If you’re always on the go and want easy access to pay processing tools wherever you are, check out our top recommended payroll apps.

6 Best Payroll Apps

This article is part of a larger series on Payroll Services.

The best payroll apps let employers handle payroll right from their smartphones or tablets. While the apps are usually free to download, you’ll typically need to pay for the service to access its features. Some payroll apps don’t allow e-filing for payroll taxes, but others offer full functionality, letting you run payroll, pay employees and taxes, and approve time—all via the app.

To find the best payroll apps for small business owners, we evaluated 15 solutions and narrowed the list to our top six recommendations:

- Square Payroll: Best overall, ideal for restaurants and retail shops

- Paychex: Best for solopreneurs and growing businesses

- Fingercheck: Best for startups needing payroll financing services

- Paycom’s Beti: Best for guided employee-run payrolls

- Roll by ADP: Best chat-based mobile payroll tool

- SurePayroll: Best for simple pay runs (no major reporting or customization requirements)

Best Downloadable Payroll Apps Compared

While all the payroll apps in this guide are free to download, you need a paid software subscription to use its tools. These payroll management apps also allow you to view basic reports and process wage payments for employees and contractors. Below are some of the key features.

Our Score (Out of 5) | Starter Monthly Pricing | Other In-app Tools | ||

|---|---|---|---|---|

4.15 | ✕ | $6 per employee + $35 base fee |

| |

4.07 | First three months are free | Custom pricing |

| |

3.89 | ✕ |

| ||

3.76 | ✕ | Custom-priced |

| |

| 3.61 | First three months are free | $5 per employee + $39 base fee |

|

| 3.59 | Up to six months free |

| |

Quiz: Which Payroll App Is Best for You?

Square Payroll: Best for Retailers & Restaurant Business Owners

Pros

- Affordable full-service payroll with unlimited pay runs

- Offers next-day direct deposits and instant payment options

- Timecard management features included in mobile app

- Seamless integration with Square POS

Cons

- Next-day direct deposits and instant payments require having funds from Square balance or Square checking accounts

- Standard direct deposits take four days for those without a Square Payments account

- App only for employers; employees have a separate app to view pay stubs

- Occasional app glitches

Overview

Who should use it:

Square Payroll is an ideal solution for retail shops and restaurants because its seamless integration with Square POS allows them to accept payments and track employee hours from their mobile devices. All that data flows right into the payroll system, including tip reporting.

Why we like it:

The Square Payroll app is available only for employers to run payroll, track time-off balances, and check benefits plans. You can even check if Square has completed filing the required payroll tax forms for you—a mobile app functionality that none of the providers in this guide offer. For your employees, they can clock in and out for work and view their schedules, paystubs, and tax forms (like W-2s and 1099s) via the app.

Meanwhile, its main software offers full access to all its features, such as creating profiles for new employees and downloading custom reports. Viewing and managing payroll summaries, timecards, and employee benefits are also easier through its main platform because of the larger screen.

Mobile app: The Square Payroll app is free to download on Google Play and the App Store but you have to pay software subscription fees to use its features.

Software subscription fees:

- Pay employees and contractors: $35 per month + $6 per employee monthly

- Pay contractors only: $6 per person monthly

With just a few clicks, you can pay employees easily via the Square Payroll app. (Source: Square Payroll)

For Employers

- Set up a Square payroll account

- Manage, process, and submit payroll for employees and contractors

- Set up automatic payroll and let the system run payroll itself

- Automated payroll taxes (Square will handle tax filings for you)

- Import employee work hours and tips from Square POS or partner timecard apps (via third-party software integration)

- Track sick leave, paid time off (PTO), and overtime

- View, edit, and create employee time cards

- Choose payment options (via direct deposit, manual check through self-printing, and the Square Cash App)

- View payroll histories and payroll summaries

- View payroll tax filing status (whether or not Square has filed applicable tax forms)

- Check and enroll employees in benefits plans (such as health, retirement, and workers’ compensation plans)

For Employees

- Clock in/out for work

- Receive reminders about when to clock in/out for shifts and breaks

- View and manage work schedules (eg., set availability, claim open shits, and swap shifts with other employees)

- View actual hours worked and timecards

- View estimated pay for the workweek

- View benefits and edit personal information (including bank account details)

- See pay stubs and download tax forms

Paychex: Best for Solopreneurs & Growing Businesses

Pros

- Flexible payroll and HR plans, including one for solopreneurs

- 24/7 support for all plans and a dedicated payroll specialist for higher tiers

- Multiple pay options (i.e. paper checks, direct deposits, pay on-demand, and pay cards)

Cons

- Pricing isn’t transparent

- In-app tech support isn’t responsive

- Tracking employee attendance requires a separate app

- Time tracking is a paid add-on

Overview

Who should use it:

Paychex is great for solopreneurs and growing businesses because it offers flexible payroll and HR plans. You can start with its Paychex Solo solution for solopreneurs and then transition to Paychex Flex—and maybe even its professional employer organization (PEO) option—if you need to offer competitive benefits or want to outsource more of the HR and compliance function to a team vs doing it yourself

Why we like it:

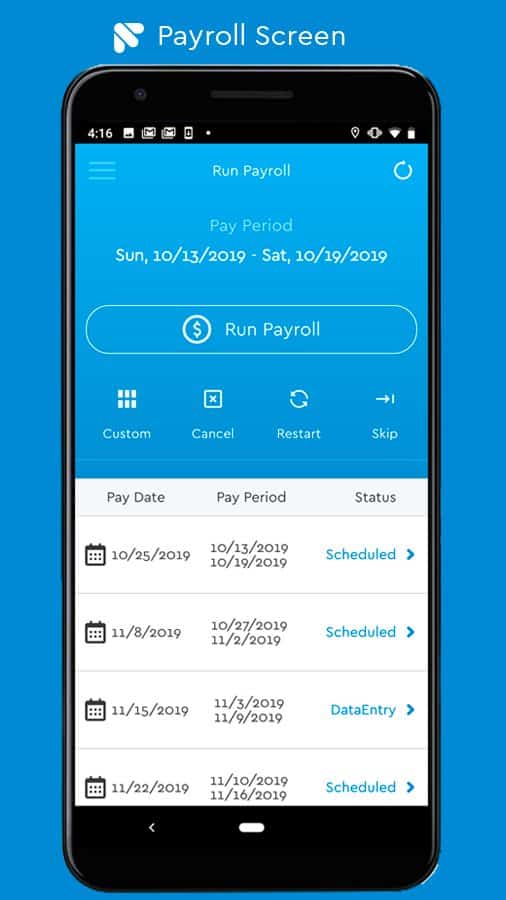

The Paychex Flex app has the flexibility to run, review, and submit payroll while on the go. And, if you start processing payroll via its main software but need to stop midway, you can easily resume the pay run via the app and vice-versa. This is a mobile app functionality that none of the providers we reviewed offer. It even comes with both employer and employee self-service solutions for managing staff profiles and viewing benefits plans.

With Paychex Flex’s cloud-based software, you have additional access to HR documents and forms, onboarding tools, analytics, and an online employee handbook builder. Learning sessions like compliance and professional development programs are also available, including tools to help you create online training courses with interactive quizzes, video guides, and anonymous surveys.

Mobile app: The app is free to download on Google Play and the App Store, but you have to pay software subscription fees to use its features.

Software subscription fees:

- Paychex Flex Select: Custom-priced

- Paychex Flex Pro: Custom-priced

- Paychex Flex Enterprise: Custom-priced

Paychex plan for solopreneurs and the self-employed

- Paychex Solo: Custom-priced

- Includes payroll, self-employed 401(k), and incorporation services

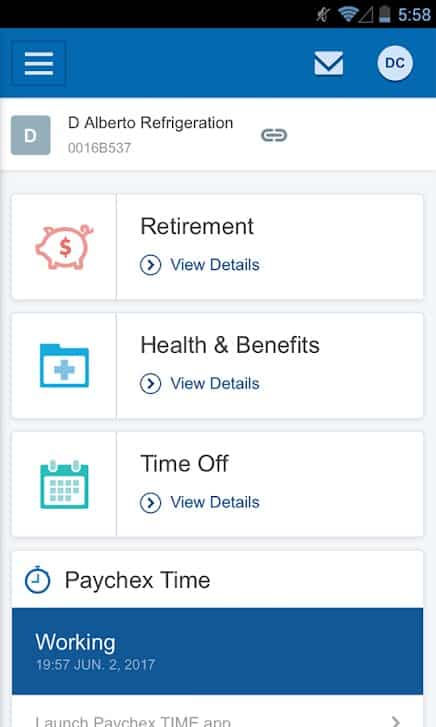

With the Paychex app, you can process payroll and provide employees access to benefits, payslips, and PTO details. (Source: Paychex)

For Employers

- Enter, review, and submit payroll

- Resume pay runs started on your tablet, laptop, or desktop computer

- Access payroll reports, payroll cash requirements, and employee check stub details

- Automated payroll taxes (Paychex will handle tax filings for you)

- View employee profiles, compensation details, taxes and deductions, and PTO balances

- Check retirement plan balances, participation rates, and employee eligibility

- Access health and benefits carrier information and member guides, including employee enrollment and election information

For Employees

- Check pay stubs and payroll tax forms (W-2s only)

- View employee profiles, compensation details, taxes and deductions, and PTO balances

- Access health, dental, and life insurance benefit details, deductions, and contact information

- Check retirement balances, contributions, returns, and loans

Fingercheck: Best for Startups Needing Payroll Financing Services

Pros

- Mobile app lets you run payroll

- Reasonable pricing with a wide range of features

- Unlimited pay runs

- Offers payroll funding services with an affordable weekly interest rate and quick access to funds

Cons

- Limited integrations with third-party software

- Employee onboarding can be problematic

- You need to subscribe to at least its “Small Business Starter” plan to get mobile payroll features

Overview

Who should use it:

Fingercheck offers a comprehensive HR platform and mobile app for startups and small businesses. It includes tools for payroll as well as for managing employee attendance, schedules, benefits plans, hiring, and onboarding. It’s the only provider on our list that offers payroll financing—a great option for startups to secure funds in time for payroll.

Why we like it:

The differences between the functionalities of Fingercheck’s mobile app and online software are very minimal. Apart from the ease of navigating through its many solutions (since laptops and desktop computers have wider screens/monitors than mobile devices), you are granted additional access to HR workflow automation tools and a custom report builder with a library of report templates.

Its partnership with Infinity Capital Funding also helps you get financing assistance so that you can always run payroll even when cash flow is thin—something that no other provider on this list offers.

Mobile app: The app is free to download on Google Play and the App Store but you have to pay software subscription fees to use its features.

Software subscription fees:

- Time & Attendance: $20 per month + $7 per employee monthly

- Small Business Starter: $39 per month + $8 per employee monthly

- 360: $59 per month + $10 per employee monthly

- 360 Plus: $99 per month + $12 per employee monthly

Fingercheck lets you run or cancel payroll right from your mobile phone. (Source: Fingercheck)

For Employers

- View and approve time sheets

- Enter punches for employees and view clock-in details with GPS and photo

- Check who’s working and where

- Edit and modify employee information

- Onboard new hires

- Preview and process payroll

- Automated payroll taxes (Fingercheck will handle tax filings for you)

- Access the employee directory

- Approved requests (eg., time off and reimbursement claims)

- Run all Fingercheck reports

For Employees

- Clock in/out with GPS tagging and photo capture

- View time sheets, work schedules, and PTO balances

- Timesheet approvals via digital signatures

- View pay stubs and pay history

- Request PTO and expense reimbursements

- Update tax withholding and contact information

- Manage emergency contacts and dependents data

- Access the employee directory

Note that the features you and your employees can access through its mobile apps depend on the functionalities included in your chosen Fingercheck plan. Upgrade to its highest tier to unlock all tools (such as hiring, expense tracking, and shift scheduling solutions)

Paycom’s Beti: Best for Guided Employee-run Payroll

Pros

- Beti’s in-app step-by-step guide helps employees process payroll accurately

- Sends alerts and provides warnings of errors and discrepancies before payroll submissions

- Dashboard allows HR to monitor Beti’s payroll progress and tasks that need immediate action

Cons

- Pricing isn’t transparent

- You may need to conduct basic payroll training so employees feel confident using the app and running their own payroll

- Paycom’s other modules (like time tracking and benefits administration) cost extra

- Not ideal for businesses with complex payroll

Overview

Who should use it:

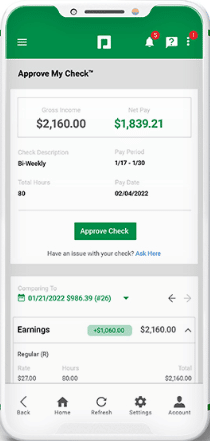

Paycom’s Beti is the best payroll app for businesses that want to empower employees to manage their own payroll. It provides them access to pay and deduction details so they’re aware of how much salary to expect every payday. Running payroll is easy, given its in-app guide designed to help workers process accurate wage payments. None of the payroll apps in this guide offer a self-service payroll tool for employees.

Why we like it:

Similar to Roll by ADP, Paycom’s Beti app is one of the more unique products in the market. It provides a step-by-step guide for employees to review and approve their own payroll before paydays, allowing you to spend less time managing pay processes. The seamless integration between Paycom’s solutions (such as time tracking and expense management) also makes it easy for Beti to pull payroll-related data, like compensation changes, employee pay rates, approved business expense claims, and actual hours worked.

Additionally, the text and screen sizes are bigger if the software is accessed via computers and laptops. The main platform is also more intuitive than its mobile app, making it easier for you to view and manage HR payroll tools, online documents and checklists, and onboarding forms like I-9s and W-4s.

Mobile app: Paycom’s Beti app is free to download on Google Play and the App Store, but you have to pay software subscription fees to use its features.

Software subscription fees: Custom-priced; you have to contact Paycom to discuss your requirements and request a quote.

Paycom’s Beti has in-app help guides and an “Ask Here” button that employees can use if they need assistance or have paycheck issues. (Source: Paycom)

For Employers

- View employee profiles and timecards

- Approve requests for punch changes, PTO, and expense claims

- Manage employee schedules

- View applications of qualified candidates

- Automated payroll taxes (Paycom will handle tax filings for you)

- Access personnel action forms to document and approve employee movements (such as promotions, demotions, lateral transfers, and changes in salary)

For Employees

- Run, review, and approve own payroll before scheduled pay dates

- Access personal data, benefits information, performance reviews, tax forms, and pay stubs

- Clock in/out or input hours worked directly into an online time sheet

- Submit and request approvals for PTO, time sheet changes, and expense claims

- View PTO accruals, work schedules, and time sheets

- Access online training courses

Note that access to mobile app features can vary, depending on the Paycom modules you selected. Its solutions cover a wide range of features, such as hiring, learning courses, performance management, compensation budgeting, benefits administration, and expense tracking.

Roll by ADP: Best Chat-based Mobile Payroll App

Pros

- Affordable plan with unlimited pay runs and live chat support

- Same and next-day direct deposits available

- Artificial intelligence (AI)-powered assistant guides you through the payroll process and conducts error checks in real time

- Unlimited pay runs

Cons

- Slight learning curve due to its chat-based commands

- No benefit options, automated 1099 tax filings, and live phone support

- Limited reporting

- Chat support wait times can be lengthy

- Integrates only with QuickBooks Online (as of this writing)

Overview

Who should use it:

It is a good option for small businesses (with up to 10 employees) that require low-cost yet smart mobile payroll tools without all the features of cloud-based payroll software. It offers an affordable plan, costing only $39 plus $5 per employee monthly.

Why we like it:

Roll by ADP is the only payroll app for small business owners that lets you run payroll and set up staff profiles online through chat commands. While its chat-based mobile system may take some getting used to, its smart in-app assistant can help guide you through its functionalities. It even runs error checks and sends proactive alerts. Although it doesn’t have an online software, it offers desktop access—allowing you to view its mobile app via computers and laptops.

Mobile app: The app is free to download on Google Play and the App Store, but you have to pay software subscription fees to use its features.

Software subscription fees: $39 per month + $5 per employee monthly

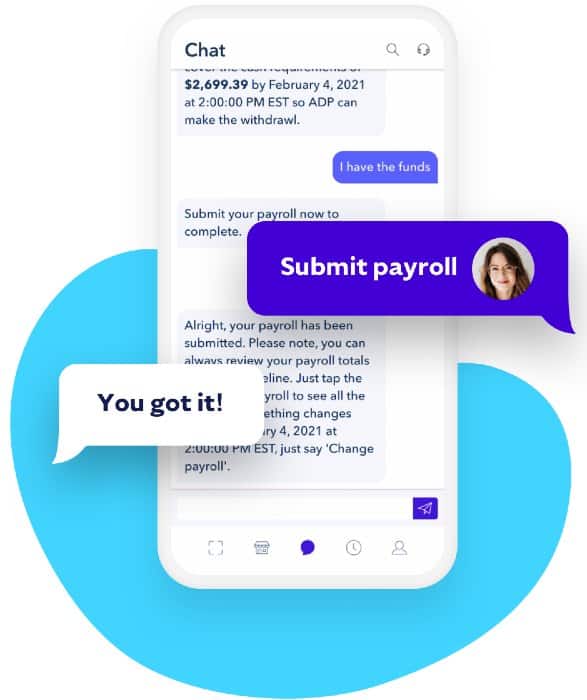

With Roll by ADP, you simply need to type the chat command to run and submit your payroll. (Source: ADP Roll)

For Employers

- Run unlimited payroll for employees and contractors

- Automatic deductions for retirement and benefits plans

- Pay via direct deposits (next- and same-day options available) or manual paychecks (you have to prepare this yourself)

- Real-time, artificial intelligence (AI)-driven error checks

- Automated payroll taxes (Roll by ADP will handle tax filings for you)

- Payroll reports and payroll registers sent to you and your accountant (via email)

- Get personalized payroll-related reminders and alerts

- Change employee pay amounts, company information, and more

- Access Roll by ADP’s 24/7 chat support

For Employees

- View job, pay, and benefits information

- View and download pay stubs

- Access and download tax forms

- Receive payday notifications

- Update employee data

SurePayroll: Best for Small Business Owners With Simple Payroll Needs

Pros

- Offers affordable full-service payroll and DIY tax filing plans

- Unlimited and automatic pay runs

- Two-day direct deposits

- Has US-based support with extended weekday and weekend hours

Cons

- Charges add-on fees for Ohio and Pennsylvania local tax filings

- Accounting and time tracking integrations are paid add-ons

- Lacks onboarding tools; you have to manually collect paper forms and input the new hire’s personal information (e.g., address and bank account details) directly into the system

Overview

Who should use it:

SurePayroll is an ideal solution for businesses that grow and expand to additional states. Although it might cost extra to run payroll in more than one state, it helps you maintain compliance minus the complexity of other payroll services. Its Full Service package calculates and files your payroll taxes plus pays employees. Just in case you want to do the tax filing yourself, it offers a DIY option.

Why we like it:

Like the other payroll apps in this guide, SurePayroll by Paychex lets you process and manage employee payments while on the go. If you subscribe to its Full Service Payroll plan, the provider will even handle tax filings for you. However, its mobile app isn’t as feature-rich as both Fingercheck and Paycom’s Beti, which include access to online learning sessions. Its payroll tool also isn’t as flexible as Paychex Flex, which lets you start pay runs via its online platform and continue the process through its mobile app and vice-versa.

On the other hand, SurePayroll’s online software gives you additional access to HR forms, documents, and workplace compliance posters. Plus, you can generate all of its payroll reports via the main platform, as well as some of its pre-employment screening tools like background checks, behavioral assessments, and skills testing.

Mobile app: The app is free to download on Google Play and the App Store, but you have to pay software subscription fees to use its features.

Software subscription fees

- Full Service plan: $39 per month + $7 per employee monthly

- Includes unlimited pay runs and payroll tax filing services

- No Tax Filing plan: $20 per month + $4 per employee monthly

- Full Service features but without tax filings—you have to handle this yourself

Add-ons

- Ohio and/or Pennsylvania local tax filing services: $9.99 per month

- Multiple state filings: $9.99 per month

- Software integrations: $9.99 per month for time tracking tools and $4.99 per month for accounting solutions

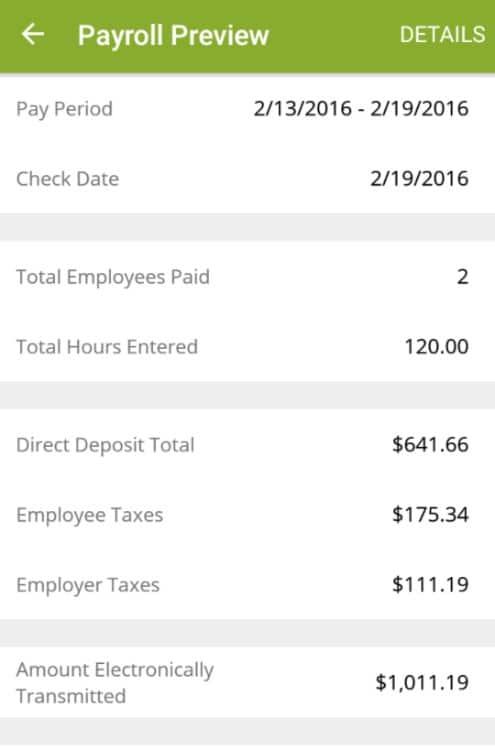

With SurePayroll, you can preview and submit payroll summaries for approval while on the go. (Source: SurePayroll)

For Employers

- Run and edit payroll for employees and contractors

- Enter wages and hours for payroll and paid leaves (like vacation and sick leaves)

- Preview payroll totals and payment methods

- View payroll deadlines, bank holidays, employee birthdays, and compliance updates

- View detailed reports of employee and company earnings, taxes, deductions, and year-to-date (YTD) totals

- Access employee contact information

- Get payroll submission and approval alert notifications

- Receive alerts notifying the Approval and Administrator of payroll approval status

For Employees

- View paycheck details, including earnings, taxes, deductions, and YTD totals

- View used, available, and earned vacation, sick, and personal leaves

- Check wage rates and retirement deduction/contribution rates

- View multiple paychecks distributed in a single pay period

- Access past pay stubs

- View and verify the accuracy of contact information on file

How to Choose a Payroll App

When selecting the best payroll app for your business, it is essential to consider several criteria to ensure it meets your needs and preferences. Here’s a breakdown of important factors to consider:

Pricing

Before committing to a payroll app, carefully review its pricing structure. Compare different plans and pricing tiers to find one that suits your budget and offers the features you need. Also, keep an eye out for any additional fees or hidden costs that may apply.

Key Features

Consider the key features offered by the payroll app and how they align with your business requirements. Look for essential functionalities, such as payroll processing, tax calculations, employee self-service options, reporting tools, and integration capabilities with other business systems, as these directly impact your business. These features can help ensure accurate and efficient payroll management, reducing the risk of errors and ensuring compliance with regulations.

Security

This is very important when it comes to payroll processing because it involves handling sensitive employee data and financial information. Ensure that the payroll app follows industry-standard security protocols and encryption measures to protect against data breaches and unauthorized access.

User Feedback

Comments from real-world users can provide valuable insights into the performance and reliability of a payroll app. Read reviews and testimonials to gauge overall satisfaction and identify any recurring issues or concerns. Pay attention to both positive and negative feedback to make an informed decision.

Ease of Use

An intuitive and user-friendly interface is essential for seamless payroll management. Choose a payroll app that is easy to navigate and understand, minimizing the learning curve for you and your team. You might also want to try the demo version or trial period to assess the app’s ease of use before making a decision.

Methodology: How We Evaluated the Best Payroll Apps

We looked at ease of use, payroll and HR features, and mobile app-specific functionalities. We also considered pricing, such as whether the app is free to download and if the software subscription fees. Then, we rated each function on a 5-star scale designed to assess payroll apps.

To see our full evaluation criteria for best payroll apps, click through the tabs in the box below.

40% of Overall Score

Mobile solutions that allow employers to run payroll, track PTO balances and requests, and access self-service tools (like viewing payslips and managing employee data) received high marks. Extra points were also given to apps that can be accessed by both employers and employees, have positive mobile app reviews (average of 4-plus stars), and offer in-app tech support.

30% of Overall Score

Automatic payroll runs, payroll tax filings, W-2 and 1099 form preparation, manual check capabilities, and two-day direct deposits are some of the features that we looked for. Providers also get points if they can handle both employee and contractor payroll and offer pay card and pay-on-demand options.

10% of Overall Score

15% of Overall Score

5% of Overall Score

Having access to a professional who can provide expert advice on compliance issues is one of the top criteria, including new hire state reporting. Following closely behind these is the capability to provide online onboarding and employee benefits like health insurance and workers’ compensation that are available in all 50 states.

Payroll App Frequently Asked Questions (FAQs)

The best app to pay employees comes with full-service pay processing features, including automatic payroll and tax calculations, tax form filings, direct deposit payments, pay schedule notifications, and alerts for potential pay errors. Access to basic payroll registers and reports is important so you can easily review the deductions and salary payments per pay run. It should also offer time tracking and PTO management tools, allowing you to easily capture employee attendance data for pay processing.

While most payroll apps are free to download, you need to pay software fees to use its features. For an app with essential payroll tools, you should expect to pay around $5 to $50 monthly. If you require additional solutions, like time tracking and hiring, some providers charge software fees of more than $50 per month.

Mobile payroll apps are downloadable apps that you can install directly into your tablets or smartphones. These payroll apps typically have only a handful of the features that their main platform offers, mainly because of the system size limitations that mobile apps and smartphones have.

On the other hand, payroll software with mobile responsive platforms can easily be accessed through mobile web browsers—no app download required. You simply need to go to the provider’s website, log into your account, and access all of its features online.

Bottom Line

Using mobile apps to manage payroll out of the office is a necessity for many business owners. Those that are considered good are designed to provide payroll services that help employers pay their staff accurately and on time and avoid potential tax-filing penalties. The best payroll apps for your business also depend on the type of workers you hire (employees versus contractors), your compliance needs, and whether or not you have in-house payroll or HR support staff to handle employee pay processing.

Our recommendation for the best payroll app is Square Payroll. It lets you run payroll, manage tax deductions, track PTO, access benefits plans, and set up automatic pay runs all from your mobile device. Moreover, it’s easy to use and integrates with Square POS seamlessly—a plus for retail shops and restaurants already using the provider’s point-of-sale software. Sign up for a Square Payroll plan today.