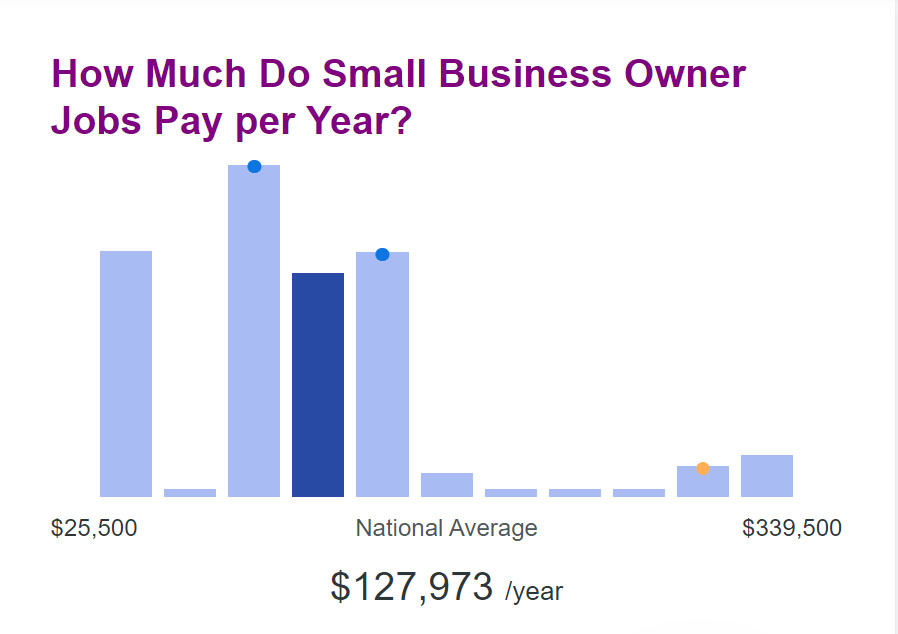

Based on self-reported numbers, the average US small business owner income is around $127,00 per year, or $62 per hour. That is considerably higher than the National Wage Index[1] for non-self-employed workers, which lists the average annual US wage at $63,795. However, small business owner incomes can range between $25,000 and $339,500 annually[2], based on location and business type.

The highest-earning industry for small business owners is medical services—dentists and dermatologists tend to do very well[3]—and small business owners in New York earn the most, averaging $143,878 annually. Seven of the top 10 cities with the highest-earning small business owners are located in California[4].

Key Takeaways

- On average, small business owners typically earn higher incomes than non-self-employed people.

- Small business owner income varies by industry, location, business demand, and other factors.

- Getting professional certifications and investing in marketing can increase your small business owner income.

(Source: ZipRecruiter)

Tracking the income of self-employed workers is difficult, as traditional data sources like the United Bureau of Labor Statistics (BLS) track unincorporated self-employed people separately from those whose businesses are incorporated. Incorporation essentially makes the self-employed business owner a salaried employee of their incorporated business, so those income figures are tracked along with all wage and salary workers. BLS figures may also be more than a year old before they are published. So I chose to compare figures based on current job postings and self-reporting to get the most current information.

Average Small Business Owner Income By Industry

A small business can be anything from a corner coffee cart to an acupuncture studio, from a realty office to a small boutique. The biggest variable in a small business owner’s income is the industry you work in. I’ve listed some of the most common small business industries in the list below, with the salary range based on current job postings and self-reporting from self-employed business owners on ZipRecruiter.

- Personal services (hair stylists, make up artists, etc.): $19,500–$152,500[5]

- Accounting/ Bookkeeping: $20,500–$108,000[6]

- Restaurant owners: $21,500–$294,500[7]

- Retail store owners: $25,500–$339,500[8]

- Financial advisors: $36,000–$144,000[9]

- Realtors: $36,500–$154,500[10]

- Lawyers/legal services: $47,000–$138,000[11]

- Veterinarians: $49,500–$294,000[12]

- Management consultants: $39,500–$75,000[13]

- Dentists: $59,500–$338,000[14]

Related:

Average Small Business Owner Income By Location

The second largest factor in your small business owner income potential is your location. There is some correlation between population density and earnings, but exceptions exist to even that rule. According to data from ZipRecruiter, one of the top states for high small business incomes is one of the least populated—Vermont. Though seven of the top 10 cities for the highest small business owner incomes are in California.

Small Business Owner Income By State

Source: ZipRecruiter

Within each state, however, income potential varies by city. For example, the state of California ranks 32nd for small business owner income according to data from ZipRecruiter2, but seven of the top 10 cities for average small business owner incomes are located there.

Top 10 Cities for Average Small Business Owner Income

City | Average Small Business Owner Income |

|---|---|

San Francisco, CA | $158,104.00 |

San Jose, CA | $152,876.00 |

Oakland, CA | $149,599.00 |

Hayward, CA | $149,344.00 |

Ashland, CA | $149,329.00 |

Vallejo, CA | $149,189.00 |

Antioch, CA | $148,904.00 |

Seattle, WA | $148,440.00 |

Lebanon, NH | $147,982.00 |

Everett, WA | $147,054.00 |

Source: ZipRecruiter

Factors That Impact Small Business Owner Income

Besides your industry and location, other factors that impact a small business owner’s income are: your level of expertise, your regulatory expenses, and your end customer type. Demand for your services and the longevity of your business also play a role.

Specialized Training & Degrees

Industries that require specialized training or degrees tend to have the highest earning potential. Many dentists, dermatologists, lawyers, and psychiatrists and therapists are small business owners. Their degrees and certifications instill confidence in patients and clients. Building tradespeople like electricians and plumbers also have specialized training for the work they do; the higher their qualifications (such as a master plumber), the higher their earning potential.

Regulatory Requirements

Some industries—like food production and medical services—are highly regulated. The more regulated your industry, the higher your costs for permits and licenses. These expenses can eat into your income.

Market Demand

Services that are in high demand can naturally charge higher prices and bring in higher income. Some examples of in-demand services include building trades like electrical and plumbing work and business support services like bookkeeping, accounting, and technical support.

Customer Type

Small businesses that fill a need for deep-pocketed customers tend to generate higher incomes for the small business owner. Businesses that provide services to the government have a steady client with deep pockets. But wedding photographers and event planners also tend to work for clients with large budgets.

Business Size & Growth Stage

The longer you have been in business, the higher your income from your small business tends to be. As your small business becomes established, you’ll naturally expand your network through referrals and word of mouth. As your reputation grows, you can charge higher prices for your products and services.

Tips to Increase Your Small Business Owner Income

There are many ways to increase your income as a small business owner, with marketing being an obvious one. But you don’t always have to spend money to increase your small business owner income potential.

Get Certifications

If you provide a good or service in an industry that recognizes business certifications, try to attain the highest level of certification you can afford. For example, the building trades have many certification levels from apprentice to journeyman to master. Master plumbers and master electricians earn thousands of dollars more annually than journeyman technicians. A caterer can charge more for their services if they are also a certified nutritionist.

Look for certification programs that you can afford that will increase your appeal to your target customers. Health and wellness clients tend to like to see that service providers have trained under recognizable wellness coaches. Private chefs can generate interest from working alongside well-known chefs or learning new cuisines.

Build a Strong Network

Word of mouth recommendations have long been considered the strongest form of marketing. Potential clients and customers tend to trust the recommendations of friends and family over advertisements. You can generate more referral business by casting a wide net and making a point to befriend other small business owners, people who offer services or products related to your business, or by incentivizing past clients to refer new business.

Related:

- 8 Business Networking Statistics to Generate New Opportunities

- 7 Referral Email Templates for More Word-of-Mouth Referrals

Market Your Business

You can’t land clients or customers if they don’t know how to find you. So spending some money on marketing your small business is a great way to increase your small business owner income.

Your marketing materials should make it clear that you are a small business. An overwhelming majority of consumers (82%) regularly make purchases from small businesses. And 72% of American consumers are willing to pay higher prices to get their products and services from small businesses.

Related:

- 24 Effective Marketing Materials for Small Businesses (Print + Digital)

- 20 Cheap or Free Small Business Marketing Ideas

Provide High-Demand Products or Services

The higher the consumer demand for a product or a service, the higher the price customers are willing to pay for it. Or, in a twist on the same concept, the longer customers will wait for the opportunity to obtain a product or service, like a restaurant reservation or home renovation work. This can allow some small business owners to increase income by booking clients throughout the year rather than just in historically busy seasons.

A spa might start offering the latest facial products or services that are trending on social media. An entrepreneur in a tourist community could earn major income from house cleaning, housesitting, or providing general upkeep for second homes and rental properties.

Related: How to Choose a Business to Start: A 5-Step Guide

Specialize Your Services

Look for ways to create a niche for your services. A roofing company might begin to specialize in standing-seam metal roofing because of it’s higher price point and unique installation style. A caterer might be able to charge a premium by specializing in allergen-friendly meals and event catering. Consider your highest profit products or services. Do they have anything in common? Or look at your market, is there a product or service that is missing? Any opportunity to offer a unique product or service can increase your demand and expand your customer base.

Related: How to Find a Niche Market in 4 Simple Steps

Frequently Asked Questions (FAQs)

These are some of the most common questions we hear about small business owner income.

According to data from the United States Census Bureau and job listing sites that track this information, small business owners earn more annual income than standard wage workers. Sometimes the difference can be as much as twice the average US annual wage. Small business owner income varies a lot based on industry, location, and time in business

The average small business owner salary varies depending on business type, the owner’s role in the day-to-day operations, and the business’s profitability. Whether you pay yourself a regular salary or sporadic withdrawals from your profits, its smart to pay yourself less than your total profits so your business retains some profits to grow with. According to the Small Business Administration, most small business owners pay themselves less than 50% of their profits.

Most small business owners get paid when their businesses turn a profit through a system known as a “draw.” A draw is essentially a withdrawal from your profits, that can sometimes be higher if you are repaying yourself for personal funds that you used to establish the business. Other business owners prefer to pay themselves a standard salary for managerial or administrative tasks they perform for the business, saving or reinvesting profits into their business.

Bottom Line

Small business owners tend to bring in a higher income than standard wage-earning employees; in many cases, a small business owner can earn twice as much as the national average wage. How much income you earn as a small business owner depends on your industry, location, and other factors like market demand and your business longevity. But those factors don’t necessarily determine your fate; you can increase your small business owner income through marketing, networking, and other strategies.

References:

- Social Security Administration ↑

- ZipRecruiter | What Is the Average Small Business Owner Salary by State? ↑

- U.S. Bureau of Labor Statistics | Highest Paying Occupations ↑

- ZipRecruiter | Small Business Owner Salary ↑

- ZipRecruiter | Independent Hair Stylist Salary , ZipRecruiter | Independent Make-up Artist Salary ↑

- ZipRecruiter | Independent Accountant Salary ↑

- ZipRecruiter | Independent Restaurant Owner Salary ↑

- ZipRecruiter | Independent Shop Owner Salary ↑

- ZipRecruiter | Independent Financial Advisor Salary ↑

- ZipRecruiter | Independent Realtor Salary ↑

- ZipRecruiter | Independent Lawyer Salary ↑

- ZipRecruiter | Independent Veterinarian Salary ↑

- ZipRecruiter | Independent Management Consultant Salary ↑

- ZipRecruiter | Independent Dentist Salary ↑