Cryptocurrency payment gateways allow businesses to accept cryptocurrencies (such as Bitcoin) as a payment method. Big names in commerce such as Microsoft, AT&T, Overstock, and Amazon have been accepting cryptocurrency as a mode of payment through these payment gateways.

Adding a crypto payment gateway is easy—even for small businesses. The best offer secure currency conversion, flexible settlement options, and affordable transaction fees.

According to my research, the best crypto payment gateways are:

- BitPay: Best overall

- Coinbase Commerce: Best for cryptocurrency support

- Crypto.com Pay: Best for lowest merchant fees

- PayPal: Best for PayPal users

- NOWpayments: Best for versatile payment services

- PaymentCloud: Best for high-risk merchants

All the providers in this list are available to US merchants. In the sections below, I outline how to add each as a payment method to your website.

Flexible payment processing for any business |

|

Best Crypto Payment Gateways Compared

Merchant Fees | Accepted Cryptocurrency Types | Supported Fiat Currencies | Supported Payment Channels | Settlement Options | |

|---|---|---|---|---|---|

From 1% + 25 cents-2% + 25 cents | 16 including Bitcoin, Ethereum, and Litecoin | 8 including USD, CAD, and EUR | Online, in-person, digital invoice | Cryptocurrency, fiat currency | |

1% | 150+ including Bitcoin, Ethereum, and Litecoin | 100+ including USD, GBP, and EUR | Online, digital invoice | Cryptocurrency, fiat currency | |

| $0 | 20 including Bitcoin, Ethereum, Cronos, USD Coin | USD, EUR, AUD, GBP | Online, in-person, digital invoice | Cryptocurrency, fiat currency |

$0-$30 (PayPal fees), 3.49% + 49 cents | Bitcoin, Bitcoin Cash, Ethereum, and Litecoin | 100+ including USD, CAD, and EUR | Online, digital invoice | Cryptocurrency, fiat currency | |

From 0.5%-1% | 300+ including Bitcoin, Ethereum, and Litecoin | 25 including USD, CAD, and EUR | Online, in-person, digital invoice | Cryptocurrency, fiat currency | |

| From $10 | 120+, including Bitcoin, Ethereum, and Litecoin | 12, including USD, CAD, and EUR | Online, in-person, digital invoice | Cryptocurrency, fiat currency |

BitPay: Best Overall Cryptocurrency Payment Gateway

Pros

- Simple QR code invoice

- Daily payouts

- Locked-in exchange rates

- No free processing for low-volume transactions

Cons

- Tiered transaction volume limits

- Reports of passwords disabled without notice

- Limited supported cryptocurrency

Overview

Who should use it:

Businesses with global customers/clients

Why I like BitPay:

BitPay is one of the earliest cryptocurrency platforms offering both cryptocurrency trading and merchant payment gateway solutions. The platform is accepted in 229 countries, making it a perfect option for international merchants. I find the platform easy to use, and I particularly liked the level of customization it provides for security and payouts.

However, what sets it apart is its volatility shield function. BitPay locks in the exchange rate applicable at the point of the transaction so users get the exact value they requested deposited into their account.

This makes BitPay ideal for merchants who only want to accept payments for goods and services and avoid dealing with currency fluctuation that can result in loss.

Pricing

- 2% + 25 cents processing fee for businesses with under $500,000 in monthly transactions

- 1.5% + 25 cents processing fee for $500,000 to $999,999 in monthly transactions

- 1% + 25 cents processing fee for at least $1 million in monthly transactions

- Higher fees apply to high-risk merchants

Key Features

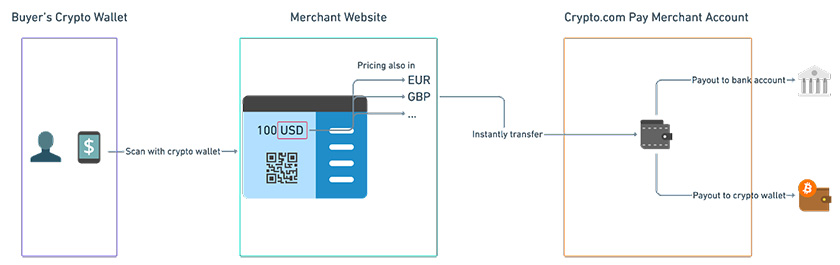

- QR code payment

- Daily payouts through local bank transfers and cryptocurrency wallets

- Integrates with ecommerce platforms such as Shopify, WooCommerce, Magento, and 3dcart

- Integrates with QuickBooks

- Offers volatility shield by locking in the exchange rate

- Allows multi-user access

- Can set two-factor authentication

- Gateway features include creating payment buttons, accepting donations, setting up mobile POS checkout, creating recurring billing and invoice

BitPay allows you to set up payment and donation buttons, design hosted checkouts, and create invoices you can embed on your website. You can even set up recurring billing for subscription customers. It also has a mobile point-of-sale (POS) function if you wish to provide a cryptocurrency payment method to customers at the cash register with the BitPay checkout app. Payouts are processed daily, and you can track them from your BitPay dashboard.

BitPay displays the invoice with a QR code on your website or on your checkout device. (Source: BitPay)

How to Add Crypto Payments With BitPay

BitPay integrates with popular ecommerce platforms such as WooCommerce and Shopify by creating an API token on your BitPay dashboard and linking it to your ecommerce platform account. This only took a few clicks to set up, very similar to how you integrate third-party software into your website. For POS, you only need to download the BitPay mobile app for Android or iOS and pair your app with your BitPay merchant account with an API token.

Learn more: What is a merchant account?

Coinbase Commerce: Best for Accepting Multi-cryptocurrency Options

Pros

- No transaction limits

- Quick account setup

- Accepts over 150 cryptocurrency types

Cons

- Requires a Coinbase account for payouts

- Limited ecommerce integration

- Only supports settlement in US dollars

Overview

Who should use it:

First-time users and US merchants looking for a wide range of cryptocurrency options

Why I like Coinbase:

Coinbase Commerce is Coinbase’s merchant services feature that allows small businesses to accept cryptocurrency as an alternative payment method. As the largest centralized cryptocurrency exchange market in the US, Coinbase supports a long list of cryptocurrency options. This means small merchants can accept more cryptocurrency types as payments from customers. A large exchange market also means Coinbase has the capability to insure merchant funds if they let Coinbase manage their account.

Like BitPay, Coinbase is easy to use, but I think first-time users will like that you only need an email address to sign up for the payment gateway. The sheer number of supported cryptocurrencies plus the considerably lower fees also makes Coinbase a better option than BitPay if most of your customers use crypto. Note, however, that Coinbase only supports US dollars and USDC for settlements.

Pricing

- 1% payment processing fee

- Via Lightning network processing fee: 0.1%

- Free currency conversion and settlement

Note that this pricing does not cover trading rates such as P2P between two crypto wallets.

Key Features

- Requires only an email address to set up

- Provides invoicing, customized payment buttons, and hosted checkout pages

- Known for its ease of use, ideal for first-time users

- Out-of-the-box e-commerce integrations are available via WooCommerce, Primer, and Jumpseller.

- Prevents volatility by instantly converting to USD and USDC

- Offers free instant settlement

- Well-documented API for custom ecommerce integrations

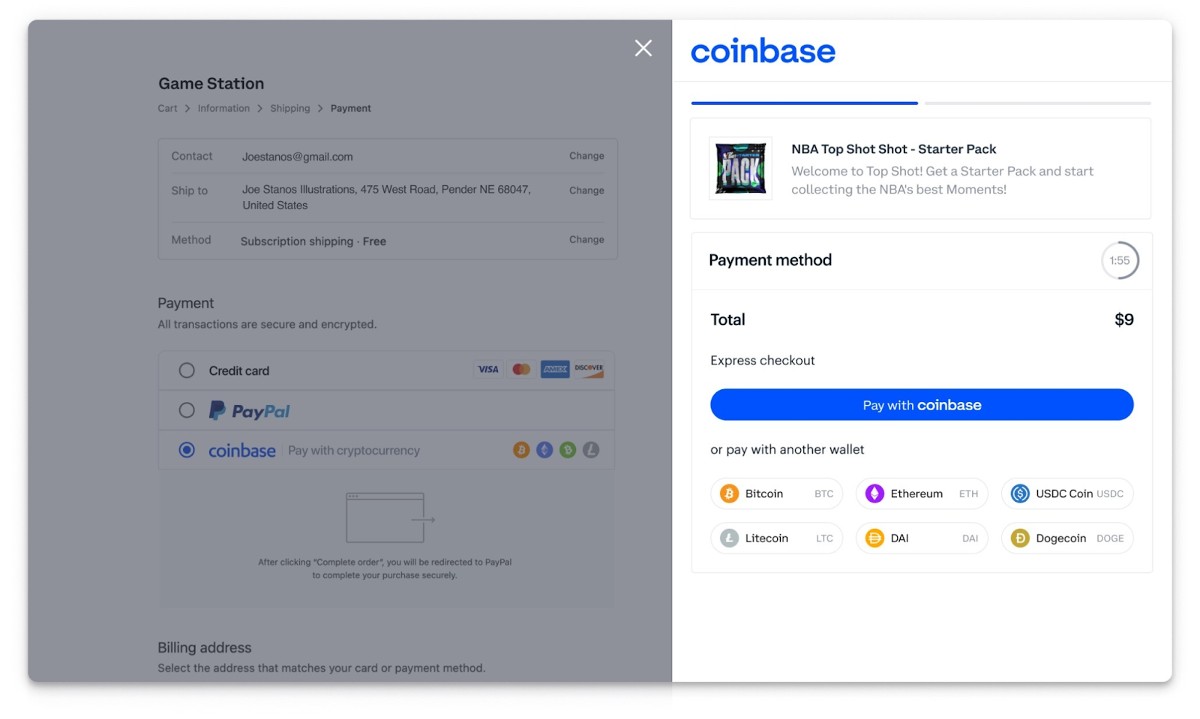

Coinbase enables you to accept payments from your website with various options depending on your business size. Small merchants can create invoices, simple hosted checkouts, and Coinbase payment buttons. It also provides APIs for more customized payment processing. For ecommerce stores, Coinbase can be integrated with Shopify and WooCommerce.

However, unlike BitPay, Coinbase doesn’t support mobile POS functionality. It also offers fewer ecommerce platform integration options.

Creating hosted checkouts comes with a simple on-screen guide to help you generate a static link to share with customers.

(Source: Coinbase)

How to Add Crypto Payment With Coinbase

With a self-managed funds plan, you only need an email address to sign up for a merchant account. Once your email address is confirmed, you can start accepting payments. I was a bit disappointed that the website integration options were limited but the process of adding Coinbase is seamless and easy with just a few clicks. Developer-friendly APIs are also available for a more customized payment processing flow.

Crypto.com Pay: Best for Lowest Merchant Fees

Pros

- Partners with several online shops

- Integrates with multiple ecommerce platforms

- No merchant account fees

Cons

- Not available for merchants in New York

- Limited settlement options

- No lock-in conversion rate feature w/third party transactions

Overview

Who should use it:

Best for small businesses on a budget

Why I like Crypto.com Pay:

Pay is Crypto.com’s digital wallet that allows merchants to accept cryptocurrency payments both online and in person. While settlement methods and ecommerce integration options are limited, I’m happy to see that Crypto.com has since added more cryptocurrency selections and updated its interface to be more user-friendly.

Crypto.com supports ecommerce platform integrations, invoicing, recurring payments, and subscriptions making the system very useful for online businesses and service professionals.

Unlike BitPay and Coinbase, Crypto.com Pay does not charge transaction fees, so small businesses on a tight budget can start with Crypto.com without worrying about additional costs.

However, the system does not support a lock-in conversion rate feature if your customer pays using a different cryptocurrency wallet, so there’s a tendency for merchants to be underpaid or overpaid. Merchants based in New York are also prevented from using this platform.

Pricing

- Monthly fees: $0

- Transaction fees: $0

- Withdrawal/Payout fee:

- Fiat currency: varies based on bank intermediary

- Cryptocurrency: 0.01BTC to 100 USDC

- Minimum $100 for payout

Key Features

- Over 20 cryptocurrency options

- No transaction fees for accepting payments

- Includes ecommerce integrations with easy-to-use APIs

- Partnerships with online stores

- Supports invoicing, recurring payments, and subscriptions

- Accept in-person payments with QR codes

- API-based integrations

- User-friendly customer wallet

- Built-in marketing features such as co-promotions and digital ads

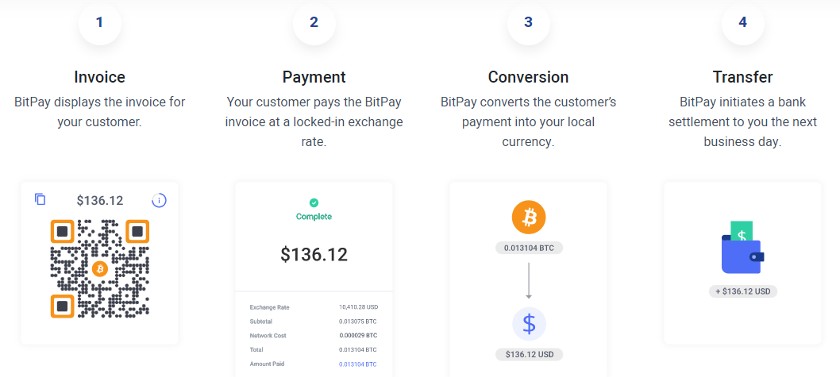

Accepting payments with Crypto.com Pay is as simple as accepting payments with any popular digital wallet like PayPal. Customers can go to your website to purchase a product and choose to pay via cryptocurrency. This will display your Crypto.com Pay checkout page, where customers can scan a QR code or receive a digital invoice. The customer is charged the equivalent value of your product in cryptocurrency, which will then be credited to your Crypto.com Pay wallet.

Crypto.com Pay partners with over 150 brands and online shops for seamless transactions.

With Crypto.com Pay, merchants are not charged transaction fees for accepting payments. The platform earns from trading, conversions, balance top-ups, and withdrawals. You can choose to withdraw your balance and send it to your bank or your own cryptocurrency wallet.

How to Add Crypto Payment With Crypto.com Pay

Crypto.com Pay offers a plug-and-play solution for online merchants. It has pre-made SDK codes for creating checkout and subscription buttons, page redirection, and page banners. There are also pre-made APIs that set up your entire payment procedure, from creating a payment object to authentication, flagging errors, generating a payment ID, canceling a transaction, and processing a refund. It also lets you set up customer profiles.

All you need to do is copy the code provided in Crypto.com’s knowledge base and follow the instructions to paste it on your website. The setup itself is easy enough as long as you’re familiar with your ecommerce platform. Note, however, that it takes Crypto.com a few days to approve a business account.

PayPal: Best for PayPal Users

Pros

- Supports its own cryptocurrency wallet

- Easy signup process

- Converts crypto to local currency at no extra cost

Cons

- Expensive transaction fees

- Monthly fees depending on transaction type

- No direct volatility shield

Overview

Who should use it:

Merchants already using PayPal Business

Why I like PayPal:

PayPal is a pioneer in mobile payments and offers one of the oldest digital wallets on the market. Since cryptocurrency began gaining popularity, I’ve been waiting for PayPal to add this feature, and it did not disappoint. PayPal allows its users to trade cryptocurrency, but what I like most is how seamless it is for customers to switch between their fiat and crypto balances to make payments.

Feature-wise, PayPal is behind Coinbase and even BitPay regarding supported crypto and settlement options, but PayPal is more well-known with an established customer base. Plus, PayPal is compatible with other payment processors, so you can add it to any website as an additional payment method. It even has its own stablecoin PYUSD, to protect cryptocurrency from volatile exchange rates during a transaction.

If you already use PayPal for your online checkout, adding crypto to your payment methods is as simple as a few clicks. Merchants using PayPal with or without a cryptocurrency account with PayPal can offer checkout with crypto. There are no extra fees for accepting cryptocurrency payments, and PayPal does not charge for conversion to fiat currency. Moreover, merchants accepting this type of transaction get 24/7 fraud protection and purchase protection for qualified items.

Pricing

- Monthly fees:

- PayPal account: $0 to $30

- Virtual terminal: $30

- Recurring billing: $10

- Recurring payment Tool: $30

- Payment gateway: $0 to $25

- PayPal Payments Online: 3.49% + 49 cents

- Chargeback fee: $20

- Converts cryptocurrency to fiat currency when accepting payments

Key Features

- In-house stablecoin to protect from volatility

- Well-known brand with an established customer base

- Easy to switch between PayPal and cryptocurrency balance

- Uses PayPal’s compatibility as an add-on payment method with other payment processors

- Simple and advanced checkout customization

- Converts crypto payments to USD without additional cost

Crypto will automatically display for customers with a sufficient PayPal cryptocurrency balance in their wallet. During payment, their cryptocurrency holdings will be converted into fiat currency equivalent to the outstanding transaction amount at no extra cost.

Your customer’s cryptocurrency balance will be converted to fiat currency during checkout. (Source: PayPal)

How to Add Crypto Payments With PayPal

Checkout with crypto is automatic as long as the customer has a PayPal cryptocurrency account and sufficient funds equivalent to the transaction amount in the local fiat currency. Merchants receive the payment in USD or their local currency. As with everything about PayPal, setup is fast and easy.

Note that this type of transaction falls under the PayPal Payment Online category, and merchants will be charged 3.49% plus 49 cents in transaction fees.

NOWpayments: Best for Payment Services

Pros

- Wide range of settlement options

- Native payment processing service

- Can process online and in-person transactions

- Long list of supported cryptocurrencies

Cons

- Volatility shield on request

- Fluctuating minimum transaction value

- Additional application process for fiat settlements

Overview

Who should use it:

Online merchants looking for a full range of payment services that accept cryptocurrency

Why I like NOWpayments:

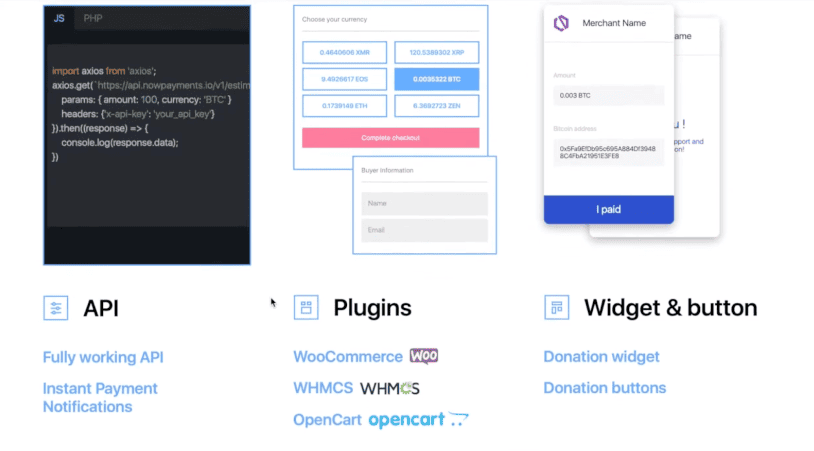

NOWpayments is a relatively new player compared to other providers like BitPay in our list. But that doesn’t stop it from offering one of the most diverse crypto payment gateway services on the market. NOWpayments supports more than 300 cryptocurrencies, the most in this guide, as well as payment services such as invoicing, billing, and donation tools. NOWpayments also supports both online and in-person integrations and even offers a choice of plug-and-play, API, and custom gateway solutions.

What I like most about NOWpayments is its fee optimization feature. The system is designed to make sure that your crypto payments will use the lowest conversion rate which works best if you have volatility shield enabled. However, Unlike BitPay, there is a 1% fee to apply a volatility shield per crypto transaction, which you also need to request to activate.

Also, note that while you only need an email address to sign up for NOWpayments, there is a separate application process if you intend to accept fiat currencies and convert them to crypto.

Pricing

- Transaction fee: 0.5% per transaction

- Exchange fee: 0.5% to 1%

- Custody conversion fee: 0.5% service fee

- Fiat fees: Depends on provider

- Fiat payout fee: 2.3% to 1.5%

Key Features

- Fee optimization

- Wide range of payment services

- Option for custodial and non-custodial transactions

- Multiple integration options

- Ready ecommerce integration with WooCommerce, Ecwid, Shopify, and more

- Extensive documentation for integrations

- Supports over 300 cryptocurrencies

- Volatility shield via 1% fixed fee

- Supports some high-risk industries

NOWpayment’s payment process is simple. At checkout, the customer chooses crypto as a payment method. The system will then ask for a cryptocurrency and automatically display the equivalent amount of the outstanding payment. The customer will be asked to log into their crypto wallet to confirm the transaction.

For invoices, the merchant generates the invoice and chooses a cryptocurrency to accept payment. Once this is done, NOWpayments will generate a QR code that will be included in the invoice.

How to Add Crypto Payments With NOWpayments

Once the gateway is installed, you can embed NOWPayments on your invoice, billing service, ecommerce checkout, and even on your POS terminal. For ecommerce, a standard plug-and-play is available where you can choose NOWPayments from the ecommerce platform payment settings and download the ecommerce platform plugin from the NOWpayment website.

PaymentCloud: Best for High-risk Merchants

Pros

- Gateway agnostic and custom gateway solutions

- Real-time BitCoin payments

- Same-day settlement

- Crypto microtransactions

Cons

- Lengthy and comprehensive application process

- Third-party crypto partnerships may require additional fee

- Limited payment services information on the website

Overview

Who should use it:

High-risk merchants looking to accept cryptocurrency payments

Why I like PaymentCloud:

In 2022, PaymentCloud partnered with RocketFuel Blockchain, allowing its merchants to accept crypto. RocketFuel can issue digital invoices and manage recurring billing with a crypto payment method. PaymentCloud, meanwhile, makes it possible for high-risk businesses to acquire a merchant account and provide an option for getting paid with cryptocurrency.

I also like that this PaymentCloud partnership includes a fiat-crypto conversion, something that other providers in our list such as Crypto.com currently do not have.

PaymentCloud stands out from others in this list because it is gateway agnostic, which means it can work with any payment gateway, in this case, a cryptocurrency one provided by a partner blockchain. This also means that businesses that already have a preferred gateway can continue using it, avoiding any business downtime.

What’s more, PaymentCloud can even help provide a tailored payment gateway (combining specific business requirements) for those looking for a custom solution. However, there are certain trade-offs, such as a more extensive application process and higher fees.

Pricing

- Monthly account fee: $10 to $45

- Virtual terminal: $15 to $45 per month

- Payment gateway: $15 per month

- Low-risk transaction fee: 2% to 3.1%

- Medium-risk transaction fee: 2.3% to 3.4%

- High-risk transaction fee: 2.7% to 4.3%

Please note that PaymentCloud’s pricing is custom for each solution and that the above are estimates provided by PaymentCloud.

Key Features

- Supports a long list of high-risk businesses

- White-glove customer support from application to onboarding

- Real-time payment with Bitcoin

- Over 120 cryptocurrency

- One-click cryptocurrency checkout

- Crossborder B2B payment service

- Flexible pricing structure and custom rates

- More than 1000 plug-and-play integrations

- Fast payouts

- Supports crypto microtransactions

PaymentCloud adds a cryptocurrency checkout option on your ecommerce or POS platforms. When a customer chooses to pay with crypto, the gateway prompts the user to choose their crypto wallet and log in to their account. The customer then chooses their preferred cryptocurrency and confirms the payment. Funds are automatically converted into US dollars without additional fees.

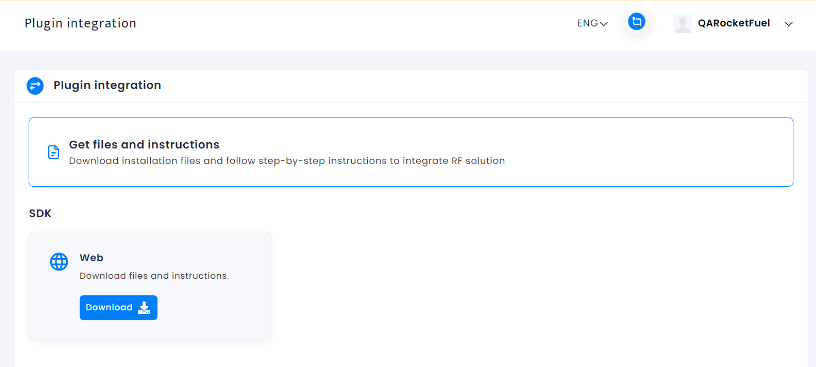

How to Add Crypto Payments With PaymentCloud

Like NOWpayments, merchants using PaymentCloud to accept cryptocurrency should be able to add a crypto payment method with a plugin from RocketFuel. Head to the settings dashboard of your ecommerce platform and search for “RocketFuel Payment.” Then, click on “Install”. Once this is done, click on “Activate”. You will be asked to log in to your ecommerce merchant account to confirm the integration.

What Is Cryptocurrency?

Cryptocurrency is a decentralized digital currency built on blockchain technology. It only exists online and is not regulated by a government or other entity. Compared to fiat Government-issued currency, such as the US dollar, that is not made with or backed by a specific commodity, such as gold. currency, crypto trading is faster and cheaper because there are fewer regulations to go through. However, rate volatility is a significant risk to consider.

There are different cryptocurrency types, but the most popular and widely accepted are Litecoin, Ethereum, and Bitcoin. Consumers primarily acquire cryptocurrency for investment, but in the past few years, there has been a steadily growing demand to use crypto to pay for goods and services. A digital wallet allows users to accept, hold, convert, and trade crypto.

How Do Cryptocurrency Payment Gateways Work?

Payment gateways allow users to accept cryptocurrency as a payment method, primarily on ecommerce sites, but the best ones offer POS compatibility, especially if the software is created from an app-based platform such as Android OS. Adding crypto as a payment method has become as easy as adding traditional options like PayPal to your website.

What to Look for in a Crypto Payment Gateway

Unlike traditional payment methods, making cryptocurrency work to boost your sales goes beyond just consumer preference. There are many cryptocurrency payment gateway providers on the market and it’s easy to get bogged down by technicalities as you try to decide which one is best for your business.

So I listed some guidelines below to help you get started. When choosing a payment gateway solution to accept cryptocurrencies, make sure to:

- Check for legalities. Before anything else, make sure that a crypto payment wallet or platform is valid to use in the country or state where your business is located. While most crypto payment gateways support US dollar conversion, it’s still important that you check the terms of service.

- Look for exchange rate security. Also known as volatility security, this feature ensures that the exchange rate value of your cryptocurrency is locked for a specific period of time to protect your transaction from any loss due to volatility.

- Evaluate trustworthiness. Because crypto payment gateways are unregulated by nature, it’s important that you research the platform’s history/background for any complaints or legal actions.

- Identify security functions. Look for security features such as two-factor authentication, temporary lock-in rates during transactions, and even reliable, responsive 24/7 customer support in case issues come up with your account.

- Check for integrations and partnerships. Crypto payment gateway can integrate with website builders and online marketplaces and partner with online stores that provide you access to a larger customer base.

- Easy withdrawal and deposits. Not only should you make sure that your crypto payment gateway provides you with the fastest deposit times. It should also allow you to choose among different withdrawal options such as banks, cards, and even digital wallet balances for instant access. You should also be able to choose between fiat and cryptocurrency withdrawal options. Don’t forget to compare fees.

Methodology: How I Evaluated Crypto Payment Gateways

To create this guide, I put together a list of top cryptocurrency platforms that offer a payment gateway functionality, then narrowed down the options to those that are legally available to US merchants. I also considered a number of traditional payment gateway providers, such as Shopify, Stripe, and PaymentCloud that support cryptocurrency payment methods.

From there, I evaluated each provider based on key crypto payment gateway requirements:

- Volatility shield: Whether built-in, via third-party, or through stablecoins

- Settlement options: Options for fiat, crypto, or both. I also considered whether the provider supports holding crypto or just a specific fiat currency (auto conversion)

- Number of supported cryptocurrencies: Hundreds of cryptocurrencies are available, including stablecoins.

- Supported payment services: Includes invoicing, billing, subscriptions, donations, B2Bs, crossborder, and high-risk

- Supported payment channels: Ability to accept payments online, in-person, and on a mobile app.

- Available integrations: With ecommerce platforms, other crypto wallets, POS software, billing management, and other business solutions.

- Ease of use: Compared user experience, signing up for the platform, setting up the payment gateway, working with integrations, and using the checkout.

- Security and reliability: Available security features that protect users against unauthorized access, such as two-factor authentication and tokenization.

- Fees: Compared each provider’s transaction, conversion, settlement, and other related monthly and incidental fees for using the payment gateway.

Crypto Payment Gateway: Frequently Asked Questions (FAQs)

No. While most providers support conversion to US dollar currency, it does not automatically mean that the gateway is available for US merchants. CoinGate, for example, is only available for merchants within certain US states (Alabama, Arkansas, Arizona, Iowa, Kentucky, Maine, and Mississippi).

Meanwhile, NOWPayments’ user agreement section 4.1 includes the United States of America (including all US territories) among its list of prohibited jurisdictions. Make sure to check the provider’s website for this type of restriction beforehand.

Cryptocurrency payments are not subject to chargebacks, so you don’t need to worry about chargeback fees or fraudulent transactions. You can also opt for payment gateways like Coinbase that offer to insure their user’s funds.

Yes, most crypto payment gateways support conversion into your preferred fiat currency and even deposit your funds into your local bank account via ACH or wire transfer.

Like most payment gateways, it takes two to three business days for withdrawn funds to reflect in your bank account.

- Choose a crypto payment gateway

- Register for a merchant account

- Validate your account

- Integrate the payment gateway with your website or send invoices via email

Bottom Line

One report found that one out of three US consumers own at least one cryptocurrency in 2023, and 13% hold crypto to use for making purchases. Merchants need to begin adopting this payment method to enjoy a share of the revenue. If you have a small business, several reliable crypto payment gateway solutions can help you start accepting cryptocurrency payments in no time.