Nanny payroll software is essential for families that prefer not to handle payroll themselves, as it helps them comply with federal, state, and local tax laws. We assessed several nanny payroll solutions, ranging from full-service providers with tax filing services to DIY programs. Then, we selected the top five services with features for paying domestic workers:

- SurePayroll by Paychex: Best overall nanny payroll service

- Paychex: Best full-service nanny payroll with comprehensive benefits

- QuickBooks Payroll: Best for consolidating accounting and nanny payroll needs

- HomePay: Best compliance and customer support for household employers

- HomeWork Solutions: Best nanny payroll tax support, including back taxes

The nanny payroll software on our list offer automatic pay runs, new hire reporting, online payslips, direct deposit payments, Schedule H form preparation (apart from QB Payroll), and tax filing services. Some providers also offer basic benefits, such as health insurance and dental insurance.

Although Poppins Payroll didn’t make our top 5 list, it is a great option for households on a budget. It offers its full range of services—from payroll to taxes—at one low price of $49 per month. Poppins Payroll scored well in our rubric, however, it didn’t make our list because its services are not yet available in all 50 states.

Best Nanny Payroll Compared

Our Expert Score (out of 5) | Free Trial | Pricing Starts At | Available in All 50 States | Tax Filing Fees | |

|---|---|---|---|---|---|

| 4.26 | $39 per month + $10 per additional employee per month | ✓ | ✕ | |

4.22 | 6 months free | $39 base fee + $5 per employee per month | ✓ | ✕ | |

4.18 | 30 days | $50 base fee + $6 per employee per month | ✓ | ✕ | |

| 3.77 | 30 days with the purchase of the Premium plan | ✓ | $100 per year | |

| 3.52 | ✕ | $239 per quarter (biweekly payroll) $69 per additional employee per quarter | ✓ | $125 per year per employee |

Honorable Mention | |||||

| 4.09 | First month free | $49 per month | ✕ | |

Looking for something else? Find more payroll software in our best payroll services guide. If you need help in choosing a payroll service, check out these expert tips on how to find the right payroll solutions.

Best Nanny Payroll Service Quiz

Which Nanny Payroll Service is Right For You?

SurePayroll by Paychex: Best Overall Nanny Payroll Service

Pros

- Unlimited and automatic pay runs

- Files your 1040-ES and provides a signature-ready Schedule H form

- Tracks PTO and sick leaves

- Two-day direct deposits

Cons

- No free state registration or federal tax ID setup for new household employers

- Local tax payments and filings in Ohio and Pennsylvania cost extra

Overview

Who should use it:

SurePayroll, now a Paychex product, is a cloud-based payroll software that can handle the pay processing needs of small businesses, including household employers. It has direct deposit payments, unlimited pay runs, and payroll tax filings.

Plus, if you or your household workers speak Spanish, it’s the only nanny payroll service on our list that has Spanish-speaking support (in addition to English) available through chat and phone, Monday to Friday, from 7 a.m. to 8 p.m., and Saturday, from 9 a.m. to 1 p.m., Central time.

Why I like it:

SurePayroll is my top pick for nanny payroll services because it is an affordable option for paying nannies and offers tax compliance. Plus, because it handles all tax work for you—calculating wages, deducting the correct taxes, and filing the appropriate forms—it saves you time so that you can focus on your household.

SurePayroll earned 4.26 out of 5 on our evaluation, earning the top spot in this buyer’s guide. Unlike HomeWork Solutions, users can create and customize reports on SurePayroll. It provides full-service payroll–you can pay as many times as you like—at one price. Plus, it offers HR support to assist with compliance, and a range of benefits: 401k plans, workers’ compensation, and health insurance.

Additionally, users who left feedback on third-party review sites, like G2 and Capterra, like the platform’s straightforward navigation. It scored an average of 4.3 out of 5 across both sites.

- $39 monthly for one household employee

- Includes free auto payroll, unlimited payroll runs, multiple pay rates and schedules, easy direct deposit setup, calculation of federal, state, and local payroll taxes

- $10 monthly for each additional household employee

- 6 months free If you sign up before November 30, 2024 you get 6 months free (discount spread out over 12 months)

- Complete Nanny Payroll Service: While SurePayroll doesn’t help get your federal employer identification number (EIN), it efficiently handles the rest of your payroll needs. It calculates nanny pay with withholdings and benefits and pays household employees via direct deposits. If you hire a new nanny, it handles state new hire reporting for you, something not offered with QuickBooks Payroll, and only offered in higher premiums with HomePay. It also offers compliance resources and guides to help you stay on the right side of the law.

- Automated Tax Payment And Year-end Report Filing: SurePayroll is a better option than HomePay for nanny payroll services because it automatically withholds, pays, and files taxes on the federal, state, and local levels. This includes local filing for Ohio and Pennsylvania, which HomePay does not offer. SurePayroll also offers quarterly and year-end tax filings for free, while HomePay and other services charge extra for these services.

- Integrations With Third-party Accounting Software Providers: It works seamlessly with QuickBooks Online, Xero, Intacct, AccountEdge, Less Accounting, Zoho Books, and Sage 50-US Edition.

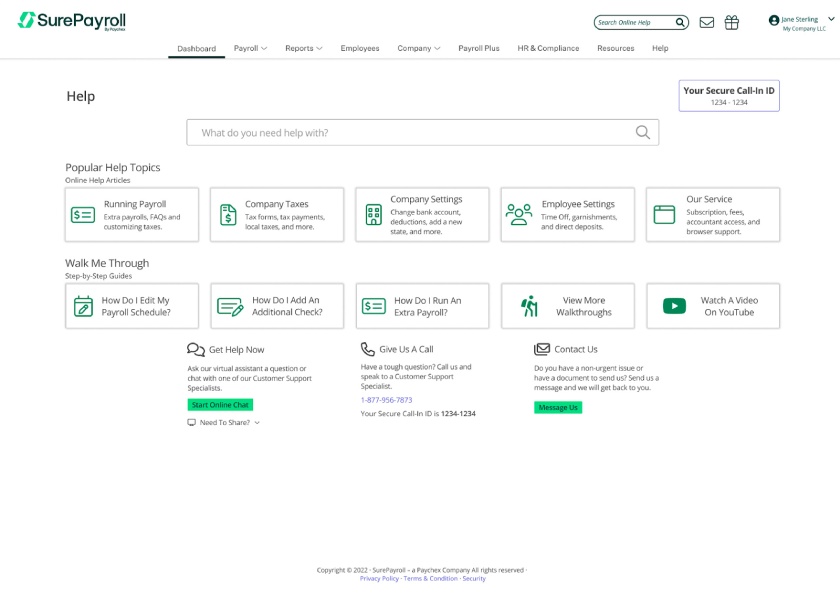

SurePayroll’s help center will help you with popular topics like running payroll and company taxes. (Source: SurePayroll)

Do you want to learn more about paying nanny taxes? Our guide to nanny taxes has all the information you need to know about calculating and paying nanny taxes, including the tax forms that household employers need to submit.

Paychex: Best Full-Service Nanny Payroll With Comprehensive Benefits

Pros

- Reasonably priced

- Dedicated payroll specialist

- Online and mobile payroll processing

- Benefits options include health plans, 401(K) plans, and workers’ comp

Cons

- Pricing isn’t all transparent

- You need to pay for year-end tax report prep and online delivery (W-2s and Schedule H)

- Employee benefits cost extra

Overview

Who should use it:

Paychex is the best nanny payroll service with comprehensive benefits because it can help you set up and administer benefits for your nanny, such as health insurance, dental insurance, and 401(k) plans. The service also ensures that your payroll taxes are filed correctly and on time, helping you avoid costly penalties. It also offers a mobile app, for those who need to manage their payroll on the go.

Why I like it:

I like Paychex because it is a big-name provider for small businesses that offers an overall experience—payroll, benefits, dedicated support, and hiring and onboarding assistance. You can also use its time tracking service (at an additional cost) to track your nanny hours and push those directly to payroll for payment. Plus, you can manage PTO and sick time.

There is a bit of a learning curve with its platform, so for households that have zero experience with payroll software, it may prove to be a bit difficult. However, it does offer support for all its products (although you will have a different rep for each of its products).

Paychex earned an overall rating of 4.26 out of 5 in our evaluation, with perfect marks in user popularity and high scores in nearly all of our criteria. While its pricing details are not readily available on its site, we were able to secure pricing quotes that show it is affordable for household employees.

Users on third-party review sites, like G2 and Capterra, praised its intuitive platform and efficient payroll tools. It scored an average of 4.2 out of 5 stars across the sites.

- Essentials ($39/month + $5/employee)

- Includes access to plans and payroll tax filing services have additional fees, 24/7 support

- Select ($128.50 per weekly pay period for 25+ employees)

- Includes everything in Essentials + one-on-one support, employee training and development system

- Pro (custom pricing)

- Includes everything in Essentials and Select + full-service setup

- Flexible Payroll Processing Features: Paychex makes it easy to run payroll with just two clicks from your desktop or mobile device. You can pay your employees via direct deposit or live check, and Paychex even offers check-signing services. Paychex also supports multiple pay schedules, which is not always the case with other providers like HomeWork Solutions and HomePay.

- Tax Filing Features: Paychex can help you set up your tax accounts and file taxes for your household employees. It can do this in all 50 states and for local areas. However, it does charge for some of its payroll tax services.

- Full Range of HR and Payroll Features: Paychex stands out from other nanny payroll service providers on our list by offering a wider range of features. In addition to basic tasks like new hire reporting and PTO tracking, Paychex also allows you to offer health plans and other benefits for your employees, purchase workers’ compensation insurance, and integrate time tracking into its platform. These features are not included in the base price of Paychex, but it may be worth the investment if you have multiple full-time household employees.

- Dedicated Support: Paychex offers a team of compliance experts and payroll specialists who can provide knowledgeable advice on tax and labor regulations. It is the only provider on this list that also offers consultation service, a dedicated representative, and 24/7 customer and technical support via phone and chat.

- Online And Mobile Self-service Portal: Paychex and SurePayroll are the only nanny payroll services in this guide that offer free mobile apps for household employees. These apps allow employees to access their payslips, update their personal information, and more. HomePay does not offer a mobile app, but it does have a mobile time tracker solution.

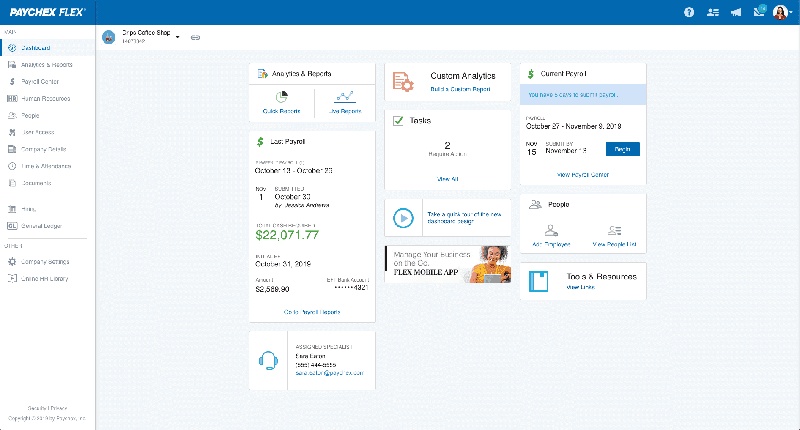

Paychex has an easy-to-navigate dashboard that highlights your last and current payrolls. (Source: Paychex)

QuickBooks Payroll: Best for Consolidating Accounting and Nanny Payroll Needs

Pros

- Integrates with QuickBooks Accounting seamlessly

- Same- and next-day direct deposits

- Protection from tax payroll penalties

- Low-cost contractor payments

Cons

- No Schedule H preparation

- Local tax filings not included in the basic plan

- No app for employee self-service

- Can be complicated for first-time users

Overview

Who should use it:

Households that already use QuickBooks’s accounting software will benefit from using QuickBooks Payroll for their nanny payroll needs as well. Payroll is a simple add-on for existing users and accounting and payroll easily sync to consolidate your reporting. This makes household budgeting simple through one platform.

Why I like it:

I recommend QuickBooks Payroll for household payroll because it is easy to use and provides excellent tax compliance services. But, it is also great for employers who are already using QuickBooks Online to manage their expenses, as their payroll module is an easy add-on.

However, their mobile app is not as user-friendly as others on our list, so if you’re trying to manage your nanny payroll on the go, it may not be the right provider for you. Consider SurePayroll or Paychex if you need a more mobile experience.

It got a 4.18 rating out of 5, with perfect scores in its reporting features. Like SurePayroll, it has unlimited pay runs at no extra cost. Unlike SurePayroll, however, it does not issue Schedule H, which significantly affected its score.

QuickBooks Payroll also offers automated taxes, paycheck and tax calculations, and next-day direct deposit. But most importantly, it can help you stay compliant with all the relevant tax laws. To get a more in-depth look on how you can use it, check out our What is QuickBooks article.

On third-party review sites, like G2 and Capterra, users like QuickBooks Payroll because it’s an easy platform to navigate, has great customer service, and includes the features needed for nanny payroll. It scored an average of 4.2 out of 5 stars across both sites.

- Core: $50 base fee + $6/employee/ month

- Includes full-service payroll, auto payroll, 1099 E-File & pay, expert product support, next-day direct deposit

- Premium: $85 base fee + $9/employee/month

- Everything in Core, plus same-day direct deposit, track time on the go, 24/7 expert product support, expert review

- Elite: $130 base fee + $11/employee/month

- Everything in Premium, plus expert setup, tax penalty protection, personal HR advisor

- Automatic Tax Management: QuickBooks Payroll uses a variety of factors to calculate the amount of taxes that need to be withheld from an employee’s paycheck, including the employee’s filing status, number of allowances, and pay frequency. It also takes into account the current tax laws, so you can be sure that you are withholding the correct amount of taxes.

- Employer Taxes: In addition to withholding taxes, QuickBooks Payroll also calculates and remits the employer’s share of payroll taxes. This includes Social Security and Medicare taxes, as well as federal and state unemployment taxes.

- Live Setup Support: QuickBooks Payroll is the only payroll service on this list that offers live support. When you enroll in the Elite plan and do not try the 30-day free trial, you can get the one-time live setup support within the first 30 days after you sign up. A QuickBooks expert will guide you through the entire setup process, including setting up automations, connecting your bank accounts and credit cards, and learning best practices. If you encounter any problems after that, it offers 24/7 live chat support.

- Analytics and Reporting: QuickBooks Payroll offers a wide range of reports, including payroll billing summary, payroll deductions and contributions, payroll tax liability, total pay, workers’ compensation, and more. You have the flexibility to customize these reports by adding or removing columns according to your preferences before generating them.

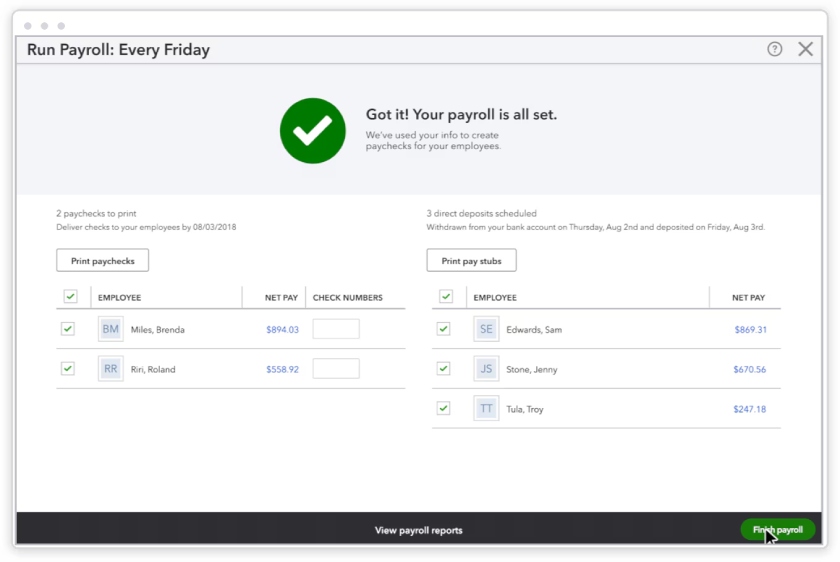

QuickBooks Payroll provides a report of all employees paid, their net pay, and the ability to enter a check number and print paychecks.

(Source: QuickBooks Payroll)

HomePay: Best for Employers Needing Compliance & Customer Support

Pros

- Sets up federal and state tax accounts for new household employers

- Tracks PTO accruals and other reimbursements

- Unlimited chat, email, and phone support with audit assistance, if needed

- Experts on staff for advising on compliance issues

- Access to Care.com’s network of caregivers and household staff

- Offers a “happiness” guarantee: new clients unhappy with HomePay’s services within the first six months can ask for a refund

Cons

- Doesn’t prepare, file, and remit local taxes

- Year-end tax preparation costs extra

- Lacks access to employee health insurance plans

Overview

Who should use it:

HomePay by Care.com is the most expensive option on our list of best nanny payroll services. That might make sense since it manages the entire process, from setting up your employee in its system to processing payroll and managing taxes. It also has experts on staff who are available to advise on compliance issues. It has a self-service portal for your employee and gives you lifetime access to pay stubs and other payroll records—none of the other nanny payroll services we reviewed do that (except Paychex).

Why I like it:

HomePay is a bit pricier than others on our list; however, I recommend using this provider for its excellent tax and audit coverage. Additionally, since it partners with Care.com you have a go-to source for finding and paying a nanny or household employee.

Another thing I like about this provider is that it will set up your tax entities for you, helping you get established as a household employer. However, it doesn’t pay local taxes, which can be a huge issue if you are in a city like New York City, which requires federal, state, and local taxes.

The solution scored 3.77 out of 5 in our evaluation, with a perfect score in its reporting capabilities. It would have gotten a higher score in payroll functionalities if it offered payroll tax services for all levels. With HomePay, only federal and state taxes are filed, and you need to pay for year-end tax preparation—unlike SurePayroll, which doesn’t charge extra for this.

It also scored the lowest in popularity because it doesn’t have user reviews on popular review sites like G2 and Capterra as of this writing.

- Basic: $59 per month

Pricing available for new clients only.

- Includes preparing, filing, and remitting your federal and state taxes for you; payroll management; direct deposit; employee onboarding

- Premium: $79 per month

Offer available only for new clients and includes $79 (1 month free) + Care Premium with active HomePay account.

- Includes everything in the Basic plan, plus serves as tax agencies point of contact, unlimited audit support, applies for federal and state tax ID’s for you, full service phone support

- $100 for year-end tax preparation

- Employee Setup: HomePay will only require your nanny’s email address to set up an online profile in its system. The provider will even collect the household employee’s personal information, W-4 withholding elections, and bank account information for you. Aside from HomePay, only Paychex offers this level of onboarding support.

- Payroll Processing: HomePay calculates and facilitates employee payments automatically through direct deposit or manual paycheck. If you want to monitor your household staff’s attendance, HomePay has a mobile time-tracker app. The other nanny payroll service providers we reviewed lack time tracker apps, although SurePayroll can integrate with time clock software.

- Tax Management: It will also calculate and withhold applicable taxes or payments that need to be made for each pay period. However, unlike the other nanny payroll services on our list, HomePay handles federal and state taxes only.

- HR Features: Aside from new hire reporting, HomePay tracks PTO accruals and reimbursements. HomePay will also maintain general nanny information and payroll record-keeping for you.

- Online Self-service Portal: HomePay’s self-service portal allows your household staff to view their payroll records and pay stubs online. You are also granted lifetime access to payroll and tax records.

- Service Accuracy Guarantee And a “Happiness” Guarantee: Similar to the other providers in this guide, HomePay offers a service accuracy guarantee where it will handle any incurred tax penalties for mistakes its representatives make. On top of that, its “happiness” guarantee reimburses clients who are unsatisfied with HomePay’s quality of service within their first six months. None of the other providers on our list offer this.

- Access to Care.com’s network: HomePay’s connection with Care.com enables you to access its network of caregivers, tutors, nannies, and other household staff. It also provides online tools to help you find and hire household employees.

- Unlimited Support: With HomePay, you can reach its customer support via phone, chat, or email on weekdays.

HomeWork Solutions: Best for Employers Looking for Dedicated Nanny Tax Support

Pros

- Complete nanny payroll service and a tax filing-only plan

- Federal ID and tax account setup services for new household employers

- Back taxes assistance

- Dedicated payroll specialist

- Payment options include direct deposits, live checks mailed to household staff, and direct payments from employer to employee

Cons

- One-time setup fees

- New account setup takes five to seven days

- Year-end tax preparation and back taxes management cost extra

Overview

Who should use it:

HomeWork Solutions is an all-in-one payroll and tax compliance software that offers flexible plans. It has a full-service payroll option and a tax filing option for household employers who only need tax assistance. It also has a dedicated payroll representative, sets up federal ID and tax accounts for new household employers, and can calculate the previous quarter’s nanny payroll taxes for an additional fee.

Why I like it:

I think HomeWork Solutions, although one of the pricier on our list, is a great option for households that need expert tax assistance. It will set up your tax account for you and pay federal, state, and local taxes (something not all the providers on our list handle).

Also, if taxes are all you need, HomeWork Solutions has a tax-only plan. This allows you to calculate all required taxes, and then you can simply write your employee a check out of your business account, without the need for pricey payroll software.

In our evaluation, HomeWork Solutions scored 3.52 out of 5. It scored high (4 and up) in payroll functionalities and our expert assessment of whether it is a good nanny payroll service option. However, its setup and year-end tax prep fees, as well as its lack of onboarding tools, in-house workers’ compensation plan, and benefits options, prevented it from ranking higher.

Additionally, I wasn’t able to get real-world user experience because there are no references to HomeWork Solutions on G2 or Capterra.

- Essential Tax (tax prep and filing services only): $185 per quarter

- Includes employer account Set-Up with IRS, State, & Local tax authorities; federal, state, & local tax withholding for your employee; employer tax filing, creation of year-end Schedule H & W-2 documents; account support

- Complete Payroll + Tax Service:

- $239 per quarter for one employee’s biweekly payroll

- $259 per quarter for one employee’s weekly payroll

- $69 per quarter for each additional employee

- Includes everything in Essential plan, plus personalized payroll, direct deposit, healthcare reimbursement payments, timecard tracking, employee self-service portal, ability to add your own tax pro, tax notice management, dedicated payroll specialist

- Premium Household Payroll + Tax + HR Service: $389 per quarter

- $69 per quarter for each additional employee

- Includes everything in Complete plan, plus VIP priority service, weekend support, personal payroll specialist, personal household employer tax coordinator, live onboarding, on-demand payroll report, expert quarterly HR reviews

- Add-ons:

- Setup fee: $120 (one-time fee)

- Year-end tax form prep: $125 per employee

- Flexible Plans: HomeWork Solutions has both a do-it-yourself (Essential) plan and a full-service (Complete) payroll package. The Essential plan provides you the option to outsource payroll tax calculation and form preparation, including tax payments and filings, and simply handle nanny salary payouts yourself. Meanwhile, its Complete payroll package lets you choose between weekly and biweekly pay runs and includes payroll and tax calculations and tax payment and filing services.

- Extensive Tax Filing Features: HomeWork Solutions can help you set up your household employer account with the IRS and relevant state tax authorities. HomePay also offers this service. HomeWork Solutions automatically files and pays employment taxes at all levels (federal, state, and local). This is unlike HomePay, which does not handle local taxes.

- HR Features: HomeWork Solutions ensures employer compliance with state-specific new hire reporting rules. Similar to Paychex, it can connect you with insurance partners to assist with workers’ compensation requirements. Both HomePay and SurePayroll also offer workers’ compensation insurance and other benefits, but charge extra.

- Dedicated Account Representative And Unlimited Support: HomeWork Solutions has a dedicated payroll representative who can come to your aid whenever you need it. It also provides unlimited “concierge” support that you can reach either online, by email, or by phone from Mondays through Fridays, 8 a.m. to 7 p.m., Eastern time.

Honorable Mention: Poppins Payroll

Although it didn’t make our list because it doesn’t offer its services in all 50 states, Poppins Payroll is ideal for households on a budget, because it charges one flat rate that covers everything—employer registration, calculations, payments, tax returns, PTO and sick leave tracking, and bookkeeping services.

One of the things I like best about Poppins Payroll is that it is exclusive to household payroll. That means it is meticulous on becoming experts and knowing the laws in the states it covers. And, if you do have small business payroll needs, it partners with Gusto.

If your state is not one that they provide payroll in, however, Poppins Payroll will not be right for you. Services are not available in Alaska, Delaware, Hawaii, Kentucky, Mississippi, Montana, North Dakota, Pennsylvania, South Dakota, West Virginia, and Wyoming. However, Poppins Payroll expresses that they are moving towards offering their services in all 50 states.

Poppins Payroll is the only payroll service on our list that does not charge extra for other additional services—everything is included in the monthly fee. It is also very easy to use, and even users not familiar with payroll can navigate it. Compared to the other providers on this list, it is not available in all 50 states—but it deserves special mention because it does not charge extra for its additional services, making it an ideal choice for households on a budget.

It is priced at $49 per month for one user, plus $10 for each additional user.

Some key features include:

- Sample Nanny Contracts: Poppins Payroll and HomePay are the two providers on this list that have this feature. However, Poppins has a wide range of sample nanny contracts to offer. These can be customized to fit the specific needs of each household. The contracts cover a variety of topics, including hours of work, pay, benefits, and termination. These are a valuable resource for users, as it can help them create a contract that is fair to both the nanny and the household.

- Secure Digital Library: Poppins Payroll has a secure online library that stores all of your tax and payroll documents. This includes your nanny’s W-4 form, your payroll reports, and your tax filings. The library is accessible to you at any time, from anywhere. It also keeps your data for five years, allowing you to access and print them when needed.

Read more in our Poppins Payroll review or Visit Poppins Payroll to sign up for its services.

How to Choose the Best Nanny Payroll Service

When choosing the best nanny payroll service there are several key things to look at—affordability, tax compliance, range of services, and customer support.

- Budget: As a household employer you may not have the funds of a full-fledged business. Therefore, keeping costs down will be a huge factor in choosing the right nanny payroll service.

- Features: Another key thing to consider is the features you need. Do you need to track time or PTO? Do you want to offer other benefits, such as 401k and healthcare coverage?

- Compliance: If you know nothing about taxes, you’ll want to look for a provider that provides the best compliance support–everything from helping you set up your household as a business to calculating and paying taxes.

- Support: If you could do it all yourself, you wouldn’t need a provider to assist. And, largely important, is the support they provide. When choosing the best nanny payroll service, consider the support, whether dedicated or extended hours available.

- Reviews: What are other people saying about the service? Reading third-party reviews can help (although not everyone leaves a review) in determining the best provider.

Methodology: How We Evaluated the Best Nanny Payroll Service

To find the best nanny payroll service, we compared 18 nanny payroll services against features we believe are most important for those hiring household employees. Aside from pricing, we looked at pay and tax processing functionalities specific to nanny payroll. We also considered ease of use and customer support since household employers don’t usually have much experience with processing payroll.

Click through the tabs below for our full evaluation criteria.

30% of Overall Score

Providers were given priority scoring to those that offer unlimited payroll runs, direct deposit payments, paper checks, and tax payment and filing services, including year-end tax form submissions (W-2 and Schedule H).

15% of Overall Score

This criteria was determined by looking at the monthly costs and setup fees of the providers, as well as whether their pricing details are readily available on their websites. We gave preference to those that charge less than $50 per month for one employee and don’t have setup fees.

10% of Overall Score

A payroll service should allow homeowners to create payroll reports, customize them, and be able to export or import these reports.

15% of Overall Score

Payroll service and software should be easy to access and set up and have a user-friendly interface. We gave high points to those that provide a dedicated representative, employer ID and tax set-up assistance, and live phone support that resolves issues promptly.

15% of Overall Score

This criterion reflects how well we think the software works for families in particular as far as price, tax prep, and ease of use. Each of our experts thoroughly reviewed each provider for affordability, features, and ease of use.

10% of Overall Score

Providers were prioritized for those that handle onboarding and offer a self-service portal for nannies to see payments made, edit information, and/or print forms. We also looked for providers that offer workers’ compensation and other employee benefits options, as well as access to experts who can advise users on compliance issues.

5% of Overall Score

Online user reviews were considered from third-party sites like G2 and Capterra. Extra points were given to providers with an average of 4+ stars and at least 1,000 reviews.

Meet the Experts

Robie Ann Ferrer, an expert senior payroll staff writer for Fit Small Business, created the original version of this buyer’s guide and evaluated all the providers in this list against the original rubric (according to the methodology listed).

The last version was updated by Genevieve Que, another expert staff writer for Fit Small Business, with updates to the comparison table and scoring updates based on her review of the existing rubric.

For this version of the best nanny payroll services, I re-evaluated the original rubric, reformatted the BG for better user experience, and updated our content with new features and pricing changes. Due to scoring changes, HomePay moved up a spot above HomeWork Solutions.

Learn more about the experts below:

| Robie Ann Ferrer is an HR expert writer at Fit Small Business, with over 8 years experience focusing on small business HR and payroll software content. Robie also worked as an HR specialist for 10 years where she managed various facets of HR—from payroll and benefits to employee services and HR systems. |

| Genevieve has more than 13 years of writing experience, working with different clients in various industries. Genevieve also worked as an HR Head of a local manufacturing company, and has helped small businesses set up their business and HR processes. |

| Jennifer Soper has 25+ years of writing and content design experience, working with small businesses and Fortune 100 companies. For over a decade, Jennifer worked as an HR generalist, providing expertise in accounting, payroll, and HR by implementing payroll and benefits best practices and creating onboarding and employee-relations documentation. |

| Jessica Dennis is the HR lead writer at TechnologyAdvice and also lends her expertise reviewing content for Fit Small Business. She has B.A. in English Literature from the University of Michigan and over six years of experience in onboarding, payroll, benefits, compliance, and workforce management as an HR generalist. Since joining TA, she’s covered additional topics like DEI, engagement, training, communication, hiring, and performance management best practices. Her expertise, in-depth research, and hands-on experience with HR software ensures she provides the best people operations and technology insights to readers. |

Nanny Payroll Frequently Asked Questions (FAQs)

Paying your nanny (or other household employees) is different from paying a casual babysitter or neighborhood kid to do your lawn. There are laws around having a domestic worker on your payroll. Partnering with a provider that offers nanny payroll services/software can help you navigate the intricacies of managing payments for household employees.

No, nannies cannot be considered independent contractors because the amount of control over their work hours and environment qualifies you as an employer according to the IRS. Thus, you are responsible for tax withholdings, Social Security and, in some states, workers’ compensation.

Beyond the legalities, registering yourself as a household employer and registering your nanny or other household workers as an employee offer some benefits. These include:

- Building your employment history

- Enabling household staff to collect unemployment insurance

- Building your Social Security

- Helping household staff qualify for loans

- Potential tax breaks for household employers under the Dependent Care Assistance Program (DCAP) and the Child and Dependent Care Tax Credit

You need a federal EIN from the IRS. Tax accounts with state and local agencies may also be needed, so it’s best to check the relevant guidelines in your area. In addition to your and your nanny’s name and Social Security numbers, you’ll be asked to provide your email address, the physical address where household staff will provide service, the phone number associated with the physical address, and confirm their identity and eligibility to work in the United States.

No, you can’t. It is illegal to process payments for your household staff through your business payroll. If you are a small business and don’t want to use two different platforms, look for vendors that allow you to conduct payroll through multiple entities. I recommend Paychex for this because you can set up separate company IDs with different payroll dates and methods.