Remote offers human resource (HR) solutions and services for managing international payroll, taxes, benefits, and compliance for all business sizes. Benefits packages tailored to specific countries are also available, plus its employer of record (EoR) services allow it to handle payroll and hiring needs in countries where you don’t have business entities. It also offers low-cost contractor payroll and management tools.

In our review of the best international payroll services, Remote earned an overall score of 4.59 out of 5. What brought its score down was its popularity. Although those that were able to use it rained it with positive reviews, the total number of online reviews it received were far fewer than what most other payroll services have.

Pros

- Reasonably priced contractor management tools

- Can serve as EoR

- Available in 180+ countries

- Has a free HRIS

- Offers discounts and special plans for startups, nonprofit organizations, and businesses hiring refugees

Cons

- Customer support via email, live chat, and help widget only

- Access to dedicated support only available in the Global Payroll plan

What We Recommend Remote For

- Businesses that need to pay international employees: Remote is one of our recommended international payroll services because, aside from its EoR services, it also has a standalone global payroll solution that streamlines your employee payment processes. In addition to managing local employment taxes and processing payroll in multiple local currencies, it comes with automated payments and built-in compliance tools.

- Employers with plans to expand globally or have employees spread across countries they don’t have business entities in: Remote’s EoR service makes it easy for you to hire, onboard, offer benefits, and pay local employees without setting up business entities in locations outside your home country. This is made possible through its network of fully owned local entities, enabling Remote to assume the legal responsibilities of an employer and manage essential HR processes for you.

- Companies that hire refugees: If your business wants to support refugees to get back on their feet, Remote can help you hire qualified refugee talents—provided that they are legally allowed to work in the country where Remote’s services are available. As of this writing, the provider is even offering its EoR solution for free to those hiring refugees.

- Global employers looking for low-cost international contractor payroll services: Remote, which is included in our list of best contractor payroll solutions, has a contractor management module that lets you onboard and pay United States-based and global contractors in their local currencies. This costs $29 per contractor per month.

- Global companies that want robust invention rights and intellectual property (IP) protection: While some global employment providers may not offer in-house IP protection tools, all of Remote’s fully owned local entities are covered by its IP Guard solution. Designed to prevent IP risks, it helps ensure you retain ownership over your trademarks, copyrights, and patents. Remote also monitors IP laws and has a team of international legal professionals who provide expert advice on how to protect your IP.

When to Use Something Else

- Companies that don’t have international business expansion plans: Remote’s solutions and services are designed to handle global hiring and payroll. Its tools may be more than you need, especially if you’re not looking at expanding your business in countries outside of the US. For those with US-based workers needing payroll and HR tools, read our best HR payroll software guide to find a more suitable option.

- Employers that need 1099 year-end reporting: Remote’s contractor management module only generates 1099 tax forms. If you’re hiring primarily US-based contractors and need year-end 1099 filings, we recommend Gusto. It handles year-end tax reporting for contract workers and has a budget-friendly contractor-only payroll plan that costs $35 plus $6 per contractor monthly. Read our Gusto review for more in-depth information.

- Global businesses looking for an affordable global payroll: Remote’s Global Payroll starts at $29 per month, which might be too much for startups and small businesses with international employees. Papaya Global may be a better alternative, as its payroll solution is affordably priced (at $15 monthly). Read our Papaya Global review and discover how you can benefit from it.

- Businesses that need expert help with employee onboarding: While Remote has hiring and onboarding features, it doesn’t have a dedicated representative that handles hiring and onboarding as Oyster does. Aside from this, Oyster assigns a representative for each employee or contractor hired. Read our Oyster review to explore more of its features.

Top Remote Alternatives Compared

Best for | Paid Plans Start at | Setup Fees | Dedicated Representative | |

|---|---|---|---|---|

Companies looking for low-cost contractor payroll services | $29/contractor/month for global payroll; $699/ month for EoR | ✕ | ✓* | |

Small international businesses looking for affordable global payrol | $599 per employee for EoR services; $15 per employee for global payroll | Onboarding fees (Call for a quote) | ✓ | |

Employers needing 1099 reporting | $49 per month + $6 per person per month | ✕ | ✓* | |

Businesses needing employee onboarding assistance | $599/employee/month for EoR services $29/employee for Contractor** | ✕ | ✓ | |

** Oyster’s Contractor plan is $0 for the first month

Remote Deciding Factors

Supported Business Types | Small to large businesses that need global HR tools and services to compliantly hire and pay international employees and contractors |

Free Trial | Contractor management has a 14-day free trial |

Pricing |

|

Discounts | Discounts of up 30% for qualified startups and registered nonprofit organizations |

Standout Features |

|

Ease of Use | Relatively easy to use but you need to know the basics of paying international employees and global contractors |

Customer Support |

|

In our evaluation, Remote’s pricing got a perfect score for this criterion given its multiple plans, reasonable fees, and separate payroll option for global contractors. It also doesn’t charge setup or client onboarding fees. Additionally, Remote’s pricing details are all available on its website.

Remote has an inexpensive Contractor Management solution for onboarding and paying international contractors. It also offers a Global Payroll module at $29 per employee monthly and an EoR option with hiring, payroll, benefits, and compliance functionalities. Those fees range from $599 or $699 per employee monthly, depending on whether you select an annual or monthly plan.

For those needing an HR solution, Remote has a free HRIS tool that allows you to manage your employee onboarding and offboarding, time and PTO tracking, employee profile, and document management.

Contractor Management | Global Payroll | EoR | |

|---|---|---|---|

Monthly Pricing | $29 per contractor* | $29 per employee monthly | $699 per employee** |

Unlimited Admin Seats | ✓ | ✓ | ✓ |

Legal Compliance and IP/Invention Rights Protection | ✓ | ✓ | ✓ |

Benefits Management and Administration | ✕ | ✕ | ✓ |

Payments to Tax Authorities and Insurance Providers | ✕ | ✓ | ✓ |

Annual Statutory Employer Reports | ✕ | ✓ | ✓ |

Custom Reports and Integrations | ✕ | ✕ | ✕ |

Quarterly Consults With Remote’s Team of Experts*** | ✕ | ✕ | ✕ |

24/5 Customer Support | ✓ | ✓ | ✓ |

*Contractors may be charged 1% to 2% of their payment if they require currency conversions via Remote’s payment partner.

**Remote also offers an annual-billed option that costs $599 per employee monthly (paid in a lump sum).

***Consists of HR, legal, benefits, tax, and immigration professionals.

Remote’s prices are the management fee only and are on top of the total cost of employment for your employee, which includes their wages and any government-required additions like Social Security, as well as the price of benefits packages. Remote offers competitive rates on benefits with no additional administration costs.

As of this writing, it provides free EoR services to companies hiring refugees and special packages for startups and social purpose organizations (with up to 10 employees):

- Companies that hire refugees: Remote will act as an EoR for your refugee talents at no cost.

- Qualified startups, preseed, seed, and Series A businesses: 15% off its EOR service on all full-time hires and contractor management services for the first 12 months. The EOR discount is available for annual plans only.

- Qualifying nonprofits, charities, trusts, social enterprises, and benefits corporations get this. Its other special perks and discounts include: 15% off its EOR service on all full-time hires and its contractor management services for the first 12 months. The EOR discount is available for annual plans only. It also provides co-marketing opportunities.

Paying Remote’s management fees annually is more cost-efficient because you get slightly lower rates compared to paying on a month-to-month basis. However, you have to pay the entire year’s subscription with that employee’s first invoice. If that employee is terminated before their 12-month billing cycle ends, Remote won’t refund the unused management fees. It also doesn’t prorate monthly fees even if your staff member’s contract is terminated before the end of the month.

Remote bills you the actual payroll costs, such as salaries, Social Security, and benefits contributions, plus the applicable management fees. It can also send billing statements that reflect your selected currency. It bills in EUR, USD, AUD, CAD, DKK, GBP, JPY, NZD, NOK, SEK, or CHF.

Remote does not charge any transaction fees. However, it charges a 3% service fee if you use credit cards for payments.

Remote lets you view and pay billing statements online.

(Source: Remote)

Companies with globally distributed teams will find Remote’s payroll solutions and services helpful and convenient to use. It got a perfect score in this criterion because of its solid pay processing tools, payroll compliance support, the wide coverage of its payroll services (more than 100 countries), and for having local entities in the countries it services.

Remote lets you pay both local and international contractors with just a few clicks.

(Source: Remote)

Remote users said they appreciated how it handles payroll for them. Remote manages payroll and country-specific employment taxes through its network of local entities. It can handle bonus and incentive payments for international staff and even supports the Dutch 30% ruling, wherein qualified highly skilled migrants who moved to the Netherlands for specific jobs get tax-free allowances equal to a maximum of 30% of their gross salary.

You can add incentives and bonuses to employee pay as a one-time or recurring event. (Source: Remote)

It also follows a payroll cut-off timeline that’s due on the 11th of every month. This means that you have to input bonus, commission, incentive, and expense reimbursement details into its platform before 11:59 p.m. UTC on the 11th so they can be processed. In case you miss the deadline and don’t want to wait for the next payout schedule, Remote can run off-cycle payroll for an additional fee. This cutoff date is for onboarding as well.

If you are in a country that allows semimonthly payroll, if you miss the deadline, it will pay out at the next pay period.

Salaries are remitted to their accounts and in their local currencies through bank transfers (via Single Euro Payments Area (SEPA) and ACH if the local currency is the euro and US dollar, respectively). If local bank transfers in the employee’s local currency aren’t available, Remote will send the payments via international wire transfer. Note that processing timelines vary depending on the payment method used, although this typically takes around two to nine business days.

Remote can help you with approving and paying contractor invoices in more than 170 countries around the world. It offers invoicing tools so your contractors can create and send invoices directly from its platform. This is ideal for businesses with long-term contractor contracts as it allows you to review, approve, and pay invoices online. You can even set up automatic invoice approvals and payments in Remote.

Aside from debit/credit cards, payments can be made via ACH and SEPA transfers. Remote supports 65 currencies. If your contractor’s local currency is different from the currency that Remote bills you with, the provider will use TransferWise to pay contractors. Note that transfer fees or exchange rate differences (if applicable) will be shouldered by your contract workers. If you want to cover these costs, you can add a small buffer amount to your contractor payments.

In addition, Remote’s integration with Stripe Connect allows eligible contractors to be paid directly from the platform. Contractors can set up a Stripe account on the Remote platform and create invoices through Stripe Connect.

With Remote, you can pay contractors by card or set up a bank transfer instead.

(Source: Remote)

For those with US-based contractors, Remote generates year-end tax forms but doesn’t offer 1099 filing services. Contractor payslips are also unavailable mainly because payments for these workers are made through Remote’s invoicing tool and not its payroll solution.

Remote earned a perfect rating for HR functionalities given its online onboarding solutions, localized employee benefits plans, and international HR compliance tools. It handles your essential global HR needs—from managing paid time off (PTO) and local employment taxes to ensuring you stay compliant with the statutory benefits requirements and tax regulations. As an EoR, Remote can help find and hire qualified candidates for you in countries where it has local entities.

You can select one of the countries on Remote’s list to get information about hiring in that country. (Source: Remote)

Onboarding tools for both employees and contractors include sending your new hires their employment contracts and conducting right-to-work and/or medical checks (if required by local labor regulations). It also removes the burden of having to manage employee onboarding yourself since Remote assigns each worker to a dedicated specialist who will guide them through the process and answer questions about their contract and new hire requirements.

Users found the onboarding tools easy to use, but some complained of delays when their dedicated specialist was unavailable.

New hires will receive a link to Remote so they can input their personal profile into the system and complete documentary requirements. (Source: Remote demo)

Employees can file PTO requests directly from Remote’s platform, and the approved transactions will be deducted automatically from your staff’s PTO credits at the end of the month. Remote bases time off on an 8-hour workday, and employees can request partial time off, and even vary time off over multiple days using a single request. If necessary, they can request unpaid leave and if approved, the time is deducted from the payslip at the end of the month.

The system sends email notifications of approved PTOs, although employees can check the details of their paid and unpaid leaves (if any) either online or via their electronic payslips.

Employees can request full or partial days off using the Remote platform. (Source: Remote)

Your global staff members are provided access to competitive benefits packages available in their country. You can even include contractors if you desire. Here are some of the benefits that Remote offers (options may vary by country):

- Health care insurance

- Dental and vision

- Travel insurance

- Retirement plans/401(k)

- Stipends and allowances

- Stock options

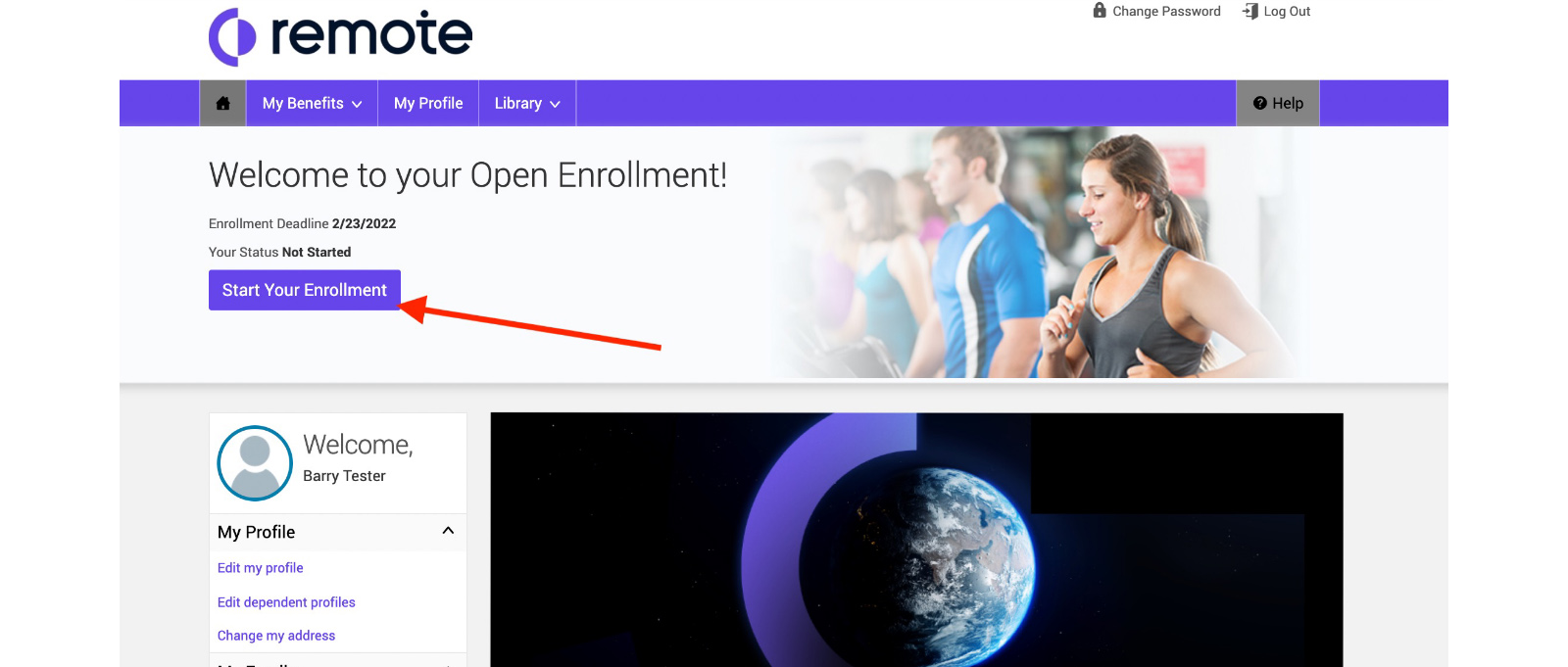

Remote uses bSwift for US Benefits open enrollment. (Source: Remote)

Remote will also manage the benefits plans and ensure that full-time employees are covered by country-specific Social Security programs. Its services include helping you handle the complexities of statutory benefits so that the correct coverage is provided to your staff based on the country’s regulations. In addition, it works to ensure that you are providing the same benefits for employees in a country regardless of their job level. Furthermore, if you need to provide a single employee with a one-off benefit, it can work with you to find the best complaint approach.

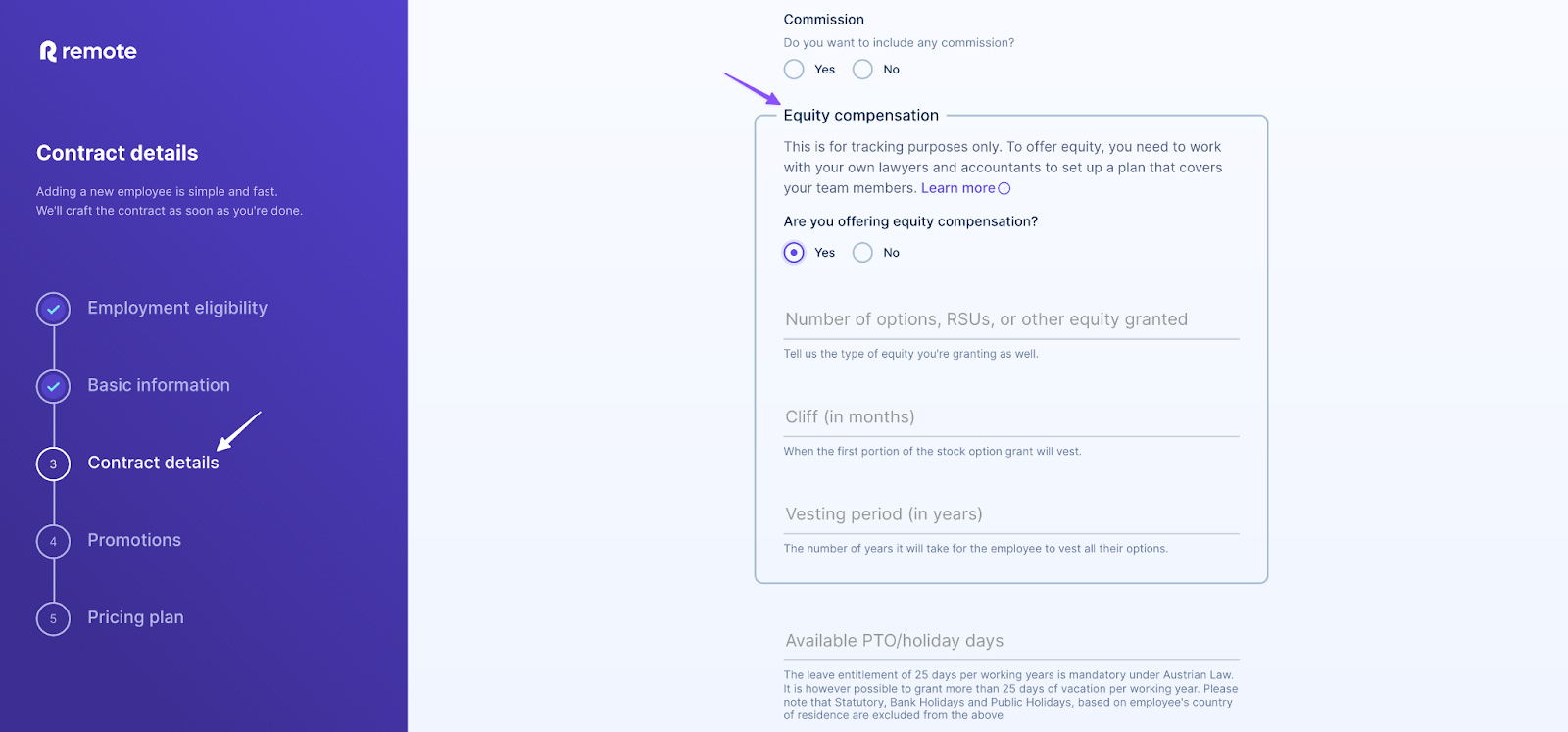

Offering stock and stock options to employees is a great way to invest them in the company’s success. Remote can help you with planning and executing your equity plan, including country-specific tax and withholding compliance. You can sign up for a free 30-minute equity incentive planning consultation to learn more.

When adding a new employee into Remote, you can select to include equity compensation. (Source: Remote)

Remote offers comprehensive IP and invention rights protection via its Remote IP Guard solution. It covers various industries, such as finance, manufacturing, technology, and energy, and uses a secure two-step process to transfer to you IPs of work products created by your international employees. Further, Remote offers the expertise of international legal professionals to ensure that your IP is protected.

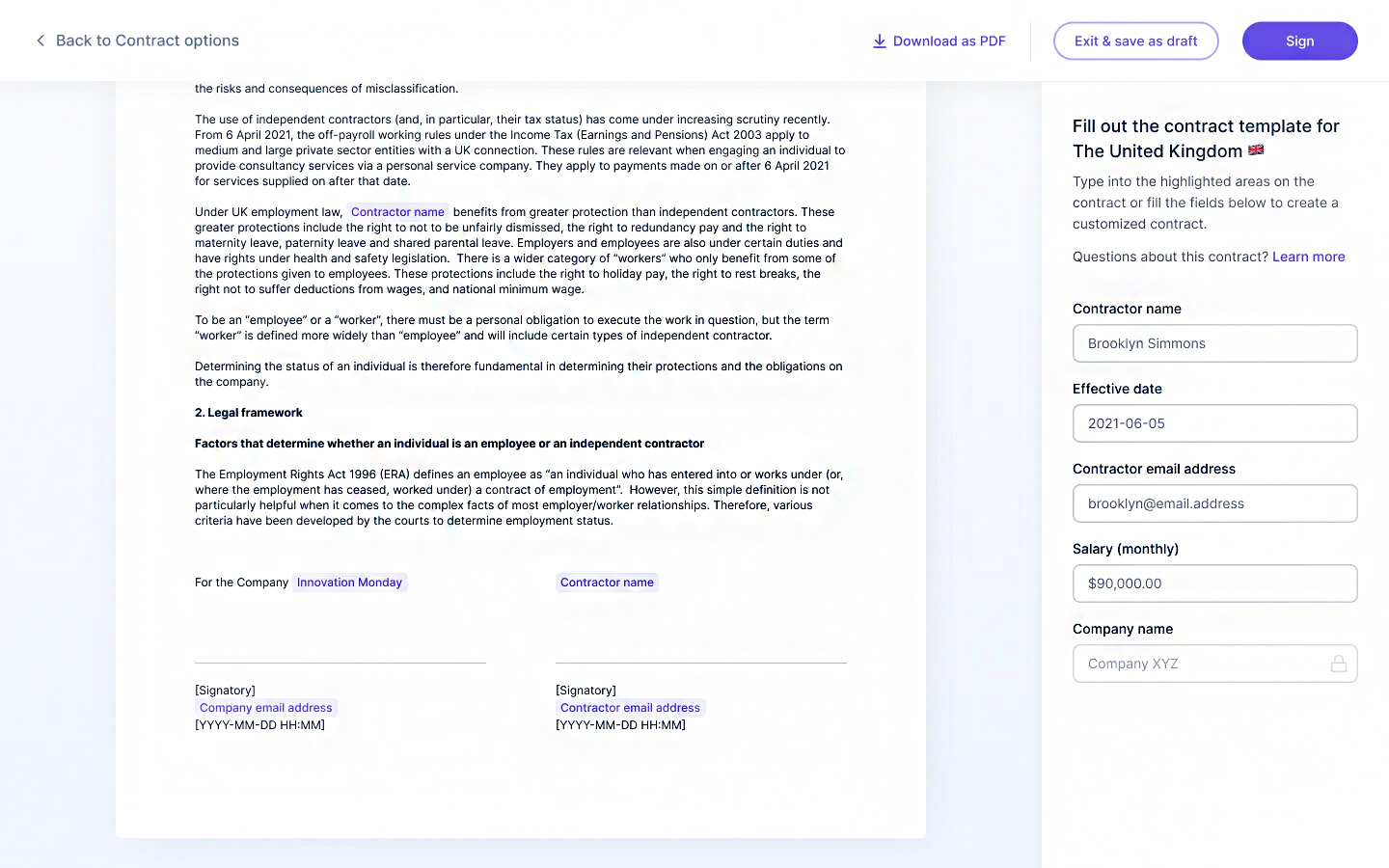

In addition to contractor hiring and onboarding tools, Remote provides customizable contract templates to help protect your business against potential employment misclassification issues and legal claims. These documents have also been localized to meet the labor laws of 34 countries. Users say they appreciate knowing upfront what’s required in each country.

Understanding the country-specific rulings for employing contractors can be challenging, but Remote makes it easy to comprehend with its helpful online guides. Created by its in-house legal experts, these resources not only detail the relevant laws but can help save you money from having to hire an external legal counsel to review contractor contracts.

Remote’s customizable contractor contracts are available in multiple languages and have data fields that you can fill in easily. (Source: Remote)

This is another criterion where Remote received a perfect score in our evaluation. Basic payroll and tax reports are available and you can easily download these into CSV files. Apart from contractor invoices, Remote can generate expense reports for specific workers or all employees. Plus, hiring and onboarding tasks are made easy with its customizable employment contract templates that comply with country labor laws and regulations.

Remote’s relatively user-friendly platform, good customer support, and helpful online guides contributed to this provider’s high score in this criterion. It lost points because it doesn’t offer live phone assistance and you have to upgrade to a higher plan to get dedicated support.

- User-friendly interface

- Dedicated onboarding specialist for each new hire

- Legal compliance tools

- Fully owned local entities in dozens of countries

- Access to dedicated support team

Remote takes the stress away from hiring, onboarding, and paying both international employees and contractors. Unlike similar global payroll and EoR service providers that have third-party partners in the countries that it services, Remote fully owns the local legal entities in the countries where it handles employees, so you’re assured of getting solid HR/payroll services and comprehensive IP protection. It assigns each of your new hires a dedicated onboarding specialist who can answer their contract and/or onboarding-related questions.

Its interface is also simple to learn and use, with built-in legal compliance tools that include localized contractor contracts that you can easily customize. While it lacks phone support, it offers 24/5 assistance via email and access to a dedicated support team—provided you’re on its higher plan. Its online help center is also full of how-to guides that cover a wide range of topics—from new hire onboarding to payroll and contractor management.

Remote even integrates with third-party software, such as Stripe, Greenhouse, BambooHR, and AngelList Talent. With its application programming interface (API) tool, you can integrate its platform with popular HR, benefits, legal, applicant tracking, and payroll systems.

In our expert assessment of Remote’s overall pricing, features, and software intuitiveness, this provider only earned a 4.38 out of 5 score. It may offer essential tools and services to manage global payments efficiently for both employees and contractors, but its suite of HR solutions doesn’t have the additional tools that similar providers, like Gusto, offer, which has a feature-rich HR, payroll, expense management, and information technology (IT) platform in addition to EoR and PEO services.

Many of the Remote reviews on third-party sites like G2, Capterra, and Trustpilot generally are positive—though it received far fewer reviews than what most other payroll services receive. In our evaluation of Remote’s popularity among users, this provider earned a 2.5 out of 5 rating mainly because we gave higher points to providers with more than 1,000 reviews. Remote, on the other hand, has less than 1,000. This seriously impacted its score, as fewer reviews may not properly show how well a payroll service functions in-practice.

| Users Like | Users Don’t Like |

|---|---|

| Easy to use | Lacks 24/7 chat support |

| Reasonable pricing with discounts for startups | Onboarding module doesn’t have automatic alerts that notify users if onboarding emails have been sent to new hires |

| Good customer support | Payment details per region are difficult to navigate to |

Users who work in HR or run the company said that it has a straightforward interface with tools that are easy to learn. They also commended its helpful and responsive support team. A few reviewers complained about the lack of chat support, alerts to show onboarding progress, and per-region payment details that are easily accessible on its platform.

Employees had more complaints, which included difficulties with onboarding that resulted in working without benefits or having to sign a contract with unanswered questions. A few said their dedicated support person disappeared (possibly on vacation) and no one was able to help them. Most did say that the interface was easy to use, however. Complaints generally stemmed from contract questions or unusual requests.

At the time of publication, Remote.com reviews earned the following user ratings:

- G2: 4.5 out of 5 based on almost 960+ reviews

- Capterra: 4.8 out of 5 based on nearly 40+ reviews

- Trustpilot: 4.5 out of 5 based on about 1,149+ reviews

Bottom Line

Hiring and paying international employees can be challenging because each country has different labor regulations, statutory benefits, and local tax employment laws. Remote takes away the stress and burden of handling these complex HR, benefits, and payroll processes yourself. As an EoR, it can help you manage the entire employee lifecycle of your global staff while keeping you compliant with local laws and tax rulings in more than 170 countries. Sign up for a Remote plan today.