A clock-in/clock-out policy sets guidelines for your company for accurately recording employee work hours, compliance with the Fair Labor Standards Act (FLSA), and proper monitoring of employee performance and safety. This information is critical for ensuring employees are compensated fairly and making informed decisions about promotions, raises, and disciplinary action.

A strong clocking in and out policy should include employee eligibility, an overview of the process, and repercussions of noncompliance. Continue reading for a more in-depth discussion of these and other necessary elements and download our free clocking in and out policy template to get started. Use the template to create your own policy—but speak with legal counsel to ensure it complies with state and local regulations.

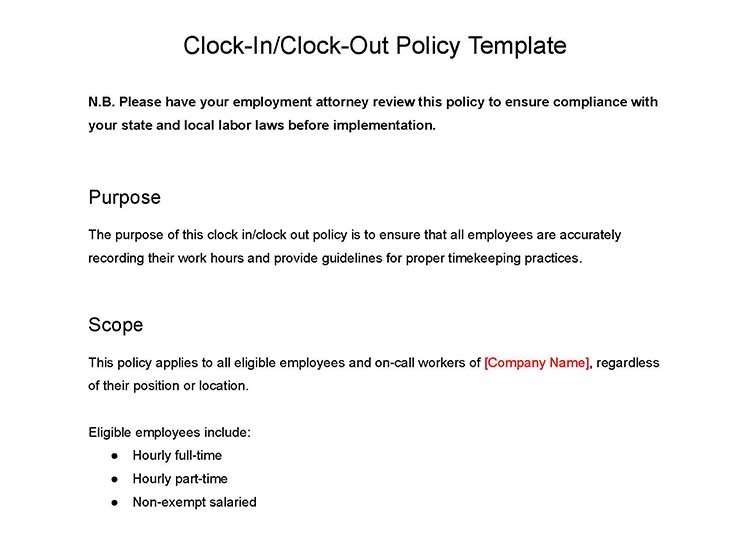

Eligible Employees

This portion of your policy will dictate who the policy applies to and how time is tracked. While the FLSA has no requirement that your small business record hours in a specific way, it does require that you track the hours worked for certain employees (more on the recordkeeping requirements later).

These employees include:

- Hourly full time

- Hourly part time

- Nonexempt salaried

Hourly employees need to record time somehow for you to know how much to pay them. You may want to use paper time sheets for simplicity, but that can result in intentional and unintentional errors. Many assume that those paid a salary do not need to track their hours, but in some cases, they do.

There are two types of salaried employees for our discussion: exempt and nonexempt.

- Under the FLSA, exempt employees are not eligible for overtime pay. To be exempt, an employee must make a minimum salary and meet other requirements.

- Nonexempt employees are those who do not meet the requirements of an exempt employee. These workers are eligible to receive overtime pay, so their hours must be tracked so you know when to pay them overtime versus straight pay.

It’s a good idea to have every employee track their hours. Your small business gets great insight on how much time employees log and can better track costs and time for different projects. Learn more about tracking time in our guide on how to track employee hours.

On-call Hours

In industries like retail, healthcare, customer support, hospitality, and food service, employees are on call if their employer needs them to work on short notice. Timekeeping requirements for on-call employees depend on whether the employee is considered “engaged to wait” or “waiting to be engaged.”

“Engaged to wait” employees must remain at the workplace or nearby and cannot use their time for their own purposes. All time spent on call should be considered hours worked and must be compensated accordingly.

“Waiting to be engaged” employees can use their time for their own purposes while on call. Only the time spent actively engaged in work-related activities should be considered hours worked and compensated accordingly.

In general, on-call employees should clock in and out when they begin and end their shifts and accurately record all time spent on-call or engaged in work-related activities. Employers should also consider providing on-call employees with guidelines or expectations around when they should be available and what activities they should be engaged in while on call.

Check out our guide to on-call scheduling for more information as to how it works and how to approach it. However, take note that the on-call and shift work regulations of some states are governed by federal law, while others have their own regulations. As such, consult with your legal counsel to ensure compliance with all applicable laws and regulations in your area.

How to Clock In & Out

In your policy, explain to employees how to clock in and clock out. We strongly recommend against using paper time sheets, as this is ripe for misuse and mistakes.

If an employee has technical issues or simply forgets to clock in or out, you need to have a process for them to request a punch. This is easy with an electronic system, through which an employee can enter a clock in or clock out and request an adjustment to a different time. That request will go to their manager or another person you designate. If your company is not using an electronic system, make sure your employees know how soon they need to report a missed punch and who to report it to.

A good clock-in/clock-out tool generates reports for you, so you can see if employees habitually arrive late or leave early. It also makes it easy for your employees to clock in and out, as they can use their computer or a mobile app. You can even regulate where they can punch the clock, putting restrictions on how far away from a worksite an employee can be at the time. Homebase, our top-recommended time and attendance software, lets you track employee hours, prep for payroll, and better control your labor costs.

Time Sheet Approval

Managers or supervisors should verify that the hours recorded on the time sheets match the hours worked by the employee and confirm that any overtime or time off requests have been properly approved. It helps to avoid errors and potential legal issues down the line.

A good clocking in and out policy should require employees to electronically or physically submit their time sheet to their manager for quick approval at the end of the workweek or pay period. This will help keep payroll accurate and your overhead costs in check.

Use our free downloadable time sheet templates if you need a simple way to keep track of logged time.

Employee Breaks

Your policy should discuss company breaks. Although the FLSA does not require employers to provide meal and rest breaks, if you choose to do so, take note that rest breaks are compensable as work hours according to federal law. Additionally, some states require that employers provide paid rest breaks of 10 to 15 minutes for every four hours worked.

For meal breaks, federal law requires that businesses provide nonexempt employees with a 30-minute unpaid break for every eight hours worked. Check your state or local laws, as some jurisdictions do require breaks, depending on the number of hours your employee is scheduled to work.

If an employee takes a break but cannot step away from their duties, you are required to pay them. For example, if you have a receptionist who eats lunch at their desk and answers the phone during their lunch period, you must pay them for the entire lunch break, even if they answer only a few calls.

Compliance note: Travel time that is considered “work” time, such as time spent driving between job sites, must be accurately recorded and compensated. This must NOT be filed under breaks.

Rounding Hours

Businesses are also allowed to round hours, though you are not required to do so. If you choose to round hours, make sure you note this in your policy so your employees are aware. Under the FLSA, you can round hours to the quarter-hour. You must round fairly, however, rounding up and down appropriately.

For minutes one to seven, round down; for eight to 14, round up. For example, if an employee clocks in at 8:29 a.m., you would round up to 8:30 a.m. If that employee clocked out at 5:05 p.m. you would round down to 5 p.m.

Read our in-depth guide on how to convert minutes for payroll and download our free conversion chart for an easy time converting time.

Overtime Calculations

Your policy should also address overtime calculations. In most states, eligible employees who work more than 40 hours in one workweek are entitled to overtime pay at 1.5 times their normal hourly rate. In some states, like California, and some cities, overtime is calculated more frequently—so ensure you’re following the law in your state.

Compliance note: Employers must NOT require or allow employees to work “off the clock” without compensation.

Disciplinary Actions

Your policy should include information about abuse and dishonesty. Effective employee management often requires disciplinary action when workers abuse a policy—a clock-in/clock-out policy is no exception.

Common violations include:

- Buddy punching: This refers to an employee clocking in or out for a co-worker who is not present at work. This is a common violation and can lead to businesses paying employees for time they did not work.

- Unauthorized overtime: This occurs when an employee continues to work beyond their scheduled shift without prior approval from their supervisor. It can result in employers paying overtime wages not budgeted for, negatively impacting a business’s finances.

- Time theft: This happens when an employee claims they worked hours they didn’t work or when they falsify their time sheet. It can result in the employer paying for the time that the employee did not work, and it can also lead to legal action.

- Neglecting to clock in or out: Employees who neglect to clock in or out can cause inaccuracies in the payroll system, leading to issues with pay and benefits.

If your company uses paper time sheets, which we don’t recommend, your employees could easily adjust their hours, noting their arrival time much sooner than their actual arrival time. Using an electronic system to clock in and out can prevent this type of bad behavior since each employee has a different login, and the system tracks IP addresses and GPS locations if employees use an app.

For violations of this policy, we suggest sticking with the three-strikes approach—a form of progressive discipline—and making the first offense a minor disciplinary action, followed by a written warning for a second violation. A third violation should be severe and may include termination. This type of behavior is inappropriate and costs your company money.

Recordkeeping Requirements

The FLSA does not mandate that your small business use a time clock. However, you must maintain an accurate record of each employee’s hours worked for hourly and nonexempt salaried workers.

To give you a good idea, here are some of the most important details that you must keep for at least three years for each employee:

- Full name

- Social Security number

- Full birth date, if under age 19

- Job title

- Time and day of the start of the workweek

- Hours worked by day

- Total hours for each workweek

- Type of pay (hourly, weekly, or salary)

- Regular pay rate

- Total weekly regular-time earnings

- Total weekly overtime earnings, if any

- All additions and deductions from employee’s wages

- Total net wages

- Date of payment

- Pay period covered by the payment

Check out our in-depth payroll records guide for more information on what records to keep and for how long to keep them.

Bottom Line

Accurately tracking time is crucial for any business type and size to maintain their budget. To achieve this, you must have a clear clock in/clock out policy so that all employees understand how to record their time and what happens if they violate the policy.

The best way to ensure compliance and ease of use is to use an electronic time clock. Homebase is our top recommended time clock for employers. Besides having robust functionalities, it has a free plan for businesses with only one location