ZipBooks and Wave are cloud-based accounting programs, and both offer a free option. Wave is a better choice for companies that have transactions in multiple currencies, whereas ZipBooks is better for service firms that bill clients by the hour. While ZipBooks doesn’t currently have a mobile application, Wave has an app that allows you to create invoices and accept payments on the go. Also, ZipBooks allows you to track time and track income and expenses by project, and Wave does not.

- ZipBooks: Best for service firms that bill by the hour

- Wave: Best free software for basic bookkeeping needs

Neither ZipBooks nor Wave is adequate software if you have inventory. We recommend QuickBooks Online for inventory accounting. QuickBooks also has the advantage of a huge network of independent ProAdvisors to help you.

- QuickBooks Online: Best for small businesses with inventory or wanting local bookkeeping help

ZipBooks vs Wave at a Glance

|  | |

|---|---|---|

Monthly Pricing Plans | $0 to $35 | $0 or $16 |

Maximum Users | 1 to unlimited | 1 or unlimited |

Bank Reconciliation | ✓ | ✓ |

Send Invoices & Track Collections | ✓ | ✓ |

Manage Unpaid Bills | ✓ | ✓ |

Track Inventory | ✕ | ✕ |

Multiple Currencies | ✕ | ✓ |

Capture & Organize Receipts | ✕ | ✕ |

Manage 1099 Contractors | ✓ | ✓ |

Time Tracking | ✓ | ✕ |

Track Income & Expense By Project | ✓ | ✕ |

When To Use

Fit Small Business Case Study

We used our FSB case study to evaluate ZipBooks and Wave across 15 key areas. You can read our full ZipBooks review and Wave review for detailed analysis and information. Here are the results:

ZipBooks and Wave FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

ZipBooks $0 to $35 monthly; $35 as tested

-

Wave Free or $16 monthly; $16 as tested

In the chart above, we compared ZipBooks Sophisticated plan and Wave’s Pro plan. The two software products seem to be on par with each other across many features, but ZipBooks has the advantage in terms of project accounting, reporting, and integrations.

Which Accounting Software is Right for you?

ZipBooks vs Wave: Pricing

ZipBooks | Wave | |

|---|---|---|

Monthly Pricing | $0 to $35 | $0 or $16 |

Number of Users | 1 to unlimited | 1 or unlimited |

Number of Billable Clients | Unlimited | Unlimited |

Free Trial (Paid Plans) | 30 days | ✕ |

Businesses looking for an affordable option will be satisfied with either ZipBooks or Wave, which both offer the most basic bookkeeping services for free. While ZipBooks’ pricing increases based on the number of users and available features, Wave only supports a single user in the free plan and provides unlimited user access in the paid version.

ZipBooks’ pricing may make it attractive to sole proprietors and microbusinesses. It offers a free starter plan and three paid plans, including an accountant version, which start at $15 per month, depending on the number of users and features required. The Accountant version allows you to manage clients from one dashboard.

- Starter: Free for one user

- Smarter: $15 for five users

- Sophisticated: $35 for unlimited users

- Accountant: Custom priced for unlimited users

ZipBooks is a great accounting program for growing businesses. Businesses using the free version can upgrade to Smarter or Sophisticated anytime the need arises. And accountants who offer bookkeeping and accounting services on ZipBooks can connect to your ZipBooks account easily.

Wave offers a free version (Starter) for a single user and a paid subscription option (Pro) for unlimited users. Both plans include basic accounting and invoicing tools, but Pro provides more features, like unlimited user access, receipt capture, bank feed connections, and discounted credit card processing fees.

Add-ons available:

- Receipt scanning: $11 monthly or $96 annually (Starter only; free in Pro)

- Bookkeeping support: $149 per month (available in Starter and Pro)

- Assisted payroll: $40 monthly for tax service states and $20 monthly for self-service states plus $6 monthly per employee

Takeaway: ZipBooks charges for plans with advanced features, some of which are available for free with Wave. However, other features in the ZipBooks advanced plans aren’t found in Wave.

ZipBooks vs Wave: Features

ZipBooks Starter | ZipBooks Smarter | ZipBooks Sophisticated | Wave Starter | Wave Pro | |

|---|---|---|---|---|---|

Monthly Pricing | Free | $15 | $35 | Free | $16 |

Unlimited Invoicing & Billing | ✓ | ✓ | ✓ | ✓ | ✓ |

Accepting Digital Payments | ✓ | ✓ | ✓ | ✓ | ✓ |

View Basic Reports | ✕ | ✓ | ✓ | ✓ | ✓ |

Create Recurring Invoices | ✕ | ✓ | ✓ | ✓ | ✓ |

Bank Connections | One | Five | Unlimited | ✕ | Unlimited |

Time Tracking | ✕ | ✓ | ✓ | ✕ | ✕ |

Tag by Location, Projects, or Custom Tags | ✕ | ✕ | ✓ | ✕ | ✕ |

Bank Reconciliation | ✕ | ✕ | ✓ | ✓ | ✓ |

ZipBooks vs Wave: Accounts Payable

ZipBooks | Wave | |

|---|---|---|

Manage & Track Unpaid Bills | ✓ | ✓ |

Capture Expense Receipts | ✕ | ✕ |

Create Recurring Payments | ✓ | ✓ |

Record Purchase Order | ✕ | ✕ |

Enter a Vendor Credit | ✕ | ✕ |

Pay an Independent Contractor | ✓ | ✓ |

ZipBooks’ accounts payable (A/P) features work great for recording unpaid bills. Users can create vendors, designate vendors as 1099 contractors, and assign bills to expense accounts. The form layout of ZipBooks’ bill creation window is simple and easy to understand. You can add attachments to support your entry and even enter the payment terms. Since ZipBooks doesn’t have inventory tracking, the software doesn’t ask for quantities of goods ordered. You’ll need to use a spreadsheet to keep track of inventory units and costs.

Wave shares the same features as ZipBooks and is also a great application for tracking and managing unpaid bills. Unlike ZipBooks, Wave asks about the quantity of the goods you ordered. This feature puts Wave at a slight advantage over ZipBooks since it shows the number of units, which can be vital for manually tracking units.

ZipBooks vs Wave: Accounts Receivable

ZipBooks | Wave | |

|---|---|---|

Create & Send Invoices | ✓ | ✓ |

Customize Invoices With Logo | ✓ | ✓ |

Email & Print Invoices | ✓ | ✓ |

Choose From Different Invoice Templates | ✕ | ✓ |

Create Recurring Invoices | ✓ | ✓ |

In accounts receivable (A/R), we’re looking for invoice customization and invoice management features. ZipBooks doesn’t offer a lot of customization options for invoices. There’s no option to change the layout or color of the invoice. However, you can add your logo and include a personalized message.

ZipBooks compensates for this missing feature by allowing unbilled expenses to be added to invoices. This feature is often reserved for the higher and more premium plans of accounting software like QuickBooks Online Plus. If you like this feature, you must upgrade to Sophisticated. For only $35 a month, you get a flagship feature for an extremely low price.

Invoices in Wave are a bit better looking than those in ZipBooks. You can upload your company logo in either Wave plan and change the invoice theme color in the paid plan. When creating invoices, you can directly add a new customer, which makes Wave easier and more efficient to use. It also includes premium features, like creating recurring invoices and detailed tax reports, which aren’t present in ZipBooks unless you upgrade to ZipBooks Sophisticated.

ZipBooks vs Wave: Reporting

ZipBooks | Wave | |

|---|---|---|

Balance Sheet | ✓ | ✕ |

Profit & Loss (P&L) Statement | ✓ | ✓ |

Statement of Cash Flows | ✓ | ✓ |

A/R Aging | ✕ | ✓ |

A/P Aging | ✓ | ✓ |

Income/Loss by Month | ✓ | ✕ |

Income/Loss by Customer | ✓ | ✕ |

Income/Loss by Class | ✓ | ✕ |

Income/Loss by Location | ✓ | ✕ |

Income/Loss by Project | ✓ | ✕ |

Unbilled Charges | ✓ | ✕ |

Unbilled Time | ✓ | ✕ |

Transaction List by Customer | ✕ | ✓ |

Expenses by Vendor | ✓ | ✓ |

General Ledger | ✓ | ✓ |

Trial Balance | ✓ | ✓ |

ZipBooks excels in its reporting features, with the ability to generate reports that we believe should be available in small business accounting software. A bonus is the variety of data-driven intelligence reports, which allow you an insight into your company’s performance. It will even assign your business a health score and score your completed invoices by quality. Wave offers only 12 reports, and it doesn’t allow for report customization. However, both ZipBooks and Wave allow you to export reports from the print screen.

ZipBooks vs Wave: Sales & Income Tax

ZipBooks | Wave | |

|---|---|---|

Add Sales Tax to Invoices | ✓ | ✓ |

Track Independent Contractors | ✓ | ✓ |

Adjust Sales Tax on Credit Memos | ✕ | ✓ |

View Sales Tax Liabilities in Detail | ✕ | ✓ |

Pay Sales Tax Liability | ✕ | ✕ |

File Sales Tax Returns | ✕ | ✕ |

You can add sales tax items in ZipBooks by jurisdiction and then add them to your invoices but, first, you need to encode sales tax rates in the settings. In ZipBooks Starter, you can include 1099 classification for independent contractors and charge sales taxes to invoices. Wave also shares the same features, plus creating sales tax adjustments on credit memos and viewing sales tax liabilities in detail. However, you can’t file sales tax returns and pay sales tax liability within ZipBooks or Wave.

ZipBooks vs Wave: Ease of Use

ZipBooks | Wave | |

|---|---|---|

Accessibility | Cloud | Cloud |

Set Up in a Few Minutes | ✓ | ✓ |

Shortcut Buttons | ✓ | ✓ |

Unlimited Customer Support | ✕ | ✕ |

ZipBooks and Wave are designed for the accounting novice, and both make it easy to find what you’re looking for without the need to spend much time learning the software.

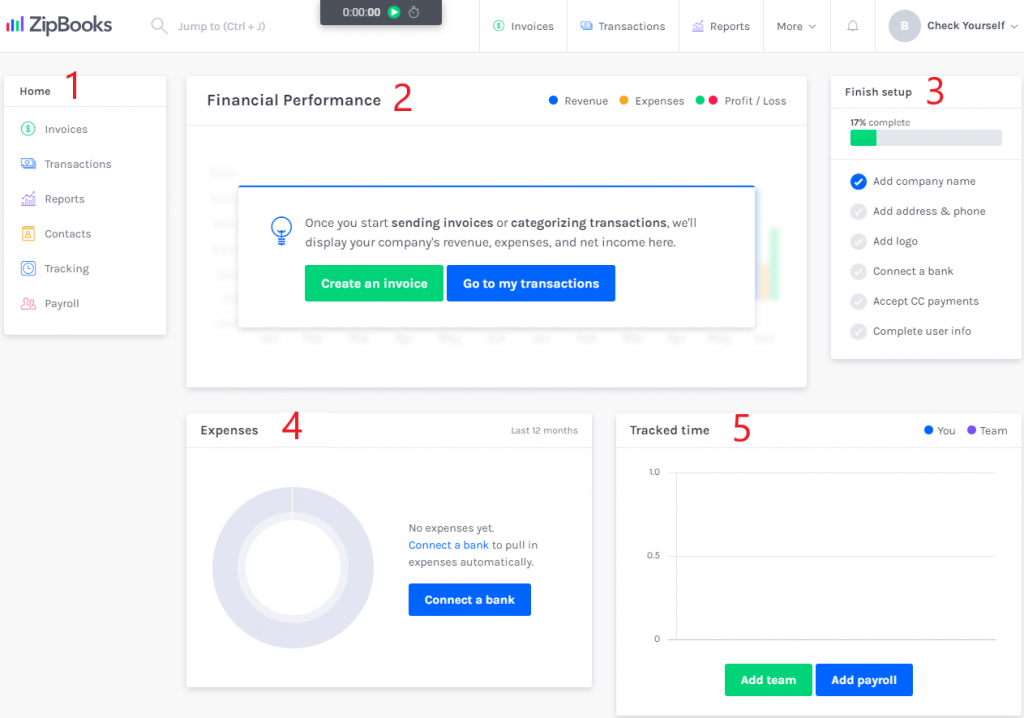

Upon sign-in, ZipBooks displays a financial performance dashboard that provides a summary of all recent expense and invoicing activity. An intuitive user interface means less time learning the application. Navigation is easy, with the vertical menu to the left of the main screen offering quick access to all system functions:

ZipBooks dashboard

- Home: The navigation bar on the left side gives you access to Invoices, Transactions, Reports, Contacts, Tracking, and Payroll. You can also access these at the top of the page.

- Financial performance: This report is shown in graph format and is a summary of your business’ revenue, expenses, and net income.

- Finish setup: This is displayed to show your progress with tasks needed to set up your account, including adding an address and phone number, adding a logo, and connecting a bank.

- Expenses: After you connect your bank account, your transactions will be downloaded and displayed here automatically.

- Tracked time: This feature summarizes your unbilled time so that you can see the status of what is yet to be invoiced. There is also a timer at the top of the page, which you use and then import into ZipBooks.

Sending a Simple Invoice

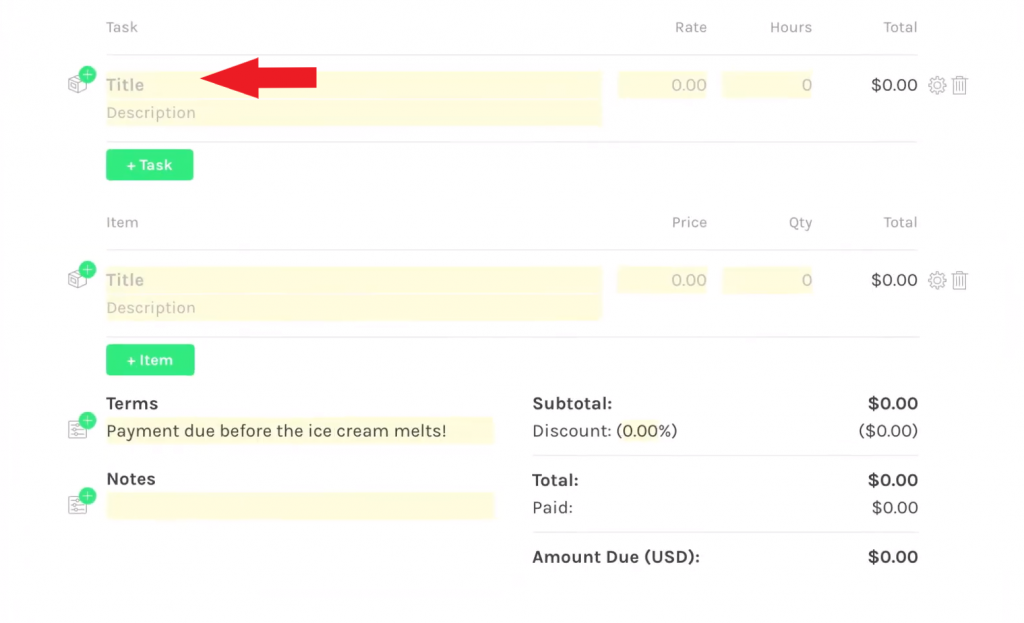

Adding a line to a ZipBooks invoice

Because the Starter version doesn’t use items on its invoices, you type the description you want on each line of the invoice. For this reason, we included it as the best free software for simple invoices in our roundup of the best free accounting software. However, while it’s simple, it’s also inefficient because you’ll need to retype product and service descriptions in each invoice.

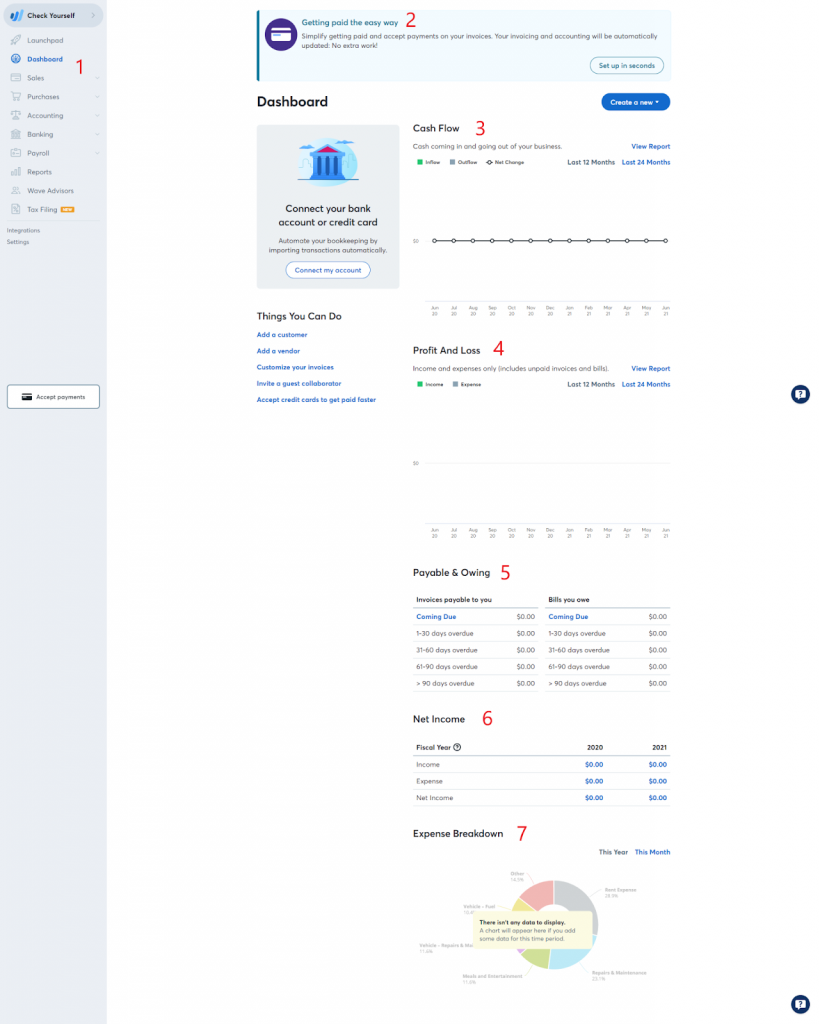

Wave also has a dashboard that displays current business performance along with a cash flow graph, a two-year net income summary, and a graph that illustrates expenses by category. You accept credit cards on invoices by going through the setup process on this page:

Wave dashboard

- Left navigation bar: Use this section to navigate to various sections of the software, including Sales, Purchases, Accounting, Banking, Payroll, Reports, Wave Advisors, and Tax Filing.

- Accept payments: This feature walks you through accepting credit card payments on your invoices and signs you up for Payments by Wave.

- Cash flow: This report reflects the cash going in and out of your business.

- Profit and loss: This report shows income and expenses only, including unpaid invoices and bills.

- Payable and owing: This section summarizes both invoices payable to you and unpaid bills, broken down by aging periods.

- Net Income: This is a two-year comparison that shows income, expense, and net income figures.

- Expense breakdown: This graph illustrates your expenses by category so that you can view what percentage is spent in each.

ZipBooks vs Wave: Assisted Bookkeeping

ZipBooks | Wave | |

|---|---|---|

Assisted Bookkeeping Service | ZipBooks | Wave Advisors |

Monthly Pricing | Starting at $125 | Starting at $149 |

Access to Experts | ✓ | ✓ |

Communication | Live chat and chatbot | Live chat and email |

Account Reconciliation | ✓ | ✓ |

Bookkeeping Advice | ✓ | ✓ |

User-friendly Dashboard | ✓ | ✓ |

1099 Reporting & Preparation | ✓ | ✕ |

Accounting & Payroll Coaching | ✕ | ✓ |

ZipBooks doesn’t provide assistance with the preparation and filing of income tax returns, but it offers bookkeeping and tax support services for an additional monthly fee, providing you with a dedicated bookkeeper and online support. Prices range from $125 per month for Simple Bookkeeping to $145 per month for more advanced bookkeeping. Form 1099 reporting and preparation starts at $175 per month and includes all features of Simple Bookkeeping. The bookkeeping plans already include a ZipBooks plan.

Wave Advisors assist with bookkeeping, accounting coaching, and taxes. You can hire Wave Advisors to handle bookkeeping tasks such as categorizing bank transactions, performing bank reconciliations, and tax planning.

- Bookkeeping and payroll support: For $149 per month, Wave Advisors will categorize transactions, perform account reconciliations, and take care of your payroll.

- Accounting and payroll coaching: For a one-time fee of $379, Wave Advisors will help you set up your Wave account and teach you how to do the bookkeeping and payroll yourself.

ZipBooks vs Wave: Integrations

Neither ZipBooks nor Wave offers an extensive list of integrations, but with the addition of Zapier, Wave has significantly more offerings. However, the dozen integrations that ZipBooks offers cover basic business needs such as business management, payment acceptance, and appointment scheduling.

ZipBooks currently has 12 integrations, which include:

- Payments and ecommerce: PayPal, Square POS, Square for Retail, and Square Payments

- Customer relationship management (CRM): Spiceworks Network Monitor

- Appointment scheduling: Square Appointments

- Business management and automation: Slack, Asana, Google Drive, and Google Workspace

- Payroll and human resources (HR): GrandMaster Suite and eNETEmployer

Wave offers a limited number of integrations that include PayPal, Etsy, and Shoeboxed. It also supports a Zapier integration, which connects Wave with more than 1,000 add-ons. These include:

- Payments and ecommerce: Shopify, Square, Stripe, PayPal, and Etsy

- CRM: HubSpot, Pipedrive, and Harvest

- Email marketing: Automational, Mailchimp, and SendPulse

- Appointment scheduling: Calendly and Acuity Scheduling

- Business management and automation: Slack, ShipStation, FormStack Document, Google Sheets, and Approval Donkey

ZipBooks vs Wave: Mobile App Functionality

ZipBooks | Wave | |

|---|---|---|

Issue Invoices | ✕ | ✓ |

Accept Payments | ✕ | ✓ |

Enter Bills | ✕ | ✕ |

Capture Expense Receipts | ✕ | ✓ |

Assign Expenses to Customer or Projects | ✕ | ✕ |

Enter Bill Payments | ✕ | ✕ |

Categorize Expenses From the Bank Feed | ✕ | ✕ |

Record Time Worked | ✕ | ✕ |

Assign Time Worked to a Customer or Project | ✕ | ✕ |

View Reports | ✕ | ✕ |

Until ZipBooks updates its mobile app, you can use your device’s browser to access ZipBooks, which is very mobile-friendly. For an extra timesaver, you can create a shortcut on your phone for easier access. The Wave app is limited to sending invoices, receiving payments, and capturing receipts.

ZipBooks vs Wave: Customer Support

ZipBooks | Wave | |

|---|---|---|

Phone Support (Callback) | ✕ | ✕ |

Phone Support (You Make the Call) | ✕ | ✕ |

Live Chat Support | ✓ | ✓ |

Chatbot | ✓ | ✕ |

Email Support | ✕ | ✓ |

Self-help Resources | ✓ | ✓ |

Support is limited for both ZipBooks and Wave. ZipBooks offers a chatbot, live chat, and self-help information on their Help Center. Wave offers self-help information, and you can only access live chat and email support when you purchase an add-on in the free plan or upgrade to the Pro version. Overall, both software service providers have limited customer support. We recommend FreshBooks for the best customer support because users have multiple ways of contacting support.

Bottom Line

Both ZipBooks and Wave offer free plans for basic accounting needs, but ZipBooks has paid plans if you want more advanced features. ZipBooks can also track time and manage 1099 contractors, two features that aren’t available with Wave. Wave can handle multiple currencies, while ZipBooks cannot. While Wave has an app for invoicing customers and receiving payments, ZipBooks’ app is currently discontinued.