Square Point of Sale (POS) is an all-in-one business solution that offers forever-free yet feature-rich software including payment processing and ecommerce. In addition to the excellent value it offers, Square is also one of the most user-friendly systems on the market. Real-life users agree, giving Square POS lots of positive reviews.

Overall, Square is our top POS recommendation for most small businesses.

Square Overview

Pros

- Free software and online store

- Affordable, industry-leading hardware (Free card reader included)

- Highly mobile; can accept payments anywhere

- Easy-to-use, intuitive system

- Month-to-month billing, no long-term contract

Cons

- Limited or inconsistent support hours

- Limited customization options

- Does not process age-restricted products online

- Businesses that process more than $10,000 per month will need to upgrade to a paid plan

Deciding Factors

Supported Business Types | Flexible Pop-up shops, small brick-and-mortar or simple ecommerce retailers, simple food businesses |

Standout Features |

|

Monthly Software Fees | Very Competitive $0–$89 per month, per location |

Setup and Installation Fees | Very Competitive $0 |

Contract Length | No long-term contract; pay month-to-month and cancel any time |

Payment Processing Options | Limited Locked into Square’s built-in payment processing (Square Payments) |

Payment Processing Fees | Average

|

Customer Support | Average

|

Is Square POS Right for You?

Square consistently does well in our evaluations of POS systems—it is our best overall free POS and iPad POS. Square is also suitable for mobile sales and solopreneurs like on-site repair and beauty services.

When to Use Square POS:

- Small startups on a limited budget

- Merchants needing a simple POS system

- Small businesses looking for an omnichannel POS solution

- Mobile businesses that need flexible POS hardware

When to Use an Alternative:

- Merchants with a preferred payment processor

- Retailers selling age-restricted products

- Growing and specialty businesses that require complex inventory functions

As an all-in-one solution, what I liked most about Square is how feature-rich its free plan is. There’s much you can do without being charged a monthly POS software fee, so if you run a pop-up shop or a small specialty business and have a mobile device, Square is definitely the most cost-effective solution.

What you get with a Free Square POS account:

Standard Square POS software | Invoicing |

Square payments processing | Virtual terminal |

Mobile POS app | Customer directory |

Ecommerce plan (Square Online) | Starter team management plan |

Payment Links | First magstripe mobile card reader |

I downloaded Square’s POS software on my iPad and it didn’t take long to set up with the helpful prompts so it’s definitely easy to set up and use.

On the other hand, I find Square’s inventory management features limited compared with other POS software—even with a paid plan. Square is not the best fit if your shop needs complex inventory management (look to our inventory POS recommendations for that), a high degree of customization, or relies on subscription products. Grocery stores, liquor stores, or convenience stores will also find more suitable systems with industry-specific tools.

If you specialize in subscription boxes or similar, you’ll be better off with a processor like Helcim (read our Helcim review). Ticketed venues should check out KORONA instead—see our KORONA review for more details.

Which Square POS is right for you?

In addition to the generic Square POS, Square offers specialized POS software for various business types:

- Brick-and-mortar retail businesses should consider Square for Retail.

- Restaurants can find tables and check management tools in Square for Restaurants.

- Appointment-based businesses like sales should check out Square Appointments.

Square POS Alternatives

Best for | Monthly Fee From | |

|---|---|---|

$5 | ||

| Businesses needing a simple online and international mobile payment app | $0 |

Businesses needing an all-in-one solution with a dedicated merchant account | $0 | |

Our Comparisons of Square POS vs Other Software

- Square vs Lightspeed

- Clover vs Square

- Square vs SumUp

- Square vs PayPal

- Shopify vs Square

- Vagaro vs Square

Square POS User Reviews

| Users Like | Users Don’t Like |

|---|---|

| Free software | Limited/poor quality customer support |

| Easy to use; beginner-friendly | Higher fees for card-on-file and keyed transactions |

| Flexible and seamless payment options | Issues connecting mobile card readers |

| Sleek and affordable hardware | Account stability issues |

| Straightforward pricing and no hidden fees | |

The Square POS system is top-rated by users and critics alike. Real-life users find Square POS an overall cost-effective solution though it is not free from challenges such as connectivity and account stability issues.

Third-party review sites rate Square POS as follows:

The Square POS app earned the following scores:

- Apple App Store[3]: 4.8 out of 5 stars from around 460,000 users

- Google Play Store[4]: 4.8 out of 5 from around 225,000 users.

Square POS Pricing

Square POS offers a completely free plan. It has no setup fees or monthly fees—all you pay are processing fees on credit and debit card payments. This is true for the generic POS, Square for Retail, Square for Restaurants, and Square Appointments. However, all of the industry-specific POS systems also have more advanced plans you can upgrade to for a competitive monthly fee.

Overall, Square’s pricing is extremely transparent and predictable. It has flat-rate, pay-as-you-go transaction fees and month-to-month billing for software products. There are no contracts or long-term agreements regardless of your plan, and users can add or change any add-on subscriptions at any time. You can also cancel at any time with no termination fees.

- Point-of-sale app: Free; Industry-specific POS plans available for from $29–$89 per month, per location

- Online ordering and ecommerce: Free; upgrades available from $29–$79 per month

- Payroll: $35 per month plus $6 per employee

- Team management: Free; upgrade to Team Plus at $35 per month, per location

- Email marketing: Starts at $15 per month for up to 500 customer contacts

- Text message marketing: Starts at $20 per month for up to 250 customer contacts

- Loyalty program: Starts at $45 per month, per location, for up to 500 loyal visits

- In-person: 2.6% + 10 cents per transaction

- Invoices: 3.3% + 30 cents per transaction

- Ecommerce sales: 2.9% + 30 cents per transaction

- Recurring billing and card-on-file transactions: 3.5% + 15 cents per transaction

- ACH payments: 1%, $1 minimum per transaction

- Buy Now, Pay Later (BNPL): 6% + 30 cents (via Afterpay)

- Keyed-in payments: 3.5% + 15 cents per transaction

- Volume discounts: Square will create custom pricing packages for any business processing over $250,000 in credit card sales

Square Fee Calculator

Square Hardware

The Square POS app can be downloaded and used on any iOS or Android device, and the browser-based Square Dashboard can be accessed from any computer. To process transactions using Square, you just need to connect a card reader to your smartphone or tablet.

Square also has several full POS hardware setups available that you can use with, or instead of, a smartphone or tablet.

Square Card Readers

Square Reader for Magstripe | Square Reader for Contactless and Chip |

|---|---|

|  |

First unit free; additional unit $10 | 1st generation $49; 2nd generation $59 |

Accepts payments via magstripe (swiped); available in jack or lightning connector | Bluetooth reader that accepts EMV (chip) and NFC (Apple Pay, Google Pay) payments |

Square POS Registers & Terminals

Square Stand for Contactless and Chip | Square Terminal | Square Register |

|---|---|---|

|  | |

$149 or $14 per month for 12 months | $299 or $27 per month for 12 months | $799 or $39 per month for 24 months |

All-in-one credit card machine with POS, card reader, and receipt printer add-ons | Standalone mobile POS that can take orders, accept card payments, and issue receipts | Full POS with touch-screen monitor, detachable customer-facing display, and credit card machine |

Square Hardware Kits

Square Stand Kit | Square Register Kit |

|---|---|

|  |

$619 | $1,199 |

|

|

Note that every new Square account also comes with a free magstripe card reader that connects to iOS or Android smartphones and tablets to accept credit card payments. Square says to expect your card reader in 10 days, but in our experience, it usually doesn’t take that long.

However, I recommend purchasing an EMV/chip reader since it makes your transactions more secure. These readers start at $49. Square offers interest-free payment plans for larger hardware purchases like Square Stand (if you want to use your iPad) or Square Terminals.

Square POS Features

Square is an all-in-one POS solution that’s easy to use. Its ecosystem includes a variety of POS features and business management tools that allow users to scale easily. Most of Square’s POS features are available on the free plan.

Checkout and Register Tools

Square’s checkout tools are the most comprehensive we’ve found in a free POS. Most small businesses are able to process their first sale within an hour or two after creating a Square account. No other POS we have encountered has such a short setup time, especially with integrated payment processing and online ordering.

Your Square POS will accept:

- Cash

- Checks

- All major credit and debit cards

- Apple Pay

- Google Pay

- Cash App

- Plastic and e-gift cards

- Invoice payments

- Online payments

- Tap-to-pay on iPhone and Android

- Buy now, pay later through Afterpay

Once your store is set up, you can accept card payments right away by manually entering card numbers into the POS or you can connect a Square card reader.

Alternatively, Square’s tap-to-pay feature allows users with an iPhone 11 or later (running on iOS 15.5 or later) to accept credit and debit cards and mobile wallet payments simply by tapping the iPhone. No card reader is necessary.

Your Square POS can scan barcodes with an attached barcode scanner or use the integrated iPad camera. Square also supports split payments and customizable digital and physical receipts, collects customer data, and includes customer feedback tools at checkout.

You can import items using the bulk import tool in the Square dashboard. Additionally, you can refund sales, apply discounts, and accept online and third-party orders directly in your POS.

Square Management Tools

One downside of Square is that while its management tools are enough for small stores and startups, active businesses may find Square’s functionalities easy to outgrow.

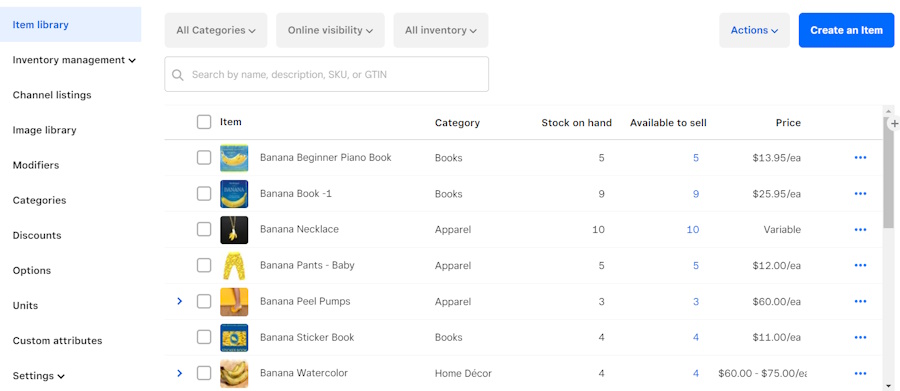

Inventory Management

Square lost some points for inventory management because detailed inventory tools require third-party integrations, and its reports are not as customizable as some other paid POS subscriptions. Your Square POS will send you automated emails to alert you to low stock.

I have personally tested this feature and found that the alerts reliably appear in my inbox (until I turn them off or replenish the stock). However, if you need vendor or purchase order management, you’ll need to add a third-party integration with an app like Shopventory or SKU IQ.

Learn more about inventory management for this POS with our in-depth Square Inventory Management guide plus video.

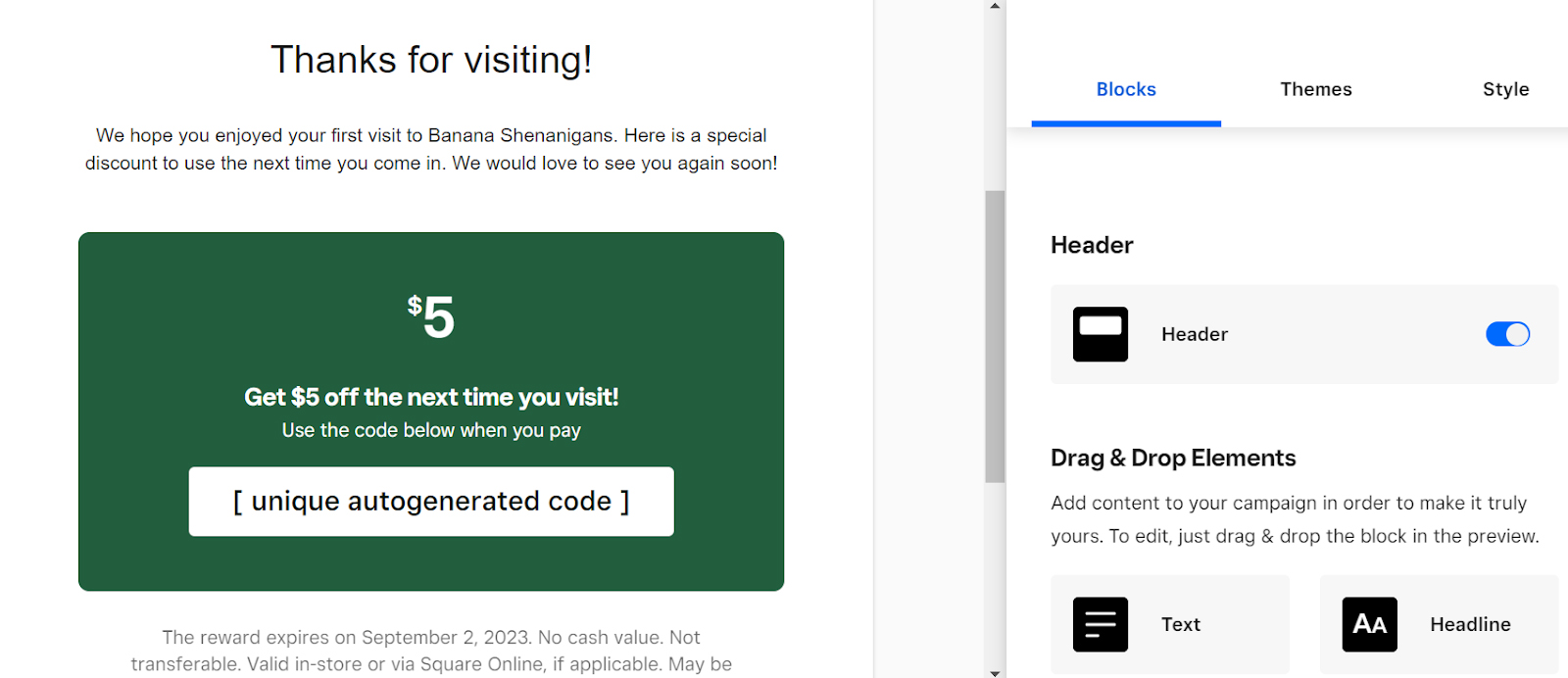

Marketing Tools

Square POS offers excellent marketing and employee management tools. Its email and text marketing modules are both templated and easy to use. It lets you quickly design sharp-looking messages to send to your customers. You can also set it and forget it; after you create an automated text or email message chain, Square will automatically send customers the relevant message based on their purchases or behavior.

You can create and customize marketing materials from the POS dashboard before sending them out to customers.

Pricing for both marketing tools is based on the number of messages sent. So, you only pay for what you use, which is great for small businesses that want access to big business tools.

Team Management

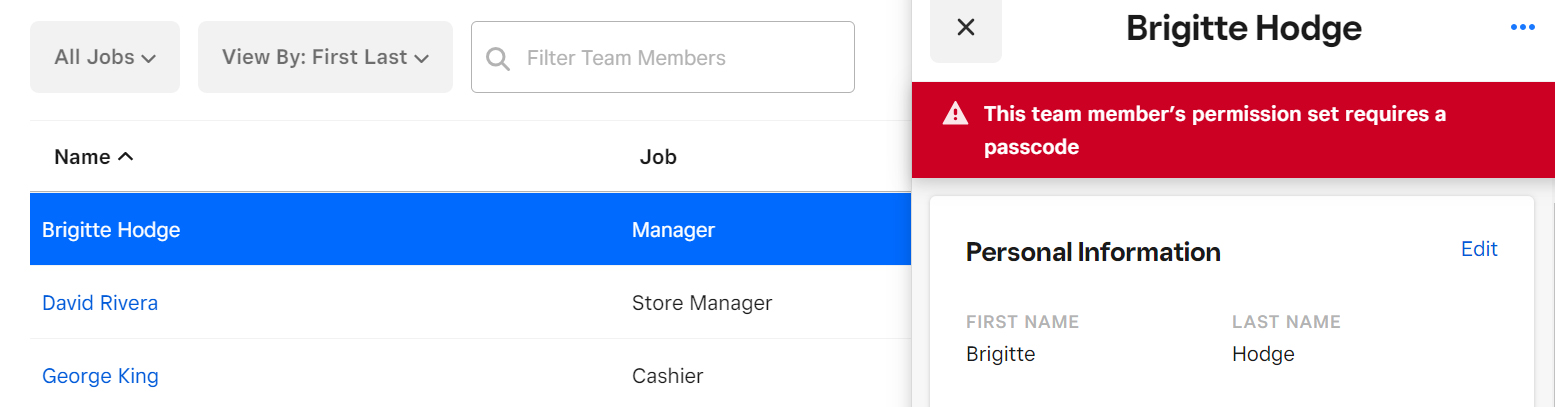

Square’s basic employee management module, Square Teams, is included in the Square POS. This allows your employees to clock in and out at the POS. You can also set up customized user permissions to control what functions each employee can perform.

More advanced features like employee scheduling and detailed performance reporting require an upgrade to a paid Team membership, which starts at $35 per month, per location (a 30-day free trial is available).

Photo Studio App

Square has a free photo-taking and editing app for iPhone called Photo Studio. Apart from letting you take photos that you can then use for marketing or to improve the look of your online store, the app also provides tips for optimizing lighting and framing. There is even a built-in camera stabilizer to keep your images sharp and consistent.

As for photo editing, you’ll have AI assistance for changing backgrounds, editing shadows, and manipulating factors like contrast, saturation, and image rotation. After editing, you can sync the photos with the item catalog in your Square POS. You can also create a payment link in the app itself, and then add this to your business’ social media page.

In Square’s Photo Studio App, you can edit various aspects of your product photos (with AI assistance) to make them look as good as possible for your online store. (Source: Square)

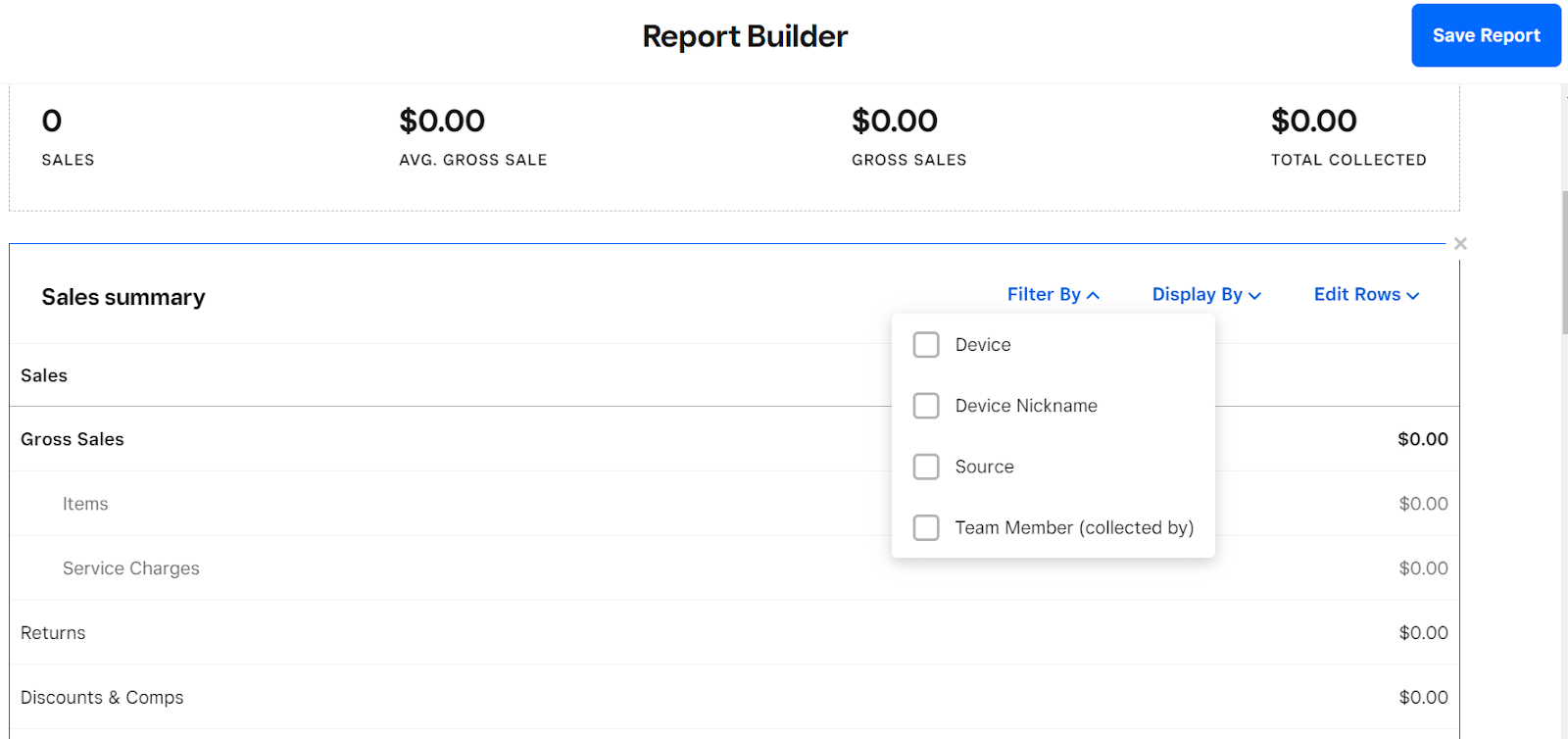

Reporting

Square has reporting features available both in the desktop POS and on mobile, though certain advanced functions (such as labor vs sales reporting) will require a paid upgrade.

For desktop POS reports, you can view performance based on several different categories such as individual item sales, team sales, and even labor costs vs sales. You can also review any discounts that were applied over a specific period, along with gift cards availed, voids, comps, and taxes paid.

Finally, you can create custom reports that allow you to see exactly the data you need; you’ll have options to filter data by team member, device, and source of the sales.

You can choose to view data either in one of several templated formats or by creating a custom report.

As for reporting on Square’s mobile app, it allows for most of the same data viewing options: overall sales over time, cash drawer history, disputes, and gift cards. However, I was not able to find a custom report builder in the mobile app.

On both the desktop and mobile dashboards, you can specify the time period over which you want to gather data as well as the device or source of the data.

Employee Management

Square includes free team management and scheduling features, though a Plus version ($35 per month per location; 30-day free trial) is available to unlock advanced functionality.

The free version gets you basic settings for access permissions, as well as personal passcodes for employees to access devices, perform functions like giving out discounts, and generally improve POS security. You can, of course, also view current team members and add new ones.

For improved security, you can require a passcode input to change team member permissions.

With the Plus plan, you’ll get unlimited customizable access, team member badges, sales reporting and performance per team member, and more. You’ll also be able to set commissions for team members, giving them greater incentives to improve their performance. These commissions can be flat-rate or tiered, and you can integrate them into employee payroll to make accounting easier.

Square POS Ease of Use & Customer Support

Square is an incredibly user-friendly system. Plus, it maintains a seller site with tons of articles, blogs, videos, and community resources. Unique support features include in-app messaging in the mobile POS app and guided step-by-step tutorials.

Setup

As an all-in-one solution, Square POS is hands down the easiest POS for any user. The POS app works with iOS devices and its proprietary hardware requires minimal setup. There are no long-term contracts, nor is there any application process to start accepting payments with the built-in payment processor.

This makes Square POS incredibly popular with small business owners. We’ve seen the Square POS used for everything from pop-up shop vendors, gift shops, and small retailers, to food trucks, coffee shops, and craft fairs.

Learn how easy it is to set up Square with our Square POS video setup guide.

Built-in Payment Processor

Square requires businesses to use its built-in payment processor, which is certainly easy. The ease of setting up Square’s payment processing is part of what makes this POS so user-friendly. You just connect a bank account and go—no waiting for account approval.

But while Square’s rates are competitive, they are not the lowest available, especially for high-volume sales. You can, however, get a custom rate quote if you process more than $250,000 annually.

Customer Support

Live 24/7 support is available to certain customers who purchase software subscriptions or hardware. However, for free Square users, phone support isn’t always available.

Square’s support hours are limited to extended business hours, from 6 a.m. to 6 p.m. Pacific time, Monday through Friday, and only available to active customers, so it can be a hassle if you need to get support quickly.

However, the online seller community is very active with advice from other Square users and the Square support team.

Square POS Expert Score

Square POS is hands down the easiest POS for any user to set up. The free price tag and the wide range of hardware options make the Square POS one of the best available POS systems for all business types—plus, it is also incredibly popular with small business owners. We’ve seen the Square POS used for everything from pop-up shop vendors, gift shops, and small retailers, to food trucks, coffee shops, and craft fairs.

Square POS is truly designed to serve the smallest businesses that are typically overlooked by large POS brands. The processing rates and limited customization options make this system a bit too niche for large or high-volume businesses. If you like the Square ecosystem and have a high-volume business, you should consider Square’s paid POS platforms Square for Retail, Square for Restaurants, or Square Appointments, instead.

Methodology: How We Evaluated Square POS

When evaluating small business POS systems, we look for software that is affordable for independent business owners and includes basic POS functions like the ability to process multiple forms of payment, process discounts, and track inventory. We also looked for systems that support multiple business types or dominate in the industry they serve.

Using those criteria, Square emerged as the highest-scoring POS system for most individuals and small businesses.

Click through the tabs below to see the full evaluation criteria.

30% of Overall Score

20% of Overall Score

Businesses need speedy and customizable checkout tools, easy customer management, mobility to sell anywhere, a process to track orders, and a way to process online orders. Because the way businesses operate has changed so much in recent years, we also considered contactless payments, integrated online ordering, and online store features.

15% of Overall Score

15% of Overall Score

20% of Overall Score

Frequently Asked Questions (FAQs)

These are some of the most common questions we get about Square POS.

Small businesses and solopreneurs who need a mobile, free POS that operates in English or Spanish should check out Square. Small businesses that need multi-channel tools for in-person and online sales are also a great fit.

Businesses that process more than $250,000 annually or need advanced features like floorplans, matrix-level inventory, or appointment scheduling will be better served by Square’s sibling POS systems, Square for Retail, Square for Restaurants, or Square Appointments.

Yes, the software is free to use. All you need to pay are processing fees when you process digital payments.

Bottom Line

Square POS offers unbeatable value for new and small businesses or individuals looking to sell products or services. Instant setup, integrated payments, free software (including an online store), affordable and flexible hardware options, and modular add-ons make Square one of the best POS systems on the market. Visit Square to create a free account.

1 G2

2 Capterra

3 Apple App Store

4 Google Play Store