Human resources (HR) compliance is the process of ensuring your company adheres to all employment laws and regulations—from hiring and onboarding new employees to administering their benefits and ending the employment relationship. Small businesses are uniquely susceptible to compliance violations because they often lack the oversight necessary to notice and correct issues.

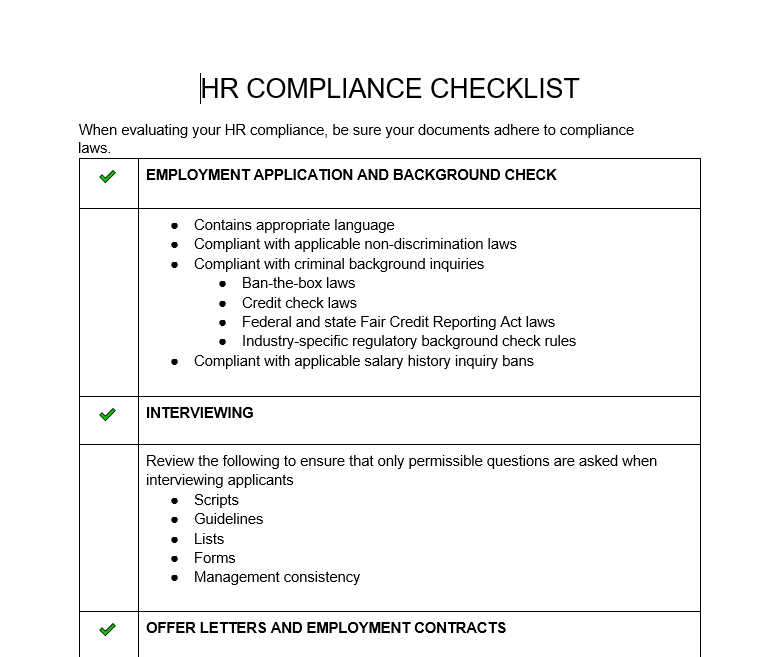

To ensure you are remaining compliant in all areas of HR, download our free HR compliance checklist.

Thank you for downloading!

Thank you for downloading!

If you need to automate any HR tasks like payroll, consider our recommended payroll software partner, Gusto. Gusto automatically files new hire paperwork, calculates and files payroll taxes, generates year-end W2s and 1099s, pays via direct deposit, and even helps employees choose and manage their benefits, all from one platform.

To help you remain compliant, consider using HR compliance software, such as Gusto. This simple software helps you run payroll, file payroll taxes, handle compliance, and take care of general HR needs—hiring, onboarding, benefits administration, time and attendance, and more. Start today and get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

Top HR Compliance Categories

The biggest HR compliance concerns for small businesses center around payroll, benefits administration, recruiting, and more. Scroll through our top HR compliance categories below.

There are many regulations you’ll need to stay abreast of to maintain payroll compliance. For instance, most states require businesses to establish a payroll cycle without modification. Whether your company pays weekly, every other week, or twice monthly, you cannot change this schedule without advance notice to your employees. Some states even require companies to pay at least twice per month or more frequently.

Minimum Wage Compliance

Your company must pay employees at least a certain minimum wage. The federal minimum wage of $7.25 per hour applies to all employees in the US, but many states have gone above the federal amount and set their own minimum wage. Some cities have even gone beyond that, so make sure you know the minimum wage you must pay your team.

Overtime Compliance

You must also ensure compliance with your local payroll and overtime laws. California, for example, goes beyond the federal overtime laws and requires daily overtime pay for employees who work over eight hours in a single day. Learn more in our article about How to Do Payroll in California.

Be sure to calculate overtime correctly. Most states require you to pay time and a half for any hours beyond 40 worked in a single workweek. Some states also have daily work hour regulations for overtime. You can learn how to calculate overtime with our free overtime calculator.

Records Retention

Record retention for payroll is extremely important, and your company must keep certain records under federal law. Your state may also require you to keep additional records relating to when you paid employees, how much you withheld from paychecks, and how many hours they worked during each pay period.

As a best practice you should keep payroll-related records a minimum of two years (for merit-based increases in pay), and potentially up to six years (for retirement income and 401(k) documents). Your pay stubs and employment tax documents should be kept for a minimum of four years.

If your business operates with 50 full-time equivalent (FTE) employees, you need to adhere to the Affordable Care Act (ACA) and the Family and Medical Leave Act (FMLA). Even if you have always offered benefits to your employees, hitting the 50 full-time employee mark makes it mandatory for your company.

The ACA requires that you offer healthcare options to your employees. Administering healthcare benefits can be problematic for small businesses, especially those with inexperienced or overworked HR staff. Read more in our article about setting up employee benefits.

Under the FMLA, you must provide unpaid leave to eligible employees. The FMLA covers employees out for the birth of a child, recovering from an injury, caring for a sick family member, and many other scenarios. Small businesses too often ignore the requirements of FMLA and mandate employees to use paid time off or sick leave or even terminate employees for being out of work for an FMLA-covered reason. These actions, even innocent mistakes, can lead to serious penalties and employee lawsuits.

Your company’s employment practices can create problems for even the best-intentioned hiring managers. Several federal laws affect small business hiring practices and prohibit discrimination in employment, starting from the job posting itself.

The biggest concern for your small business is the training your hiring managers receive. If they don’t understand what issues to avoid, they may get your company into trouble. We recommend annual compliance training for any employee who will be involved in the hiring process.

Your employees need to know the difference between questions that are illegal to ask in interviews and those questions that are just bad. Your hiring managers also need to know how to navigate a conversation when an employee says they’re pregnant or have a disability

There are several tests to determine whether an employee is exempt or nonexempt. Many companies, especially small businesses, interpret this to mean salary versus hourly employees. It’s not. Salaried employees can still be entitled to overtime pay.

Working through these tests can be confusing, and it’s not always cut and dry. You may even need to engage an employment attorney to make sure you are correctly paying overtime. Violations of this law can result in costly fines and penalties, including your company having to pay back overtime to employees and cover their share of taxes, including your company’s.

Many small businesses work with freelancers to help supplement their business needs. But the Internal Revenue Service (IRS) has made clear distinctions between employees and contractors.

Employee | Contractor |

|---|---|

|

|

|

|

|

|

|

|

Many companies misclassify employees as contractors. If your small business uses contractors and any of the following is true, your contractors may actually be employees and your company could be subject to massive fines and penalties:

- A contractor has a supervisor at your company.

- Your company tells a contractor when to work, how many hours to work, and what work to do each day.

- Your company conducts regular performance reviews for contractors.

If your company controls the contractor’s daily work duties, you might be stepping over the line and inadvertently converting a contractor into an employee, subjecting your company to fines and penalties.

All employers in the US are required to verify an employee’s eligibility to work in the country. Every new employee must complete a Form I-9 and provide the appropriate identification within three days of hire. This form is used to verify a worker’s eligibility to work in the US. Because this form contains personal and sensitive information, it must be kept separate from an employee’s personnel file. Keeping an I-9 in an employee’s personnel file can result in fines.

Even how you complete the form can subject your company to compliance violations. When having an employee provide documentation for you to complete the employer portion of the I-9, you cannot mandate the documentation a new hire gives you. Direct them to the instructions on the form, stating clearly what documentation is allowed and how many forms of identification are required.

At-will employment is the standard across nearly all states and cities. This means that employers can terminate employees at any time, and employees can leave a company at any time. Even though employers can terminate employees without a reason, if challenged, the company must have a non-discriminatory reason for the termination.

Terminating an employee for any of the following reasons could lead to a wrongful termination lawsuit against your company:

- Discrimination against a protected class (race, gender, national origin, disability, religion, gender, age)

- Retaliation

- Whistleblowing

- Pregnancy

HR Compliance Laws

Several laws on the federal and state level come into play when dealing with HR compliance. See a list of the federal laws below. We recommend you check with your state for additional HR compliance laws that may apply to your business.

- Affordable Care Act (ACA): mandates that you must offer healthcare options to your employees if your business employs 50 or more employees.

- Age Discrimination in Employment Act (ADEA): protects individuals from discrimination against their age.

- Americans with Disabilities Act (ADA): protects individuals with disabilities from discrimination.

- Equal Employment Opportunity Commission (EEOC): requires small businesses to keep certain employment records and to post information about discrimination laws.

- Equal Pay Act (EPA): requires pay equity between men and women for similar work duties. Like overtime laws, many states have enacted their own equal pay laws that go above and beyond the EPA so be sure to check yours.

- Fair Labor Standards Act (FLSA): establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments.

- Family and Medical Leave Act (FMLA): mandates that you must provide unpaid leave (up to 12 weeks) for eligible employees.

- Form I-9 Rules and Regulations: requires that employers verify every employee’s eligibility to work in the United States.

- Title VII of the Civil Rights Act of 1964: prohibits employment discrimination based on race, color, religion, sex, and national origin.

Best Practices for Improving HR Compliance

Implementing HR compliance practices requires a combination of clear policies and procedures, comprehensive training programs, regular internal audits, and monitoring legal changes. These ensure you stay compliant with applicable laws while fostering a positive work culture that values fairness and respect for all employees.

- Establish Clear Policies and Procedures: Having clear policies and procedures that are aligned with federal, state, and local laws will help maintain compliance in HR. Regularly reviewing and updating these policies ensures that they remain up to date with changing regulations and industry best practices.

- Conduct Regular Compliance Training: By educating employees about compliance, they become better equipped to navigate workplace situations appropriately. Additionally, training managers on topics such as avoiding discrimination or harassment can help them handle sensitive issues effectively while ensuring compliance with anti-discrimination laws.

- Conduct Internal HR Audits: An internal audit is a review of your HR policies to ensure compliance with all applicable federal, state, and local labor laws. Conducting regular HR audits will show you gaps in your compliance, giving you direction and focus on improving your processes.

- Monitor Legal Changes: In order to mitigate risks, it is essential for HR professionals to have a comprehensive understanding of current legislation and proactively monitor any changes. Advanced technology solutions, like those found within Gusto, can provide real-time updates on new laws and regulations relevant to your HR practices.

- Create an HR Compliance Checklist: A well-documented system records all employee information accurately and maintains proper records of any disciplinary actions or grievances. Use a checklist, like the one provided in this article, to ensure you have recorded all necessary information.

Bottom Line

Ignoring potential HR compliance issues only makes it more likely that your company will face fines or employee lawsuits, costing you even more than what it would to conduct regular compliance audits. Knowing what your compliance issues are allows you to correct them, thus helping avoid costly fines and lawsuits.