FreshBooks is a cloud-based accounting program that allows you to create and send unlimited invoices, manage clients and projects, and accept payments online. It offers a robust set of features, including double-entry accounting, recurring invoices, project management, and mobile accounting.

It has four plans with monthly fees starting at $19 for one user. You can pay for more seats as needed ($11 per user, per month). Continue reading my in-depth FreshBooks review and evaluation for details on features, pricing, and user reviews.

Pros

- Includes unlimited invoices in all plans

- Lets you track time and bill clients for hours

- Has great customer service

- Offers a mobile app for accounting and invoicing

Cons

- Can’t track inventory and COGS

- Can’t assign payments to a specific bank account until the transaction clears the bank

- Can’t track and reconcile bank accounts without a live bank connection

- Includes only one user in base price for each plan

Monthly Pricing |

Each additional seat costs $11 per month. |

|---|---|

Discount | ✕ |

Free Trial | 30 days |

Payroll | FreshBooks Payroll (Powered by Gusto) starts at $40 plus $6 per person, per month |

Standout Features |

|

Scalability | Marginal—additional users are $11 each per month, which becomes expensive for four or more seats than comparable small business accounting software |

Ease of Use | Generally easy to use for DIY users; experienced bookkeepers might become frustrated with the workflow and limitations of some features |

Customer Support | Phone support, chatbot, email support, and self-help resources |

Average User Reviews | Very good, with users liking the customer service and easy-to-use interface |

- Invoicing customers: FreshBooks is on our list of the top-recommended invoicing software because of its powerful invoicing capabilities. You can create professional invoices in seconds, choose your preferred currency, and send invoices from anywhere with its mobile app.

- Tracking billable hours: It has a built-in time tracker that can help track billable hours. Since the time tracker is within the software, it’s easy to add billable hours to client invoices when it’s time to bill them, making FreshBooks one of our best accounting software for consultants.

- Recurring billing for project-based businesses: It earned a spot on both our top recurring billing software and leading project accounting software lists because you can create recurring invoices assigned to specific projects and track actual vs project revenue and expenses for those projects.

- Freelancers and solopreneurs: Since it focuses on simplicity, self-employed individuals who want DIY bookkeeping will find it easy to use—even without bookkeeping experience. Hence, it is one of our best accounting software for freelancers.

- Service-based businesses looking for a QuickBooks alternative: It is one of our top-recommended QuickBooks alternatives because it offers competitive features, including expense categorization, receipt capture, billable time tracking, and simultaneous users, even at its low price point.

- Businesses often working remotely: We selected FreshBooks as one of the leading cloud accounting software, especially for sole proprietors and freelancers tracking time. Not only does FreshBooks offer robust time tracking and invoicing features, but it also has a powerful mobile app that allows you to track mileage and communicate with clients directly through the app.

- Airbnb: FreshBooks made it to our roundup of the best accounting software for Airbnb and vacation rentals. It’s best for users with just a few rental properties since it is easy to use but doesn’t have rental-specific features.

FreshBooks Alternatives & Comparison

Overall, FreshBooks receives some of the best reviews we’ve seen for small business accounting software. Reviewers consistently praise its ease of use and customer service.

| Users Like | Users Dislike |

|---|---|

| Outstanding customer support | Limited billable clients |

| Visualization and look and feel | Too costly for multiple users |

| Excellent invoicing features | Limited integrations |

| Integration with Teamwork for detailed time tracking | Not as comprehensive as QuickBooks |

Below is the summarized feedback from users and my expert opinion:

- Excellent invoicing features: Reviewers said that they like its invoicing features. They also mentioned that the time-tracking tool works perfectly when invoicing clients. I definitely agree and think that invoicing is one of FreshBooks’ biggest strengths, as you can produce very professional-looking invoices that perfectly represent your brand.

- Expensive: Some find it pricey for multiple users because each additional is $11 a month. I agree that FreshBooks is too expensive when you get more than about four seats. For example, the Premium plan is $104 monthly for five seats. If you subscribe to QuickBooks Online Plus, which includes five users for $99 a month, you get much more powerful accounting software.

- User-friendly interface: Some like the easy interface; however, larger businesses find it too basic and simple for their needs—I think both are really good points. FreshBooks is definitely designed to be easily used by nonaccountants, which can create weak features that larger businesses won’t like.

For instance, when recording an expense, you can’t designate which bank account it is paid from. This is great for nonaccountants who often forget to designate an account but terrible for businesses needing to track the balance in bank accounts before the transactions clear.

As of this writing, here’s how Zoho Books is rated on third-party sites:

- Capterra: 4.5 out of 5 from over 4,475 reviews

- G2: 4.5 out of 5 from around 880 reviews

Fit Small Business Case Study

To determine how FreshBooks stacks up against similar software, I used our accounting software case study to compare it with QuickBooks, Wave, and Xero. The chart below sums up the results.

FreshBooks vs Competitors

Touch the graph above to interact Click on the graphs above to interact

-

FRESHBOOKS PREMIUM $60 PER MONTH

-

QUICKBOOKS ONLINE PLUS $99 PER MONTH

-

WAVE PRO $16 PER MONTH

-

XERO ESTABLISHED $80 PER MONTH

FreshBooks scores lower than QuickBooks Online in every category except Value, Integrations, and User Reviews. I believe FreshBooks and QuickBooks Online offer a comparable value because while FreshBooks is slightly less expensive, it also isn’t as powerful.

FreshBooks scores the lowest among all providers in Banking, primarily because you can’t track checks and expenses until they clear the bank, as discussed in the banking section below. Its strongest category compared with its competitors is A/R, which includes invoice customization. FreshBooks started as an invoicing software, and it shows with its professional, customizable invoices.

FreshBooks Pricing

FreshBooks pricing took a hit in my evaluation because the platform’s Premium tier costs $104 per month for five users, which is $5 more than QuickBooks Online Plus ($99 a month) and $24 more than Xero Established ($80 monthly). Both platforms accommodate five seats and have much better features, such as inventory. Although FreshBooks is affordable for one user, I considered the fact that some small businesses might need to add more seats.

Its four plans have monthly fees starting at $19, but paying annually will save you 10%. They vary in terms of the maximum number of billable clients and the advanced features available, such as automated recurring invoices, double-entry accounting reports, and access to support. You’ll need to subscribe to Premium to manage unpaid bills—which is offered in the QuickBooks Simple Start plan for only $25 monthly.

Lite | Plus | Premium | Select | |

|---|---|---|---|---|

Monthly Price | $21 | $38 | $65 | Custom |

Seats Included | 1 | 1 | 1 | Custom |

Additional Seats | $11/user/month | $11/user/month | $11/user/month | $11/user/month |

Billable Clients | 5 | 50 | Unlimited | Unlimited |

Unlimited Customized Invoices | ✓ | ✓ | ✓ | ✓ |

Double-entry Accounting Reports | ✕ | ✓ | ✓ | ✓ |

A/P | ✕ | ✕ | ✓ | ✓ |

Access to Exclusive Support Teams | ✕ | ✕ | ✕ | ✓ |

FreshBooks New Features

- Timestamps are now in the invoice, proposal, and estimate history.

- Advanced search is now available to find specific invoices using different filters or tags.

- The dashboard is now customizable, which enables you to rearrange the dashboard and hide the information that you don’t need.

- A dedicated journal entries section is now available.

FreshBooks has most of the general features I expect to see in small business accounting software. You can modify the chart of accounts, turn account numbers on or off, and make adjusting journal entries. Importantly for nonaccountants, you can invite an accountant user to access your books to help keep things straight or get information to file your tax return. Thankfully, you don’t have to pay an additional user fee to add an accountant user.

While FreshBooks allows you to track income and expenses by project, it doesn’t provide for bigger-picture separations like class or location. It also doesn’t allow for custom tags that can be used to classify transactions—something that QuickBooks, Xero, and Zoho Books all do.

The banking features in FreshBooks are disappointing. In its noble quest to make user-friendly software, I think FreshBooks went too far in simplifying and arrived at a banking function that is nearly useless to businesses that actively use their software versus those that simply accumulate income and expenses after the fact. In other words, if all you want to do is record transactions as they clear the bank, then FreshBooks is extremely simple and almost foolproof.

So, if you need to keep track of your available bank balances after subtracting outstanding transactions, then FreshBooks isn’t for you. This is particularly problematic if you write paper checks because paper checks can take months to clear the bank. However, it’s also not great for credit card charges that can take several days to clear and come through your bank feed.

Because of how the banking is set up, you must establish a live bank feed to track expenses from multiple accounts. Bank feeds are the only way to import transactions into FreshBooks—it doesn’t allow importing transactions from a bank statement or CSV file. This might be problematic if you don’t wish to give FreshBooks access to your online bank accounts. I believe FreshBooks is a secure platform and wouldn’t hesitate to provide my bank sign-in credentials, but not all are comfortable with it.

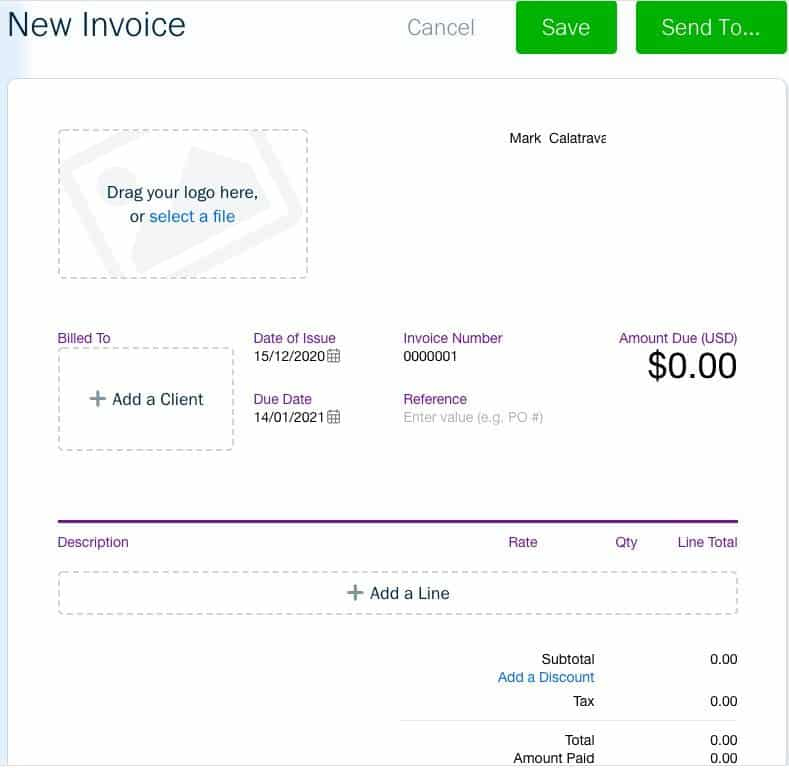

Accounts receivable is FreshBooks’ strongest feature, which is unsurprising since it started as an invoicing software. It covers all the basics like printing or emailing invoices, accepting short payments from customers, and issuing credit memos. Some advanced features include invoices and the ability to set prices for commonly used items and quickly add them to invoices.

My favorite invoicing feature of FreshBooks is the ability to quickly add time and expenses to invoices. You can designate time and expenses to specific customers and projects as they are incurred. The next time you invoice that customer, you’ll be prompted to add the unbilled items. This makes FreshBooks a great choice for professional service providers that charge an hourly rate.

I agree with the many users who praise FreshBooks’ invoices. They look great and can be customized to reflect your company style. You can choose from multiple templates, customize the colors, upload your logo, and create a personalized message to include on each invoice. Beyond just cosmetics, you can easily designate which fields to include on your invoices, thus keeping the invoice simple and focused on just the information the customer needs.

Create a New Invoice Screen in FreshBooks

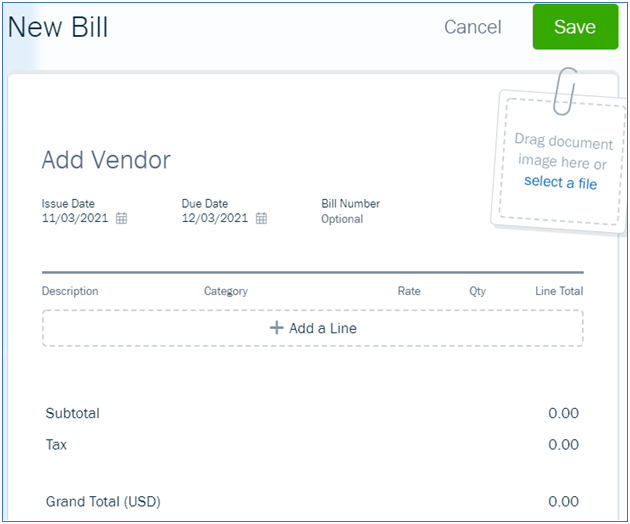

Available for Premium and Select subscribers, the A/P tool includes bill and vendor management features. I was a bit surprised to find there isn’t a feature to issue credit memos to your customers, something that seems like a pretty basic requirement for many businesses. Beyond that, FreshBooks doesn’t provide a vendor portal or allow the recording of purchase orders. Moreover, it makes it hard to record expenses without bank connections as I discussed in the banking section.

However, I was able to create a new vendor on the fly while entering a bill, which definitely saves time if you have a lot of clients. You can enter a bill from scratch or upload a receipt as discussed below. To enter a new bill, click on the Expenses menu, select the Bills drop-down menu, and then hit the New Bill button. Provide the required details in the New Bill screen and then click Save.

Add a New Bill Screen in FreshBooks

FreshBooks has great receipt scanning features, which is something I expect from accounting software. Receipts can be submitted via email, uploaded from your computer, or sent through the FreshBooks app. They are read using OCR technology and can be attached to an existing transaction or create a new transaction.

While you can easily set up inventory descriptions to be added to bills, you cannot track the number of items on hand, the value of stock available, or the cost of your inventory sold.

If you need project accounting, FreshBooks is ideal—unless you also need inventory accounting. It can’t record inventory used in projects but includes project management features that work directly with its invoicing tool. This helps you manage timelines and simplify project workflows.

You can create an estimate and add items such as labor, inventory, and sales taxes. Once approved, you can convert an estimate to a project and allocate actual labor cost details. You can also compare estimated costs against actual costs, which is important for budget planning.

FreshBooks does a good job of basic sales tax accounting. You can create multiple sales tax items from different jurisdictions and them to your invoices on a line-by-line basis. I like that you can designate particular invoice items as either always subject to sales tax or not. Of course, you can always override that when issuing a particular invoice. It’s easy to view and pay your sales tax liability.

Beyond the basics, FreshBooks doesn’t offer much for sales tax management. It won’t help you decide which jurisdiction a particular customer is subject to, nor will it help you file your sales tax returns. If you operate in multiple jurisdictions, I recommend integrating FreshBooks with Avalara, which offers both of these features.

If you only need basic financial reporting, you should do fine with FreshBooks. It generates a wide range of reports, but they aren’t as detailed as QuickBooks Online’s.

For instance, the balance sheets only show main categories, which means I can’t drill down in reports for more specific levels of detail, such as classes and location. Other reports available include A/R aging, A/P aging, income or loss by month or by customer, trial balance, and general ledgers (GLs).

FreshBooks has a capable mobile app that you can use for sending invoices. It can execute almost all the functions of the desktop interface—you can enter bills, accept payments, attach receipts, and record time worked. If you often do your business on the go, the app won’t disappoint.

However, there’s no way to enter bill payments, categorize bank feed transactions, and assign expenses to projects on the app. I praise FreshBooks for its project accounting features—and I’d like to see this in the app as well.

FreshBooks has what I view as the most critical integrations, which are for payroll, payment processing, sales tax management, time tracking, and electronic bill payment. It integrates with over 70 software programs, including

- Gusto

- Zoom

- Shopify

- Squarespace

- Google Workspace

- Fundbox

- Stripe

- Bench

- QuickBooks Online

- HubSpot

- Dropbox

- PayPal

- Slack

- Mailchimp

I evaluate usability in four areas: bookkeeping assistance, customer service, ease of setup, and ease of use.

My biggest usability concern for FreshBooks is the lack of bookkeeping support. Customer service is good, but that’s not the same as providing direct bookkeeping support.

It doesn’t have a formal advisor network where you can locate a bookkeeping expert in your area. For instance, QuickBooks ProAdvisors are easy to locate almost anywhere in the US. While the website does invite accounting partners, there isn’t a list the small business owners can see that provides contact information for these accounting partners.

FreshBooks also doesn’t offer any monthly bookkeeping services to subscribers, though it does partner with third-party bookkeeping provider Wave. In contrast, QuickBooks, ZipBooks, and Wave all offer monthly bookkeeping plans where they will classify transactions, reconcile accounts, and provide financial reports.

Users often praise customer service in their reviews, but I’d like to see FreshBooks expand the ways in which it provides it. I love that clients can pick up the phone and call customer service directly, but it would also be nice if they could chat with an agent directly from the software. It would also be good to get 24-hour customer service.

FreshBooks is missing a few features that would have made it easier for me to set up my sample company. For instance, there wasn’t a wizard to walk me through all of the necessary steps. I was also unable to import my chart of accounts and input beginning balances; instead, I had to enter them as a journal entry. This isn’t a big deal for a pro, but FreshBooks is targeted at business owners, and they might struggle with this opening entry.

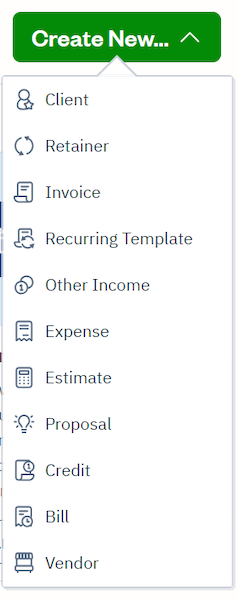

FreshBooks is easy to use. Its dashboard is laid out so that the major accounting functions are readily accessible. You can create any transaction by clicking on the Create New button and then selecting the transaction type.

Create New Transaction Button in FreshBooks

I also like how most of the information you need to manage your business is available within FreshBooks without having to print a report. For instance, you can view customer and vendor balances, outstanding invoices, and transaction summaries.

How I Evaluated FreshBooks

I evaluated FreshBooks using an internally developed scoring rubric with 13 major categories. You can read a more detailed description of the methodology by heading over to our accounting software case study.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

A widely known disadvantage of FreshBooks is that it cannot account for inventory and COGS. Additionally, I think that not being able to track checking account balances until transactions clear the bank is another major disadvantage.

QuickBooks scored much better than FreshBooks in our case study. However, FreshBooks is designed for simplicity and is preferred by some business owners. The simplicity comes at a significant cost, as FreshBooks is missing many of the features found in QuickBooks. Read our FreshBooks vs QuickBooks comparison to see how they stack up.

Yes, FreshBooks is a reputable accounting software provider that has been around for many years.

Some, but most FreshBooks users are business owners because it is designed to be very simple to use for small business owners. Small business accountants in the US overwhelmingly prefer QuickBooks. If finding an accountant to support your DIY bookkeeping is important, I’d recommend QuickBooks over FreshBooks.

Bottom Line

FreshBooks may lack some important features like managing your inventory and tracking income by class, which are present in slightly more expensive software, such as Xero and QuickBooks Online. However, FreshBooks’ powerful invoicing and project management features and excellent customer service make it a terrific choice for your small business.