Switching to a new accounting system is not an easy process, but an accounting software implementation plan can make things easier:

- Step 1: Planning. Assess the need for a new platform and the software product you want to use.

- Step 2: Preimplementation. Prepare the entire company for implementation, wherein you examine if the technology in place matches the requirements of the new system.

- Step 3: Implementation and transition. Implement the new software by migrating data, training employees, and authorizing the use of the new software.

- Step 4: Monitoring. Continue to monitor the performance of the new solution and support the accounting staff in solving problems or redesigning workflows.

- Step 5 (optional): Documentation. Document the entire process if you have extra bandwidth. Documentation can be a good reference in the future.

In this guide, we provide you with the most comprehensive implementation plan that you can adapt or further improve. You may also download our free implementation checklist below to help you get started with the transition.

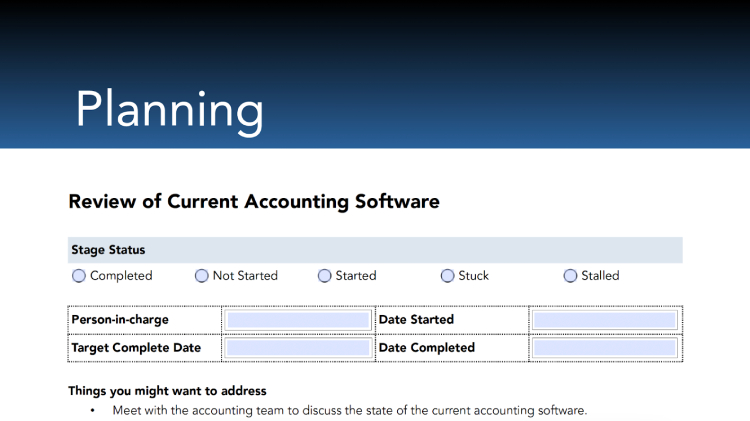

Part 1: Planning

Just like any other business plan or activity, planning is always the first step in the process. A well-planned accounting system implementation will make it easier for everyone to adapt to the new system that the business wants. A good plan solidifies the need for new software and lays out the foreseeable steps during the implementation process.

Getting a new accounting solution must be worth every dollar spent. It must solve most, if not all, of the current problems, bottlenecks, and inefficiencies of the current accounting system. Hence, a comprehensive review of the current system is important to further solidify the need for a new one.

Here are some action items that can get you started with this review:

- Meet with the accounting team to discuss the state of the current accounting software.

- Gather feedback from accounting department employees about inefficiencies in the process, such as number of users and the continued use of spreadsheets for transactions that can’t be tracked or entered into the current accounting system.

- Compile a list of missing features that are essential to your business’ accounting process.

- Make a “wish list” of features or improvements that accounting department employees would like to see in the new platform.

Another relevant question to ask is, “Do we really need to change accounting systems?” Perhaps, you can explore upgrading to a higher plan or choosing a customized plan. Switching software providers can be difficult, so ensure that you’ve exhausted all possible options with your current provider.

A new accounting platform must satisfy your goals. If you’ve decided to switch to a new accounting software provider, start making goals for the new accounting software implementation plan. The accounting department is responsible for setting these goals, which must yield an overall benefit to the company.

When setting goals, here are some areas to look at:

- Number of users: How many users do you want to onboard in the software? Does the new software solve the problem of limited users in the current system? Will the number of seats available be enough should the accounting team expand in the future?

- Overall efficiency: Will the new software make accounting processes faster and more efficient? Can it reduce the data entry work of employees?

- Granularity in tracking and reporting: Can the platform track items of income and expenses that can’t be tracked by the current software? Can the solution generate reports that were previously created manually in spreadsheets? Does it create custom reports that require a few clicks?

- Reduction in spreadsheets: Can the solution reduce the use of spreadsheets in at least 80% to 90% of the process?

- Business intelligence (BI) integration: Does the platform integrate with BI software or does it have built-in BI features?

- Cost and affordability: Can the business pay for the monthly or yearly subscription and maintenance costs of the solution? Can you sponsor training and certifications for employees who will use the software?

Everything that happens from start to finish must be documented in a timetable so that everyone can see how long it will take to complete the transition. The transition duration depends on the following factors:

- Size of the accounting data: When you have years of data to back up and migrate, the transition may take longer.

- Difficulty of the software: Accounting platforms can get complex, which requires hours of training and months of support. Remember that accounting department employees will do this training on top of their regular accounting tasks.

- Size of the company: The transition will also depend on the company size and how many people should be trained. Larger companies will take more time during the transition, while smaller ones will require less time.

- Willingness to transition: It’s possible that some employees may resist the transition—and the friction may slow down your plans. If you encounter this situation, review your goals and try to work with employees toward a solution.

With goals set, the accounting department can start proposing new accounting systems. It’s best to let the accounting department make the proposal since they’ll be the ones using the platform daily. Ask them to come up with a list of possible systems that they think are best for the business. If the team has additional bandwidth, you may ask them to come up with possible pros and cons of each solution.

Check our roundup of the best small business accounting software to get you started in proposing new solutions. If you’re looking for industry-specific or use case-specific choices, we’ve compiled a list of buyer’s guides that might help you in creating a proposal:

- Startups: Best startup accounting software

- Multicompany accounting: Best multi-company accounting software

- Consultants or consulting firms: Best accounting software for consultants

- Small manufacturers: Best accounting software for small manufacturers

- Farmers: Best farm accounting software

- Project-based businesses: Best project accounting software

- Small retailers: Best accounting software for small retail businesses

- Ecommerce: Best ecommerce accounting software

- Amazon sellers: Best accounting software for Amazon sellers

- Trucking: Best trucking accounting software

- Construction: Best construction accounting software

- Law firms: Best law firm accounting software

- Hotels: Best hotel accounting software

- Restaurants: Best restaurant accounting software

Our guide on how to choose the right accounting software for your business may also be of interest.

Implementing a new accounting software affects not only the accounting department but the whole company as well. This change must be properly communicated to stakeholders, especially those working closely with accounting, such as finance or treasury departments. Non-admin department heads must also be aware of this change because it might impact how requests or reimbursements are handled once the new system is implemented.

Releasing a memo or making a quick announcement in your business’ messaging platform is one way of informing business stakeholders. However, you may want to conduct a town hall meeting with directly affected departments or employees so that you can address their concerns and hesitations. This meeting can also be an opportunity to get more ideas or proposals from other team members.

The list you created in Step 1.3 should be narrowed down to a maximum of three possible accounting software products. First, review each software provider and score them based on the goals you’ve enumerated in Step 1.2. Consider the suggestions and concerns in Step 1.4 to further narrow down the list to a maximum of three. While there’s no hard and fast rule on how many should be included in the final list, limiting it to three will save you a lot of time.

Once you have finalized your list, contact each provider and request a demo to check whether the platform is the best fit for your needs. The accounting department head must be present in the demo. It would be best if other employees were there, too, so that they could ask questions about the system. We only recommend selecting three providers because you’ll be doing the process thrice.

The majority of the decision should rest with the accounting department. However, upper management must also provide guidance. Once you’ve decided, complete the purchase of the software with the provider. If there is a written agreement, review it before signing.

Part 2: Preimplementation

The preimplementation stage prepares your business to adapt to the new accounting software implementation process in Part 3. This stage establishes the prerequisites for the new accounting system and ensures that it can be implemented successfully for testing.

Create an inventory of existing company devices such as laptops, desktops, or workstations. This step is crucial for desktop accounting programs that have device limits or are license-based. But for cloud-based accounting solutions, the number of devices isn’t a major issue. Coordinate with the software provider for expert assistance.

During this process, you may also encounter very old devices that are due for replacement. Hence, be prepared for these additional costs. A good starting point is within the accounting department; then, branch out to other departments with access to the existing accounting tool. If you have a small company, gathering this information won’t take long.

A new software may require an updated device. Every device must match the new solution’s minimum requirements.

We recommend that you exceed the minimum requirements to future-proof the device. For instance, if the new platform requires a minimum of an Intel i3 processor, getting the latest i5 or i7 device is ideal for future-proofing.

Aside from the processor, you should also consider the RAM. Accounting personnel will likely multitask, so a higher RAM can handle multiple open applications at the same time. At a minimum, 8 GB of RAM is recommended for productivity tasks. If you’re getting a cloud-based accounting platform, the web browser will also consume RAM. Therefore, having enough RAM is paramount to prevent random app crashes or lagging.

If your company is investing in security, this is the best time to review if current security measures are in place. Coordinate with your IT team to assess if every employee is following standard security protocols, such as password hygiene and antivirus updates.

At this point of the pre-implementation stage, you need to back up all accounting data. This backup will not be migrated to the new software—it will only be a backup copy for if problems arise and migrated data are deleted. However, that’s highly unlikely nowadays. The backup will range from the first transaction up to the backup date.

Your business will still be using the old platform because the new platform isn’t fully implemented yet. Later on, you’ll have to back up the more recent transactions and migrate them to the new system.

Migration will cause downtime for the old accounting software. It’s best if you can do this outside office hours. But if it’s unavoidable, make arrangements with concerned employees so that the accounting department cannot process transactions while migration is ongoing. You should also coordinate with your relationship manager to help you in the migration process.

The time of migration depends on the size of the data being migrated and the method of migration. It’s best to work with the software support team during the migration.

Accounting personnel should use the old accounting solution again once the migration is complete. At this point, it’ll be business as usual. Then, the accounting system implementation team should start setting up the new software. The setup differs per accounting software, but it usually includes reviewing the following:

- The chart of accounts, account codes, and account titles

- Customer and vendor information

- Products and services codes and information

- Transaction history

Testing involves generating sample reports or creating test transactions to verify if the software is working properly. For example, try to generate a trial balance that covers a specific period using the new and old accounting platforms. The reports must show the same information and totals. If the reports don’t match, there might be missing data in the new system.

Part 3: Implementation & Transition

The implementation and transition stage officially starts the deployment of the new software in the company. During this stage, you may still use the old solution, but it is recommended that new transactions be entered into the new platform.

This step is applicable only if you opt for a desktop program, as no installation is required for cloud-based solutions. Desktop installations must be performed in batches to prevent work interruption.

Here are some action items you need to take:

- Announce the software installation activity to all employees, especially those directly affected by the transition. Be sure to list down the dates so that every worker can be in the office on the said dates.

- Create a schedule and communicate these dates to staff. In the schedule, enter the name of the employee and the date and time of installation. If a worker is unavailable on that date because of a preapproved paid time off (PTO), you can reschedule the installation to their next available schedule.

- Implement the schedule to avoid delays and problems.

Once every employee has the new platform installed on their devices, you can start setting up roles and access. If you’re implementing cloud-based accounting software, you can easily change roles in the settings. Setting new roles poses new challenges such as user limit constraints. If all employees can’t be onboarded to the new system, this is the best time to redefine access controls.

As much as possible, sharing login credentials isn’t recommended. If you’re faced with user limits, password sharing is fine—but it should be shared securely using password-sharing apps.

Training is important even if you have an experienced accounting team. A new platform brings in new processes that might differ from old ones. Training can be done asynchronously or synchronously, whichever you prefer. If synchronous, you must schedule a date that’s most convenient for the accounting team.

Here are some guidelines for formal training.

Part 4: Monitoring

The monitoring stage may last for a month or up to a year at most. Since some tasks in the accounting software are done only once a year, such as when closing the books, the accounting team has yet to experience these non-recurring tasks. However, employees can fully adjust to the new platform in less than three months. But while everything is still new, continued support should be given to the accounting team at this crucial time.

If there is remaining data in the old accounting system, you should continue parallel running. During a parallel run, both the new and old accounting software are actively used, but more recent transactions and tasks are performed in the new accounting platform. A parallel run will end only if all data have been backed up and migrated.

During this stage, the accounting team may have noticed the nuances of the new accounting solution after continued use.

Conducting catch-up meetings is optional—but we highly recommend that you organize it. This meeting can help the accounting department pivot to address the nuances of the new system. It is also an opportunity for the accounting team to redesign the existing workflows so that they match the new software’s processes.

You may experience problems such as lagging, crashing, or downtime. We recommend reaching out to the support team as soon as possible to address these problems. If you’re using a cloud-based accounting solution, you can perform some basic troubleshooting like clearing the browser cache or restarting the internet connection.

For a desktop accounting program, lagging and crashing can be fixed by restarting the device. It’s also possible that the device can’t handle the demands. That’s why in Step 2.2, we recommended that you check device compatibility to avoid post-transition issues. If problems persist, then it’s best to contact the support team to address the issue.

Once all data has been migrated and backed up, you may now retire the old solution. Consider the following during this stage:

- For old cloud-based accounting software:

- Review subscription terms and keep using the platform until it expires.

- Remove your payment methods in the old accounting software so that it doesn’t auto-renew and auto-charge your credit card.

- Reach out to the customer success manager and inform them that you’ll be discontinuing the system.

- For old desktop accounting software:

- Review subscription or license terms and keep using the solution until it expires.

- Uninstall the old desktop accounting software to free up space.

- Most desktop programs don’t auto-renew. But for those that are subscription-based, like QuickBooks Desktop Enterprise, remove your payment methods to prevent auto-renewals.

Part 5 (Optional): Process Documentation

While this part is optional, documenting the entire process can help you in the future in case you need to switch accounting software again. However, we don’t recommend that because it’s tedious and costly. A process documentation of this transition and implementation phase can also be a good reference for if, or when, you implement a different kind of software, such as an expense tracker and time tracker, in the business.

Frequently Asked Questions (FAQs)

First, carefully plan the whole process. Talk to employees and stakeholders about this upcoming change. Second, start preparing for the implementation. Make necessary changes and inform employees about their responsibilities and what they need to do to make the implementation easy.

Third, implement the software. Conduct training, offer support, and authorize the use of the new platform. And lastly, monitor results. Ask employees to share best practices, workarounds, and solutions to make the adjustment process easier and faster.

It depends on a variety of factors, such as company size, needs, data size, and complexity of processes. But for small businesses with less than two to three years of transactions, it may take a month or two at most. Larger businesses may require more time, which depends on a lot of factors. However, it may take four to six months to fully integrate a new system in a large business.

Bottom Line

Implementing new accounting software is costly and rigorous. It requires a lot of adjustment and pivoting to fully integrate the new platform into your business. We hope our guide has given you an idea of how implementation works and some inspiration for how you can adapt our checklist to your business.