The leading contactless payment system, Apple Pay, lets your customers pay via their Apple Watch or iPhone (iOS 6 and higher). It is secure for both merchants and customers and costs merchants the same processing fees as regular credit cards.

Accepting Apple Pay starts with choosing a compatible payment processor, purchasing a near-field communication (NFC) card reader, setting up the Tap to Pay on iPhone feature, adding an Apple Pay button to your online checkout, and letting customers know you accept the mobile payment service.

Find more details on how to accept Apple Pay in our step-by-step breakdown below:

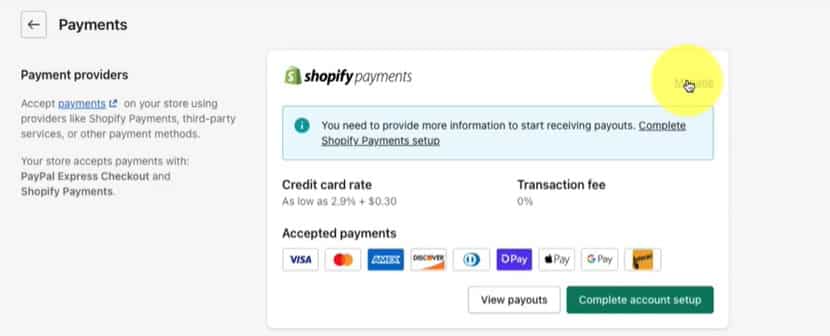

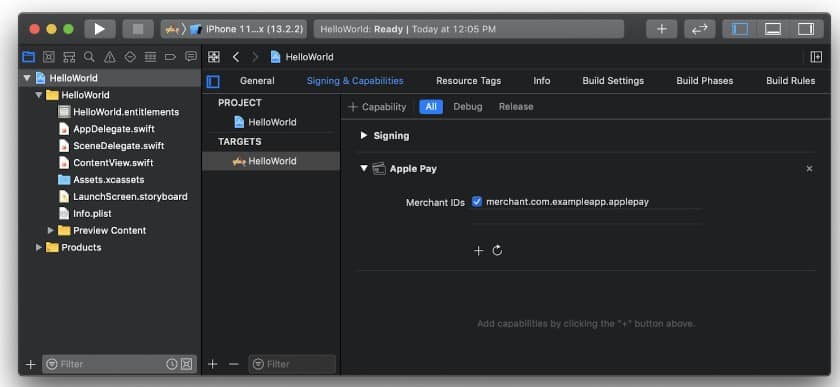

Step 1: Choose a Payment Processor That Accepts Apple Pay

You need to sign up for a merchant account with a payment processor to start accepting Apple Pay. Most popular payment processors do handle Apple Pay transactions, usually at the same rates they charge for regular credit card transactions. Check the full list of ecommerce platforms and payment service providers that support Apple Pay.

If you already have a merchant account, call or check the “Help” section of its website for how to enable Apple Pay payments. This usually just involves updating the payment method options in the settings.

You may need a new card reader or terminal that accepts contactless (tap) payments. Alternatively, Apple Pay’s new Tap to Pay on iPhone feature allows you to use your iPhone instead of a NFC reader to process payments.

Don’t have a merchant account? See our recommendations for the best merchant services.

Costs of Accepting Apple Pay

If you already accept card payments and have a contactless card reader, there are no additional costs for accepting Apple Pay.

The fees for an Apple Pay transaction are the same as a card payment transaction. Typically, Apple Pay payments made in-store are assessed as card-present rates, while using Apple Pay to make payments in-app are assessed card-not-present rates.

Step 2: Purchase & Install NFC-enabled Hardware

Apple Pay—like other contactless payments—uses near-field communication (NFC) technology, which lets two systems communicate wirelessly when in close proximity to each other. Therefore, you need a card reader that has this kind of technology.

Most card readers are already so equipped, but there are still a few that aren’t, like Square’s free magstripe card reader. You’ll need to check that your card reader allows tap payments. If in doubt, check the specs or look for the wireless symbol on the reader.

Installing NFC Hardware for Apple Pay

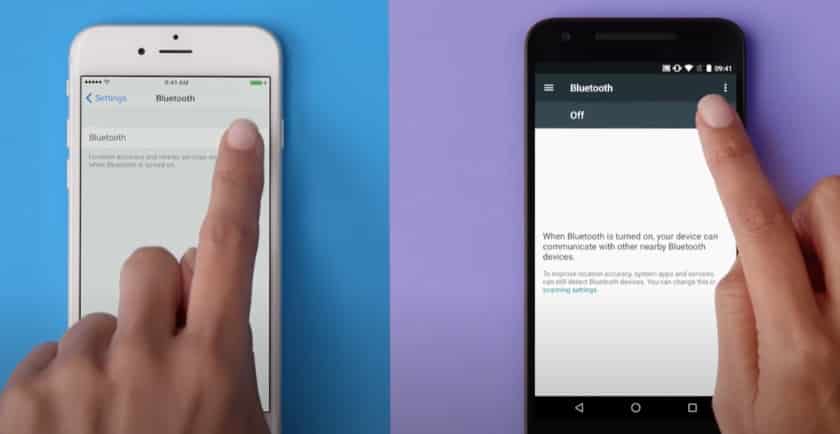

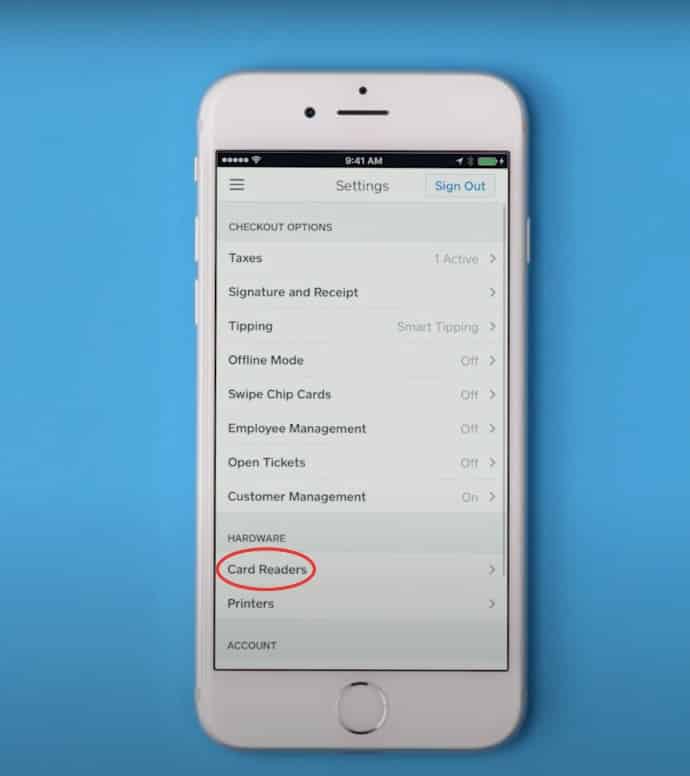

Setting up your card reader is easy. Instructions may vary by app or point-of-sale (POS) system, but the basic steps are the same. Make sure your software or app is updated before pairing your hardware. We’ll use Square as an example.

Square processes Apple Pay with its Square Reader and Square stand for contactless and chip, Square Terminal, and Square Register. Square makes our favorite card readers for small businesses.

Step 3: Use Apple’s Tap to Pay on iPhone Feature

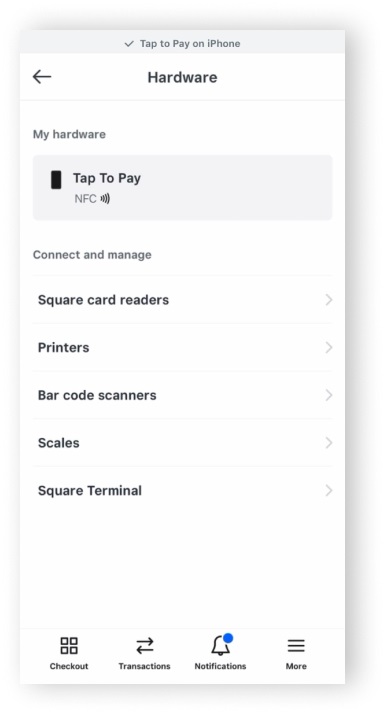

If your business is not yet equipped with a card reader that accepts contactless payments, you may still accept Apple Pay using the Tap to Pay on iPhone feature. You will need to use at least an iPhone 11 running iOS 15.5 or later as your contactless card reader. The Tap to Pay on iPhone feature makes use of the iPhone’s built-in NFC reader to capture the payment information.

Setting up an iPhone for Tap to Pay

Check if your payment processor is capable of accepting payments using Tap to Pay on iPhone. Square and Shopify are two of the few processors equipped with this feature. We’ll use them for this example.

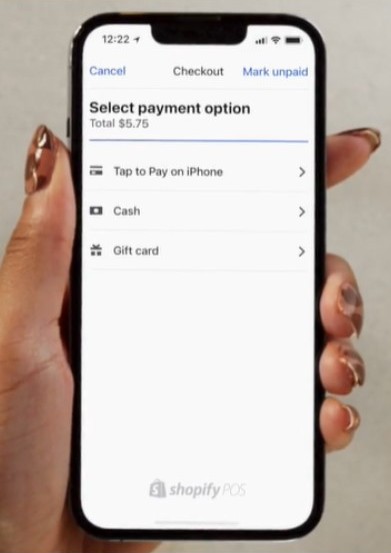

Accepting Payments Using an iPhone

After setting up your iPhone to accept payments using the Tap to Pay feature, your customers will be able to pay using their iPhone, contactless cards, and Apple Watch. Here’s a guide on how to do this in the Square and Shopify Point of Sale apps.

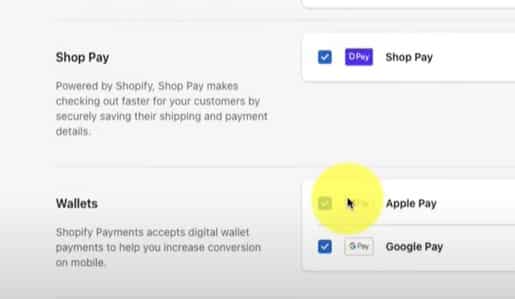

Step 4: Add an Apple Pay Button to Your Online Checkout

How easy it is to add Apple Pay to your online store depends on the payment processor and webstore program. Check the Help section of your specific software for instructions, but we’ll look at Shopify and Stripe as examples.

Step 5: Let Customers Know You Accept Apple Pay

Apple offers free decals and icons you can add to your brick-and-mortar and online stores. It also has instructions for adding notices to your Maps setting and provides other guidelines. Learn more at Apple Pay. Some payment processors, like Square, offer their own Apple Pay marketing kit.

How Can Your Customers Use Apple Pay?

For customers to use Apple Pay, they will have had to sign up for it on their iPhones and put in their credit card information. After that, using Apple Pay is simple: The customer simply holds their iPhone within an inch of the card reader while they have their finger on the Touch ID or using their Face ID. Then, they wait until they see Done and a check mark on the display. Some systems may have a different notification.

How Apple Pay Works for Merchants

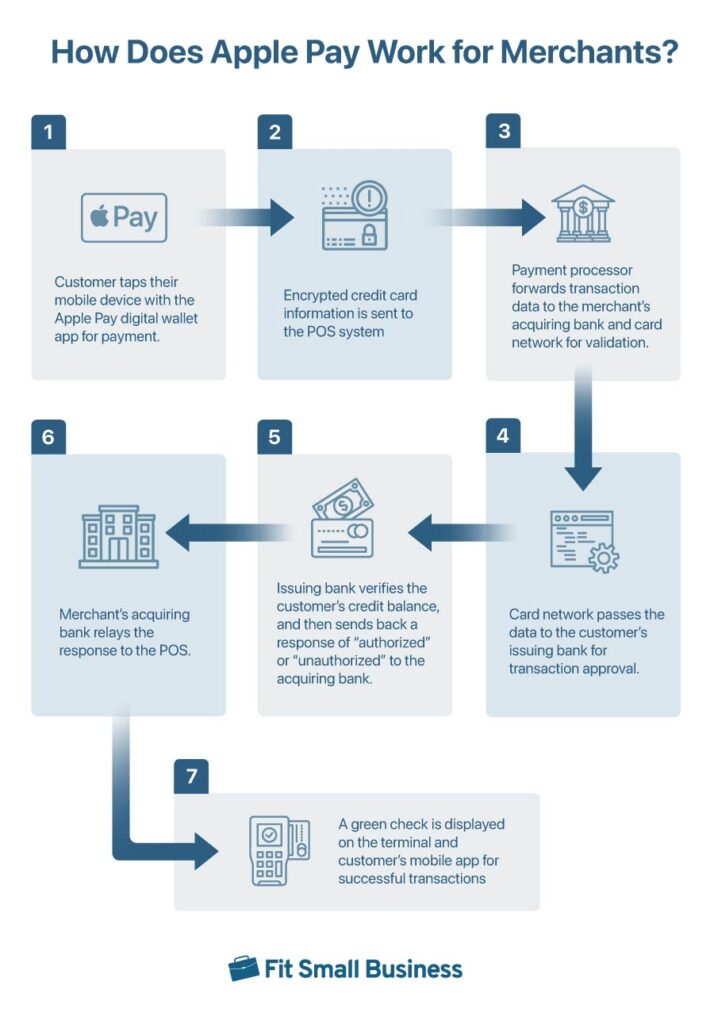

To understand how to accept Apple Pay as a business, we take a closer look at how Apple Pay secures and relays the transaction data for approval.

Apple’s digital wallet app allows customers to store multiple cards. Each card is then assigned with a unique encryption so the customer’s credit card information is not shared with the merchant during transactions.

Once a customer opts to use Apple Pay to make a payment, the customer’s transaction information and encrypted credit card data are transmitted to the POS terminal through the EMV contactless chip technology. Then, the payment processor for the POS forward the transaction data to the merchant’s acquiring bank and the card network where the information is validated before it is sent to the customer’s issuing bank.

The customer’s bank then verifies the customer’s credit balance and responds with either “authorized” or “unauthorized” to the merchant’s acquiring bank based on the result. The payment processor receives this information and proceeds with the transfer of funds to complete the transaction.

Benefits of Accepting Apple Pay

- Speed: Apple Pay, like other contactless payments, processes quicker than credit card payments (both chip or stripe) and is certainly faster than cash. That means faster checkouts, shorter lines, and greater customer satisfaction.

- Secure for customers: Apple Pay tokenizes and encrypts card data, making it hard for fraudsters to access it. It also requires fingerprint verification or authentication using the customer’s phone password. So even if a thief had a customer’s phone, they still can’t get the Apple Pay account.

- Secure for businesses: When using Apple Pay for online payments, Apple saves all the card information, so you don’t need to worry about saving customer card info.

- Popularity: Apple Pay has around 45.4 million users in the US, making it the top mobile payment option, ahead of Google Pay and Samsung Pay. It is available in 69 countries, and according to Statista, more than 55% of US and Canadian consumers have used it to buy something in person (nearly 70% in the UK). The percentage is between 20%–30% for online sales in these countries.

- Reduced abandoned carts: Some of the top reasons for people not completing online sales are because they didn’t trust a site with their credit card information (19%) and their frustration with the checkout process (18%). Apple Pay makes it easy and keeps card information to itself.

Alternatives to Apple Pay

Although many customers still prefer to pay using cash or card, there is significant growth in mobile payment use. The year-over-year increase in transaction value of purchases made via mobile payments started at 3.7% in 2020, to 4.6% in 2021 and 6.3% in 2022. The projected increase by the end of 2023 is at 7.9%.

If you would like to offer other mobile payment options besides Apple Pay, the top options are Google Pay and Samsung Pay. Both work pretty much the same way as Apple Pay. For Google Pay, you will need to install the app, which is available for both Android and iOS. On the other hand, Samsung Pay is only available on Samsung phones and watches.

Learn more about contactless payments and apps:

Frequently Asked Questions (FAQs)

Here are some of the most common questions we get around accepting Apple Pay.

Yes, it is. Secure and easy for both merchants and customers, Apple Pay is a good way to send and receive payments.

Very! In addition to encrypting and tokenizing card information, it requires fingerprint verification when paying.

The process is the same for Apple Pay on Apple Watch, although there is no fingerprint requirement for the watch. The watch simply needs to stay on the wrist and needs to be paired with the phone.

Yes, you can program your online store to accept Apple Pay.

Accepting Apple Pay on your website is to log into your merchant account dashboard and update your online payment gateway settings. Find Apple Pay in the list of payment methods, activate it, and save the new settings. Moving forward, your website’s checkout page will display Apple Pay as a payment option.

Bottom Line

Apple Pay accounted for 4.1% or $199 billion out of the $4.9 trillion of total retail sales in the US in 2022. Learning how to accept Apple Pay as a business can speed up checkout, improve customer satisfaction, and help increase the number of sales. Talk to your payment provider about accepting Apple Pay to get started with this convenient and secure mobile payment service.