If you meet the criteria to complete Schedule C—an attachment to Form 1040—you will use it to report your business income and expenses for the year. To do so, you’ll need your profit and loss (P&L) report or any other report that consolidates the income you received and expenses you incurred during the year.

Who needs to file Schedule C?

- It must be completed for all single-member LLCs A single-member LLC is an entity formally registered with the state and is owned by one person. Single-member LLCs can elect to report income as a corporation instead of on Schedule C. and for all business activities for which you are the sole proprietor A sole proprietor is someone who owns and runs their own business but has not created a formal entity structure with any state. .

- Married couples operating a qualified joint venture must file separate Schedule C forms to report their share of the business activity. Learn more about qualified joint ventures.

Download the IRS’s Schedule C and follow along as I walk you through the steps on how to fill out Schedule C for your single-member LLC or sole proprietorship. Remember that your 2024 Schedule C is due on or before April 15, 2025.

Step 1: Gather the Necessary Business Information

Before filling out your Schedule C, you need to prepare your P&L report for the year. You’ll also want to have your general business information ready, like your employer identification number (EIN) if you have one. If this isn’t your first year filing, have your prior one available as it will provide a lot of the required information.

Five Things You Need to Complete the Form

- Schedule C instructions: Our article explains how to complete your Schedule C—but the IRS’s instructions for Schedule C are handy for identifying the Principal Business or Professional Activity code for your business.

- Your EIN: If you have a separate EIN for your business, you must include it on your Schedule C. If you don’t have an EIN, we have a step-by-step guide for how to get an EIN.

- Your P&L report for the tax year: You can find the financial information that you need to fill out your Schedule C tax form on your P&L report. Ensure you have generated the report using the correct accounting method; while the accrual method is required for some companies, most small businesses file their tax returns using cash-basis accounting.

- If you use accounting software to track your income and expenses, you can run your P&L report for the tax year. If you don’t, I recommend QuickBooks Online, which you can learn more about by reading our QuickBooks Online review. It will ensure your books stay organized and can track your vehicle mileage.

- If you prefer for someone else to keep your books, read our Merritt Bookkeeping review to learn how it can compile your income and expenses for only $250 per month, regardless of the size of your business.

- Inventory count and valuation as of the end of the tax year: For businesses selling items, determine the COGS during the tax year, which can be done by completing an annual physical inventory and comparing that information with your point-of-sale (POS) or other inventory management software. If you track inventory, ensure the cost of the inventory shown on your balance sheet matches your actual inventory; if you have less than $25 million in gross receipts, you’re not required to track inventory unless you’ve done so on a prior return.

- Mileage records: If you are using your personal vehicle for any business activity, it’s necessary to keep accurate mileage records to deduct those expenses. You can either use a paper mileage log or one of the best mileage tracker apps.

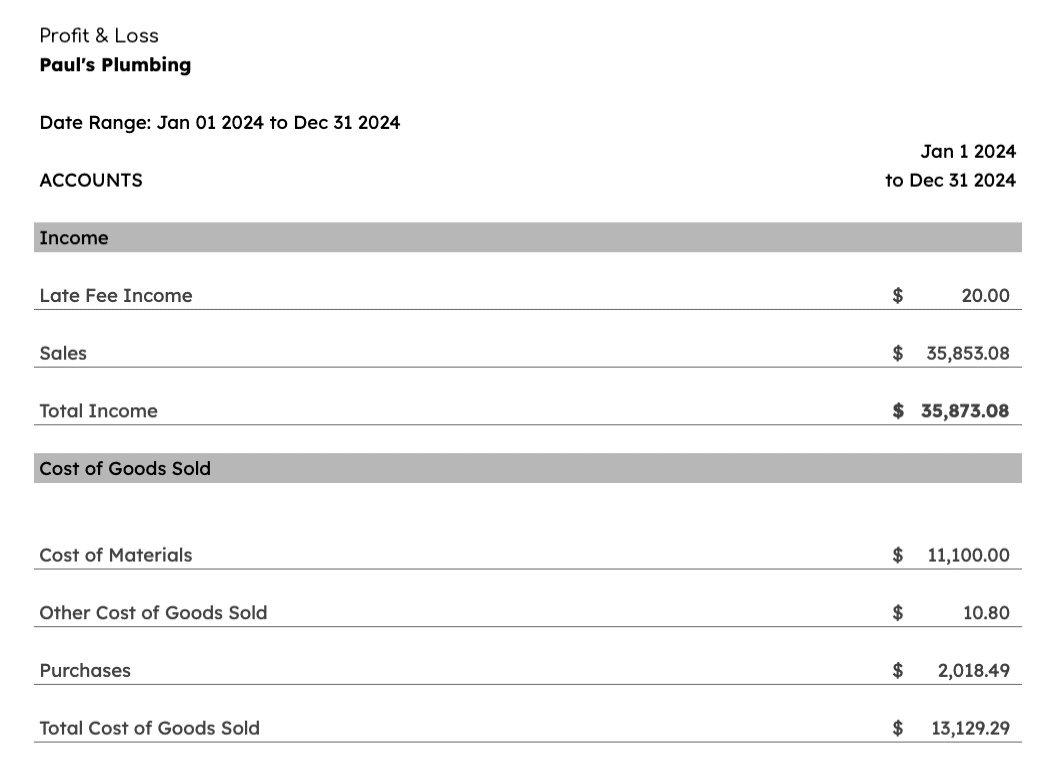

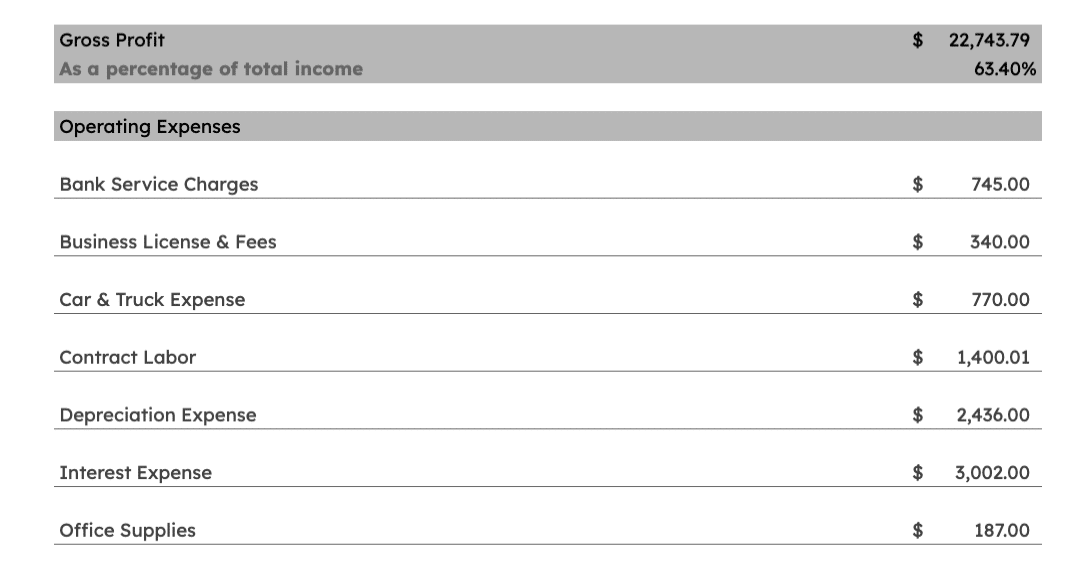

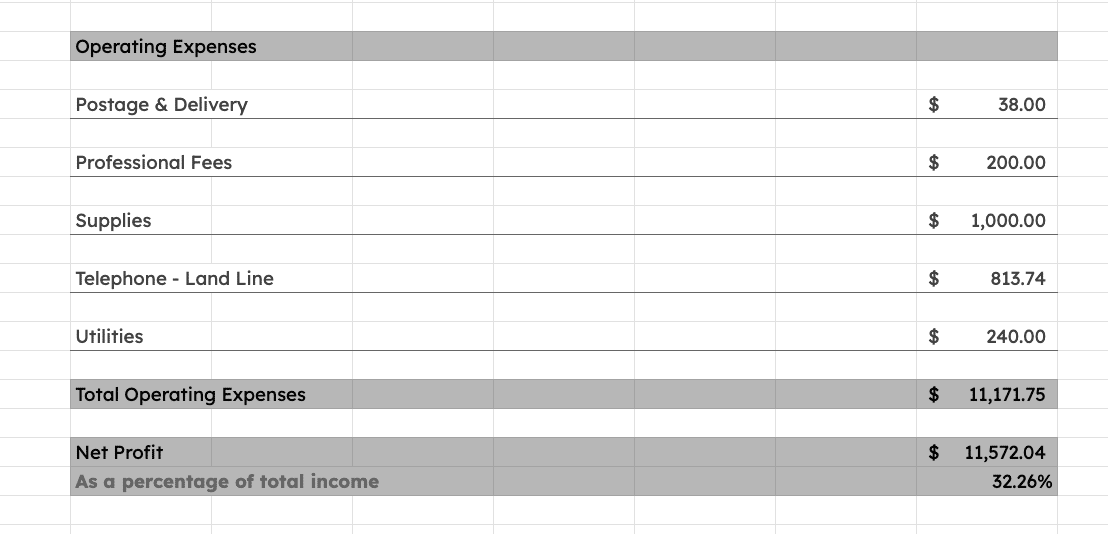

P&L Report With Completed Schedule C Example

The P&L report, often referred to as an income statement, is a financial statement that summarizes the revenue, costs, and expenses incurred during a specific period, usually a fiscal year or a quarter. It provides information about a company’s ability to generate profit by increasing revenue, reducing costs, or both.

Below is a sample P&L report I created with Wave Accounting that provides the information necessary to complete Schedule C.

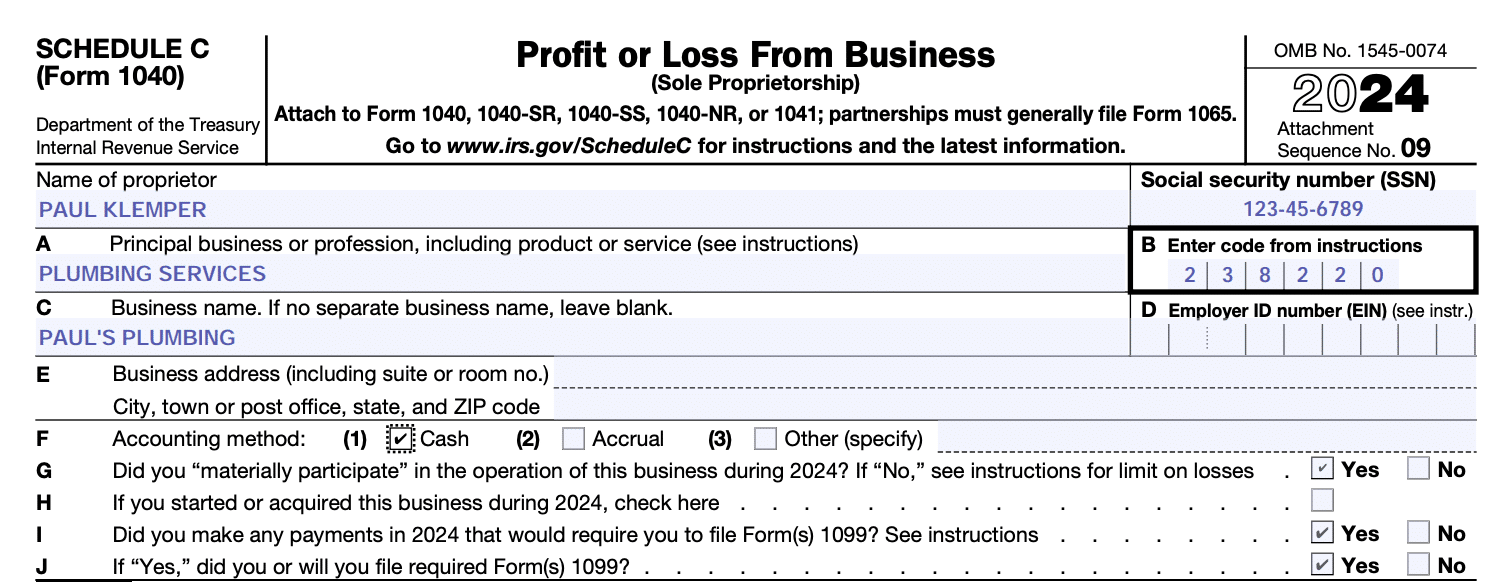

Step 2: Fill Out Basic Business Information

To complete the form, you can use the IRS’s fillable PDF of Schedule C or DIY business tax software. Visit our suggestions for the Best Tax Software for Small Businesses to explore your choices.

Below, you’ll find a brief explanation of how to complete each of the fields in this section.

Schedule C (Form 1040) Header Information

- Name of proprietor: Enter your name in this field.

- Social Security number (SSN): Since the profit on Line 31 carries over to your Form 1040, you must enter your SSN on Schedule C, even if you also have an EIN.

- Line A: Principal business or profession, including product or service—indicate the type of business you have and whether you sell products or services.

- Line B: Principal business or professional activity code—select the code that best describes your business from the last page of the IRS’s instructions for Schedule C.

- Line C: Business name—put the name of your business in this field. If you don’t have a business name, leave this field blank.

- Line D: EIN—enter your nine-digit number. If you don’t have one, then leave the field blank. If you have employees, then you need an EIN.

- Line E: Business address—enter the physical address of your business. Don’t enter a post office box here. Leave the field blank if the address is the same as your address listed on Page 1 of Form 1040.

- Line F: Accounting method—select the accounting method that you use to track income and expenses (cash- vs accrual-basis accounting). This must be the same as the prior year. You may choose your method if this is the first year of the business, but most small businesses use the cash method as it is much simpler.

- Line G: Material participation in the business—material participation means that you were heavily involved in business operations and not just an investor. If you perform at least 500 hours per year of service for the business, or you perform the majority of the services for the business, then you materially participate.

- Line H: If you started your business in the current tax year, check this box. Otherwise, leave it blank.

- Line I: If you paid a contractor $600 or more during the tax year, then tick “Yes” on this line. By selecting Yes, you are required to send a 1099-NEC Form to each contractor you paid $600 or more during the tax year. To learn more, check out our guide to Form 1099 reporting.

- Line J: If you selected “Yes” on Line I, then you should also select “Yes” on Line J and be sure to send out the required forms.

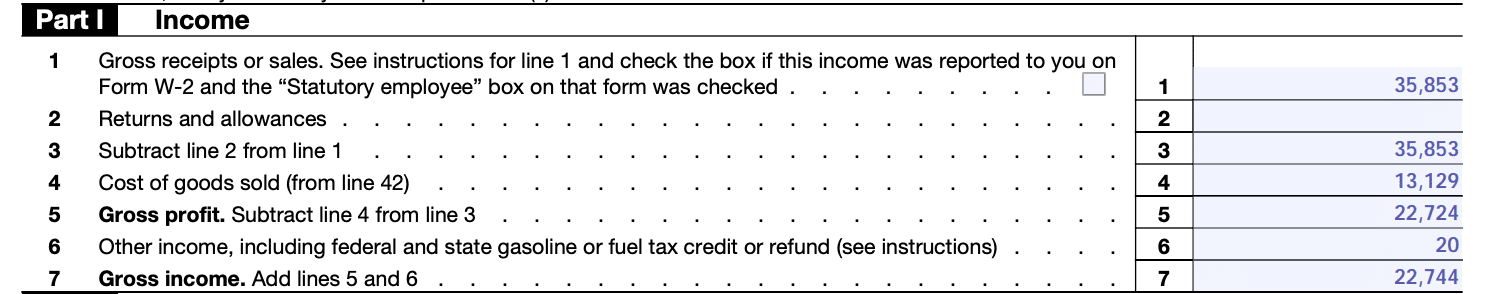

Step 3: Complete Part I (Income)

The purpose of this section is to report the income of your business. It’s also where you’ll calculate your gross profit and your gross income.

Schedule C (Form 1040) Part I

- Line 1: Gross receipts or sales—this is the total amount of all products and services sold to your customers before taking into account any product returns or other related costs to generate those sales. If you’ve received any Form 1099-NECs from your customers, ensure the amounts are included in Line 1.

- Line 2: Returns and allowances—this is the total amount of refunds that you gave to customers for returned or damaged products.

- Line 3: Enter the difference between your total income and any refunds given to customers here.

- Line 4: Cost of goods sold—this is the cost of producing all of the products or services sold and must match Part III, Line 42.

- Line 5: Gross profit—subtract Line 4 from Line 3 to calculate the gross profit.

- Line 6: Report any income that doesn’t come from your normal business operations. This is often listed as Other Income on your P&L statement. For our example, I included my Late Fee Income of $20 from my P&L statement.

- Line 7: Gross income—this is the sum of Line 5 and 6.

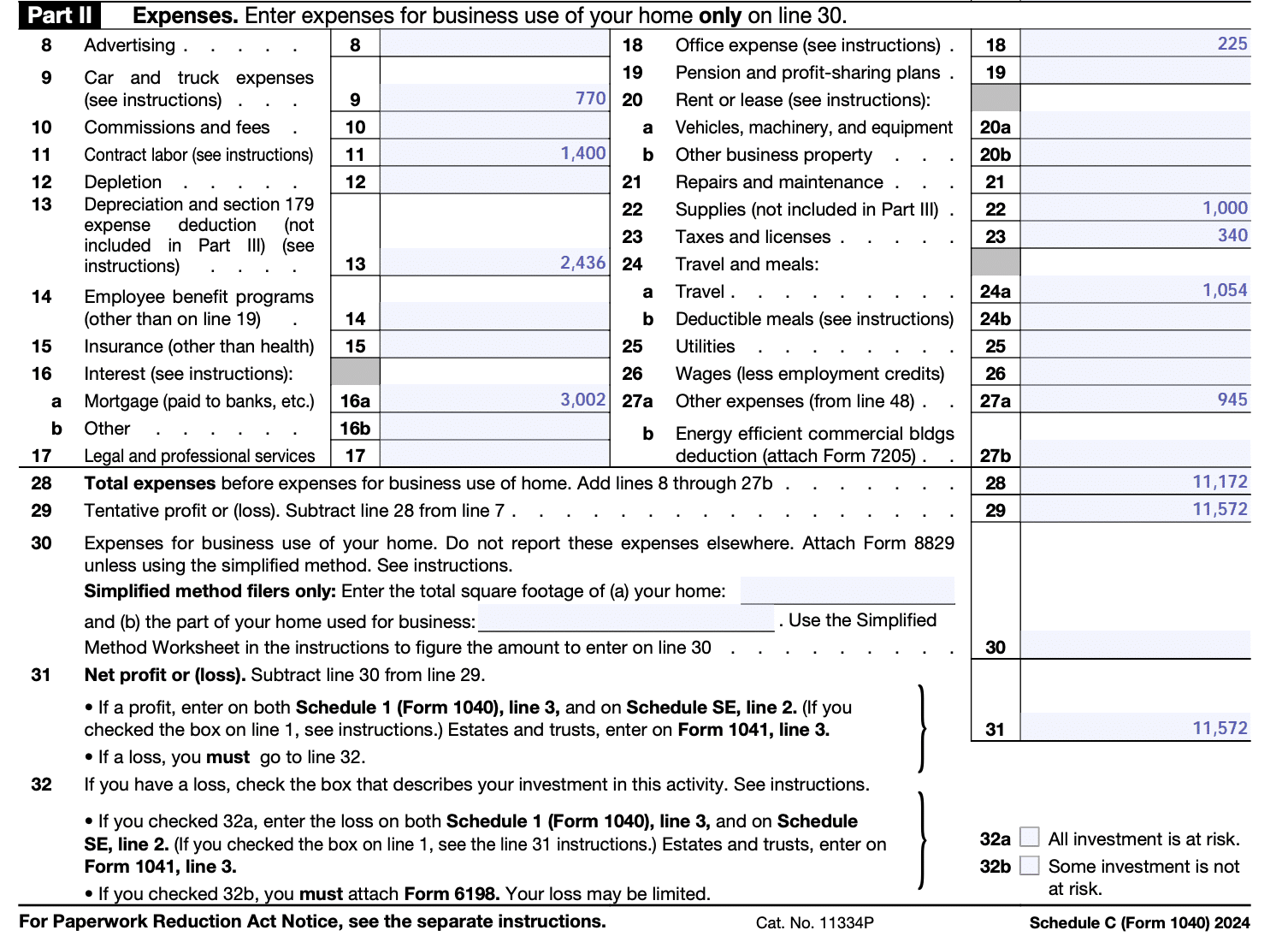

Step 4: Complete Part II (Expenses) and Part V (Other Expenses)

The expenses incurred by your business reduce its profit, and this translates to a lower tax liability. Most of the fields in Part II are self-explanatory, and you can pull this information from your P&L statement.

Part II (Expenses)

Below, you’ll find a brief description of what information you need to report in the expenses section of 1040 Schedule C. For a complete description of deductible expenses, see our guide to IRS Business Expense Categories.

Schedule C (Form 1040) Part II

- Line 9: Car and truck expenses—you have the option to deduct the actual expenses of using your vehicle for business or taking a standard mileage deduction. Learn more through our article on standard mileage vs actual expense method.

- Line 11: Contract Labor—enter payments made to independent contractors for services provided. Exclude any wages paid to employees reported on Form W-2.

- Line 12: Depletion—depletion is only reported by companies that own and use natural resources, such as mining, timber, and petroleum businesses.

- Line 13:Depreciation and section 179—include the annual deduction allowed to recover the cost of business equipment or investment property used in your business that has a useful life beyond the tax year.

- Line 18: Office expense—deduct office supplies and postage expenses here. Expenses related to maintaining a home office belong on Line 30, not on Line 18.

- Line 19: Pension and profit-sharing plans—deduct any contributions that you made for the benefit of your employees to a pension or profit-sharing plan. Retirement contributions for yourself don’t get reported on Schedule C but rather on Part II of your Form 1040 Schedule 1.

- Line 21: Repairs and maintenance—deduct minor repairs and maintenance that don’t add to the property’s value. For example, paying a plumber to repair a toilet or unclog a sink would go here.

- Line 23: Taxes and licenses—you can deduct real estate and personal property taxes on business assets, licenses and fees for your trade or business, and the employer portion of Social Security and Medicare taxes paid on wages of your employees.

- Line 24: Travel and meals—in most cases, you can only claim 50% of the meals and entertainment deduction. The meals must be incurred while away from home overnight or have a specific business purpose. You must keep documentation of the business nature of the expense as well as the name of the client or potential client with which you dined to support this.

- Line 26: Wages—enter total salary and wages paid to employees for the tax year included on Form W-2. Amounts paid to yourself are owner draws and not a deductible expense, but also not included in your income.

- Line 27a: Other expenses—list any business expenses that you didn’t report on Lines 8 through 30. You’ll provide the details of these expenses in Part V of Schedule C.

- Line 28: This is the sum of all your expenses on Lines 8 through 27a. This amount should equal the total expenses on your P&L, with adjustments made for nondeductible expenses, such as 50% of your meal expenses.

- Line 30: Expenses for business use of home—you may be eligible for the home office tax deduction, which allows you to deduct expenses if you use a portion of your home exclusively for business.

- Line 31: Net profit (or loss)—this is the taxable income from your business. Positive amounts on Line 31 must be reported on Form 1040, Schedule 1 Line 3, and Schedule SE, Line 2. Negative amounts on Line 31 are usually deducted on Form 1040, Line 12, unless not all your investment is at risk or you don’t participate materially. If this applies to you, it is best to speak with an accountant or tax professional.

- Line 32: If Line 31 is negative, you need to check one of the following boxes:

- 32a: All investment is at risk—select this option if you have a business loss and all of the amounts you have invested are at risk, meaning there is no protection against the loss. Most Schedule C business owners have all their investments at risk. Learn more through our guide on at-risk rules for Schedule C businesses.

- 32b: Some investment is not at risk—select this option if you have a business loss, but not all of your investment in the company is at risk. The most common example is nonrecourse loans used by the business to purchase equipment.

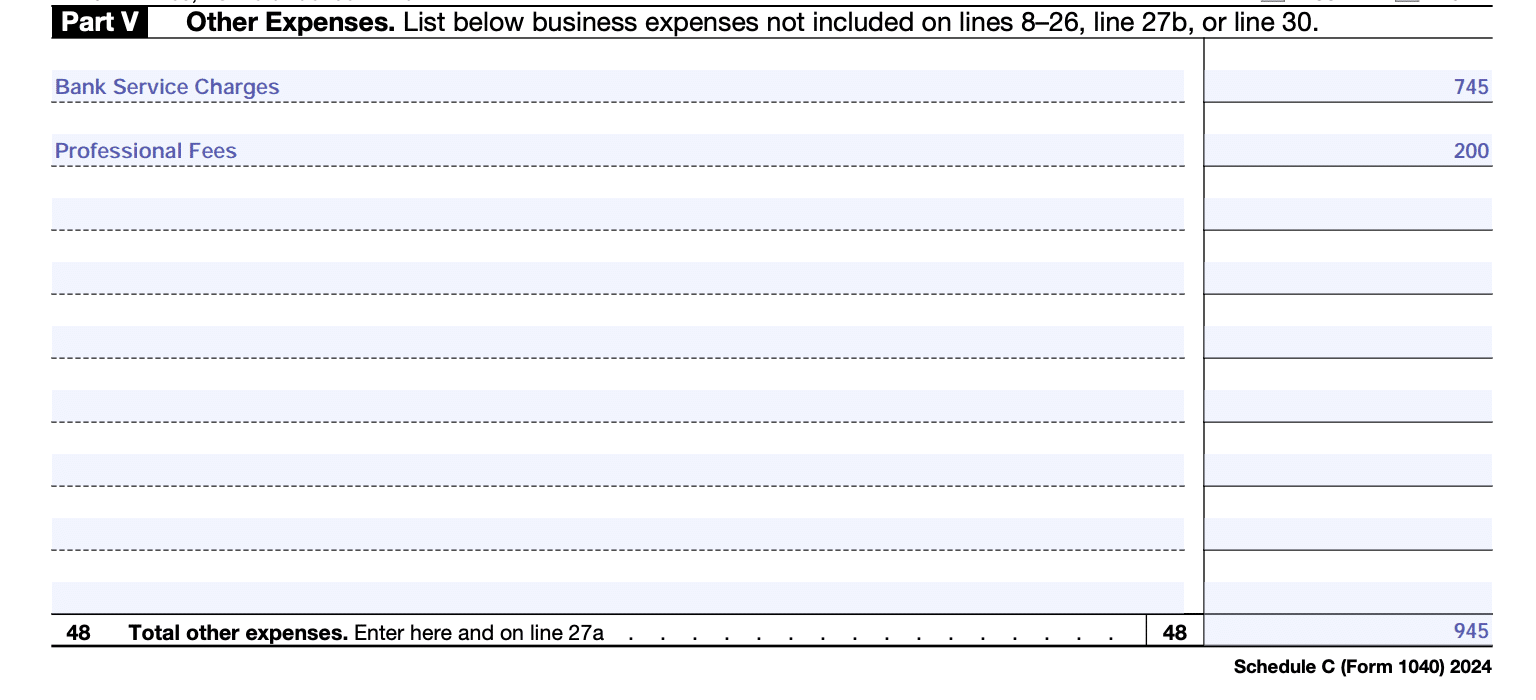

Part V (Other Expenses)

Part V provides a breakdown of other expenses. A good rule of thumb is to keep any expenses labeled as “Miscellaneous Expense” to a minimum since there is substantial room for ambiguity. Ambiguous expenses may lead to additional inquiries from the IRS, which taxpayers generally try to avoid.

When completing Part V of the form, ensure the total on Line 48 matches Line 27a from Part II.

Schedule C (Form 1040) Part V

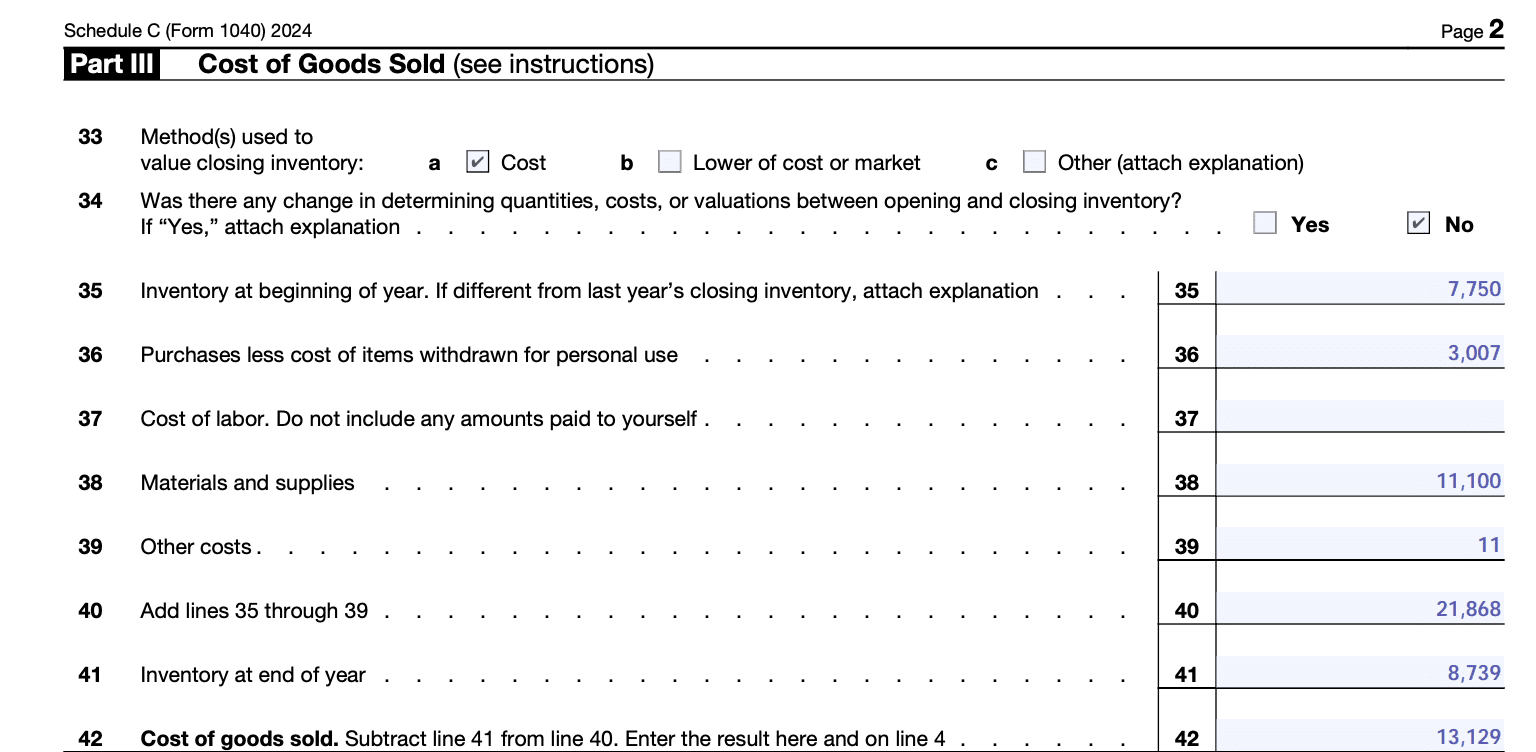

Step 5: Complete Part III (Cost of Goods Sold)

Complete this section if you sell goods or merchandise or use subcontractors to generate income. It reports the direct cost of producing the sales reported on Line 1.

Most of these lines are self-explanatory. You can pull the amounts requested directly from your P&L or POS system or make a simple calculation to determine the necessary subtotals. Be sure not to duplicate any expenses that were included in Part II.

Schedule C (Form 1040) Part III

- Line 33: Inventory method—you don’t need to keep track of inventory if you have less than $25 million in gross receipts. However, tracking inventory might help you to manage your business. If you do track it, select the valuation method that you use; you can value inventory using any method approved by the IRS.

However, if you’re using the cash method of accounting, then you’re required to use the cost method to value inventory. The other option is “lower of cost or market,” which means that you’re valuing your inventory at either the historical cost or the current market value, whichever is lower. If you decide to change how you account for inventory, file Form 3115. Refer to IRS Publication 538 for more information on valuation methods.

- Line 35: Beginning inventory—indicate the inventory on hand at the beginning of the tax year. This should match your ending inventory from last year. You need to provide an explanation if it doesn’t.

- Line 36: Purchases—enter the total amount of inventory purchased less any product used for personal reasons.

- Line 41: Ending inventory—enter the cost of inventory on hand at the end of the year.

- Line 42: Cost of goods sold—total cost of goods sold on this line must match the cost of goods sold on Part I, Line 4.

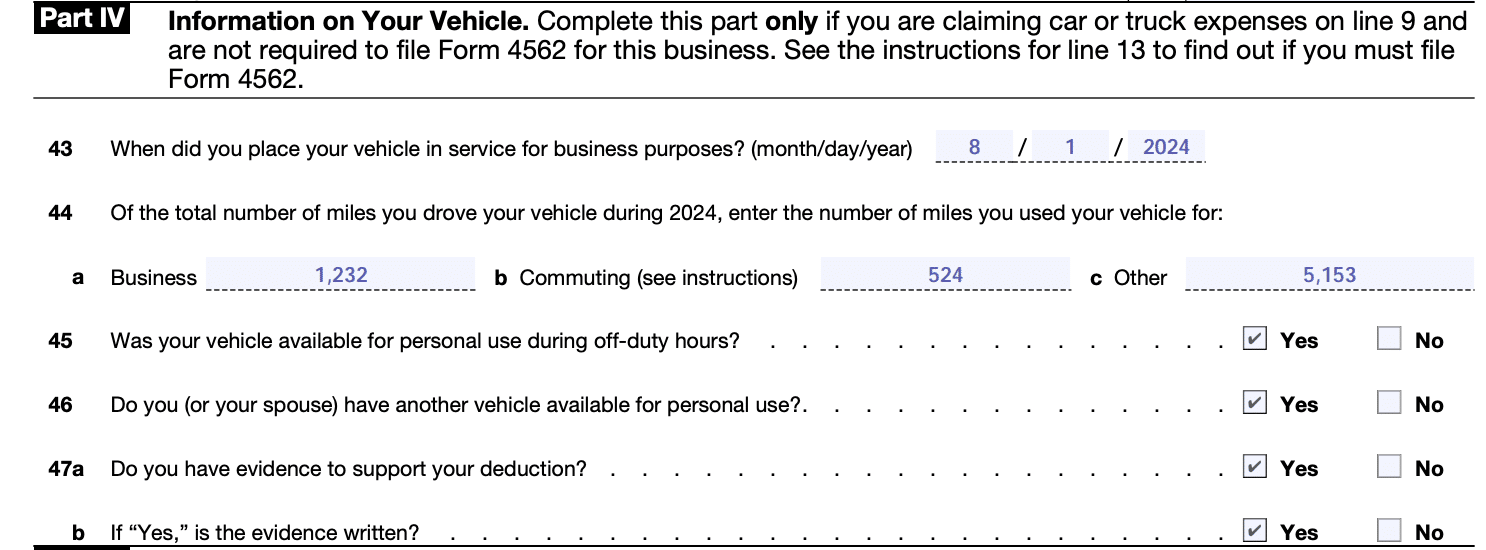

Step 6: Complete Part IV (Information on Your Vehicle)

Most taxpayers report vehicle information on Page 2 of Form 4562, which is also used to report depreciation. However, if you are claiming vehicle expenses on Line 9 but are not claiming depreciation for any assets, then complete Part IV instead of Form 4562.

Schedule C (Form 1040) Part IV

Your records must include the following information:

- Date and purpose of the trip

- Name of the client or supplier, if applicable

- Total miles driven round trip

Schedule C Due Dates

Schedule C, Profit and Loss From a Business, is filed along with your personal income tax return, Form 1040. It’s usually due on April 15 of the following year. If April 15 falls on a weekend or holiday, it’s due on the following business day.

Tax Year | Due Date |

|---|---|

2024 | April 15, 2024 |

2025 | April 15, 2025 |

For the 2024 tax year, you can receive an automatic six-month extension until Oct. 15, 2025, by filing Form 4868—but an extension of time to file doesn’t extend the time to pay. You must estimate the tax you’ll owe and make a payment when you file Form 4868.

Additional Filing Requirements for Schedule C Businesses

Your Schedule C is now complete, but don’t forget to do the following:

- Report your net income from Schedule C on Form 1040, Schedule 1, Line 3.

- Calculate the Qualified Business Income Deduction (Section 199A deduction) on Form 8995 or Form 8995-A and report it on Form 1040, Line 13. Most Schedule C businesses with positive net income qualify, but see the IRS’s instructions for Form 8995 to learn more.

- Complete Schedule SE if your net income is over $400 and report your self-employment tax on Form 1040, Line 23.

What Happens After You File Schedule C?

Once your Schedule C has been filed with your personal tax return, the IRS will review what was reported and process the filing. This process takes about three weeks but may take longer if the IRS has a backlog or finds conflicting information.

If the IRS finds errors or inconsistencies, it will issue a notice and may withhold the refund for the entire return until further clarity is provided. In some cases, the IRS may ask to review the business’ financial records and the underlying support. This inquiry is referred to as an IRS audit and may be conducted by mail or in-person, depending on the details included in the IRS notification.

Frequently Asked Questions (FAQs)

Yes. If you own more than one unincorporated business, you must complete a Schedule C for each business.

A statutory employee will report their earnings on Schedule C, Line 1, and may deduct business expenses related to those earnings.

Yes,1099 gig workers or freelancers should use Schedule C to report income and related expenses to the IRS.

Bottom Line

The most difficult part of filing your Schedule C is accurately summarizing your income and deductions, which is why I recommend using one of the best small business accounting software. Once you have a complete and accurate Statement of Profit or Loss, you should be able to complete your Schedule C without much difficulty.