Square Payroll is built specifically for small business owners to simplify payroll processing. It is designed to work flawlessly with Square POS, making it an ideal payroll tool for retailers and restaurateurs who use its point-of-sale solution. Square Payroll also offers flat-rate pricing ($35 per month plus $6 per employee monthly) with a cancel-anytime account option. It earned an overall score of 4.51 out of 5 in our evaluation of the best payroll software for small business users.

Square Payroll Overview

Pros

- Easy to use

- Flat-rate pricing with a low-cost contractor-only payroll plan

- Seamless integration with Square POS

- Offers instant and next-day payment options with a Square balance or Square Checking account

Cons

- Basic HR features only

- Lacks a dedicated payroll specialist

- Phone support is available only on weekdays; difficult to reach at times

- Standard direct deposit has a four-day processing timeline

Deciding Factors

Supported Business Types | Small retail shops, restaurants, and contractor-only businesses needing online tools to manage payroll and benefits |

|---|---|

Pricing |

|

Standout Features |

|

Ease of Use | Relatively easy to learn and use, provided you have basic knowledge of how to run payroll |

Customer Support |

|

Square Payroll’s solid pay processing tools and tax filing services make it a great choice for a wide variety of businesses and users. It is even featured in several of our buyer’s guides.

- Best Restaurant Payroll Software

- Best Payroll Apps

- Best Cheap Payroll Services

- Best Payroll Software for Mac

- Best Human Resources Payroll Software

- Best Payroll Services for Small Businesses

Square Payroll Is Best For

- Small businesses: Square Payroll is specifically intended for small businesses. It is affordable ($35 per month plus $6 per employee monthly) and makes providing employees with benefits like healthcare, workers’ compensation, and retirement plans easy.

- Contractor-only companies: It has a contractor-only plan for managing and paying 1099 workers and is one of our recommended contractor payroll services for small businesses. At $6 per person monthly, it can pay contractors via direct deposit and file 1099-MISC forms for you.

- Square POS users, especially retailers and restaurants: If your business works with Square’s POS solution, simply add its payroll tool to your subscription to start running employee payments. The seamless integration between its POS and payroll solutions allows you to track and capture employees’ actual hours worked and tips earned for easy pay processing.

Square Payroll Is Not Best For

- Large businesses: Square Payroll is not designed for large operations with thousands of employees; the flexibility and customization needed aren’t available. If this describes your business, consider either ADP or Paychex since both offer flexible pricing plans and robust HR features. To see how both compare against each other and with Gusto, check out our ADP vs Paychex article.

- Companies looking for professional employer organization (PEO) services: While it provides efficient pay processing tools, Square doesn’t offer professional employer organization (PEO) services to help you manage day-to-day HR tasks. Read our guide to the best PEO companies to find a good option for your business.

Top Square Payroll Alternatives

Best For | Starter Monthly Fees | Contractor-only Plan | Learn More | |

|---|---|---|---|---|

| Small restaurants and retail shops | $35 base fee plus $6 per employee | $6 per contractor monthly | |

| Flexible payroll plans and dedicated support | $39 base fee plus $5 per employee | Included in monthly plan | |

| Fast-growing businesses | Custom priced | Custom priced | |

| Full-service payroll and solid HR support | $40 base fee plus $6 per employee | $35 base fee plus $6 per employee | |

Our Comparisons of Square Payroll vs Other Software

Looking for something different? If you need something even more low-cost than Square Payroll, check out our free payroll software guide.

Square Payroll has a perfect mark in pricing, given its affordability and transparent monthly fees. Its unlimited pay runs and zero setup fees also contributed to its high score.

You can choose from two Square Payroll pricing plans: full-service payroll and contractor-only payroll. With the full-service option, you get all its features—from automatic pay calculations and tax filing services to online time cards and multiple employee payment options (such as direct deposits, manual checks, and via its Cash App).

For businesses that only employ independent contractors, Square Payroll only charges $6 monthly for each person paid. This plan comes with unlimited payroll, time tracking tools, and the digital delivery of year-end 1099 forms.

Features | Full-service Payroll | Contractors-only Payroll |

|---|---|---|

Monthly Pricing | $35 plus $6 per worker paid | $6 per worker paid |

Unlimited & Automatic Pay Runs | ✓ | Unlimited payroll only |

Multistate Payroll | ✓ | ✕ |

Pay via Check, Direct Deposit, and Square’s Instant Payments/Cash App | ✓ | ✓ |

Direct Deposit Timelines | 2 and 4 days; next-day and instantly via the Cash App | 4 days; instantly via the Cash App |

Federal, State, and Local Tax Payments and Filings | ✓ | ✕ |

Digital Delivery of Year-end W2s & 1099s | ✓ | ✓ |

Time Tracking via the Square Team App | ✓ | ✓ |

Tip Calculations and Imports | ✓ | ✕ |

Benefits Deductions and Contributions | ✓ | ✕ |

Online Employee Accounts & Simple Onboarding | ✓ | ✓ |

Square Payroll Pricing Calculator

Need a quick way to compute costs? Use our online calculator to get the estimated monthly and annual fees based on your employee count.

Add-on Solutions

For an additional fee, you can add more features to Square Payroll’s platform and services. However, some add-ons are limited to the full-service payroll plan. Here are some of the options:

Square Payroll Subscription Management

One of the things I like about Square Payroll is that you’re not required to sign an annual contract to use its platform. The provider will bill you monthly based on the number of employees and contractors paid. And while you can pause and cancel your Square Payroll account at any time, there is some important information you should note.

Whether you employ hourly workers, monthly paid staff, or contractors, finding a payroll service to manage wage payments is critical for small businesses. With Square Payroll, you can pay workers through direct deposits, manual paychecks, and its Cash App. It also helps you accurately calculate the prorated salaries of both new hires and resigning staff, especially if they’re joining or leaving outside your company’s pay periods.

In my evaluation of its payroll features, Square earned nearly perfect marks (4.5 out of 5) given its solid pay processing tools. In addition to unlimited and automatic pay runs, it can handle multi-state payroll, custom pay schedules, PTO tracking, and multiple pay rates. If you’re a Square POS user, you can import employee tip and commission data directly into Square Payroll. This feature saves you time and removes potential errors from manual data entries.

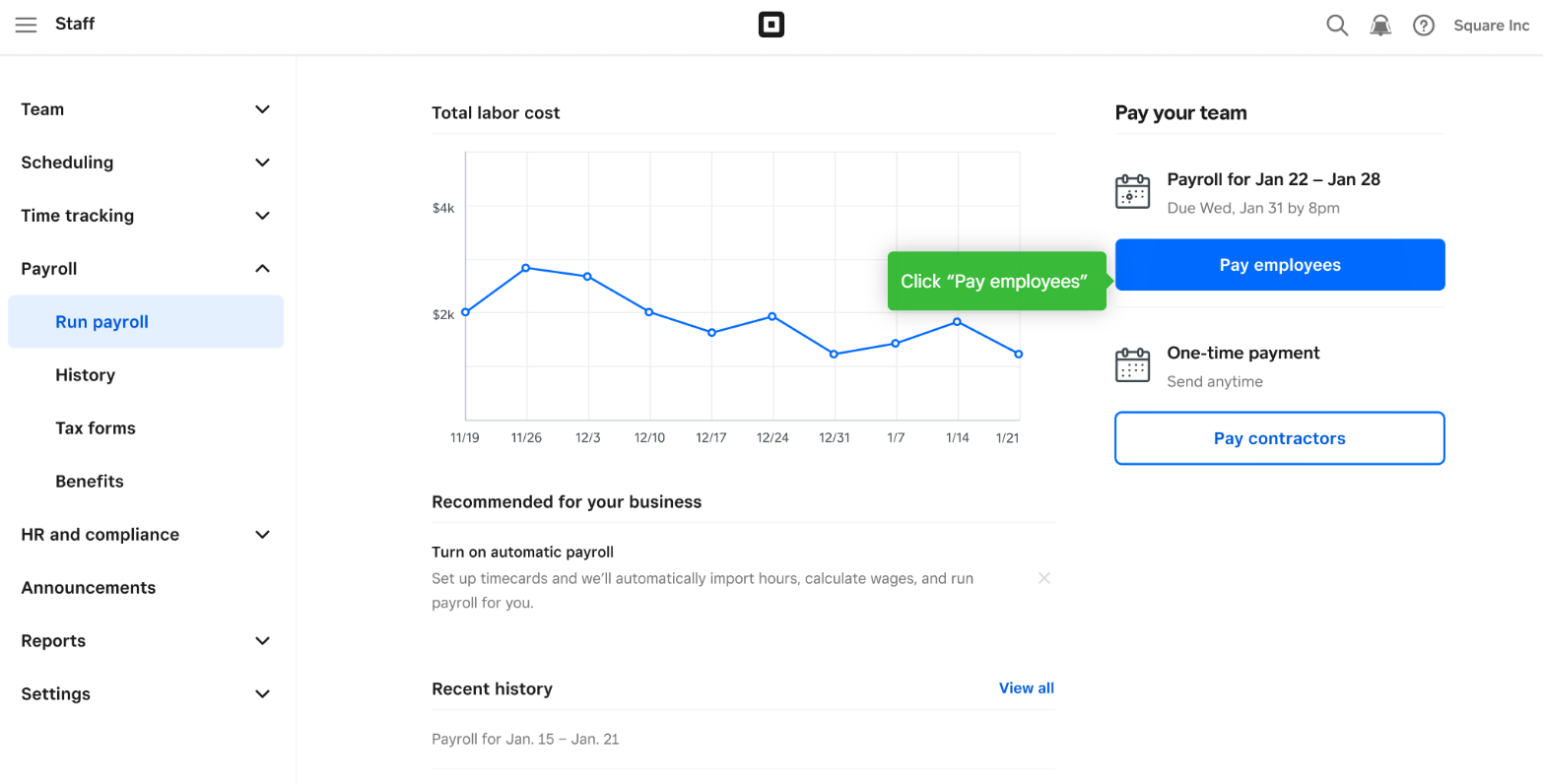

Square Payroll lets you start pay runs manually but it can also process payments automatically, provided you activate its automatic payroll feature. (Source: Square Payroll)

Instant Payments

While Square Payroll’s standard direct deposit processing time is four days, this feature lets you pay employees the next business day and even instantly through its Cash App—provided you have available funds in your Square balance or Square Checking account. This is ideal for businesses that accept customer payments through Square and maintain funds in their Square account.

Tax Filing Services

Square Payroll provides automated tax calculations, payments, and filings for federal, state, and local taxes. At the end of the year, it generates and files W-2 and 1099 MISC forms. Your employees can also download the tax forms and view their pay stubs via the Square Team app (for iOS and Android devices).

Square Payroll App

Square Payroll has a mobile payroll app designed specifically for employers and payroll administrators. It allows you to run payroll, track PTO, manage pre- and post-deductions, and view benefits plans on iOS and Android devices—provided an internet connection is available.

With the Square Payroll app, you can process and review payroll with just a few clicks.

(Source: Square Payroll)

While Square Payroll may have limited HR features, the solutions it offers are sufficient enough to help you handle essential employee management processes with ease. Its new hire reporting, benefits plan options, and online employee accounts with self-onboarding tools are just some of the functionalities that contributed to this provider’s 4.25 out of 5 rating for HR features.

Square would have received a higher rating in this criterion if it had its own team of HR professionals who could provide expert advice in handling compliance issues. As of this writing, its HR advisory services are available via its partner, Mineral—plus, this costs extra. It also doesn’t offer advanced HR solutions for managing recruitment, learning programs, performance reviews, and compensation plans.

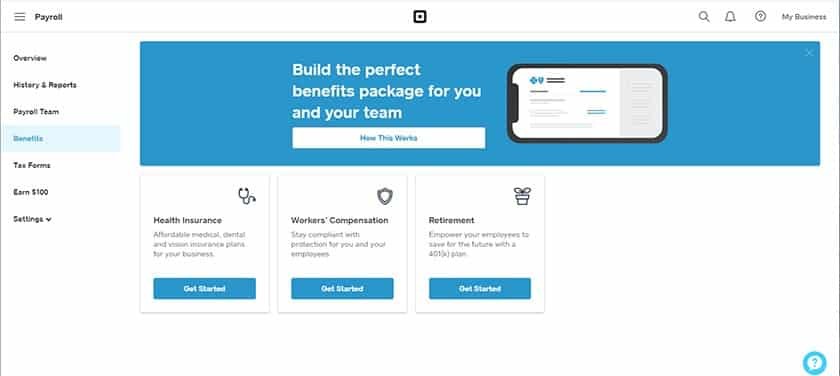

Square’s partnership with SimplyInsured, Guideline, and NEXT enables you to access and offer benefits plans to your employees. The options include health insurance, retirement plans, and pay-as-you-go workers’ compensation. If you’re already offering benefits, you can add the applicable benefits deductions and contributions into its system. As of this writing, Square Payroll supports the following benefits types:

- Health savings account (HSA)

- Health insurance (Section 125 plan)

- Flexible spending account (FSA)

- Dependent care FSA

- Simple IRA

- 401(k) and 403(b) retirement plans

- Roth 401(k) and 403(b) retirement plans

- 457(b) deferred compensation plan

- Roth 457(b) deferred compensation plan

- Roth IRA

Employees can even enroll in benefits online—saving you from having to manage the entire enrollment process by yourself. You also don’t have to manually track benefits deductions since Square Payroll automatically syncs all deduction and contribution data every pay run. Note, however, that if you choose not to use Square’s insurance partners, you have to manage premium payments yourself.

With Square Payroll, you can create a custom benefits package that you can offer to employees.

(Source: Square Payroll)

With Square, you can capture employee work hours through its “Timecard” feature, which allows workers to clock in and out via the Square POS and Square Team apps. Both solutions sync directly with Square Payroll, so you don’t have to manually import employee time cards.

The system also automatically creates online timecards based on your employees’ actual clock-ins/outs. Aside from viewing, editing, and deleting timecards, you can create new ones for your team members.

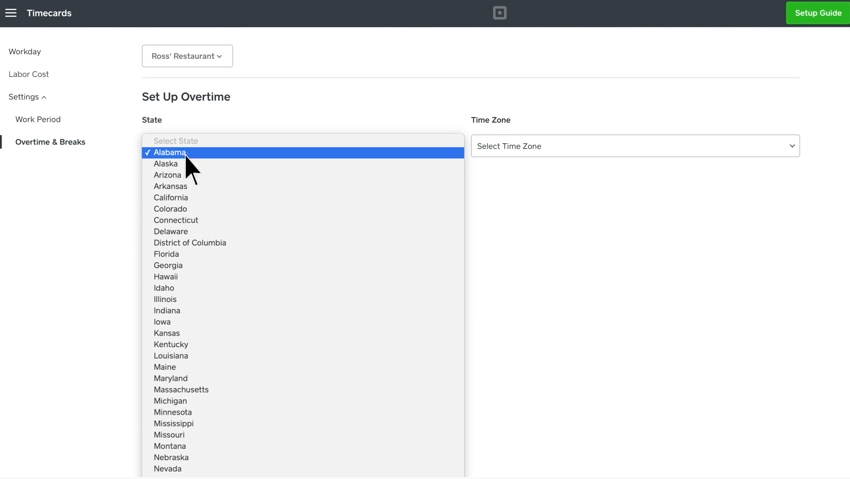

Setting up overtime and break rules in the system is very easy. Aside from helping you track overtime and shift breaks, you can use these settings to identify the pay rates (such as the employee’s hourly rate × 1.5) for overtime work. The system will even notify you of time entries that violate your overtime and break rules.

Note, however, that the system will not compute overtime for contractor payments. You also can’t use the overtime settings to include commissions and bonuses in pay calculations. You have to manually add that information into Square Payroll.

Square Payroll has built-in state overtime settings that you can select and use.

(Source: Square Payroll)

Aside from tracking time, you can set up PTO and sick leave policies in Square Payroll. This allows you to calculate accruals and track the available balance for vacation and sick leaves. Employees can also view their PTO and sick leave balances through their online accounts or via their paystubs.

If you need basic scheduling tools, Square Payroll lets you plan work shifts of up to 10 days out. It also allows you to manage and publish schedules for yourself and team members. However, this functionality is only available in the full-service payroll plan.

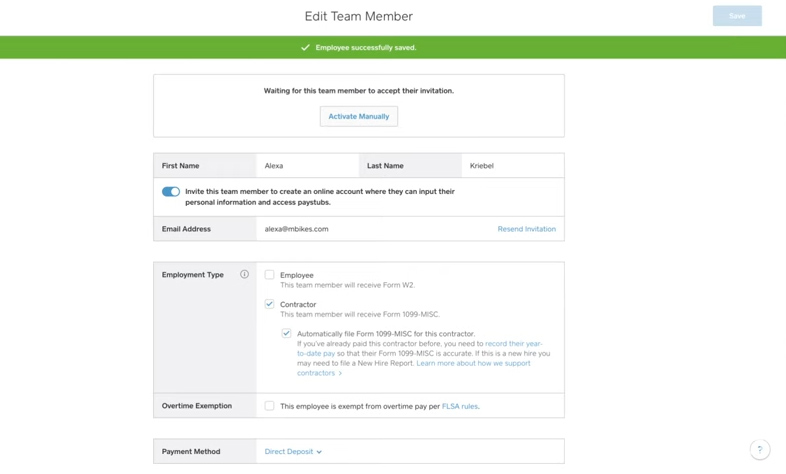

System administrators can create online profiles for new employees that contain basic information, such as full name, email address, job title, hire date, and compensation details. You can manually input all the information needed, using data from paper forms submitted by employees. Or, you can have Square send an email to your new hires so they can create their online accounts and complete the onboarding process, which includes providing their bank account details (for direct deposit payments), W-4 information, and additional personal data (like birthdays and addresses).

Square will also handle new hire reporting for you based on the regulations of the state where your business is located. To enable this feature, select the “File a New Hire Report on my behalf” option when you add a new employee to the system.

If new hires have yet to create their online accounts, Square Payroll has a “Resend Invitation” button you can click to re-invite new hires and remind them to complete their profiles. (Source: Square Payroll)

Square Payroll earned a perfect score in reporting, given its built-in payroll and employee-related reports. It also allows you to create custom payroll reports by selecting the information you want and filtering specific data points (like date ranges). While Square Payroll reports may be exported to partner systems (such as labor cost data into an accounting program), you can easily download these to your computer as CSV files.

One of the things you’ll notice highlighted in our Square Payroll review article is the software’s ease of use. Although it didn’t get perfect marks on this factor due to limited customizability, its intuitive and simple-to-learn interface makes paying employees and even tracking time easy. Apart from automated tax filings, Square Payroll has advanced features that enable you to track tips, manage workers’ compensation, and handle deductions for healthcare.

- User-friendly interface

- Mobile payroll processing

- Live support for account setup

- Helpful how-to guides

- US-based onboarding and customer support

- Integrates with other Square business solutions

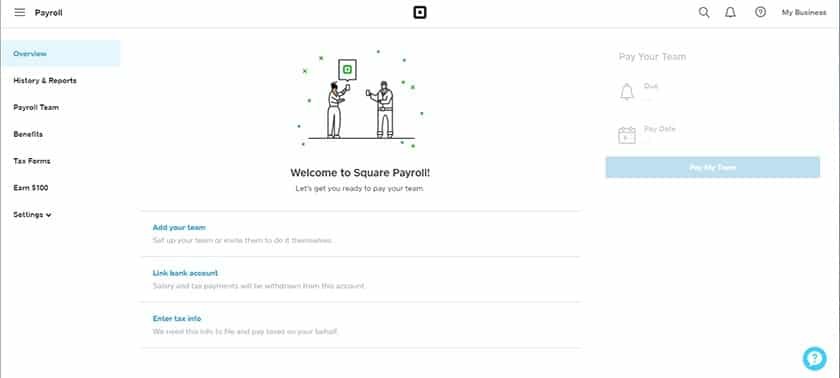

Square Payroll is also simple to set up. Getting the software up and running takes very little time, provided you have all your business and staff information on hand and only need to add a few employees to the system. If you need setup assistance, Square offers live support for new clients.

The overview screen is Square Payroll’s main dashboard. From here, you can easily access basic functions such as adding employees.

(Source: Square Payroll)

If you have questions about its features, Square has a library of how-to guides that you can access online. You may contact the Square Payroll customer service team via email and phone for assistance—although the estimated wait time for an email reply is from 24 to 48 hours, while phone support is available only from Mondays to Fridays, 6:00 a.m. to 6:00 p.m. Pacific Time (PT). Another help option is Square’s automated online assistant, which is a chatbot that provides links to FAQs and guides but can also connect you to a customer rep if you want live support.

Further, you can easily connect with other Square users through its online community forum. This is great if you want insights from business owners using the same Square products. You can even post your queries about the platform’s functionalities in the forum, and Square users who are willing to help can share tips about how to use the system.

Integration Options

Square Payroll scored fairly well (4.38 out of 5) in my expert assessment of its pricing, overall features, and whether it can meet the HR and payroll needs of SMBs. While it doesn’t have multiple plans that can cater to the HR needs of growing companies, the monthly cost of Square Payroll makes it one of the most budget-friendly payroll packages in the market. It’s even more affordable than popular small business payroll software like Gusto, which has a starter monthly fee of $40 plus $6 per employee (Square Payroll costs $35 plus $6 per employee monthly).

Features-wise, you get all of the essential tools for processing employee and contractor payments. It even has time-tracking and scheduling functionalities—tools that similar payroll providers offer either in their higher tiers or as a paid add-on.

However, if you need other HR tools like job postings, applicant tracking, and performance reviews, consider other HR solutions, such as those listed in our Best HR software guide. Most of these providers, such as TriNet Zenefits and BambooHR, include payroll in their suite of solutions. Rippling even offers basic IT tools to help you monitor company-assigned computers and handle software provisioning processes in addition to managing HR and payroll.

While a majority of the Square Payroll reviews on third-party sites are positive, this provider only scored 3.75 out of 5 in our user popularity criterion, mainly due to its average number of user reviews on G2 and Capterra not reaching 1,000.

| Users Like | Users Don’t Like |

|---|---|

| Easy to use | Can get expensive if you use other Square products |

| Affordable and transparent pricing | Support team isn’t always responsive; difficult to reach at times |

| Simplifies payroll processing and payroll tax filings | Limited report options |

Users who left Square Payroll reviews online like its ease of use, adding that it helps simplify payroll and payroll tax processing. They also appreciate its seamless integration with Square products (such as its POS solution), including the automatic imports of tips and employee time data into its system.

Some commented that while Square Payroll is affordably priced, it can get expensive as you grow your workforce and if you use other Square products. Several reviewers said that one-on-one customer support can be challenging to reach and that its support team’s response time is less than ideal.

At the time of publication, Square Payroll earned the following scores on popular user review sites:

- Capterra: 4.7 out of 5 based on over 600 reviews

- G2: 4.2 out of 5 based on 30 reviews

Methodology: How We Evaluated Square Payroll

To determine whether Square Payroll is ideal for small businesses, I checked for features that would make paying employees easy for users. These include unlimited pay runs, multiple payment options, and a full-service package with automatic calculations and payroll tax filing services. I also looked for live phone support, benefits plans for employees, and basic HR tools to manage staff information and new hire onboarding. I even considered the feedback that actual users posted on popular user review sites.

Click through the tabs below for a more detailed breakdown of the evaluation criteria:

20% of Overall Score

I checked if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. Providers priced at $50 or less per employee monthly were also given extra points.

20% of Overall Score

I gave points to payroll software that offer multiple pay options, two-day direct deposits, tax payments and filings, year-end reporting (W-2s and 1099s), and a penalty-free tax guarantee.

20% of Overall Score

In this criterion, I checked if the payroll solution is simple to set up, user-friendly, and customizable. I also looked for live support and integration options with online tools that most small and medium businesses (SMBs) use.

15% of Overall Score

I looked for onboarding, new hire reporting, and self-service tools that allow employees to view pay stubs, edit information, and access forms online. I also gave points if the payroll software provider offers expert HR support, benefits options, and health insurance plans that cover all US states.

15% of Overall Score

In this criterion, I checked whether the software’s ease of use, pricing, and the width and depth of its payroll and HR tools are ideal for SMBs.

5% of Overall Score

I checked reviews that actual users left on third-party sites like G2 and Capterra. I gave higher points if the software received more than a 4-star rating and had over 1,000 reviews.

5% of Overall Score

For this criterion, I looked for built-in basic payroll reports and customization options.

Square Payroll Frequently Asked Questions (FAQs)

If you use Square Payroll to pay employees, you will spend $6 per employee monthly plus a base fee of $35 per month (as of this writing). However, if you’re only paying contractors, Square Payroll will charge you a monthly fee of $6 per worker.

Square Payroll’s full-service plan is cheaper than QuickBooks Payroll’s starter tier. As of this writing, Square charges a monthly fee of $35 plus $6 per employee, while QuickBooks Payroll’s Core plan is priced at $50 plus $6 per employee monthly.

However, if you only pay contractors, QuickBooks offers a more affordable option than Square. Its contractor payments package only costs $15 monthly for 20 workers (plus $2 for each additional contractor); whereas, Square Payroll charges $6 per worker monthly for contractor-only payments.

Yes, it does. Square Payroll and other Square products, such as its POS module, can integrate with QuickBooks accounting, making data transfers easy and convenient for users.

Bottom Line

Square Payroll is simple to use, and you don’t need a lot of accounting or HR experience to figure out how to set it up—making it ideal for small business owners. If you are already using Square POS, it makes sense to add this payroll service to help you efficiently manage employees’ hours worked, PTO, deductions, and tax obligations. Square Payroll pricing is also affordable, with flat rates to help you manage your business’ budget. Sign up for a Square Payroll plan today.