Sage 50 Accounting (formerly Sage 50cloud) is scalable, on-premise accounting software that automates administrative tasks such as invoicing, payments, and inventory management. Its features include a cash flow manager, bank reconciliation, job costing, payroll, and reporting.

Pricing starts at $61.92 per month for a single user. You can sign up for the 30-day test drive program and get access to a cloud-hosted version with free sample data; you don’t need to provide your credit card information when signing up. User reviews are mixed because some find the software good for reporting but too expensive for most small businesses.

Pros

- Backs up accounting data to the cloud via Microsoft 365 integration

- Can consolidate parent and subsidiary companies

- Offers strong inventory and project accounting capabilities

- Has comprehensive reporting tools

- Provides accessible customer support

Cons

- Is not hosted online; cloud features are limited only to remote data sharing and backups

- Requires desktop installation

- Can be difficult to use for nonaccountants

- Is more expensive than most small business accounting software

- Lacks a mobile app for accounting

Monthly Pricing | Sage 50 can scale up to 10 users. For 11 or more seats, custom pricing applies.

|

Discounts | Annual billing is priced lower than monthly billing |

Free Trial | None, but there is a free test-drive account with sample data |

Payroll | From $1,043 per year for 1 to 10 employees |

Standout Features |

|

Scalability | Highly scalable; has custom plans for businesses needing 11 or more users |

Ease of Use | Has a steep learning curve and is not suitable for users without experience in accounting software |

Customer Support | Phone support, email, live chat, chatbot, and self-help resources |

Average User Reviews | Mix of positive and negative reviews. Users who like it mentioned that it’s a good pick for making detailed reports. Others said that it’s just too expensive. |

- Businesses with an experienced bookkeeper: Given Sage 50’s steep learning curve, it is not software for DIY bookkeeping. Regardless of the software your bookkeeper is familiar with, they won’t struggle with Sage 50 because most desktop accounting software share a similar level of complexity and structure. This means transitioning between platforms typically involves understanding minor differences in features and workflows rather than starting from scratch.

- Businesses looking for an alternative to QuickBooks: Sage 50—one of our leading QuickBooks alternatives, specifically for desktop—supports multiple companies. Also, its Quantum Accounting edition offers more industry-specific functionality than QuickBooks Online.

- Users needing consolidated financial statements: It’s one of our best multicompany accounting software for consolidating entities. Purchase the Premium Accounting plan to set up and manage as many companies as you want. You can also consolidate the financial statements of multiple companies, and Sage 50 will take care of reconciling intercompany accounts and transactions.

- Businesses seeking desktop software: It is designed to be installed on a desktop computer but has the convenience of the cloud for data backups and sharing.

Sage 50 Alternatives & Comparisons

Our Comparison of Sage 50 Accounting vs Other Software

| Users Like | Users Dislike |

|---|---|

| Easy to create new accounts | Difficult to use |

| Excellent financial reporting | Expensive pricing |

| Integration with Microsoft products | Old fashioned interface |

Users who left positive reviews often mentioned how Sage 50 streamlines daily accounting tasks, which aligns with my findings. Its reporting features stand out, offering a range of detailed reports that earned it top marks in my evaluation.

On the flip side, there’s no denying the software has a steep learning curve. Many users find its interface outdated and not user-friendly, and I agree. The design feels clunky, which could make it difficult for newcomers to get up to speed.

In my opinion, it’s hard to determine the full experience of Sage 50 Accounting because it provided only a test drive, not the full software. However, I do agree that it has a steep learning curve, and I only recommend it for experienced bookkeepers.

The overall user reviews are just above average. Here are the Sage 50 Accounting review scores from third-party sites:

I compared Sage 50 Accounting with QuickBooks Enterprise and NCH Express Accounts using our accounting software case study.

Sage 50 Accounting secures strong scores in project accounting, reporting, integrations, and banking, as evident in the graph, where it performs well across these categories. However, when stacked against QuickBooks Enterprise, Sage 50 falls short. QuickBooks Enterprise maintains its lead as the most comprehensive solution, particularly for businesses with advanced accounting needs.

In terms of value, Sage 50 lags behind both QuickBooks Enterprise and NCH Express Accounts, primarily due to its lack of a free trial—a key factor in our evaluation. That said, Sage 50 Accounting consistently earns above-average to high marks across most features, except for usability mobile app functionality. This positions it between NCH Express Accounts, which lacks robust capabilities, and QuickBooks Enterprise, the premium option.

For businesses seeking a balance of affordability and advanced cloud features, Sage 50 serves as a strong middle-ground solution.

Sage 50, QuickBooks Enterprise & NCH Express Accounts

Touch the graph above to interact Click on the graphs above to interact

-

Sage 50 Accounting Starts at $61.92 per month

-

NCH Express Accounts Starts free for five or less users

-

QuickBooks Enterprise Starts at $142 for one user

Sage 50 Accounting secures strong scores in project accounting, reporting, integrations, and banking, as evident in the graph, where it performs well across these categories. However, when stacked against QuickBooks Enterprise, Sage 50 falls short. QuickBooks Enterprise maintains its lead as the most comprehensive solution, particularly for businesses with advanced accounting needs.

In terms of value, Sage 50 lags behind both QuickBooks Enterprise and NCH Express Accounts, primarily due to its lack of a free trial—a key factor in our evaluation. That said, Sage 50 Accounting consistently earns above-average to high marks across most features, except for usability mobile app functionality. This positions it between NCH Express Accounts, which lacks robust capabilities, and QuickBooks Enterprise, the premium option.

For businesses seeking a balance of affordability and advanced cloud features, Sage 50 serves as a strong middle-ground solution.

I awarded Sage 50 a Value score of 3, the same as QuickBooks Enterprise but below NCH Express Accounts. While Sage 50 offers robust features, they fall short of QuickBooks Enterprise, which delivers more advanced functionality for a similar price. Although slightly less capable, NCH Express Accounts stands out as a cost-effective option with its free version. Overall, Sage 50 provides moderate value but may be overpriced compared with its competitors.

Sage 50 Accounting has three plans on either monthly or annual billing.

Pro Accounting | Premium Accounting | Quantum Accounting | |

|---|---|---|---|

Monthly Pricing ($/Month) | $61.92 | $103.92 to $239.17 | $177.17 to $452.67 |

Annual Pricing ($/Year) | $625 | $1,043 to $2,391 | $1,780 to $4,546 |

Number of Users | 1 | 1 to 5 | |

Bank Reconciliation | ✓ | ✓ | ✓ |

Expense Management | ✓ | ✓ | ✓ |

Remote Data Access | ✓ | ✓ | ✓ |

Job Costing by Phase & Cost Level | ✕ | ✓ | ✓ |

Advanced Budgeting Tools | ✕ | ✓ | ✓ |

Multicompany Support | ✕ | ✕ | ✓ |

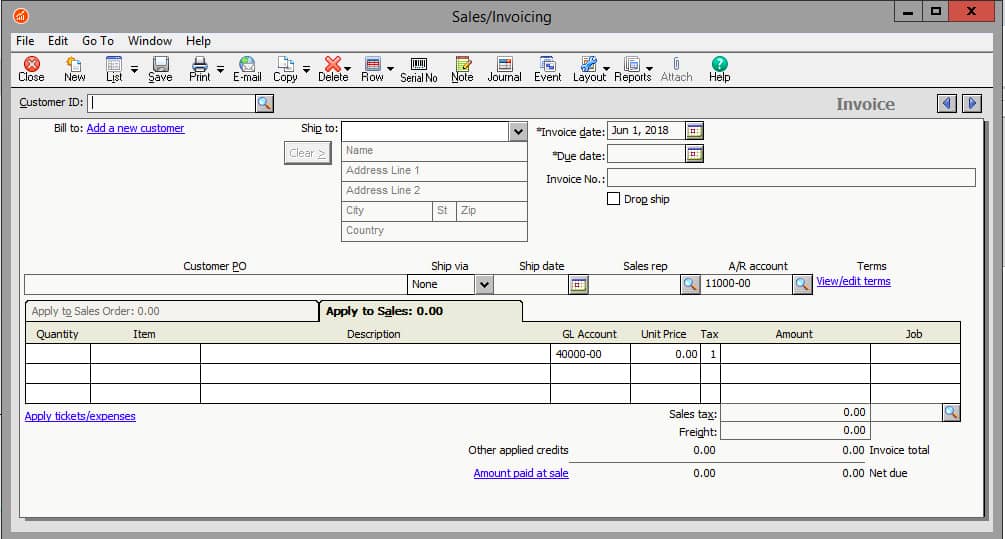

In my experience, Sage 50 allows you to input essential company details, including entity type and fiscal year-end, along with the ability to import or modify the chart of accounts and set user restrictions. However, its interface feels dated, resembling QuickBooks Desktop’s older design. Unlike QuickBooks, which now features a more modern and intuitive layout, Sage 50’s interface can be challenging for first-time users, making the learning curve steeper.

Sage 50 Accounting offers flexible banking features, allowing you to either connect your bank accounts or upload bank statements manually. I appreciate that it doesn’t force a bank connection to perform reconciliations, which gives you more control over how you manage your data. During reconciliation, however, it provides clear details for outstanding checks, deposits in transit, adjusted balances, and unreconciled differences, which makes the process straightforward.

I found it inconvenient that you can’t combine checks and cash into a single deposit, which makes matching deposits between the check register and bank statement more difficult. This cost Sage 50cloud points in my assessment of Banking, but despite this limitation, Sage 50’s reconciliation tools are effective and reliable.

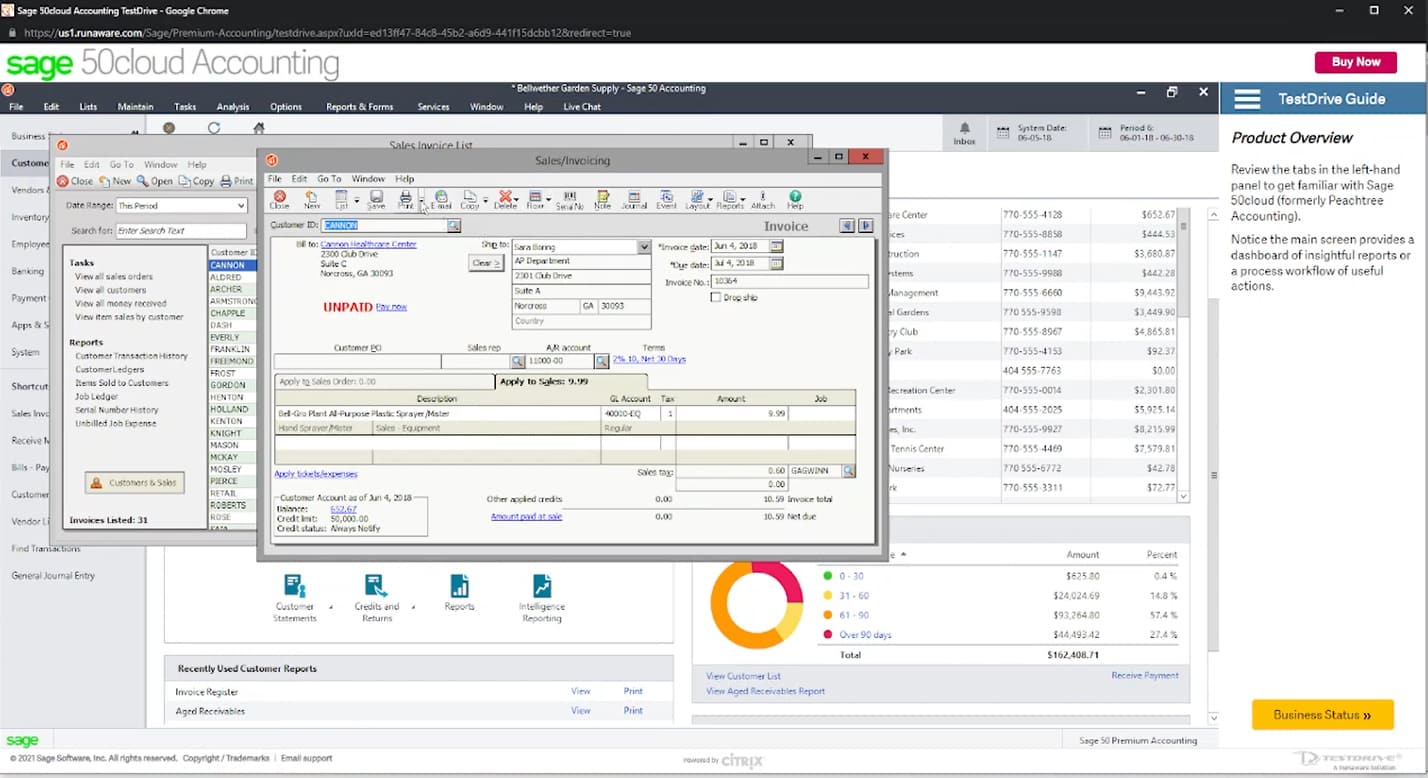

Sage 50’s A/R module covers the basics, though I believe it lacks the polish of more modern competitors. It allows users to generate PDF invoices, issue receipts and credit memos, and easily view customer account details. However, one drawback—which is where Sage 50 took a hit in my review—is the absence of a feature to issue checks for customers with credit balances, which could be a dealbreaker for businesses that rely on this functionality.

While Sage 50 provides a solid range of features, I believe the dated user interface affects overall UX. Its interface reminds me of the old Windows 97 setup, with menu bars, drop-downs, and a cascade of pop-up windows. I find it frustrating every click spawns a new window, which can slow down the workflow. That said, once you get past the design quirks, the features themselves are robust and won’t disappoint.

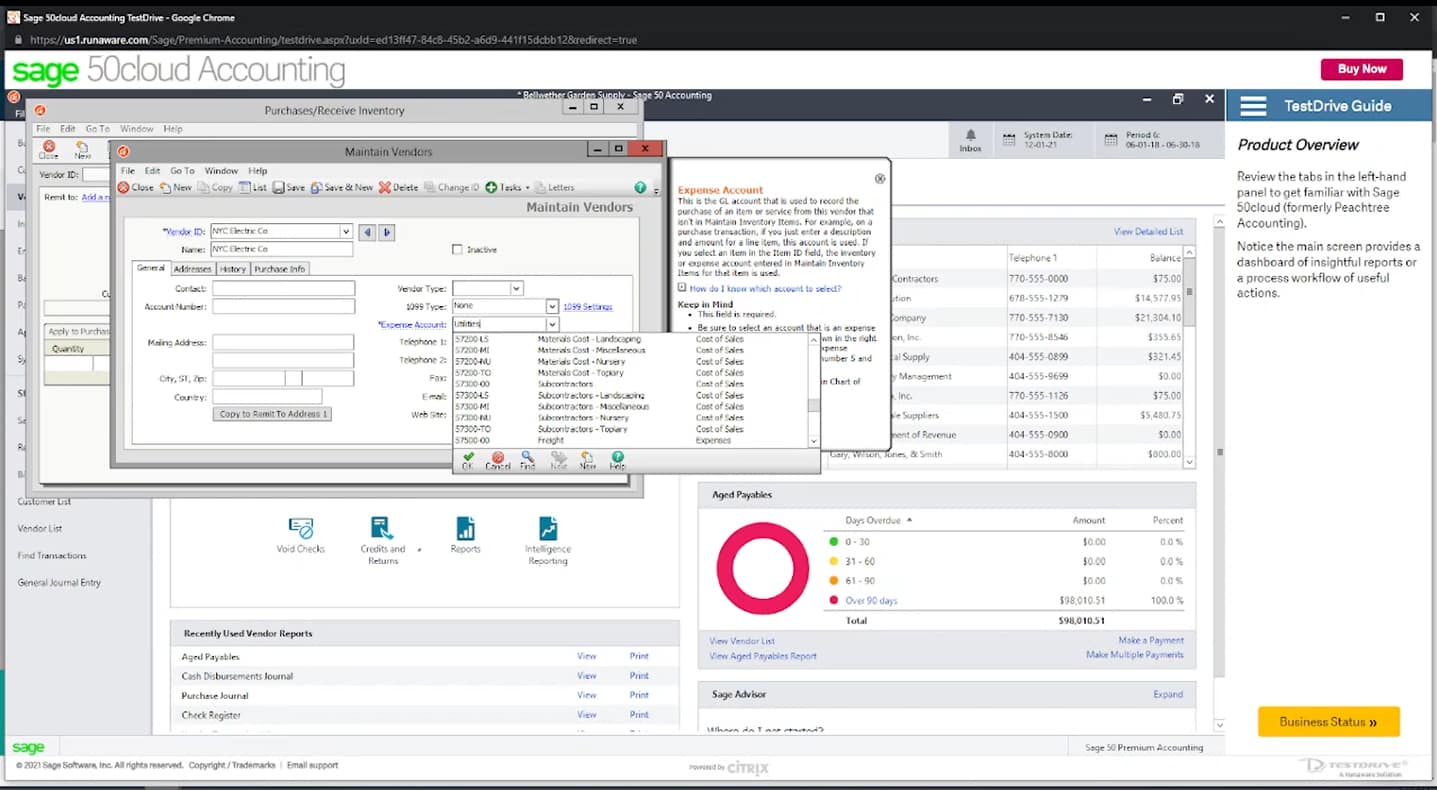

Sage 50 did great in my A/P evaluation, though it lacks features like vendor portal and electronic payments. I don’t consider these as a major miss because these are nice-to-have features but not necessarily essential in desktop accounting software.

Its A/P module is packed with features, allowing you to manage vendors, record expenses, create purchase orders, and handle billings and service items. The software allows recording of standard costs for services, which is a nice touch for businesses with fixed pricing structures.

The A/P functionality is robust and deserves praise on that front. However, I believe the module’s complexity makes it less user-friendly, especially for small businesses looking for a more straightforward accounting solution.

Sage 50 A/P module

Sage 50’s interface is crowded, and its reliance on multiple popup windows makes navigation cumbersome. In my opinion, it’s more geared toward accounting professionals rather than small business owners or managers. Without a solid understanding of accounting principles, navigating the software and making sense of its features can be a real challenge.

Sage 50 lags slightly behind QuickBooks Enterprise when it comes to inventory management, but it has some advantages. Unlike QuickBooks, Sage 50 supports both FIFO and LIFO costing methods, giving users more flexibility. It also handles crucial tasks like automatic COGS accounting and calculating the cost of ending inventories effectively.

Despite its strengths, I found some limitations in Sage 50. Recording partial inventory receipts on POs can be cumbersome, and its ability to display the total cost of inventory on hand is somewhat restricted. Even with these shortcomings, I believe Sage 50 remains a solid option for businesses needing comprehensive inventory features.

Note: Our evaluation ties inventory management closely to A/R and A/P, which is why no dedicated video is provided for this section.

My assessment revealed that Sage 50 Accounting excels in project accounting because of its comprehensive suite of features. This doesn’t come as a surprise because, in my years of evaluating accounting software, most desktop accounting programs have excellent project accounting features.

While Sage 50’s interface may not be as user-friendly as some competitors, it covers all the essentials, from creating projects to assigning costs and setting estimates. One standout feature is its ability to compare actual project costs to estimates, a capability that QuickBooks Online lacks. This comparison is crucial for effective project management and cost monitoring, and it’s a feature I’m glad to see in Sage 50.

Tax tracking in Sage 50 is simple and effective. In my rubric, Sage 50 and QuickBooks Enterprise are tied in this criteria. Like QuickBooks, it cannot file and pay sales tax liabilities directly within the software. However, both platforms handle the essentials well, such as tracking sales taxes via a sales tax liability account and allowing users to set up various tax rates.

Note: This functionality is seamlessly integrated within Sage 50’s A/R, A/P, and general accounting features, which is why there’s no separate walkthrough for this section.

Sage 50 offers a wide variety of reports, making it a versatile tool for small business accounting. For our case study, we focused on essential reports that meet the needs of small businesses.

Here are the key reports Sage 50 provides:

- Balance Sheet

- Profit and Loss Statement

- Statement of Cash Flows

- General Ledger

- Trial Balance

- Accounts Receivable Aging

- Accounts Payable Aging

- Income/Loss by Month

- Sales by Customer

- Income/Loss by Class or Location

- Transaction List by Customer

- Transaction List by Vendor

Sage 50 Accounting has no mobile app, so it has a zero score in my rubric. However, in my opinion, it’s common for desktop accounting software to be lacking in this area mainly because it is hard to replicate the desktop functions for mobile. Hence, if I were to make a decision, I wouldn’t put too much weight on this criterion.

Sage 50 integrates with 115 third-party applications, covering areas like data entry, ecommerce, and time tracking, which is why it nailed my assessment of this category. One of its standout integrations is with Microsoft 365, wherein you gain access to premium features, including Word, Excel, PowerPoint, Access, and Outlook, along with 1 TB of OneDrive storage.

There are more apps that can connect with Sage 50, available in the Sage Marketplace. Particularly, the Sage suite has products that integrate with Sage 50, such as:

- Sage Payroll for payroll integration

- Sage Timeslips for time tracking and billing

- Sage Payment Solutions for electronic payments

I evaluated usability using four important criteria, as seen below. While Sage 50 offers great customer service and marginal ease of use and setup, it doesn’t have a US network of bookkeepers, making it difficult to find assistance. It took a hit in my evaluation of the Usability category because of limited bookkeeping assistance and a steep learning curve.

Sage 50 isn’t ideal for DIY business owners or small shop owners without accounting software experience. It’s not the easiest to navigate, so if you’re planning to handle your own bookkeeping, this might not be the best choice. However, if you have an in-house accountant who’s either experienced with advanced accounting software or willing to learn Sage 50, it can work well for your business.

The software has a steep learning curve and challenging setup process, which is something that’s expected with any desktop accounting software, regardless of the brand. While it includes a setup guide, I prefer a more interactive setup wizard that walks new users through each step. The guide pops up every time you open Sage 50 unless you disable it, which can be a bit intrusive. That said, if someone familiar with Sage 50 handles the setup, the process can go much more smoothly.

Users get solid customer service, with 24/7 phone and online chat support included in all plans at no extra cost. In addition to live support, it provides a wealth of self-help resources and a community forum where users can connect and share solutions. This makes it easier for users to get the assistance they need, whether through direct support or by tapping into the broader Sage user base.

Sage offers a network of Sage Advisors, but it’s not widely recognized in the US. Additionally, there are no bookkeeping assistance services directly provided by Sage, which could be a drawback for businesses looking for hands-on support in managing their books. The lack of a US network of bookkeepers was a major factor in Sage’s low score for usability.

How I Evaluated Sage 50

I evaluated Sage 50 Accounting and other leading small business accounting software using an internal scoring rubric. You can read a more detailed description by visiting our accounting software case study page.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

Sage Business Cloud Accounting was purely cloud accounting software and has been discontinued. Sage 50 is a desktop application with cloud features. In terms of functionality, Sage 50 has more robust accounting features than Sage Business Cloud Accounting.

No, it doesn’t, because the Sage 50 software isn’t hosted on the web. The cloud functionality only allows multiple desktop users to share data remotely by transmitting via the cloud, which is included in all Sage 50 subscriptions.

PeachTree Accounting became Sage 50cloud in 2012 and then renamed to Sage 50 in 2023.

Bottom Line

Sage 50 Accounting has plenty of features that small businesses can benefit from, but I only recommend it if you have an in-house accountant. Its steep learning curve makes it hard for DIY business owners, and finding support in the US can be challenging. If you’re planning to handle your own accounting, consider alternatives like QuickBooks Enterprise or Xero, which are easier to use and offer better support.

User review references: