Thank you for downloading!

💡 Quick Tip:

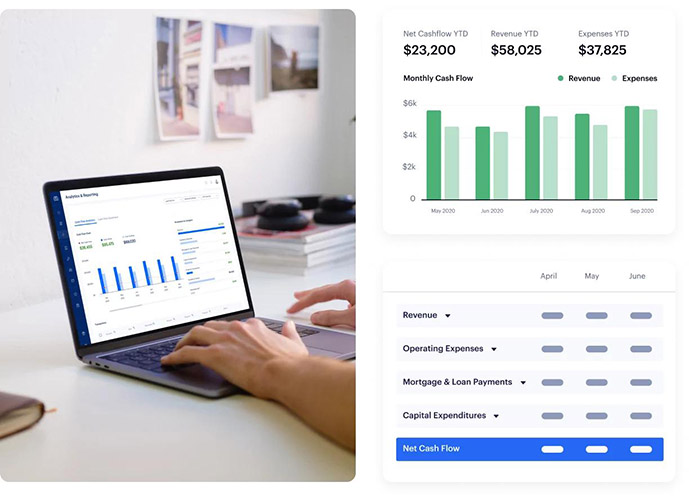

Baselane is an online rent payment service provider offering various features to collect, automate, and track tenant rent payments effectively.

Reports can also be generated that track cash flow, expenses, and property metrics to gain insights and guarantee properties are at their most profitable.

Rent receipts keep track of payments made and received and act as proof of payment for landlords and tenants. They can be physical or digital, but must include names and contact information, property address, date of receipt, payment period and amount, and how the payment was made. We have provided four free downloadable rent receipt templates that you can customize for various rental situations, including vacation rentals, 12-month or short-term leases, month-to-month rentals, and commercial rent receipts so that you can get started today. Then, continue reading to learn more about what to include in rental receipt templates, when and how to send them, as well as software providers who can assist with rental receipt automation.

When to Use a Rent Receipt

It’s generally recommended that landlords and property managers use a rent receipt for all transactions. However, if the tenant mails a check, then the check stub and bank statement can serve as their rent receipts. While many states like California and New York require that landlords provide their tenants with rent receipts, states like New Jersey and Ohio do not.

Samples of rent receipts

However, a landlord can err on the side of caution and provide a rent receipt, so there’s no disagreement later on about if rent was paid or when it was paid. The following scenarios generally call for a rent receipt:

- A landlord collecting cash from a tenant

- A property manager collecting cash from a tenant

- The tenant requests a rent receipt

- All online rent payments

- Renting out a room in your home

- Renting out your vacation rental property

- The property manager of a turnkey rental property

- Collecting rent from a duplex, triplex, or quadruplex

- Commercial property managers and landlords

- Monthly and yearly leases

Rent receipts should always be provided if a tenant pays in cash as it may be the only written proof that payment was made. It’s a requirement by the state if you have properties in Washington, Maryland, and New York. While you may just provide a receipt for rent paid, some states require receipts for all payments made by the tenant. Massachusetts requires landlords to provide rent receipts in all circumstances, so ensure you abide by local laws to avoid any possible litigation.

Also, tenants may request rent receipts for various reasons. They may need documentation for their employer or for tax purposes. Whatever the reason may be, the landlord should always comply with the request, even if a tenant pays with a check or credit card.

Pro tip: While you’re screening potential tenants, explain your process for providing rent receipts. Provide a sample rent receipt to tenants as part of the application packet so they know what to expect as your tenant. It will show your diligence as a landlord as well as reinforce your expectations for on-time rental payments from them.

Why Receipts for Payment Are Important

As a landlord, your rent collection process needs to be as seamless and efficient as possible. It not only represents your business acumen, but the easier the payment process is, the more likely you’ll get your rent on time. It also is a way for you to stay organized and track all payments so your records are up to date. This will help you avoid a lengthy eviction process because of poor recordkeeping.

Providing rental receipts can benefit landlords by time-stamping all payments received, thereby documenting any late or partial payments if they occur. This is beneficial especially if you’ve recently increased your rent and tenants have not paid the updated amount. It would allow you to collect any late fees or penalties if present in the lease agreement.

Rent receipts can be used as legal proof that rent was paid for disputes, evictions, tax purposes, or simple recordkeeping. Tenants may keep copies of rent receipts to show a new landlord that their rent was continuously paid on time. Conversely, a landlord may keep copies of rent receipts to decide not to renew the lease if their payments are often late.

What You Should Include in a Rent Receipt

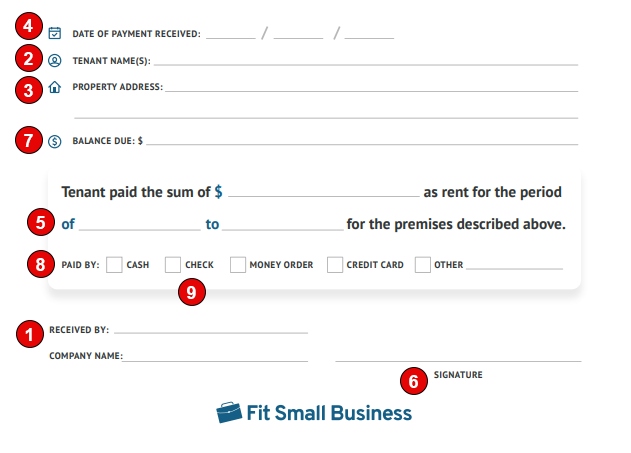

A rent receipt is much like a sales receipt that provides proof of purchase. Generally, the rent receipt templates contain important payment information, such as the date of the transaction, rental period applied to, landlord’s name, tenant’s name, and the amount of rent paid. Rental receipts can exist in both residential and commercial properties, and should be provided whether the tenant is month-to-month, short-term, or has a multi-year lease.

Other detailed information that can be included in a rental receipt template:

- The landlord or property manager’s name, address, and phone number: The name of the party receiving the payment should be identified clearly on the receipt.

- Tenant(s) name: Full name of the party paying should be documented. Rent receipt templates should state who the monies were received from.

- Property address with unit or apartment number, if applicable: Should include the building and unit address that the lease is for and where the money should be applied to.

- The date of the receipt: The exact date the funds were received.

- Payment period: The time frame the monies should be applied to.

- Acknowledgment of receipt: A signature of the receiver or landlord acknowledging receipt, and a copy should be given to the tenant.

- Payment amount: Dollar amount received to be applied to payment history.

- How payment was made: Can be listed as cash, by check, or by credit card for future payment identification.

- The check number, if applicable: If payment was made via check, landlords should document that check number for recordkeeping.

Example of simple rent receipt format

Although not legally required, landlords and property managers should keep duplicate copies of rental receipts in the event you need to provide proof of rental income. Providing electronic rent receipts gives landlords the ability to store digital paperless copies, so not only are they easy to access, but it reduces most of the manual written work when you have multiple properties.

How Rent Receipt Works

The process of how a rent receipt works is simple, similar to making a purchase at a grocery store and receiving a receipt for your items. The following steps should be used to issue either monthly or one-time tenant payment receipts:

- The rent payment is sent from the tenant to the landlord.

- The rent is received by the landlord.

- To confirm receipt of the money, a receipt is written and signed by the landlord.

- The landlord sends the receipt, physically or electronically, to the tenant.

- The landlord and the renter keep a copy of the rent receipt for their records.

If you find it difficult to create an electronic rent receipt, get our rent receipt download above for faster and more transparent transactions.

How to Send Rent Receipts

How you receive rent payments will determine how you should send rent receipts. If a tenant is paying in cash, a physical rent receipt should be given to them at the time of payment since cash has no paper trail. If you have multiple tenants paying in cash, create multiple copies of rent receipt templates, and make sure to keep a duplicate copy for yourself. Most paper receipts come with carbon copies, so you can file away the copy for your records.

Example rent receipts from Amazon

Other forms of payment, like checks and electronic payments, allow you to send rent receipts electronically. Include all relevant information in the email or attachment to avoid confusion on when payment was received and for how much. This process gives both parties a digital receipt for recordkeeping. If you still choose to send out a rent receipt in the mail, send it on time and keep adequate records for yourself.

Baselane: A Software Provider With Automated Rent Receipt

Whether you just began your real estate investment journey or have multiple units to manage, implementing a software system for rent payments and receipts can make being a landlord or property manager much easier. Some of the best online rent payment services have features to increase on-time payments, payment reminders, accept electronic payment, and automatically send out rent statement receipts on your behalf.

Simple and consolidated ledger for all your transactions (Source: Baselane)

Baselane is one of the best online rent payment services to create a seamless payment process. Its free plan contains features like direct deposit, auto-pay, automated late fees, and payment reminders. Also, Baselane accepts all forms of payment, including ACH, debit, and credit card payments, making collecting rent seamless and easier to track accounts.

Learn more about Baselane and other rent payments services in our article 6 Best Online Rent Payment Services for Landlords 2023.

Bottom Line

Rent receipts help landlords keep detailed records, manage taxes and rent roll, assist with disputes, and encourage on-time payments from tenants. Landlords can distribute receipts via software or manually, but all receipts must document the who, when, and which method of rent bill payment was used to collect the monies. This will ensure that a landlord’s profits and investments are protected.

Frequently Asked Questions (FAQs)

Including the correct details on the rent receipt is merely the first step in making it look professional. You must ensure that the receipt is well-structured so that it is easy to fill out. Keep the layout simple and the relevant details in the same area on the receipt. For example, the tenant’s name, the property’s address, and the lease period should all be in the same section.

You can deliver your rent receipt to your tenants in a few different ways. You can give the receipts to your tenants in person or online. If you want a more effortless and hassle-free way to issue receipts, emailing them is your best option. You can create a PDF of the rental receipt, fill it out, and email it to your tenants.