Tenant scams take advantage of unassuming landlords who fail to implement the right procedures for screening renters, writing contracts, and collecting payments. Although scams come in different forms, some of the most common are submitting false employment records, faking credit reports, forging checks and pay stubs, and hiding property damages. These scams cost landlords valuable time and risk their incomes and businesses.

To avoid these, we’ve exposed 15 tenant scams that should raise a red flag to landlords, along with tips on how to prevent falling for them.

1. Giving Fake Checks for Rent & Security

Tenants who provide written checks aren’t usually questioned about the validity of their payments. In particular, if a check was written from what looks like a reputable financial services company (e.g., Western Union) or a nationally known bank (e.g., Wells Fargo, Chase, or Bank of America), it doesn’t raise suspicions.

Tenants using fake checks scams will provide these checks for rent, security, and possibly a deposit to get access to the unit without the intention of ever paying. By the time the landlord cashes the check, they realize these funds are invalid and now have to deal with getting paid, evicting the current tenant, or realizing immediate damage was made to their property, like stolen appliances.

How to Avoid

Spotting a fake check (Source: wikiHow)

The Federal Deposit Insurance Corporation (FDIC) is responsible for insuring bank deposits and overseeing financial institutions for safety and consumer protection. The FDIC and Better Business Bureau (BBB) have listed multiple ways to spot fake checks, so landlords know of any inconsistencies or suspicious elements:

- Look for items like watermarks, security threads, or color-changing ink. These high-security features usually cannot be duplicated on false checks.

- Consider where the check was mailed from if not presented in person by prospective tenants. If checks were not directly mailed from a valid bank, make sure the checks clear before allowing access to the property.

- Landlords should also be aware of the differences between cashier’s checks and money orders. Money orders are extremely hard to trace funds, whereas cashier’s checks allow law enforcement to trace criminals much easier.

- Make sure the check doesn’t feel like it’s been printed on flimsy or suspicious material.

- The check number listed on the upper right of the check should match the check number following the account number at the bottom of the check.

2. Writing a Check Larger Than the Move-in Amount

According to the Financial Crimes Enforcement Network (FCEN), banks reported an 84% increase in check fraud from 2021 to 2022. JP Morgan’s 2022 Payments Fraud and Control Report also found that 66% of financial professionals reported check fraud activity in both 2020 and 2021. Knowing these statistics should raise a red flag for landlords for tenants who write checks, especially in a larger amount than necessary.

When a tenant wants to give you more money upfront than you asked for, we’re wired to think it’s a good sign. Rental scams targeting landlords, like rent overpayment, should be a huge red flag. These tenant fraudsters will write you a check for more than the amount you need for rent, security, deposit, etc., then ask you to refund the balance.

The Federal Trade Commission says banks are required by law to make deposited funds available within two days. Many landlords may see the available funds and assume the checks have cleared. However, checks can still bounce before you can figure out you’ve already sent funds back to the tenant and are stuck with the money owed to the bank.

How to Avoid

When landlords receive a check for more than the required amount, they should promptly return it to the tenant instead of depositing it into their bank account. Landlords can also include policies in the lease to address rent overpayment. Any excess funds can be applied to the remaining months of the lease, or the overpayment can be returned at the lease’s end. Another way to ensure security with checks is to cash them before providing tenants with possession of the property.

3. False Employment Records

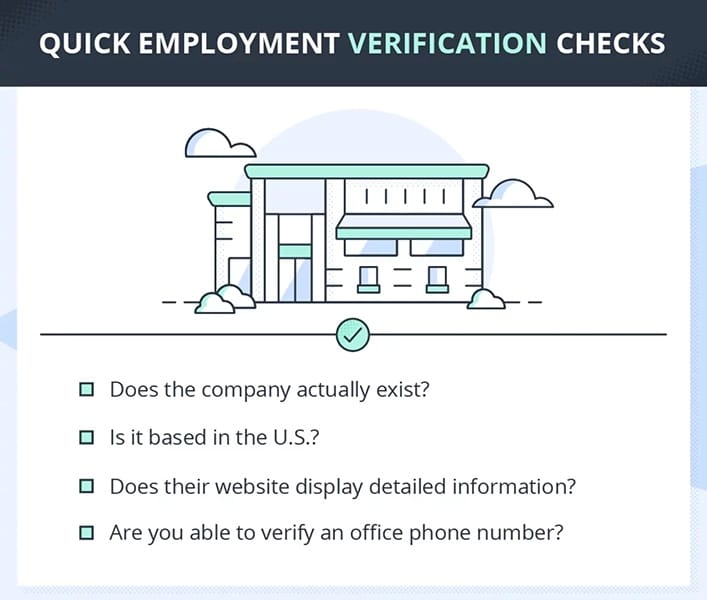

False employer information on rental applications is a common fake tenant scam that can cause problems for landlords. According to a study by Snappt, 66% of property managers reported receiving fraudulent applications. Tenants often provide fake employment history and ask friends or family to pose as employers to verify false employment. This tactic is used when tenants lack stable income sources, raising concerns for landlords about their ability to pay rent.

How to Avoid

When making rental application decisions, don’t solely rely on the information given by the tenant. Take the initiative to call the employer yourself for verification, even if they can only provide limited details due to policies.

Request additional documents like pay stubs, employment letters, and bank statements to assess the tenant’s suitability. Compare all information, including employer names, logos, and salaries, for consistency. You can also perform a quick Google search or check LinkedIn to validate employment history.

Employment verification tips (Source: TurboTenant)

Read our article on How to Screen Tenants for Rental Property to learn more.

4. Providing a Fake Credit Report

Fair Isaac Corporation (FICO) lists the average credit score in 2023 as 716, which is considered in a good range based on a scale of 300 to 850. Although credit scores can indicate financial responsibility, landlords should take a deep dive into payment history to understand a tenant’s track record in making on-time payments to their liabilities.

Common tenant scams can also occur from tenants providing their own fake credit reports. Tenants who have been denied from multiple units will come prepared with their own report in an attempt to help you save a few bucks on running the report.

However, the information listed on the credit report may be changed to show a more favorable report. An oversight made by landlords screening tenants for their properties happens when they trust the credit report provided to them quickly and base their decision on application approval solely on credit score alone.

How to Avoid

Landlords should always conduct their credit and background checks. They can run credit manually or utilize property management platforms. This enables them to pull credit, background, and eviction reports, providing a better understanding of prospective tenants.

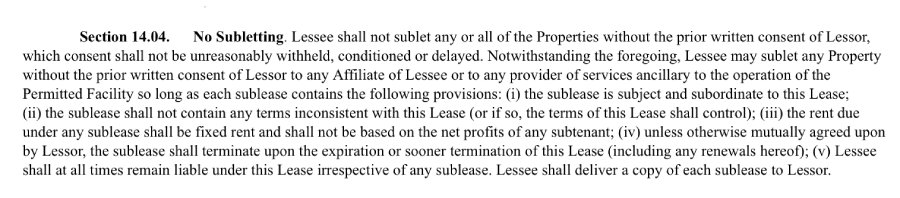

5. Renting on Behalf of the Owner

Subleasing a property to a new third party is not illegal as long as it’s permitted within the terms of your lease. The rental scam occurs when a tenant subleases their property to a third party without notifying the landlord. The tenant will collect months of payment upfront from the third party and never transfer those funds to the landlord. By the time a landlord attempts to collect the payments, there is a new tenant in the property who’s already paid their rent to the leaseholder.

How to Avoid

Make it extremely clear with your tenants at lease signing that subleasing is not allowed, and legal action may take place if they breach the agreement. Landlords can also add a “no subletting” clause within the lease that prohibits subletting without the landlord’s consent.

No subletting clause in the lease (Source: U.S. Securities and Exchange Commission)

In addition, landlords have the right to inspect their properties. Schedule regular visits or provide short notice before inspecting the property if they suspect non-primary residents are living there. The tenant’s response or lack thereof may indicate whether illegal subletting is taking place. Check the lease for the required notice period before conducting a visit.

Address late rent payments promptly to prevent any delay in detecting potential renter scams. Landlords can monitor late rental payments by using online rent payment services, some of which offer notifications on the rent deposits. Additionally, these services may report rent payments to credit bureaus, ensuring that late or missed payments are reflected on the credit report for future reference by other landlords.

6. Fake Pay Stubs

Providing pay stubs during the application process is a way for landlords to verify tenants’ proof of income and determine if they can afford the rent. Tenants scamming landlords with fake pay stubs usually fail to meet standard rental income requirements, suggesting they are likely less financially stable than they appear.

These prospective tenants attempt to get their leasing applications approved by providing fraudulent pay stubs. Creating fake pay stubs is easily accessible to tenants online, as they can find affordable options with minimal turnaround time.

How to Avoid

Landlords should examine all pay stubs for any discrepancies in numbers, formatting, and quality. Telltale signs of a fake pay stub include income rounded to a whole number and a lack of professional details. Professional details include the employer’s name, address, and company logo.

Items to look for on a fake pay stub (Source: RentSpree)

Landlords can call the applicant’s employer to verify employment. Keep in mind that some employers are not allowed to provide salary information, but will verify if the applicant is a current employee. If you are uncertain if a pay stub is valid, you can always ask for bank statements to match the check deposits or a W2 for additional proof of income.

7. Tenants Doing Things to Reset the Eviction Process

Over 2 million evictions have occurred since March 2020 in Connecticut, Delaware, Indiana, Minnesota, Missouri, and New Mexico. A frequent tenant eviction scam that occurs during the eviction process is resetting the eviction timeline. Tenants can make a late or partial payment of a significantly smaller amount than what is owed, and if the landlord accepts it, it can reset the eviction clock.

Landlords will also need to restart the eviction process if the tenant requests additional time in the unit and you accept the request. Additional time can be a few days or even as little as a few hours.

The Eviction Tracking System (Source: Eviction Lab)

Landlords are able to give tenants an eviction notice with or without cause. Usually, an eviction notice without cause would be for unit renovations and improvements to increase rent, but landlords would need to provide adequate notice to the tenant. Eviction notices with cause are usually due to lack of rent payment or misbehavior. Evictions, on average, can take a few weeks to a few years, depending on the case.

How to Avoid

Landlords should take all precautions to avoid a long eviction process and the cost of eviction. Sometimes landlords may even decide to procure cash for keys agreement with the tenant to avoid the eviction process altogether.

Read our article about how to evict a tenant and the important steps you need to take to prevent a minor mistake that can cause you more loss in rental income.

8. Stealing Your Listing

Unfortunately, with the increase in online lead generation and advertising efforts for vacant properties being marketed digitally, there has been an increase in stolen listings by tenant fraudsters. These fraudsters will copy your property photos and listing information, and advertise it on a site for a significantly lower monthly rent to attract unsuspecting renters.

How to spot fake listings (Source: Landmark)

They then proceed to rent your property out without proper leasing processes and ask for money upfront from the prospective renter. Once the money is received, the fraudulent landlord will tell the prospective tenant that keys are available to be picked up at the property with no intention of ever handing over keys.

How to Avoid

Property owners must protect their real estate investments at all costs. They can create Google Alert for their property addresses so any web pages containing that address will prompt a notification to the owner.

Another easy way to prevent theft of property photos is to include watermarks on all photos that can contain your name, contact information, or business. This will drive prospective tenants to contact you, which may alert you of the false listing or make it difficult for the scammer to crop out the watermark to look like a legitimate listing.

Example of a watermarked property photo (Source: Uconomix)

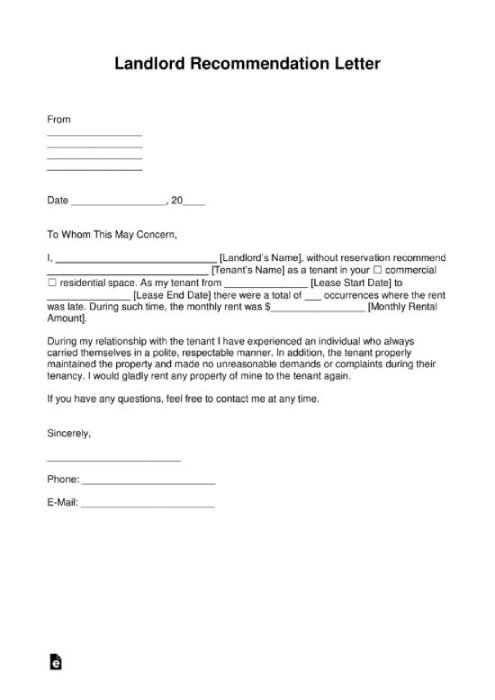

9. False Rental History Verifications

Requesting rental history on an apartment application is a common request from most landlords. Landlords seek to verify if tenants paid their rent in a timely manner and abided by the property rules. Moreover, they use history verifications to come up with an overall character judgment. And the best person to validate this information would be a past landlord.

Landlord reference letter template (Source: eForms)

Tenants who do not have any rental history, poor rental history, or simply do not remember their landlord’s contact information will provide false landlord information on their rental application to scam a new landlord. The fake landlord reference will validate false rental history and/or provide a positive review for prospective tenants to help them with their rental application.

How to Avoid

In addition to asking for a former landlord’s contact information and property address, landlords may ask for utility bills to cross-reference addresses for proof of residence. Furthermore, with the rise of third-party listing sites like Zillow or Realtor.com, you can find contact information for property addresses to try to get in contact directly with the landlord.

If the tenant was residing in a large multi-unit building, those properties typically have large property management companies that you could reach out to directly to verify history. Pay close attention to the responses of the former landlord. If the responses are short and vague, that might be an indicator that it’s a fake landlord contact.

10. Using Residential Property for Commercial Usage

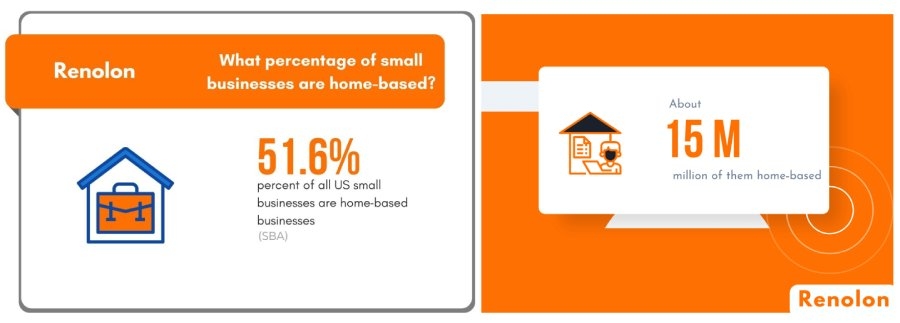

Home-based businesses make up 51.6% of all small businesses in the U.S., with a substantial count of around 15 million operating from people’s residences. Running a business from a home is not necessarily illegal—as long as it doesn’t create any nuisance to the property or surrounding neighbors. The businesses that you should be concerned about are those that are of illegal activity or can damage property. Tenants involved in such activity will not voluntarily disclose this information to you during the application process.

Small business statistics (Source: BusinessDIT)

Tenants who want to avoid obtaining commercial space for their business might also think they can save money by using their residential property. Some residential properties are not property zoned for commercial activity, so landlords may also be penalized and forced to pay fines depending on tenant activity.

How to Avoid

Since some states allow you to evict tenants who violate the terms of a lease, landlords can avoid troublesome tenants by adding a clause to the lease agreement, prohibiting some or all businesses or commercial activity to be operated out of the property. That way, you’re not entirely banning it, but want to have insight and the ability to forbid it if it’s an issue.

11. No Intention of Paying the Rent

Eighty-four percent of landlords cite payment problems as their number one concern about tenants. Some scammers will have no intention of paying rent beyond what is needed to get them access to the property. In this type of scam, tenants will provide valid funds, like the first month’s rent and security to move into the property, but never make any subsequent payments. This forces landlords to start the eviction process, giving the scammers an extra month of free rent before they move out.

How to Avoid

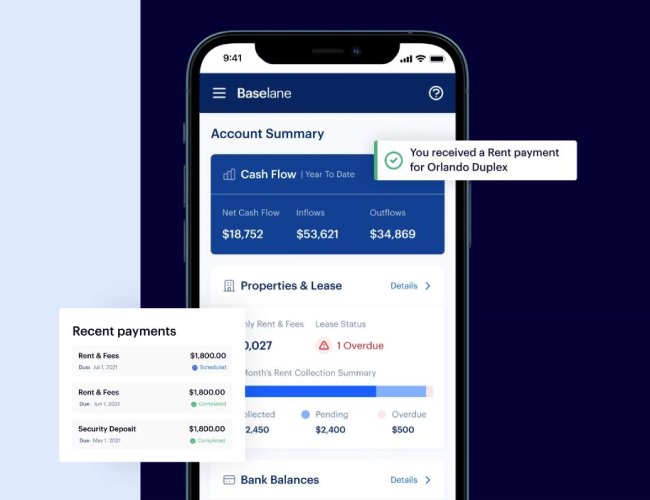

To ensure thorough tenant screening, property owners must implement a process that covers rent history, background checks, eviction history, employment history, and income verification. Landlords can manually verify documents or use efficient software like Baselane, which offers banking, bookkeeping, and rent collection services. It also provides additional resources such as a rental property calculator and blog articles offering tips and guides for landlords and investors.

Have a stress-free rent collection through Baselane (Source: Baselane)

12. Hiding Property Damage When Moving Out

Turnover costs may be costly for landlords as they include managing, marketing, and repairing expenses. A tenant turnover rate exceeding 50% can lead to problems in the long run. If tenants cause damage to the property, the turnover cost can become even more expensive and lead to delays in accommodating future tenants.

This scam involves tenants attempting to deceive landlords to get their security deposit back after moving out. It includes various tactics, such as temporarily fixing plumbing issues, concealing cracks and scuffs with plaster and paint, and sometimes hiding signs of infestations that may affect future tenants.

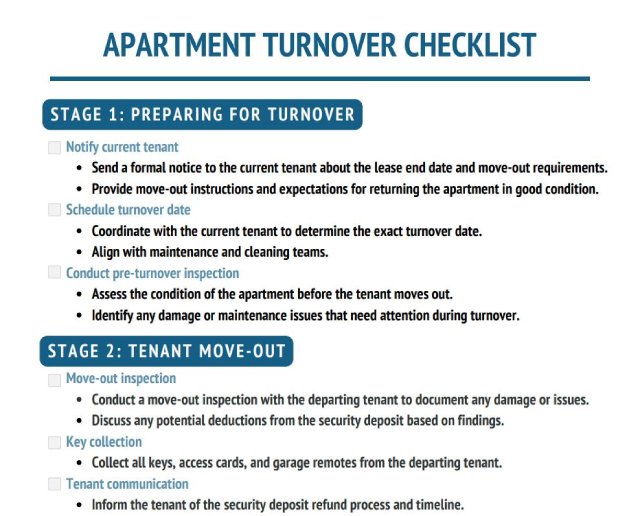

How to Avoid

To avoid this scam, landlords must be aware of the difference between normal wear and tear and property damage. The lease mandates tenants to leave the premises with only normal wear and tear. For example, a small scuff on the wall falls under normal wear and tear, while a hole in the drywall would be considered damage.

In addition, using an apartment turnover checklist helps ensure a thorough inspection. Landlords should schedule the turnover inspection in the presence of the tenant to identify any damages together. Refrain from refunding a tenant’s security deposit prior to inspection, so any necessary repairs can be deducted from the deposit. Download and use our free apartment turnover checklist:

For more information, read our article Normal Wear and Tear for Rental Properties: A Landlord’s Guide.

13. Unexplained Urgency to Rent

Landlords should not be deceived by tenants displaying an unexplained urgency to rent. Such urgency could be a significant indication of tenants scamming landlords, using the sense of urgency to bypass proper tenant application processing.

If prospective tenants pressure you to quickly countersign the lease, be cautious, as there might be errors in the lease documents favoring them. These tenants may also need to secure housing on short notice due to a current eviction before it goes on their record.

How to Avoid

Although landlords would like to avoid any vacancy in their buildings, sometimes putting tenants in too quickly can cost you more money in the long term. Given that U.S. landlords file around 3.6 million eviction cases every year, landlords must have strong processes in place to screen tenants before handing over keys.

Meet prospective tenants

One tip to help when there is such urgency to rent is to avoid unseen rentals. Make sure you meet the prospective tenants to help you make a better assessment in person. Also, take your time screening tenants, regardless of how quickly they push you to review their documents and make a decision.

14. Lying About Co-tenants

One of the more common scams from tenants is lying about co-tenants who may be living on the property unofficially. Although this may seem quite innocent initially, concealing unauthorized tenants may be due to criminal background or credit history issues.

The non-disclosure of such information can be a liability for property owners with the possibility of nonpayment of rent if the primary tenant moves out, property damage with no leaseholder accountable, and negligence of lease terms since the occupant did not sign the lease agreement. Additionally, in the event of unforeseen catastrophes like a fire where the unknown tenant gets injured, there could be consequences for the landlord.

How to Avoid

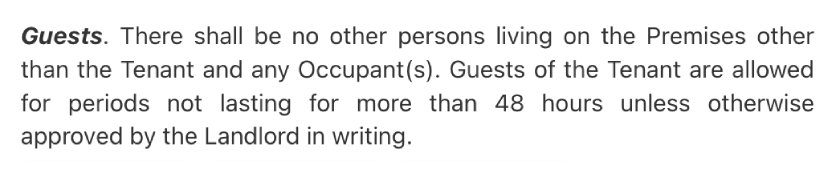

Although eviction is always an option due to a violation of the lease agreement, evicting an unauthorized tenant is one of the more challenging eviction cases. Landlords can avoid this situation by being clear to tenants on guest rules and how long guests are allowed to stay before needing to be an official tenant on the lease.

Example guest policy on the lease agreement (Source: Law Insider)

Guest rules should be a specific category on the lease agreement and be stated as a clear violation with repercussions. A strong and communicative tenant-landlord relationship can assist with making sure tenants follow your rules, whereas an absent landlord may entice tenants to push the boundaries of house rules. Also, make sure to inspect the property regularly, with notice, so you are knowledgeable about guests coming and going on the premise.

15. Service Animal Discrimination

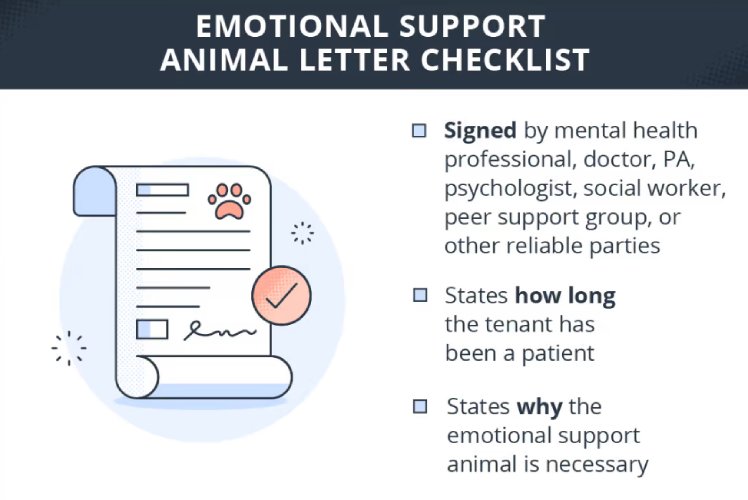

Landlords have the right to include a no-pet policy in the lease agreement since pets can cause disturbances to other tenants, lead to excess wear and tear on the property, and increase property infestations. Nevertheless, some tenants attempt to bypass pet fees or deposits by falsely claiming their animal as an Emotional Support Animal (ESA) or service animal with fake ESA letters. This scam results in an untrained pet with no deposit to cover potential damage when the tenant moves out.

How to Avoid

Understanding the Fair Housing Act and landlord/tenant laws can quickly help you see if your property is exempt from the rules. Owner-occupied buildings with no more than four units, single-family homes sold or rented without a real estate broker, and property owned by religious or private clubs housing their members are all exempt from the housing discrimination laws.

Emotional Support Animal Housing Letter checklist (Source: TurboTenant)

If your property does not fall in the exempt categories, you may request an ESA letter sent directly from a mental healthcare professional. Call the healthcare professional to confirm the validity of the letter or check their certification online. While you cannot deny an applicant solely because they have an ESA, you may have other factors that make you choose a more qualified tenant, such as income requirements or credit history.

Bottom Line

Although you cannot be 100% certain that a tenant is not a scammer, having a thorough tenant screening process can ensure you are putting the best tenants in your units. Understanding these tenant scam tactics can help you identify red flags and protect yourself when a tenant might be taking advantage of you.

Frequently Asked Questions

To spot and avoid rental scams, take crucial steps such as carefully screening tenants through employment and credit checks. Additionally, make sure you prohibit subletting in the rental agreement, examine payment information for inconsistencies, and implement measures to prevent lengthy eviction processes and costs.

Protect your listing by creating a Google Alert for your property’s address, cross-reference prospective tenants’ residence history by requesting former landlord contact information, and pay attention to their responses for insights. Avoid renting properties without personal showings to potential tenants to prevent unseen rentals, and ensure clear communication of guest rules to avoid any confusion or misuse of the rental property. These precautions will significantly help you in avoiding tenant scams.

Landlords fear problematic tenants, extended vacancies, property damage, legal liabilities, regulatory changes, rental market fluctuations, and financial risks associated with property ownership. Mitigate these concerns through proactive management, open communication with tenants, and staying informed about rental laws.

If you’re a victim of a rental scam, make sure to contact local authorities, contact the listing website, report it to the Federal Trade Commission (FTC), and file a complaint. You can do it through the Internet Crime Complaint Center (IC3), which makes reporting a crime that takes place online easier for individuals.