Amid economic changes and persisting retail growth, the retail world is changing in terms of shopping habits, consumer preferences, technology advancements, and more. Whether you’re a well-established operation or just starting a business, understanding these changes is vital for your success.

In this article, we will look at some retail industry statistics to help your business get ahead.

US Retail 2023 Sales and 2024 Forecast

For the 2023 sales and 2024 forecast and projections for retail, we rely on the figures presented by the National Retail Federation (NRF), the world’s largest retail trade association.

Annual retail sales in 2023 amounted to $5.1 trillion

In the US, retail sales amounted to $5.1 trillion, a 3.6% growth over 2022.

Nonstore and online sales in 2023 amounted to $1.38 trillion

Nonstore and online sales in the US reached $1.38 trillion in 2023, an increase from 2022’s $1.03 trillion sales. Bricks-and-mortar locations remain the primary point of purchase for consumers, accounting for approximately 70% of total retail sales.

2024 retail sales are forecast to reach $5.23 to $5.28 trillion

The NRF forecasts that retail sales for 2024 will experience a 2.5% to 3.5% growth from 2023, ranging between $5.23 and $5.28 trillion. This growth is in line with the prepandemic, 10-year growth rate.

Source: NRF

Nonstore and online sales are expected to reach $1.47 to $1.50 trillion

Nonstore and online sales, included in the total retail sales figure (above), are expected to grow between 7% and 9% year over year. This amounts to $1.47 to $1.50 trillion, a slight increase from 2023 sales.

NRF forecasts slower GDP growth in 2024

NRF’s projection for this year’s GDP growth is 2.3%, slightly slower than 2023 at 2.5%. While the figure might be lower, they say it is strong enough to sustain job growth.

Retail Impact in the US

The following figures are based on The Economic Contribution of the US Retail Industry, an NRF and PricewaterhouseCoopers (PwC) report.

Retail is the largest private-sector employer in the US

The retail industry generated 55 million full-time and part-time jobs in 2022—an equivalent of more than one in four American jobs. It takes care of more than a quarter (26%) of the total employment in the US.

Retail accounts for 20.4% of the total US GDP

The retail industry’s total gross domestic product (GDP) contribution was $5.3 trillion in 2022, accounting for 20.4% of the US GDP.

The retail industry’s labor income contribution is $3 trillion

The industry’s total labor income contribution was estimated to be $3 trillion or 20% of national labor income in 2022.

There are more than one million private retail establishments in the US

According to the latest data from the US Bureau of Labor Statistics, there are 1,081,728 private retail establishments as of the first quarter of 2024. This shows an upward trend from the 1,028,242 establishments in 2012.

Much of the growth is attributed to the rise of nonstore retailers—including ecommerce businesses—especially in the years after 2020.

Retail Jobs

Retail is still the biggest employer in the US, with teenagers getting their first jobs in the industry and plenty of adults staying in the jobs long-term. Retail employees say that career growth (and the subsequent salary increase) is possible in a shorter period of time compared with other industries.

The retail industry directly employs 32 million Americans

Retail jobs include anyone involved in consumer products, including product suppliers, factory workers, logistics drivers, and sales associates. Retail helps people get employed more than any other industry, employing 32.2 million Americans.

This figure is not even an accurate representation of the total number of employees in the industry, as the US BLS only counts employees who work in stores and excludes retail workers in business areas such as corporate headquarters, distribution centers, call centers, and innovation labs.

However, as you can see in the graphic below, retail jobs remained stable even during the COVID-19 pandemic marked by massive layoffs.

Source: NRF

17% of part-time employees work in retail

In the US, part-time work plays a crucial role in the economy. Seventeen percent of those working part-time are in retail because of the flexibility it provides—37% are still studying, 21% work other jobs, and 11% are stay-at-home parents. In fact, 29% of retail employees are part-timers.

6 in 10 Americans have worked a retail job

Six in 10 Americans have been in a retail job. In fact, nearly a third (32%) of Americans’ first jobs were in retail.

1 in 4 American teenagers work in retail

Working in retail is often the first introduction to the workplace. The average age for a first job in retail is just 16.

Retail job earnings increase 54% on average with only 2-5 years of experience

Retail starting salaries are comparable to other industries, but compensation is faster in retail. According to an NRF research study in 2023, earnings increase 54%, on average, with only two to five years of experience in the industry.

Those who stay in retail for more than five years can expect a 122% increase in compensation requiring two to five years of experience.

Leading Retailers

Walmart and Amazon are the two largest retailers in the US for brick-and-mortar and ecommerce respectively. The two giants share the top spots for ecommerce as well, further cementing the consumer preference and demand for an omnichannel shopping experience.

Walmart is the leading US retailer in terms of sales

There hasn’t been a lot of change in the top retailers compared with the 2023 list. Walmart has been the perennial leader among retailers for the last five years, topping $533.96 billion in sales across 5,321 stores.

Most companies in the top 10 are huge with deep pockets and have the existing capital and credit to maintain their positions with ease, according to experts.

Source: NRF

Dollar Store has the most number of retail stores in the US

In terms of the number of retail stores, Dollar General operated 20,583 stores throughout the United States in 2023. It is ranked 17th in the top 100 retailers list in 2024 by the NRF.

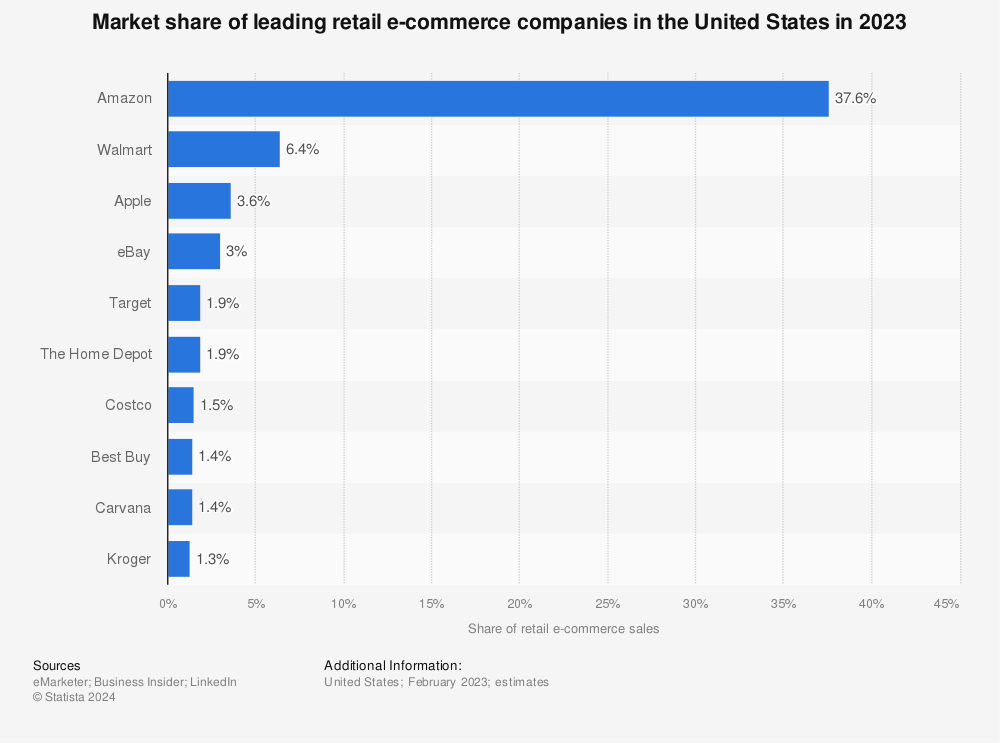

Amazon is the leading online retailer in the US

Amazon leads the pack of online retailers, getting 37.6% of the market share in the US in 2023. Walmart is at a distant second at 6.4%.

It is also the most popular online shop in the US, with consumers having bought something from the platform in the past 12 months, and the most visited online marketplace in the world, accounting for 20% of desktop visits in this category.

Source: Statista

Brick-and-mortar Retail Store Statistics

Brick-and-mortar stores remain an important part of the shopping journey for customers, leaning towards curated experiences and not solely just for purchasing items. It is crucial for retailers to amp up the store experience, and they can do so by leveraging technology that is centered around convenience and customer loyalty.

There were 5,645 store openings in 2023

In 2023, US store openings outpaced closings for the second straight year. Major retailers opened 5,645 stores, a 4.7% increase from 2022. More than a third (34.3%) of those openings were general merchandise discount stores.

There were 4,913 store closures in 2023

Conversely, 4,913 store closures happened in 2023, up 28.6% year over year, mostly from major retailers.

Home and office retailers accounted for nearly a third of these closures, followed by apparel. Off-mall retailers experienced most openings and closures of any retail location type.

There have been 4,548 store closures already in 2024

As of August 9, 2024, Coresight Research reported that US store closures have outpaced store openings through early August of this year, fueled by an increase in bankruptcy filings. According to the report, 4,548 stores had closed so far this year, slightly beating the 4,426 announced store openings during the same period.

More than a third of consumers purchase an item in-store right away after discovering it

Brick-and-mortar stores are still effective in encouraging impulse purchases. EMARKETER reports that 31.5% of shoppers made a purchase after an in-store discovery right away, compared with 19.1% of those who visit retail websites.

More than two-thirds of US retail sales take place in physical stores

EMARKETER forecasts that 83.7% of retail sales in the US take place in brick-and-mortar stores.

Retailers use technology to improve the in-store experience

According to the October 2023 Retail Systems Research data by EMARKETER, retailers are using in-store technology to enhance and increase customer engagement as well as streamline the shopping experience.

Among the technologies implemented, a loyalty program or branded app, in-store Wi-Fi, customer portal, and cashierless checkout are the most used.

Related: How to Create a Customer Loyalty Program

More than a third of customers choose to shop in-store to see and touch items

According to a FedEx and Retail Dive report, in-store shopping is still relevant, with six in 10 customers going to the store so they can see and touch items. Around a quarter (27%) shop in-store to be able to immediately receive a product.

Six in 10 shoppers look for curated experiences when going to retail stores

Retailing is now more than just a transaction; it’s an experience as more shoppers go to physical stores for new experiences, too. Retailers are rising to these expectations by adding experiential components—think dining, events, and wellness spaces.

51% of retailers are focusing on enhancing the physical store experience in the next 12 months

As the physical and online components of the retail experience blend together, the physical store component is now expected to deliver experiences rather than just products. As such, it is no surprise that more than half of retailers have shifted focus on improving the in-store experience.

In the next 12 months, 61% of surveyed retailers plan to offer more in-store options like a coffee or wine bar, while 60% are interested in offering paid advertising space in their physical stores, and 56% will be renting store space for events.

Ecommerce Retail Stats & Online Shopping Behavior

Ecommerce and online shopping are mainstream and can no longer be considered trends. Even product discovery is now happening online instead of traditional ads, so retailers would do well in shifting priorities and establishing an online presence.

There are almost 28 million ecommerce stores worldwide

As of August 2024, there are 27,849,612 ecommerce stores detected on the Internet. It marks a 3.83% increase from 2023, which means almost 2,700 ecommerce websites launched daily between 2023 and 2024.

The US is home to half of the ecommerce stores worldwide

There are around 14 million ecommerce stores in the US as of this writing—14,349,970 to be exact.

The majority of ecommerce stores are powered by Shopify

Shopify powers 18.76% of ecommerce websites—around 5,225,274 stores. Wix and WooCommerce follow next with around 12% each.

There are 2.71 billion online shoppers worldwide

As of 2024, 33% of the world’s population—2.71 billion people—is shopping online, a 2.7% increase from 2023.

There are more than 270 million online shoppers in the US

Online shoppers in the US increased 5.6% from 2023 to 273.49 million. This figure is expected to rise yearly, reaching 333.5 million by 2029.

The US recorded $291.6 billion in online sales in the second quarter of 2024

There was a 1.3% increase in ecommerce sales from the first quarter of 2024, resulting in $291.6 billion in online sales in the second quarter. Ecommerce sales accounted for 16% of total retail sales in the time period.

The majority of shopping journeys begin online

An overwhelming 83% of shoppers research online before visiting physical stores—44% begin with an internet search and 41% start looking at online stores.

34% shop online once a week

According to the IPC Cross-border E-commerce Shopper Survey 2023, 34% of shoppers make online purchases at least once a week. This figure jumps to 82% when you include shoppers making purchases every month.

Marketplaces play a big role in cross-border purchases

US retail marketplace sales are projected to reach $603.2 billion in 2027, representing nearly 35% of total retail ecommerce sales.

The top marketplaces worldwide are Amazon (24%), AliExpress (16%), SHEIN (9%), and Temu (7%) in 2023.

Social shopping is a mainstream of online shopping

There are 239 million social media users in the US, around 70% of the country’s population. Among these users, 57% have bought through social media—a big figure, but still lower compared with 90% in China.

Smartphones are the most popular device for online shopping

More than three-quarters (78%) of consumers use their phones to shop, according to a report from Integral Ad Science. In fact, 75% of mobile shoppers shop at least once a week.

Omnichannel Retail Journey

Brick-and-mortar and ecommerce should be considered parts of the whole customer purchase journey, not two separate components. Both retail experiences should be seamlessly integrated as the majority of shoppers demand a consistent shopping experience between the two.

Ecommerce and in-store retail complement each other, having a halo effect

The original ICSC The Halo Effect study in 2018 has updated its figures, reaffirming how online stores and brick-and-mortar shops complement each other, creating a halo effect.

ISCS found that online sales increased after opening a physical store—around 6.9% increase in sales. And the online halo effect is two times for emerging and direct-to-consumer (DTC) retailers that open physical stores in the same trade area.

Source: ICSC

91% of customers prefer brands that offer omnichannel experiences

The latest Worldmetrics.org report shows that nearly all customers (91%) prefer brands that offer omnichannel experiences, with 70% of shoppers expecting an omnichannel experience in stores.

Only 56% of retailers offer a consistent shopping experience across all channels

Despite customer preferences, retailers still have a lot of work to do to provide a seamless shopping experience to their customers. Only 56% of them provide a consistent shopping experience across all channels.

The NRF surveys show that over 50% of retailers currently offer, or plan to offer, ship-from-store capabilities.

Retail Payments

To attract and appeal to the largest audience possible, aim to provide a variety of payment options both online and offline, as shopper preferences vary by age and shopping method.

90% of shoppers want retailers to offer multiple payment options at checkout

It is no surprise that an overwhelming majority of shoppers now want more payment options. Retailers see that offering more checkout methods leads to more sales—from mobile payment methods to buy now, pay later (BNPL) and peer-to-peer apps.

Nearly half of in-store shoppers now prefer contactless payment methods

According to Square, 48% of in-store shoppers prefer contactless payment methods, a five-point increase from 2022 (48% vs 43%).

In-store shoppers’ top preferences in paying are through traditional card payments (33%) and touchless card payments (29%). Gen Z in-store shoppers, in particular, preferred touchless card payments in addition to mobile wallet apps over other forms of payment.

Retail Technology

As with every aspect of our world, retail is adopting more technology. Small and large businesses alike are using new business solutions and tools to make running their brands easier and enhance customer experience. Take a look through the figures below to see what technologies businesses are investing in.

80% of business owners have digitally optimized their businesses

Over the course of the last year, 80% of businesses have optimized their operations, adopting new tools like cashless payment terminals, mobile banking solutions, social media brand building and optimization, digital marketing, and cloud-based software platforms. These tools have subsequently helped these businesses save time, improve their operations, and enhance customer experience and satisfaction.

A quarter of retailers see AI as a top investment priority

Artificial intelligence (AI) in retail is becoming an essential trend, as 28% of retailers consider it a crucial investment priority. AI is seen to optimize operations and improve customer experiences while keeping costs down.

A 2024 McKinsey & Company survey showed that 31% of respondents experienced a cost reduction of up to about 19% because of AI adoption in their supply chain management in 2023. Moreover, 48% reported a revenue increase of up to 10% because of AI.

In-store automation is the top retail innovation among 14% of retailers

Automation is expected to continue to impact the retail industry with 14% of companies saying it’s an innovation that has a great impact on their operations. Think cleaning robots for hygienic and safer in-store experiences for customers, virtual shopping assistants for sales boosts, and home-based order management for workforce upgrades to boost productivity and streamline costs.

What’s better is that shoppers love this innovation, too. Seventy-three percent of consumers prefer their local retailers to automate at least one aspect of their purchase journey instead of using staff, and 44% want to be able to use an automated tool to get more product information and availability.

Retail fulfillment is shifting to decentralized fulfillment in response to the rise of Q-commerce

Retail fulfillment, traditionally marked by centralized, fewer, and larger warehouses, is now being decentralized. Last-mile delivery and microfulfillment centers are being built because of the rise of Q-commerce (quick commerce), which is basically on-demand delivery, bringing an order to the customer in less than 30 minutes.

Decentralized fulfillment can reduce delivery times by up to 50%. And this has been proving effective. Sixty percent of retailers have integrated their ecommerce and physical store operations—converting their physical stores into microfulfillment centers.

According to StartUs Insights, innovating fulfillment is a priority for 20% of retailers. Both physical and online retailers are targeting to enable local and hyper-local delivery services by repurposing stores as distribution centers or collaborating with logistics partners.

50% of restaurants plan to deploy untethered (mobile) POS systems in 2024

Untethered or mobile point-of-sale (POS) have revolutionized the checkout experience. It has allowed retailers and their sales associates to meet shoppers where they’re at, thereby increasing sales.

Mobile POS transactions are expected to reach $3.76 trillion this year, and 50% of restaurants plan to deploy untethered (mobile) POS systems, too—an increase from last year’s 48%.

Related:

- POS Trends & Technologies Shaping the Future of Retail

- Point-of-Sale Statistics

More than two-thirds of restaurants plan to add new features to their current POS, primarily enabling self-service options

According to the latest 2024 study of Hospitality Technology, a significant 84% of surveyed restaurateurs plan to add new functionality or modules to their current POS software, underscoring the need to improve customer service and streamline operations.

From this data, 85% are seeking to enable self-service options, addressing the need for convenience, optimal workforce, and streamlined operations. A very close second (83%) plan to upgrade to centralize data and understand their customer preferences and behavior.

Retail Sustainability & Recommerce

Key takeaways:

- Recommerce (secondhand commerce) appeals to cost- and eco-conscious shoppers.

- Drive store traffic and revenue by dedicating a section of your offerings to gently used or almost-new items.

- Capitalize on recommerce by inviting consumers to bring gently used items to stores for a credit, encouraging further spending in-store.

Almost half of digital shoppers bought used products in 2023

Recommerce is emerging, with brands from lululemon to Kate Spade and Patagonia selling pre-owned merchandise last year to meet the demand of consumers. Ninety-three percent of US consumers have resorted to “recommerce” (buying used goods) to avoid the impact of inflation.

Moreover, this growth is mobile-driven, with recommerce platforms seeing 90% of their customer traffic come through mobile devices.

Resale items accounted for one in three of all apparel sold in 2023

According to the ThredUp’s Resale Report in 2023, one in three apparel items bought in the last 12 months was secondhand.

What’s more, 64% of Gen Z—today’s largest consumer group—now look for secondhand items before buying new.

Resale is driving Gen Z’s purchasing decisions

Eighty-three percent of Gen Z, the largest consumer group, have shopped or are open to shopping secondhand apparel. Two in five items in Gen Z’s closet are secondhand.

In fact, it also drives purchasing decisions for them as 42% of them are less likely to buy an item if it does not have a good resale value (compared with 23% of overall consumers). Sixty-four percent of them even look for a secondhand version of an item they like to buy before purchasing it as a new item.

The US secondhand market is expected to reach $70 billion by 2027

Resale has been increasingly growing, experiencing five times the growth as much as the retail clothing sector in 2022. With continued accelerated growth in 20223, resale is expected to grow nine times faster than the broader retail clothing sector by 2027.

Nearly two in three retailers say resale will be integral to their long-term growth

Retail has opened its doors to resale items too, with major brands like lululemon offering “like new” items in their stores. Two in three retailers have expressed their intent to include resale in their long-term strategy.

In addition to driving store traffic and conversion, resale also offers an entry point to higher-end brands, introducing new customers to luxury items they might not have purchased at full price.

Bottom Line

Retail is a fluid and ever-changing industry that evolves with our culture and can change in an instant. Over the past couple of years, especially, retail has seen new trends and shopping behaviors emerge in the rapid acceleration in retail technologies and a tumultuous economy. Using the retail industry statistics above, you will be more prepared to combat the changing retail market and allow your business to adapt and thrive as the industry evolves.