The best free payroll software for small business owners can calculate pay for hourly and salary workers, handle tax calculations and deductions, and print checks and pay stubs. Some of the systems even file taxes and offer direct deposits. We examined several free payroll services in this guide and narrowed them down to our top five recommendations.

- TimeTrex: Best overall free payroll software for small businesses

- Payroll4Free.com: Best free payroll services for companies with 10 or fewer employees

- HR.my: Best for startups needing a free multilingual platform with basic HR payroll tools

- eSmart Paycheck: Best for single or infrequent paycheck creation

- ExcelPayroll: Best free software for payroll that runs on Excel

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

Top Free Payroll Software Compared

Employees in Free Plan | Free Time Tracking & Scheduling | Tax Filing & Payment Services | Live Phone Support | Our Score (Out of 5) | |

|---|---|---|---|---|---|

| Unlimited | ✓ | Included in paid version | ✓ (included in paid version) | 4.05 |

Vacation time tracking only | $35 monthly | ✓ | 3.84 | ||

| Unlimited | Time tracking only | ✕ | ✕ (via community forum) | 3.24 |

| Unlimited, but input individually | ✕ | Included in paid version | Limited | 3.03 |

| Up to 50 active workers | ✕ | ✕ (via email) | 3.01 | |

Note: When to Consider Paid Payroll Software

Paid payroll software comes with a wider range of tools and services. Most providers offer employee benefits plans, automatic payroll tax table updates, compliance support, and payroll tax payment and filing services to further streamline and automate processes. Some even provide free trial offers, like those on our best payroll software and top payroll services guides, so you can try its features.

Top on those lists is Gusto—an all-in-one and easy-to-use payroll and HR solution. Get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

TimeTrex: Best Overall Free Payroll Software

Pros

- Automatic pay runs with free direct deposits

- Feature-rich free plan (comes with basic payroll, time tracking, scheduling, and HR management tools)

- Integrates with other payroll tools like QuickBooks, ADP, and Paychex

- Offers two software deployment options (on-site and cloud-hosted)

- Available in multiple languages

Cons

- Details about its free Community Edition are difficult to find on its website

- Doesn’t handle payroll tax filings; only generates tax forms

- Has features that aren’t intuitive and look somewhat dated

- User dashboard looks cluttered and confusing

What We Like

TimeTrex is our top-recommended free payroll software for small businesses because it includes time tracking, scheduling, paid time off (PTO) monitoring, and HR management solutions that you can access at no cost. You even get an online time clock that lets your employees clock in/out through web browsers. However, it does not file payroll taxes—consider Payroll4Free if this is something you need (although it does charge a nominal fee).

Scoring an overall rating of 4.05 out of 5, TimeTrex earned perfect marks in pricing and the highest scores in popularity and reporting. However, its lack of tax filing services and a mobile app where you can run payroll hurt its pay processing score. Users and our experts also found it less intuitive than others on our list. Like all free options on our list, its integration capability is limited.

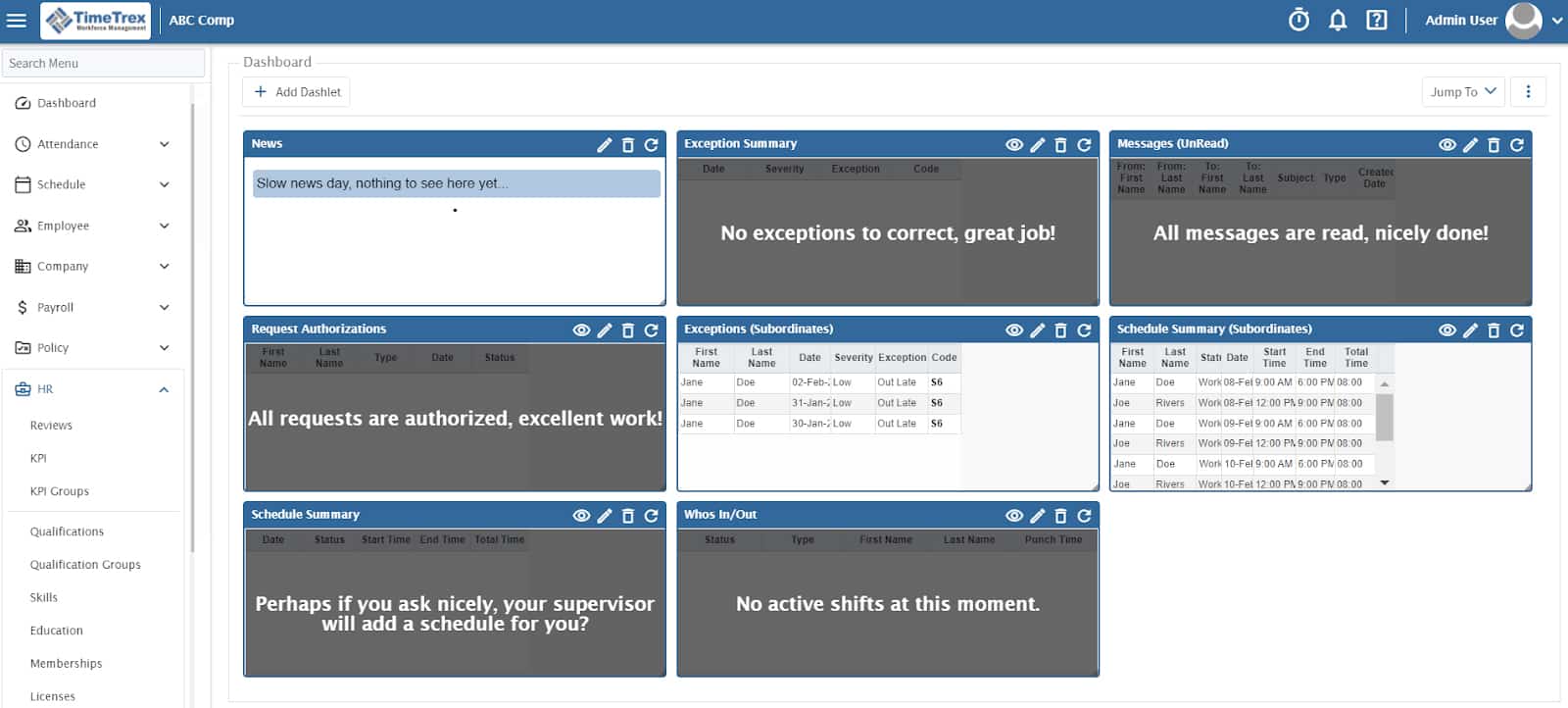

TimeTrex has “dashlet” widgets you can select if you want to view schedule summaries, real-time attendance data, alerts, and messages on its main dashboard. (Source: TimeTrex)

The free plan, or Community Edition, includes basic time and attendance, scheduling, leave management, HRM tools, and payroll. If you need more, its paid plans come with customer support, a mobile app (for iOS and Android devices), and advanced functionalities, like facial recognition clock-ins, geofencing time tracking, expense management, and online tax forms.

Pricing for the below plans covers up to 10 employees. Contact TimeTrex if you require a quote for large teams.

- Professional Edition: Starts at $30 per month

- Corporate Edition: Starts at $50 per month

- Enterprise Edition: Starts at $80 per month

TimeTrex also offers installation support and initial setup support for new users for a fee.

- Feature-rich free tier: Even at its free level, TimeTrex lets you create schedules, capture clock-ins/outs, monitor PTO, pay employees, track performance reviews, and record staff information in a centralized database. This is more than what Payroll4Free (it doesn’t have free HR tools) and HR.my (lacks performance reviews) offer as part of their forever-free solution.

- Online time tracking: TimeTrex has robust time tracking capabilities—making it one of our best time and attendance software for small businesses. Its web browser-based time clock allows you to turn computers into employee time tracking devices. Payroll4Free, by contrast, will integrate with a separate time clock.

- Pay processing: TimeTrex’s free edition covers all day-to-day payroll basics, from paid time off (PTO) accruals to automatic tax calculations and custom deductions. It also offers electronic pay stubs, free direct deposit for small businesses, and paychecks you can print in several formats.

- Third-party software integrations: TimeTrex integrates with QuickBooks, ADP, Paychex, Ceridian, and Sage. The other providers on our list don’t have this functionality, while Payroll4Free.com has limited options and connects with other software through payroll data exports and time data imports.

Payroll4Free: Best Free Payroll Service for Companies With 10 or Fewer Employees

Pros

- Free-forever payroll services with essential HR tools (including an employee portal)

- Email and phone support with access to payroll and tax experts

- Tax filings and direct deposits (not using own bank) are affordable add-ons

- Can import information from time clocks

- Integrates with QuickBooks & other accounting

Cons

- Limited system compatibility (Windows only)

- Payroll software comes with ads; interface looks outdated

- New user sign up process isn’t straightforward; requires several forms and documents to create account

What We Like

Payroll4Free is an excellent payroll software free for small businesses with 10 or fewer employees. It calculates payroll and taxes, tracks PTO accruals, prints paychecks, and provides free direct deposits if you use your own bank. The software can also handle year-end tax reports (W-2s and 1099s), providing you with pre-formatted forms to send to the government. However, you have to pay Payroll4Free to file tax forms for you.

In our evaluation, Payroll4Free earned a score of 3.84 out of 5. It would have ranked higher if it didn’t have an employee limit—the others handle unlimited employees—and if it offered direct deposits and tax filings for free. Plus, its average user rating on third-party review sites (like G2 and Capterra) is only 3.85 out of 5 as of this writing. Some users even said that its platform is unintuitive, often taking extra steps to complete what a paid program can do in a single click. They also don’t appreciate the ads that appear while using the tool.

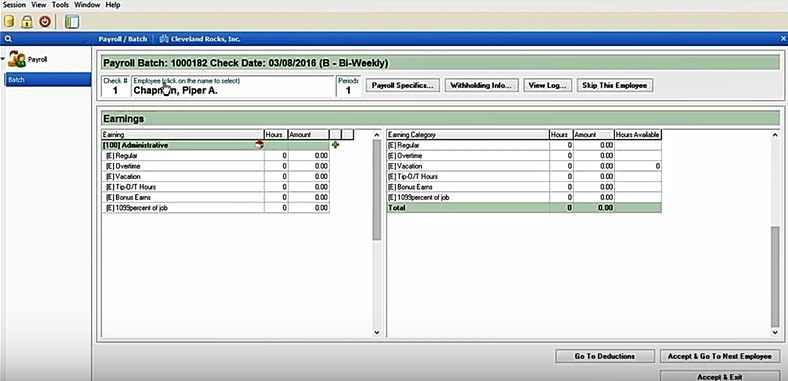

For every pay run, you have to input employee work hours and other payment details directly into Payroll4Free.

(Source: Payroll4Free)

Become a shareholder: Payroll4Free is seeking investors through Wefunder, and offers free payroll tax services for the life of your business for an investment of $1,250. This, of course, also comes with shares in the company.

You can use its platform at no cost, provided you only pay 10 or fewer unique individuals (not number of employees) per calendar month. Payroll4Free charges a fee of $10 per payroll batch if you pay 11 up to 25 workers per month. On the other hand, if the employees you pay in a calendar month exceed 25 unique individuals, Payroll4Free will bill you a processing fee of $35 per payroll batch for that month.

The provider also offers several add-on services to help streamline your payroll processes. You can check the full fee schedule on its website, but the most important add-ons are below:

- Payroll tax payments and filings: $35 monthly

- Direct deposit transfers using Payroll4Free’s bank account Direct deposit services require a security deposit equal to the highest estimated net payroll you plan to process in a seven-day period. : $35 monthly

- Bundle payroll tax and direct deposit services: $40 monthly

- Live training: $100 per hour

- Employee data setup or reprocessing This is optional and only if you need assistance entering a new employee's data into Payroll4Free. The same also applies if you require changes to the original system setup information after the initial setup has been completed. : $100 per hour

- Pay processing: It allows you to track PTO time on the system and will consider that when calculating payroll. Payroll4Free also computes taxes and integrates with time clocks (something eSmart Paychecks cannot). Unlike TimeTrex, it charges you if you want to use them for direct deposit or provides a free ACH file so you can use your own bank free instead.

- Check printing setup assistance: Payroll4Free.com can help set up its software to add any data you want to appear on the check. You won’t get the said free service with both HR.my and TimeTrex, although eSmart Paycheck does have a simple check setup.

- Employee portal: Unlike eSmart Paycheck and ExcelPayroll, Payroll4free has an online employee portal where they can check accrued PTO, see and print pay stubs and W2/1099 forms, and update personal information.

- Access to payroll and tax experts: Payroll4Free offers unlimited customer support and has a team of experienced payroll and tax specialists you can contact if you need payroll advice. However, it doesn’t have the community forum that TimeTrex and HR.my offer, which allows you to get input from other business owners and HR professionals.

HR.my: Best for Startups Needing Multilingual Software With Basic HR Payroll Tools

Pros

- Free HR solution includes payroll, basic HR, expense claim management, and online time clock tools

- Multilingual platform that supports up to 66 languages

- Additional paid features are only $5 per month

- Mobile app includes manager tools and employee portal

- Expense management has a receipt upload feature

Cons

- Doesn’t generate, file, and pay payroll taxes

- User guide isn’t robust and can be confusing to follow

- Lacks phone support

- Sponsorship ads appear on the dashboard and its other online tools

What We Like

HR.my is a free multilingual HR software that is crowd-funded and includes small business payroll software free. The company works with those interested in translating the software into additional languages. As of this writing, it has 66 language options—more than the free solutions we reviewed, including most paid payroll software. It has basic payroll and HR features (such as employee information management, time tracking, and expense claims) that you can use for free.

Overall, it earned 3.24 out of 5 in our evaluation, with perfect marks in pricing. What pulled its score down includes the lack of custom reporting, online tax forms, and payroll tax filing services. It also doesn’t offer phone support or have a support team. If you need help with a feature, you can visit its community forum and access its online user guide—which is more of an FAQ page, but with limited information.

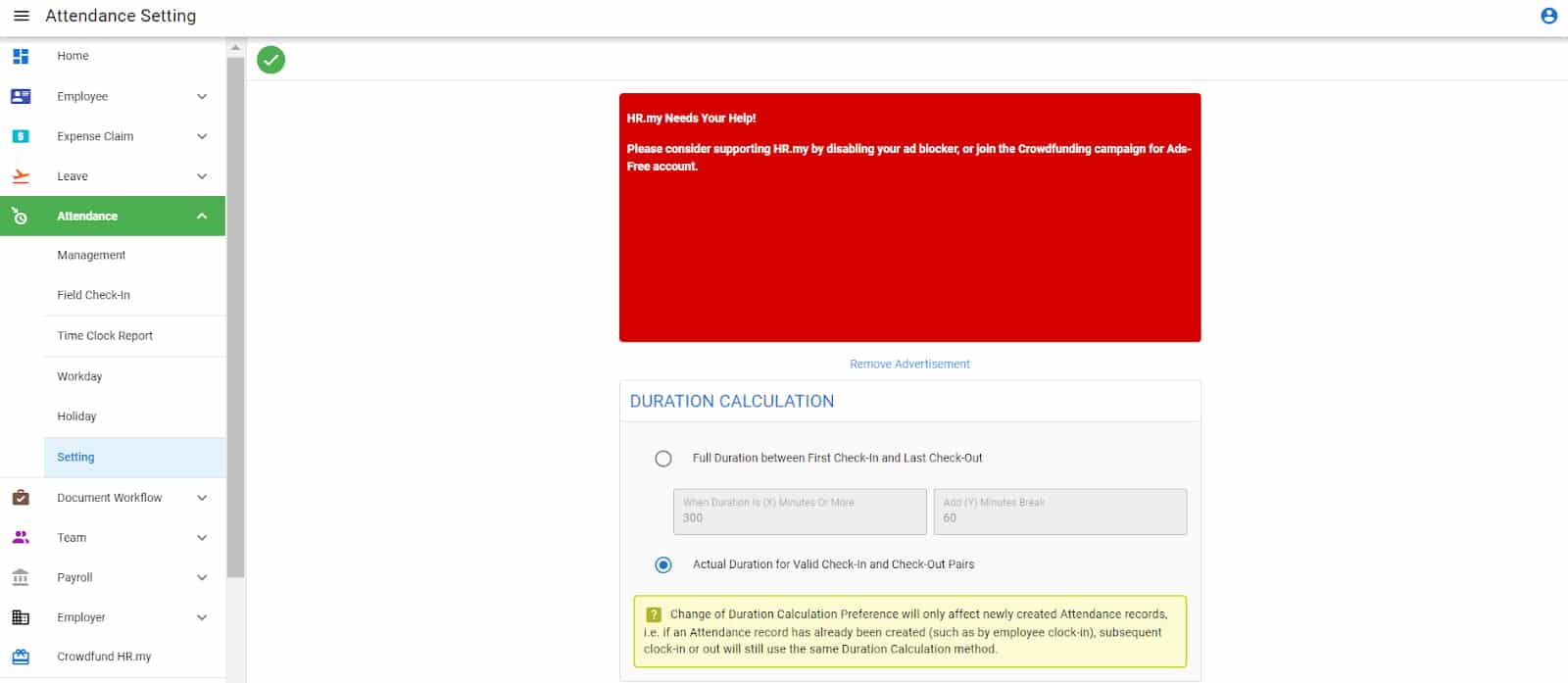

HR.my’s sponsorship ads appear from time to time while you’re setting up your time tracking rules and using its online features. (Source: HR.my)

While HR.my offers HR and small business payroll software free with 6GB of storage, it also has a sponsorship program. For $5 monthly, you get ad-free web accounts, early access to new features, an additional 3.5GB of online storage, and one extra “HR Role” user seat per unit of sponsorship. Note that for a 12-month sponsorship package, you get the same perks but with 7GB of additional online storage (instead of 3.5GB) and two extra “HR Role” user seats (instead of just one).

- Payroll processing that includes expenses: HR.my accounts for employee leave transactions, lets you import time, has automatic pay runs, and offers online payslips. It even includes employee expenses in pay runs, unlike TimeTrex, which offers expense management tools in its paid version.

- Employee portal: While TimeTrex has an employee portal as well, we liked HR.my’s because it also allows for expense management, including uploading receipts via mobile. Employees can also manage documents and forms, view past and future PTO, and of course, see pay information.

- Cloud-based and mobile-accessible: HR.my is the only payroll software free both on the cloud and on mobile on our list. Payroll4Free and eSmart lack mobile apps, while TimeTrex’s free Community Edition doesn’t come with a mobile app.

- Multilingual platform: While its default language is English, you can change HR.my’s system setting to any of 66 languages, like Chinese, Korean, French, Spanish, Japanese, and Vietnamese. TimeTrex has some additional languages, but many have been discontinued because of a lack of upkeep.

- Feature-rich free HR solution: In addition to free payroll, HR.my offers time tracking, PTO management, and even incident reporting tools. It sets alerts for important events like expiring contracts or work visas, probation or performance reviews, and even employee anniversaries (which can affect pay scale).

eSmart Paycheck: Best for Single or Infrequent Paycheck Creation

Pros

- Easy online calculator for creating a printable paycheck and stub

- Automatically calculates state and federal taxes

- Can add custom deductions for tax and non-tax items

- Straightforward interface

Cons

- Does not save information—must recreate each paycheck

- No reports (you need to upgrade to its paid version to access reports and tax forms)

- Does not file taxes

- No direct deposit capability

What We Like

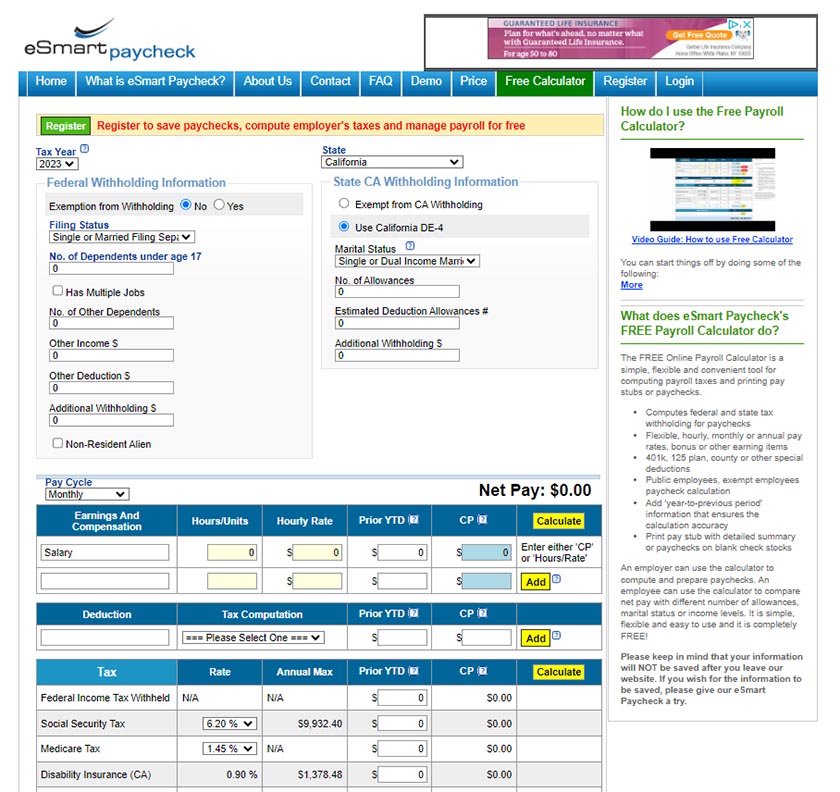

If you only have a couple of employees or need to cut a quick payroll check, then eSmart Paycheck’s payroll calculator is a free and easy way to do it. Unlike the others on our list, eSmart’s interface is right on the website; just fill out the information, and it can create a pay stub or paycheck that can print on regular paper or blank payroll checks. It’s easy to use; you can add deductions as needed, and it will adjust taxes accordingly.

eSmart Paycheck earned 3.03 out of 5 on our evaluation. It lacked reports and user reviews, although it is recommended by many business magazines. It does not provide a file you can use for direct deposit, although you can take the information manually and print the pay stub. While it calculates taxes, it does not file them for you. Overall, it’s easy to use but best for very small businesses or for preparing the occasional paycheck.

eSmart Paycheck free calculator lets you input data, calculates taxes, and prints a paycheck. (Source: eSmartpaycheck.com)

eSmart’s free plan is limited to creating and printing a single paycheck or pay stub at a time. If you wish to have paid payroll services, they offer annual subscriptions based on the number of employees you have. These run $75 to $450 a year and include:

- Unlimited paycheck preparation

- Payroll tax calculations

- Printing checks and pay stubs

- Printing and filing tax forms

It also offers these add-ons:

- Deposit federal taxes automatically: $35

- Deposit state taxes as applicable: $30

- Print state payroll forms: $20 per type

- E-file state payroll forms as applicable: $20

- E-file W-2 to states, as applicable: $20 + $2 per form

- Print and mail W-2: $2 per form

- Simplicity: Compared to the others on our list, eSmart Paycheck’s free plan is the simplest of all. It is designed to let you create and print a single paycheck. You put in the information, and it does the calculations.

- Easy to customize: If you need to add a deduction, garnishment, bonus, or expense, it’s as simple as adding a line in the appropriate section. eSmart will ask you whether it’s taxable and make calculations accordingly. You can also set the pay cycle from weekly to annually as needed.

- Print checks or stubs: You have the option of printing a simple pay stub (to use the information for Direct Deposit and to give to your employee), printing a check on blank paper, or using a company-printed paycheck.

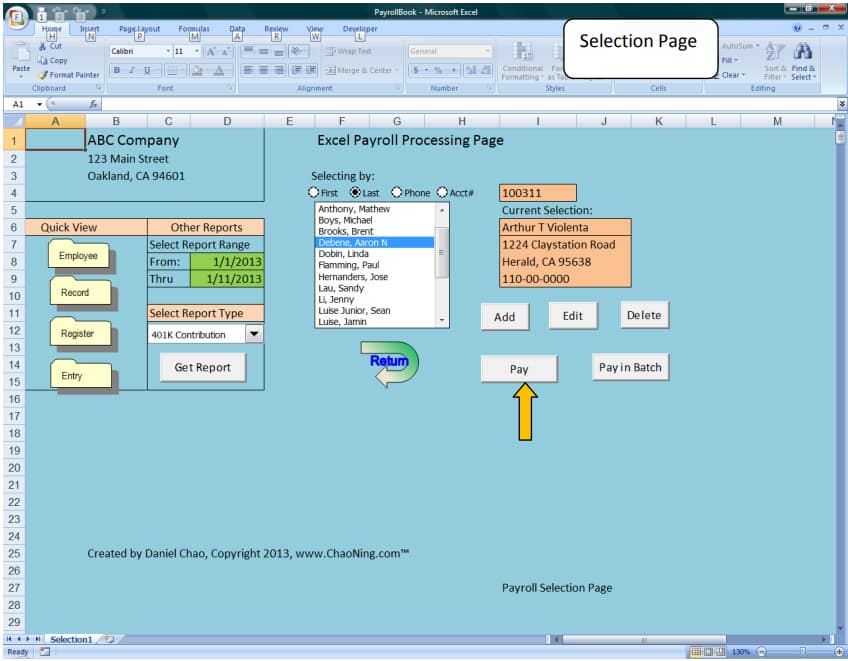

ExcelPayroll: Best Free Payroll Software for Excel Users

Pros

- Great for Excel users

- Prints checks, W-2 forms, and other tax-forms

- Includes basic leave accrual tracking

- Generates accounting entries

Cons

- Up to 50 active employees only

- Sets default limits to some entries, like hourly must be $7.50/employee

- Does not work with current versions of Windows or Excel

- No tax filing services; must pay for state tax schedules

What We Like

If your needs are basic and you’re comfortable with Excel, then ExcelPayroll is a great alternative. Like the others on our list, it lets you put in salary, hourly, and other compensation information; figures out taxes; and prints up paychecks, pay stubs, and tax documents.

ExcelPayroll earned 3.01 out of 5 upon evaluation. Like eSmart Paycheck, it does not have the many HR tools, time clocks, and extras that the top three on our list offer. You need to input a lot of information manually, and it creates the calculations. However, the software is severely dated. ExcelPayroll only runs on the PC versions of Microsoft Excel 2007, 2010, and 2013. Computers that run on Microsoft Windows 10 or use Excel 2016, Office 365, or later versions may block the macro or VBA code. To run it, you may need to set your computer to trust the program or downgrade to Excel 2007 or 2010.

ExcelPayroll has a dated design, but Excel users should find it easy to use. (Source: ExcelPayroll)

Want up-to-date templates? We also have Excel templates for payroll that you can download for free. Check out our guide to free payroll templates, including tips on how to use them.

ExcelPayroll is completely free to use and will update with federal tax schedules. However, for state tax table updates, you have to pay $50 per state except for Alabama (which costs $100).

- Powerful processing: ExcelPayroll lets you add applicable pay rates, timecard information, and deductions. It can handle payroll on a per-employee basis but can do it in batches, as well as reprocess previous payrolls—something Payroll4Free may charge you for.

- Employee profiles: It can store up to 1,000 employee profiles in its database, although it will only accept 50 active employees at a time. Profiles include contact information, payment details, deductions, and tax information.

- Paycheck printing: Like eSmart Paycheck, ExcelPayroll only prints checks. However, it is not tied to a particular period, so you can print a check whenever you need to. It can also collate payment information for direct deposit payouts like Payroll4Free does.

- Time card: While ExcelPayroll does not integrate with time clocks, it does have a timecard feature where you can input hours, and it will do the calculations accordingly.

How We Evaluated

We started our research with seven providers that offer free payroll services for small businesses rather than merely free trials. Then, we examined the features and ease of use, focusing on paycheck processing and tax preparation. To view our full evaluation criteria, click through the tabs in the box below.

20% of Overall Score

We specifically chose payroll services with free payroll functions. However, we favored those that don’t have limits (like a specific number of employees) for its forever-free plan.

10% of Overall Score

We considered online user reviews from third-party sites (like G2 and Capterra) based on a 5-star scale, wherein any option with an average of 4+ stars is ideal. We also looked at the features and services that reviewers liked, including factors that prevented users from leaving a higher score on these review sites.

10% of Overall Score

We gave points based on the reports available and whether you could customize them.

35% of Overall Score

Having access to payroll tax calculation, payment, and filing services is preferred as these can simplify pay processes. We also considered other tax and payroll functions, such as year-end reporting, multiple employee payment options (such as via direct deposit or printable checks), and the capability to add deductions and garnishments.

25% of Overall Score

Free is no good if you have to fight the program. We looked for software with an intuitive interface, checked how easy it was to learn, and compared support options. We also considered whether it integrates with other programs or at least allows CSV file downloads.

How to Choose a Free Payroll Software

First step is to consider your business’ payroll needs. Identify the essential features you need to compliantly and accurately pay employees. For example, the free software should be able to calculate employee payments, deductions, and taxes. Downloadable reports should also be available so you can use those to comply with payroll compliances and track payroll data.

Next, compare your options and check for exceptions where they may charge you. Some free payroll systems charge extra fees if you exceed a specific number of employees, while others may require you to upgrade to paid plans for advanced pay processing tools.

Lastly, check user reviews from online software review sites. Find out whether the software providers’ customers are happy with their service and the system in general. User reviews also provide helpful insights about the software’s ease of use, customer support quality, and if there are features that don’t work well or are glitchy.

If you need help selecting the best option for your business, follow our step-by-step guide on choosing payroll services.

Frequently Asked Questions (FAQs) About Free Payroll Software

The most common requirements that a small business will need include an employer identification number (EIN), the employees’ pay rates, and a bank account with sufficient funds to pay employees. You also need to understand payroll compliance regulations, such as the required payroll deductions, tax payments at all levels (federal, state, and local), and the tax forms you need to submit. Further, you need a payroll expert or payroll software that can handle and streamline your company’s pay processes.

First, check federal and state laws, as some states may have payday schedules for specific types of employees. Next, take a look at the payroll frequencies that best fit your business and workers—the options are biweekly, weekly, semimonthly, and monthly.

You can manually calculate payroll with a calculator or use Excel to compute all earnings and deductions. There are also online payroll calculators you can use for free, but you have to input the salary information one employee at a time to get each worker’s net pay (like eSmart Paycheck). Note that while these options can save you money since you don’t have to pay a software provider or a payroll accountant to handle it—we only recommend these to businesses with up to 10 employees.

Bottom Line

Businesses that are on a tight budget or have limited payroll needs may find free payroll software as a way to save time and help prevent mistakes that can cost money and even legal problems. The free payroll services on our list offer online tools to make your pay processing tasks easier.

Overall, we found TimeTrex to be the best free payroll software because of its wide range of useful features that include tax calculations, automatic pay runs, and free direct deposits. Its free version provides you with efficient payroll and HR tools, while its paid tiers offer even more HR functions. Sign up for a TimeTrex plan today.