Mobile credit card processing allows merchants to sell products and accept card payments from almost anywhere with a smartphone or tablet. The best mobile credit card processor should be reliable, have affordable transaction fees, come with a free business management app, and function offline.

Based on our evaluation, the best mobile credit card processors are:

- Square: Best overall mobile credit card processing app

- Clover Go: Best for compatibility with most business types

- SumUp: Best for small mobile businesses with low-ticket sales

- Shopify: Best for ecommerce businesses expanding to in-person sales

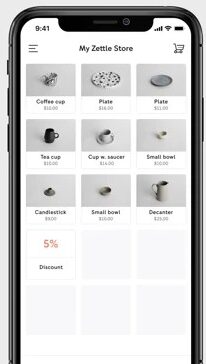

- PayPal Zettle: Best for occasional sales and PayPal users

- Payment Depot: Cheapest for small, established businesses U.S. businesses only

Best Mobile Payment Processors Compared

Get a Personalized Recommendation

Unsure which credit card processor is best for you? Take this four-question quiz to find out. You’ll get a recommendation without being redirected to another page.

Square: Best All-purpose Mobile Credit Card Processor

Pros

- Mobile, in-store, and online sales channels

- Free top-rated POS

- Instant signup—no application or approval required

- Grows with you—business tools, banking, and payroll add-ons possible

Cons

- Expensive for large businesses

- Account instability

- Not suitable for high-risk or high-volume businesses

- It can be difficult to reach customer service

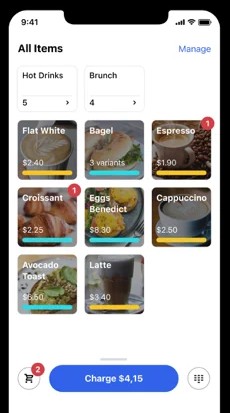

Square is our pick for the best mobile credit card processor for small businesses. The mobile payment processing option has no monthly or startup fees, and the application process is easy. You can get up and running in no time with the free POS app while you wait for the free magstripe credit card reader to arrive. If you have a compatible iPhone or Android device, you can start receiving card payments using your mobile device as a card reader. The app works offline and has an excellent inventory program.

When You’ll Outgrow Square

Square is geared toward small businesses and individuals. Once your business grows and is consistently processing more than $10,000 monthly, you can get lower fees and a better overall value by switching to solutions like Payment Depot, which offers interchange-plus pricing.

If your business is ecommerce, you’ll likely want a mobile payment processor that’s connected to your online store. In this case, Shopify offers a much more robust online selling solution, and its mobile POS app is the best for multichannel sales.

If you already have a merchant account and need a mobile card reader, Clover is a popular mobile POS and hardware solution that works with many merchant accounts.

Square Pricing

- Monthly fee: $0

- Card reader: Free magstripe, $49 chip and tap

- Card-present transactions: 2.6% plus 10 cents

- Keyed-in transactions: 3.5% plus 15 cents

- Ecommerce transactions: 2.9% plus 30 cents

- Invoices: 3.3% + 30 cents per transaction (free plan), 2.9% + 30 cents (paid invoice plan)

- Chargeback fee: Waived up to $250

Square Features

- Next-day deposits

- Instant payouts for a 1.75% fee

- Free invoicing

- Free online ordering page

- QR code payments

- Offline processing

- Tap to Pay on iPhone or Android

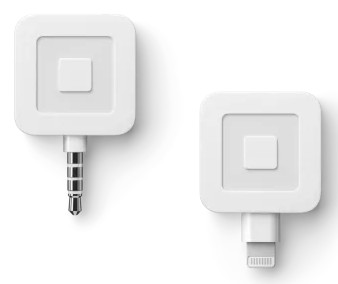

Square Card Readers

|  |

First free, additional $10 | $49 |

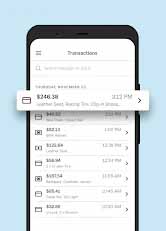

Square Mobile App

|  |

4.8 out of 5; 403,000+ reviews | 4.8 out of 5; 214,000+ reviews |

Square Offers the Best All-around Payment Solution

In general, we recommend Square as the best all-around mobile payment processor for its free iPhone and Android processing solutions, affordable and high-tech mobile card readers, and feature-rich payment app.

Square rated best overall in:

- Best Card Readers for iPhone

- Best Card Readers for Android

- Best Card Readers for Small Businesses

- Best Credit Card Payment Apps

Clover Go: Best for Compatibility With Most Business Types

Pros

- Works with a variety of merchant accounts

- Supports barcode scanning

- Robust smartphone POS

- Easy to use

Cons

- Pricing and contract varies depending on who you sign up with

- Monthly fee

- Poor customer service

- Hardware cannot be reprogrammed

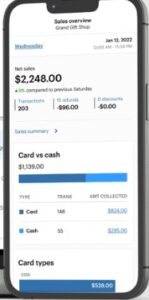

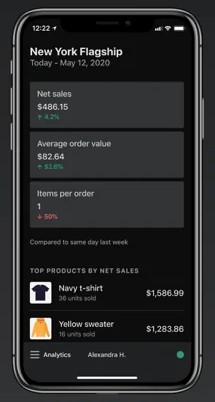

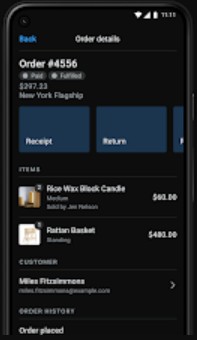

Clover offers everything a standard mobile processor does, including payment processing, inventory management, and analytics reporting. After Square, Clover has the most feature-packed point-of-sale (POS) app on this list, but what makes Clover interesting is that it can be programmed to work with almost any traditional merchant account.

You can either set up your account through Fiserv, which owns Clover, or one of its authorized resellers. However, while Clover provides more variety than any other app on our list, the pricing and support you receive can vary greatly depending on which merchant account provider you choose. You also can’t reprogram the card readers if you decide to switch payment processors.

Clover Fees*

- Monthly fee: $0 to $14.95

- Card reader: $49

- Card-present transactions: 2.6% plus 10 cents

- Keyed-in transactions: 3.5% plus 10 cents

- Chargeback fees: $25

Clover Features

- Proprietary 3-in-1 card reader

- Add multiple employees and permission levels

- Extensive app market

- Offline processing

- Tap to Pay on iPhone

*Pricing from Clover website for Clover Go product. Available at different rates through resellers and other merchant service providers.

Clover Mobile Card Readers

Clover Mobile App

|  |

4.8 out of 5; 35,000+ reviews | 4.7 out of 5; 4,800+ reviews |

Learn more in our comparison of Clover vs Square.

SumUp: Best for Small, Mobile Businesses With Low-ticket Sales

Pros

- Includes a virtual terminal

- Pay-as-you-go subscription

- Free payment app

Cons

- Poor user reviews for mobile app

- Does not support high-risk merchants

- Limited ecommerce integrations

SumUp offers a unique line of advanced yet cost-effective mobile card reader solutions. Its card readers are some of the most affordable in the industry, offering 3-in-1 (swipe, chip, and tap) readers at $39. Merchants also have the option of using any compatible iPhone or Android device as a contactless card reader.

Mobile credit card payments with SumUp costs 2.75%—most economical for small ticket sales. Other options on this list charge a 10- to 30-cent transaction fee, which can be expensive for businesses selling $5 to $20 items. SumUp is a great alternative to Square if you have a mobile business and with ticket items averaging anywhere between $20–$50.

SumUp Pricing

- Monthly fee: $0

- In-person transaction: 2.75%

- Online transaction: 3.25% plus 15 cents

- Invoicing: 2.9% + 15 cents

- Virtual terminal processing: 3.25% plus 15 cents

- Card reader: $39 to $199

- Chargeback fee: $0

SumUp Features

- Supports 3-in-1 mobile device-based and standalone card readers

- Easy two-step setup

- Inventory management tools

- One to three business days’ deposit speed

- Tap to Pay on iPhone or Android

SumUp Card Readers

|  |

$39 ($49 with dock) | $129 ($199 with printer) |

SumUp Mobile App

|  |

3.5 out of 5; 300+ reviews | 3.1 out of 5; 80,000+ reviews |

The SumUp mobile app is getting better reviews with every update for this guide. However, it doesn’t seem to be as popular with merchants using iPhones (based on the number of reviews) compared to those using Android smartphones.

SumUp appears on several of our “best of” lists, including:

Shopify: Best for Online Businesses Needing a Mobile App for In-person Sales

Pros

- User-friendly and intuitive interface

- 24/7 support

- Powerful reporting tells you which items are most likely to sell

- Integrates multichannel selling

Cons

- Costs at least $39/month for a full ecommerce store

- No low-stock alerts without upgrade

- 3-in-1 card reader only for iOS

- Can’t process credit cards offline

If you want to sell primarily online but need a mobile app for in-person sales, then Shopify could fit the bill. It’s our top pick for best mobile credit card processing for Shopify merchants and our top-recommended ecommerce platform. Other apps on our list, like Square, come with online stores but none have the power of Shopify. It ties your online store to your mobile POS so that as you sell items, inventory stays up-to-date in both applications.

Like PayPal, Shopify has a wide international reach with transaction fees similar to Square’s. It also offers some business services, such as marketing and shipping tools.

Shopify Pricing

- Monthly fee: $0–$89

- Ecommerce subscription: $39–$399

- Card reader:

- Basic Shopify card reader: $49 chip and tap

- Stand-alone mobile POS w/ card reader: $99.75 x4 ($399)

- Card-present transactions: 2.4% to 2.7%

- Keyed-in transactions: 2.4% plus 30 cents to 2.9% plus 30 cents

- Online transactions: 2.4% plus 30 cents to 2.9% plus 30 cents

- Additional fee if not using Shopify Payments: 0.5%–2%

- Chargeback fee: $15

Shopify Features

- Supports 3-in-1 and 2-in-1 card readers

- International sales

- Includes online store

- Gift card processing

- Multichannel sales

- Marketing and shipping tools

- Dropshipping functions

- Tap to Pay on iPhone

Shopify Mobile Card Readers

|  |

(iOS and Android) $49 | Shopify Go (Standalone) $399 or $99.75 x4 through Shop Pay |

Shopify Mobile App

|  |

4.5 out of 5; 7,300+ reviews | 2.9 out of 5; 2,000+ reviews |

User reviews for the Shopify POS app for Android has been on a downward trend and there have only been 200 additional reviews since the last update.

Learn more about Shopify:

PayPal Zettle: Best for Occasional Payments & PayPal Users

Pros

- Easy to set up and use

- Affordable for small, occasional transactions

- Instant payout to your PayPal account

- Trusted by consumers

Pros

- Account stability issues

- Limited inventory management features

- Weekly limit for swiped and keyed-in payments

- May freeze funds at any time; 30-day hold on funds over weekly limit

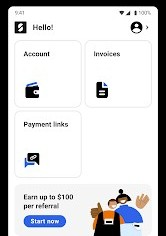

PayPal is a popular and versatile mobile credit card payment processor. It works online and in person, with other payment processors or on its own. PayPal also does not charge monthly fees for inactivity, making it great for the solopreneur and hobbyist needing only occasional payment processing. Like Square, PayPal can deposit sales instantly, but fees are slightly better.

Zettle’s mobile card reader comes with a PIN pad at a significantly affordable price when compared to Helcim (offering a similarly built card reader that cost $109 and did not make it to our list). It also recently launched a standalone mobile POS with a built-in card reader that cost $199–$269. If you are not keen on purchasing a card reader, PayPal Zettle has Tap to Pay on iPhone and Android so you may use any compatible mobile device as your contactless card reader.

PayPal Zettle Pricing

- Monthly fee: $0

- Card reader:

- Basic card reader: $29 for the first; $79 after

- Stand-alone mobile POS w/ card reader: $199–$269

- Card-present transactions: 2.29% plus 9 cents

- Keyed-in transactions: 3.49% plus 9 cents

- Quick response (QR) code transactions: 2.4% plus 5 cents to 1.9% plus 10 cents

- Invoices and other commercial transactions: 3.49% plus 15 cents

- Chargeback fee: $20

PayPal Zettle Features

- Accept PayPal and Venmo payments

- Proprietary 2-in-1 card reader with PIN pad

- Payouts in one to two business days

- Instant access to funds with PayPal balance

- Simple product catalog

- Configure tax and tip settings

- Tap to Pay on iPhone and Android

PayPal Zettle Card Reader

|  |

$79, first one discounted $29 | Zettle Terminal (Stand-alone) $129–$269 |

PayPal Zettle Mobile App

|  |

3.0 out of 5, 700+ reviews | 3.4 out of 5, 42,600+ reviews |

Unfortunately PayPal also continues its downward trend in user review ratings for its mobile app. This is from both iOS and Android mobile users. It’s important to note that most of the negative reviews stem from former PayPal Here users switching to PayPal Zettle.

Learn more about PayPal Zettle with our comparison of Square vs PayPal and analysis of pros and cons of PayPal for small businesses.

Payment Depot: Best Mobile Credit Card Processing for Small, Established Businesses

Pros

- No mark-up transaction fee

- 90-day money-back guarantee

- Free equipment and equipment programming

Cons

- Low processing limits

- Lacks native recurring payments processing

- US merchants only

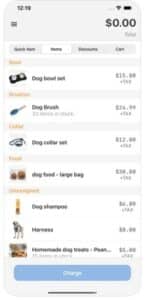

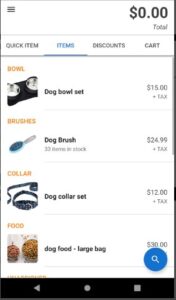

Payment Depot by Stax, offers all-in-one subscription-based plans, wholesale transaction rates, and Stax payment processing tools at a more affordable price range. Because it is a dedicated payment processor, Payment Depot can offer secure payment processing and reliable software to small, growing businesses processing up to $250,000 per year.

As for mobile payments, Payment Depot partners with SwipeSimple for credit card processing. You can add tips, save payment information, use a product catalog, and process returns. Note that Payment Depot also offers free equipment reprogramming and free equipment to qualified merchants.

Payment Depot Pricing

- Monthly fee: $79

- Card reader: $49

- Card-present transactions: Interchange plus 8 cents

- Keyed-in transactions: Interchange plus 18 cents

- Chargeback fee: Varies, from acquiring banks and passed on to merchants

Payment Depot Features

- Mobile powered by SwipeSimple

- Supported by Stax payment processing tools

- Wholesale interchange-plus pricing

- Free equipment reprogramming available

Payment Depot Card Readers

|

(Usually $49) Contact Payment Depot for pricing |

Payment Depot Mobile App

|  |

4.8 out of 5, 4,900+ reviews | 4.4 out of 5, 1,700+ reviews |

SwipeSimple’s Android payment app is holding its high ratings, even with 200 more reviews since our last update. This consistency clearly shows that the majority of merchants like the app.

Payment Depot frequently makes our “best of” lists, including:

Compare Your Processing Fees

Compare your estimated monthly fees when using our recommended mobile credit card processors.

Not quite what you’re looking for? Check our guide to the best merchant services.

How We Evaluated the Best Mobile Credit Card Processors

For this update, we prioritized affordability and value for money when evaluating each mobile credit card processor. Our goal is to offer the best recommendations for small merchants—from startups to growing businesses. We made sure each provider is convenient, flexible, and reliable and has low or no upfront costs and competitive processing rates.

We evaluated over a dozen mobile credit card processors based on price, ease of use, the mobile app, reliability, and web-based and general account features, then narrowed the list down to the six best solutions. Click through the tabs below for our full evaluation criteria:

20% of Overall Score

To receive a perfect score, mobile processors need to offer month-to-month billing with no contracts, cancellation fees, chargeback fees, monthly minimums, or strict application processes.

20% of Overall Score

We awarded points for each type of payment each mobile processor can handle, including point of sale, invoice, virtual terminal, and contactless payments. We also awarded points for mobile apps with split tender options and flexible tipping solutions.

20% of Overall Score

The best mobile processors can accept payments offline, operate on iOS and Android devices, issue SMS and email receipts, and be used to manage a product catalog. The best systems also have a free POS app with business management functions like reporting.

20% of Overall Score

We prioritized mobile processors with free 24/7 customer support, fast deposit times (next day or sooner), multiple card reader options, and robust sales tax management.

20% of Overall Score

How to Choose Mobile Credit Card Processors

When choosing the best mobile credit card processors, it’s important to look at both the mobile app and the card reader and review its overall reliability, security, and value-for-money.

Step 1: Identify your business needs

Mobile credit card processing needs differ from one business model to another. For example: restaurants and service professionals may need a mobile app that can handle tips or keep open tabs. Other businesses may need a full stand-alone mobile POS device instead of a simple credit card reader attached to a smartphone.

Every merchant should be familiar with the ins and outs of accepting card payments. Read our guide on how to accept credit card payments in six steps.

Step 2: Evaluate options using mobile payment processing considerations

Whether you run a primarily mobile business or are expanding sales by adding a mobile payment method, there are a number of factors to consider before choosing a mobile credit card processor:

- Card-reader compatibility: So many poor reviews for mobile apps involve problems with connecting (and keeping) mobile devices connected to a card reader. It’s important to check your smartphone’s software compatibility to make sure that your mobile device specs match that of the mobile app requirements.

- Internet connectivity: While you can use your smartphone’s data to keep connected to the internet, experiencing downtime can be expected while on the move. Losing internet connection while processing a payment is a bad experience for both you and your customer.

- Payment methods: Convenience is what makes mobile payment processing popular with both merchants and customers. Be sure that you choose a provider that offers a wide range of payment method options like digital wallets, buy now, pay later (BNPL), and tap to pay.

Step 3: Assess hardware reliability

Evaluate a hardware’s reliability before jumping at the opportunity to grab free credit card readers. Make sure that the provider offers ample warranty, accessible technical support, and does not charge a pretty penny for replacement or repairs. You should also read the latest real-life user reviews of both the hardware and payment app.

Step 4: Consider value-for-money features

You should not have to spend so much in monthly fees for a mobile payment processing service with features that your small business currently doesn’t need. Conversely, there’s also no sense in getting a credit card reader for free if it doesn’t come with the payment methods and features you often use, or requires you to pay additional fees for access. Look for a merchant processor that gives you free access to your preferred payment tools while also having advanced features that can grow with your business.

Mobile Credit Card Processing Frequently Asked Questions (FAQs)

Click through the sections below to learn more about the most common questions we get about mobile credit card processing for small businesses.

For small businesses, the best app for credit card processing is Square. Not only does Square offer the most reliable set of mobile credit card readers but it also provides merchants with free POS software with built-in online store, invoicing, and employee management tools—all of which you can access from the Square mobile app.

Square does not require an application process so you can start accepting mobile credit card payments in minutes. Transaction rates are competitive and there are no monthly fees, making Square the best value-for-money credit card processing app in the industry.

Square is the overall cheapest when it comes to credit card processing for small businesses, which includes mobile payments and other payment methods. However, there are other affordable credit card payment processors depending on your business size and type. Square and most of the providers in our list can be found in our rundown of the cheapest credit card processing companies.

There are several options to accept credit cards without purchasing a card reader. You can key in your customer’s credit card information to process payments but transaction rates for this method are slightly higher. Another option is to choose a provider that offers tap to pay on mobile, which allows any compatible mobile phone to be used as a card reader.

There is no absolute way to accept credit card payments for free. Even when you operate in an area that allows you to pass merchant fees to your customers, such as credit surcharging, you will still need to budget for monthly charges and incidentals.

Bottom Line

Whether you’re a brand-new business that is starting out with cellphone credit card processing or an established store looking to take your business on the go, the best mobile credit card readers would be ones that are cost-effective, reliable, and easy to use. It’d be even better if you didn’t have to deal with monthly transaction minimums, fees, or contracts.

Square provides great mobile credit card processing for small businesses. It is easy to use, has a full POS, and lets you accept payments anywhere, even offline. No applications, startup fees, or hardware costs mean it’s a risk-free investment. Plus, the Square app comes with the POS features you need to manage a business on the go. Visit Square to get started with a free account and mobile card reader.