ZipBooks is a cloud-based accounting software that helps you balance your books effectively, get paid faster, and make informed business decisions through actionable insights. While not as powerful as its higher-priced competitors, I find it fairly easy to use and believe it’s a value-priced solution for small service-based businesses without intensive invoicing or bill payments. It’s not suitable for businesses with inventory or needing ecommerce integrations.

It offers a free option, and its paid plans start at only $15 per month. However, I recommend using the Sophisticated tier for $35 monthly as the lower plans are missing some pretty basic features that most businesses will need. Most importantly, you can’t customize your chart of accounts in the two lower-tier plans.

Reviewers seem to agree, rating ZipBooks high across ease of use, support, and value but a little lower for functionality. Most negative feedback is regarding the lack of basic features in the lower-tier plans. Overall, users definitely like ZipBooks.

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface; we immerse ourselves in every platform we review by exploring the features down to the finest nuances.

We have an extensive history of reviewing small business accounting software, and we stay up-to-date with the latest features and enhancements. Our first-hand experience, guided by our internal case study, helps us understand how the different products compare with each other and how they work in real-world scenarios.

Pros

- Sophisticated plan provides full-featured software for unlimited users

- Extremely easy to use

- Switch between cash and accrual accounting

- Integrated time tracking

- Assisted bookkeeping options

Cons

- Free and Smarter tiers lack some basic features

- No mobile app

- Cannot track inventory cost

- No integration for electronic bill payments to vendors

Are you looking for something different? Check out our list of the best small business accounting software.

Is ZipBooks Right for You?

Is ZipBooks Right for You?

ZipBooks Alternatives & Comparison

Here are a couple of articles where we provide an in-depth analysis of ZipBooks versus other popular accounting software.

ZipBooks Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Simple to use with no software installation | Free plan features are too limited |

| No unneeded features to wade through | Bank and payment processor connections sometimes need to be renewed |

| Integrated time tracker | No feature for deferred revenues |

| Support team is very responsive | |

Most who left a ZipBooks review praised the ease of use, layout, and user experience (UX). One reviewer even mentioned that they like the fact it only has the basic features they need, so they don’t have to “wade through” a bunch of unnecessary clutter. I think this reviewer makes a great point. By eliminating the advanced features included in programs like QuickBooks, ZipBooks improves on ease of use. Of course, if you need those advanced features, then ZipBooks probably isn’t right for you.

The vast majority of user dislikes center around the lack of features within the free plan, and I understand their frustration. While reviewing ZipBooks, I inadvertently activated a paid plan multiple times. When you click on a feature that requires a paid tier, it automatically upgrades you without asking you to confirm. It’s easy enough to change your subscription back to the free plan, but it’s a nuisance. ZipBooks provides a symbol next to features that require an upgrade, but you’ll need to watch carefully to stay on the free subscription.

Other criticisms were several years old and related to its below-average app, which is no longer available. I commend ZipBooks for shutting the app down instead of supporting an inferior product. Hopefully, it’ll put out a new and improved one soon.

Here is a summary of average ratings of ZipBooks reviews from major third-party websites:

ZipBooks Case Study

We used an internal case study to evaluate the fitness of ZipBooks in small business accounting. We emphasized 15 key areas in small business accounting and included other factors, like pricing and user reviews. Here are the results of our ZipBooks case study as compared to its direct competitors, QuickBooks Online Essentials and Wave:

ZipBooks vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

ZipBooks Sophisticated: $35 per month

-

Wave: Free forever

-

Quickbooks Essentials: $60 per month

Users love ZipBooks as it beats both QuickBooks Online and Wave in user reviews. Wave and ZipBooks Sophisticated scored pretty similarly across most categories, despite Wave being a completely free program.

However, ZipBooks is better than Wave at project accounting, reporting, and ease of setup. The ease of setup is particularly important when bringing an existing company into new software. ZipBooks allows you to import most of your important lists, such as accounts, customers, and vendors, whereas they’ll need to be manually entered in Wave.

ZipBooks is also better than QuickBooks Essentials for Project accounting. However, QuickBooks users who upgrade to QuickBooks Plus for $90 per month will have project accounting superior to ZipBooks.

Not surprisingly for a more expensive plan, QuickBooks Essentials dominated ZipBooks across almost every category. Wave also beat ZipBooks in a couple of categories—for ease of use because of its useful dashboard and the ability to create any transaction from a central location and for the mobile app, albeit with limited features.

ZipBooks Pricing

ZipBooks has three plans for business use and one plan for accountants. The Accountant plan has everything in the Sophisticated plan but is intended only for accountants who handle many clients.

Pricing & Features | Starter | Smarter | Sophisticated | Accountant |

|---|---|---|---|---|

Pricing (Cost per Month) | Free | $15 | $35 | Custom priced |

Users | 1 | 5 | Unlimited | Unlimited |

Connected Bank Accounts | 1 | Unlimited | Unlimited | Unlimited |

Invoices | Unlimited | Unlimited | Unlimited | Unlimited |

Accept Square & PayPal Payments | ✓ | ✓ | ✓ | ✓ |

Recurring Invoices | N/A | ✓ | ✓ | ✓ |

Time Tracking | N/A | ✓ | ✓ | ✓ |

Custom Tags | N/A | N/A | ✓ | ✓ |

Customized Chart of Accounts (COA) | N/A | N/A | ✓ | ✓ |

Cobranding | N/A | N/A | N/A | ✓ |

Access Client ZipBooks Account | N/A | N/A | N/A | ✓ |

I didn’t give ZipBooks perfect marks for pricing because I share users’ frustrations that the free plan doesn’t have the necessary features to be a really useful bookkeeping software. Specifically, you can’t customize your chart of accounts, which is troublesome and a basic feature rarely omitted from simple software. Even the Smarter tier for $15 per month doesn’t allow you to change your chart of accounts. However, the Sophisticated plan is really good and an excellent bargain at $35 per month for unlimited users.

ZipBooks Features

The platform offers competitive features that can be seen in other accounting software products. In this ZipBooks review, I’ll examine its Sophisticated tier’s features to help you determine if it’s a good fit for your business.

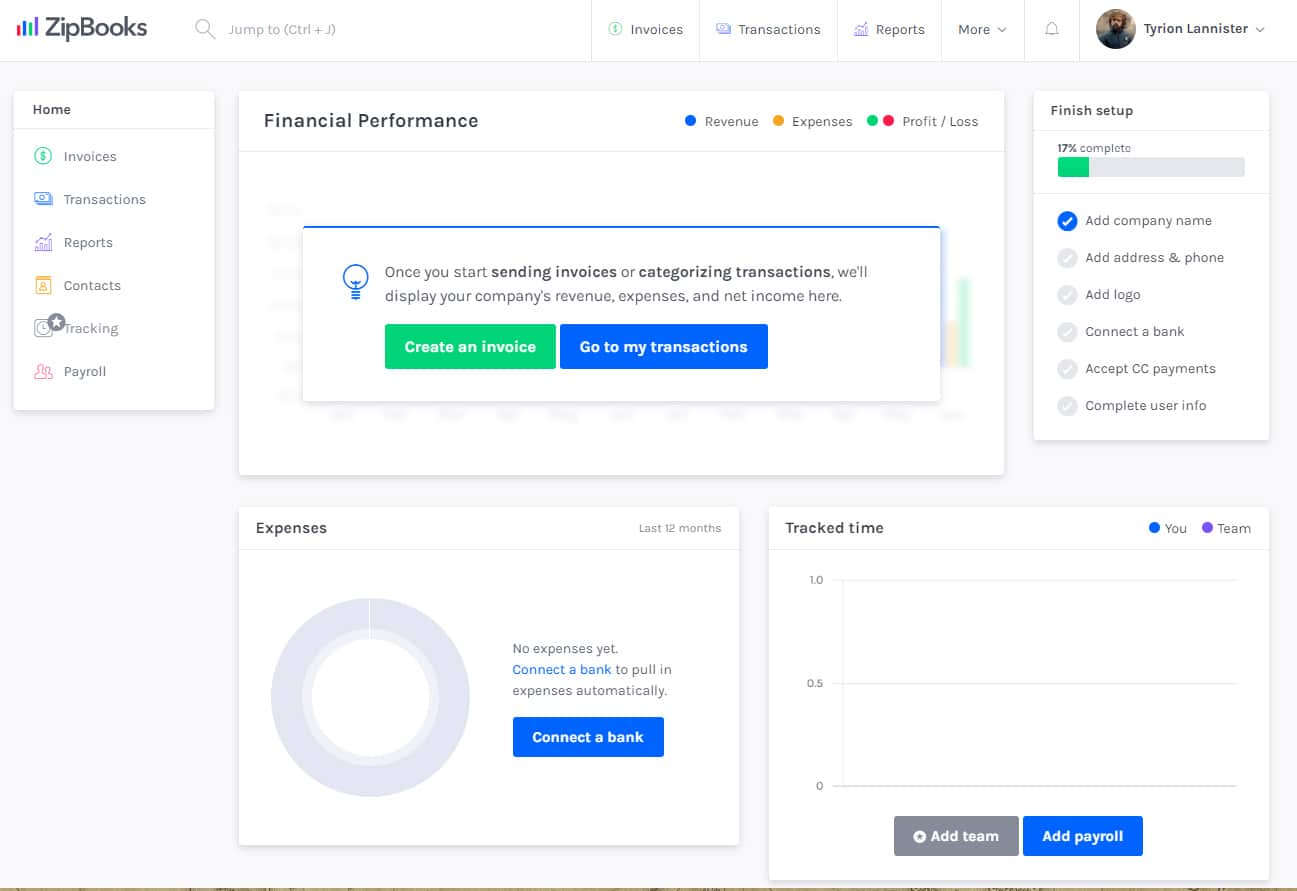

ZipBooks offers a fresh and clean look right out of the box. The dashboard is clean and informative. On the left side, you can see a quick access menu. If you want to see the complete list of actions, you can click “More” on the top right portion of the dashboard beside the bell icon.

One thing missing from the dashboard that I find in a lot of other software is the ability to add any new transaction directly from the dashboard. I’d like to see them add something like an “Add Transaction” button somewhere.

ZipBooks Dashboard

Setting up your company in ZipBooks is easy. The settings aren’t too technical, and you can adjust your company name, details, and other information in the Company settings module. In the Accounting Preferences section, you set crucial accounting settings, such as accounting basis and closing date of the books.

What’s missing in the company setup process included recording a fiscal year-end, setting an entity type, and importing beginning account balances. The only way to record a beginning balance in an account is with journal entries:

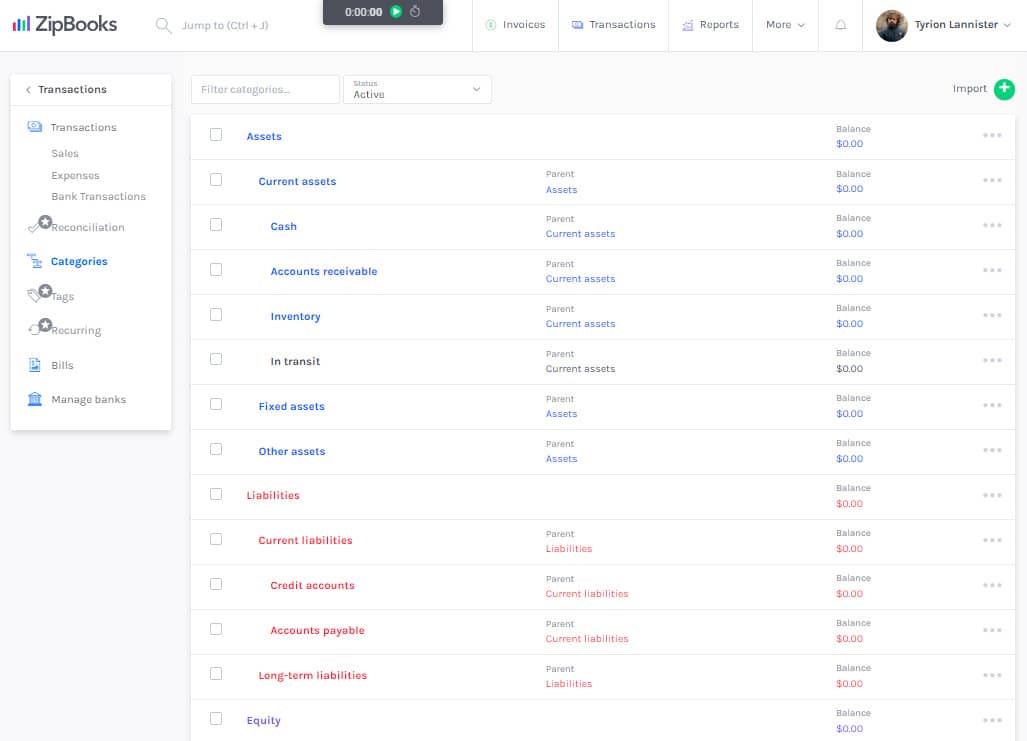

Chart of Accounts: Assets and Liabilities

ZipBooks has a default COA set up once you purchase the software. However, users of the Sophisticated plan can add more accounts, like valuation accounts for depreciation, amortization, and bad debts. I found out that the COA lacks an Accumulated Depreciation account, so I created an account for it with Fixed Assets as its parent account.

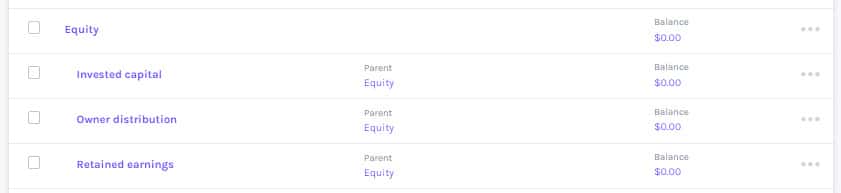

The equity section of the COA is built for a sole proprietorship. However, you can adjust the section by adding corporation accounts like Common Stock, Additional Paid-in Capital, and Retained Earnings.

Equity Accounts on ZipBooks

ZipBooks General Features Video

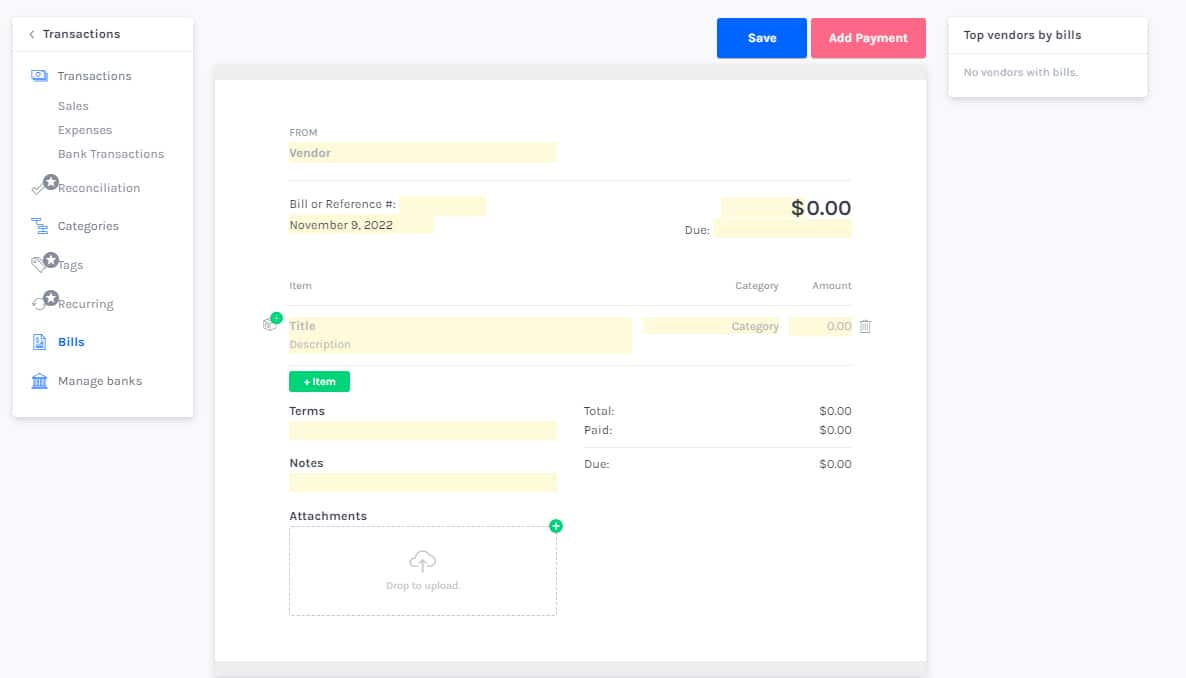

The A/P module is under the Transaction tab. Creating vendors in ZipBooks is straightforward, and there’s an option where you can designate the vendor as a 1099 Contractor. When creating bills, you can include items and assign which expense account is debited.

However, I find it inefficient that users can’t tag bills for custom grouping during bill creation. It would be a time saver if we could tag departments or projects all together while creating a bill. Instead, you can only tag bills in the Expense tab:

Creating a Bill for Inventory Purchase

In the image above, I created a bill for the purchase of widgets. Ideally, the software should ask me to input the quantity of the goods purchased. But in the case of ZipBooks, it only asks for the total cost of the widgets. This makes it impossible for the software to track inventory unit costs and COGS. If you have inventory, then ZipBooks isn’t the right software for you—try QuickBooks Online, which has great inventory accounting.

ZipBooks A/P Video

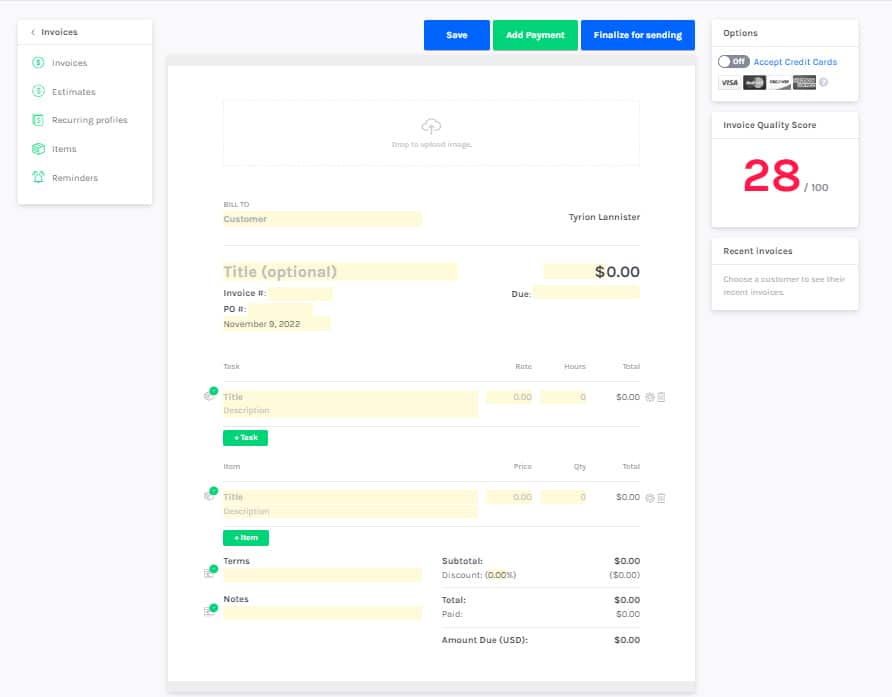

The basic invoicing function in ZipBooks is pretty good, but it’s not the best I’ve seen. You can upload your logo and choose a customer color for the invoice, but you can’t change the basic layout of the template. However, you can also create a personalized message below the invoice:

Creating an Invoice

What I like about ZipBooks invoicing is that users can add unbilled expenses and time to customer invoices, which is a feature usually reserved for higher-priced plans like QuickBooks Online Plus. But in ZipBooks Sophisticated, priced at $35 monthly, this feature is a competitive advantage over similarly priced software.

Partial payment of invoices is allowed in ZipBooks. When a customer partially pays an invoice, ZipBooks will mark the invoice as “Partial,” and it’ll show the amount paid side-by-side with the total invoice amount on the invoice screen.

However, ZipBooks is missing a couple of important A/R features that I find in other software. Particularly troublesome is you can’t issue credit memos to customers when a refund is given, although you can go in and manually input a negative item on the original invoice. ZipBooks also can’t issue a receipt for cash sales—you must first issue an invoice and then mark it as paid.

ZipBooks A/R Video

If invoice customization is important to you, read our guide to the best invoicing software.

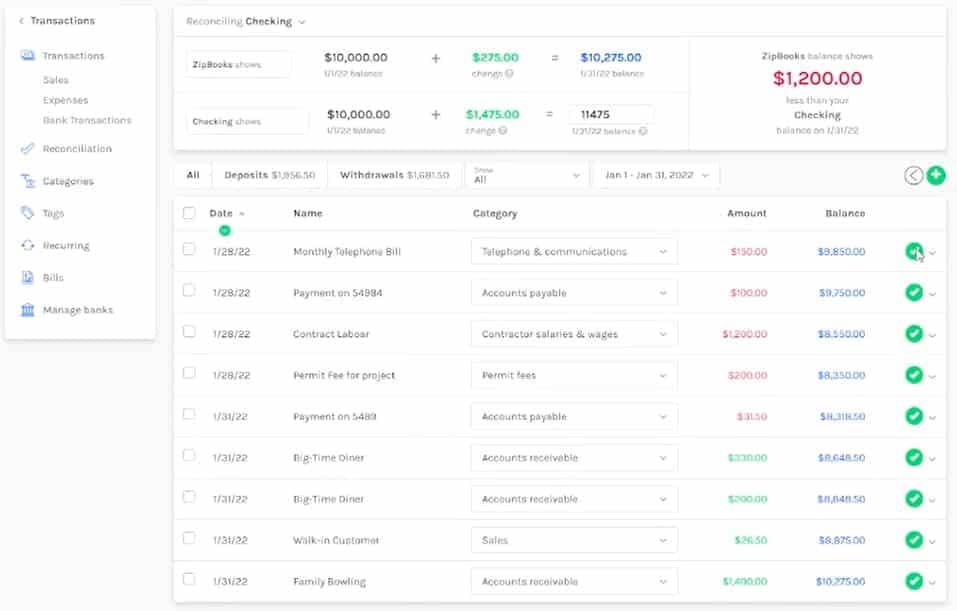

Reconciling your checking account is also easy—just don’t forget to turn on “Reconciliation” in the account settings. The way ZipBooks presents bank reconciliation is different from what I usually see in other accounting software. ZipBooks doesn’t show the typical line items in bank reconciliation, like deposits in transit and outstanding checks. Instead, it’ll only show the difference between the book and the bank balance.

To reconcile the balances, just uncheck the items presented by ZipBooks or create an adjustment entry for charges found in the bank statement that haven’t yet made their way to the books.

Balancing a Checking Account

The downsides to ZipBooks’ banking features are that it cannot produce a reconciliation report and print checks. If you issue checks regularly for vendor payments, I don’t recommend ZipBooks, as it would be inefficient to manually write checks. Instead, check out QuickBooks Online for check printing and outstanding bank reconciliation features.

ZipBooks Banking & Cash Management Video

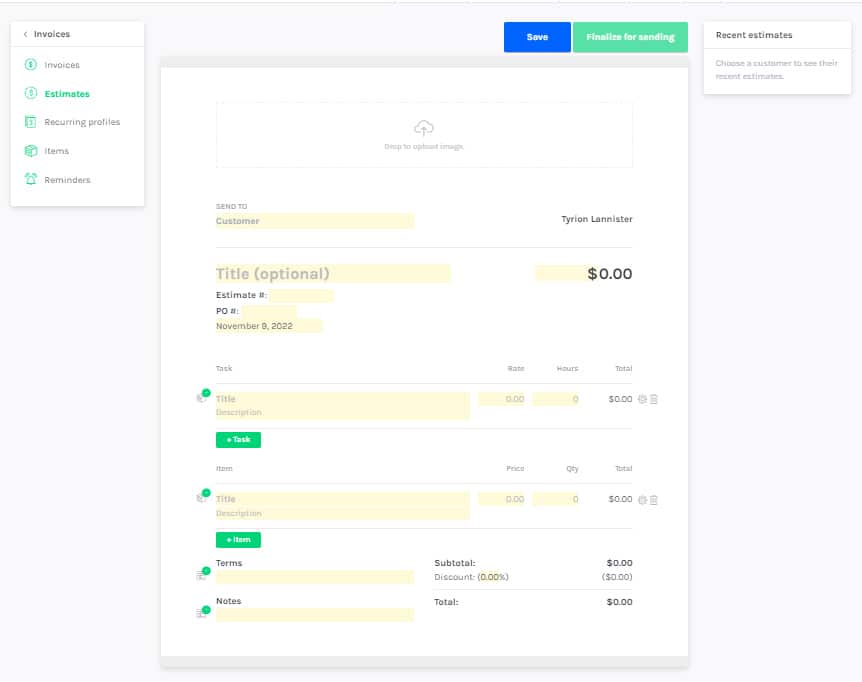

Project accounting in ZipBooks is commendable and convenient because it has a built-in time tracker. You can create projects, assign a contractor for the project, and tag income and expenses to the project. Billable expenses can be converted into invoices during invoice creation. If your clients need estimates, you can create these in the Invoice tab, and the interface of the estimates form is similar to invoicing

Creating an Estimate

Unfortunately, you can’t compare estimates to actual project costs in ZipBooks. Xero is our best alternative if you need project accounting features that include a comparison of estimated and actual project costs. To learn more about the platform, read our review of Xero.

ZipBooks Project Accounting Video

You can create a sales tax item to track sales taxes collected by jurisdiction. However, the program doesn’t provide a very detailed report of your sales tax liability. ZipBooks is also missing any features to help pay your sales tax or file your sales tax return. There is no separate video for this area since it was already discussed in the A/R and A/P video.

Unfortunately, ZipBooks doesn’t have inventory tracking features. There’s no way to keep track of inventory units ordered and sold, and the software doesn’t record COGS and determine the cost of ending inventory automatically. I recommend choosing QuickBooks Online for its outstanding inventory stock and cost tracking features. Since inventory was discussed in the A/R and A/P video, there’s no dedicated video.

Reporting is one of ZipBooks’ strong points. It can generate the reports that I believe should be available in small business accounting software. Here’s the summary of reports:

Balance Sheet | ✓ |

Profit and Loss (P&L) Statement | ✓ |

Statement of Cash Flows | ✓ |

A/R Aging | ✓ |

A/P Aging | ✕ |

Income/Loss by Month | ✓ |

Income/Loss by Customer | ✓ |

Income/Loss by Class | ✓ |

Income/Loss by Location | ✓ |

Income/Loss by Project | ✓ |

Unbilled Charges | ✓ |

Unbilled Time | ✓ |

Transaction List by Customer | ✕ |

Expenses by Vendor | ✓ |

General Ledger | ✓ |

Trial Balance | ✓ |

ZipBooks is generally easy to use, especially the Sophisticated plan. I find the Free and Starter options to be hard to use because of the ease with which you can accidentally upgrade to the Sophisticated tier by accident. If you click a feature only in the Sophisticated plan, you’re automatically updated without asking you to confirm the change. I had to navigate to my subscription and downgrade back to the Free plan several times during my evaluation.

Another factor lowering the Ease of Use score is the dashboard. I’d like to see a feature where you can customize your dashboard to see exactly what you want as soon as you open the program. I’d also like to see a single button you can click from the dashboard to start a new transaction of any kind.

The ease of setup deals with the difficulty in transferring your company information from your previous bookkeeping software. Ease of setup will be less important if you’re starting a brand new company.

The ease of setup is one area that I find many inexpensive software to do poorly—but not ZipBooks. It provides most of the tools needed to automatically transfer your data from your prior software. Here are the items I would like to see software be able to import from a spreadsheet or comma-separated values (CSV) and how ZipBooks fared:

Item to Transfer | |

|---|---|

Chart of Accounts | ✓ |

Vendors | ✓ |

Customers | ✓ |

Service/Inventory Items | ✕ |

Beginning account balance | ✕ |

ZipBooks also scored high here for the onboarding support and new company wizard to help with your setup.

ZipBooks’ customer service isn’t as accessible as that of other accounting software providers. It doesn’t offer customer service through phone calls, though you can use the chatbot or chat with a live representative.

The live chat feature can be found at the bottom right corner of the screen, and ZipBooks provides an estimate of how long it’ll take to accommodate your inquiries. While waiting for a reply, you can browse through its Help Center to look for a quick fix for your problem.

ZipBooks doesn’t have a mobile app. If you need one, I recommend Zoho Books because it has an outstanding and full-featured mobile app that can send invoices, receive payments, assign expenses, enter bill payments, categorize bank expenses, record time, and view reports.

ZipBooks integrates with Gusto to provide payroll processing. You can automatically sync the hours tracked in ZipBooks with Gusto so that the hours you pay your employees for match the hours you’ve tracked for accounting. ZipBooks also integrates with Square and PayPal to accept electronic payments from your customers.

The only missing integration I’d like to see in ZipBooks is an integration to pay your bill electronically. An integration with BILL would be a great addition so that users can send an electronic payment directly from an unpaid bill in ZipBooks.

ZipBooks Assisted Bookkeeping Options

ZipBooks offers bookkeeping services. If you have complex bookkeeping needs, it can build a custom plan for you.

- Simple Bookkeeping: Starts at $125 per month:

- A personal bookkeeper

- A ZipBooks plan

- Monthly bookkeeping assistance and financial statements

- Up to five bank or credit accounts

- Expert bookkeeping advice

- Online bookkeeping support

- Multi-classifications Bookkeeping: Starts at $145 per month:

- All services in Simple Bookkeeping

- Tagging and tracking multiple locations, business units, or classes

- Individual and consolidated financial statements

- Comparison financial statements across all classes

- Vendor and 1099 Preparation: Starts at $175 per month

- All services in Simple Bookkeeping

- Tagging or tracking of vendor payments

- 1099 reporting and preparation

How We Evaluated ZipBooks

We evaluate bookkeeping software based on a weighted average score across 15 different categories:

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and the number of users.

5% of Overall Score

This section focuses more on first-time setup and software settings. The platform must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

5% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

5% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

5% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

10% of Overall Score

Customer service is evaluated based on the number of communication channels available, such as phone, live chat, and email. Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform.

10% of Overall Score

This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

10% of Overall Score

Ease of use includes the layout of the dashboard and whether new transactions can be initiated from the dashboard rather than having to navigate to a particular module. Other factors considered are user reviews specific to ease of use and a subjective evaluation by our experts of both the UI and general ease of use.

5% of Overall Score

This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available.

5% of Overall Score

The software must have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. Some of the features we looked into include the ability to create and send invoices, accept online payments, enter and track bills, and view reports on the go.

7% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

No, ZipBooks has no payroll features, but you can track time on ZipBooks and sync it with Gusto, a payroll provider.

Yes, it uses 256-bit TLS encryption, which is similar to the encryption used by banks and entities handling sensitive information.

Yes. ZipBooks is made in Utah. Aside from accounting software, it also offers bookkeeping and tax assistance for a separate fee. It competes with QuickBooks in providing accounting software services to service-based businesses.

Bottom Line

ZipBooks offers the basic accounting functions you need for your business, as long as you don’t have significant inventory. The software is easy to use, even for do-it-yourself (DIY) accounting. While I recommend their Sophisticated plan to service-based businesses, I’d avoid the Free or Starter plan as they lack some pretty basic features, including the ability to customize your chart of accounts.