PayPal has nearly 400 million consumer accounts and 35 million merchant accounts, making it the largest online payment processor in the world. On January 25th, PayPal announced six new features during a highly advertised “PayPal First Look” video event. The premise was that PayPal would “revolutionize commerce.”

These new features primarily involve artificial intelligence (AI), focus on improvements to the customer experience (faster and easier checkouts), and opportunities for small businesses via new advertising options. PayPal’s improvements and new tools will be rolling out throughout 2024.

Here, we break down the key takeaways from the PayPal First Look event, including those six new features and how they impact small businesses.

1. New and Improved PayPal Checkout

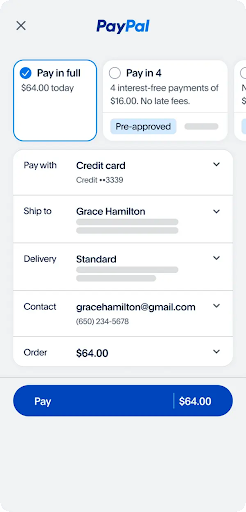

The new PayPal checkout. Source: PayPal

Biometric logins (facial recognition and fingerprint) let customers check out twice as fast, with details including credit card, shipping, and contact information automatically populated based on the data saved in customers’ PayPal accounts.

The dropdowns will allow customers to easily select other saved payment, shipping, and contact information. They will also be able to choose delivery options right from this screen.

2. Fastlane by PayPal

Fastlane automatically detects PayPal shoppers during the checkout process. Source: PayPal

Fastlane by PayPal is a new guest checkout option that merchants can add to their website. Fastlane allows customers to checkout quickly and easily without creating an account or remembering passwords.

Fastlane recognizes PayPal customers and simply asks for a confirmation code to confirm identity. PayPal claims that Fastlane can increase checkout speeds by 40% compared to regular guest checkouts.

How is Fastlane different from PayPal’s existing checkout?

PayPal’s current guest checkout requires a traditional login via email and password. Source: PayPal

PayPal already offers a guest checkout option businesses can add to websites. However, the existing PayPal checkout requires shoppers to log in to their PayPal account via a separate pop-up window (shown below).

PayPal’s current guest checkout requires a login. Source: PayPal

With Fastlane, customers won’t be prompted to log in. Instead, PayPal will simply confirm their identity. Skipping the username and password prompts makes for a faster checkout experience and fewer opportunities for abandoned carts. It is a user experience similar to Apple Pay or Shop Pay.

BigCommerce merchants piloted PayPal’s new checkout, including Fastlane. BigCommerce reports that merchants using PayPal’s new checkout saw conversion rates as high as 70%. This rate is astronomical, as the average conversion rate across all ecommerce industries is closer to 2%.

3. AI-powered Smart Receipts

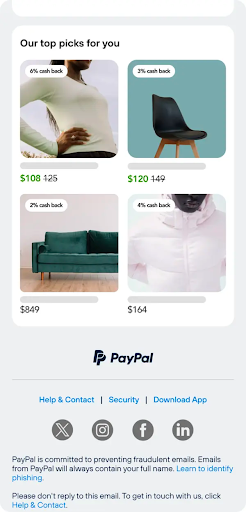

Personalized product selections and cashback offers at the bottom of a PayPal Smart Receipt. Source: PayPal

PayPal boasts a 45% open rate for digital receipts. The company is redesigning these digital receipts to place personalized product offers and discounts at the bottom of each one. These recommendations are AI-powered, based on the individual PayPal user’s transaction history and will consist of products or services from the same merchant as the goods on the receipt.

According to the release, “PayPal is also leveraging AI-powered suggestions that are based on shopper behavior data, combined with the scale of what PayPal can see across the web. Through personalized AI, PayPal is giving any sized merchant the power of being one of the largest retailers in the world.”

4. Advanced Offers Ads

PayPal’s new ad platform leverages transaction data to deliver personalized ads, and businesses only pay when a customer takes action. Source: PayPal

Whereas the first three features are updates to existing products, PayPal’s Advanced Offers Ads is a brand-new platform. This platform will give merchants of all sizes access to AI-powered advertising that is highly personalized to individual PayPal shoppers. And it is performance-based, so merchants only pay when customers take action on the ads.

PayPal is also launching transparent privacy controls for consumers so they can opt in or out of data sharing for targeted ads.

If you’re wondering where customers will shop these ads, that brings us to PayPal’s following announcement:

5. PayPal Consumer App Redesign & CashPass

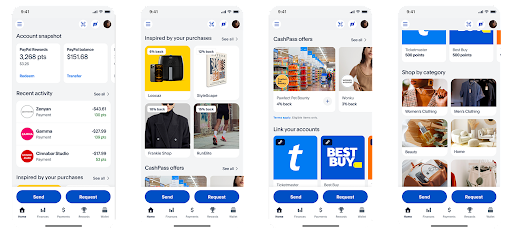

The new PayPal app will feature promotional offers in addition to transaction data and account management. Source: PayPal

PayPal is overhauling its consumer-facing app to feature personalized deals and cashback offers. In fact, the PayPal CEO says, “These are the biggest changes to the PayPal app in a decade.”

Currently, the main home screen of the PayPal app shows consumers their latest transactions. In the app redesign, users will see a variety of product recommendations with cashback offers, deals from different retailers, and options to browse and shop directly from the app.

What is CashPass?

CashPass is a new feature in the PayPal app that enables and processes cashback offers. When a customer taps on a cashback offer within the PayPal app, shops that offer, and completes the transaction using PayPal, the cashback reward will be automatically available in their PayPal balance.

6. Enhanced Venmo Business Profiles

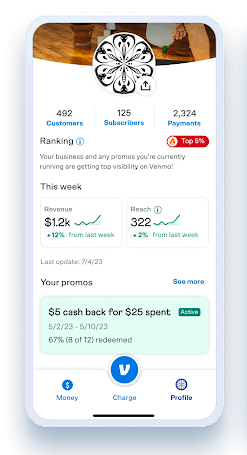

Improved Venmo Business Profiles show performance metrics and feedback on offers. Source: Venmo

Because of its social feed, Venmo (owned by PayPal) is an engaging payment platform. The feed lets users see what their friends, family, and sometimes even strangers buy. In other words, when someone uses Venmo to make a payment at a small business, their friends and family may see that transaction as a kind of word-of-mouth referral.

Currently, Venmo has over 90 million active business accounts since Business Profiles rolled out in 2021. This year, PayPal is adding new features to those profiles, including promotional tools like discounts, cashback offers, profile rankings, and the ability for customers to subscribe to businesses for updates.

Why These PayPal Features are a Big Deal for Small Businesses

With biometric payments becoming increasingly popular among shoppers, and more and more consumers prioritizing convenience in their shopping journey, these customer-facing improvements can positively impact revenue for retailers that use PayPal as a payment option.

Fewer Abandoned Carts

A faster, more streamlined checkout process means fewer fields for shoppers to fill in and fewer opportunities to stop and abandon the transaction. A mind-blowing 97% of shoppers have abandoned an online order because it was complicated or inconvenient to finish.

Higher Sales, Better Conversion Rates

Naturally, fewer deserted carts lead to more sales. PayPal boasts that Fastlane can increase checkout speeds by up to 40%. BigCommerce piloted PayPal’s new checkout, and merchants saw conversion rates as high as 70%.

Did you know? Even without these advancements, PayPal checkout options boost sales. PayPal checkout boosts conversions by 28%, increases unplanned purchases by 19%, and increases repeat purchases by 13%, compared to checkouts without PayPal as a payment option.

Additional Consumer Touchpoints

Smart receipts, product recommendations, and shoppable cashback offers offer small businesses additional customer touchpoints. PayPal promises these touchpoints will be AI-powered based on customer data and paid on a performance basis, making it an affordable option for small businesses looking to increase retention and sales per customer.

Want to hear more directly from the source? See PayPal’s video and press release:

- Press Release: PayPal and Venmo Unveil Six New Innovations to Revolutionize Commerce

- Video: PayPal First Look

Bottom Line

The technology updates PayPal announced are not new – competitors like Shopify have already adopted similar checkout improvements and app updates. However, PayPal has the advantage of a significant market share – 78% of retailers already accept or plan to accept PayPal. PayPal’s market dominance means that the improvements it rolls out this year will have a bigger impact on the industry, both for the consumer experience and small businesses.