit you from asking about prior criminal convictions during the interview process, you can still run a background screen on employees once you give them a formal job offer.

But a bookkeeper isn’t just an ordinary employee. They have access to your company financials, credit cards, and bank accounts. Performing a background check on a bookkeeper you wish to hire can provide you with helpful information about their past, including issues with two of the most important traits of a competent bookkeeper: trustworthiness and financial security.

The background check performed on an employee must be related to the duties of the job. For a receptionist, for example, you could run a simple seven-year criminal background check. For a truck driver, you could include a driver’s license check. However, for a bookkeeper, I recommend you include a financial background check.

- Personal credit report

- Credit card debt

- Tax liens

- Judgments

- Foreclosure

- Related criminal convictions and arrests

- Bankruptcy

This is vital information that directly relates to the core duties of the role. Ask the candidate to explain anything you are concerned about in the background report. Your bookkeeper will have access to highly sensitive information about both your company and employees. You must protect your existing employees’ confidential data by ensuring you hire a trustworthy employee.

If you find the person’s background screen results disqualify them from employment, consider the legal implications. When you make a hiring decision based on the background check results, it’s considered an adverse employment decision subject to anti-discrimination employment laws. To be lawful, you must base your decision on a non-discriminatory reason. Failing to disclose substantial liens or personal bankruptcies could be a lawful and non-discriminatory reason when directly related to the job description.

Use one of our recommended background check companies to make the process easier.

Bottom Line

Above all, you must trust your bookkeeper. So whatever you do, don’t rush the recruiting and hiring process. Having a bookkeeper that matches your needs will eliminate the stress and anxiety of doing this work yourself or having someone else do it who may not have the skills necessary. By providing accurate and up-to-date financial information to help steer your business, a dependable bookkeeper should make your life easier and less stressful.

If you’d prefer to take some of the stress out of the hiring process, consider partnering with Bench. They ensure their team is fully trained and has the skills necessary to be your in-house virtual bookkeeper. Try them today.