Mobile point-of-sale (mPOS) apps allow businesses to take payments and complete sales on the floor, tableside, curbside, and on the go. The best mobile POS apps include card-present and keyed-in payment processing and offline functionality, and operate as part of a complete POS system with tools like inventory tracking, CRM, loyalty, and ecommerce integrations—all at an affordable price.

We looked at over 15 of the top mobile POS systems on the market and selected our top eight based on pricing, POS features, mobile tools, ease of use, and our expert evaluation.

Based on these criteria, the best mobile POS are:

- Square: Best overall and best free mobile POS system

- Clover POS: Best for choosing your own merchant account

- Loyverse: Best for free customer loyalty program

- Shopify POS: Best for omnichannel sellers

- Lightspeed Retail: Best for managing complex inventories

- PayPal Zettle: Best for international sales

- Helcim: Best for multiple payment types and low rates

- Lightspeed Restaurant: Best for full-service restaurants

Best Mobile POS Apps Compared

Our score (out of 5) | Monthly POS fees | Mobile hardware costs | Payment processing fees from: | Offline mode available? | Mobile Compatibility | |

|---|---|---|---|---|---|---|

4.48 | $0–$89 Add-ons: From $15 per month | $0–$299 (monthly financing available) One free magstripe reader with every account | 2.6% + 10 cents | Yes | Android and iOS | |

4.20 | $15–$310 (for 36 months) | $49–$1,799 (monthly financing available) | 2.3% + 10 cents | Yes | Android and iOS | |

| 4.07 | $0 Add-ons: $5–$25/month | None | Depends on payment processor (SumUp, Zettle, and Worldpay available) | Yes | Android and iOS |

4.06 | POS plan: $0–$89 Ecommerce plan: $39–$399 | $49–$299 (monthly financing available) | 2.4% | No | Android and iOS | |

4.05 | $89–$269 | Quote-based | 2.6%+ 10 cents | Limited | Android and iOS | |

3.99 | $0 | From $74 | 1.75% | No | Android and iOS | |

3.66 | $0 | $99 | 1.93% + 8 cents (average) | No | Android and iOS | |

3.62 | $69–$399 | Quote-based | 2.6% + 10 cents | Limited | Android and iOS | |

Square: Best Overall Mobile POS App

Pros

- Free base plans with affordable in-house tools and advanced plans to support you as you grow

- Click-and-collect tools available

- Specific POS systems and apps for restaurant, retail, and service-based businesses

- Afterpay payment processing for in-person and online purchases

Cons

- Limited or inconsistent support hours (M.–F. 6 a.m.–6 p.m., Pacific time)

- Locked into Square Payments

Pricing

Software:

- Free basic POS system

- POS Plus Plans: $29–$89 per month (Custom pricing available)

- 30-day free trial for Advanced plans

Hardware:

- Free magstripe reader with every account ($10 for additional readers)

- Chip and tap readers: From $59

- Terminals: From $299 (financing available)

- Tap to Pay on iPhone: Free via Square app

Add-ons:

- Team Plus: $35 per month

- Payroll: $35 per month plus $6 per employee

- Marketing: From $15 per month

- Loyalty program: From $45 per month

Square Overview

Square POS is not only our top choice for mobile POS apps, it is also the best overall POS software and the top-recommended free POS solution because it’s compatible with many business types and offers high-quality features at a low price. It offers free POS accounts for retailers, restaurants, and service businesses, all including corresponding apps that you can download for free to take your business on the go.

Every Square plan comes fully kitted with all the basic tools, including a basic in-house ecommerce site and flat-rate payment processing. Square also has advanced point-of-sale plans, add-on tools to support your growth, and affordable hardware options for both mobile operations and your cash wrap.

In our evaluation, Square earned a 4.48 out of 5. This POS system aced the ratings for price and expert evaluation but took hits for its limited customer service hours and lack of a free loyalty program (which is a paid add-on, unlike with Loyverse). Its inventory management tools do not have the in-depth reporting or product details you find with Lightspeed or Shopify, and there is no option for creating custom reports in the Square POS Android mobile app.

With Square’s Tap to Pay function, customers can simply tap their payment method to your iOS or Android device to process the transaction. (Source: Square)

- Versatility: Run a restaurant? Square has a specialty POS for that. Need something for your beauty salon? Try Square Appointments, which is also free. Square also has a free online store with all plans. It has paid add-ons for loyalty, employee scheduling, and even payroll—all of which integrate natively into Square POS. Further, Square has branched into banking with checking and savings accounts and loans.

- Integrations: Square integrates with accounting software like QuickBooks, booking software like Acuity, or time trackers like Homebase. You can choose among ecommerce, delivery services, invoicing, analytics, events, and loyalty apps that integrate seamlessly.

- Offline mode: Like most systems on our list, Square works offline. It can record and store transactions to sync with the cloud once your internet connection is restored.

- Square add-ons: Square is a highly versatile system with lots of extra features (both free and paid). You can get a payroll add-on with unlimited pay runs per month; tools for invoicing, estimates, and contracts; a customizable loyalty and rewards program; SMS and email marketing tools; an Afterpay option for customers; and more.

- Square Online: Square Online allows you to accept and process multichannel orders right from your POS dashboard. You’ll get a website builder with SEO tools, local delivery and pickup, and social media selling—all for free. Upgrade to the paid plans (up to $79 per month) and you’ll unlock website themes, greater customization options, QR code ordering, personalized ordering for customers, and more.

- Age verification: Square does not have age-verification tools, and you can’t integrate the system with a high-risk payment processor—you are locked into using Square Payments. Consider Clover if you process high-risk sales or want to use a third-party merchant account.

- Free loyalty program: Square charges extra for this program. Zettle and Clover have at least some tools, like loyalty points, included in the base tier, and Loyverse has a complete loyalty program for free.

- Scheduling: To create employee schedules or have advanced clock-in/out or time-tracking capability, you need Square Teams, which costs extra. If time tracking is important to you, consider Loyverse, Clover, and Lightspeed.

Clover POS: Best for Choosing Your Own Merchant Account

Pros

- Choice of payment processor

- Offline payment processing

- Can be used internationally

- Lots of add-ons and integration options

Cons

- Contracts and fees vary depending on processor

- No vendor management tools

Pricing

Software:

- Retail POS: $60–$185/month

- Restaurant POS: $100–$310/month

- Service POS: $15–$135/month

Hardware:

- CloverGo Card Reader: $49

- Terminal and other hardware: $599–$1,799

- Tap to Pay on iPhone: From $49 with the Clover Go app

Clover Overview

Clover’s POS system is a combination of software and hardware. This system is good for high-volume and high-risk businesses that already have a merchant account, and want to use that account to process transactions through their POS.

While you can use nearly any merchant account, unless otherwise specified, Clover will default and automatically enroll its new members into Fiserv upon sign-up if you purchase directly through the Clover website.

Note that Clover terminals can’t be reprogrammed for different payment processors once you have opted in—so you’ll have to stick with the processor you purchased it from.

Clover earned 4.20 out of 5 in our evaluation. It has high marks for mobile POS features, but its general user ratings are not as good. There are a lot of complaints about third-party resellers trapping retailers with hidden fees. However, Clover does have strong customer and loyalty tools and integrations.

The Clover Go mobile app, along with Clover’s portable credit card reader, lets you accept card and mobile wallet contactless payments on the go. (Source: Clover)

- POS: Clover has a hearty POS system that accepts all types of payments, lets you set up discounts, and processes refunds. You can set up a virtual terminal and take online orders from your website or delivery services. It also has an offline mode.

- Customer engagement: Clover includes both loyalty programs and customer engagement features. You can create real-time promotions via email, text, or social media; start a rewards program; and create profiles that automatically update credit card sales and contact info.

- Hardware: Clover has proprietary hardware that you can purchase from Clover directly or from authorized resellers. The Clover Mini and tablet devices are paid via monthly financing, billed with your software subscription. Or, you can get a CloverGo card reader for only $49, which you can pair with your smartphone.

- Customization options: Clover prides itself on being a highly customizable POS option. Not only can you use the merchant account of your choosing to process transactions, but Clover also has a massive suite of app integrations for any tools or features you need to run your business at no cost.

- Microbusiness capability: The monthly price and hardware make Clover a poor choice for hobbyists or solopreneurs with limited sales. Consider Square or Zettle instead.

- Flexibility: Once you have your merchant provider, your hardware is locked to them. Be completely sure of your contracts before purchasing Clover.

Loyverse: Best for a Free Loyalty Program

Pros

- Choice of merchant processors

- Free loyalty program with every account

- Offline mode for both transactions and inventory/sales syncing

- Employee clock in/clock out

Cons

- Monthly integration fee if using third-party service

- Limited payment integrations; only integrates with Zettle by PayPal and WorldPay for North American users

- Limited inventory management and reporting tools in free plan

Pricing

Software:

- POS account and dashboard: Free

- POS customer display (CDS): Free

- POS kitchen display (KDS): Free

Hardware:

- No in-house Loyverse hardware

- Operate the free Loyverse POS app from your Android or iOS device + a compatible card reader (starting at $50)

Add-ons:

- Employee Management: $5 per month, per employee

- Advanced Inventory: $25 per month

- Integrations: From $9 per month

- 14-day free trial for add-ons

Loyverse Overview

Loyverse is an extremely popular free POS software and mobile app that works with a variety of payment processors worldwide. The app includes loyalty, inventory, and even employee management features—though some of these require additional fees. Notably, Loyverse can also work offline for both transactions and sales/inventory syncing—not even Square can do that.

It earned 4.07 out of 5 on our evaluation, including a very high score for mobile-specific features. Loyverse also scored well for its 24/7 customer service and ease of use.

Its range of features rivals Square, and with a choice of payment processors, you can find rates that suit you. However, unlike Square, Loyverse charges extra for integrations and does not include a native ecommerce platform.

Loyverse also lost points for its limited payment integration options, lack of custom reports, and lower-than-average user ratings for its app on third-party software review sites.

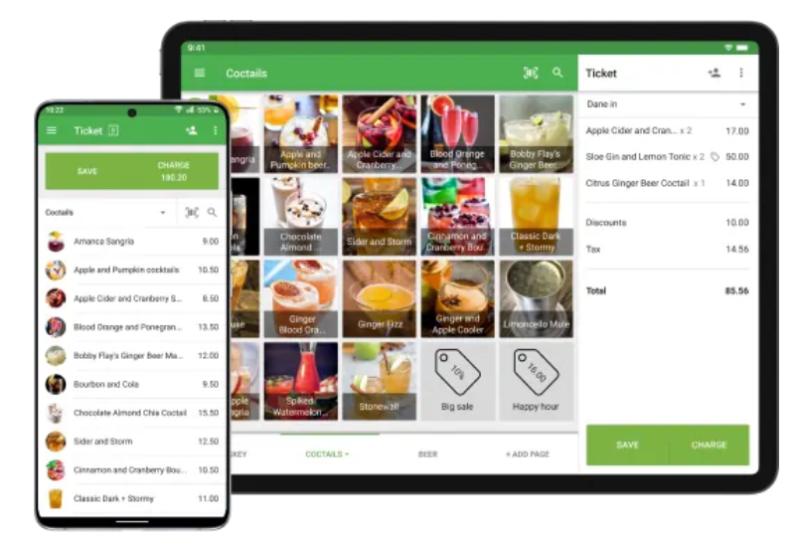

Loyverse’s POS app has lots of visuals to make it easy to use. (Source: Loyverse)

- Loyalty: This is where Loyverse gets its name (an abbreviation of Loyalty Universe) and where it stands out. Its customer relationship and loyalty program has a database for keeping information like contact information, purchase history, customer notes, and points tracking. The built-in program also offers scannable loyalty cards where customers can keep their rewards. Square charges extra for its loyalty program.

- POS: Loyverse lets you use your phone’s camera as a barcode scanner. (Shopify and Zettle also do this.) Plus, it has extra features like open tickets and weight barcodes. You can also set up options for takeout or delivery. Finally, it works offline, something Shopify and Zettle can’t do.

- Inventory management: Loyverse boasts a strong inventory management system with item variants and modifiers, bulk upload, low-stock alerts, and inventory tracking. However, if you want purchase orders, the ability to transfer items between stores, inventory counting, and ingredient tracking, you need the advanced inventory program, which carries an additional monthly fee. For the best inventory system, look at Lightspeed or Shopify.

- Employee features: Loyverse has a free time clock for employees to clock in and out. If you purchase the employee management system, you also get time cards, access restriction capabilities, and employee analytics. Compare this to Square’s free plan, which lets you create schedules, clock employees in and out, and track breaks; its paid plan has analytics and advanced time clock functions.

- Payment processing: Like with Clover, you can choose your payment provider, although choices for Loyverse are more limited. It works with SumUp, Zettle, Worldpay, Tyro, Smartpay, Yoco, STORES Payment, PAYGATE, SB payments, KICC, and NICE. Many of these are only available for iOS, and some are limited to specific countries. However, note that if you integrate a third-party service, you will have to pay a $9 monthly integration fee.

- Proprietary hardware options: Unlike the other software on our list, Loyverse does not offer any in-house hardware.

- Integrations: While Loyverse can integrate with ecommerce and accounting software, you need to pay an additional $9 per store per month for this. The other mobile POS solutions on our list offer integrations for free. Additionally, there are limited payment processing integrations, with PayPal and Worldpay as the only options in North America.

- Growth: While Loyverse does have add-ons, there are not many, and there are no advanced POS plans. As your business grows, Loyverse might not be able to support it, and you will need to switch providers rather than upgrade your plan. We recommend Square, Lightspeed, or Shopify for POS options with many plans to support your needs now and in the future.

Shopify POS: Best for Omnichannel Sellers

Pros

- Great ecommerce platform included in all plans

- Reliable platform

- Full inventory tools

- Highly rated mobile app

Cons

- Ecommerce subscription required to access Shopify POS system

- No offline-payment processing

- Reports of downtime and disconnecting card readers

Pricing

Plans:

- POS system:

- POS Lite: $15 (free with Shopify ecommerce plan)

- POS Pro: $89 per month, per location

- Ecommerce plan: $39–$399/month

- 3-day free trial

Hardware:

- Card reader: $49

- Tap to Pay on iPhone: First 100 transactions per month free with Shopify plan; $0.25 per transaction thereafter

- Shopify POS Go mobile device: $299

Shopify POS Overview

Shopify is one of the leading ecommerce solutions today and also has great tools for in-person sales, social media selling, and click-and-collect orders. In fact, it’s our top-recommended multichannel POS system for retailers.

Businesses that do heavy online sales and need an excellent ecommerce solution and in-store POS application will appreciate the strong inventory and customer management tools. However, if you already have an ecommerce solution and are not willing to give it up, look into PayPal Zettle or Square, which have free POS apps that integrate with popular online stores.

Shopify earned 4.06 out of 5 on our evaluation. It took a hit because it does not offer a built-in time clock or restaurant features, and does not have an offline mode. Nonetheless, it earned a high score for general POS features and maxed out our expert score for value for the dollar.

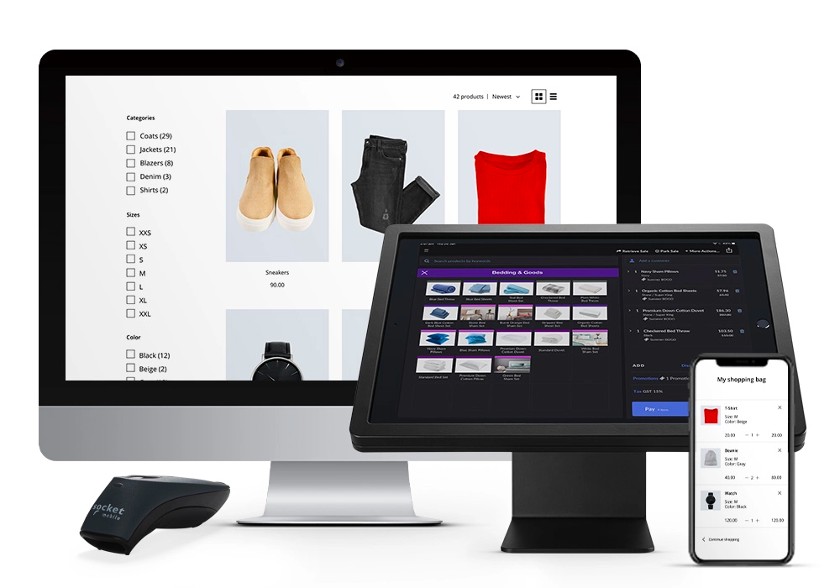

The Shopify POS app has a customizable home screen for your most important tools. (Source: Shopify)

- Online sales, mail order/telephone order (MOTO), and dropshipping: Shopify gives you shipping discounts—a great asset for mail order companies. Except for Square, no other mobile POS on our lists offers this. Plus, if you’d like to add dropshipping to your offerings, you can connect Shopify to one of hundreds of dropshipping companies.

- POS features: Shopify, like most of the mPOS on our list, handles sales with taxes and discounts, collects customer information, and sends receipts. Like Loyverse, you can use your phone’s camera to scan barcodes. It ties seamlessly to Shopify’s online store, so you get all the advantages of Shopify as well.

- App library: Shopify has a huge selection of app integrations that you can add to your POS and/or ecommerce site so that you have all the tools and features you might need at no extra cost from Shopify.

- Shipping: Not only does Shopify have great order management for all your online orders, but it also partners with all the major carriers to offer discounted, fast shipping. Not only that, shipping rates and label printing are integrated right into your POS.

- Multi-sales-channel support: Shopify is an excellent choice for businesses wanting to invest in multiple sales channels. This software supports in-store transactions, ecommerce, Google sales, and social media selling via Facebook, TikTok, Instagram, Pinterest, and Snapchat—all from a single POS platform.

- Age verification: If you sell age-restricted items, you need a third-party application like Age Check. Clover, on the other hand, has this in its system.

- Free use of other merchant accounts: While Loyverse and Clover let you use third-party merchant accounts without charge, Shopify adds a 0.5% to 2% fee. And, while you can use other payment processors for online orders, you’re locked into using Shopify Payments for POS sales.

Lightspeed Retail: Best for Managing Complex Inventories

Pros

- Extensive inventory processing functions (granular and custom reports, matrices, supplier network)

- 24/7 phone service and free onboarding

- Age verification

- In-house ecommerce store included in advanced plans

Cons

- Hardware is custom-quoted, can be expensive

- Plans can be expensive for small businesses

- Must use Lightspeed Payments for lowest monthly rates

Pricing

Software:

- Retail POS: $89–$269 per month

- 14-day free trial for all accounts

- Lower prices available if paid annually

Hardware:

- Quote-based

- Mobile and cash wrap kits available

- Tap to Pay on iPhone/iPad via Lightspeed Mobile Tap: From $89

Lightspeed Retail Overview

Lightspeed Retail’s POS system topped our ranking of POS inventory management systems (you’ll find Square and Shopify on this list, too) because of its extensive toolset, including granular and customizable reports, inventory matrixes, an integrated product catalog, and purchase ordering. Not only that, but Lightspeed Retail has a preloaded catalog of vendors where you can shop and place orders right from its POS dashboard. It also features low-stock alerts, inventory counting tools, the ability to place special orders, and more.

While Lightspeed Retail has a lot to offer when it comes to inventory management, it does have some drawbacks. To start, Lightspeed Retail’s mobile app and POS dashboard are not the easiest to learn (especially when compared to Square or Shopify). This yields lower user reviews. A more complex interface, limited mobile app functionality, and paywalls blocking many advanced tools earned Lightspeed 4.05 out of 5 in our evaluation.

Lightspeed lets you operate your business from a desktop or on the go, with its app. (Source: Lightspeed)

- Inventory: Lightspeed offers multiple item variants, sophisticated analytics, a supplier network, and smart pricing. It also syncs with its online store, Lightspeed eCom. Shopify comes close to Lightspeed for inventory features, but Lightspeed has more granular details and customization options.

- Age verification: Lightspeed has age verification features in the register app. This makes it a great choice for stores that sell age-restricted items.

- Payment processing: Every Lightspeed account holder is automatically enrolled in Lightspeed Payments for processing transactions through your POS. Lightspeed Payments offers competitive processing rates and is conveniently pre-integrated into your account. The biggest drawback here is that if you do want to use a third-party processor, your monthly POS fees will increase—unlike with Clover, which lets you choose your own processor for free.

- Free plan: Lightspeed has a 14-day free trial, but no free version and relatively high monthly fees. Look to Square, Loyverse, or Zettle if you want a free POS.

- Loyalty program: The omnichannel loyalty program is only available in the highest subscription tier—Advanced ($269). You can also get the same loyalty features in the Enterprise plan (custom-quoted), but this is only available for high-volume merchants and large businesses; call sales for eligibility and pricing. On the other hand, Square posts its loyalty program price at $45 per month.

- Affordability: While Lightspeed does have some of the most advanced tools of the POS systems on this list, it is also an expensive option and many of those tools (such as loyalty and advanced reporting) are only available in Lightspeed’s higher-tier plans. Look to Square for a free mobile POS system with affordable upgrades and add-ons.

PayPal Zettle: Best for Selling Internationally

Pros

- Free POS and affordable hardware

- International payment processing

- Easy to use; high user reviews

- Ecommerce and accounting integrations

Cons

- No custom reports

- No offline mode

- Must use PayPal payment processing

Pricing

Software:

- POS system: Free

Hardware:

- Card reader: $74

- Terminal: From $187

- Tap to Pay on iPhone: Free via Zettle POS app

Payment Processing

- In-store: 1.75%

- Online: 2.5%

- Invoices: 2.5%

PayPal Zettle Overview

Zettle is a free mobile POS system brought to you by PayPal. With tools like inventory controls, staff management, and reporting, Zettle has similar tools in its free plan as Square or Loyverse.

With Zettle, you will also be locked into PayPal payment processing. PayPal not only offers competitive rates, but can also process payments worldwide—perfect for international sellers. Not only is the Zettle by PayPal mobile app highly rated and user-friendly, but PayPal has also made its Zettle Terminal available to small businesses in the US. This terminal is an all-in-one POS solution offering increased mobility in-store. It features a touch screen and sleek design, and doesn’t need to pair with any additional devices—just start using it right out of the box.

With a rating of 3.99 out of 5, PayPal Zettle earned a perfect score for pricing and a high score in the expert score categories. Zettle lost points for lacking an offline mode, a time clock feature, and tools for specific industries like restaurants or appointments.

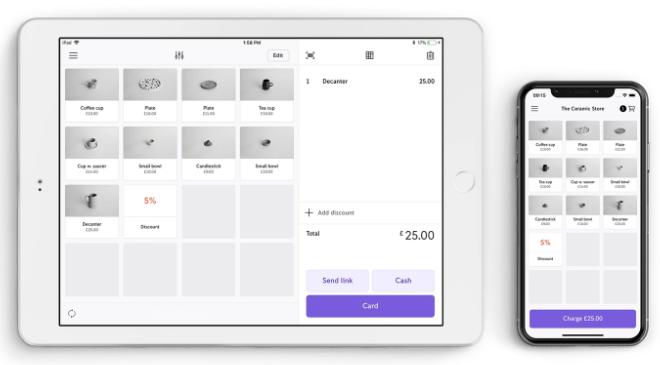

Zettle’s mobile POS app handles products, customers, multiple cashiers, and more. (Source: PayPal Zettle)

- International payment processing: Zettle originally served the European market; plus, PayPal works in over 200 markets and 100 currencies. The POS software can handle sales in-store, across borders, and in different currencies. Clover also has international processing, and many Pacific nations, like Japan and Korea, use Loyverse.

- Online sales: Zettle integrates with Shopify, BigCommerce, and WooCommerce, and more for online sales. However, PayPal integrates just about anywhere, from social media to eBay. Square and Shopify, of course, have their own online stores included in your POS account.

- Basic, free POS: Like Square, PayPal Zettle offers a free, fully functional mobile POS system with affordable in-house payment processing. It includes a user-friendly checkout, inventory tracking, and reporting tools, and can manage multiple sales channels. Unlike Square, however, PayPal does not offer advanced POS plans or industry-specific options for restaurants and service businesses.

- Offline processing: If you need this feature and still want a free POS, consider Square or Loyverse. If you need an international payment processor that also has an offline mode, look at Clover.

- Age verification: Like Square, Zettle does not include age verification, and we did not find an established third-party integration for this. Consider Clover or Shopify with Age Checker if you sell age-restricted items.

- Online ordering or takeout: While you can integrate PayPal into online ordering sites, Zettle itself does not have these options. Consider Square instead.

Helcim: Best for Multiple Payment Types & Low Rates

Pros

- Free fully integrated POS software

- Many payment types accepted

- Ecommerce and online ordering system available

Cons

- No mobile barcode scanning

- No offline mode

- No employee clock-in/clock-out

Pricing

Plans:

- POS system: $0 per month

- Processing rates: Interchange-plus pricing

- In-person processing rate (average): 1.93% + 8 cents

- Keyed-in and online processing rate (average): 2.49% + 25 cents

Hardware:

- Card reader: $99

- Smart Terminal: $329

Helcim POS Overview

Helcim is a credit card processing and merchant services company that also offers a POS system integrated into its software. This system operates on desktop and mobile hardware and is compatible with iOS and Android systems.

Helcim mobile POS got a score of 3.66 out of 5 in our evaluation. It got high marks for its free POS software, interchange-plus pricing with low average processing rates, and multiple payment types that can be accepted (ACH, card-on-file, virtual terminal, invoices, recurring payments, links, and more). However, this POS scored less than well on several mPOS features: it does not have an offline mode, mobile barcode scanning, or native basic employee management features.

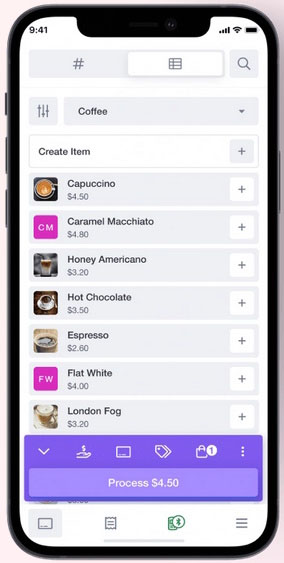

Helcim’s free mobile POS system lets you sell items, view various reports, and manage an automatically synchronized product inventory. (Source: Helcim)

- Broad reporting capabilities: Your Helcim account lets you view many different types of reports, giving you insights into your business health and helping you determine next steps. You’ll have access to reports that tell you which products are selling best, invoices you’ve created, summaries of credit and debit transactions, taxes collected, and more.

- Multichannel inventory management: The system tracks your inventory in real time, whether you sell at a physical location, online, or by sending invoices. You can view your product list from desktop and mobile devices, receive low-stock alerts, upload images, and create variants or categories.

- Interchange-plus pricing: Helcim stands out for its interchange-plus (or cost-plus) pricing. This model means that you get access to very low processing rates per transaction. What’s more, Helcim offers volume-based discounts and is transparent about the margins they charge: anywhere from 0.15% + 6 cents to 0.50% + 25 cents depending on your monthly credit card sales volume.

- Helcim Fee Saver: With Helcim, you can choose to pass your credit card processing fees onto your customers, essentially allowing you to accept card payments at no cost. Customers will see these additional fees on their invoices and receipts, and you can toggle the Fee Saver option on or off any time you send an invoice. If customers don’t want to pay the additional fees, they still have the option of ACH payments. This will result in a processing cost for you, but it will be much lower than a card processing fee (0.5% + 25 cents; capped at $6 per transaction).

- Mobile barcode scanning: Though Helcim works with external barcode scanner devices and QR codes for mobile, you won’t be able to use your mobile device to scan barcodes for sales or inventory management.

- Offline mode: Helcim does not have an offline mode, so many of your business functions will be put on hold if you lose your internet connection.

Lightspeed Restaurant: Best for Full-service Restaurants

Pros

- Ingredient-level tracking

- Built-in CRM, loyalty, and inventory tools

- Strong kitchen display system (KDS)

- Bar pre-authorization feature available

Cons

- Advanced inventory management not included in base plan

- No driver management in delivery tools

Pricing

Software:

- Restaurant POS: $69–$399 per month

- Custom pricing available

Hardware:

- Quote-based

- Compatible third-party hardware available

- Tap to Pay on iPhone/iPad via Lightspeed Mobile Tap: From $89

Lightspeed Restaurant Overview

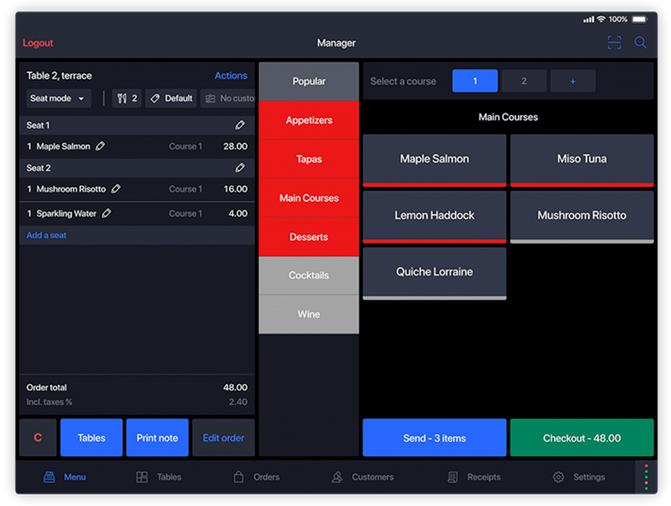

Lightspeed Restaurant’s POS is a great choice for full-service restaurants that want to run operations via iPads or cellular devices. The POS system comes equipped with user-friendly order management, robust and dynamic KDS, table mapping and adjustments, integrated takeout and delivery management, tableside payment processing, tons of payment options, ingredient-level inventory management, and much more.

While it has a lot to offer, Lightspeed Restaurant does have some drawbacks that kept it at 3.62 out of 5 in our overall scoring. First, while it has delivery tools, there are no driver management or tracking tools. Additionally, compared to the other options on our list, especially Square and Loyverse, Lightspeed Restaurant’s POS is quite expensive and locks many features—like advanced inventory management, online and contactless ordering, multilocation management, and other advanced tools—behind more expensive plans.

Lightspeed Restaurant ranks among our evaluations of:

- Best cafe POS systems

- Best iPad POS systems for restaurants

- Best bar POS systems

- Best restaurant POS systems

- Best quick service restaurant POS systems

Lightspeed offers a user-friendly mobile restaurant POS system that lets you serve customers anywhere, and send orders automatically to the bar or kitchen. (Source: Lightspeed)

- Delivery: With integrated delivery and online ordering tools, you can expand your restaurant’s offerings and start selling on UberEats, Skip the Dishes, and DoorDash. All online orders integrate seamlessly with your kitchen as they come in alongside your other orders.

- Inventory management: Lightspeed has inventory tools that let you easily complete inventory counts with barcode scanners, reporting on stock, including freshness reports and ingredient-level tracking that updates as items are ordered from your menu.

- Mobile capabilities: Lightspeed Restaurant is our most recommended iPad Restaurant POS system. It has a user-friendly interface, mobile payment processing, tableside order placing, and restaurant management tools, all from its mobile point-of-sale app.

- Payment processing: Every Lightspeed account holder is automatically enrolled in Lightspeed Payments for processing transactions through your POS. Lightspeed Payments offers competitive processing rates and is conveniently pre-integrated into your account.

- Flexible payments: Every Lightspeed Restaurant POS account comes pre-integrated with Lightspeed Payments. While you can opt to use a different merchant account, you will incur a higher monthly fee and lose access to certain advanced features.

- Paywall for Advanced Features: While Lightspeed has a lot of great features, many are locked behind high plans with bigger price tags. If you need a mobile POS app that includes a lot more in its base plan, consider Square.

How to Choose a POS System

Choosing a point-of-sale system is a crucial step for your business—the software you ultimately go with will be responsible for key functions like checkout, inventory management, customer relationship management, ecommerce, and more. Choosing the right system will make everything in your business run more efficiently, and choosing poorly can slow you down in many ways.

Consider the following factors when deciding on a POS system for your business.

Suitability for your business type

The first and most important thing you need to think about when picking a POS system is whether that system is suited to your business. While some software such as the basic Square POS can be adapted to various business types, you should consider getting a system designed specifically for your industry. (Though it’s worth noting that Square also offers POS systems tailor-made for retail shops, restaurants, and appointment-based businesses.)

Features

A POS system’s suitability for your business type will naturally influence the set of features included in that system. A good retail-specific POS system will have features such as variants and modifiers for inventory, while a restaurant POS system will offer ingredient-based inventory management and online ordering or takeout features. An omnichannel system like Shopify POS should include tools like social media integration and shipping options.

Mobility

You also need to consider the mobility of the POS system before you make a final decision for your business. Mobility in this case is generally a matter of hardware: you’ll want to check whether the POS can be downloaded and used on mobile devices like smartphones and tablets, which are essential tools for traveling retailers, restaurants wanting to offer tableside ordering, or just businesses with large sales floors.

Confirm what devices and operating systems the POS is compatible with—and note that some providers offer proprietary hardware which may be mandatory when using the POS software. When buying from a POS provider, you’ll have access to individual devices and full hardware kits, for fixed or custom-quoted prices.

Pricing

Finally, think about the pricing scheme for the POS system you are considering, and whether it is something you can afford on a long-term basis.

Some providers offer free plans for their systems, with the option to upgrade to a paid subscription with additional features. For other systems, you’ll need to pay in order to use them at all, and price ranges vary widely—you might be paying less than $30 per month or up to $400 per month, depending on which system you choose. Most providers offer monthly pricing, as well as annual pricing which will often get you a discount.

You’ll also need to consider processing rates, which differ not only across different POS providers, but also across different payment methods (for example, manually keyed-in card payments tend to carry higher fees than swipe payments due to the increased risk). Since your business will (hopefully) be processing hundreds or thousands of transactions in the future, it’s a good investment of time and effort to shop around for the best processing rates.

Methodology: How We Evaluated Mobile POS Systems

We pulled from decades of experience by our researchers, personal use, operating POS systems in retail settings, and studying and testing these systems. Then, we combined this with feedback from long-term, real-world users who have posted reviews on trusted third-party sites.

The best mobile POS apps optimize the balance of hardware, software, and payment processors. We started by selecting only those with a mobile app. This ensures you can run the program on a smartphone or tablet. However, many, like Square or Clover, had their own hardware as well.

Then, we looked for software features that not only let you ring up sales but also track inventory and manage customers (such as Loyverse’s loyalty program). For payment processing, we selected a mix of those with proprietary merchant services and those that offer you a choice.

As often happens when evaluating POS software, Square tops the list. In addition to being the best POS app for small businesses, it’s also on lists for POS for restaurants, payment processing, and more. Square was built for mobile, and its POS application reflects that focus even as it has grown to encompass brick-and-mortar applications.

Click through the tabs below for our full evaluation criteria:

25% of Overall Score

Pricing involves more than subscription fees. There are also transaction fees, with some providers allowing you to shop providers and others locking you into a set payment processor. And finally, there are hardware costs. Square, Lightspeed Retail, and Zettle earned 5 out of 5 stars in this category.

20% of Overall Score

These are the basics any strong POS system should have: processing multiple payment types, managing customers, tracking inventory, integrating with third-party software, and having strong reports. We gave extra credit for loyalty programs. Shopify got the highest score in this category.

20% of Overall Score

To make it onto our list, products needed a handheld device that processed payments and synced with a web-based device. We also considered operating systems, offline mode, and digital receipts. Loyverse earned the highest score in this category, followed by Clover.

15% of Overall Score

For this, we relied heavily on the reviews of real-world users who use the system daily. We considered the performance of mobile apps as well as the POS app. We also looked for 24/7 customer support since businesses may need help anytime. Square earned the highest score with 4.38.

20% of Overall Score

This is a value score based on our expert opinion, popularity, feature set, and how easily you can learn (or teach your employees) the device. Square, Shopify, and Loyverse got perfect scores here

Frequently Asked Questions (FAQ)

POS apps serve as a way to conduct sales, process transactions, and run your business from your pocket—without needing a large POS register or terminal all the time. Click through the sections below to learn more about POS apps.

Yes. Many POS providers make their systems available as apps for your mobile device. You can use these mobile POS apps to manage inventory, view reports, sell items, and other vital business functions.

The closer the app is to the main desktop version of the POS in terms of features and functionality, the better. Look for inventory management, reporting capabilities, online selling, payment processing, loyalty programs, employee management, social media connection, and as many POS integrations as possible.

It depends on your highest priority. If you have a complex inventory, try Lightspeed. Loyverse is great for loyalty programs. Clover is highly flexible, Shopify shines in omnichannel selling, and PayPal Zettle is great for selling internationally.

The best overall free mobile POS app that we recommend is Square. It has a forever-free subscription option, high versatility, a good feature set even in the free plan, an offline mode, and it is easy to set up and use.

Bottom Line

There’s no reason to be tied to the counter. Many POS apps have a mobile component, either as a handheld device or with a downloadable application. The best mobile POS systems sync with the main program, handle offline transactions, and let you access the backend.

Overall, Square has the best features for the best price while being the easiest to use. Even better, its POS system is free with a competitive payment processing fee. Go to Square and download the POS today.