Mobile payments are transactions and purchases completed using a mobile device such as smartphones, tablets, or smartwatches. Mobile payments are popular for both consumers and businesses for their convenient setup, ease of use, and security.

Key takeaways:

- Mobile payments are growing in popularity for their convenience and ease of use.

- Most payment processors now offer mobile payment services at no extra cost.

- Biometric security built into smartphones creates an additional layer of security.

- Payment-enabled smartphones are expected to grow up to 97% by 2027.

Types of Mobile Payments & Examples

The types of mobile payments are categorized by the platforms being used. Users can make purchases from their mobile device via accessing online shops with a mobile browser, from a mobile shopping app, through in-person payments using a merchant’s credit card reader, or by checking out with a mobile wallet app. See mobile payment examples below:

Mobile Browser Payments

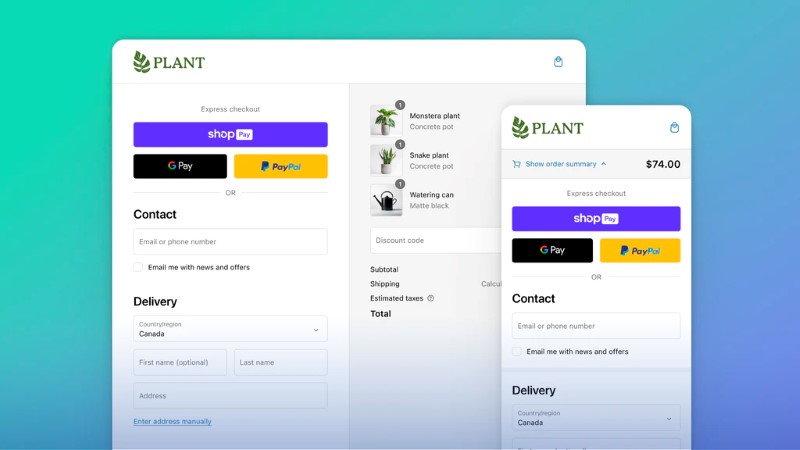

Modern business websites are designed for mobile optimization so customers can see the same elements on both their desktop and mobile devices. For online sales, customers are provided with a convenient checkout experience on their mobile devices.

Left: Shopify online checkout page on a desktop. Right: Shopify online checkout page on a mobile device (Source: Shopify)

Mobile App Payments

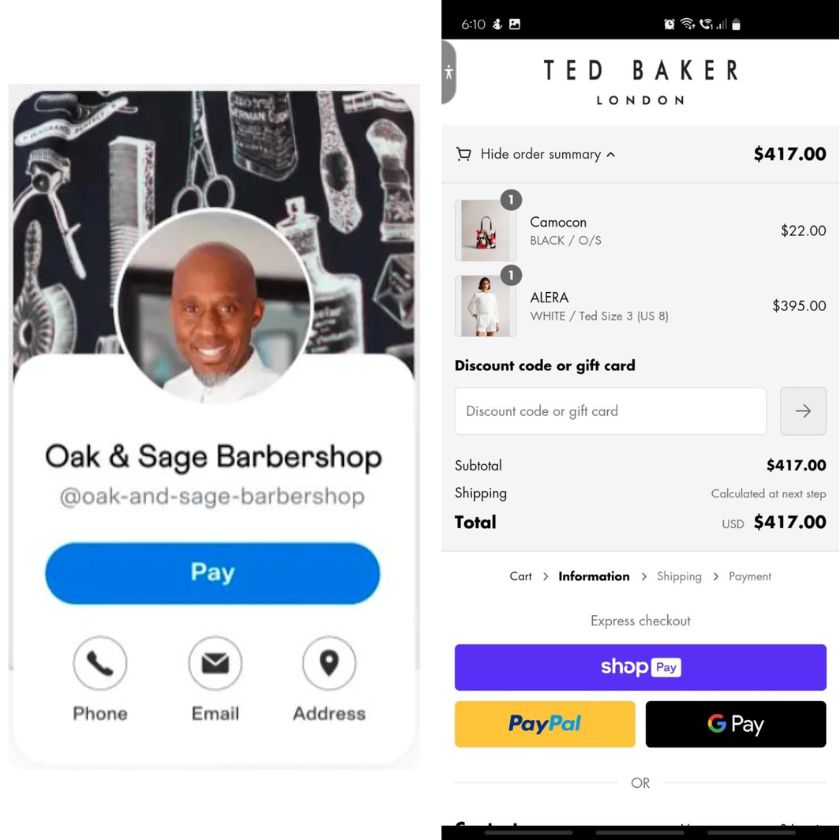

Mobile app payments allow users to exchange funds (like with Venmo or PayPal) and pay for goods and services (like with Ted Baker and Starbucks) without leaving the app. The app is embedded with its own payment gateway Customer-facing check out page for online, mobile, and in-person sales with a variety of payment methods.

Mobile sales apps come with embedded checkout and payment solutions. Left: Venmo app. Right: Ted Baker mobile app

Mobile Credit Card Readers

Smart devices are not limited to mobile phones and tablets. For this mobile payment type, the smart device is used by the merchant instead of the customer. Standalone mobile credit card readers are equipped with their own point-of-sale (POS) software/app and payment processing feature. The system is integrated with the merchants’ primary POS system so sales and inventory data are synced in real time.

Standalone credit card readers allow merchants to accept payments tableside, curbside, or anywhere within the store. (Source: Helcim)

Mobile Wallets

Mobile wallets, also known as digital wallets, or e-wallets are mobile apps that can safely store and transmit a user’s payment information to a payment processor’s card reader using wireless technology. The app can hold multiple cards and can be used for purchases both in-person and online. Learn more about mobile wallets.

Mobile wallets allow customers to make purchases without presenting their physical credit/debit cards. (Source: Square)

Related reading:

Learn about various mobile payment methods:

- Ultimate guide to NFC mobile payments

- What is tap to pay & how does it work?

- Guide to QR code payments

How Mobile Payments Work

Mobile payment processing starts with a transaction initiated on a mobile device—either a customer’s smartphone or watch, or a merchant’s mobile reader. Then, the payment is verified and approved or denied. Depending on the type of mobile payment, the specifics can look slightly different.

Let’s take a look at how tap to pay works:

Near-field communication (NFC) technology-enabled card readers and smart devices are activated and exchange encrypted data when they come less than two inches apart. Once the card reader receives the customer’s information, the payment processor initiates the verification, validation, and funding process.

If approved, the merchant’s acquiring bank notifies the merchant via the payment processor and proceeds to credit the funds to the merchant’s bank account. A notification is received by both the customer (on their smart device) and the merchant (on the checkout screen) that the transaction was successful. Tthe entire transaction is processed in seconds.

Benefits of Accepting Mobile Payments

Mobile payments are becoming increasingly popular as a payment method to both customers and merchants for many reasons:

Convenient

More and more customers look for mobile payment methods for both in-person and online transactions because it allows them the option to make purchases without manually entering their credit card details (for online payments) or physically presenting their credit card (for in-person payments), essentially making transactions quicker. It has also opened more avenues for selling such as social media platforms Facebook, Instagram, and TikTok.

At the same time, accepting mobile payments is easy to set up with the right mobile payment app with or without a merchant account from a payment processor.

Inexpensive

Setting up a mobile payment method is practically free. If you already work with a payment processor, it will most likely be readily available and the hardware is already NFC-enabled. Even freelancers and gig workers who prefer to get paid with a simple mobile app can download and sign up for a business account for free.

Highly secure

Mobile wallets come with built-in encryption tools that protect the customers’ payment information while stored in the app and sent wirelessly to a merchant’s payment gateway. Additionally, smartphones are equipped with biometric security that guards access to a user’s personal information.

Frequently Asked Questions (FAQs)

These are some questions we frequently encounter about mobile payments:

Mobile payments are transactions completed using a smart mobile device (smartphones, tablets, smart watches, smart (standalone) terminals)

Yes, as there are no downsides to adding mobile payments as a payment method for your business. Not only are mobile payments convenient to use, but they are also easy to set up and are popular among consumers.

Most mobile payments come built into leading payment processors and do not cost an additional monthly fee to add to your payment methods. Transaction fees also fall within the range of average in-person and card-not-present rates depending on your service provider.

Bottom Line

Convenience, security, and a seamless checkout experience have given mobile payments a permanent place among other payment processing methods. With the latest mobile apps, consumers now use mobile payments to purchase goods and services, pay bills, and exchange funds with peers.

So whether you are a merchant running an ecommerce or a physical store, knowing how mobile payments work and working with the right payment processor to get started can significantly increase potential sales without heavy upfront investment.