Paycom is a comprehensive HR and payroll software for growing businesses and midsize to large companies that want to manage all their HR functions in one system. Its platform is designed to streamline and automate recruitment, time and attendance, payroll, benefits, and talent management processes. However, pricing isn’t transparent—you have to call Paycom to request a quote.

While it has a feature-rich and integrated human capital management (HCM) system, Paycom didn’t rank in any of our best HR software lists. It lost several points in our evaluation mainly because of its non-transparent pricing, lack of unlimited pay runs, and slightly steep learning curve.

Paycom Overview

Paycom Is Best For

- Growing businesses switching from a smaller provider: Changing payroll providers can be an intricate process, but it’s necessary when you outgrow your old one. Paycom has a wide range of features (recruiting, payroll, HR, and benefits) to handle the HR requirements of growing businesses. It even provides a dedicated specialist, so you get all the support you need, not just during setup but when managing payroll and HR as well.

- Firms that are hiring and want to streamline talent acquisition and management processes: Paycom’s recruitment and onboarding tools can help you find qualified candidates for open positions, monitor applicants as they move through the hiring process, and onboard new hires. It also has online solutions for improving engagement through online learning sessions to boost skills, performance assessments to identify improvement areas, and compensation planning to reward and retain employees.

- Companies with remote workers: With Paycom’s mobile apps for iOS and Android devices, managers and system administrators can review and approve paid time off (PTO) requests, attendance data changes, and expense claims. Employees, on the other hand, can check their hours worked, update personal information, view pay stubs and tax reports, and even run their own payroll for every pay period.

Paycom Is Not Ideal For

- Small businesses needing basic payroll and HR: Small businesses may find Paycom’s extensive line of HR tools overwhelming, and there can be a learning curve due to all of the features available. It’s also not the most affordable solution for those just needing to process employee payroll. Check out our guide to free payroll software for more options.

- Companies looking for a customizable HR payroll software: While you can choose the HR features that you can add to Paycom’s core payroll platform, the system itself has limited customization options. If you’re looking for a system that allows a lot of flexibility in managing HR processes, consider any of the providers on our list of top HR payroll solutions.

Looking for something different? Read our guide to the best payroll software and top payroll services to help you find a service or software that’s right for your business.

How Paycom Compares With Top Alternatives

Best For | New Client Promotions* | Starter Monthly Fees | Our Reviews | |

|---|---|---|---|---|

| Midsize to large businesses looking for an integrated HCM system | ✕ | Custom-priced | |

Companies that want HR, payroll, and IT solutions in one platform | First month is free | $35 base fee plus $8 per employee** | ||

| Small businesses needing full-service payroll and solid HR support | One month free*** | $40 base fee plus $6 per employee | |

Startups and small to midsize businesses that want a customizable HR software | First three months free | $39 base fee plus $5 per employee | ||

*These can end at any time. Visit the providers’ websites to view the latest promos. **Pricing is based on a quote we received. ***Get one month free when you run your first payroll with Gusto. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled. | ||||

If you want to see how this provider compares with some of its competitors, check out our top Paycom competitors guide.

Paycom Pricing

Paycom doesn’t publish pricing details on its website. You have to call the provider to discuss your requirements and request a quote. Note that Paycom’s core platform is payroll, so if you want time tracking, benefits administration, and other HR tools, those are paid add-ons.

In the Paycom pricing quote we received, the system setup costs $500 for 15 employees and $1,200 for 40 employees. This service includes training, initial system setup, and software implementation assistance. Pay runs are priced at $4–$6 per employee per paycheck, with an additional $6.95 for each Form W-2 and a $75 annual transmittal fee. Its other HR services and solutions, like time and attendance, cost an extra $4 per employee in our quote.

Paycom Features

There’s a wide range of Paycom features for managing employees from time of hire to retirement, but its core platform helps you pay employees. It has a customizable payroll grid, allowing you to adjust the layout to fit your requirements. Payroll and employee data also syncs systemwide to eliminate reentry and errors. Plus, Paycom automatically calculates, withholds, and remits your taxes on their due dates and files tax reports (Forms 940, 941, and W-2) on your behalf.

Payments to employees and contractors are made via direct deposit and paycheck, but getting Paycom’s Vault Visa payroll card unlocks on-demand pay for your employees. This allows them to access earned wages in between paydays.

If you prefer paycheck payments, Paycom allows you to issue checks through its bank account. This saves you from having to reconcile paper checks after every pay run and reduces general ledger transactions. The platform will even inform you of employees whose paychecks remain uncashed 180 days after issuance and automatically refund these transactions to you. Note that you need to ensure that the employees get the refunded amount to avoid payroll compliance and labor issues.

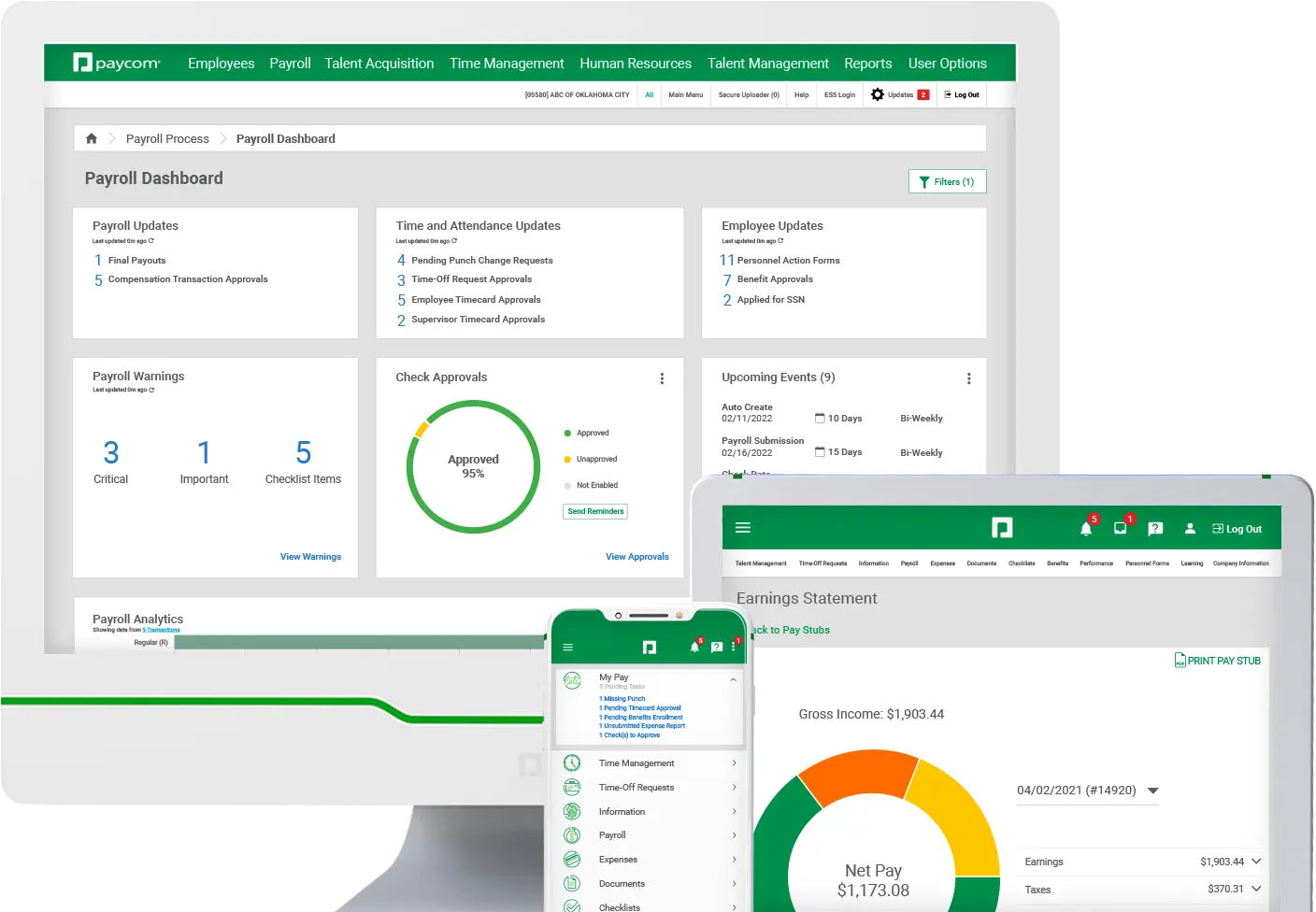

Paycom has a cloud-based HR payroll system, allowing users to access it on computers, smartphones, and tablets. (Source: Paycom)

Its payroll solution comes with payroll accounting data tracking, expense management, mileage tracking, analytics and reporting, and garnishment administration. Employees are granted 24/7 access to a self-service portal (via its iOS and Android mobile app, Beti) that not only shows their pay stubs and basic information, but also lets them run payroll themselves.

In addition to payroll, you can use Paycom to find, hire, onboard, train, and retain talent. Its extensive tools are designed to automate your organization’s core HR processes while helping you manage your workforce efficiently. Here are some of Paycom’s essential HR features:

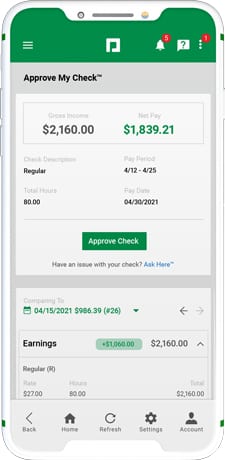

Paycom’s Beti, a mobile app and feature that sets this provider apart from other HR payroll software, has removed the burden of processing payroll from HR and payroll administrators. Aside from its in-app guides that show employees how they can fix errors (like missing time data) and process their own pay every payroll period, Beti offers your workers advanced knowledge and full insight into their expected paychecks and deductions while reducing the payroll work you and your HR team need to do.

Paycom’s Beti solution is great for companies that don’t have a lot of off-cycle payouts. You only need to set the recurring pay cycles in the system, and Beti will automatically notify employees when it’s time to process and submit their own pay. Once the payroll is good to go, Beti will inform you to finalize the pay run. It even has a dashboard where you can view the employees’ payroll progress, pending tasks, and other issues that need to be addressed.

Paycom’s Beti lets employees check, review, and approve their own payroll. (Source: Paycom)

Your employees can clock-in/out through Paycom’s web-based time clock, mobile app, and a physical time clock you can purchase or lease. Aside from editing and approving digital time cards, its time tracking software lets you add restrictions (such as geofencing and IP address filtering) to prevent buddy punching and time theft. Employees, on the other hand, can review and submit timesheets, request PTOs, and allocate hours to different projects and locations.

Paycom also comes with a scheduling solution that includes shift templates, schedule swapping, and labor cost forecasting tools. Further, all data from staff scheduling and time tracking flows automatically into its payroll module. This eliminates the need for manual data uploads since Paycom’s products work seamlessly with each other.

Paycom’s time clock terminals support clock-ins/outs through fingerprint scans, RFID card swipes, and proximity fob taps. (Source: Paycom)

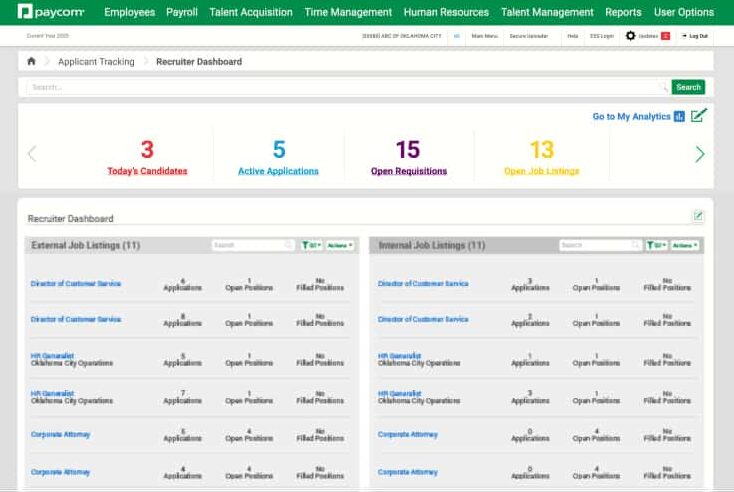

Paycom’s talent acquisition solutions let you post open positions across online job boards, track applicants, send customizable offer letters, onboard new hires, and run background checks. In addition, it will help you determine whether or not job applicants may be Work Opportunity Tax Credits (WOTC)-eligible, allowing you to enjoy financial incentives for hiring individuals belonging to groups that typically face significant challenges in finding employment. Some of these groups include military veterans, former felons, and designated community residents in rural renewal counties and empowerment zones.

Paycom’s recruiter dashboard shows snapshots of your open requisitions, job listings, and candidate applications. (Source: Paycom)

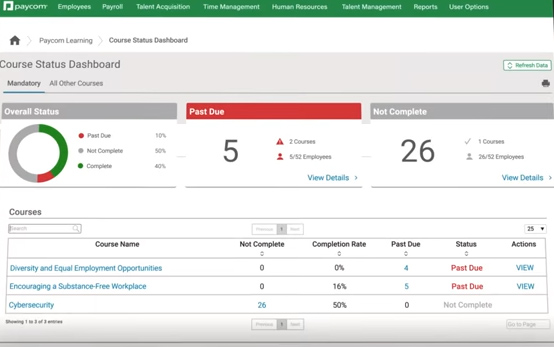

Develop your workforce and improve employee engagement with Paycom’s suite of talent management solutions. Aside from a learning management module where you can deploy online training courses, the platform has a compensation tool for creating payroll budgets and merit matrices. You can also use it to track your compensation budget and ensure that salary increases are equal to the employees’ work contributions.

You can track the completion status of learning sessions through Paycom’s “Course Status Dashboard.” (Source: Paycom)

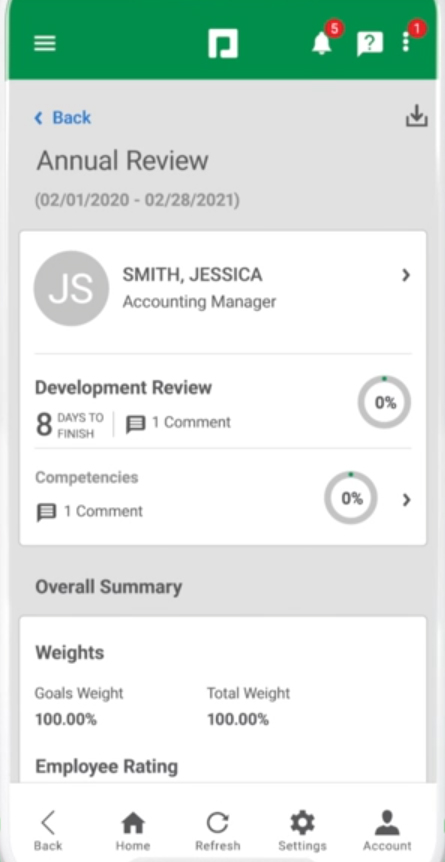

To help monitor your staff’s work performance, you can use Paycom’s performance management module, which offers assessment forms that employees can fill out and submit online. People managers can also give real-time feedback, while system administrators can track the submission progress from a dashboard.

You and your employees can access performance reviews on Paycom’s mobile app. (Source: Paycom)

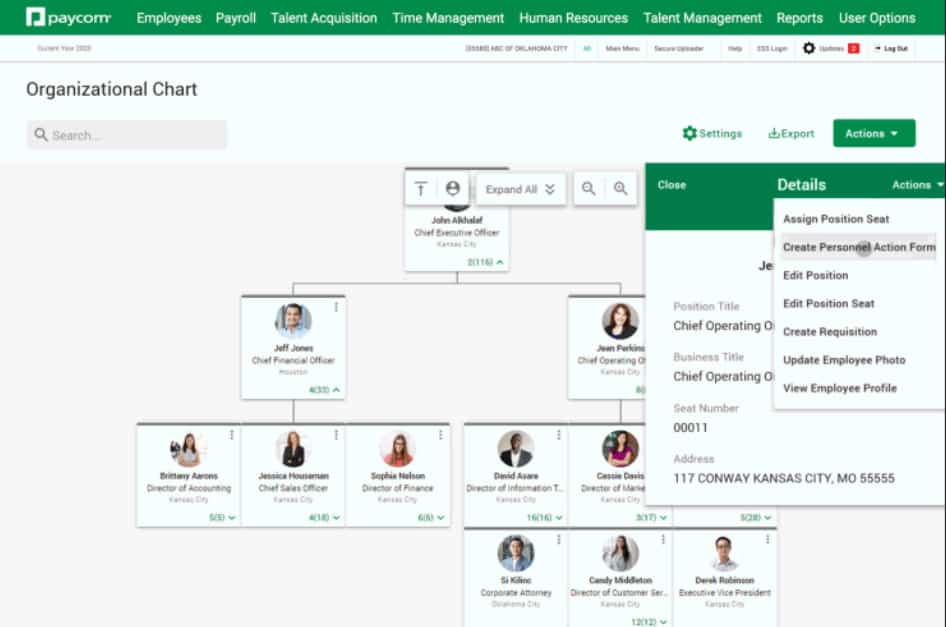

To help streamline the process of managing personnel movements through various positions in your organization, Paycom offers a customizable solution that allows you to create an org chart, manage reporting relationships between roles, and set up salary grades for positions. This is helpful when adding, promoting, and moving employees as it increases the visibility of vacant positions. And since position-related changes are captured automatically throughout Paycom’s platform, it reduces the risk of human errors due to manual data entry.

You can even assign attributes to positions to help you manage permission settings, training programs, performance reviews, and compensation planning. Plus, if you link positions to benefits eligibility profiles and time tracking protocols, you don’t need to manually tag which employees are entitled to specific benefits and time tracking rules (like overtime exemption)—Paycom will automatically reflect the changes.

Paycom eliminates the need to maintain physical PAFs to document changes in the employee’s position and salary, including when they were hired or separated from the company. Its PAF solution lets your managers edit and submit e-PAFs through its software or mobile app. It has built-in change categories to ensure that the reasons for the movements are uniform and accurate. You can even link it to Paycom’s position management module so that the position titles used in the e-PAFs are consistent across the organization. All approved changes will also reflect automatically across the platform’s various modules.

Paycom will also send the approved e-PAFs to the concerned employees. Your staff can access this through its software or mobile app; the system will require employees to accept the change (i.e., promotion, lateral movement, or salary adjustment) by clicking the “Acknowledge” button.

You can create e-PAFs directly through Paycom’s organization chart. (Source: Paycom)

Paycom’s HR management solutions include tools for managing online documents, employee satisfaction surveys, and checklists for staff onboarding and offboarding. You can also use it to set up your company’s employee benefit plan/s, deduction amounts, and enrollment dates. It even comes with an “Ask Here” feature to help your workers find the answer to their HR and payroll questions. While it can route the employees’ queries to the appropriate HR staff, you can set up custom FAQs to automate and streamline the process.

In addition, Paycom offers a self-service portal for employees to clock-in/out, submit time off requests, view pay stubs, access tax forms, take online training courses, and update personal information. Managers also have access to a self-service portal to approve PTO requests, timecard edits, ePAFs, and schedule changes.

Aside from viewing benefits plans, your employees can add and edit dependent information through Paycom’s mobile apps. (Source: Paycom)

Paycom Ease of Use

- Intuitive interface

- Integrated suite of HR and payroll solutions

- Hands-on transition process

- Access to a dedicated specialist

- Mobile apps for employees and managers

- Beti payroll for employees with a guided process

Paycom has an intuitive platform that’s generally easy to use, but learning how to navigate through all of its functionalities may take time given the many solutions that it offers. The time it takes to set it up differs, depending on the number of employees you have and the Paycom features you selected. However, you get setup assistance. As soon as an agreement is reached, the company assigns a dedicated specialist to help you through the setup process and answer your HR and payroll queries. For midsize and enterprise clients, a no-cost on-site training for you and your employees is also available.

What’s also great about Paycom is its integrated solution suite, where data flows automatically from one module to another. The system sends your employees’ actual hours worked from its time and attendance solution to its payroll tool for processing. Similarly, employee movements and salary changes as reflected in approved e-PAFs are automatically updated throughout the software.

Processing payroll through its Beti solution is also made easy for employees. Beti guides your staff through the whole payroll process to ensure accurate and timely payouts. Plus, HR administrators don’t have to worry about employees changing their pay rates or time entries since everything goes through an online approval process.

What Users Think About Paycom

| Users Like | Users Don’t Like |

|---|---|

| Software is easy to use | Inconsistent customer support quality |

| HR and payroll tools are available in one platform | Has a learning curve |

| Robust mobile app | Occasional software lags and login glitches |

Many users left positive Paycom reviews on online third-party sites like G2 and Capterra. Most of them appreciate its easy-to-use interface and robust mobile app with functionalities that aren’t all available in similar apps. Others like that they can access several HR solutions in just one platform, allowing them to manage nearly all HR processes—from applicant tracking and pay processing to compensation planning and performance reviews.

Several reviewers, however, said that it has a steep learning curve given the wide range of features it provides. Some also dislike the inconsistent quality of its customer service, while a few users complained about having experienced login errors, slow loading pages, missing clock-ins, and software glitches from time to time.

At the time of publication, Paycom software reviews earned the following scores on popular user review sites:

- G2: 4.2 out of 5 based on more than 1,100 reviews

- Capterra: 4.4 out of 5 based on nearly 800 reviews

How We Evaluated Paycom

For this Paycom review, we looked at the essential features that can help streamline a business’ HR and payroll processes. We considered pricing, ease of use, customer support options, and assessed Paycom pros and cons to help you gauge if it’s the right software for your company. We also checked the feedback that actual users left on popular review sites.

Bottom Line

Paycom is a cloud-based payroll and HR software that’s best fit for scaling businesses and established large enterprises. It has a single-database solution that allows users to access all functions without logging into multiple systems. It also provides its users with information and monthly enhancements to get full advantage of its system. Users attested that it helped them improve their business processes a lot and has a generally helpful support team.

Schedule a free demo today.