QuickBooks Self-Employed is a cloud-based accounting software specially designed for self-employed individuals, such as freelancers, real estate agents, rideshare drivers, and independent consultants. It lets you monitor income and expenses, track mileage to and from clients, and file your taxes with its QuickBooks Self-Employed Tax Bundle. It offers three pricing plans that range from $20 to $40 per month.

The platform scores high among users, with praise given for its ease of use and integration with TurboTax. However, because it is designed for a specific user base, it may lack some of the more advanced features that larger businesses might need, such as payroll and inventory management. The reporting capabilities are also more basic compared to other QuickBooks products.

QuickBooks Self-Employed is no longer available to new users and has been replaced with QuickBooks Solopreneur, which we think is a substantial improvement – especially for invoicing. Read our QuickBooks Solopreneur review to learn more.

At Fit Small Business, our editorial policy is rooted in our company’s core mission: to deliver the best answers to people’s questions. This mission serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions readers have. This ensures that the content is rooted in knowledge and accuracy.

We also employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased.

QuickBooks Self-Employed Alternatives & Comparison

QuickBooks Self-Employed Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Easy to use with an intuitive interface | Not designed for businesses with employees or inventory |

| Multiple staff and accountant access with restriction options | Lacks project tracking tools |

| Simple to integrate bank and credit card for reconciliations | Doesn’t accommodate multiple businesses |

Most of those who left a QuickBooks Self-Employed review commended its intuitive user interface. Many reviewers said that they like that they can add new transactions instantly and that the software guides them when filing taxes.

However, some wish that it had more features, such as recurring invoices and the ability to send estimates, a payroll integration, and the ability to manage 1099 contractors. We agree that its features are very limited and recommend QuickBooks Online if you send invoices to customers regularly or have employees.

Below are QuickBooks Self-Employed’s ratings from popular review websites:

- Software Advice[1]: 3.9 out of 5 stars based on around 100 reviews

- TrustRadius[2]: 8 out of 10 stars based on around 50 reviews

QuickBooks Self-Employed Pricing

QuickBooks Self-Employed has three pricing plans that range from $25 to $40 per month. All subscriptions include income and expense tracking, business mileage tracking invoicing, and a mobile app.

If you want to file one state and one federal tax return and pay quarterly estimated taxes online, you need at least the Self-Employed Tax Bundle. This tier also lets you get unlimited live help from TurboTax experts or talk to a real certified public accountant (CPA) when needed.

Users who want to have a TurboTax pro prepare the return for them cannot bundle this service with QuickBooks Self-Employed—they must instead purchase the service separately. The price for TurboTax Live Full Service Premium is $409 for federal and $64 for state returns.

See the table below for more information about the features that are included with each plan:

Self-Employed | Self-Employed Tax Bundle | Self-Employed Live Tax Bundle | |

|---|---|---|---|

Monthly Fee | $25 | $30 | $40 |

Discount | 50% for 3 months | 50% for 3 months | 50% for 3 months |

Send & Track Invoices | ✓ | ✓ | ✓ |

Organize Expenses Into Schedule C Categories | ✓ | ✓ | ✓ |

Separate Business & Personal Expenses | ✓ | ✓ | ✓ |

Track Mileage Automatically | ✓ | ✓ | ✓ |

Calculate Quarterly Estimated Taxes Automatically | ✓ | ✓ | ✓ |

Pay Quarterly Taxes From QuickBooks | ✕ | ✓ | ✓ |

Import Data Into TurboTax | ✕ | ✓ | ✓ |

One Federal & One State Return Filing Included | ✕ | ✓ | ✓ |

Access to TurboTax Live Experts | ✕ | ✕ | ✓ |

CPA Review of Tax Return | ✕ | ✕ | ✓ |

QuickBooks Self-Employed New Feature for 2023

- Tags: You can use customized tags to sort transactions based on key metrics that are important to your business. For instance, if you want to track more details about your locations, you can set up tags, such as a specific business site or region.

QuickBooks Self-Employed Features

While QuickBooks Self-Employed doesn’t have a balance sheet and can’t track assets and liabilities, it includes many features that help you organize your income and expenses.

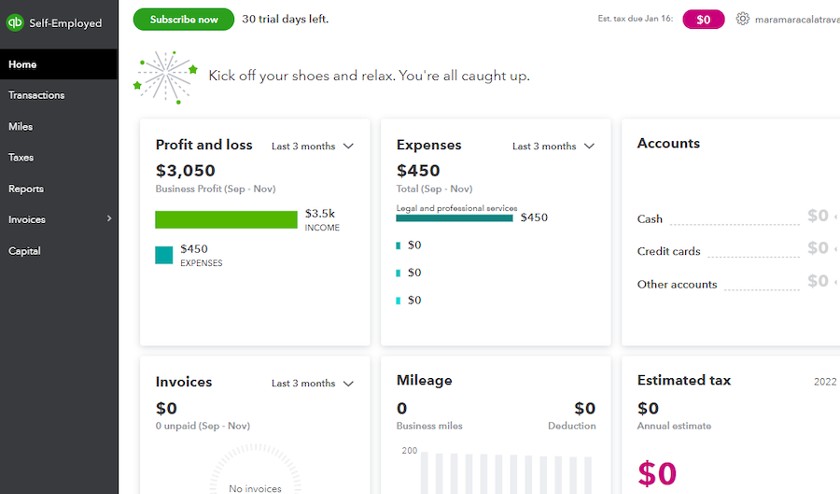

The dashboard includes a left navigation bar where you can access its features, including income and expense entry, tax tracking, invoicing, and reporting. It also shows important numbers, including your profit and loss (P&L), expenses, accounts, invoices, mileage, and estimated taxes.

QuickBooks Self-Employed’s dashboard

You can categorize the transactions downloaded from your bank account or those that you have entered in QuickBooks Self-Employed manually from the Transactions menu. When an income or expense is recorded, you can mark it easily as personal or business.

If you’re using the desktop interface, click the transaction entry you wish to categorize. Then, select the Mark as business or Mark as personal button in the top menu bar of the Transactions screen as shown below.

Categorizing transactions as business or personal (desktop interface)

An easier way to categorize your transactions is by using the mobile app. You can categorize your expenses with a swipe—swipe left to categorize it as business and swipe right for personal.

Tip: Any payments from your bank account not related to your business should be categorized as personal expenses so that they aren’t deducted from your tax return. For example, you’ll want to classify a mortgage or rent payment as a personal expense.

Our guide on how to separate business and personal finances can help you avoid potential issues.

There’s no law preventing a Schedule C business from paying personal expenses out of their business checking account, but an IRS audit will go much more smoothly if you keep personal activity out of your business. It’s better to keep business and personal activity in separate checking accounts with a periodic transfer from your business checking account to your personal account as needed for personal expenses. For other helpful practices, see our bookkeeping and accounting tips for small businesses.

QuickBooks Self-Employed allows you to classify income and expenses using categories that align with the IRS Schedule C, such as utilities, legal fees, and commissions. Once this information is entered, you can view and print a summary of your taxable income and expenses, which can take some of the guesswork out of filing your taxes. If your plan doesn’t include the Tax Bundle, you can use this summary to input your Schedule C information into a tax program of your choice manually.

If you drive for business reasons, you can deduct a standard rate per mile or actual vehicle expenses. QuickBooks Self-Employed has a mileage tracker app that you can download on your Android or iOS phone. It’ll log all of your car travel automatically and keep a running tally of your business miles, calculating the corresponding deduction at the current IRS mileage rate.

You can download your bank and credit card transactions directly into your QuickBooks Self-Employed account. From there, you can categorize each transaction into the appropriate expense category or designate it as a personal expense.

QuickBooks Self-Employed’s invoicing feature allows you to generate and track invoices. It also lets you sign up to make the invoices payable online. If you choose this option, be aware that while bank transfer transactions are free, credit card payment rates are 2.99%. Once your invoice is completed, you can email it to your customer as a PDF attachment. You can also send invoices through the mobile app.

Compared to invoices in QuickBooks Online, invoices in QuickBooks Self-Employed are not that customizable. While you can upload your logo and change the font color, there are no templates to choose from. Here’s an email and PDF preview of a sample invoice in QuickBooks Self-Employed.

PDF and email preview of a sample invoice in QuickBooks Self-Employed

Tip: If you don’t see the Invoicing feature in your dashboard, then you need to enable it by toggling the invoicing button to On under Settings (gear icon).

The QuickBooks Self-Employed mobile app for iOS and Android allows you to take a picture of a receipt and attach it to a transaction directly from your mobile phone. Not only will this save you time, but it’ll also provide the documentation required by the IRS to deduct an expense.

QuickBooks Self-Employed Labs is a place where Intuit experiments with new features. It can be accessed by clicking the gear icon on the desktop site and then selecting “Labs” under TOOLS.

You’ll be able to view the latest integration and innovations available for you to opt into, such as its integration with Amazon. When you link your Amazon account to QuickBooks Self-Employed, you can label individual items in your order as business or personal without having to calculate the split yourself. Other items featured in the lab include custom color-coded tabs and the ability to import mileage trips from Google.

The QuickBooks Self-Employed Tax Bundle includes a subscription to TurboTax. You can transfer all of your Schedule C information automatically to TurboTax to complete your tax return. You should choose this plan if you prepare your own taxes.

QuickBooks Self-Employed Tax Bundle includes both a federal and state tax return for $15 per month or $180 per year. Purchased separately, TurboTax Home & Business costs $130 and includes the state return.

Based on the tax profile that you complete during setup, QuickBooks Self-Employed will project your annual profit, calculate your estimated tax payment, and alert you of tax due dates. This valuable tool helps protect you from an underpayment penalty because of not making the required quarterly estimated tax payments. Just be sure to stay up to date on categorizing your transactions and inputting your business income.

It’s important to note that QuickBooks Self-Employed only offers federal quarterly tax estimates. So, if your state collects income tax and requires estimated quarterly payments, then you’ll need to calculate that on your own.

Read our guide on independent contractor taxes for the list of taxes, tax rates, and deductions. We also include the steps on how to file the taxes, the dates of when to pay them, and some tips on how to keep independent contractor taxes organized.

The platform will calculate your quarterly tax liability, and the QuickBooks Self-Employed Tax Bundle allows you to pay the quarterly tax online. It may help avoid a federal underpayment penalty but excludes state-estimated tax payments, which might be due, depending upon where you live. Remember that to pay your federal quarterly taxes through QuickBooks Self-Employed Tax Bundle, you need to sign up for the Electronic Federal Tax Payment System (EFTPS).

Is your small business growing and are you looking for accounting software that can accommodate your need for more advanced features? Our guide on how to switch from QuickBooks Self-Employed to QuickBooks Online will walk you through each step.

QuickBooks Self-Employed Customer Service & Ease of Use

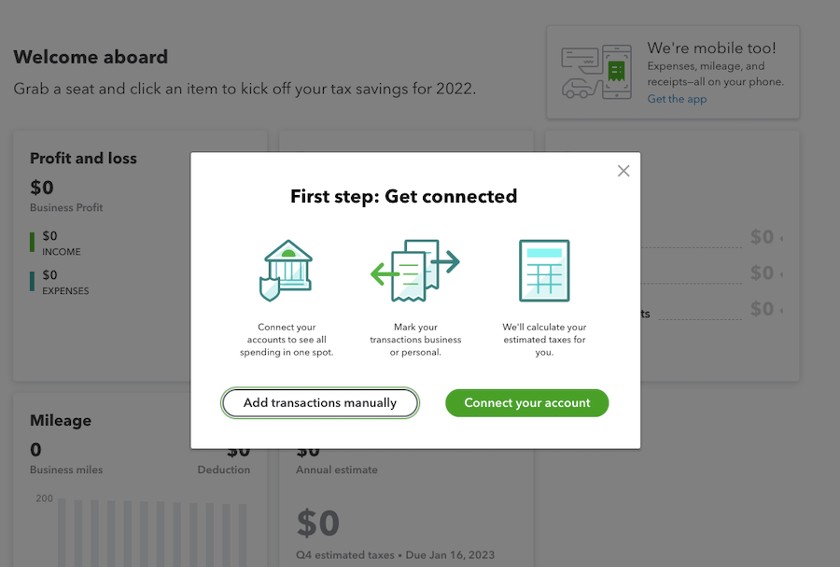

QuickBooks Self-Employed has an intuitive dashboard that’s easy to navigate. The tabs on the left side of the dashboard make it easy to explore the other features. Overall, it’s intuitive and not cluttered with unnecessary information, making it approachable for accounting novices. When setting up your account for the first time, you can choose to connect your bank account or manually enter transactions.

Add transactions manually or connect your bank accounts

Meanwhile, QuickBooks offers multiple customer support options. These include QuickBooks blogs, video tutorials, a built-in live chat, a help center called Learn & Support, a community forum, and an in-software automated assistant.

Frequently Asked Questions (FAQs)

No, it isn’t, as it supports only one user and lacks advanced features. When your business and accounting needs grow, you need to switch to a different solution, like QuickBooks Online.

Yes, it is. The cloud-based software has a streamlined interface that’s easy to navigate. It uses simple language and doesn’t have unnecessary features, so it takes very little time to get acquainted with it.

If you want options similar to QuickBooks Self-Employed, you can choose from our top-recommended QuickBooks Self-Employed alternatives, which includes QuickBooks Online Simple Start, Zoho Books, ZipBooks, and Wave.

While QuickBooks is a full-featured small business accounting software that’s available both for desktop and online, QuickBooks Self-Employed is suitable for freelancers needing to track their income and expenses for tax purposes. However, it has limited features and customization options, no integration with other software, and limited customer support.

Bottom Line

QuickBooks Self-Employed isn’t a true double-entry accounting program like QuickBooks Online, but its simple features make it very easy to use. It has an excellent mobile app that can serve modern freelancers in terms of invoicing their clients, tracking business mileage, and monitoring business expenses. It’s a good choice to monitor your deductions, and it uses that information to complete your tax return.

If you’re a freelancer needing a solid solution for tracking income and expenses, sign up and receive 50% off the first three months. However, if you anticipate outgrowing QuickBooks Self-Employed, we suggest that you choose QuickBooks Online.