Editor’s note: We will continuously update this post with new features of QuickBooks Online, so be sure to check back regularly.

QuickBooks Online regularly introduces new features to make the platform more user-friendly and help users improve work efficiency. Below, we’ve listed the latest QuickBooks Online updates, including new features and changes, and discussed how they can help you streamline business workflows and improve your overall QuickBooks Online experience.

As of May 2024

QuickBooks Ledger

One of the latest QuickBooks Online updates is the addition of QuickBooks Ledger, a product built exclusively for accounting professionals using QuickBooks Online Accountant. It’s an accounting ledger focused on after-the-fact accounting and managing tax-only clients.

For instance, it allows you to compile income and expenses, reconcile accounts, and generate financial reports. Since it’s designed as a low-cost option for after-the-fact bookkeeping, it doesn’t have features to manage the day-to-day operations of a business, like issuing invoices and tracking bills. It costs $10 per company file and is available only to QuickBooks ProAdvisors through QuickBooks Online Accountant.

Unpaid Balance Customer Reminder

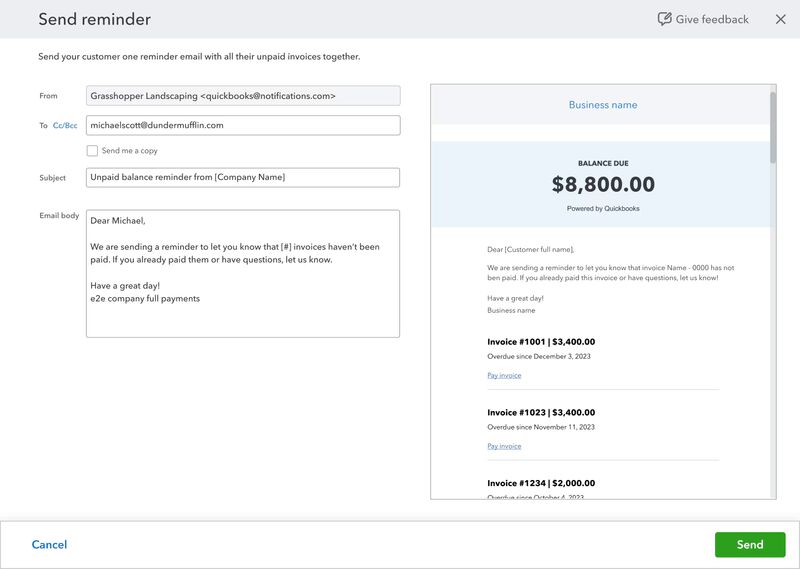

Instead of sending separate email reminders to your customer for each unpaid invoice, you can now send a single, consolidated reminder that includes a total of all their unpaid balances. The reminder includes a list of the unpaid invoices and a respective link to where they can easily process the payment.

Sending a balance due email reminder to a customer in QuickBooks Online (Source: QuickBooks)

Document Management Through QuickBooks Online Payroll

To help you better manage your employees’ important records, you can now upload and share documents to their profile through QuickBooks Workforce, the app for QuickBooks Payroll and QuickBooks Time.

Employees can securely log into Workforce and navigate to the documents section to locate and view the documents shared with them. However, as of this writing, employees can only access shared documents through QuickBooks Workforce on the web, not the mobile application.

Automatic Import of Chase Bank Statements

This feature is particularly beneficial to QuickBooks Online users banking with Chase. With the new QuickBooks version, you can now view your monthly statements directly within the platform, as opposed to manually uploading files of statements or tracking them down. To access this feature, navigate to the Reconciliation screen, select the Chase bank account, and then click on View statements.

Multi-condition Workflows

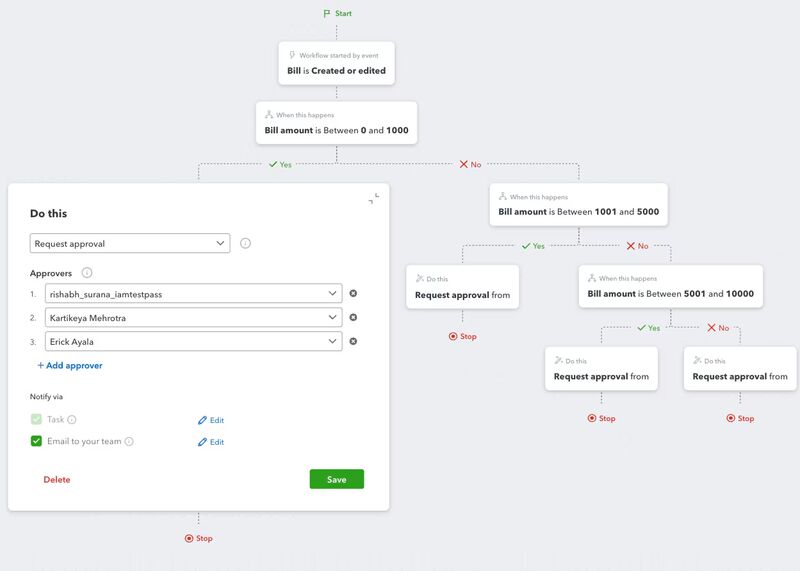

If you have complex billing processes, you can now set up multiple condition workflows and approvers to gain better control of your accounts payable processes. This allows you to create workflows with multiple sequential conditions so that the bills meet specific criteria before they get paid. For instance, you can set up a workflow where all bills exceeding $2,000 must be approved by a manager and then a finance director.

Setting up multi-condition workflows in QuickBooks Online (Source: QuickBooks Online)

Enhanced Custom Roles

To gain better control over your financial data, you can now set up more granular user access to certain data in QuickBooks Online. This allows you to completely control what a user can view and edit within QuickBooks, depending on their specific roles.

For instance, you might want to set up a custom role for a junior accountant who handles basic transaction entry but shouldn’t have access to certain transactions and task areas. Let’s say they can only view invoices and estimates, but they can’t create, edit, or delete them. They can also track bank transactions; however, they aren’t allowed to modify or reconcile them.

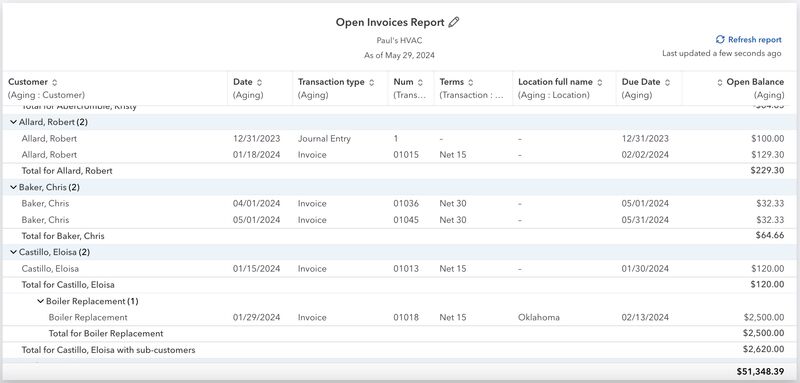

Modern Report Views

QuickBooks Online is transitioning its reports to a new Modern View to enhance user experience. Some of the new features and capabilities include faster loading times and improved stability, plus the ability to immediately preview customizations before finalizing reports. To help users familiarize themselves with the new features, the transition to Modern View is being rolled out gradually.

At this time, here are some of the QuickBooks Online reports that are already using the Modern View:

- Invoice List

- Open Invoices

- Terms List

- Unbilled Charges

- Sales by Customer Type Detail

- Customer Contact List

- Sales by Customer Detail

- Deposit Detail

- Unpaid Bills

- Check Detail

Sample Open Invoices Report using the Modern View in QuickBooks Online

Enhanced Time Tracking

With the updated time tracking features, you can now view detailed timesheet information within time entries in QuickBooks Online. This includes tracked time, contractor time, GPS points, notes and attachments, and a list of employees who are missing pay rates. Also, you can now track what device your employees use for clocking in and out and get alerted when an employee has tracked overtime.

QuickBooks Bill Pay for Accountant-billed Clients

QuickBooks Online now offers the option to add QuickBooks Bill Pay for accountant-billed clients. This means QuickBooks ProAdvisors can now customize their clients’ accounts payable workflows with tools and features customized to their unique needs.

QuickBooks ProAdvisors can add QuickBooks Bill Pay for accountant-billed clients by navigating to the Subscription & Billing page in QuickBooks Online Accountant and then clicking on Add Bill Pay under Client Actions. There are three subscription plans to choose from: Basic, Premium, and Elite.

QuickBooks Bill Pay

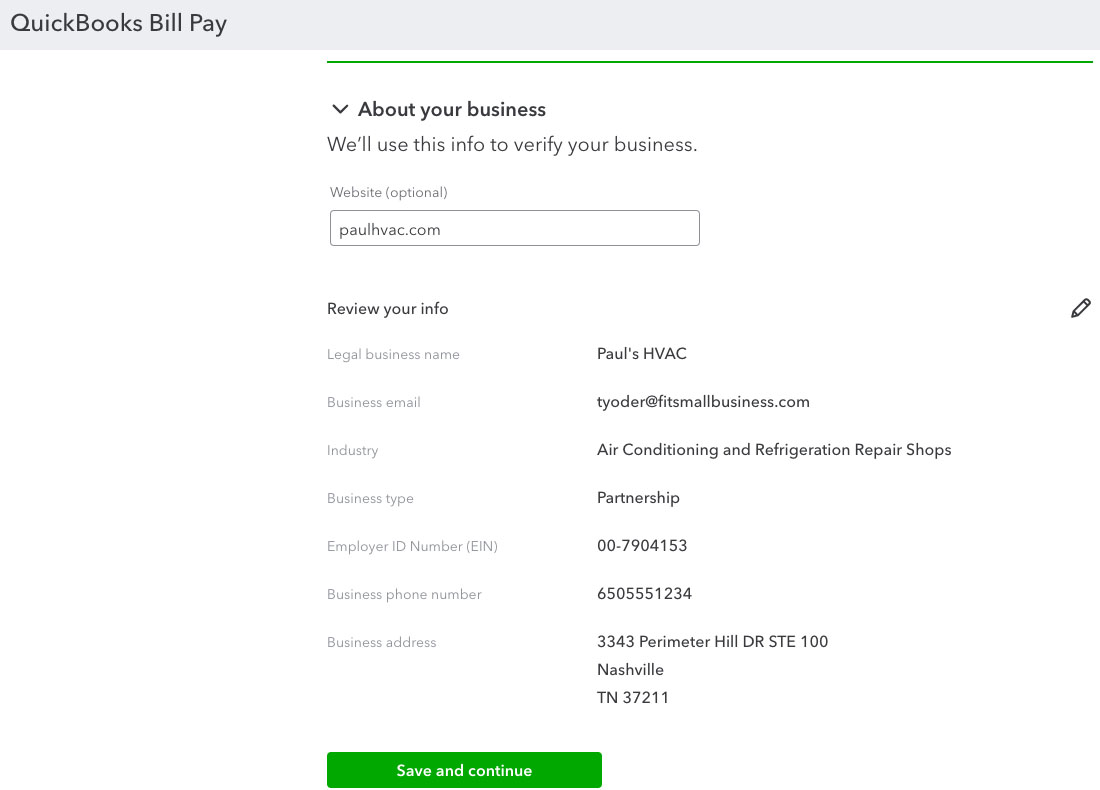

QuickBooks Online has transitioned from using Melio to having its own built-in bill payment feature called QuickBooks Bill Pay. It is a new solution that allows you to pay your bills directly from the QuickBooks Online platform.

Available exclusively for QuickBooks subscribers, QuickBooks Bill Pay helps you manage the different aspects of your accounts payable (A/P) through its key features. These include approval workflow setup, bill payment processing via automated clearing house (ACH) or checks, automatic vendor invoice capture, and 1099 filing. The program is available in all QuickBooks Online plans, except QuickBooks Self-Employed.

You can set up QuickBooks Bill Pay from your QuickBooks Online account when scheduling a bill payment. You can choose from three subscription options, and once subscribed, you’ll be prompted to provide information, such as company details and personal information.

Setting up QuickBooks Bill Pay in QuickBooks Online

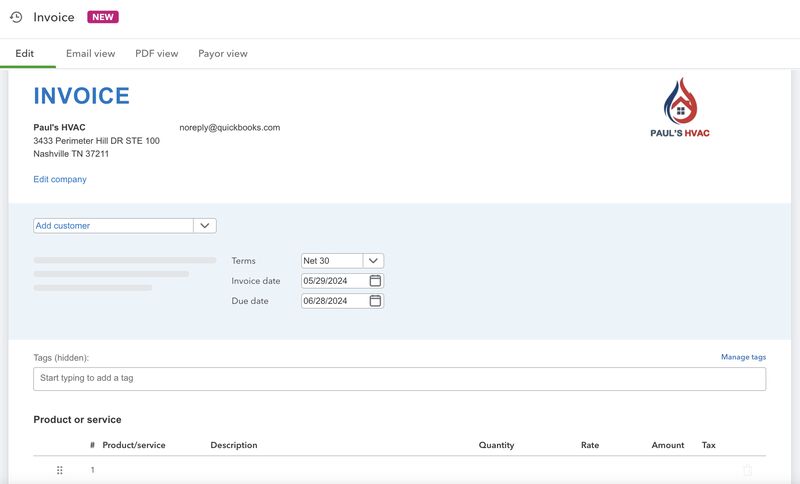

New Invoice & Estimate Experience

The new QuickBooks Online version now includes real-time PDF creation, allowing you to see a live preview of your invoice or estimate as you enter or adjust the data in the invoicing or estimate form. This helps you customize your document easily without repeatedly clicking the preview button, ensuring it looks exactly as you desire before you finalize it.

New invoicing layout in QuickBooks Online

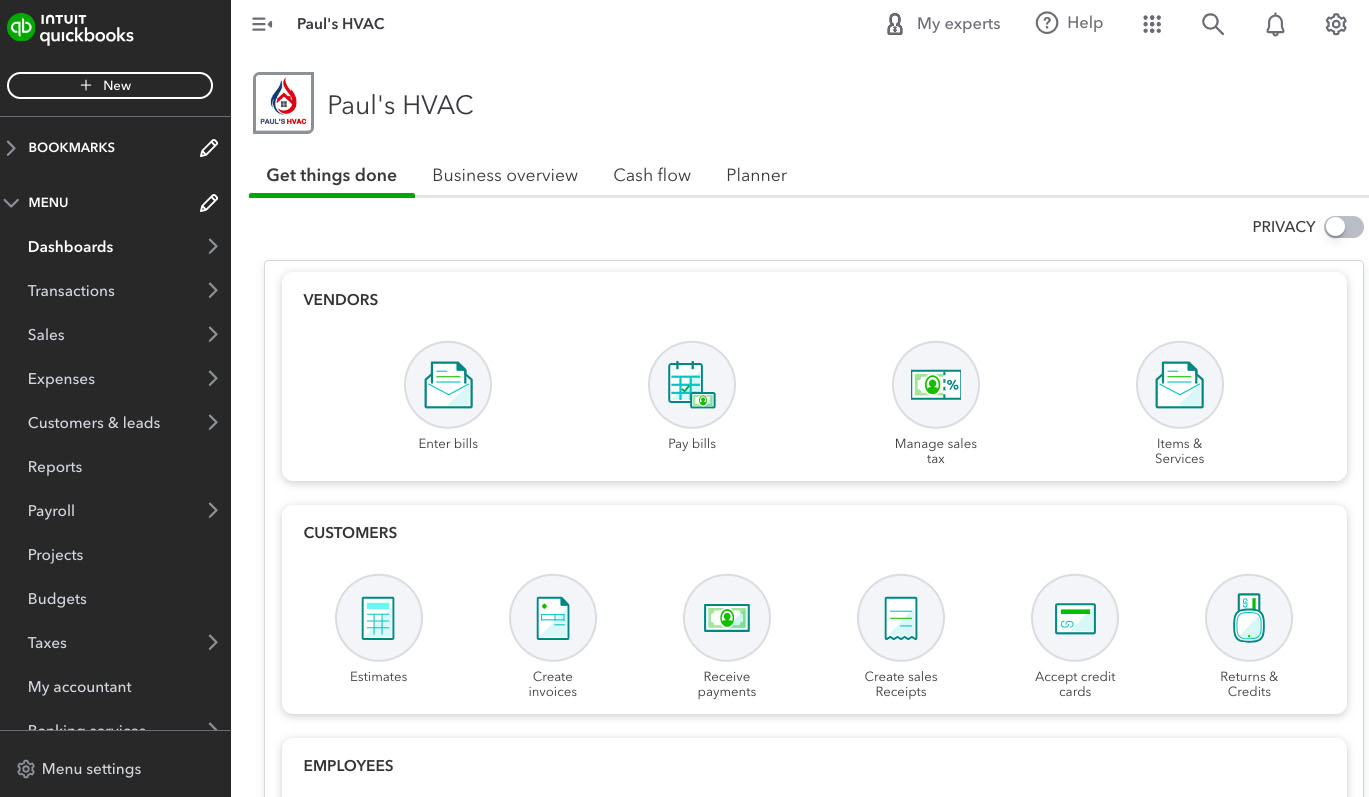

Navigation Menu Enhancements

QuickBooks Online has made some significant changes to the navigation menu. For instance, you can now customize your menu by expanding and collapsing various sections so that you can only see what’s most important to you. Bookmarks have been moved to the top so that you can access your frequently used features easily.

Also, you’ll notice that QuickBooks now has a unified left-side menu, regardless of whether you are in the Business View or Accountant View. You can still switch between views, and your menu won’t be affected.

New navigation menu in QuickBooks Online

HR Support Through QuickBooks Online Payroll

If you’re currently using QuickBooks Online Payroll Premium or Elite, then you can now access HR support for free through QuickBooks’ partner, Mineral Inc., a leading HR and payroll compliance platform.

- Premium and Elite users can access the HR Support Center, which includes an extensive library of resources compiled by HR professionals. These resources cover various HR topics, including hiring best practices, handbooks, compliance, creating job descriptions, and more.

- Elite users have the added benefit of accessing unlimited live expert support through HR Expert Advisory. This allows you to connect to an HR Advisor who will answer any questions you may have. They can provide personalized support on various HR topics, including hiring, termination, compliance, and benefits.

Project Estimate vs Actual Reporting

When you subscribe to QuickBooks Online Advanced, you’ll be able to generate a project estimate vs actual report. This report compares your estimated costs and revenues against the actual expenses and revenues incurred during and after a project is completed.

This new feature helps with project management in many ways. For instance, it helps business owners quickly identify where expenses are higher than expected and determine where estimates are inaccurate, then adjust them for similar future projects.

Fixed Asset Management

Also exclusive to Advanced users, the new fixed asset accounting tool allows you to record and track fixed assets, such as land, buildings, machinery, vehicles, and equipment. It allows you to enter a new asset and calculate depreciation expenses based on your selected method, such as straight-line depreciation or double declining balance. You can then run a depreciation schedule to see how much you’ve invested in fixed assets over time and how those costs are being deducted via depreciation.

Our related resources:

- Straight Line Depreciation Formula: How to Calculate

- Double Declining Balance Method: Formula & Free Template

- Units of Production Depreciation: How to Calculate & Formula

- MACRS Depreciation Calculator + MACRS Tables and How To Use

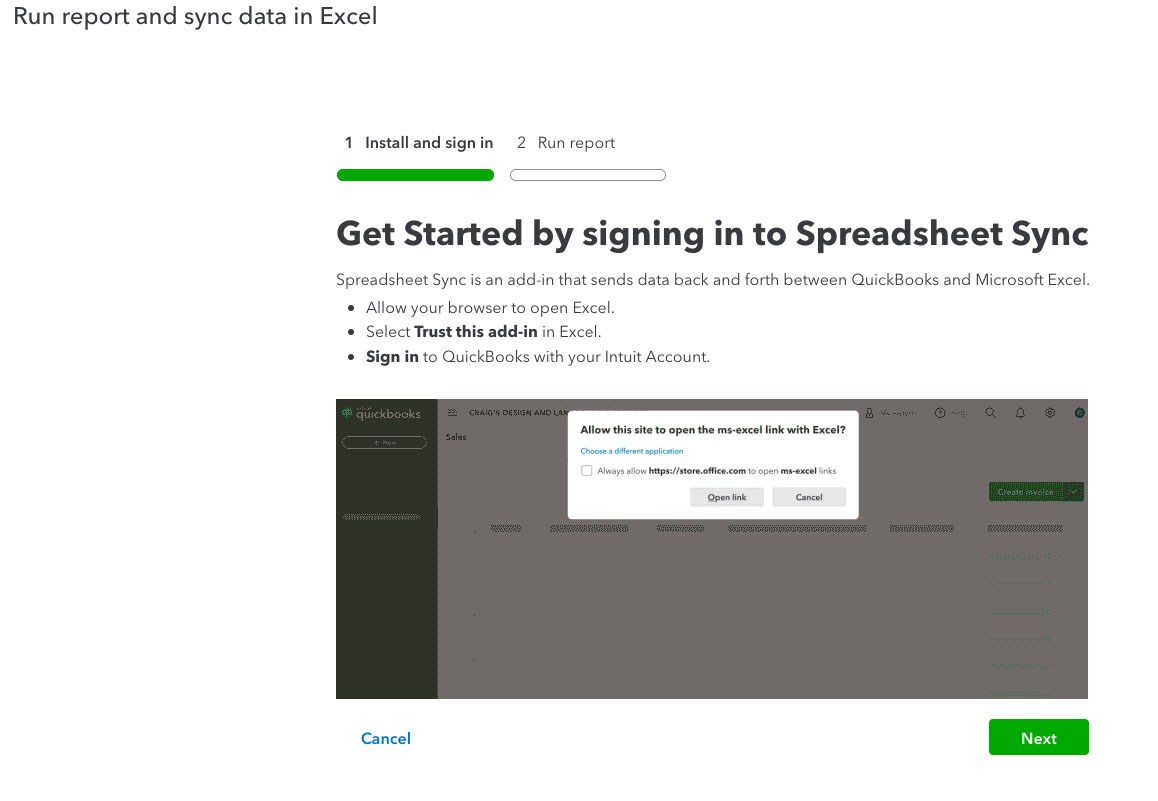

Spreadsheet Sync

Spreadsheet Sync in QuickBooks Online Advanced allows you to pull information from QuickBooks automatically and then push it into Microsoft Excel and edit it as needed. You can manipulate the data using Excel’s built-in tools, such as making complex calculations. Once the data is finalized in Excel, it can be pushed back easily to QuickBooks Online Advanced with all the changes made.

Additionally, this new feature allows you to import and export custom lists, including items, customers, and vendors. You can also generate multi-company reports in a single spreadsheet—meaning you can analyze and compare data across multiple entities without the need to switch between different QuickBooks accounts.

To get started, click the Spreadsheet Sync tab in the Reports screen. Then, follow the prompts to install the Spreadsheet Sync add-on, and sign in to your QuickBooks account.

Setting up Spreadsheet Sync in QuickBooks Online Advanced

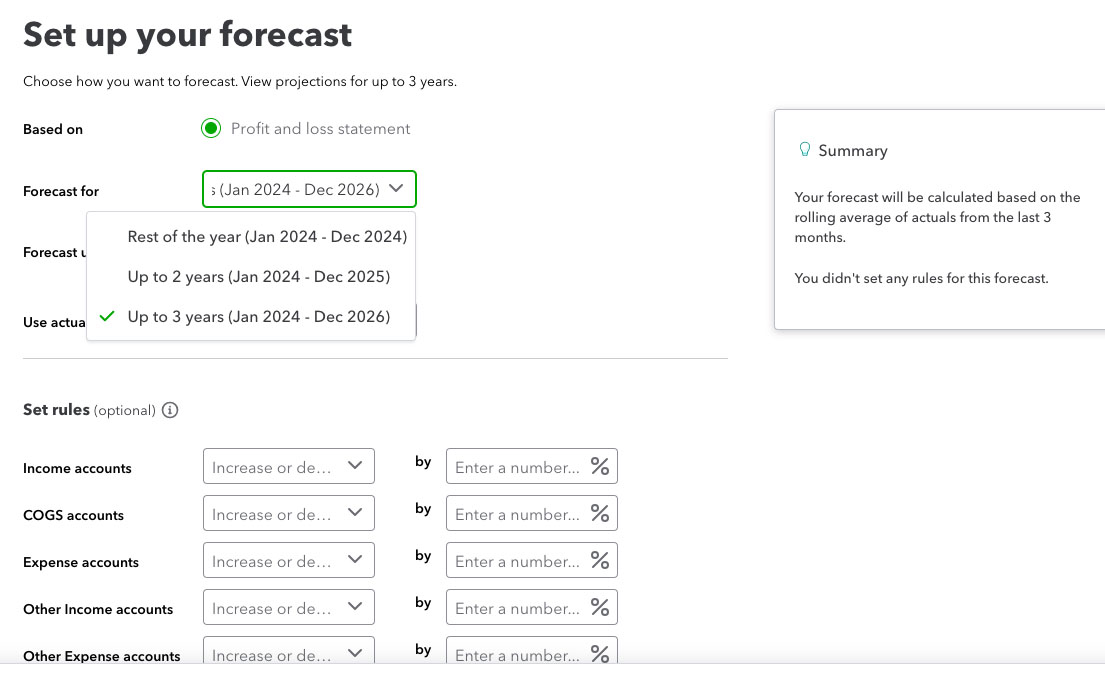

Forecasting

To gain more meaningful insights into your company’s financial future, Advanced allows you to create profit and loss (P&L) forecasts for a period of up to three years. You can build a P&L forecast either by using the prior year’s actuals or the average of actuals from the prior three, six, nine, or 12 months. After creating the forecast, you can convert it into a new budget easily.

Creating a financial forecast in QuickBooks Online Advanced

Enhanced Revenue Recognition

The revenue recognition standard, ASC 606, requires that revenue be recognized when it is earned and not when a sale happens or when a payment is received. QuickBooks Advanced recognizes revenue when it’s earned automatically, regardless of when the payment is received. This means businesses using accrual accounting no longer have to track recurring revenues manually using complex spreadsheets or creating journal entries.

Advanced also provides added benefits, such as post-invoice editing. After saving an invoice, you can edit the revenue recognition schedule based on your needs or contract arrangements. This may be beneficial for project-based companies where revenue recognition requirements may vary depending on deliverables and project milestones. Additionally, you can:

- Add new products to an invoice

- Delete existing line items on an invoice or sales receipt after the fact

- Make changes to an item’s price or service date

Frequently Asked Questions (FAQs)

QuickBooks Online is cloud-based accounting software that helps businesses manage their finances, track expenses, create invoices, and automate other bookkeeping tasks. Read our detailed QuickBooks Online review to learn more about this cloud accounting solution.

Some of the key QuickBooks Online updates as of this writing include QuickBooks Bill Pay, a new invoicing and estimate creation form, a new navigation menu, and HR support through QuickBooks Online Payroll. There are also new features exclusive for Advanced users, like enhanced revenue recognition, forecasting, and fixed asset accounting.

Yes, there are. QuickBooks Online provides a vast array of free resources, including setup guides and video tutorials. You may also browse through our free QuickBooks Online tutorials for comprehensive step-by-step guides on how to perform different QuickBooks tasks.

Wrap Up

You’ve just learned what’s new in QuickBooks Online. Keep an eye on our regular updates to ensure you have the latest QuickBooks Online tools to help your business succeed.