Managing A/P requires finding the balance between validating and approving bills, paying them on time, and maintaining enough cash for daily operations. It is one of the most important tasks of a bookkeeper.

We list 16 accounts payable best practices—from entering bills immediately and contacting vendors for discrepancies to attaching invoices and receipts to transactions and establishing fraud prevention strategies. We also offer tips to assess the efficiency of your A/P management system through reports and ratios.

1. Enter Bills as Soon as You Receive Them

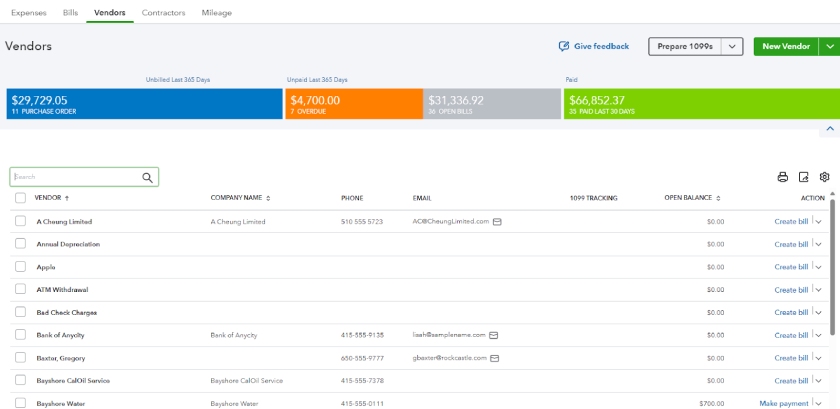

As soon as you receive a bill, you should record it immediately in your A/P software—don’t wait until you’re ready to pay it. Programs with A/P functions, like QuickBooks Online, can help organize, enter, and process your bills. In the Vendors section of QuickBooks Online, you can view all the bills per vendor, including their status, outstanding balance, and type.

List of vendor bills on QuickBooks Online

2. Input Invoice Numbers

When you receive bills from suppliers, always be sure to accurately enter the invoice number in your system. Your accounting software will then enter this reference number automatically on any check that’s written to pay the bill.

The system should also warn you if you try to enter a duplicate invoice number. Without this safeguard, it’s very easy to pay an invoice twice, especially if a vendor sends you two copies, such as one paper and one electronic copy.

3. Input as Much Information as Possible From Supplier Invoices

The goal when inputting an invoice is never to have to pull a copy of the paper invoice again. Enter all the details available on the invoice, and don’t summarize multiple line items. By completing all the fields, you’re making an electronic record of the paper invoice that can be used to summarize purchase information in any number of ways as needed to analyze your operations.

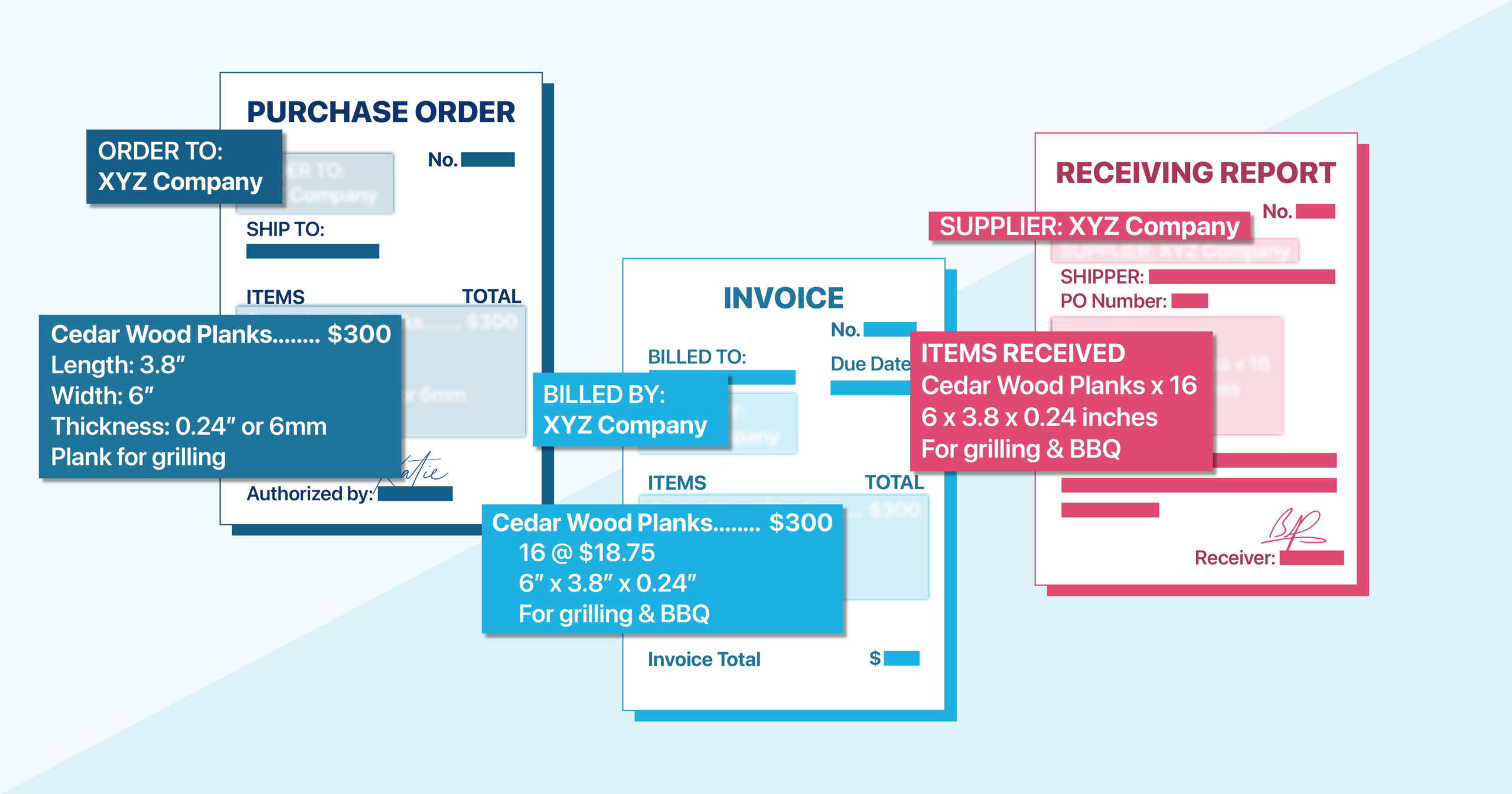

4. Match Bills to Purchase Orders and Receiving Reports

A purchase order (PO) is a document businesses send to a supplier to order goods. Once the supplier ships the goods, they’ll issue the business an invoice or bill. The receiving report (RR) documents the actual receipt of goods purchased. Before paying any bills, you should perform a three-way match of the items, quantity, and price on the invoice to the PO and RR to ensure you’re paying for exactly what you ordered and received.

5. Design a Process for Bill Approval Before Payment

In a small business setup, the approver of a bill can be the owner. The accountant should present the PO and invoice in a voucher package for the review and approval of the owner. The information in the voucher package should match before the owner approves the bill for payment. For more information, see our article about accounts payable workflow, which presents three easy steps for small businesses.

QuickBooks Bill Pay, an A/P management system built into QuickBooks Online, can be used to track payables, manage approval workflows, and initiate electronic payments. Read our QuickBooks Bill Pay review to learn more.

6. Contact Vendors for Discrepancies

If vendor bills don’t match with approved POs or RRs, you should contact the vendor to investigate the difference. However, you should first determine the exact nature of the discrepancy. Is it a mathematical error, an incorrect item or quantity, or a mismatch with the PO? Gather any relevant documents such as POs, contracts, or previous invoices to support your claim.

It is important to work quickly to resolve the matter before the due date as you should never pay a bill you know is incorrect. When contacting the vendor, clearly explain the discrepancy in a polite and professional tone, providing specific details and invoice numbers. State your desired resolution, whether it’s a corrected invoice, credit memo, or adjustment. Be sure to keep a record of the date, time, person you spoke with, and the agreed-upon resolution.

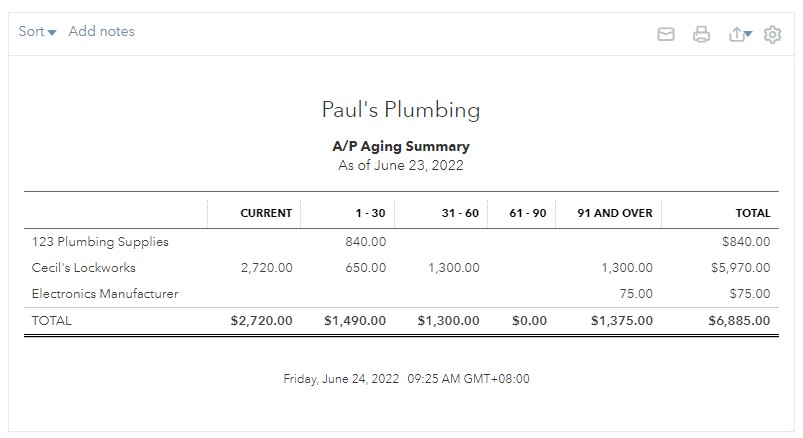

7. Review the Accounts Payable Aging Report

A/P best practices include reviewing the accounts payable aging report, which shows you a list of outstanding bills classified into age groups. You should generate a report weekly, and it should have no overdue accounts. However, if cash flow is tight, you may have to choose which overdue bills to pay and which ones will have to be late. The report is a great tool for these decisions since all outstanding bills can be viewed in one report.

You can generate an A/P aging report using QuickBooks Online, our best small business accounting software, and can choose between a summarized and a detailed report. See our tutorial on how to generate an A/P aging report in QuickBooks Online.

Accounts Payable Aging Summary on QuickBooks Online

8. Utilize a New Vendor Checklist

Before processing vendor billings for the first time, having a vendor checklist can help you remember the necessary information to collect before paying the bill. The checklist should include:

- Any contracts

- Contact information (and contact person)

- Special payment instructions

- W-9

- Certificate of Insurance if required

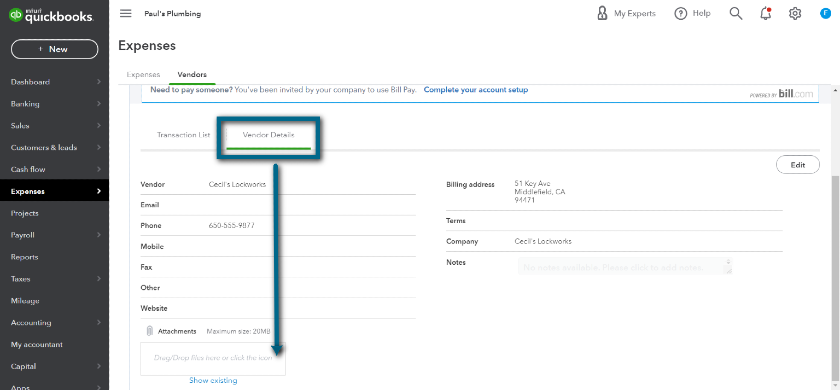

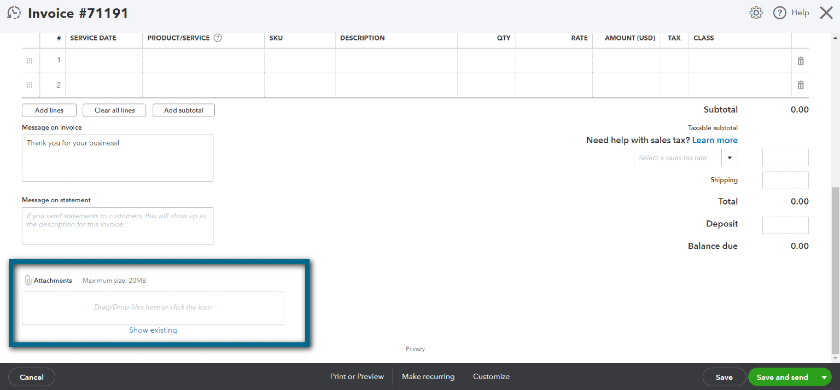

You can create an electronic file of the checklist and attach it to the vendor’s details section in your accounting software. In QuickBooks Online, you can upload files as attachments to each vendor. At the bottom of the page, you’ll see a box that says “Drag/Drop files here or click the icon.” Here, you can drag and drop the checklist and vendor documents or click this section to open the file explorer.

Attaching Files in Vendor Records

9. Attach Invoices & Receipts to Transactions in Accounting Software

One of the benefits of using accounting software programs is that you can keep accounting data in one place. You can upload scanned versions of paper invoices and bills as supporting information for electronic records in accounting platforms like QuickBooks Online.

If questions ever arise regarding a transaction, you can view source documents with one click. Dedicated receipt scanning features help you scan receipts easily and optical character recognition (OCR) functions will input readable data into fields automatically.

As shown below, receipts can be dragged to attach them to the invoice screen in QuickBooks Online.

Attaching scanned receipts and documents on QuickBooks Online

10. Avoid Paying Bills Earlier Than Necessary

If your suppliers give you a 15-day invoice payment term, you can choose to pay as late as the 15th day. In A/P management, your goal is to settle obligations near the due date so that you can use your cash for other purposes. Also, it allows additional flexibility in case of an unexpected event requiring additional cash that might take priority over paying the bill.

By holding onto your money for as long as possible, you can potentially earn interest on it. This could be through a high-yield savings account or other investment vehicles. In some cases, delaying payment might also create an opportunity to negotiate discounts or better payment terms with vendors.

Our related resources:

11. Take Advantage of Early Payment Discounts

Meanwhile, if offered by your vendors, consider taking advantage of early payment discounts whenever possible. You can pay your debt early to get a discount of around 1% to 5%.

If you’re in a tight cash position, you might even want to consider utilizing a line of credit for quick cash to get the discount. Take note that this will depend upon the amount of the discount, the interest rate paid on the line of credit, and how soon you anticipate being able to pay off the line of credit.

To maximize the benefit of these discounts, regularly review incoming invoices for discount terms. These are often expressed in terms like “2/10, Net 30,” which means that you can take a 2% discount if you pay within 10 days, or the full amount is due in 30 days. Determine the potential savings by multiplying the discount percentage by the invoice amount. Focus on invoices with the highest potential savings.

12. Record Days Payable Outstanding and A/P Turnover

Days payable outstanding (DPO) is the average number of days it takes to pay your bills. Ideally, your DPO should be equal to the average payment terms your vendors provide. This would mean that, on average, you pay your bills on their due date.

If your DPO is less than that, you’re paying your bills sooner than necessary. On the contrary, a higher DPO means that you are, on average, paying your bills late—which is probably causing you to pay late fees and penalties.

An alternative to DPO is A/P turnover, which shows the number of times you’ve paid vendors during the year. You can compute it by dividing total purchases by average A/P.

- A high A/P turnover means that you’re paying vendors quickly.

- A low A/P turnover means you’re lagging behind.

Remember that a high A/P turnover isn’t always a positive trait as it might mean you’re paying bills before they’re due.

13. Compare Your Payment Terms to Industry Standards

You should compare the payment terms prevalent in your industry to the payment terms being offered by your current vendors. You’re at a substantial disadvantage if most of your competitors are given 30 days to pay (Net 30) but you usually receive only 10 (Net 10). If that’s the case, you might ask your vendor for better payment terms or consider a different vendor with a better payment term.

However, consider your payment history. If you always pay your bills late, don’t expect your vendors to give you longer payment terms. But if you’ve proven to be a good debtor, you can haggle with your vendor and come to an agreement for a better payment term.

14. Track Payments for 1099-NEC

Ensuring correct reporting of payments to independent contractors is essential to avoid penalties and legal issues. Proper tracking also contributes to accurate financial statements and cash flow management.

You’re required to provide a Form 1099-NEC to certain contractors that you pay over $600 during the year. You should identify the contractors requiring 1099s by requiring them to complete a Form W-9 before receiving their first payment. Most accounting software have an option to select in vendor setup that indicates if they’re a 1099 contractor.

15. Establish Strategies for Fraud Prevention

There are a few strategies you can use to prevent A/P fraud. First, segregate accounting duties to prevent a single individual from handling multiple aspects of a transaction. For example, in A/P, different employees should be responsible for:

- Authorizing transactions

- Recording bills and payments

- Approving vouchers for payment

- Signing checks

- Reconciling bank and credit card accounts

Another strategy is to use accounting software that allows you to implement strong passwords and/or two-factor authentication and to restrict access to sensitive information like account numbers by setting up user roles. Many accounting software programs, such as QuickBooks Online, have a built-in audit log feature that lets you keep track of all transactions, even if they have been deleted. Also, all physical checks should be stored in a lockbox to maximize protection and avoid unauthorized access.

Keep reading:

16. Use a Supplier Portal if Possible

A supplier portal allows your vendor to log in and check the status of their invoice, which saves you the hassle of answering a phone call or email to give them the information. If they have any questions, they can message you directly through the portal, which streamlines your communication with them by keeping a record of all correspondence in one place.

The vendor can submit their invoices electronically using the portal, and automated data capture speeds up the invoice approval process. This allows suppliers to perform tasks independently while reducing the workload for A/P staff. Many supplier portals also include reporting capabilities, which enable you to generate reports on invoice volume, payment trends, and vendor performance.

Frequently Asked Questions (FAQs)

You can manage your accounts payable effectively by entering bills when you receive them, establishing a set approval process, reviewing A/R aging reports, and trying to be as detail-oriented as possible when entering and verifying information. These strategies help with preventing fraud and managing cash flow.

To accelerate A/P processing time, implement A/P software to streamline invoice capture, data entry, and approvals. Consolidate A/P functions into a centralized team to improve efficiency. Analyze and eliminate bottlenecks in your workflow, and prioritize high-value invoices. By combining these strategies, you can significantly reduce processing time and improve overall A/P performance.

You can improve vendor relationships by prioritizing open communication, timely payments, and mutual respect. Establish clear expectations, resolve disputes promptly, and explore opportunities for collaboration. You can also utilize technology to streamline interactions and maintain accurate vendor information.

Bottom Line

Proper A/P management involves paying vendors on time, ensuring that enough cash is available for payments and accurate bill processing. The involvement of the owner in reviewing and approving bills is crucial to ensure that the business is paying for liabilities on time and for the right amount. By applying accounts payable best practices in your small business, you can achieve a balance between paying vendors and managing cash without risking working capital deficiency.