Square Terminal is a handheld point-of-sale (POS) device that includes a swipe, dip, and tap card reader with a touch-screen POS display and thermal receipt printer. It can process transactions even when temporarily offline, and you can manage your inventory directly from the terminal. We scored this POS hardware in our ranking of the best credit card readers, where it earned a 4.42 out of 5 and beat out the competition to top the list. And that’s just for the credit card reader components.

With the Square Terminal, there are no long-term contracts, and most users can get started ringing up sales in a single day. The terminal costs $299, but you can get financing at $27 per month for 12 months.

Square Terminal Overview

Pros

- It has portable, versatile, compact, all-in-one card reader and POS.

- It offers an affordable installment plan.

- It can be used as a mobile or countertop solution.

Cons

- Square Payments is the only supported processor.

- It only communicates via Wi-Fi or Ethernet connection; no Bluetooth option.

- Customer service has room for improvement.

Deciding Factors

Supported Business Types | Most business types Retail, restaurants, mobile sales, service businesses, and more |

|---|---|

Upfront Cost | $299 (or $27 for 12 months) |

Monthly Fees | None for the reader itself |

Contract Length | Month-to-month |

Payment types accepted |

|

Supported payment processors | Square Payments |

Processing rates |

|

Size |

|

Weight | 417 grams (0.90 pounds) |

Battery life | Up to 24 hours |

Is Square Terminal Right for You?

Who should use Square Terminal:

- Retailers, restaurants, and service businesses needing sales mobility

- Pop-up shops or stalls in areas without a reliable internet connection

- Businesses wanting free POS software and affordable hardware

Who should use an alternative:

- Businesses wanting 24/7 support even on a free subscription

- Businesses wanting flexibility with payment processors

- Users who want to see reports and analytics directly on their mobile POS device

Square Terminal Video Review

Square Terminal Alternatives

Best for | Pricing | |

|---|---|---|

Helcim Card Reader | Large-ticket sales | Reader: $99 Processing rate: Starting at Interchange + 0.15% + 6 cents |

Clover Go | Working with an existing merchant account | Reader: $49 Processing rate: 2.6% + 10 cents |

Toast Go 2 | Restaurants needing durable, spill-proof hardware | Reader: $799.20 + $69 per month Processing rate: From 2.49% + 15 cents |

Square Terminal User Reviews

| Users Like | Users Dislike |

|---|---|

| It has compact, user-friendly hardware. | Battery life dwindles over time. |

| It has strong versatility in accepting payments. | Forced updates cannot be delayed. |

| It can print high-quality receipts. | There are occasional glitches and unreliability. |

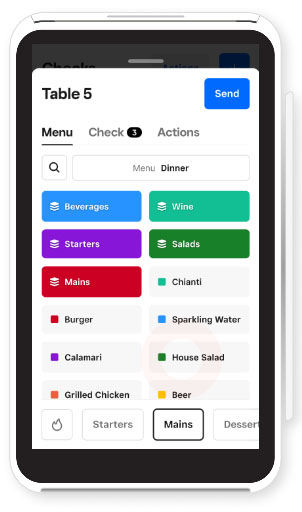

Users appreciated Square Terminal’s compact size and ease of handling and transport. This made the terminal a viable option for multiple shop types, including main storefronts and pop-up events. Despite the small size of the hardware, its screen is large, highly responsive, and easy to use.

Square Terminal was also noteworthy among users for its versatility in accepting payments. Customers can pay with chip cards, digital wallets, and via contactless payment. This not only makes things more convenient for buyers, but also keeps transactions moving quickly. Finally, users liked the built-in receipt printer, which removes the need for a separate printer.

A few buyers had negative feedback about Square Terminal. One user noted that the battery life began dwindling after about a year of use, until the terminal completely stopped working around two years in. Other users reported forced software updates on the device, which could neither be declined nor delayed; this led to impaired transactions and lost sales. Lastly, there were some reports of the device lagging, glitchy screens, and fragile construction.

There are not many Square Terminal reviews on third-party sites, but it scored 4.5 out of 5 on Amazon (3,500-plus reviews).

You can purchase a Square Terminal directly from Square for $299. Your opinion of the price will vary based on your needs. If all you need is a card reader, $299 is pricey for a single-use device. But $299 is incredibly affordable for a device with lots of POS features, especially when you consider the included receipt printer.

For solopreneurs, booth sellers, and small shops, a single Square Terminal may be all you need to run your entire business. And if $299 upfront would be a stretch, you have the option to split your purchase into monthly payments of $27 for 12 months.

The Square Terminal uses Square Payments for processing, so you’ll also want to consider that pricing. Currently Square’s processing rates are as follows:

- In-person: 2.6% + 10 cents

- Manually keyed: 3.5% + 15 cents

- Online: 2.9% + 30 cents

Businesses that process more than $250,000 annually can get custom-quoted rates from Square.

Square Terminal operates on the Square suite of POS software. So you’ll also want to factor in the costs of a POS subscription:

Square POS Subscription Costs

POS | Free | Plus | Premium |

|---|---|---|---|

Square | $0 per month | $29+ per month | Custom-quoted |

Square for Retail | $0 per month | $89 per month | Custom-quoted |

Square for Restaurants | $0 per month | $69+ per month | $165+ per month |

Square Appointments | $0 per month | $29 per location, per month | $69 per location, per month |

All Square POS offerings have a free baseline subscription tier, most of which allow you to operate the POS on multiple devices. Square doesn’t lock you into a long-term contract, so you can cancel or upgrade your Square account whenever your needs change. Square also offers a free 30-day trial of all the paid tiers of its POS subscriptions, so you can test the system before committing.

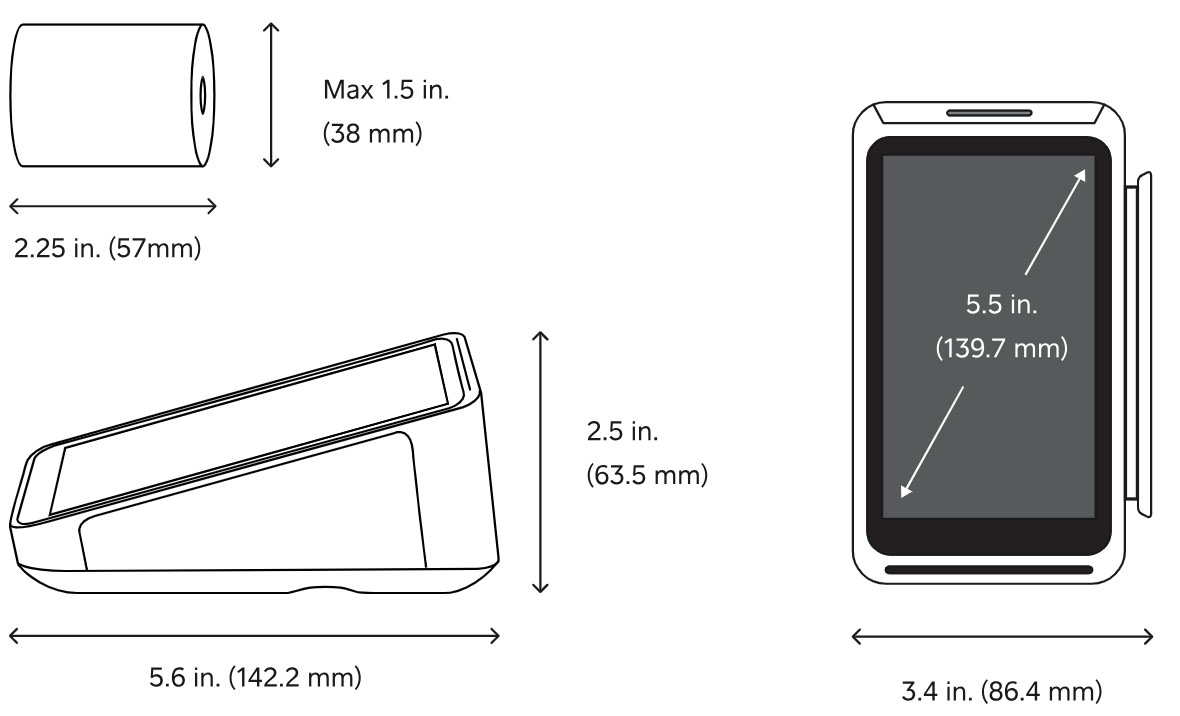

The Square Terminal is only slightly larger than a smartphone and includes a built-in thermal receipt printer. (Source: Square)

- Dimensions: 5.6 inches long, 2.5 inches high, 3.4 inches wide; 5.5-inch screen

- Weight: 417 grams (0.90 pounds)

- Available colors: White

- Materials: Metal and plastic

- Power Source: Wall plug or battery

- Battery life: Around 24 hours

- Charging time: Around 5 hours for a full charge

- Connection type: Ethernet or Wi-Fi

- Warranty: 1-year limited warranty

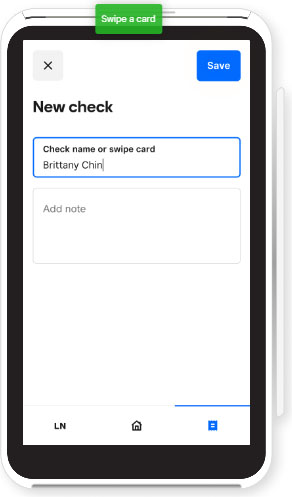

Square Terminal accepts all payment types, from tapped, dipped, or swiped credit and debit cards to mobile wallet payments and swiped gift cards. You can also add Afterpay as a payment option, and you can deposit cash sales in an (optional) cash drawer.

The Terminal can connect directly to up to three additional hardware tools—like barcode scanners, cash drawers, or a scale—via the optional Square Hub ($49). It comes already programmed with Square Payments, so you don’t need to worry about formatting the reader to work on your payment network.

In addition to Square POS software, the Square Terminal integrates with third-party apps to support the additional needs of healthcare and food businesses:

- Healthcare and Wellness apps: ClinicSense (practice management), Remedly (practice management), Reference Health Payments (healthcare payment processing), EZDERM (dermatology practice management)

- Food business apps: Mobi2Go (self-service kiosks & loyalty), Local Line (online ordering for food producers)

The Square Terminal further integrates with even more niche tools for service, membership, and appointment-based businesses:

- Rentrax: To manage rental businesses, including inventory tracking and online bookings

- GlobalTill: Automated omnichannel retail management tools

- Cleantie: Laundry and dry-cleaning service POS

- Gymdesk: Management software for martial arts studios, gyms, and other membership-based businesses

- MoeGo: Pet grooming POS and appointment booking

- TicketSocket: White-labeled ticket sales and registration platform

The addition of these integrations makes the Square Terminal an excellent tool for virtually any type of independent business. The Square Terminal (and attached Square POS) are functional enough for businesses of any size, from mom-and-pop shops to multilocation restaurants and retailers. Though Square is one of the few POS brands crafting tools for microbusinesses, its features really stand out for solo sellers and small shops.

Square Terminal also has a strong offline mode, allowing you to process transactions even without an internet connection. The terminal will record and save all transactions performed offline. As long as you reconnect to the internet within 24 hours, these transactions will go through. However, if you’re unable to connect to the internet within that time frame, further offline payments will automatically be declined.

Overall, the Square Terminal is a lightweight, user-friendly, versatile card reader for every type of business. The mobility of the card reader helps small, independent businesses remain EMV-compliant and avoid losing chargeback disputes. The ability to both ring in sales and orders and process all payment types is a game changer, especially for solopreneurs and small businesses that are commonly overlooked by technology companies.

Square Terminal comes ready with Square Payments included—all you need to do is sign up for a Square account and attach a verified bank account. In most cases, the Square account will be ready to process sales and payments in a couple of hours. The Terminals’ touch-screen interface also makes it very easy to set up, sign into your POS account, and troubleshoot if there is a problem.

Users who plan to use the Terminal with a Free POS subscription should note that the customer support hours are not 24/7 for free users. Unfortunately, it’s been the experience of many small retailers that Square’s live customer service has room for improvement. The hold times on phone calls can be long, and the service representatives don’t seem to be fluent in all of Square’s ins and outs.

If you have questions about your Terminal or the Square POS, you’re usually better off asking the Square Seller Community. These are business owners that use Square software and hardware every day to run their businesses. They’ve run into every potential issue, and most are happy to share the experiences and help other sellers solve problems.

Methodology

We scored the Square Terminal on the same scoring system that we use to rate card-reading hardware. We consider these tools against a criteria of small business pain points including price, functionality, and ease of use. Click through the tabs below for a full description of our scoring process:

25% of Overall Score

We prioritized affordable devices that can be purchased along with payment processing services that don’t require long-term contracts and offer transparent, low-cost, pay-as-you-go transaction fees. We gave high marks for low (or even free) card readers and providers that offer interchange-plus transaction rates.

25% of Overall Score

We evaluated how the device is built, taking into consideration flexibility, compatibility, and mobility. Can the card reader be used in both a mobile and countertop setup? Is it compatible with popular operating systems? We also gave extra points for card readers with extra tools such as pin pads and displays.

25% of Overall Score

We gave high marks for card readers that offer offline transaction processing, accept a wide variety of payment types, and integrate POS tools such as inventory management and ecommerce. We also looked for seamless processing by researching user experience reviews for any issues when accepting payments.

15% of Overall Score

Setting up and using credit card readers should be easy. We awarded points to providers that offer automatic updates, round-the-clock support, and extensive online user guides for setting up and maintaining their devices.

10% of Overall Score

Finally, we evaluated each device’s overall performance to award points for any standout features, assessed the overall value each reader provides for the cost, read user and critic reviews, and considered our own personal experience operating card readers and interacting with each company’s customer support.

Frequently Asked Questions (FAQs)

Click through the sections below to learn more about Square Terminal’s benefits, features, and functionality.

Most users consider Square Terminal highly useful and convenient. People use it at farm stands and craft pop-ups, food trucks, full-service restaurants, and specialty boutiques. It topped our rankings of small business credit card readers and is a great tool for small businesses overall.

Square Terminal allows you to ring in sales and process payments from a single, handheld, nonsmartphone device. It has a built-in receipt printer, so you won’t need additional hardware for that purpose. It’s also easy to figure out and use, right out of the box.

Square Terminal is designed to operate for 24 hours without recharging. The battery may drain faster if your Wi-Fi connection is weak, though. If your battery is draining looking for a Wi-Fi connection, it might be worthwhile to go into offline mode. Finally, one user did note that the maximum battery life begins to dwindle after about a year of use.

Yes, you can ring in sales and process payments on Square Terminal without a Wi-Fi connection. Payment information will be vaulted in the device until you regain internet access via Wi-Fi or Ethernet. You need to ensure that you reconnect to the internet within 24 hours, or the data could be lost.

Bottom Line

Square Terminal is an excellent card reader and mobile POS for virtually any business type. It is compatible with all Square POS products—Square POS, Square for Retail, Square for Restaurants, and Square Appointments—all of which have free baseline subscriptions. Square also doesn’t require long-term contracts for any of their tools, which is one of the reasons our retail and payments experts love it for all types of small businesses.