Wave Payroll is a user-friendly payroll software add-on to Wave’s free accounting system. Best suited for small businesses, it lets you pay employees and contractors, offers workers’ compensation insurance, and has an employee portal. While it’s quick to set up and easy to use, it pays and files taxes only for 14 states* and has limited HR features. These factors prevented Wave Payroll from ranking in any of our best payroll lists.

However, we found it an efficient and reasonably priced solution, especially if you run payroll in the states where it offers tax filing and payment services—you only pay $40 plus $6 per worker monthly. You can also use its self-service payroll with do-it-yourself tax filings for only $20 plus $6 per worker monthly.

*Tax filing and payment services only cover Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin.

Pros

- Seamless integration with other Wave products (accounting, invoicing, and payments)

- No setup fees

- Robust tax engine automatically computes federal, state, and local taxes

- Reasonably priced payroll plans

Cons

- Phone support unavailable (only offers live chat and email assistance)

- Lacks benefits options

- Very basic HR features

- Automated tax filing services and state new hire reporting are available only in 14 states

What We Recommend Wave Payroll For

Looking for something different? If you need a different accounting software that includes payroll, consider QuickBooks. Its pay processing solution, QuickBooks Payroll, comes with unlimited pay runs, fast direct deposits, and access to employee benefits. Read our QuickBooks Payroll review to help you gauge if its features fit your business needs.

Wave Payroll Deciding Factors

Supported Business Types | Startups and small businesses looking for a no-frills payroll system |

Free Trial | 30 days |

Monthly Pricing | Tax service states*: $40 base fee plus $6 per active employee or contractor paid Self service states: $20 base fee plus $6 per active employee or contractor paid *As of this writing, Wave Payroll’s tax filing and payment services only cover Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin |

Standout Features |

|

Ease of Use | Generally easy to use but you need to have basic knowledge of what payroll is and the different payroll terminologies (eg. gross pay, net pay, garnishment, etc.) |

Customer Support |

|

Want to look at other payroll options? Our guide to the best payroll services for small businesses contains our recommended pay processing solutions.

How Wave Payroll Compares With Top Alternatives

Best For | New Client Promotion* | Starter Monthly Fees | Our Reviews | |

|---|---|---|---|---|

Small businesses with simple payroll needs | ✕ | $40 base fee plus $6 per employee** | ||

Businesses needing full-service payroll and solid HR support | One month free*** | $49 base fee plus $6 per employee | ||

Small companies that use QuickBooks accounting | 50% off monthly base fees for the first three months or a 30-day free trial | $50 base fee plus $6 per employee | ||

Companies looking for an all-in-one HR, payroll, and IT solution | First month is free | $35 base fee plus $8 per employee**** | ||

*These can end at any time. Visit the providers’ websites to view the latest promotions.

**Monthly fee is for Wave Payroll’s “Tax Service States” plan.

***Get one month free when you run your first payroll with Gusto. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

****Pricing is based on a quote we received.

If you’ve narrowed your search down to a few payroll providers but still can’t decide, read our guide on choosing the best payroll solution for help.

Wave Payroll Pricing

The Wave Payroll pricing plans are location-based. If your company is in one of the 14 states where it offers automated tax services, then you get its Tax Service States plan. If not, then you’re under its Self Service States option, in which you handle tax payments and filings yourself.

Both packages come with the same payroll features, like multiple pay schedules, free direct deposits, paid time off (PTO) accruals, employee self-service tools, and tax payment reminders.

Tax Service States | Self Service States | |

|---|---|---|

Monthly Pricing | $40 base fee + $6 per active employee* or contractor paid | $20 base fee + $6 per active employee* or contractor paid |

Pay and Tax Calculations | ✓ | ✓ |

Automatic Direct Deposits | ✓ | ✓ |

Payroll Tax Payments & Filings | Wave will handle these for you | You have to do these yourself |

Year-End Tax Reporting (W-2/1099-NEC) | ✓ | Only offers W-2/1099-NEC forms that you file yourself |

New Hire Reporting | ✓ | You have to file this yourself |

*An active employee is one that’s currently employed and not on leave. To ensure that you don’t pay for inactive employees, update your employee records accordingly.

Wave Payroll also offers plan downgrade and cancellation options, including a Limited Access tier that allows you to temporarily pause payroll. To know more, click on the drop-down buttons below.

If you’re on the Tax Service States plan but prefer to handle payroll tax payments and filings yourself, Wave Payroll will allow you to downgrade your plan. Unfortunately, there won’t be any change to your monthly fees. You still have to pay the $40 base fee per month (plus the per-employee costs) even if you opt not to get the provider’s automated tax filing services.

Wave Payroll offers a Limited Access option if you need to temporarily pause your plan. It allows you to continue accessing previous payroll journal entries and generating reports without having to run payroll. Also, you’re still covered by its automated tax payments and filings (Wave reports $0 on filings during the “pause payroll” period)—provided your business is located in one of the 14 states it services. You can even input your new hires’ direct deposit information into its system for future payroll runs, plus your employees can still view their previous pay stubs and tax forms. However, you have to pay a minimal amount each month.

- For states covered by Wave Payroll’s tax services: $17 monthly

- For other states: $10 monthly

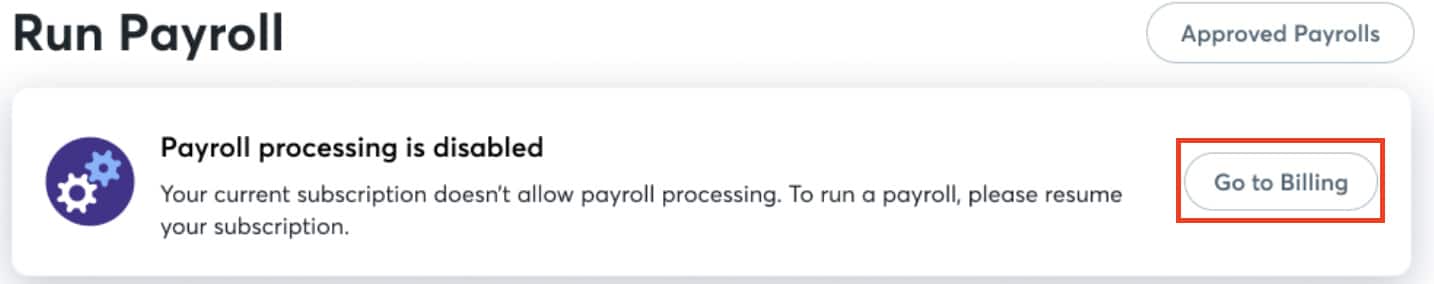

If you decide to resume pay processing, simply go to Wave Payroll’s billing menu to activate your subscription and immediately start using the software’s payroll tools. Note that Wave Payroll’s pricing will automatically switch from “Limited Access” to either its full-service or self-service option, depending on the plan you selected before pausing payroll.

Aside from manually navigating through Wave Payroll’s billing menu to unpause payroll, its “Run Payroll” page has a “Go to Billing” button for updating your subscription (Source: Wave Payroll)

Wave Payroll’s monthly billing cycle starts on the first day of every month. If you unpause your subscription in the middle of the billing cycle, then you’ll be charged a prorated amount.

Canceling your Wave Payroll plan is very easy—go to the “Payroll” menu, choose “Billing,” and then click “Cancel Payroll Subscription.” Your plan will remain active until the end of the monthly billing cycle.

For businesses located in the 14 states covered by Wave Payroll’s tax filing services: Given the quarterly tax payment and filing deadlines, consider canceling your payroll subscription within the quarter-end months (April, July, October, and January) to enjoy Wave’s tax services. Aside from remitting and submitting taxes due for the quarter you end your subscription in, Wave will refund you taxes that have been withdrawn but will not be paid by the provider.

However, if you need to cancel your payroll plan outside of the quarter-end months, Wave will only pay the tax liabilities due in the month you cancel and refund taxes that have been deducted but not yet remitted. It will be your responsibility to ensure that taxes after the month you cancel are submitted and filed to the applicable agencies.

For businesses located in other states: To generate W-2 and W-3 tax forms, you will need to temporarily reactivate your Wave Payroll account. However, the provider will charge you subscription and per-employee fees for that month.

For example, if you cancel your Wave Payroll plan in September, you should reactivate your subscription the following January to generate year-end tax reports.

Pricing Calculator: Check Potential Costs

Want to know how much you’ll need to use Wave Payroll? Use our online calculator to compute the estimated monthly and annual fees.

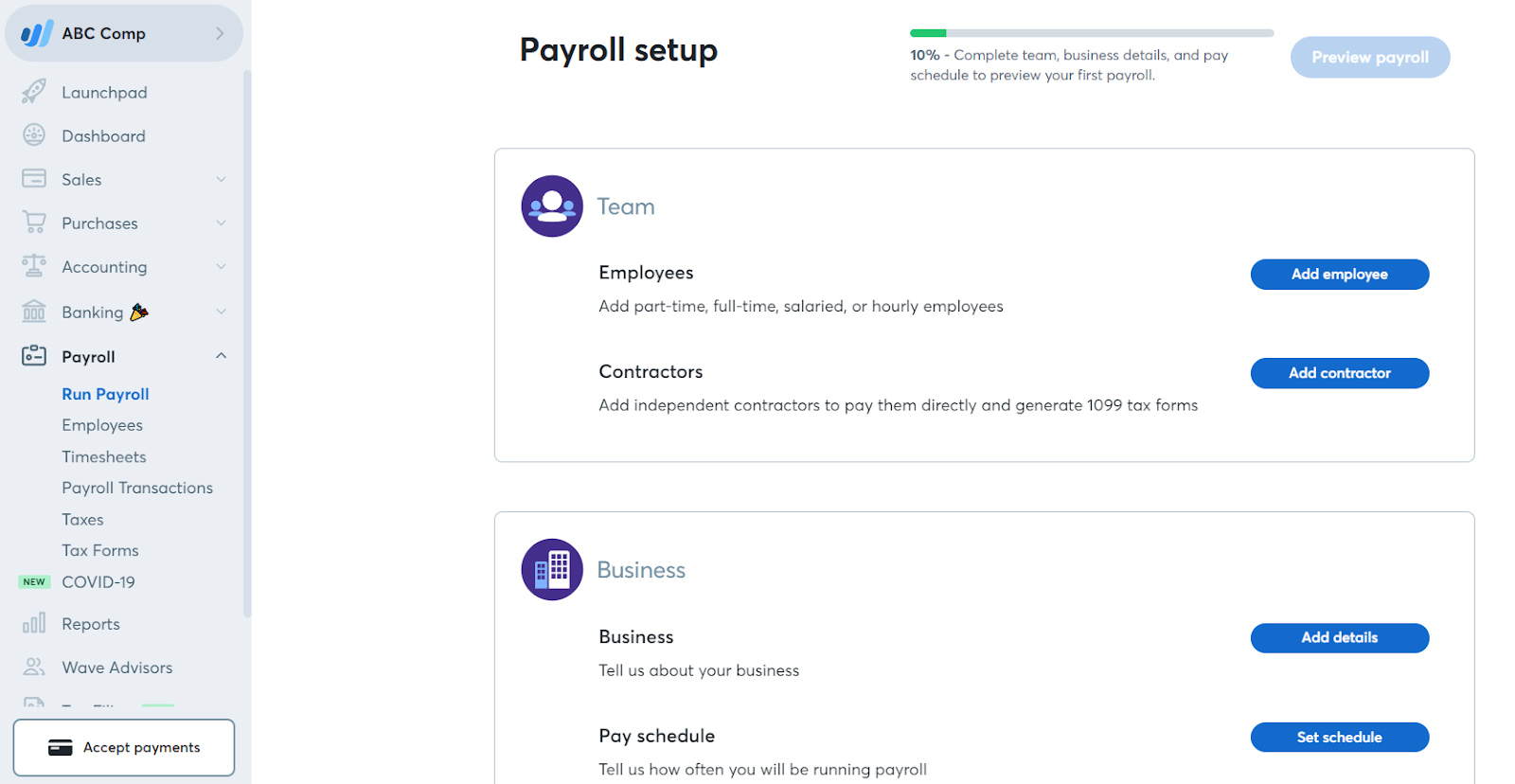

Wave Payroll Pay Processing Features

With Wave Payroll, you can pay both contractors and employees. It calculates wages, deductions, and taxes, including Federal Unemployment Tax for you. Multiple pay schedules are available—such as weekly, biweekly, semimonthly, and monthly.

Payments are made via direct deposits and paychecks that you print yourself. The system even automatically processes direct deposit payouts whenever pay runs are approved. However, its processing timeline is three days (many payroll companies have a two-day processing time).

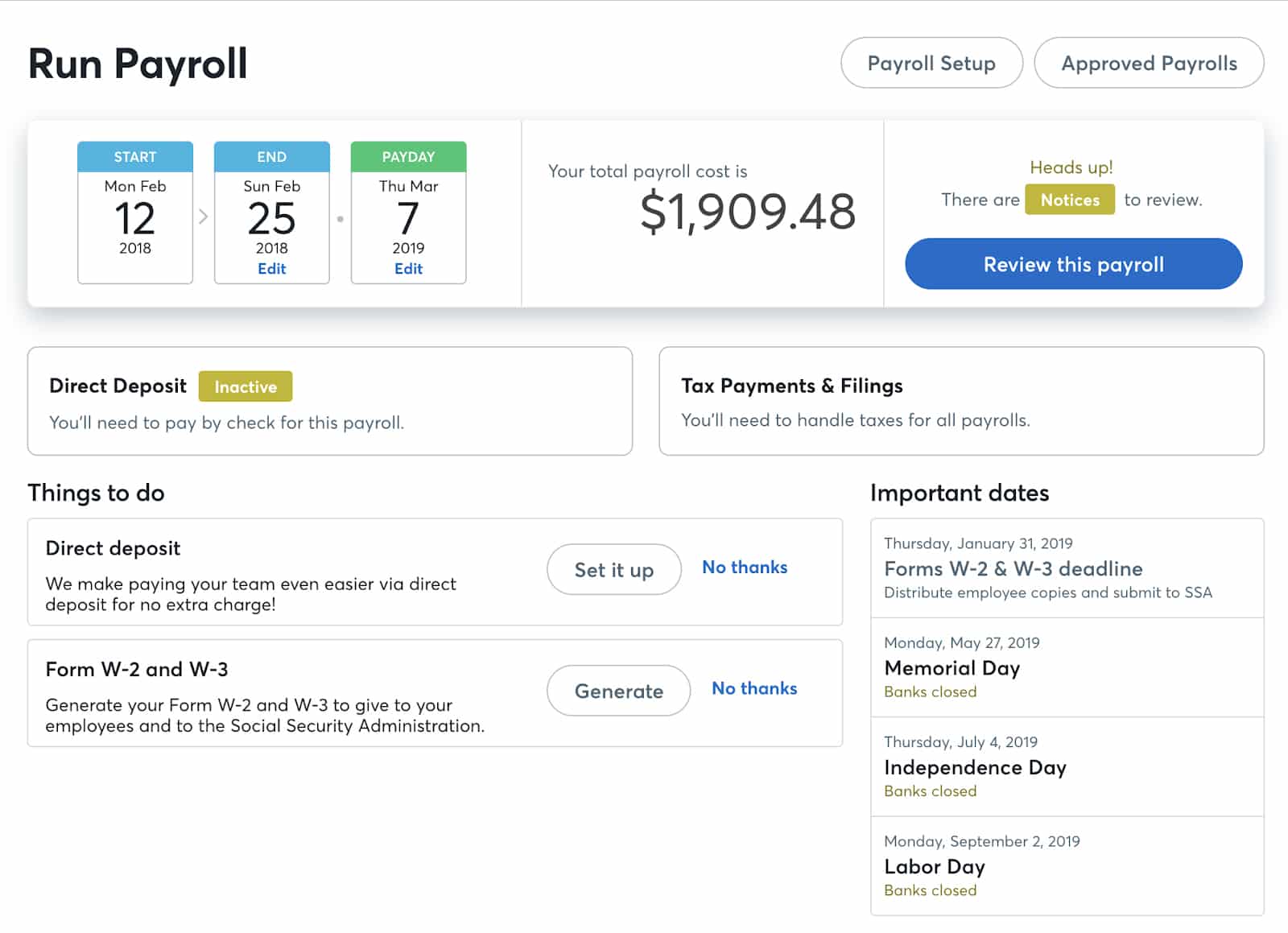

Wave Payroll also has a dashboard where you can see important payroll and tax filing dates, including holidays. It even shows your total payroll costs for the pay period. If you’ve yet to set up your direct deposits, a task reminder will appear on the dashboard that includes a link to the system’s direct deposit setup page.

Wave Payroll’s dashboard serves as your hub for running, reviewing, editing, and approving payroll. (Source: Wave Payroll)

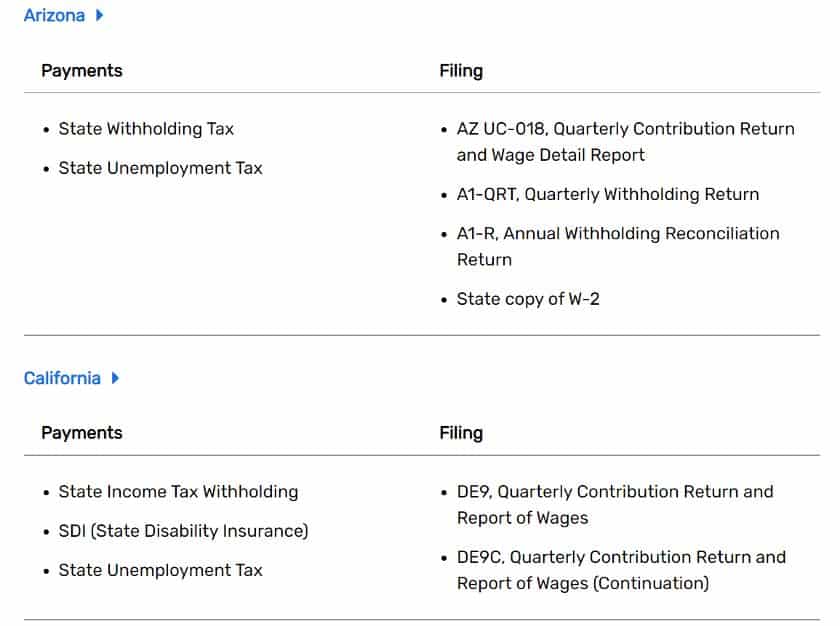

Wave Payroll is committed to providing accurate tax calculation services. Its platform has a robust tax engine that automatically computes federal, state, and local taxes. And, to help ensure that all tax computations are correct, Wave Payroll regularly updates its system with the latest tax tables and regulatory changes.

It even provides automated tax payment and filing services, including year-end reporting, but only in 14 states. However, you need to complete Wave Payroll’s tax payment information requirements before you can enjoy this service.

If your business is located in a state not covered by its tax services, Wave Payroll will calculate the applicable tax deductions from your employees’ pay. It will also generate Form W-2s that you can use to file year-end tax reports.

Wave Payroll’s tax services vary depending on the requirements of each state. (Source: Wave Payroll)

You can check your pay schedules directly in its system and get email notifications about upcoming pay runs. You can even export payroll dates into a calendar app—simply download your Wave pay schedules as an ICS file and then upload it to calendar programs like the Apple Calendar and Google Calendar. This helps you get extra reminders, plus you can easily see payroll timelines without having to log in to Wave Payroll.

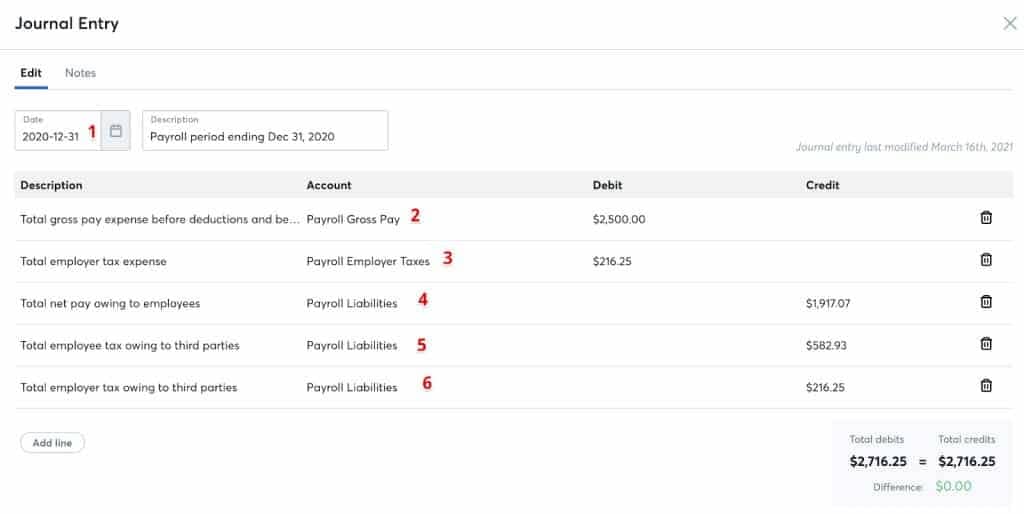

The seamless integration between Wave’s payroll and accounting products makes updating general ledgers easy for you or your accountant. Every time a payroll run is approved, the applicable bookkeeping information is logged in to Wave Accounting. The gross payroll amount is recorded in the expense category of your Account Mapping and included in the Profit and Loss report, as is the amount of taxes you owe as an employer.

Wave also creates a holding account, called “Wave Payroll Clearing,” to hold payroll and tax payment funds. As payroll and tax payments are paid out, and you replenish your account, these are reflected in the “Wave Payroll Clearing” account. The system categorizes the transactions (i.e., “Payroll Liabilities” or “Transfer to Wave Payroll Clearing”) for easy payroll bookkeeping.

Wave Payroll automatically creates a detailed journal transaction after each pay run. (Source: Wave Payroll)

Employees and contractors can log in to the self-service portal where they view pay stubs and access tax forms. They can also update payment details via this tool, as well as create profiles and update personal information.

Wave Payroll HR Features

Wave Payroll may have limited HR features, but its solutions are sufficient enough to help small businesses manage very basic HR tasks, such as time sheets and new hire reporting. It even has a simple employee database that contains your workers’ basic information, salary and tax details, PTO balances, and benefits deductions.

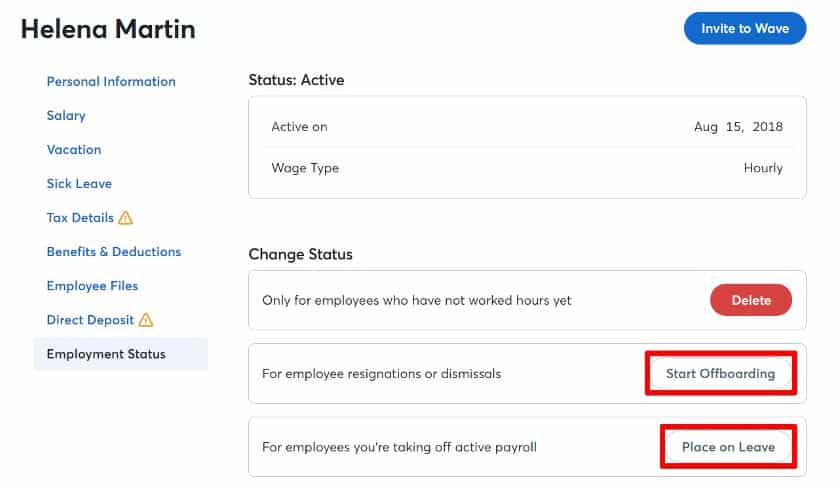

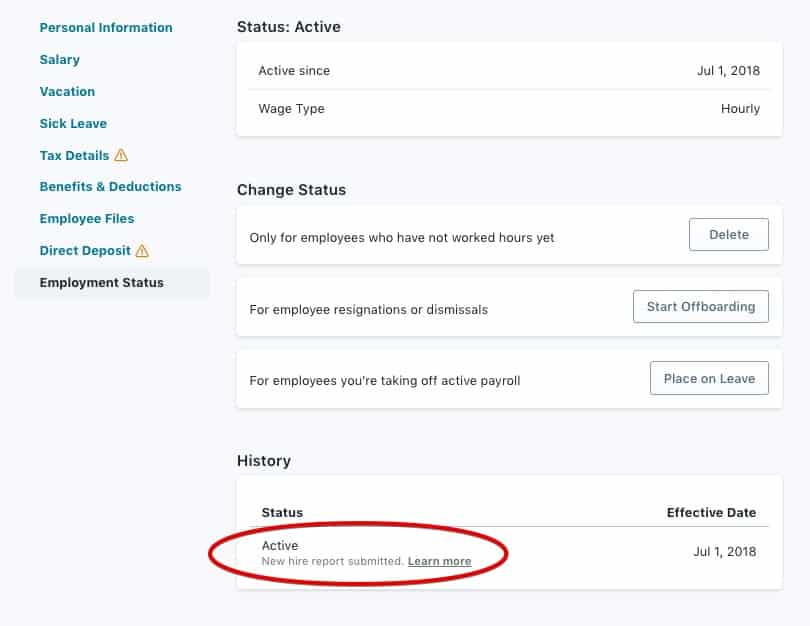

In addition to changing personal information, you can update the workers’ employment status from active to inactive. This is helpful if you have employees that work seasonally. You can exclude them from your pay runs if they’re not working by tagging them inactive and then switching them back to active status as needed.

If resigning employees are nearing their last working day, you can start the offboarding process directly from Wave Payroll’s employee module. (Source: Wave Payroll)

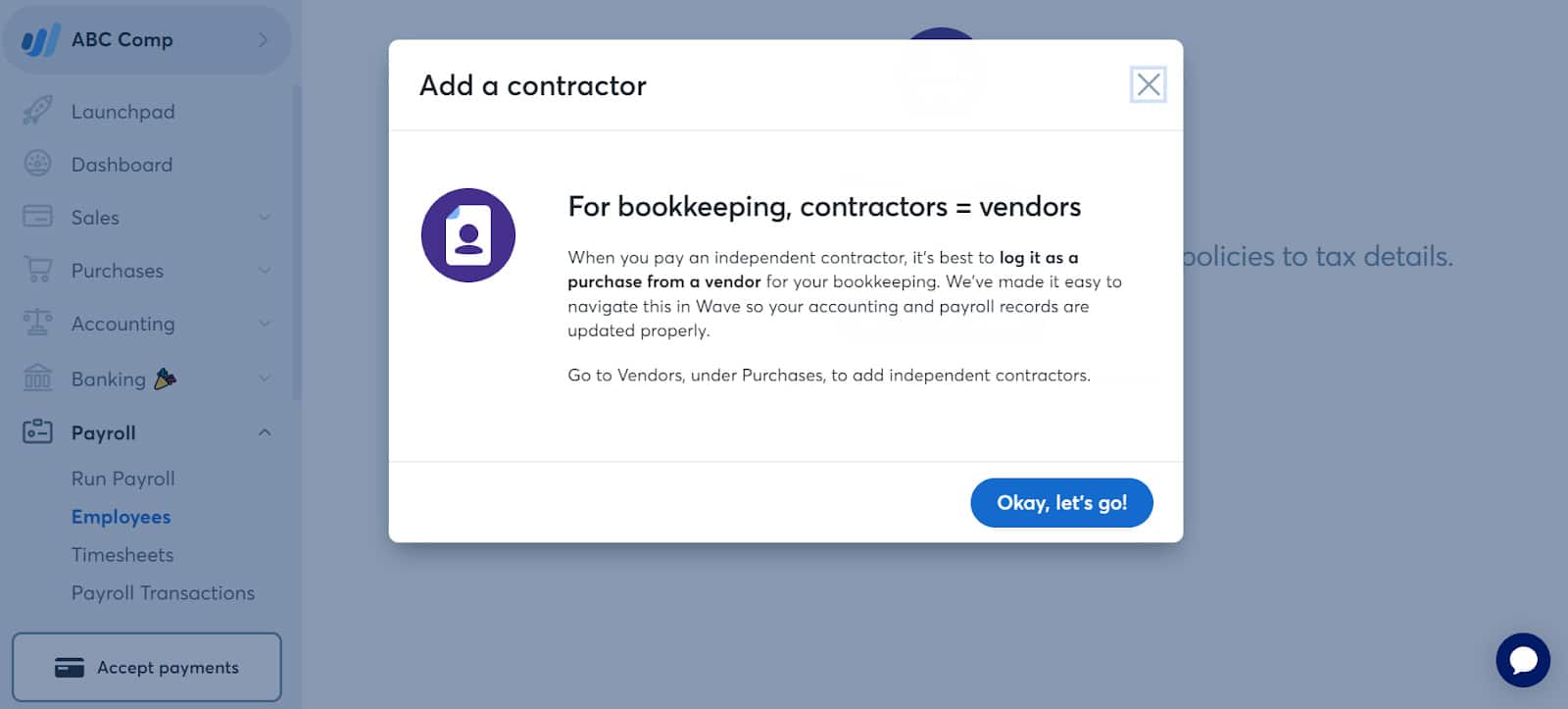

For contractors, the process of adding independent contract workers into its system is slightly different. Unlike employees, with online profiles created in its Payroll module, contractor profiles are set up in the Purchases module because Wave considers these workers as vendors.

While Wave Payroll has an “Add contractor” option, its system will automatically guide you to its Purchases module to set up vendor profiles for your independent contractors. (Source: Wave Payroll)

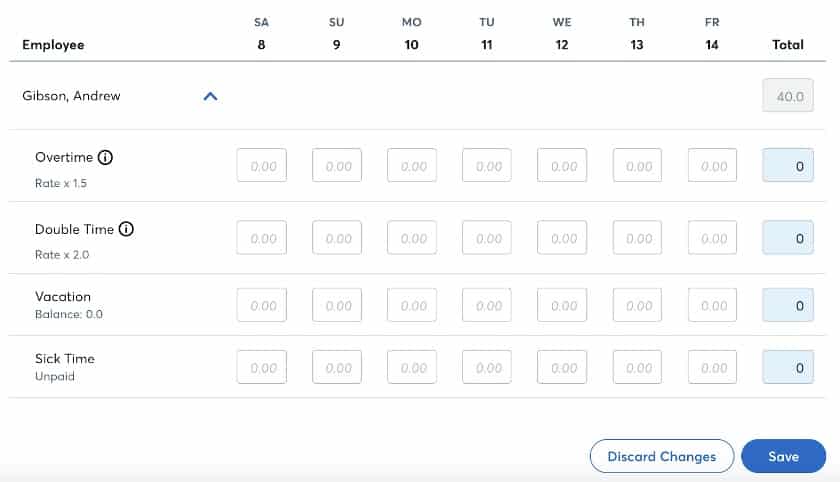

Wave Payroll doesn’t have time tracking functionalities, so you need to input the hours into its online time sheet manually. It has separate tabs for hourly workers and salaried employees. For your hourly staff, you use it to enter their total hours worked, overtime hours, and PTO information. For salaried employees, you can add in their overtime and PTO details, if any. Overtime pay is also automatically calculated at either time-and-a-half or double time, depending on when employees are eligible for it.

Besides overtime, Wave Payroll’s time sheet lets you record PTO for salaried employees. (Source: Wave Payroll)

Unlike most small business payroll systems, which streamline the process of managing PTO applications, Wave Payroll doesn’t have the capability to request and approve leave transactions online. You have to separately track PTO and input the number of approved leave hours into its online timesheets for pay processing.

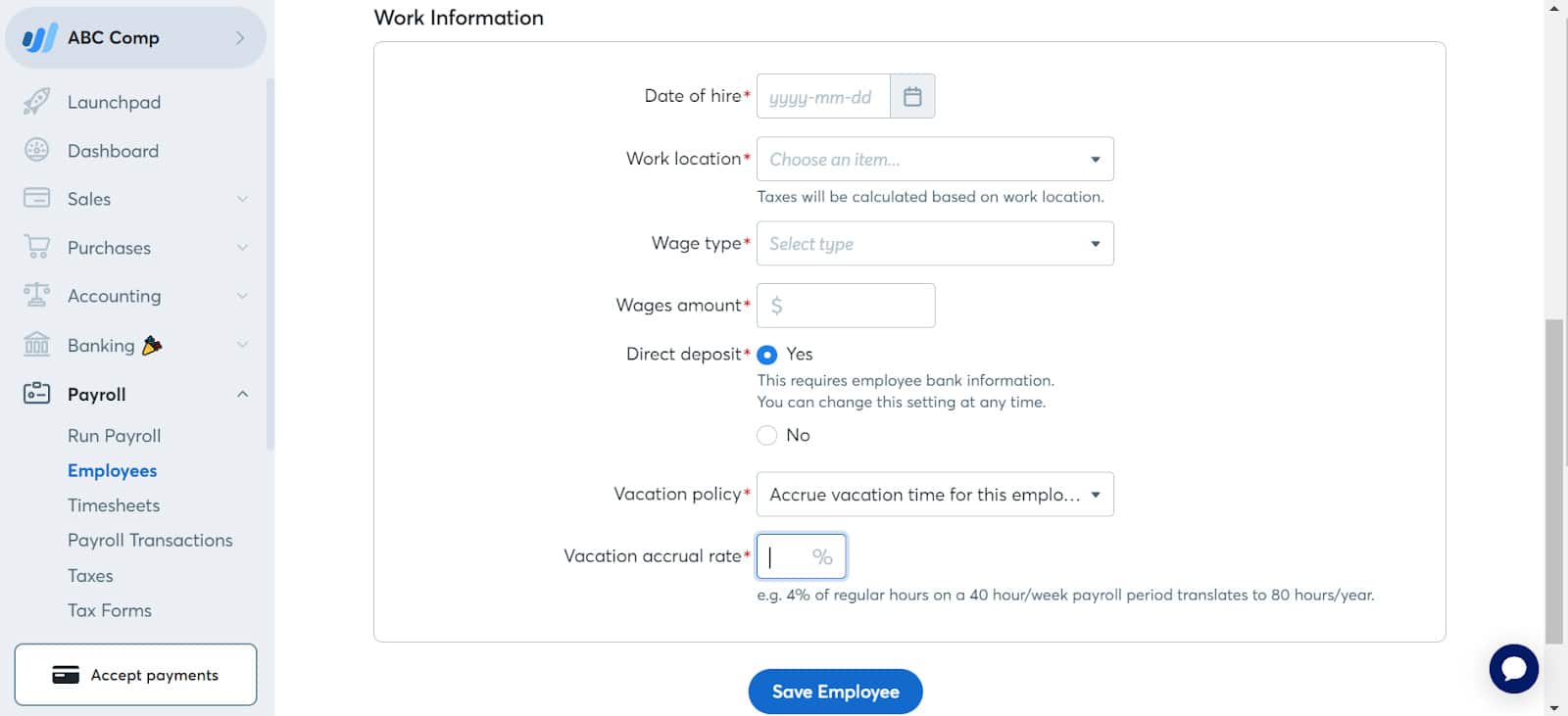

However, it does have paid sick leave policies for California, Oregon, Massachusetts, and Vermont already loaded into its system to keep you compliant, and you can add other paid state sick leave laws. It also supports paid COVID-19 sick leave and COVID-19 family and medical leave, allowing you to claim tax credits for these transactions. It even helps you calculate the vacation leave accrual credits that employees should earn weekly.

When adding new employees into Wave Payroll, you can specify the vacation accrual rate percentage and whether or not you want it to compute the leave credits. (Source: Wave Payroll)

Wave Payroll’s partnership with Next Insurance allows you to provide workers’ compensation insurance in all US states. You can sign up directly from Wave Payroll—go to “Payroll,” then “Run Payroll,” and click “Get Insured” to create your profile. From there, a Next Insurance representative will call to help you complete your setup.

Wave Payroll’s state new hire reporting service is only limited to businesses located in one of the 14 states covered by its tax filing services. The process is seamless—after adding the new employee’s details into its system, the provider will automatically generate and file the report to the applicable state agency.

You can check new hire report details in Wave Payroll’s employee module. (Source: Wave Payroll)

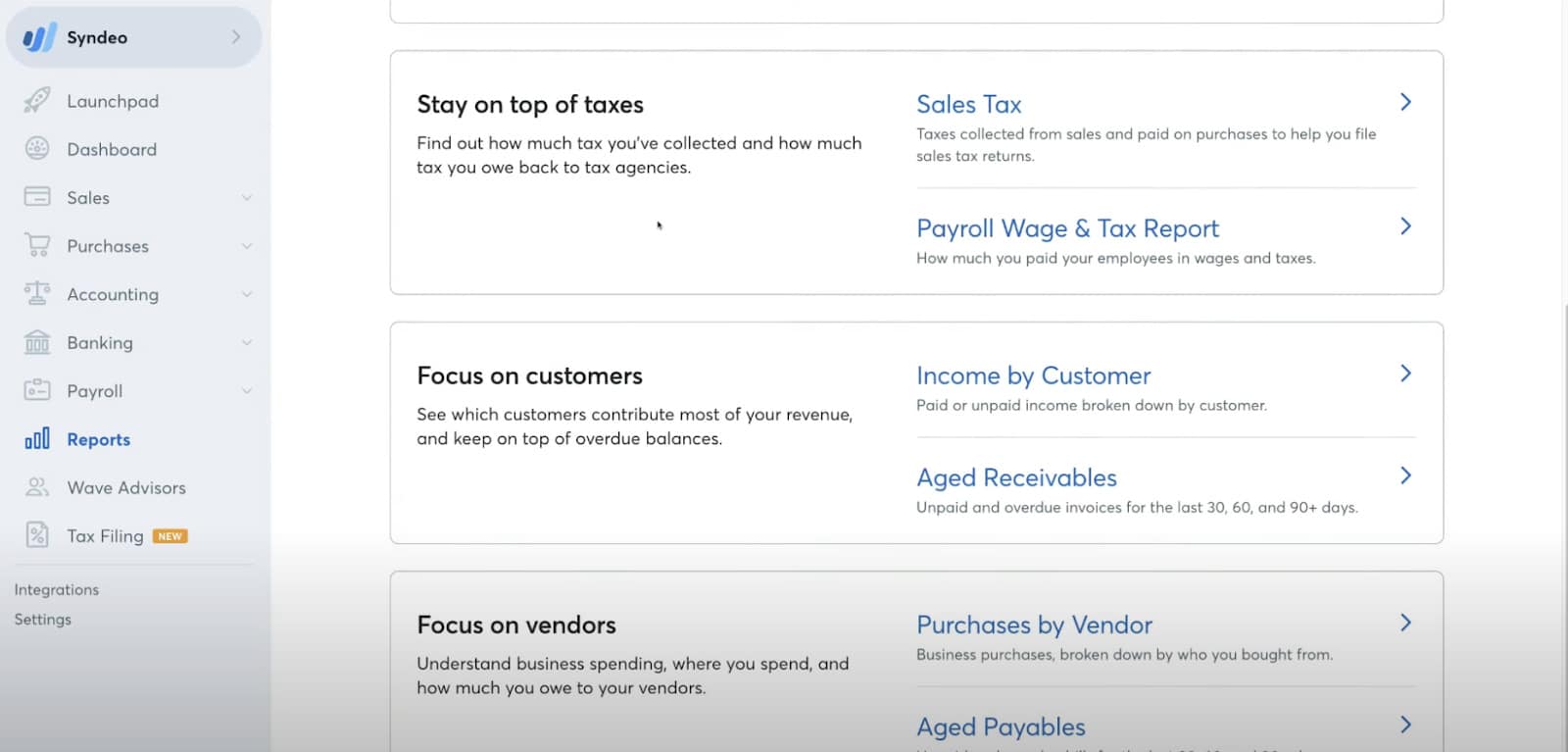

Wave Payroll Reporting

Wave Payroll only offers basic reports to help track the wages and taxes you’ve paid, as well as view employee benefits and deductions. You can select date ranges when generating reports, and download them as PDF files

If you use Wave Accounting, you can view even more reports, such as profits and loss, cash flow, sales tax, and account transactions. You may also use filters and choose the data you need to customize the reports you need.

Wave lets you track your employee wages and taxes from the reports module on the dashboard. (Source: Wave Payroll)

Wave Payroll Ease of Use

- User-friendly interface

- Easy to set up

- Preloaded sick pay policies for some states

- 24/7 support via chatbot

- Live chat and email support

- Help center with FAQs and how-to guides

- Zapier integration

- Automatic integration with Wave Accounting

Wave Payroll is easy to use, with simple menus for setting up and running payroll. And, because it doesn’t have a lot of extra HR functionalities, the interface is straightforward, and features are easy to find. While it only handles payroll tax payments and filings in 14 states, it provides the necessary information for filing in the other 36. It also has sick pay policies preloaded for several states to help you stay compliant.

Wave Payroll has an online wizard to help you through the initial setup process. (Source: Wave Payroll)

The system is quick to set up. For some of its features, the software will walk you through the process (such as setting up your account). If you have trouble using it, you can check its how-to guides or consult the 24/7 chatbot, Mave. For live support, you can chat and send an email to its customer representatives on Mondays through Fridays from 9 a.m. to 5 p.m. Eastern time.

Since Our Last Update: Wave Payroll no longer has an online community forum where you can communicate and consult with other Wave users.

Wave also integrates with Google Sheets and BlueCamroo. It even integrates with Zapier, which allows it to connect with several business solutions like email marketing, customer relationship management (CRM), appointment scheduling, and payment tools.

However, some of Wave Payroll’s online tools, while simple, take more steps or clicks than with other payroll software. It may have an online help center you can access 24/7, but not all of the articles contain step-by-step details. And while you can hire a Wave Advisor, this service costs extra (custom-priced), and you only get assistance in completing and filing business or personal taxes.

What Users Think About Wave Payroll

| Users Like | Users Don’t Like |

|---|---|

| Simple to use, easy to manage | Reports not as detailed; lacks an auto-pay run feature |

| Affordable | Software runs slow at times |

| Works with the free version of Wave Accounting | Customer support isn’t responsive; has long wait hours |

There are very few up-to-date Wave Payroll reviews online, as of this writing. Those who left feedback on third-party review sites (like G2 and Capterra) raved about its user-friendly interface and generally easy setup process. They also appreciate its affordable plans and seamless integration with Wave Accounting.

However, several users complained about having experienced poor customer service. Some dislike the long wait hours when contacting support. Others said that the support team is unresponsive and unhelpful.

At the time of publication, Wave Payroll earned the following scores on popular user review sites:

- Capterra: 4 out of 5 based on a little over 60 reviews

- G2: 4.1 out of 5 based on 30 reviews

Wave Payroll Frequently Asked Questions (FAQs)

Yes. Wave has built-in bank-grade security measures, such as 256-bit TLS encryption, to keep your payroll data safe. It also has secure data storage with servers that have strict physical access protocols and 24/7 monitoring.

With Wave Payroll, you can set up and run payroll for both employees and contractors. It calculates payments, employee deductions, and taxes in a user-friendly platform. Wave even files and remits payroll taxes for you—provided your business is located in the following states: Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin.

Processing payroll through its platform only takes a few clicks. After you have approved the pay run, Wave Payroll takes three business days to send the payments to your employees’ bank accounts (via direct deposit).

How We Evaluated Wave Payroll

When we evaluate payroll software for small businesses, we look at pricing and ease of use. We also check the provider’s customer support and whether it offers unlimited pay runs, multiple pay options, full-service payroll, and tax filing services.

Access to third-party integrations and basic HR tools like employee benefits and onboarding are also important. We even consider the feedback that actual users posted on popular user review sites.

Bottom Line

Wave Payroll is best for small businesses with very simple payroll needs. As a Wave add-on, it integrates all the information into your Wave Accounting software, making bookkeeping and payroll accounting a breeze. Users love its simple-to-use interface, even if some features take a few more steps to complete. And while it offers workers’ comp and an employee portal, it lacks benefits options and HR tools that similar providers offer. However, it’s still a good option for Wave Accounting users who need efficient payroll tools.

Sign up for a Wave Payroll plan today.