The question of whether it is illegal to not accept cash is a relevant and important question for many small businesses. The short answer is—it depends on where you are located. There is no federal law that requires businesses to accept cash, but there are some states that have laws in place that prohibit businesses from refusing cash payments.

Key takeaways:

- There are no federal laws mandating businesses to accept cash.

- There may be specific state or city regulations or laws that prohibit cashless businesses.

- Cashless systems can offer increased efficiency and enhanced security.

- A potential drawback to refusing cash is excluding certain customer demographics.

- Effective communication with customers and monitoring sales and transaction trends are crucial for a successful transition to a cashless model.

Can a Business Refuse Cash?

The legalities of cashless businesses mainly depend on where the business is located. Let’s take a look from the perspective of the Federal government and the State governments:

Federal Law

At the federal level, there are no laws explicitly requiring businesses to accept cash as a form of payment. The United States Treasury Department states that “private businesses are free to develop their own policies on whether or not to accept cash unless there is a state law which says otherwise.” This means that businesses have the discretion to determine their preferred payment methods, including whether or not to accept cash.

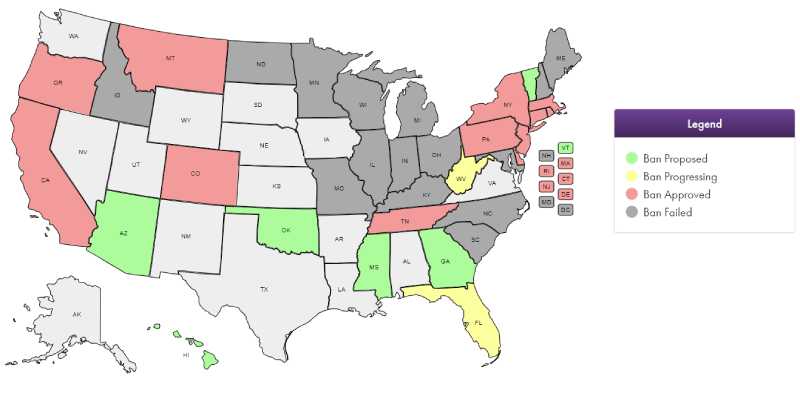

States With Cashless Ban

While there is no federal mandate, several states have implemented or are considering laws that prohibit businesses from refusing cash. These measures aim to ensure equal access to goods and services for individuals who may not have access to or prefer not to use digital forms of payment.

The status of cashless ban legislation for different US states. (Source: ATMIA)

State/City | Start Date | Exclusions | Penalties |

|---|---|---|---|

1978 | None |

| |

March 2019 |

|

| |

March 2019 |

|

| |

July 2019 |

| Not specified | |

August 2019 |

|

| |

November 2020 |

|

| |

December 2020 |

|

| |

May 2021 |

|

| |

July 2021 |

|

| |

October 2021 |

| Not specified | |

May 2022 |

|

| |

June 2022 |

| Not specified | |

July 2022 | Not specified | Not specified | |

May 2023 |

|

|

Why Are Businesses Going Cashless?

There are several reasons why businesses are increasingly opting for cashless payment systems. One significant factor is the convenience and efficiency that digital transactions offer. Cashless payments streamline the checkout process, reducing wait times and allowing businesses to serve customers more quickly. Additionally, digital payment methods such as credit cards, mobile wallets, and online payments offer greater security and protection against theft and fraud compared to handling cash.

Furthermore, cashless systems often integrate seamlessly with modern point-of-sale (POS) systems and accounting software, simplifying record-keeping and reducing administrative burdens for businesses.

From a customer perspective, cashless transactions provide greater flexibility and convenience, allowing them to make purchases using their preferred payment methods, whether it’s a credit card, mobile app, or contactless payment. Overall, the shift toward cashless payments reflects both technological advancements and evolving consumer preferences in today’s digital economy. The Federal Reserve reports that cash use has declined from 2021 (20%) to 2022 (18%), while card use has increased from 57% to 60%.

Should I Make My Business Cashless?

The decision to transition to a cashless payment system depends on various factors, including the location and nature of your business, your target market, and your operational needs. Here is a quick rundown of what you will need to consider:

Legalities

Transitioning to a cashless payment system involves considering the legal implications. While there are no federal laws mandating businesses to accept cash, it’s crucial to be aware of state and local regulations. If you’re located in a state that’s included in the table above, review the regulations and exceptions before considering the transition to a cashless payment system.

Customer Preference

The next key consideration is the preferences of your customers. If a significant portion of your clientele already prefers cashless payment methods or if you operate in an area where cashless transactions are prevalent, transitioning to a cashless model may align with consumer expectations and enhance the overall customer experience.

However, if a considerable portion of your customers are currently paying cash or a significant percentage of the local population is unbanked, transitioning to a cashless model may exclude certain segments of the population who rely solely on cash for their transactions, potentially alienating customers and limiting your market reach.

Related: Cash vs Credit Card Spending Statistics

Operational Factors

Consider how going cashless can affect your operations. Adopting a cashless system can offer numerous benefits for your business, including improved efficiency, reduced risk of theft or loss, and streamlined accounting processes.

However, it’s essential to weigh the potential drawbacks as well. Implementing cashless payment systems entails upfront costs for equipment and software, as well as ongoing transaction fees.

Related:

- Can You Run a Cash-only Business?

- Credit Card Processing Fees Explained

- What are Mobile Payments?

- How to Accept Credit Cards

- How to Accept Apple Pay

- How to Set Up Venmo for Business

- How to Set Up PayPal for Business

Tips for Making Your Business Cashless

After carefully weighing the considerations and ensuring readiness, when you’re ready to transition your business to a cashless payment system, effective implementation is important. Here are some actionable tips to guide your business through this transition.

1. Communicate With Customers

Inform your customers about the transition to a cashless payment system well in advance. Use various communication channels available to you such as signage in your establishment, social media, email newsletters, and your website to educate customers about the upcoming changes. Address any concerns they may have and emphasize the benefits of cashless transactions, such as convenience, lower costs, and enhanced security.

2. Invest in Reliable Payment Technology

Choose a reliable and secure payment processing system that aligns with your business needs. Invest in modern POS terminals or mobile payment solutions that support a variety of payment methods, including credit cards, debit cards, mobile wallets, and contactless payments. Ensure that your payment technology complies with industry standards and security protocols to safeguard customer data.

3. Offer Incentives & Rewards

Before fully transitioning to a cashless system, encourage customers to embrace cashless payments by offering incentives and rewards for using electronic payment methods. Consider implementing loyalty programs, discounts, or cashback offers for customers who choose to pay with their credit cards or mobile wallets. These incentives can encourage cashless transactions and help drive customer adoption of digital payment methods.

4. Train Your Staff

Provide comprehensive training to your staff on how to use the new cashless payment systems effectively. Ensure that they are familiar with different payment methods, understand the transaction process, and troubleshoot any issues that may arise. Emphasize the importance of customer service and responsiveness to ensure a smooth transition for both staff and customers.

5. Monitor & Adapt

Continuously monitor transaction trends and customer feedback to evaluate the effectiveness of your cashless payment system. Analyze data on transaction volumes, payment preferences, and customer satisfaction to identify areas for improvement and adaptation. Stay flexible and responsive to changing consumer preferences and technological advancements.

Frequently Asked Questions (FAQs)

Click through the sections below to read answers to common questions on cashless businesses.

Yes, it is generally legal for a business to refuse cash as a form of payment. At the federal level in the United States, there are no laws mandating that businesses must accept cash. However, check that there are no state or local regulations requiring businesses to accept cash.

The pros of making a business cashless include increased efficiency, reduced risk of theft, streamlined accounting processes, and valuable data insights. However, the cons may involve excluding certain customer demographics who rely solely on cash, potential legal requirements to accept cash in some jurisdictions, upfront costs for equipment and software, and ongoing transaction fees.

To implement a cashless system in your business, check that your state does not require you to accept cash for payments. After ensuring it is legally allowed in your location, research and select a reliable payment processing system that meets your needs. Inform your customers about the transition through various communication channels and ensure your staff are trained to use the new system effectively. Consider offering incentives to encourage cashless transactions and monitor transaction trends to adapt and optimize the system over time.

Bottom Line

Navigating the transition to a cashless payment system requires careful consideration of legal requirements, customer preferences, and operational factors. While there are no federal laws mandating businesses to accept cash, it’s crucial to research and understand state and local regulations to ensure compliance.

Implementing a cashless system can offer numerous benefits, including increased efficiency and enhanced security, but you must also weigh potential drawbacks for your business such as excluding certain customer demographics and upfront costs.

Effectively communicating with your customers, investing in reliable payment technology, offering incentives, and monitoring transaction trends can help your business successfully transition to a cashless model while maximizing the benefits for both your business and your customers.