The retail industry has seen a dramatic change in recent years as the move toward ecommerce, economic pressures, experience spending, and other shifts have resulted in a wave of retail bankruptcy and brick-and-mortar store closures. Some are referring to these fluctuations in the retail landscape as the “Retail Apocalypse.”

The retail apocalypse is a signal of transformation within retail, calling for businesses to adapt, innovate, and evolve in order to thrive during these changes. In this article we’ll give you strategies to navigate it, as well as a rundown of the factors behind the retail apocalypse, the future outlook, and a list of companies affected.

What Is the Retail Apocalypse?

The Retail Apocalypse refers to the closure of numerous physical stores due to the rise of online shopping and economic challenges. It reflects changing consumer preferences and has led to retail bankruptcies and the decline of traditional shopping malls.

Causes of the Retail Apocalypse

The factors contributing to the retail apocalypse are multifaceted, signaling not just a market correction but a fundamental change in consumer habits. These causes include:

Ecommerce Growth

The digital revolution has ushered in an era of convenience, selection, and competitive pricing that traditional retail spaces struggle to match. Online shopping offers the allure of 24/7 accessibility, a virtually limitless choice of products, and the ability to compare prices and read reviews with ease.

This shift has been driven by technological advancements and a consumer preference for the convenience of shopping from anywhere, at any time. The implications for brick-and-mortar stores have been widespread, with many experiencing a drop in foot traffic and sales as consumers opt for the digital shopping experiences.

Ecommerce’s share of total retail sales has been increasing rapidly as the digital age progresses, from 8.6% in 2016 up to over 19% in 2023. Online sales are predicted to make up close to a quarter of total global retail sales by 2027, signaling a continued decline for brick-and-mortar stores— which many consider to be a harbinger for the retail apocalypse.

It has also paved the way for ecommerce giants like Amazon to corner the market by overtaking small and large retailers alike—disrupting the retail landscape by creating untenable competition and pushing many traditional retailers toward closure or change.

In the News:

FTC Sues Amazon for Illegally Maintaining Monopoly Power

“Amazon’s ongoing pattern of illegal conduct blocks competition, allowing it to wield monopoly power to inflate prices, degrade quality, and stifle innovation for consumers and businesses”

Oversupply of Shopping Malls

For decades the US was marked by an ever-increasing number of shopping malls, built in anticipation of continued retail growth and popularity of the mall-shopping experience. In 1960, malls accounted for 14% of all retail sales, and by the 1990s they were being constructed at a rate of 140 per year. However, this expansion did not account for a shift in consumer habits toward online shopping, resulting in an oversupply of retail space.

The consequence has been a decline in mall traffic and an increase in vacancy rates, leaving many malls struggling to attract both shoppers and tenants. This has not only affected the retailers within these malls but also the surrounding communities, as malls often serve as economic and social hubs. This phenomenon began gaining attention around 2017, with predictions that up to 25% of US malls could close by 2022.

The challenge for developers and retailers alike is to reimagine these spaces in ways that meet the evolving needs and interests of the modern consumer, like integrating mixed-use developments with residential, office, and entertainment spaces, as well as bringing in successful anchor stores and frequent events that can draw consistent foot traffic.

Beyond its stores and restaurants, Las Vegas’ Fashion Show mall hosts a range of events to attract shoppers and visitors.

Consumer Demand for Experiences Over Products

The rising preference for experiences over material goods marks a pivotal shift in consumer spending habits, with more dollars flowing into travel, dining out, and entertainment. 74% of Americans now value experiences over tangible products or things, and retailers stuck in traditional sales models find themselves at a disadvantage—showing the importance of having experiential elements in modern retail spaces.

Those unable to evolve beyond the conventional shopping experience struggle to attract the modern consumer, leading to reduced sales and, in many cases, eventual closure. The experience economy demands a radical rethink of retail strategies to include value-added experiences that draw customers into physical stores.

Shrinking Middle Class

The middle class has always been a critical market segment for retailers, but economic pressures such as stagnating wages and rising living costs have impacted its purchasing power. Two-thirds of middle-income consumers say they have cut down on nonessential spending due to product price increases last year, and 41% have cut back on the quality of their purchases. This economic squeeze means that middle-class consumers are becoming increasingly price-sensitive, seeking out bargains and prioritizing essential purchases over discretionary spending.

The retail industry has felt the impact of this, with mid-tier retailers experiencing challenges as their core customer base declines. The value of price comparison, made easily accessible through online shopping, has also driven customers away from in-person shopping. Addressing this issue requires a nuanced understanding of the changing economic landscape and a strategic response with initiatives like diversifying product offerings, offering retail promotions, and investing in value-driven marketing strategies.

Faulty Retail Management

A lack of flexibility and innovation in retail management has been a big contributor to the downfall of many traditional retailers. Missteps such as overexpansion and a failure to keep pace with new market trends have made some retailers especially vulnerable to the changing preferences of consumers and pressures from ecommerce.

An inadequate online presence is one of the biggest shortcomings, as evidenced by Bed Bath and Beyond. The home goods retailer struggled significantly with its digital strategy, failing to effectively compete with online-first companies, leading to retail bankruptcy and closure of its remaining stores. Inefficient inventory management practices in the face of compromised supply chains have also contributed to the decline of many businesses.

Retailers stuck in outdated operational models risk falling further behind as the market evolves. Avoiding the retail apocalypse demands agility, customer-centricity, and a willingness to embrace technology.

COVID-19 Pandemic

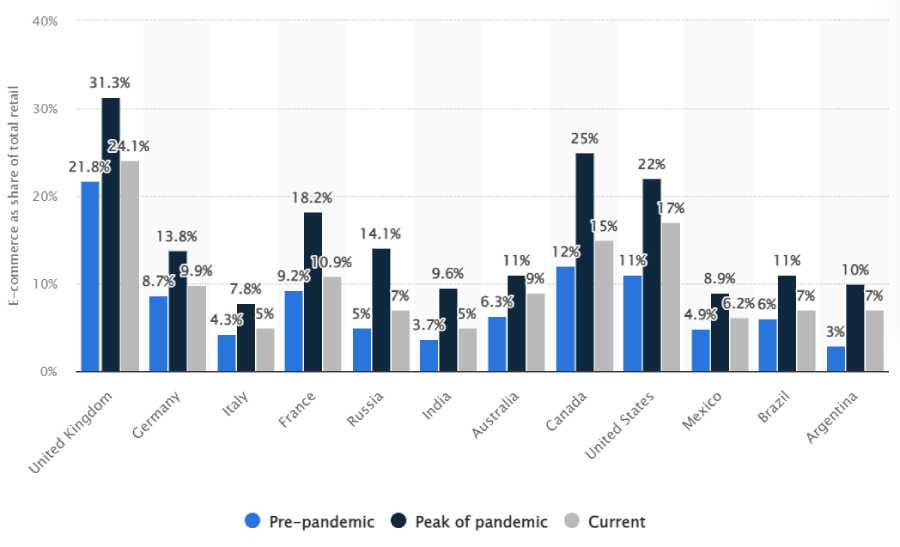

The COVID-19 pandemic accelerated retail apocalypse trends that were already in motion—notably the shift toward online shopping. Mandatory store closures and health concerns prompted consumers to flock to ecommerce platforms, causing a dramatic uptick in online sales, with an additional 19% global online sales growth for 2020 on top of the preexisting forecasts.

This surge in online shopping became a habit and consumer preference that has persisted far beyond the lockdowns.

The pandemic served as a stress test for many retailers, highlighting the importance of having a robust online strategy and the ability to quickly adapt to changing circumstances. As the world emerges from the pandemic, the retailers that will thrive are those that have learned to operate flexibly across both digital and physical platforms.

Ecommerce’s total share of retail sales soared during the pandemic, surpassing pre-pandemic levels in countries worldwide. Despite seeing post-lockdown dips, it remains significantly higher. (Source: Statista)

Supply Chain Issues

Recent years have exposed the fragility of global supply chains, with supply chain disruptions caused by the pandemic, geopolitical tensions, and environmental challenges impacting retailers worldwide.

The effects from these disruptions are felt deeply by retailers, particularly those with lean supply chain models or those heavily reliant on imported goods. For many, this has led to logistical hurdles such as stock shortages, delayed deliveries, and, ultimately, dissatisfied customers— further contributing to the pressures facing brick-and-mortar retailers.

Impacts of The Retail Apocalypse

The retail apocalypse has widespread impacts, affecting not only the retail industry but also the economy, communities, and the job market. Thousands of jobs have been lost, and once-bustling shopping areas have turned into ghost towns as the number of malls declined 16.7% per year from 2017 to 2022.

In 2023, commercial Chapter 11 bankruptcies soared 61% year over year, with 41% of these filings coming from small businesses. This shift also influences consumer choices and accessibility, as well as the landscape of urban and suburban areas.

However, as shopping malls adapt, small businesses innovate, and new models emerge, physical stores have continued to open at a rate that outpaces closures, keeping the retail landscape healthy and evolving.

Major Retail Bankruptcies

The retail apocalypse’s sharp decline in foot traffic and sales has led to retail bankruptcy and store liquidations, particularly hitting big box stores hard. Here are some of the most notable impacts:

- Bed Bath & Beyond: Filed for Chapter 11 in April 2023 after years of struggling, showing the difficulties home goods retailers face in adapting to online competition.

- Sears Holdings: Filed for Chapter 11 bankruptcy in October 2018, closing hundreds of Sears and Kmart stores, representing the decline of traditional department stores.

- Toys R Us: Filed for Chapter 11 bankruptcy in September 2017, closing all U.S. stores by June 2018, marking the end of an era for major toy retailers.

- JCPenney: Filed for bankruptcy in May 2020, planning to close at least 242 stores, a significant example of the struggles faced by mid-tier department stores.

- RadioShack: Filed for bankruptcy twice in two years, closing over 1,000 stores, representing challenges in the electronics retail sector.

- Borders Group: Closed all stores in 2011 after filing for bankruptcy, highlighting the impact of digital media on traditional bookstores.

- Blockbuster Inc.: Went bankrupt in 2010, with nearly all locations closed within years due to the impact of the shift to digital streaming.

- Barneys New York: Filed for bankruptcy in August 2019, closing most stores by early 2020, indicating the pressures on high-end department stores.

- Sports Authority: Filed for Chapter 11 in March 2016, closing all stores, showing the competitive challenges in sporting goods retail.

- Gymboree: Filed for bankruptcy twice, eventually closing all stores in 2019, demonstrating the difficulties in the children’s apparel market.

- Payless ShoeSource: Filed for bankruptcy twice, closing all US stores in 2019, highlighting the challenges in the footwear sector.

- Neiman Marcus: Filed for Chapter 11 in May 2020, a high-profile example of luxury retail struggling to adapt to new consumer behaviors.

- Forever 21: Filed for Chapter 11 in September 2019, planning to close up to 178 US stores, reflecting the fast fashion sector’s volatility.

- American Apparel: Closed all stores in 2017 after being acquired by Gildan, indicative of the challenges in the apparel industry.

- Brookstone: Filed for bankruptcy in 2018, closing all mall stores, reflecting the niche retail challenges.

- Pier 1 Imports: Filed for Chapter 11 in February 2020, closing all stores, a significant case in the home decor retail segment’s struggles.

- Lord & Taylor: Announced liquidation in May 2020, a historic department store succumbing to the changing retail landscape.

- Macy’s: Announced the closure of 125 stores by 2023, a significant downsizing by one of the most iconic American department stores.

Strategies You Can Use to Thrive Against the Retail Apocalypse

The idea of a retail apocalypse is not about unavoidable failure but rather the need for change. Retailers who understand the modern challenges and adapt, can find new ways to succeed and connect with customers. Consider the following strategies when starting a business or working to keep your brick-and-mortar store going strong in the midst of an industrywide shift:

- Enhance your online presence: Build a robust online store that provides a seamless shopping experience, from browsing to checkout. Also consider selling on popular online marketplaces—such as getting started on Amazon or Walmart—to widen your reach.

- Provide convenience services: Add BOPIS or curbside pickup options for customers to place orders online and pick up in-store, bridging the gap between ecommerce convenience and physical immediacy.

- Offer unique in-store experiences: Create engaging, experiential reasons for customers to visit your store—such as events, workshops, or exclusive in-store promotions.

- Add a loyalty program: Implement a customer loyalty program that rewards customers for their in-store purchases, encouraging repeat business.

- Leverage data and analytics: Use reports and analytics from your POS system to understand customer behavior, preferences, and trends, enabling more targeted marketing and stock selection.

- Improve your customer service: Train your employees to provide exceptional, personalized customer service to differentiate your business and build a strong customer base.

- Streamline your operations: Review your supply chain and operational efficiency to cut costs and improve profits, helping your business withstand the challenges of the retail apocalypse and invest in its future.

- Invest in branding and storytelling: Build a brand that connects with your customers beyond just transactions—through shared values, stories, and community engagement.

Retail Apocalypse Frequently Asked Questions (FAQs)

The rise of ecommerce is mostly responsible for the retail apocalypse, but other factors—including supply chain issues and economic pressure on consumers—have also contributed.

Many big box retailers have faced retail bankruptcy and mass closures in recent years, including iconic brands such as Bed Bath and Beyond, JCPenney, and Sears. Surviving companies have leveraged a strong digital presence to keep up with modern consumer preferences.

Bottom Line

The retail apocalypse is not the result of a single factor but a combination of technological, economic, and societal shifts. The survival of retail businesses in this volatile environment hinges on their ability to adapt and innovate in the face of these challenges, blending the convenience of online shopping with the unique experiences that can only be offered in-store.