ExcelPayroll is a free downloadable payroll solution designed to help small businesses and nonprofits (especially those with 10 or fewer workers) accurately pay employees. It utilizes Microsoft Excel to perform payroll processes, such as printing paychecks, generating basic payroll tax forms, and calculating the applicable salary amounts, tax withholdings, deductions, and other payments.

In our evaluation of the best free payroll software, ExcelPayroll earned an overall rating of 2.3 out of 5. Note, however, that while you can use its pay processing tools at no cost, you have to pay extra for up-to-date state tax tables, which cost either $50 or $100 per state State tax table updates cost $50 per state, except for New York and Alabama, which are priced at $100 each. .

ExcelPayroll Overview

ExcelPayroll Is Best For

- Nonprofits and small companies looking for free payroll processing software: This software is free to use and includes the essential tools to run payroll, provided you only have basic pay processing needs. It’s not intended for large organizations—and we don’t recommend it for companies with more than 10 employees.

- Microbusinesses using Excel for payroll calculations: Because ExcelPayroll is based on the Microsoft Excel program, the transition would be easy if you’re familiar with the software. The tools are just more structured and have a higher level of automation than you would get using manual spreadsheets.

ExcelPayroll Is Not Ideal For

- Small businesses looking for robust features in a free payroll software: Compared to ExcelPayroll, Payroll4Free is a better free pay processing tool (for those with up to 25 workers) given its detailed reporting, self-service portal, and affordable add-ons for direct deposit payments and tax filing services. If you’re looking for more HR tools, consider TimeTrex’s free version, which comes with basic solutions for managing employee information, attendance, schedules, and payroll. To know more about these two software, read our Payroll4Free review and TimeTrex review.

- Companies with more than 10 employees: While ExcelPayroll can compute pay based on timecard entries of 57 active employees, we only recommend it for companies with 10 or fewer team members. Businesses with more than just a handful of employees would benefit from a more complete solution with stronger payroll compliance controls and additional HR, benefits, and payment tools. Check out our best payroll software guide for more options.

- Businesses paying executive-level salaries: ExcelPayroll doesn’t support paying a single employee more than $458,300 in a year. If anyone on your payroll earns more than that amount, you’ll need a different service. Read our guide on the best payroll services for a list of other services you should consider.

- Restaurants paying tipped employees: ExcelPayroll doesn’t support paying an hourly rate less than $7.50, so restaurants with tipped workers won’t find this useful. The federal tipped minimum wage is much less, $2.13 an hour. Check out our restaurant payroll software guide if you need other options.

How ExcelPayroll Compares With Top Alternatives

Best For | Free Plan Limits | Paid Add-ons | Our Reviews | |

|---|---|---|---|---|

Small business owners and Excel users with basic payroll needs | Up to 57 active workers only | State tax table updates ($50 or $100 per state) | ||

Small companies that want free payroll with optional tax filings services | Up to 25 workers only | Payroll tax payments and filings ($25 monthly) | ||

Small businesses looking for free payroll, time tracking, and scheduling | None | Offers paid plans with more HR tools (call for a quote) | ||

Employers with a small team needing a free online payroll calculator | Calculates payroll and prints checks for one person at a time | Payroll services ($75–$450 per year for up to 40 workers) | ||

Need help deciding which payroll solution is best? Check out our guide on how to choose the right payroll provider.

If you want a small business program for payroll with more functionality but aren’t ready to spend money, consider the affordable payroll systems with free trials so you can make sure it’s worth it, risk-free. Below are three ExcelPayroll alternatives.

- Gusto*: 1 month free payroll + solid payroll with multiple direct deposit and payment options

- QuickBooks Payroll: 30-day free trial + fast direct deposits and seamless integration with QuickBooks Accounting

- OnPay: 30-day free trial + strong automation tools and system permissions to handle basic to niche payroll

*Get one month free when you run your first payroll. Offer will be applied to your Gusto invoice while all applicable terms and conditions are met or fulfilled.

While we gave ExcelPayroll a high score in this criterion, it didn’t get perfect marks because of its plan limits and requirements. It also charges extra for state tax table updates—although, you can manually upload tax tables into its system if you’re comfortable doing so and want to save money.

The ExcelPayroll pricing scheme for state tax tables is based on your business location. If your company is in Alabama or New York, tax table updates are $100 for each state. For the rest of the US states, tax tables cost $50 per state.

Plan Requirements and Limits

The provider placed several plan requirements and system limitations to ensure that its pay processing solution is used by small businesses and nonprofit organizations. If you don’t meet these requirements or exceed the limits, then you can’t use ExcelPayroll.

- Number of employees in timecard (for pay processing): Up to 57 active employees

- Minimum hourly pay rate: $7.50 per employee

- Maximum hourly pay rate: $4,807 per employee

- Maximum annual salary: $458,300 per employee

- Number of payroll transactions: 3,640 in a year

For nonprofit organizations, ExcelPayroll can adjust some of its limitations if you need to run more than 3,640 payroll in a year or have more than 57 active employees for its timecard solution. Contact the provider to discuss your requirements.

ExcelPayroll is a simple payment processing tool that’s Microsoft Excel-based. It lost a lot of points in this criterion because it doesn’t have the additional features that most free payroll solutions offer (like mobile apps, payroll tax payment and filing services, and multiple payment options).

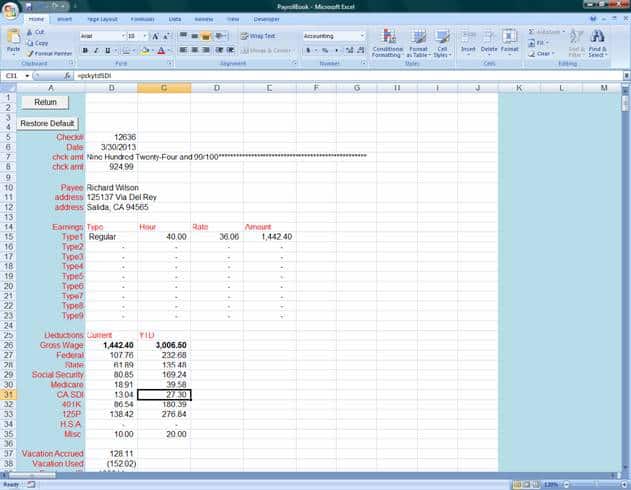

However, it can process payroll for hourly and salaried employees and supports multiple pay periods—from weekly and biweekly to semimonthly and monthly. It also manages common deductions for taxes, 401(k)s, health savings accounts (HSAs), garnishments, Social Security, and Medicare.

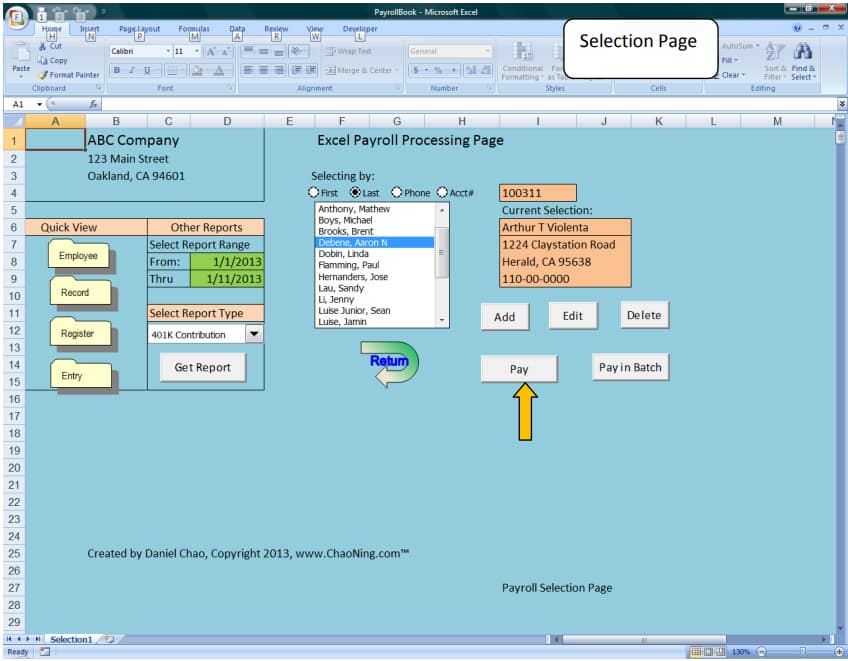

While it typically processes payroll on a per-employee basis, it lets you pay workers in a batch. You can even redo previous payroll (up to five years) and start pay runs in advance (up to two years from the current year) for recordkeeping purposes only.

A view of ExcelPayroll’s pay processing page (Source: ExcelPayroll)

Salary payments are made through paychecks you print and distribute yourself. Its system has pre-set formats for checks printed via accounting and finance software like QuickBooks and Quicken. However, if you have a preferred check layout, ExcelPayrol allows you to create custom paychecks.

You can input any date as a payroll date on the check and the applicable payroll liabilities will be processed based on the date selected. While this provides you the flexibility to print checks anytime you need, it can be a potential security issue. We suggest adding extra safeguards to your payroll protocols, such as limiting the users who have system access to prevent payroll fraud. You can also set up direct deposit payments so that you can send the employees’ salaries directly to their payroll bank accounts.

ExcelPayroll’s “customize check” feature lets you drag selected information to where you want it to appear on your employee paycheck. (Source: ExcelPayroll)

To find out more about ExcelPayroll’s other features, click the dropdown buttons below.

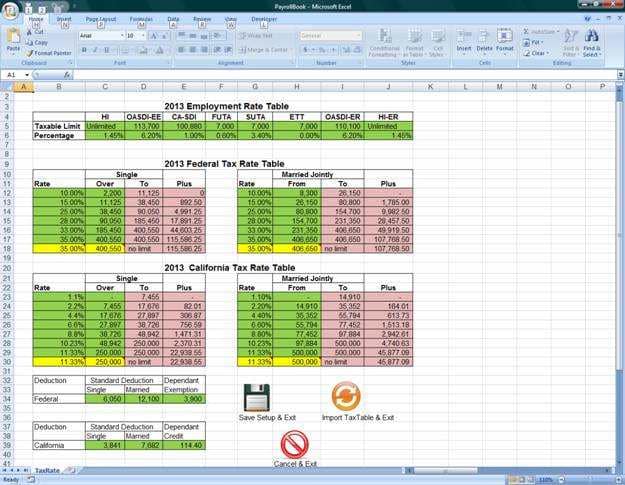

ExcelPayroll has pre-set formulas for calculating and withholding payroll taxes. It allows you to print the essential tax forms you need, such as Form W-2, W-3, 940, and 941. Note that you have to remit payroll tax payments and submit the applicable tax forms to government agencies yourself.

The system also comes with state tax tables, but you have to change this every year yourself. While you can get the latest tax table data from the IRS website and manually input it into ExcelPayroll, you can have the provider do this for you. For $50 per state ($100 each for Alabama and New York), it provides an updated tax table at the end of each year that you can add to its payroll system files.

Aside from its paid tax table update service and letting you manually input the latest tax rates, ExcelPayroll lets you import a tax table file directly into its payroll workbook.

(Source: ExcelPayroll)

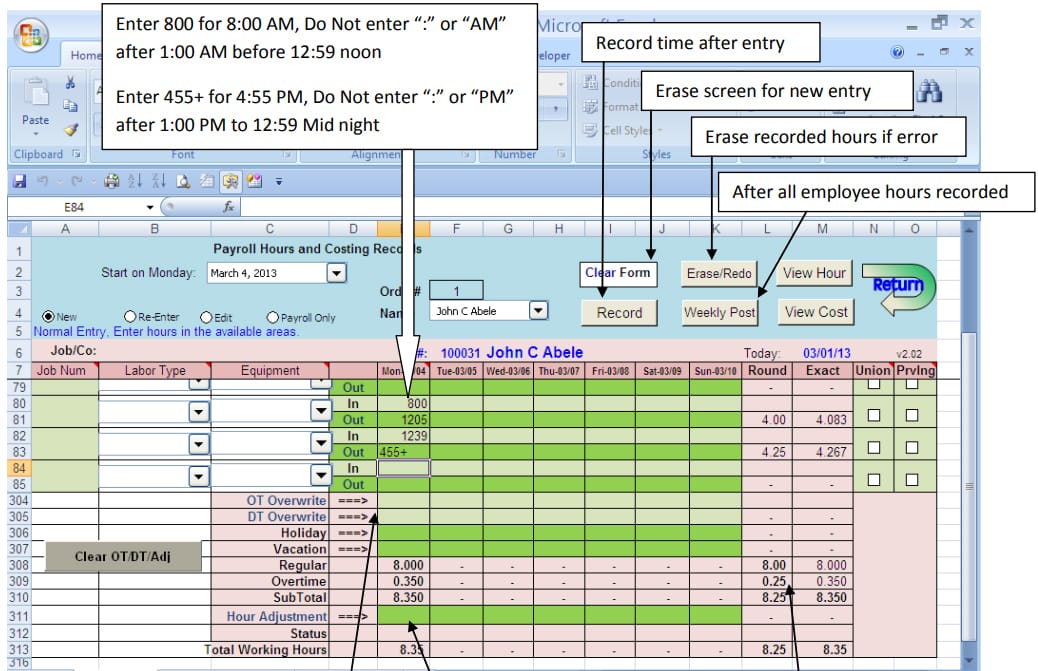

ExcelPayroll doesn’t connect to a time clock, nor does it capture employee clock-ins and outs. Time data has to be entered manually into its timecard file. Then, the system will compute the applicable regular and overtime hours to be paid.

You can also use the timecard tool to record and track the actual work hours that employees spend on each job, project, and equipment type. It even lets you input PTO data for pay processing.

If managing and tracking employee attendance is critical to your business, read our best time tracking software guide to find more suitable options.

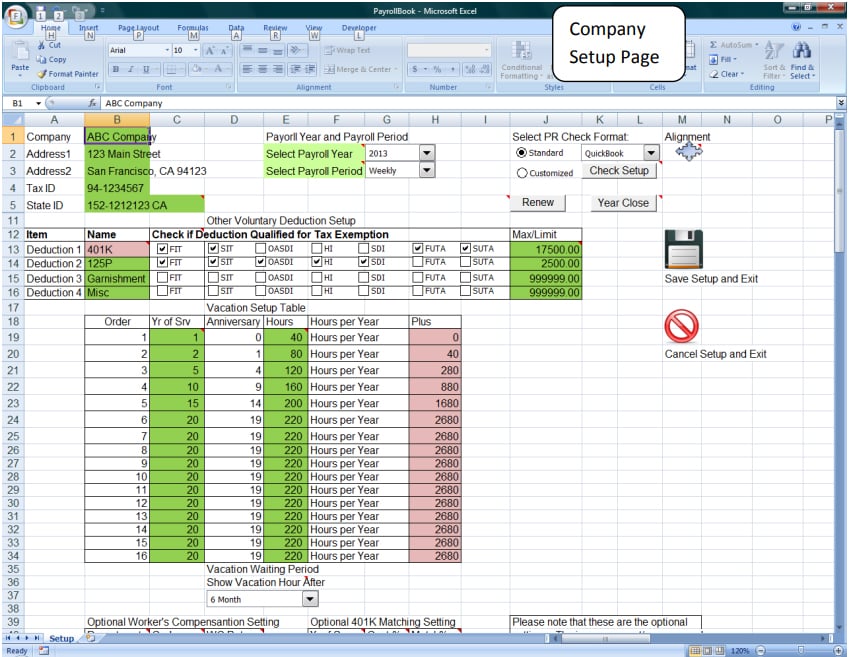

You can add vacation leave accrual data in ExcelPayroll’s company setup workbook.

(Source: ExcelPayroll)

Note, however, that ExcelPayroll has specific format requirements when inputting time data and hour adjustments. It also follows rounding rules when calculating the total hours worked based on the time entries.

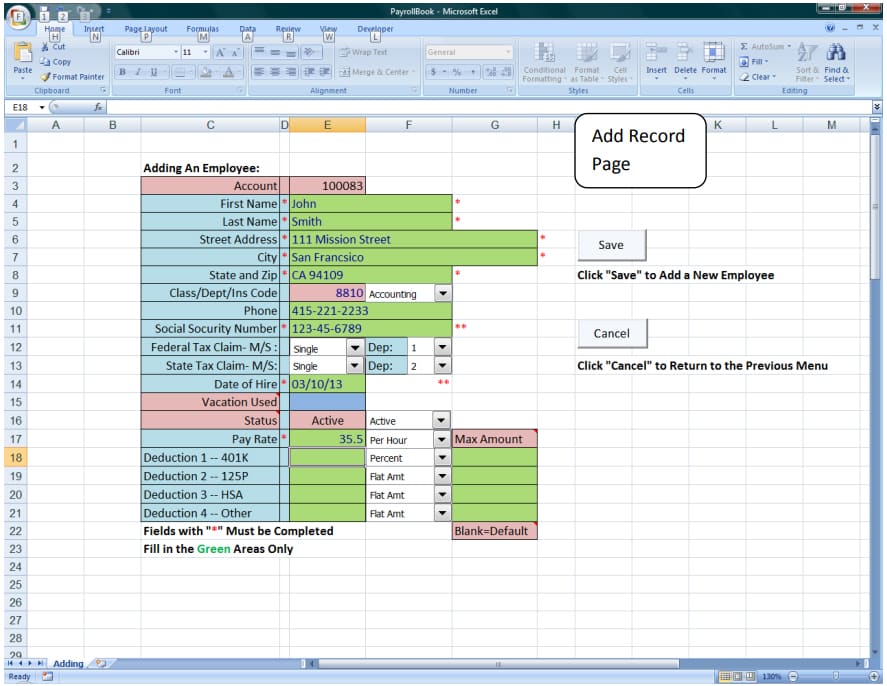

Adding new employees into ExcelPayroll is fairly straightforward. You input the employee’s complete name, contact information, Social Security number, pay rate, basic tax data, and deduction details. Its system can support up to 1,000 employee profiles, but it can only process payroll for 57 active employees.

ExcelPayroll has a simple-to-use record page for adding new employees.

(Source: ExcelPayroll)

In our evaluation, reporting is the only criterion where ExcelPayroll received a perfect score. Even as a free payroll that’s Excel-based, it can generate workers’ compensation reports and a wide range of tax forms—from Form W-2s to 941 documents and other basic tax liabilities reports. It can also handle paycheck printing and check layout customizations.

- No software installation required (provided you already have Microsoft Excel installed)

- Similar to using an Excel spreadsheet

- Calculates deductions and withholding

- Allows you to print paychecks in-house

- Full instructions included

ExcelPayroll may have a generally user-friendly platform with intuitive controls for managing basic pay runs, but we didn’t give it a high rating for ease of use because it can be challenging to use if you’re new to Microsoft Excel and doing payroll. Even if you are adept at handling both, navigating through and using its features can be a bit difficult mainly because it entails a lot of manual entries. This can be a source of potential errors, such as incorrect time and pay data, and might impact payroll security.

It isn’t a cloud-based software that you can access via web browsers or mobile apps. You have to manually save its system files to a computer that has Microsoft Excel (versions 2007, 2010, and 2013) in it. It also lacks tax filing services, HR tools like onboarding, and an employee self-service portal, which would have allowed your workers to access their pay details and tax forms online.

Plus, ExcelPayroll customer service is limited to email support. While it has video tutorials and an online guide you can view via its website, the guide isn’t easy to scroll through. All the topics (and instructions) are presented in one long list, starting with how to download its program and then going through the different steps for adding employees, running payroll, and printing forms. If you want to access specific topics—you have to scroll up or down the entire guide to find what you need.

Despite these shortcomings, ExcelPayroll is a good solution to use if you have basic pay processing requirements and only have a handful of employees. Since it is Microsoft Excel-based, it integrates with any product Excel is compatible with. It can also be used to share information with popular accounting software such as QuickBooks.

As of this writing, there isn’t even one ExcelPayroll review available on social media (like Facebook) and popular review sites (such as G2 and Capterra). This is the reason why we rated it a 0 for user popularity. Even its website doesn’t have ExcelPayroll reviews from actual users.

Methodology: How We Evaluated ExcelPayroll

For this ExcelPayroll review, we looked for features that will make it an essential solution for small businesses looking for free payroll software. These features include payroll, tax, and deduction calculations, employee payment options, and tax report preparation. We also considered ease of use, customer support, third-party software integrations, user reviews, and whether the software is completely free to use or if it charges extra for additional features and services.

Click through the tabs below for our full evaluation criteria.

20% of Overall Score

We specifically chose payroll services with free payroll functions. However, we favored those that don’t have limits (like a specific number of employees) for its forever-free plan.

10% of Overall Score

We considered online user reviews from third-party sites (like G2 and Capterra) based on a 5-star scale, wherein any option with an average of 4+ stars is ideal. We also looked at the features and services that reviewers liked, including factors that prevented users from leaving a higher score on these review sites.

10% of Overall Score

We gave points based on the reports available and whether you could customize them.

35% of Overall Score

Having access to payroll tax calculation, payment, and filing services is preferred as these can simplify pay processes. We also considered other tax and payroll functions, such as year-end reporting, multiple employee payment options (such as via direct deposit or printable checks), and the capability to add deductions and garnishments.

25% of Overall Score

Free is no good if you have to fight the program. We looked for software with an intuitive interface, checked how easy it was to learn, and compared support options. We also considered whether it integrates with other programs or at least allows CSV file downloads.

Bottom Line

ExcelPayroll targets small business owners with experience in Microsoft Excel who need a simple upgrade from a pen-and-paper payroll tool. While it lacks advanced HR solutions for managing onboarding and benefits, it has all the essential features for calculating wages, paying employees via check, and generating the required tax forms. Best of all, it is free to use, provided you have 57 or fewer active employees (we recommend it for businesses with no more than 10 employees, however).

Set up your company account and enjoy free payroll processing. Download ExcelPayroll today.