A rental application form enables landlords to examine potential tenants’ creditworthiness and capacity to make on-time rent payments. This form includes questions about the applicant’s current living circumstances, financial position, and employment history. The information gathered from the rental application form will provide landlords guidance when assessing a prospective renter’s suitability.

Download our free rental application templates below and continue reading to see the items that should and should not be included on a rental application form.

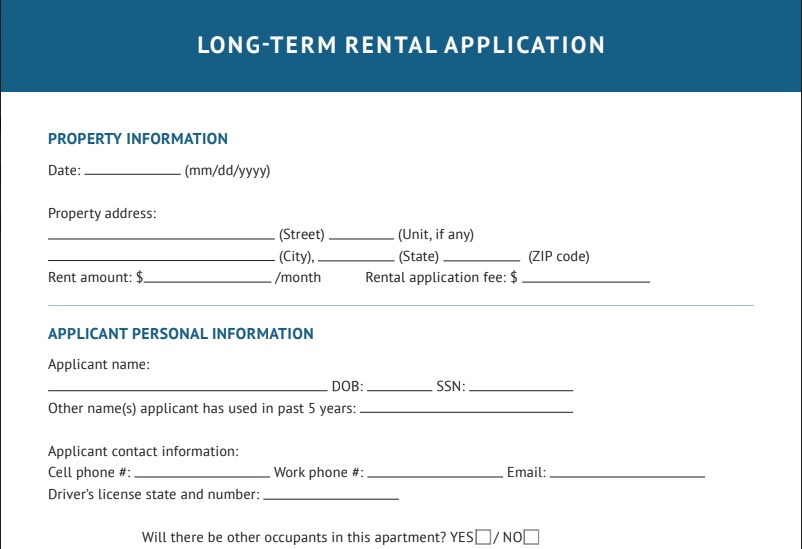

Long-term Rental Application Template

A tenant typically occupies long-term rentals for 12 months or more. They are common in single-family residences, condos, and multi-family apartment building rentals. This type of rent application form has more comprehensive questions to determine an applicant’s ability to pay rent and character to take care of the space.

Thank you for downloading!

💡 Quick Tip:

Customize rental application templates through an easy-to-use mobile app. Check out TurboTenant, a free landlord and tenant screening software, to complete the rental application process efficiently.

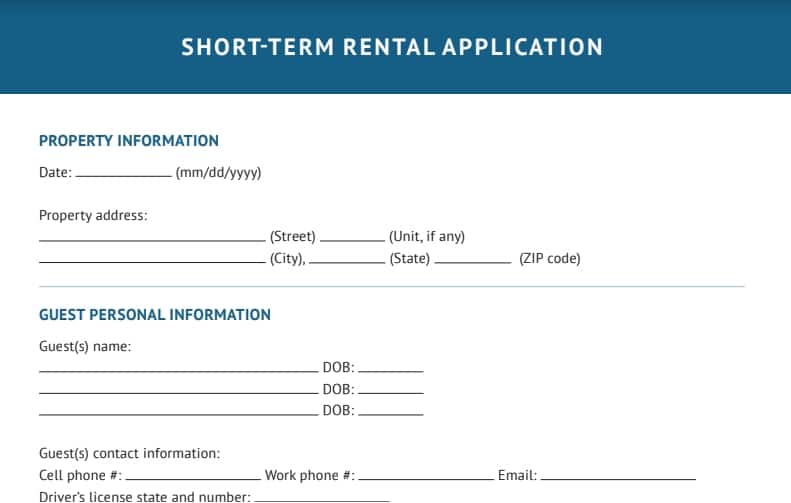

Short-term Rental Application Template

Short-term rental property can be rented on a daily, weekly, or month-to-month basis (e.g., a vacation rental with prepayment upfront), and, therefore, typically require fewer in-depth questions. Additionally, short-term rental applications benefit applicants who don’t meet long-term requirements, e.g., a person traveling from a different country for a short period without any credit or banking history.

Thank you for downloading!

💡 Quick Tip:

Customize rental application templates through an easy-to-use mobile app. Check out TurboTenant, a free landlord and tenant screening software, to complete the rental application process efficiently.

Both of these rental application templates include typically asked questions; however, landlords can also add more information to suit their needs and preferences, like “When do you want to move in?” and “Do you have any pets?”

12 Items to Include in a Rental Application Form

To find the best quality tenants, a rental application form template must include the right questions to screen applicants properly. There are elements of a basic rental application that are important to have in every rental application template. The questions on a rental application form may vary depending on the property type available.

1. Date of Rental Application Completion

The date of rental application completion is a time stamp to indicate when a prospective tenant provided all the required information to the landlord. The application completion date is essential when you have multiple applications and competing offers for the same unit. Assuming all the applications are similar, the completion date is another factor landlords can use to judge an application.

2. Rental Application Fee

A rental application fee is collected with a completed application. The application fee cost should be one of the first items listed at the top of the rental application. The landlord requests the fee to cover costs associated with application review, like pulling credit checks, running eviction history reports, administrative fees, etc. These tenant reports are not free services to the landlord. It’s the landlord’s responsibility to be upfront about the fees and clear on whether they are refundable.

The property’s location plays a significant role in the cost of the fee, as each state sets laws on how much a landlord can collect. Usually, application fees start at around $20. Collecting the application fee can offset some operating expenses associated with owning rental properties if state laws allow it. For example, Wyoming has no limitations on how much you can collect for an application, but Washington will only allow you to charge up to the cost of the actual screening.

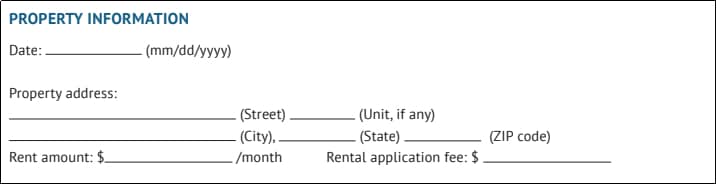

3. Property Information

Property information should be one of the first pieces of information on a leasing application form. This helps identify the property the tenant wants to occupy and is crucial if you own multiple rental units. Property information should be specific and include the complete street address, unit number, city, state, and ZIP code.

Example of property information fields on a rental screening application form

Identifying the rental property and unit ensures no confusion between the landlord and prospective tenant. Because a landlord may have multiple units available in the same building with different layouts and pricing, having the right property information will help landlords screen the tenant appropriately for a specific unit.

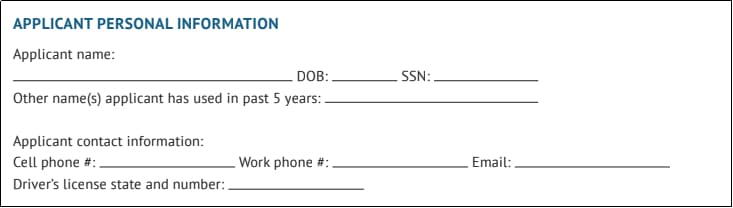

4. Applicant Information

All basic rental application templates include a section for applicant information. This information tells you who exactly is applying to live on the property and allows landlords to use it to verify identity. The information provided in this section also helps landlords pull accurate tenant reports.

Applicant personal information in a rental application example

Key application information requested on rental applications is as follows:

- Applicant name

- Date of birth

- Social Security number

- Other name(s) the applicant has used in the past five years

- Cell phone number

- Work phone number

- Driver’s license state and number

- Vehicle information, if applicable (needed so property management knows which vehicles belong to residents so as not to remove them from the property)

Having these up-to-date details will assist in contacting applicants, especially if they become tenants. In addition, requiring applicant names and Social Security numbers allows landlords to run reports properly and prevent fraudulent applicants. If reports are returned blank, an applicant may not have been truthful about their application.

Pro tip: Many individuals are apprehensive about writing their Social Security number. Inform applicants that running a proper background check and credit report is necessary. If applicants are still hesitant, allow them to call you to give their Social Security number over the phone rather than send it through email.

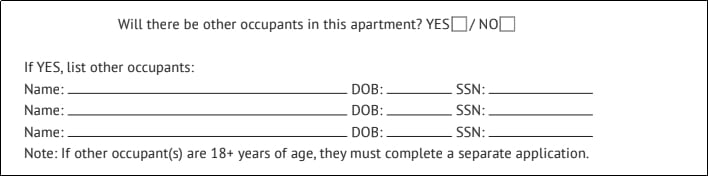

5. Other Occupants

It’s imperative to know exactly who will live in each rental unit. Other occupants accompanying the tenant could be children, spouses, parents, siblings, roommates, or friends of the tenant. Even though some occupants may not be obligated to pay rent (for example, a 5-year-old child), it is still imperative the landlord knows who is living in the apartment.

Information section for other occupants in a rental application sample form

It’s a landlord’s responsibility to protect their asset and know exactly who they will interact with if damage occurs to the unit or there is an emergency in the building. Landlords may also request that an occupant apply and be included in the lease agreement. This is especially true if occupants are held responsible for rent payments or are 18 or older. Property owners can deny an application based on other occupants. Still, they must remember that they cannot deny someone based on familial status as part of the Fair Housing Act.

Lying about co-tenants is one of the many tenant scams that landlords are subjected to. Making sure to ask the right questions on the rental application and having a solid leasing process will help landlords find quality tenants. Read more about common scams in our article 15 Tenant Scams Every Landlord Needs to Know & How to Avoid Them.

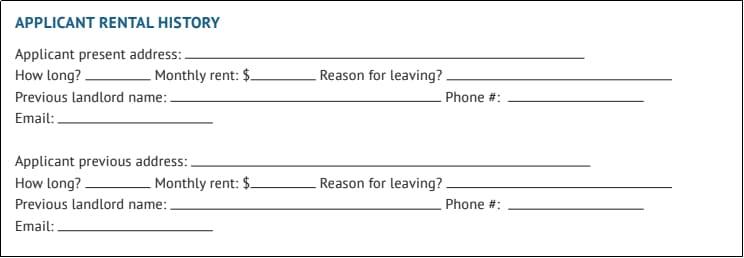

6. Applicant’s Current & Previous Addresses

After collecting personal tenant information, the following section should include information on current and previous addresses. Questions should address the applicant’s length of stay at each property, their monthly rental payments, their reason for leaving, and the previous landlord’s name and contact information. The landlord’s contact information will be used for landlord references.

Applicant rental history sample questions in a rental application form

This information gives landlords insight into an applicant’s rental history. From the provided information, landlords can understand their tenant’s intentions to stay in a short-term or long-term capacity. Property owners may also contact the previous landlord to confirm the rental and payment history and receive a character reference on the applicant.

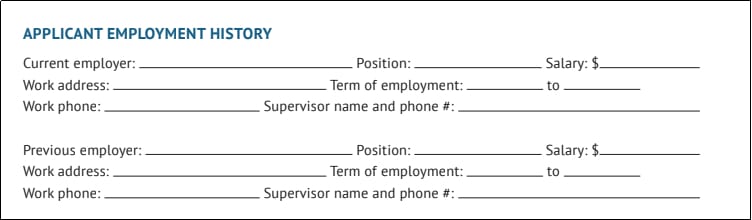

7. Employment & Income Information

Collecting employment and income information is a standard tenant screening practice. Employment history provides information on current and past employers and their position, income, length of employment, and employer contact information. Landlords can also collect pay stubs as part of the application packet to help verify the employment information provided.

Example of employment history questions

The details regarding employment and income will help you determine if a tenant has a stable job and can pay rent on time. Often, a landlord or housing market will have income requirements to ensure tenants aren’t financially stretched to make the asking rent. For example, the general income requirement in New York City is 40 times the asking rent, but most other states require three times the monthly rent.

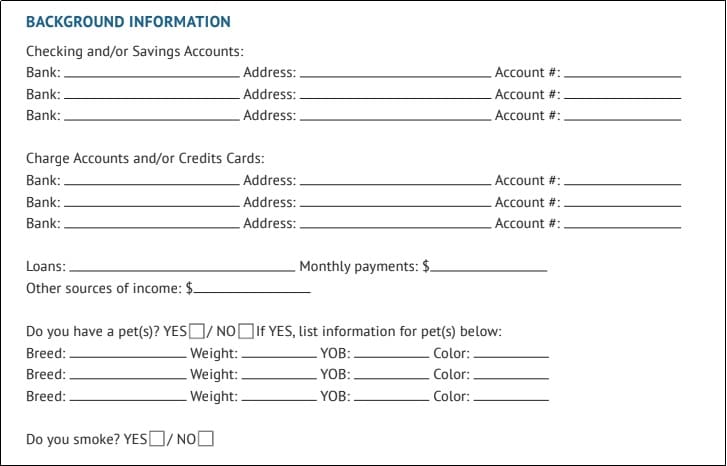

8. Background Information

The background information on a long-term rental application form typically requests information regarding a tenant’s bank accounts, charges or credit cards, other liabilities, and whether they have pets. Whether applicants smoke or play a musical instrument can also be included. This section allows tenants to provide more details on themselves to help with their application approval.

Sample background information fields in a rental application template

When processing background checks on prospective tenants, the reports should mimic the information present in this section, especially when pulling information on credit scores. Bank accounts and lines of credit should appear on a credit report, and the banking and credit history can provide insight into their overall financial profile.

Also, pet information should align with the landlord’s pet policy. However, if the pet is an emotional support or service animal, landlords should ensure they follow the Fair Housing rules and request documentation.

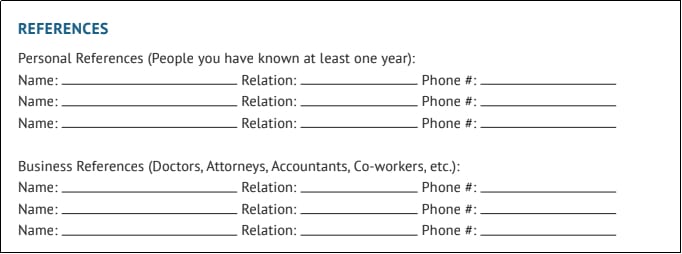

9. Personal & Professional References

The references section is broken into two sections: personal and professional. A reference’s name, relation to the tenant, and contact information should be provided. Personal references should know the tenant for over a year and don’t always have to be related to the tenant. On the other hand, business references can be a tenant’s doctor, attorney, accountant, co-worker, manager, or business associate.

Example of a references section

Calling references can uncover some truths about the tenant, giving insight into whom they associate with. Landlords shouldn’t base an applicant’s application approval entirely on their ability to pay rent, so conversations with references may uncover personal characteristics that speak to their quality as a tenant. Positive responses can support your decision to approve the application. However, negative results can help you quickly move on to the next application.

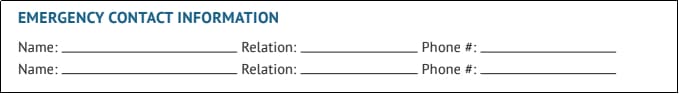

10. Emergency Contact Information

Landlords should ask all candidates for at least two individuals who can be their emergency contact. The emergency contact section should include the name, contact information, and relation to the tenant. Pro-active landlords will call the contact to ensure they exist and ask the tenant to update their contact every few months. Also, it’s another point of contact if the tenant leaves without paying rent.

Emergency contact information sample

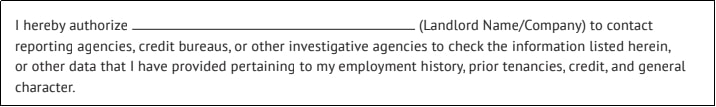

11. Disclosure

Each state has its own landlord tenant laws, detailing what must be included in the rental application disclosure. In this section, landlords should disclose they follow all federal Fair Housing laws when reviewing and approving applications. The disclosure section also gives the landlord written authorization to use the information in the rental application for screening. Generally, the disclosure states the tenant is giving the landlord permission to run credit and background checks and contact other agencies to verify the information listed on the application.

Example of the disclosure section in a rental agreement application

This also provides landlords with approval to contact a tenant’s references, employer, and previous landlords to collect information regarding their payment history, tenancy, and overall character. With proper disclosure authorization, landlords can move forward with using the information provided or running necessary tenant reports. If applicants do not sign the application, it should immediately be returned to the applicant for signature.

12. Applicant Signature & Date

The last section of the rental application template should include a request for the applicant’s signature and date. The application and disclosure are invalid without an applicant’s signature and date. The signature also holds the tenant liable for all information provided on the application. If the tenant provides inaccurate or missing information, it gives the landlord reasons to deny the applicant.

Information Landlords Cannot Include in the Application

In the rental application form, landlords cannot ask questions about prohibited topics based on Fair Housing Laws. Fair Housing ensures no one engaging in housing-related activities like buying, selling, renting, or obtaining a mortgage is discriminated against based on personal characteristics. It is illegal to discriminate or deny an applicant based on race, color, national origin, religion, sex (including sexual orientation or gender identity), familial status, or disability.

Some examples of questions that violate the Fair Housing Act are:

- Where were you born?

- What is your sexual orientation?

- Do you have a disability?

- Do you have children?

- Which church do you attend?

Refrain from including questions that may disclose such tenant characteristics. There are a few circumstances where Fair Housing Laws don’t apply. The laws don’t apply if a tenant applies to an owner-occupied building with four or fewer units, a single-family home sold or rented by the owner without an agent, or housing operated by religious organizations or private clubs with occupancy limited to its members.

To ensure you’re not violating any Fair Housing laws, review our article entitled Fair Housing Act in Real Estate: Protect Your License & Clients. Although this article is geared toward real estate agents, all real estate-related professionals, like landlords, are bound to these laws.

Rental Application Providers

Rental application providers assist with expediting the application process. They help you market, attract, and evaluate prospective tenants with tenant screening services. If you’re ready to explore options, look into Baselane, a top property management and rent payment service software for landlords, property managers, and investors with portfolios of any size.

TransUnion SmartMove tenant screening reports (Source: TransUnion)

Baselane offers features like online rent collection, tenant screening, accounting, and banking. It provides comprehensive reports and a ResidentScore to give landlords insights into lease outcomes based on applicants’ credit, demographic, and eviction data to predict the high risk of tenant default.

Read our 8 Best Property Management Software for Small Business in 2023 to discover the best tools that help you manage your rental properties more efficiently. Plus, many providers that offer tenant screening services have ready-to-use applications for landlords. Check them out in our article 6 Best Tenant Screening Services for Landlords.

Bottom Line

Rental applications provide valuable information for landlords to review and get a better assessment of a prospective tenant. The evaluation process is critical in preventing future tenant issues and protecting your real estate investment. Review the list above to determine what’s included in rental application forms, which form you should use for your property type, and items to avoid on applications to comply with Fair Housing.

Frequently Asked Questions (FAQs)

A rental application is a document that gathers information, and the information it collects should demonstrate the applicant’s ability to rent the property. Therefore, the information asked must be legitimate and precise. The applicant’s personal information, residency history, employment or income, references, disclosure, and applicant’s signature are the six primary elements of a standard rental application.

Lying on a rental application is technically fraud, and a tenancy may be terminated if any information provided on your application is false. Landlords can file charges against a tenant for lying on an application, but termination of the lease is a more likely result.

Aside from the obvious indicators, like low credit score and income, a few less noticeable details on a rental application may point to a bad tenant. Identifying these areas may be the only chance to avoid a bad tenant later on. Here are some of the most common red flags on an apartment rental application:

- Unverified income

- No contact information was provided for the current or previous landlord

- Frequent changes of residence

- The information does not match screening reports

- Currently unemployed or no verifiable income