Return fraud, also called refund fraud or refund theft, is the deceptive practice of returning merchandise or abusing a return/refund process for monetary gain. In 2023, retail return fraud cost up to $101 billion in total losses, and every $100 of returned merchandise resulted in a loss of around $13.70 for retailers.

Businesses need to learn about return fraud and how to prevent it, as this type of fraud directly impacts profitability, reputation, inventory accuracy, and operational efficiency.

Key takeaways:

- Return fraud poses a significant threat to small businesses, with losses totaling up to $101 billion in 2023 alone, highlighting the importance of proactive prevention measures.

- Implementing clear return policies, training staff on fraud detection, and utilizing technology solutions are crucial steps in preventing return fraud and safeguarding businesses’ financial health.

- Prioritizing fraud prevention efforts and fostering transparency and communication with customers can help mitigate risks and minimize financial losses.

Return policies are essential factors in customer satisfaction. According to a customer research study, 86% of online consumers check the refund policy before making a purchase and 84% say that the merchant’s return policy is an important consideration when shopping online. These policies offer reassurance and protection for buyers when a product does not fit or function well.

However, nestled within these policies lies the risk of return fraud for businesses. Fraudsters may shoplift an item and then return it for a refund, or a shopper may purchase clothing, use it, and then return it.

Related:

- Ecommerce Return Rates: Expert Guide for Small Businesses

- How to Write a Retail Return Policy (& Free Templates)

Types of Return Fraud

There are many different types of return fraud. Here are some of them:

Wardrobing

Wardrobing occurs when customers purchase items to use temporarily, such as for a special event, and then return them for a refund. This practice is particularly common with clothing, accessories, and electronics. Despite the items being used, customers exploit lenient return policies to return them for a full refund, resulting in financial losses for businesses.

Receipt Fraud

Receipt fraud involves the manipulation or fabrication of receipts to falsely claim returns. This can include using counterfeit receipts, altering genuine receipts, or even stealing receipts from legitimate purchases.

Fraudsters use these falsified receipts to deceive businesses into accepting returns for items that were never purchased or were obtained through illegitimate means.

Price Switching

Price switching occurs when a customer purchases an item at a lower price and then attempts to return it at a higher price to fraudulently profit from the price difference. This may involve switching price tags, swapping items with similar-looking but cheaper products, or exploiting discrepancies between online and in-store prices.

Return of Stolen Merchandise

Return of stolen merchandise involves individuals stealing items from stores and then attempting to return them for a refund or store credit without a receipt. This not only results in financial losses for businesses but also contributes to increased security and operational costs as businesses implement measures to prevent theft.

Related: Retail Theft Prevention Tips for Small Businesses

Bricking

Bricking involves fraudsters substituting functional products with non-functional or worthless items before returning them. This could involve stripping the item of valuable components and parts and then returning them as defective items.

Item Not Received

Item not received or INR fraud is a type of fraud where the buyer claims that the item was not delivered and then files for a refund. In this type of fraud, the buyer has already received the item.

Business Impact of Return Fraud

Return fraud poses significant financial and operational challenges for businesses, impacting their bottom line and eroding trust with customers. It is a more serious concern for online businesses, with online retail return rates at 17.6%, while brick-and-mortar store return rates are at 10%. Some key impacts include:

Financial Losses

Return fraud results in direct financial losses for businesses through fraudulent refunds, store credits, or exchanges. These losses are not small dents in revenue, especially for small businesses. Every $1000 in revenue may result in as much as $137 lost to return fraud—a significant amount that can greatly affect the bottom line of small businesses.

Inventory Distortion

Fraudulent returns distort inventory records, leading to inaccuracies in stock levels and potentially affecting purchasing decisions and supply chain management. Businesses may struggle to maintain optimal inventory levels, resulting in stockouts, overstocking, or excess inventory carrying costs.

Increased Operational Costs

Return fraud necessitates additional resources and efforts to combat fraudulent activity and mitigate its consequences. Businesses must allocate funds for implementing fraud prevention measures, such as staff training, technology solutions, and enhanced inspection protocols.

Additionally, the need for thorough inspection and verification of returned merchandise adds to the workload of staff involved in return processing, leading to increased labor costs. These heightened operational expenses strain a business’s budget and detract from other critical areas of operation, impacting overall efficiency and profitability.

How to Prevent Return Fraud

Due to the prevalence of return fraud and its negative impact on businesses, having a return and refund policy is good business practice. Knowing how to prevent return fraud can help minimize its negative impact.

- Implement clear and enforceable return policies: Establish clear and solid return policies that outline eligibility criteria, such as time limits, condition requirements, and acceptable proof of purchase. Enforce these policies consistently to deter fraudulent returns and maintain accountability among customers. Here are some examples of stricter policies that some businesses enforce:

- Impose a small return fee

- Limit the return period

- Require receipts

- Offer replacements or store coupons instead of refunds

Related: What is Returns Management: Definition & Strategies

- Train staff on fraud detection: Provide comprehensive training to frontline staff on how to identify potential signs of return fraud, such as suspicious behavior, altered merchandise, or counterfeit receipts. Equip them with the knowledge and resources to handle fraudulent returns effectively and escalate concerns to management when necessary.

- Utilize technology solutions: Leverage technology solutions, such as point-of-sale systems with fraud detection capabilities, barcode scanning software, and inventory tracking tools, to enhance the accuracy and efficiency of return processing. Implement measures like serial number verification for high-value items to verify the authenticity of returned products.

- Enhance inspection protocols: Establish rigorous inspection protocols for returned merchandise, including visual inspections, product testing, and verification of serial numbers or unique identifiers. Train staff to conduct thorough inspections to detect any signs of tampering, damage, or counterfeit items.

Related: Store Management: Managing a Retail Shop for Success

- Regularly analyze return data for signs of fraud: Monitor metrics such as return rates, reasons for returns, and customer behavior to pinpoint potential areas of concern and proactively address them. Check if there are customers who are serial returners and review the return reasons if they are legitimate.

- Foster a culture of transparency and communication: Encourage open communication with customers regarding return policies, procedures, and expectations. Clearly communicate the consequences of fraudulent behavior, such as loss of refund eligibility or account suspension, to deter fraudulent activity. For ecommerce stores, include a link to your return policy on every product page and the cart summary page. You may even require customers to accept the returns policy before placing their order. For brick-and-mortar stores, prominently label products that are non-returnable and include a clear and concise return policy in the receipt that customers need to sign.

Return Fraud Statistics

Here are some quick statistics on returns and return fraud according to the National Retail Federation 2023 report and the Happy Returns 2023 report:

- The total retail returns for 2023 are $743 billion, which is 14.5% of total sales.

- The percentage of returns that are fraudulent is 13.7%, which amounts to $101 billion.

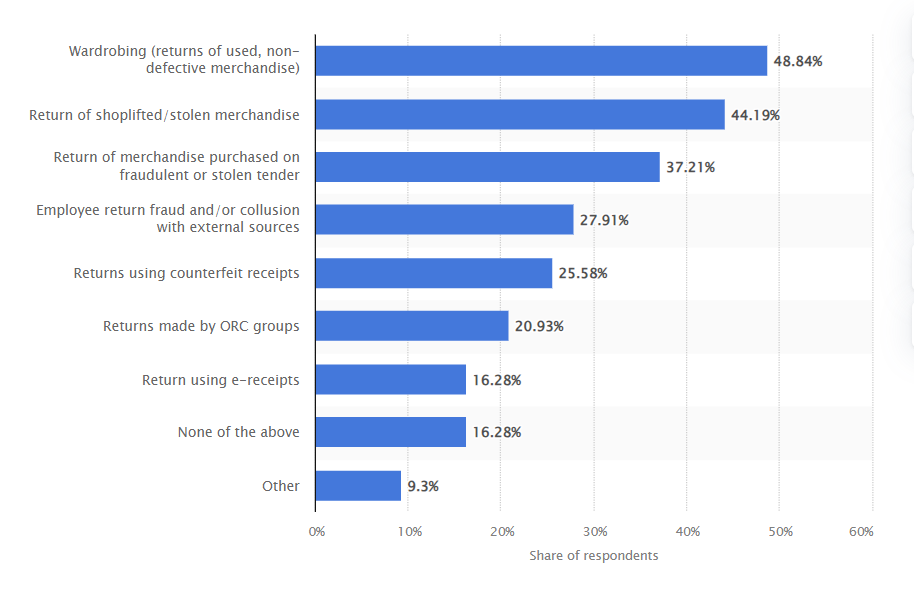

- The most common type of return fraud is wardrobing (48.84%), followed by the return of shoplifted/stolen merchandise (44.19%), and the return of merchandise purchased with fraudulent or stolen tender (37.21%).

The most common types of return fraud experienced by merchants. (Source: Statista)

- 81% of surveyed merchants in 2023 have started charging for at least one return method.

- 33% of merchants reported losing customers after implementing return fees.

- 81% of surveyed shoppers read return policies before shopping with a merchant.

- 91% of shoppers are more likely to shop with merchants that offer free in-person returns with immediate refunds

- 99% of merchants say returns fraud is a significant issue, with 69% seeing it as a very significant problem.

Return Fraud Frequently Asked Questions (FAQs)

Click through the sections below to read answers to common questions about return fraud:

Purchase return fraud involves criminals obtaining Point-of-Sale (POS) devices and programming them with credentials from legitimate merchants to clone the devices. They then use these cloned devices to process fraudulent purchase return transactions, often to gift cards, ranging from $2,000 to $6,000 per transaction.

Return abuse refers to the exploitation of a retailer’s return policy for personal and financial gain, such as habitual returning of items without legitimate reasons or the fraudulent manipulation of return processes to obtain refunds or store credits dishonestly.

Yes, returning a used item can be considered return fraud if the item was purchased with the intent of using it and then returning it after a specific event or timeframe. However, some legitimate returns involve used products that didn’t meet promised specifications or quality standards.

Bottom Line

Return fraud is a significant financial threat to small businesses. Aside from financial losses, it compromises inventory management and operational efficiency. Implementing clear return policies, training staff on fraud detection, utilizing technology solutions, and enhancing inspection protocols are crucial steps in preventing return fraud and mitigating its negative impact on businesses.