Efficient payroll designed for construction can help you save time and money by making calculations easier, filing accurate taxes and reports, and organizing job costs. The best construction payroll software has specific reports and job codes for the construction industry.

In this guide, we evaluated 18 construction payroll systems and narrowed our list to the best five.

- eBacon: Best overall construction payroll software

- QuickBooks Payroll: Best for QuickBooks Accounting users and low-cost contractor payouts

- ADP Run: Best for growing construction companies that want flexible payroll plans

- Gusto: Best construction payroll service for small companies & contractor new hire reporting

- Payroll4Construction: Best for robust construction reporting

Best Construction Payroll Software Compared

Starter Pricing | Contractor-only Payments Plan | Certified Payroll Reporting | Time Tracking | ||

|---|---|---|---|---|---|

✕ | Custom-priced | ✓ | ✓ | ||

$6 per employee + $50 base fee per month | $15 monthly for up to 20 contractors + $2 per additional worker | Via Points North integration | Included in higher tiers | ||

| Three months free payroll | $2.50 per employee, per weekly payroll | ✕ | Via Points North integration | Paid add-on |

| $49 per month + $6 per person per month | $6 per employee + $35 base fee monthly | ✕ | Included in higher tiers | |

| ✕ | Custom-priced | ✓ | Paid add-on | |

Unsure what you need? Check out our guide to finding the right payroll solution for tips on how to best evaluate the right payroll for you.

eBacon: Best Overall Construction Payroll Software

Pros

- Unlimited pay runs with built-in certified payroll and next/same-day direct deposits

- Takes advantage of tax-free fringe benefits (allows you to enjoy tax savings)

- Handles most compliance reports

- Offers basic HR solution for managing onboarding, paid time off (PTO), and employee attendance

Cons

- Not available in all 50 states (Call to see if yours is covered)

- Pricing isn’t transparent

- HR advisory services, background checks, online onboarding, and new hire reporting are add-on solutions

Overview

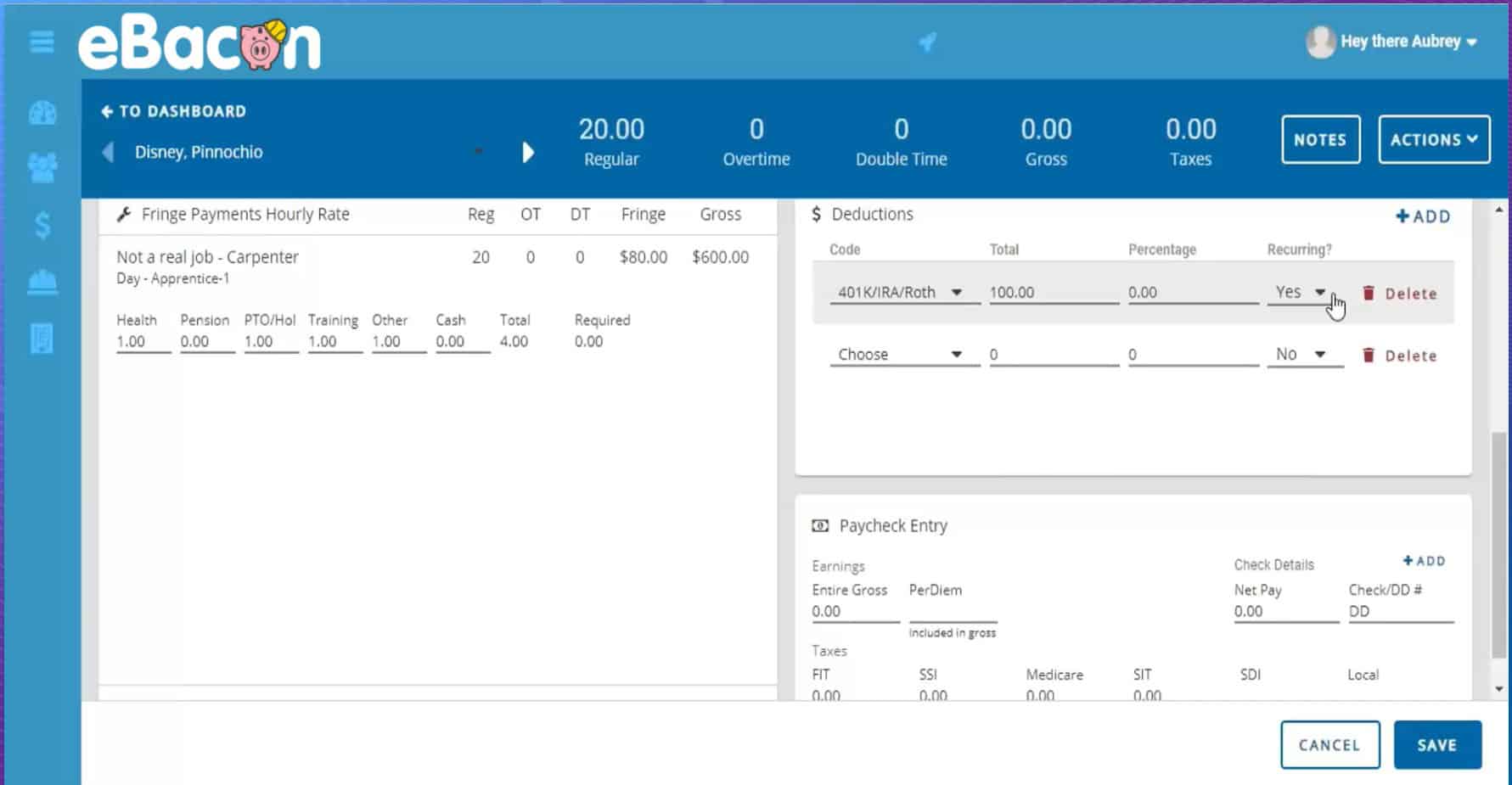

While by far the most expensive, eBacon made it to the top of our list because its features are designed specifically for construction companies. It offers certified payroll, compliance reports, fringe benefit management, union pay management, and more. eBacon provides all the tools you need to meet the needs of government contracts but works just as well for private jobs.

eBacon earned 4.22 out of 5 in our evaluation. Its ease of use, efficient HR and payroll tools, reporting, and solid construction-specific features gave it a solid lead. It’s also the only construction payroll system on our list that offers a fringe benefits trust fund from which employees can take cash advances. However, its lack of a customizable interface, non-transparent pricing, and low number of user feedback on review sites like G2 and Capterra cost it several points.

eBacon offers custom pricing for its construction payroll services. Based on a quote we received, certified payroll with union and prevailing wage calculations for 25 people can be as much as $20,000 or more annually. Note that fees may vary depending on your location.

- Payroll: Of the payroll software for contractors on our list, only eBacon and Payroll4Construction are made for construction companies that need certified payroll reports and prevailing wage reporting. It also supports city-shifting calculations and offers fringe pay trust funds, which allow you to enjoy tax benefits. Like Gusto and ADP Run, eBacon offers pay cards in addition to direct deposit.

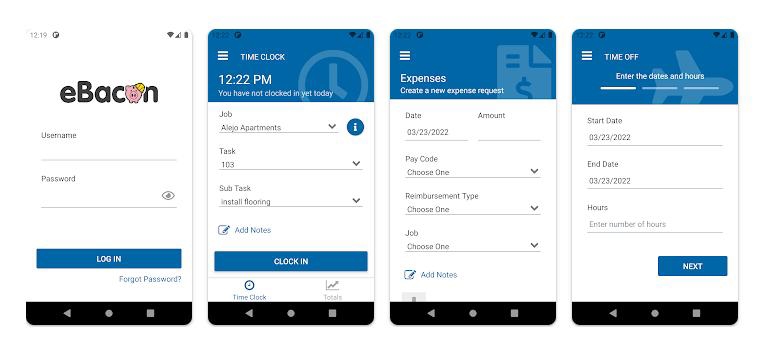

- Multiple time tracking and wage rates: eBacon is our list’s only construction payroll provider offering eight ways to track time. It can also handle multiple wage rates for a single employee on a single job in a single day.

- Tax filing: Tax features are typical—federal, state, and local taxes and year-end report prep and delivery of W2s and 1099s.

- Construction-specific tools: eBacon offers multiple job designations at multiple pay grades. Union employee and government contracting reports, such as WH-347, and Equal Employment Opportunity Commission (EEOC) reports, are also available. Only Payroll4Construction also meets these specific construction needs without paying for customization.

- HR: eBacon can help manage onboarding, paid time off (PTO), employee attendance, and background checks. It offers benefits tools to simplify online enrollments in health, dental, vision, flexible spending account (FSA), and health savings account (HSA) plans. While it can generate new hire reports, you have to submit these yourself. If automating this task is vital for you, consider ADP or Gusto (Payroll4Construction also offers this for an additional fee).

QuickBooks Payroll: Best for QuickBooks Accounting Users & Low-cost Contractor Payments

Pros

- Unlimited pay runs with next-day and same-day direct deposits

- Seamless integration with QuickBooks products

- Affordable contractor payments (if only paying contract workers)

- Tax penalty protection program covers penalties (up to $25,000/year) regardless of who makes the mistake

Cons

- Basic HR features only

- Tax penalty protection is included in the Elite plan only

- Local tax filings available only in its higher tiers

- Certified payroll reporting is via integration with Points North

Overview

QuickBooks may not be a construction-specific payroll system, but its accounting and payroll modules offer a good amount of functionality for construction companies. With native integration to QuickBooks Accounting, you get automatic data imports for budgeting and job costing and the ease of using QuickBooks for invoicing. Its QuickBooks Payroll Premium and Elite plans even include same-day direct deposit, something not offered by others on our list (except eBacon). It also works with Allstate Health Solutions to provide health benefits in all 50 states (Gusto’s is unavailable in 12 states).

QuickBooks earned 4.19 out of 5 in our evaluation. It scored high (4 and up) in most of our criteria, given its efficient payroll tools, user-friendly platform, and reasonably priced plans. Its overall rating took a hit because local tax filings require upgrading to its higher tiers and certified payroll reporting is via its Points North integration.

QuickBooks Payroll can process employee payroll with just a few clicks. (Source: QuickBooks Payroll)

- Payroll Core: $6 per employee monthly + $50 base fee per month

- Payroll Premium: $9 per employee monthly + $85 base fee per month

- Payroll Elite: $11 per employee monthly + $130 base fee per month

- Contractor payments: $15 monthly for 20 contractors + $2 per additional worker

- This is for businesses that only pay contractors

Note that QuickBooks also offers bundled plans for QuickBooks Accounting Online + Payroll. Visit the provider’s website to get pricing information.

- Payroll: You get unlimited and automatic pay runs with the option to pay employees via manual checks and next-day or same-day direct deposits. It also has PTO management tools and time trackers via QuickBooks Time (if you upgrade to its higher tiers). While QuickBooks Payroll lets you create multiple pay types for employees, it lacks union codes. Unlike eBacon and Payroll4Construction, you only get certified payroll reporting via its integration with Points North.

- Tax filing: All QuickBooks Payroll plans include federal and state tax filings, year-end report preparation, and delivery of W2s and 1099s. While local tax filings are only included in its premium tiers, the Core plan calculates them so you can file yourself. Its Elite Plan also helps you resolve tax penalties and reimburses you up to $25,000, regardless of who is at fault. None of the providers on our list offer a similar tax penalty protection program.

- Construction-specific tools: Take advantage of its multiple pay rates, multistate payroll, job-based codes (though not specifically union), and flexible options for running weekly, biweekly, semi-monthly, and monthly payroll. If you use QuickBooks Accounting, it can integrate with construction-specific apps, such as Buildertrend, and provide job costing and industry-specific reporting. If you want these features right in your payroll software, consider either eBacon or Payroll4Construction.

- HR: While not a full HR platform like ADP Run, QuickBooks Payroll provides essential tools for onboarding, document management, and workers’ compensation administration. It also has HR advisory services, provided you get its Elite plan.

ADP Run: Best for Growing Construction Businesses

Pros

- Handles multiple pay rates and union payroll codes

- Benefits plans include standard and nonstandard options like employee discounts

- Has hiring, talent management, and learning tools

- Offers a robust suite of HR solutions and services for small to large businesses

Cons

- Pricing isn’t transparent

- Charges a setup fee (although, the provider often waives this for new clients)

- Time tracking costs extra

- Certified payroll reporting is via integration with Points North

Overview

ADP Run is on our list of best payroll software for construction companies because of the wide range of solutions it offers. You get payroll, time tracking, recruiting, and onboarding tools, as well as background checks and HR consulting services. Combined with the capability to add union codes, track multiple jobs, and certify payroll, it’s a strong choice for construction payroll software. Plus, its professional employer organization (PEO) service and many HR tools make it great for businesses with plans to grow over the years to transition easily to more advanced HR solutions and services.

It earned an overall score of 4.18 out of 5 in our evaluation, with high marks (4 and up) in HR and payroll features, reporting, and user popularity. While it has union payroll codes you can use, it requires a Points North integration for certified payroll reporting (eBacon and Payroll4Construction simply provide this natively). The setup fee and lack of a contractor plan (something Gusto and QuickBooks Payroll offer) also pulled its overall score down.

You can set ADP Run on automatic, as well as run payroll manually. (Source: ADP)

- Essential: $2.50 per employee, per weekly payroll + $49 base fee monthly*

- Enhanced: Custom-priced

- Complete: Custom-priced

- HR Pro: Custom-priced

*Pricing is based on a quote we received for a business with 25 employees. Setup fees apply but are often waived for new clients.

- Payroll: ADP Run offers automated pay runs with two-day direct deposits and, like Payroll4Construction, paycheck signing and delivery services. It’s one of the three providers (Gusto and eBacon being the others) we reviewed that lets you process payments via pay cards. Similar to the other payroll services for construction companies on our list, its time-tracking features include geofencing, which is handy for monitoring the attendance of remote administrative staff and on-site workers. You can integrate it with Points North for certified payroll.

- Tax filing: All plans include tax filings at federal, state, and local levels as opposed to QuickBooks Payroll, which does not do local tax filings in its basic plan. It can create, deliver, and file W2s/1099 forms, and even offers a tax liability guarantee where it will work with you on misfilings and handle any fines.

- Construction-specific tools: ADP lets you manage multiple pay rates and has multistate, union-specific, and job-costing tools. However, unlike Payroll4Construction and eBacon, it doesn’t have construction-specific reports—you need to create these or pay extra for them to be included.

- HR: ADP excels with its full HR suite, which includes onboarding, workers’ comp, new hire reporting, and document management. If you get its higher tiers, you get access to expert HR advisers, ZipRecruiter job postings, an HR handbook wizard, and more. It offers benefits from major providers, including employee discounts with its partner retail shops. It can expand to a full PEO if you want to outsource your HR fully.

Gusto: Best Construction Payroll Service for Small Companies & Contractor New Hire Reporting

Pros

- Unlimited and automatic pay runs

- Affordably-priced contractor-only payroll plan

- Two- and next-day direct deposits

- Basic hiring and onboarding tools included in all plans

- International contractor payments in over 120 countries

Cons

- Lacks certified payroll reporting

- Doesn’t have union payroll codes

Overview

Gusto is often on our best payroll software and top payroll services lists for small companies because of its pricing, solid payroll tools, and ease of use. What sets it apart from the other payroll systems we reviewed is its new hire reporting for contractors and employees (the other construction payroll solutions on our list only report new employees to the state).

In our evaluation, Gusto scored 4.14 out of 5 with high marks in nearly all criteria. It lost points because its multi-state payroll feature is available only in higher tiers and Gusto lacks the specialized features for construction that you can find with eBacon and Payroll4Construction. If you are a small business that doesn’t do a lot of government contracts or union work, its reasonably priced plans and user-friendly tools make it a good choice.

Gusto’s payroll is easy to use. (Source: Gusto)

- Simple: $49 per month + $6 per person per month

- Plus: $12 per employee monthly + $80 base fee per month

- Premium: Custom-priced

- Contractor-only payroll: $6 per contractor monthly + $35 base fee per month

- This is for businesses that only pay contractors

Add-ons

- State payroll tax registration: Pricing varies per state

- HR advisory services for Plus plan only: $8 per employee monthly (this is included for free in the Premium tier)

- International contractor payments: Custom-priced

- R&D tax credits: 15% of identified tax credits

- Health insurance and other benefits: Pricing varies by benefit

- Payroll: You get unlimited and automatic pay runs with Gusto, but it doesn’t offer certified payrolls like eBacon and Payroll4Construction do, nor does it offer integrations for certified payroll like ADP Run and QuickBooks. You get multiple payment options, from manual checks to pay cards and direct deposits. Similar to QuickBooks Payroll and eBacon, it has next-day direct deposits, which the other providers don’t have.

- Tax filing: Gusto handles federal, state, and local tax filing, plus garnishments and levies. It files and sends W-2 and 1099 forms at no extra cost.

- Construction-specific tools: Gusto doesn’t have union payroll codes, but you can create job codes and conduct project tracking and workforce costing. Unlike eBacon and Payroll4Construction, it lacks construction-specific reports—you need to build your own.

- HR: Employee benefits include workers’ comp, medical, 401(k), commuter, and Gusto Wallet financial tools. With higher plans, you get advanced hiring and onboarding, team and project management, access to HR advisers, and a dedicated support team. However, if you want more HR tools, such as ZipRecruiter job postings, learning management, salary benchmarks, and PEO services, consider ADP Run.

Payroll4Construction: Best for Robust Construction Reporting

Pros

- Offers certified payroll reporting

- Construction-specific reports are automatically created after each pay period

- Automated rates by job, trade, and more

- Robust job costing tool

Cons

- Limited HR and employee benefits features

- Lacks online onboarding tools

- Pricing isn’t transparent

- Filing year-end tax reports costs extra

Overview

Payroll4Construction is a specialized payroll software for construction companies. It does pay calculations and payroll tax filings and provides basic employee benefits through its partner providers. It can also handle simple to complex job costing and offers a wide range of construction-specific reports, including custom ones to fit your business’ specific reporting needs.

In our evaluation, Payroll4Construction earned an overall rating of 4.06 out of 5. It received top scores (4 and up) on construction-specific tools, reporting, and payroll features. It took a hit on pricing because you need to call for a quote—although, you can get basic pricing details through the quote generator on its website. Payroll4Construction also has very few user reviews, limited integration options, and lacks the employee self-onboarding tools that ADP Run, Gusto, and QuickBooks Payroll provide.

Payroll4Construction uses a timecard system instead of a spreadsheet payroll. (Source: Foundation Software)

With Payroll4Construction, you have to call its sales team to discuss your requirements and request a quote. However, we were able to get basic pricing details from the provider’s online quote tool. For a business with 25 workers, running a bi-weekly payroll will cost you $136.25 per pay run.

- Payroll: Payroll4Construction offers automatic pay runs, two-day direct deposits, and PTO tracking. It allows you to pay hourly and salaried employees as well as contractors. The time trackers with geofencing cost extra, however, including garnishments.

- Tax filing: It handles federal, state, and local tax filings but, unlike the other construction payroll solutions on our list, end-of-year reports cost extra.

- Construction-specific tools: Since it is designed for construction, you should find all the tools you need. Examples include multiple pay rates for jobs or states, job costing, and certified payroll reports. It prepares construction-specific reports like Equal Employment Opportunity (EEO) minority compliance and union reporting automatically.

- HR: Payroll4Construction offers a self-service portal for employees and time tracking via its Foundation mobile app. It can handle benefits deductions and works with partner organizations to help manage benefits plans. However, if you want HR functions like onboarding or hiring tools, consider Gusto or ADP.

How We Evaluated the Best Construction Payroll Software

We looked at payroll services with construction features, including those that are part of a construction program. Then, we narrowed the list further by evaluating construction-specific payroll needs such as multistate and multi-job coding, union and other certified pay runs, labor costing, and more. We also considered pricing, ease of use, basic HR functionalities, and user reviews.

Click through the tabs below for our full evaluation criteria:

10% of Overall Score

We gave points for plans that cost less than $50 per employee monthly. We also looked for companies that offered transparent pricing, unlimited pay runs, and multiple plan options.

25% of Overall Score

Construction payroll companies that offer certified payroll received the most points. We also considered those that provide time tracking, union pay codes, and multistate payroll.

15% of Overall Score

We looked for HR features like online onboarding, self-service portals, and new hire reporting. We also gave points to providers that offer access to compliance experts who can offer advice if needed.

20% of Overall Score

We gave the most points to software that offers multiple payment options, such as pay cards, direct deposits, and manual paychecks. Aside from year-end tax reporting, we also looked for payroll tax services that cover all levels (state, local, and federal).

5% of Overall Score

We took the average review ratings from third-party sites like G2 and Capterra, which are based on a 5-star scale. Any option with an average of 4.5 and up is ideal. We also favored software with 1,000-plus reviews on any third-party site, although we gave some credit for those services that catered to construction businesses only.

15% of Overall Score

We looked for a basic selection of payroll reports, including customization options. We also considered if new reports can be built directly into the system.

10% of Overall Score

We highly favored payroll software with intuitive platforms, easy-to-learn tools, live phone support, and integration options with third-party software (like accounting solutions). We also credited companies that provide help guides and dedicated representatives.

Bottom Line

When choosing the right payroll system for your business, consider the size of your workforce and the functionalities that you need. Payroll software with construction features can help you stay on top of paying employees so that you can concentrate on other business challenges such as supply chain issues.

We recommend eBacon as the best construction payroll software because it has a user-friendly and feature-rich platform designed to simplify payroll processing and compliance reporting. It even offers fringe benefit management tools, enabling your employees to easily access fringe benefits while providing you with tax savings on workers’ comp and payroll taxes. Sign up for a free demo today.