QuickBooks Premier Manufacturing and Wholesale, an industry-specific version of QuickBooks Desktop Premier, is designed specifically for manufacturers, wholesalers, and distributors. It has robust inventory management features, including the ability to manage bill of materials (BOM)—which is essential for manufacturers.

The Manufacturing and Wholesale edition is priced at $799 per year for one user, which is the same as the general business edition. It may be affordable for a single individual but can get costly for two to five users. Discover if it’s worth the price through our in-depth QuickBooks Premier Manufacturing review.

QuickBooks Premier will no longer be available for new users after July 31, 2024. It has already been removed from the QuickBooks website, so you’ll need to call QuickBooks customer service to subscribe. While QuickBooks has not announced any plans for discontinuing Premier for existing users, we anticipate it will likely end support after two or three years. QuickBooks Enterprise is still available and comes in the same industry versions as Premier with the same industry-specific features discussed below.

We are committed to the Fit Small Business mission of providing accurate and independent reviews to help small businesses choose the right accounting solution for their needs. To achieve this, we use a comprehensive internal case study that allows us to objectively and thoroughly assess the software we review. This helps us provide you with impartial reviews and tailored recommendations for your business.

Pros

- Can create invoices from sales orders

- Transfers cost and quantity from raw materials to manufactured products automatically

- Tracks cost of goods sold (COGS) using the average cost method (AVCO)

- Manages inventory and manufactured products better with in-depth units available information

- Includes industry-specific reports, such as sales by representative detail and sales by customer type

Cons

- Requires a third-party add-on for first-in, first-out (FIFO) accounting for inventory cost

- Can’t track inventory across multiple locations and the weight of inventory for shipping

- Is expensive for more than one user

- Makes it difficult to share information with an off-site accountant compared to cloud-based programs

Move QuickBooks Desktop Premier to the cloud: Quick Cloud Hosting is our top choice for an affordable hosting service. It will allow you to access your QuickBooks Premier from anywhere on the internet starting at just $25 per user, per month. Visit Quick Cloud Hosting to learn more.

Is QuickBooks Premier Manufacturing and Wholesale Right For You?

Is Premier Manufacturing and Wholesale the Best Accounting Software for You?

QuickBooks Premier Manufacturing and Wholesale Alternatives & Comparison

Are you looking for something else? See our guide to the best small business accounting software.

| Users Like | Users Dislike |

|---|---|

| Easy to use and fix client errors | Unresponsive customer service |

| Customizable reports | Expensive for small businesses |

| Excellent feature set | |

We didn’t find any specific QuickBooks Premier and Manufacturing and Wholesale review, but we came across user feedback on the general business edition. These may provide you with helpful insights.

One user who left a positive review mentioned that it is simpler to use than their previous software and that it’s easier to correct client errors. We agree that for professional accountants with many clients, Premier is a great tool that helps you identify and fix client errors.

Some like that it allows them to customize reports, while others explain that their favorite features are bank reconciliation and the ability to memorize reports. The reports in Premier are very customizable, can easily be saved for future use, and can even be tagged as a “favorite” to make them easy to find.

Meanwhile, those who shared negative feedback complained that it’s a bit expensive and that its customer support is not that reliable. We agree that Premier is expensive for multiple users compared to the alternatives. We also know that the quality of customer service is going to depend on the individual customer service rep.

As of this writing, QuickBooks Desktop Premier earns the following ratings on top review websites:

- Capterra[1]: 4.4 out of 5 based on 100 reviews

- TrustRadius[2]: 8.2 out of 10 based on over 400 reviews

Fit Small Business Case Study

Given that QuickBooks Premier Manufacturing and Wholesale essentially offers the same core features as the general business edition, they earned the same ratings in our case study. For a detailed analysis and complete score breakdown for each category, please read our review of QuickBooks Desktop Premier.

Meanwhile, we conducted a comparative case study to see how QuickBooks Premier Manufacturing and Wholesale stacks up with our recommended alternatives. See the results in the chart below.

QuickBooks Premier Manufacturing and Wholesale Vs Competitors

Touch the graph above to interact Click on the graphs above to interact

-

QuickBooks Premier Manufacturing and Wholesale From $799 per year for one user

-

QuickBooks Online From $30 per month

-

Xero From $13 per month

-

QuickBooks Enterprise From $1,410 per year for one user

Where QuickBooks Premier Manufacturing and Wholesale Won

We found that Premier Manufacturing and Wholesale’s biggest strengths are banking, inventory, and project accounting. It is on par with the other QuickBooks products—QuickBooks Online and QuickBooks Enterprise—but beats Xero in these categories. All QuickBooks products allow you to reconcile bank accounts without bank feeds, something you can’t do with Xero.

Where QuickBooks Premier Manufacturing and Wholesale Lost

Premier Manufacturing and Wholesale lost to Xero in pricing because it’s a bit expensive, especially for up to five users; Xero has affordable plans that start at $13 monthly only. Another weakness is its mobile app, which is not as functional as that of QuickBooks Online.

QuickBooks Premier Manufacturing and Wholesale garnered a poor score in our evaluation because of its pricing structure. As you add users beyond one, the cost rises significantly—making it potentially expensive for small businesses with up to five users.

The table below provides a detailed breakdown of the QuickBooks Premier Manufacturing and Wholesale Edition pricing structure.

Number of Users | Pricing (Cost per Year) | Access All General Industry-specific Features | 60-day Money-back Guarantee |

|---|---|---|---|

1 | $799 | ✓ | ✓ |

2 | $1,099 | ✓ | ✓ |

3 | $1,399 | ✓ | ✓ |

4 | $1,699 | ✓ | ✓ |

5 | $1,999 | ✓ | ✓ |

If you need payroll, you can purchase the QuickBooks Desktop Enhanced Payroll an add-on for $50 a month, or $500 a year, plus $5 per employee, per month.

QuickBooks Premier Manufacturing and Wholesale New Features for 2023

- Inventory categorization: QuickBooks Premier 2023 lets you classify your inventory by groups or categories, which can help you find the products you need easily.

- Cash Flow Hub: This allows you to generate cash flow forecasts, track working capital key performance indicators (KPIs), and monitor the cash conversion cycle. It uses your bank accounts and relevant bank activity to help you predict your cash flow, helping you make detailed action plans.

- Contactless payments: This lets you accept digital payments from a single card reader, and the payments will be entered into QuickBooks automatically. You can use Apple Pay, Google Pay, EMV chips, and credit and debit card payments.

- Batch payment reminders: You can send multiple reminders in one go to customers who are behind on their payments.

QuickBooks Premier Manufacturing and Wholesale Edition Features

In addition to the general accounting features covered in our QuickBooks Desktop Premier review, QuickBooks Premier Manufacturing and Wholesale Edition offers industry-specific tools—such as BOM cost tracking, PO and SO management, and custom pricing.

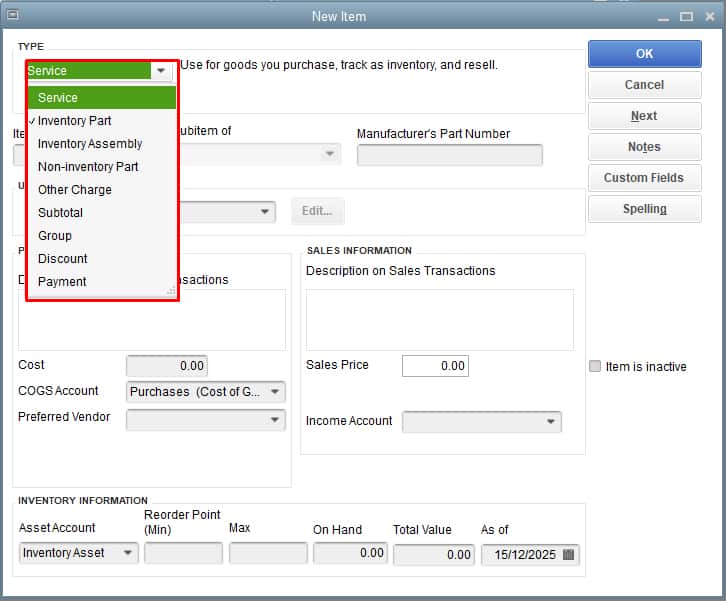

When setting up an inventory item, you can choose the type of item you want to create, whether it’s an inventory part, noninventory part, or assembly. The item will track the average cost per unit to be used if the item is either sold or consumed in an inventory assembly. You can also designate a default sales price. The item screen allows you to designate a reorder point and provides information about units on hand, POs, and sales orders.

Types of inventory items that you can set up in QuickBooks Premier Manufacturing and Wholesale

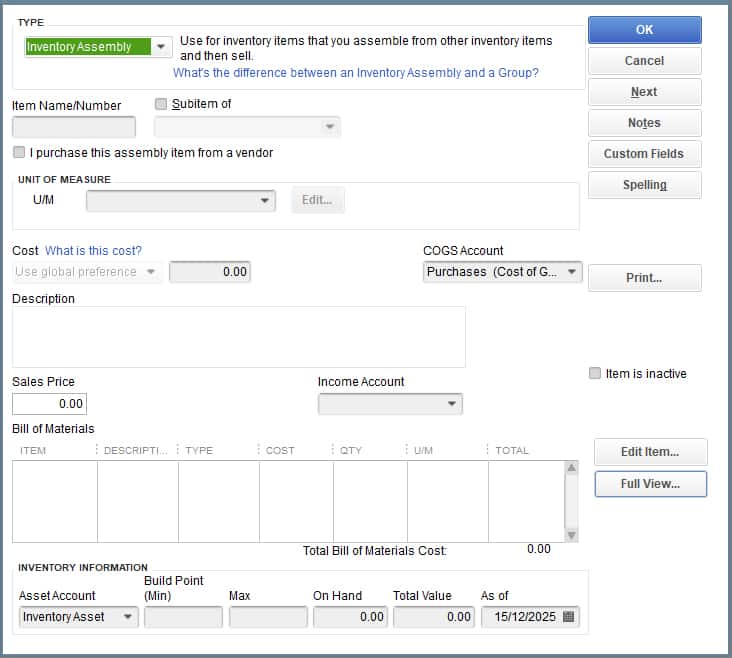

Manufacturing companies usually need to use and track inventory and supplies to build a product. QuickBooks Premier Manufacturing and Wholesale lets you track the BOM cost of each product, including the labor, overhead, and costs of subassemblies. When it detects a change in the cost of a specific part or component, it will update the labor and material costs automatically, eliminating the need for manual data entry.

As part of the inventory assembly item, you specify a BOM showing the exact items, including labor, and quantities that go into the manufactured product. The BOM will provide a total cost for manufacturing the product.

Create an inventory assembly in QuickBooks Desktop Premier

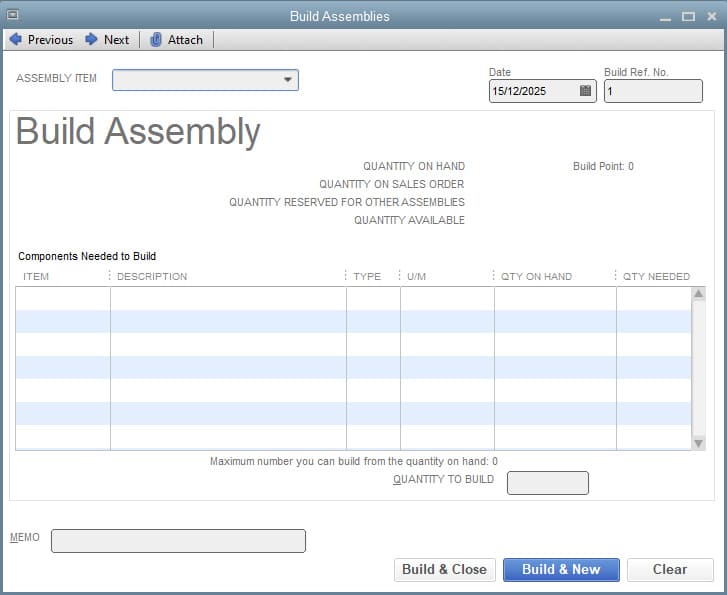

You can specify the number of products to manufacture in the Build Assembly screen, and the program will remove the items on the BOM automatically from their respective inventory counts and add them to the manufactured products inventory. The screen also provides helpful information, such as the quantity available for all needed items and the maximum number of products you can manufacture based on the inventory availability.

Build Assembly Tool in QuickBooks Desktop

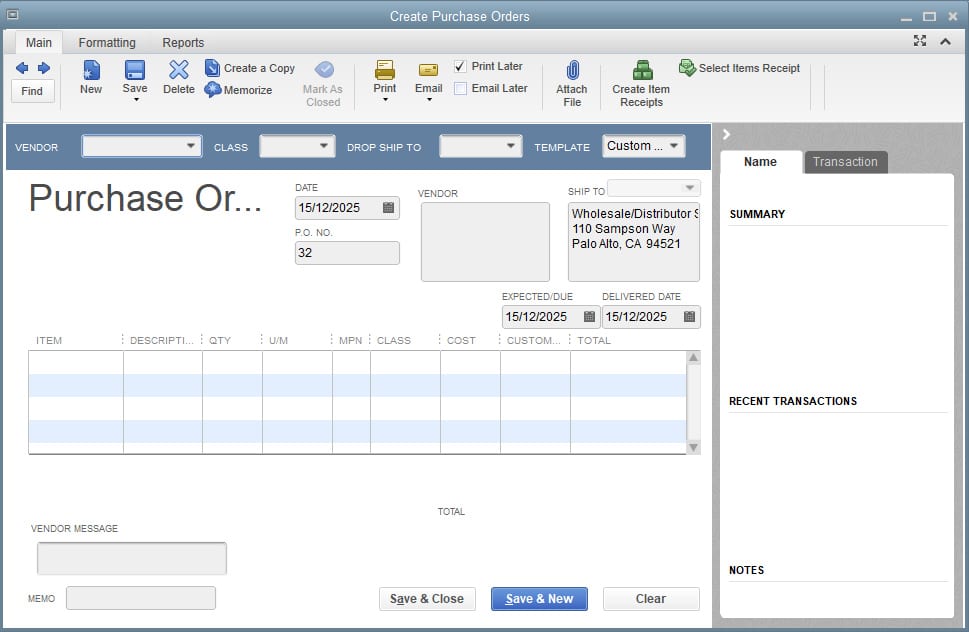

PO tracking is important for manufacturing businesses as it helps them simplify the purchase of products and materials needed for their production. The PO form in QuickBooks Desktop tells your vendors what products or items you want to order from them. You can then track your orders and know how much you have to pay for them.

PO form in QuickBooks Desktop Premier

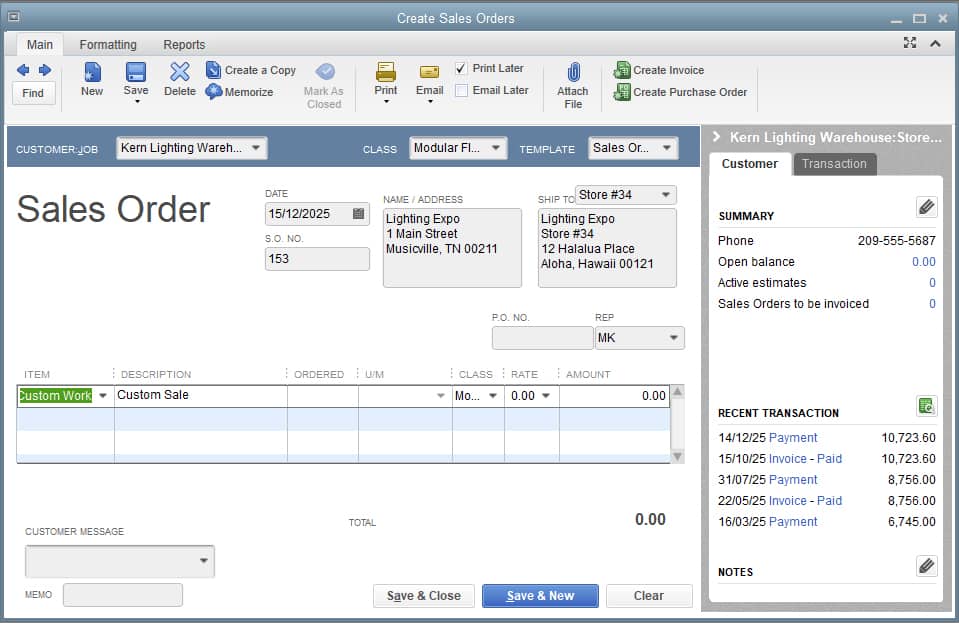

As orders are received, you can create sales orders that will remove inventory items from the quantity available so that you know when to reorder or increase the production of manufactured products. Using the Sales Order feature, you can create pick lists, shipping labels, packing slips, and invoices.

Sales order form in QuickBooks Desktop Premier

When orders are fulfilled, an invoice can be generated from the sales order and either printed or emailed to the customer. You can create an invoice directly from the sales order item by clicking on the Create Invoice button at the top of the sales order form.

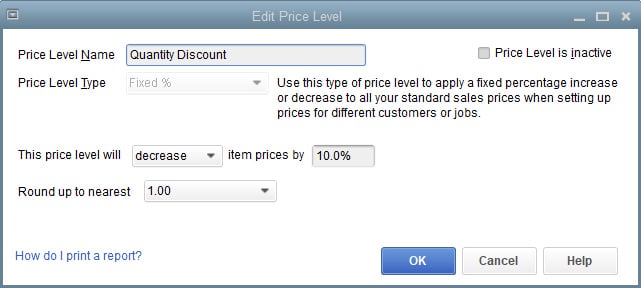

You can create customized pricing for different customers. For example, you might charge high-volume customers a lower rate on particular products or orders. You can create either a custom price level that specifies a special price item-by-item or a pricing rule that adjusts the default price by a specified percentage.

Edit price level in QuickBooks Premier

If you wish to give your customer a discount, you can apply a custom discount to your sales order or invoice. To do this, click on the Item List and select New. Click on the Type menu, choose Discount, and specify the discount amount you want to give to your customer.

In addition to the standard powerful reports that can be generated by the general business edition of QuickBooks Premier, QuickBooks Premier Manufacturing and Wholesale has some industry-specific reports, including:

- Sales by rep detail: This will show a list of invoices by sales representative for the specified period, which may be useful when determining compensation or bonuses.

Sample Sales by Rep Detail report

- Sales by customer type: You can create custom classifications for your customers. For instance, you might separate your customers into homebuilders, end users, and retailers. This report will allow you to see total sales separated by the customer classifications.

Sample Sales by Customer Type report

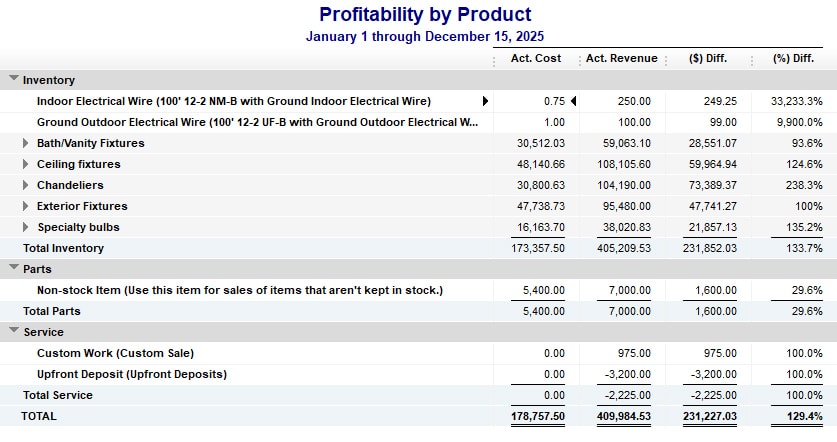

- Profitability by product: This provides the actual revenue and cost for the period, separated by each product sold. You can use this to identify profitable products and which product areas need changes.

Sample Profitability by Product report

I don’t recommend QuickBooks Premier (or any industry-specific edition) for mobile accounting. Although the version offers a mobile app, it is limited to capturing expense receipts and tracking business mileage. Many modern businesses require features, such as invoicing and payment processing on their mobile devices, which are not fully supported by QuickBooks Premier’s app.

If mobile accounting is important to your business, we recommend choosing from one of our leading mobile accounting apps.

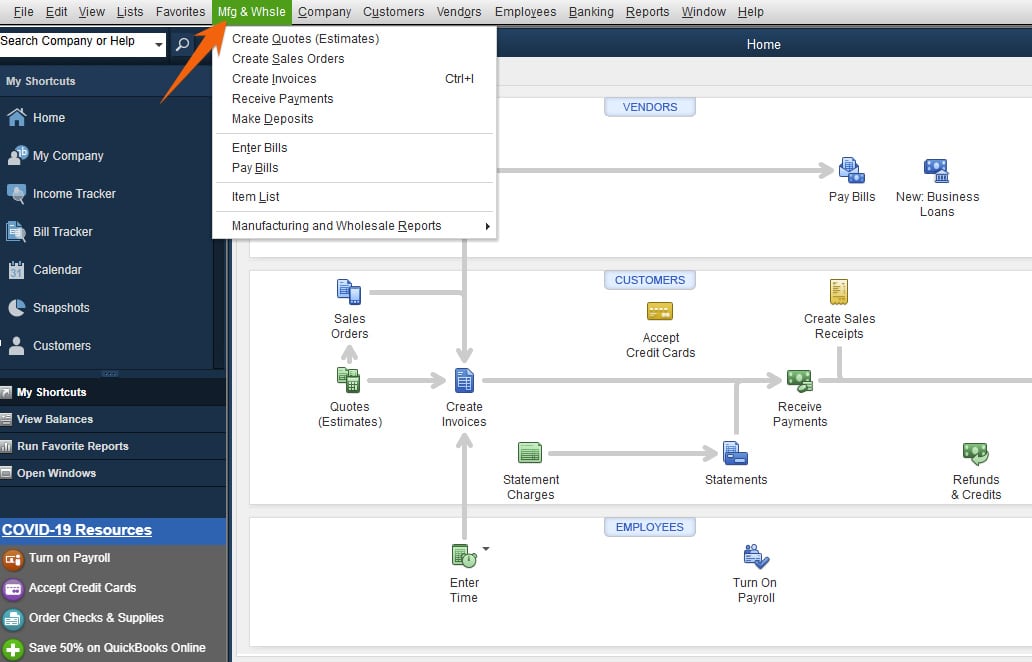

Since it’s desktop-based software, it isn’t as easy to use as cloud-based programs. However, after you learn where features are located, you’ll find the platform easy to navigate. For instance, from the Manufacturing and Wholesale menu, you can access a wide range of functions to help you complete transactions easily, such as receiving payments, making deposits, and creating sales orders, estimates, and invoices.

Access useful features from the Manufacturing and Wholesale menu

QuickBooks Premier is a very comprehensive and powerful program, so you need to devote time to fully learn how to use its features. You can seek help through its in-software help center, live chat, knowledge base of guides, and getting started information, blogs, and community forums. You can talk to a live agent over the phone after you submit a call request.

How We Evaluated QuickBooks Premier Manufacturing & Wholesale

We evaluated QuickBooks Premier Manufacturing and Wholesale using the rubric below.

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and number of users.

7% of Overall Score

This section focuses more on first-time setup and software settings. The software must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

7% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

7% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

7% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage cost of goods sold (COGS), and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

30% of Overall Score

Ease of use gets the highest weight in this case study because we want to give more credit to easy accounting software. For this section, we considered customer service, support network, and a subjective expert opinion score. Users must have easy access to customer service channels in case of problems, questions, or assistance.

Support network refers to a community of software users that can extend professional help to businesses. Having an independent software expert perform the bookkeeping is good for overall ease of use. Lastly, our expert opinion score is our subjective rating based on our experience in trying the software.

5% of Overall Score

The software must also have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops.

4% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

If you’re a manufacturing company that needs to track the cost of parts and combine these costs into an assembled product and doesn’t need access outside your office, then it’s right for you.

No. The Manufacturing and Wholesale edition has all the same features as the General Business Edition, plus it has industry-specific tools, such as BOM cost tracking.

No, you can’t. If you need location and bin tracking, you’ll need to upgrade to QuickBooks Enterprise. Read our QuickBooks Enterprise review for more information.

Bottom Line

QuickBooks Premier Manufacturing and Wholesale is a powerful industry-specific version of QuickBooks Premier. In addition to all the bookkeeping features of Premier, it allows you to better control inventory and provides more flexibility to customize pricing. While it’s great desktop software, it’s complicated and will require a dedicated and experienced bookkeeper to harness its power.

[1]Capterra

[2]TrustRadius