In the simplest terms, an invoice is a request for payment, while a receipt is a proof of payment. When an invoice is issued, it creates an obligation to the buyer or customer to complete the payment for a product or service delivered. When the buyer completes the payment, the seller issues them a receipt to acknowledge that the payment has been received and that the transaction is completed.

Let’s explore the differences in this invoice vs receipt comparison.

Invoice | Receipt | |

|---|---|---|

Purpose | Request for payment | Proof of payment |

Timing | Issued before payment is made | Issued after payment is made |

Accounting Usage (Accrual Basis) | Recorded as income and increases your A/R | Reduces A/R, but no further income is recorded |

Accounting Usage (Cash Basis) | No entry is made when issued | Recorded as revenue when cash is received and the receipt is issued |

Business and Client Information | ✓ | ✓ |

List of Goods or Services Provided | Not yet paid | Already paid |

Total Amount Shown | Total amount to be collected | Total amount paid |

Payment Terms | ✓ | ✕ |

What to Include in an Invoice vs Receipt?

Invoices and receipts may contain some similar information, including the list of products and services and the company and client information. However, each document includes unique information to serve their purposes.

Invoice

You’ll find the following sections in an invoice:

- Company logo: You may include your company logo to make it more professional.

- Invoice number: This serves as a unique identifier for the invoice, helping you track and reference transactions.

- Date: This is where you enter the date the invoice is issued. This will help you easily determine when the transaction occurred.

- Billing information: This section includes details about your business, including your company name, address, and contact information.

- Customer information: Here, you’ll see the details about the buyer or customer, including the name, address, contact information, and sometimes account number.

- Description of products or services: This shows a breakdown of the products sold or services rendered, including the product or service names, quantities, and prices.

- Total amount due: This shows the total amount that needs to be paid by the buyer, including discounts and taxes when applicable.

- Payment terms: Here, you can specify the invoice due date. Some of the most common payment terms include:

- Due upon receipt: This means payment is due immediately upon receipt of the invoice.

- Net 30/60/90: This indicates the number of dates within which the payment is due after the invoice date. For instance, Net 30 means the payment is due 30 days after the invoice date.

- Cash on delivery (COD): This means that the payment is due upon the delivery of the goods or services.

- End of month (EOM): The customer is expected to pay at the end of the month following the invoice date. For instance, if an invoice is issued on April 15th with a Net EOM 30 payment term, then the customer should make the payment by April 30th.

- Acceptable payment methods: This section provides the buyer with options for processing the payment. Some of the most common payment methods include cash, checks, credit or debit cards, and bank transfers.

- Additional information: You can input additional information, such as comments related to the transaction or a thank-you note to the customer.

Receipt

In addition to the company and customer information and product and service descriptions, receipts contain unique details specific to the completion of the transaction, such as:

- Receipt date: This is when the receipt is issued to the customer and is most likely when the sale transaction happens.

- Amount paid: This specifies the total amount paid by the customer.

- Change given: This field is relevant only when the payment involves cash and the payment exceeds the total value. You’ll often see this in handwritten checks or those processed through point-of-sale (POS) systems.

- Payment method used: This field indicates the method used by the customer to make the payment.

- Thank you message: You can add a thank-you note to express gratitude to the customer for the payment received and add notes such as looking forward to serving them again.

Related resources:

Receipt vs Invoice: Timing

Since an invoice is issued before a payment is made, it comes before the receipt. This timing difference explains why the two documents show different dates.

- Invoice: The timing for issuing an invoice may vary depending on the terms agreed upon by the seller and buyer and the nature of the project. For instance, you may issue an invoice before the work begins or after the work is completed. Also, you may create an invoice for milestones, which is usually the case in projects or services with long durations.

- Receipt: This is typically issued only after the customer pays in full. Unless there’s an obligation to process refunds or replacement claims, the sales transaction is considered closed.

How Invoices vs Receipts Are Used in Accounting

- Accrual-basis accounting: Invoices are recorded as income and an increase to A/R. When payment is eventually received, a receipt is issued and the A/R is reduced, but no further income is recorded. If no invoice has been issued, then income is recorded when a receipt is issued. This happens when a good or service is provided and paid for at the same time.

- Cash-basis accounting: In cash-basis accounting, no accounting entry is made when an invoice is issued. Instead, income is only recognized when cash is received and a receipt is issued.

Invoice vs Receipt: How to Create + Examples

Invoices and receipts are created differently.

- Invoice: You can use a spreadsheet tool like Excel or a document processing program like Word to create an invoice from scratch or choose from premade templates.

- Receipt: Businesses use an electronic POS system to generate receipts automatically. However, in smaller businesses or for transactions where POS systems are unavailable, receipts can be handwritten using a receipt book.

The easiest way to create an invoice and a receipt is to use QuickBooks Online, the accounting software that tops our list of the best invoicing software. All you need to do is provide the required information in the invoicing form, and you’ll be able to create a new invoice or receipt and email it to your client directly from the program. You can also print a PDF version of your document if needed.

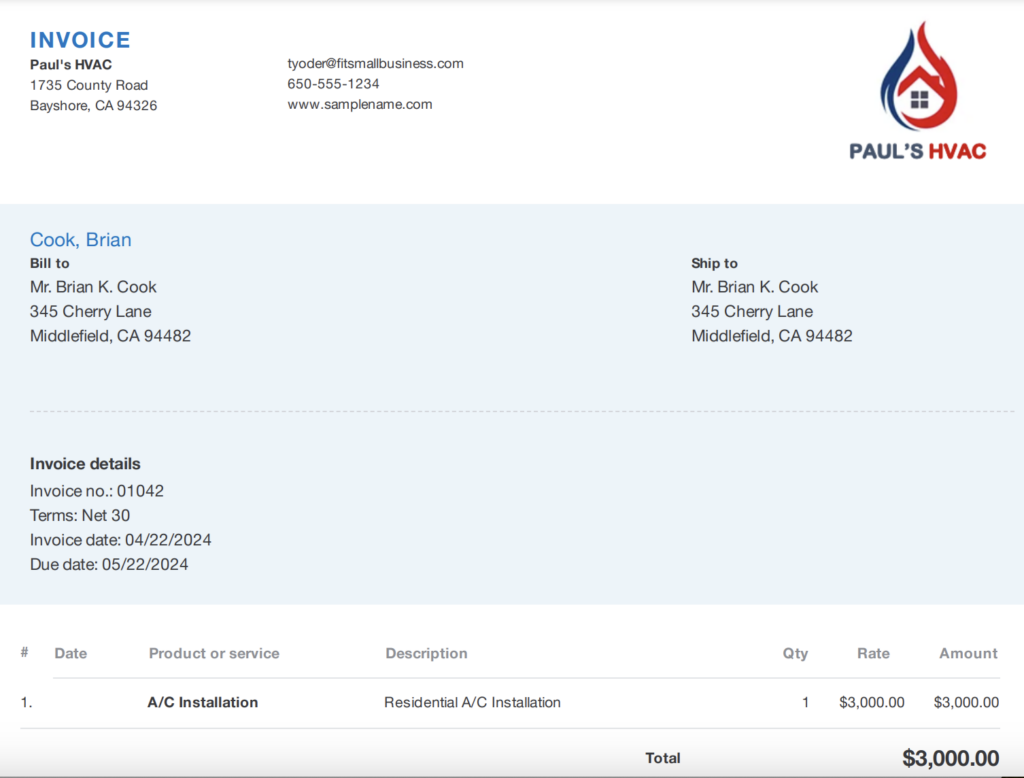

Here’s a sample created in QuickBooks Online:

Sample invoice in QuickBooks Online

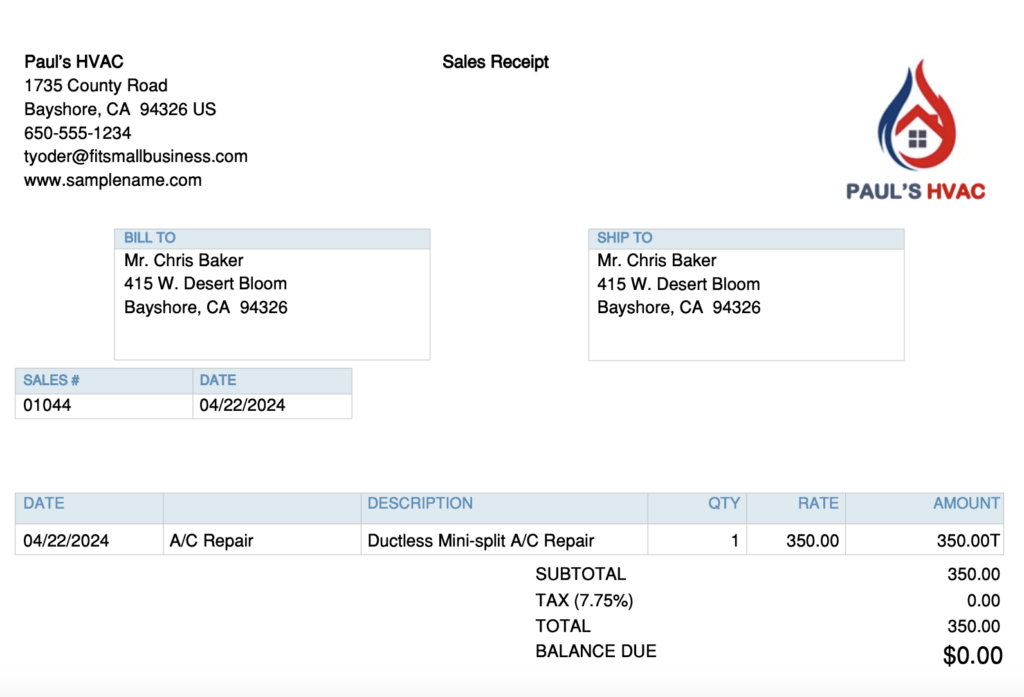

Meanwhile, here is a sample QuickBooks Online sales receipt:

Sample sales receipt in QuickBooks Online

Invoice & Receipt: Importance in Business

Both invoices and receipts play crucial roles in the financial aspects of a business, as they help with:

- Tracking payments: Both enable you to monitor payments by keeping a record of both the payment obligations of your customers and the payments received from them.

- Managing inventory: Invoices may include details of products sold, quantities, and prices, which can help you track inventory levels and manage stock.

- Complying with tax rules: Invoices and receipts are essential for calculating taxable income, claiming deductions, and filing tax returns.

- Providing legal documentation: In case of audits or disputes, you can use invoices and receipts as legal documents and evidence of the transactions in question.

- Building positive customer relationships: Providing accurate and detailed invoices and receipts creates an impression to your customers that they can trust you for their purchases.

Frequently Asked Questions (FAQs)

It depends on the preferences and capabilities of the seller, but some of the most commonly accepted payment methods include debit or credit cards, bank transfers, paper checks, and digital wallets.

You can track outstanding invoices using a manual spreadsheet tracker or an invoicing software like QuickBooks Online. You might want to check out our guide on how to keep track of invoices and payments using Excel, which includes a free downloadable invoice tracker.

No, they can’t. Invoices and receipts serve different purposes, and using them interchangeably can complicate your bookkeeping process. For instance, it makes it difficult to identify outstanding payments and calculate profits.

Bottom Line

Invoices and receipts both serve as a record of sales and include mostly the same key information. The key differences between receipt vs invoice lie in when they are issued and how they are used for accounting purposes. You’d issue an invoice to request payment from the customer, and you’d send a receipt after the customer makes the payment. Additionally, an invoice goes into the books as an accounts receivable, while a receipt is recorded as income.